Northern Data AG has rapidly transformed from a German Bitcoin miner into a diversified high-performance computing (HPC) and data infrastructure provider. Today, the company reported significant changes in revenue composition and strategic focus, including divestitures and shifts toward cloud and GPU-powered services.

Investors, customers in AI, and data-intensive industries are closely watching its financial and operational metrics as Northern Data scales infrastructure and adapts its business model. This evolution impacts sectors from cryptocurrency to enterprise computing, making this statistical overview essential for stakeholders. Explore the detailed figures below to understand where the company stands today.

Editor’s Choice

- Mining revenue up +118% in Q3 2025 vs Q3 2024 as capacity expanded and Bitcoin prices improved.

- Average daily share trading volume of ~114,230 in 2024, up from ~83,206 in 2023.

- Market capitalization ~€1.74 billion as of June 2025.

- Peak Mining divestiture valued up to ~$200 million, refocusing the company.

- Recurring cloud revenue, Taiga, is dramatically higher YoY, especially in Q1 2025.

- Cloud platform growth to ~43% of total revenue in H1 2025.

Recent Developments

- In January 2026, Northern Data formally withdrew its full-year 2025 earnings guidance amid strategic reviews.

- Peak Mining divestiture completed in November 2025, bringing $50 million in upfront proceeds and up to an additional $150 million in contingent payments.

- The company continues to issue press releases on asset sales, leadership changes, and strategic partnerships across 2025 and early 2026.

- Northern Data expanded its focus on Taiga Cloud and Ardent Data Centers, signaling a pivot to high-value enterprise services.

- Shareholder engagement events, including AGMs and earnings presentations, increased in frequency in 2025.

- Investment research firms widened coverage, recommending the stock with varying price targets in early 2025.

- Northern Data’s press pipeline includes notices on options expirations and share pledges by major stakeholders.

- Divestitures and redeployments of historic investments illustrate a strategic asset rebalancing toward HPC infrastructure.

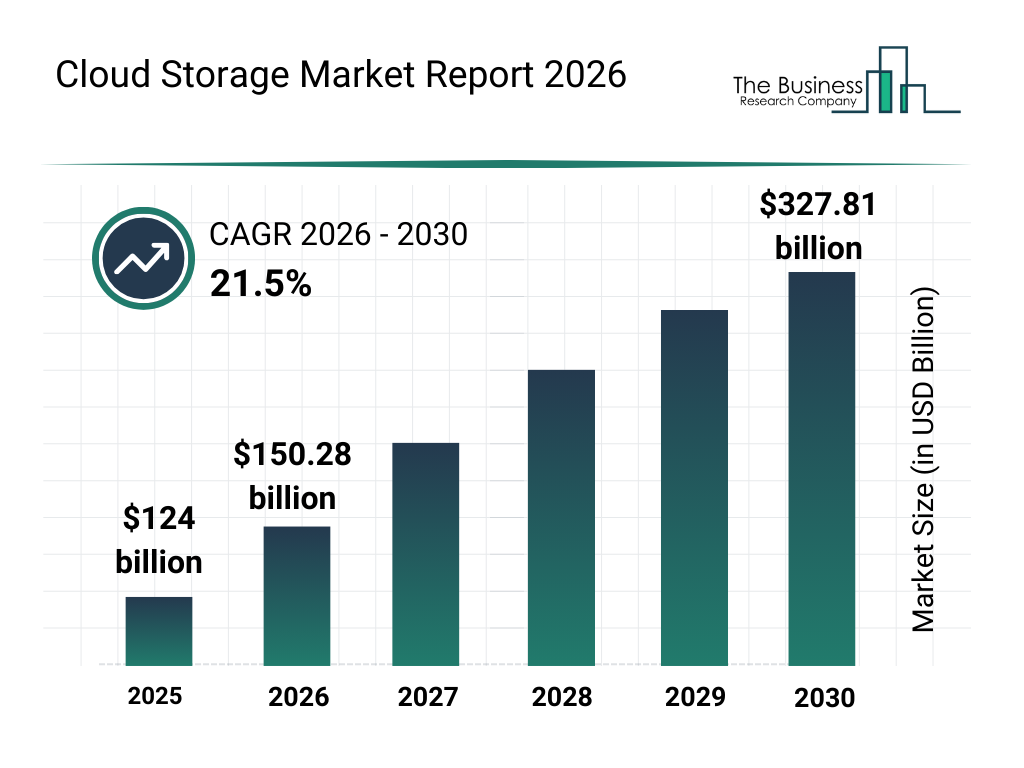

Cloud Storage Market Growth Outlook

- The global cloud storage market was valued at $124 billion in 2025, marking a strong baseline for future expansion.

- Market size is projected to reach approximately $150.28 billion in 2026, reflecting accelerating enterprise adoption.

- The industry is forecast to grow at a robust 21.5% CAGR between 2026 and 2030, signaling sustained high demand.

- By 2030, the cloud storage market is expected to surge to about $327.81 billion, more than doubling within five years.

- The steady year-over-year increase from 2025 through 2030 highlights rapid digital transformation across industries.

- Growth is driven by rising data volumes, AI workloads, remote work infrastructure, and enterprise cloud migration.

Trading Volume and Liquidity Statistics

- Average daily shares traded ~809 on the Milan exchange.

- Shares outstanding: 64,196,677.

- Market cap February: €808.88 million.

- Recent stock price ~€12.80 on February 6.

- Weekly volatility 8%, higher than 75% of German stocks.

- Average volume recent 70,320 shares.

- Trading venues Xetra, Frankfurt, Munich, Berlin, Düsseldorf, Tradegate.

- 52-week range €11.55-€50.30.

- OTC trading via NDTAF in the USA.

Cash Flow and Liquidity Metrics

- Northern Data’s net debt is forecasted to exceed €750 million by year-end.

- Borrowings are expected to reach approximately €750+ million amid infrastructure financing.

- Revenue growth projected at 37.44%, supporting cash flow improvements.

- Capital expenditures continue to be high for GPU and data center expansions.

- Operating cash flow is anticipated to be negative due to elevated capex and depreciation.

- Liquidity ratios enhanced post-Peak Mining divestiture proceeds.

- Access maintained to hardware-collateralized structured financing.

- Working capital rose with expanding cloud customer contracts.

- Cash equivalents are projected to be over €120 million for operational support.

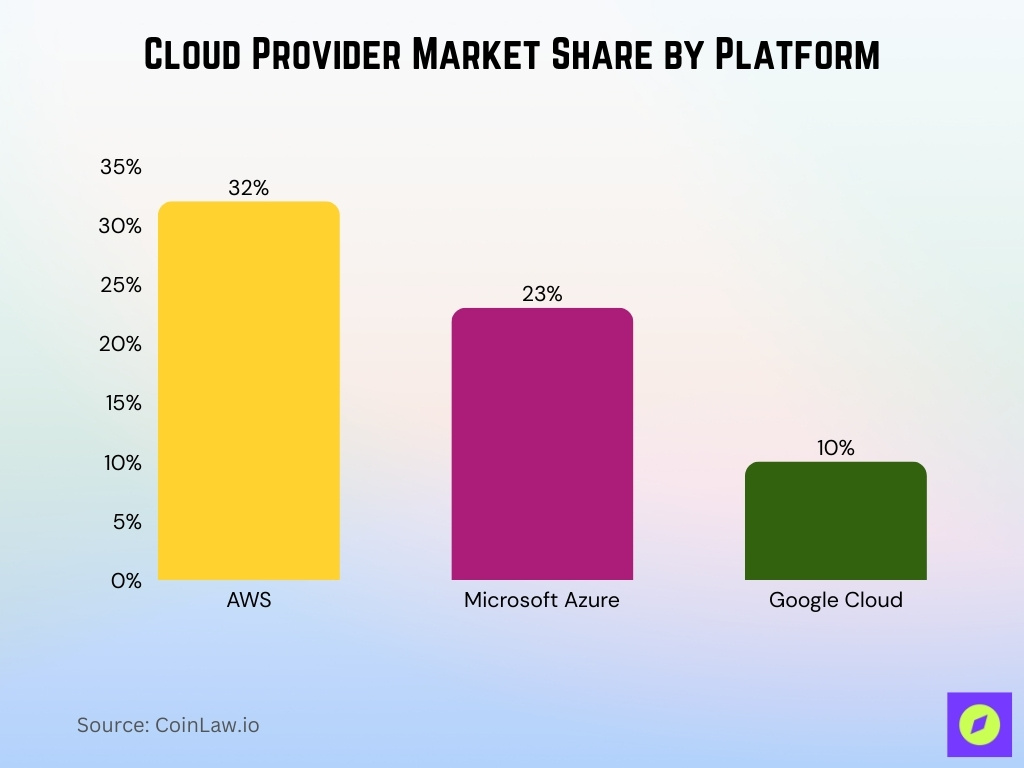

Cloud Provider Market Share by Platform

- Amazon Web Services (AWS) leads the market with a dominant 32% share, maintaining a strong position in global cloud infrastructure.

- Microsoft Azure holds the second spot with 23% market share, reflecting rapid enterprise adoption and integration with Microsoft’s ecosystem.

- Google Cloud accounts for 10% of the market, positioning it as a significant but smaller competitor among hyperscale providers.

- The combined share of the top three providers reaches 65%, highlighting strong market concentration among major cloud platforms.

- AWS alone commands nearly one-third of the global cloud market, underscoring its first-mover advantage and extensive service portfolio.

Bitcoin Mining Capacity and Hashrate Statistics

- Prior to the Peak Mining divestiture, Northern Data operated mining capacity exceeding 3.7 EH/s, exahashes per second.

- Mining revenue increased 118% year over year in Q3 2025, supported by higher Bitcoin prices and optimized fleet efficiency.

- The company previously deployed tens of thousands of ASIC mining units across European and North American sites.

- Bitcoin network’s hashrate globally exceeded 600 EH/s in 2025, increasing competitive pressure.

- Energy costs represented a major portion of mining operating expenses, often exceeding 50% of segment costs.

- Mining gross margins improved in late 2024 following Bitcoin’s price recovery above $ 60,000.

- Peak Mining divestiture deal valued up to $200 million, shifting focus away from direct mining exposure.

- Post divestiture strategy prioritizes AI and HPC over volatile crypto mining revenue.

- Mining asset impairment charges in prior periods impacted overall profitability.

Energy Consumption and Efficiency Metrics

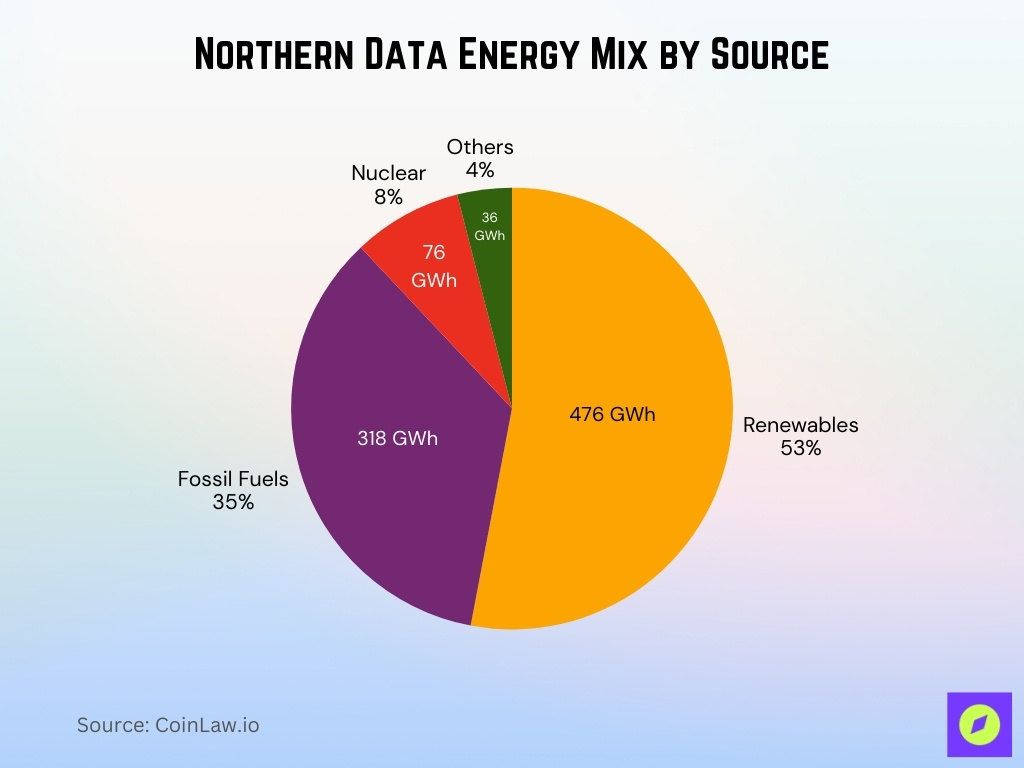

- Renewable energy accounted for 476 GWh (53%) of total consumption.

- PUE achieved 1.12 at the Swedish data center, below the 1.2 target.

- Fossil fuels contributed 318 GWh (35%), nuclear 76 GWh (8%).

- New Pittsburgh facility targets PUE as low as 1.15 with liquid cooling.

- Swedish site operates at PUE 1.07 using 100% hydropower.

- Partners maintain PUE levels of 1.2 or lower across colocation sites.

- Local hydropower capacity supports up to 4.5 GW for operations.

- GPU workloads drive increased energy needs for NVIDIA deployments.

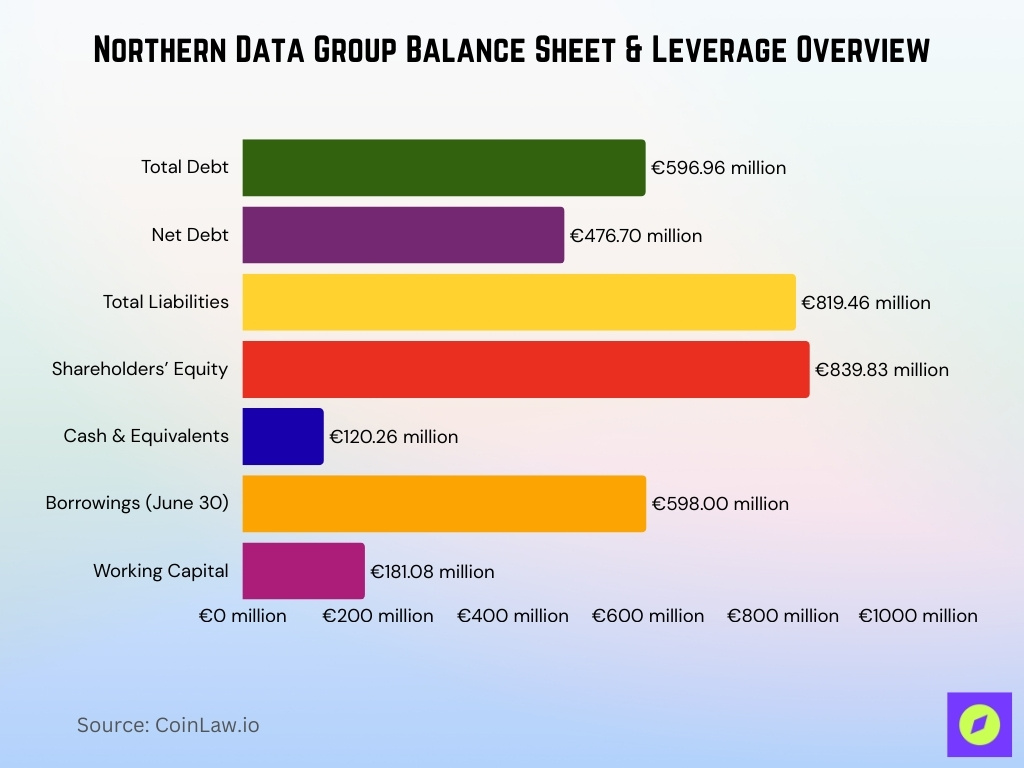

Balance Sheet and Leverage Indicators

- Total debt €596.96 million.

- Net debt €476.7 million.

- Total liabilities €819.46 million.

- Shareholders’ equity €839.83 million.

- Debt-to-equity ratio 71.08%.

- Cash and equivalents €120.26 million.

- Borrowings as of June 30: €598 million.

- Working capital €181.08 million.

Data Center Locations and Capacity Statistics

- Operates 7 data centers across 6 regions, including Germany, Sweden, Norway, the Netherlands, US.

- Aggregate HPC-ready capacity exceeds 850 MW in the Europe and US portfolios.

- Ardent Data Centers deploys 250 MW across 8 global sites by 2027.

- Pittsburgh facility provides 20 MW with 135 kW+ rack densities.

- US Georgia site develops 120 MW, expandable to 180 MW by Q1 2027.

- Amsterdam colocation offers 6 MW scalable capacity.

- Nordic sites like Boden and Lefdal leverage cool climates for efficiency.

- Lefdal Mine hosts high-density operations in Norway.

High Performance Computing, HPC, and AI Infrastructure Metrics

- Taiga Cloud revenue guided at €150–210 million for 2025, ~60–65% of group total.

- Access to up to 10,000 NVIDIA GPUs via the Core42 partnership for AI workloads.

- Portfolio enables over 850 MW HPC-ready capacity across sites.

- 22,000+ NVIDIA GPUs including 20,000 H100s integrated post-Rumble acquisition.

- Taiga operates one of Europe’s largest GPU clusters for bare metal AI.

- Cloud recurring revenue share rose to 43% in H1 2025.

- Group revenue outlook €240–320 million with Adjusted EBITDA €80–130 million.

- Pittsburgh AI/HPC center supports 135 kW+ rack densities for GPU clusters.

- Enterprise AI demand drives GPU utilization improvements throughout the year.

ESG, Sustainability, and Green Energy Metrics

- Renewables supplied 476 GWh (53%), fossil fuels 318 GWh (35%).

- Nuclear contributed 76 GWh (8%), other sources 36 GWh (4%).

- Total energy consumption hit 906 GWh in 2024, up 15% from 787 GWh.

- Swedish data center PUE achieved 1.12, partners maintain ≤1.2.

- Preparing GHG emissions under EU CSRD effective FY2026.

- Swedish site PUE 1.07 with 100% hydropower, 4.5 GW capacity.

- Liquid cooling systems are integrated for energy efficiency.

- Hardware lifecycle program remarkets/recycles discarded assets.

Customer Base and Contract Portfolio Statistics

- Enterprise customer base expanded to serve AI startups, research institutions, and enterprises across Europe.

- Taiga Cloud diversified its clients through cloud enablement, attracting new multi-tenant users.

- Core42 partnership adds a major sovereign AI customer with 10,000 GPU access.

- Rumble acquisition brings media/tech clients, valued at $767 million deal.

- Recurring cloud revenue share hit 43% of the group total in H1 2025.

- Long-term contracts provide visibility, with a Taiga run-rate of €150–210 million annualized.

- Geographic mix is primarily European, with growing US/international exposure.

- Enterprise SLAs target >99.9% uptime for HPC workloads.

- Customer pipeline stages show strong interest in scalable GPU software solutions.

Geographic Revenue and Operations Breakdown

- Europe generated €140.41 million in revenue, 70% of the total.

- Germany contributed €8.32 million, down 92.41% YoY.

- United States revenue at €32.11 million, 16% share.

- Nordic regions host ~250 MW via Ardent across Sweden and Norway.

- Europe (ex-Germany) led with €37.10 million, -12.59% growth.

- H1 cloud revenue €40.8 million, primarily European-based.

- ~850 MW HPC capacity concentrated in Europe/US.

- Post-Peak divestiture minimized North American mining ops.

- Electricity opex tied to Nordic hydro/wind grids.

Employee Headcount and Workforce Statistics

- Employee growth of 54 from the prior year amid HPC expansion.

- Revenue per employee stood at €1,006,387.

- Workforce costs rose with engineering hires for GPU/AI roles.

- ~200 specialists in data center engineering, AI deployment.

- Majority based in Germany, followed by Nordic sites.

- Shift to AI cloud engineers from mining technicians.

- Compensation expenses increased via incentive retention programs.

- Recruitment targets HPC operations and reliability engineering.

Major Risks, Controversies, and Regulatory Events Statistics

- Withdrew 2025 earnings guidance early 2026 due to GPU pricing volatility and transactions.

- Net debt at €598 million mid-2025, projected at €750+ million year-end.

- Canaccord downgrades Buy to Hold, price target cut from €27 to €15.

- EPPO probe alleges tens of millions € VAT fraud on GPU tax incentives.

- Sept 2025 German police raids on data infrastructure for regulatory scrutiny.

- Peak Mining’s sale controversy to Tether-linked entities raises conflict concerns.

- Corpus Christi sale option expired in January 2026, zeroing $200 million cash payout.

- Former execs allege financial misrepresentation, tax evasion in 2024 lawsuit.

- Customer concentration in enterprise HPC elevates revenue risk.

Frequently Asked Questions (FAQs)

Analyst models indicate a 33.1% annual revenue growth rate into the future.

Adjusted EBITDA for H1 2025 was EUR 21.3 million, an increase of 101% from H1 2024.

Taiga Cloud accounted for around 43% of total revenue in H1 2025, up from 33% in the prior year.

Conclusion

Northern Data enters today as a company in transition. It has shifted from heavy exposure to cryptocurrency mining toward AI-driven high-performance computing and cloud infrastructure. Revenue composition, capital allocation, and workforce structure now reflect that pivot. However, leverage levels remain elevated, and profitability depends on the successful scaling of recurring HPC contracts.

At the same time, global demand for AI compute continues to expand, creating a sizable opportunity for infrastructure providers with reliable European capacity. Energy efficiency, regulatory compliance, and disciplined capital management will determine how effectively Northern Data converts infrastructure investment into sustainable earnings growth. For investors and industry observers alike, this year represents a defining year in the company’s strategic evolution.