One of YouTube’s most popular creators, MrBeast, just made a bold crypto move, buying nearly $1 million worth of ASTER tokens as the project sees explosive growth.

Key Takeaways

- MrBeast accumulated 538,384 ASTER tokens over three days, worth around $990,000, through two public wallets.

- ASTER price surged over 6000 percent since launch and hit an all-time high of $2.30, before correcting to around $1.84.

- Aster’s trading volume reached $36 billion in 24 hours, driving decentralized exchange (DEX) activity to a record $70 billion.

- Market reactions to MrBeast’s move are mixed, with some calling it bullish and others warning of a potential sell-off.

What Happened?

Crypto tracking platform Lookonchain reported that Jimmy Donaldson, known as MrBeast, bought 538,384 ASTER tokens using wallets labeled 0x9e67 and 0x0e8A. He deposited $1 million in USDT to fund the purchase at an average price of $1.87 per token. This happened as ASTER made headlines for becoming one of the most traded tokens across decentralized exchanges.

MrBeast(@MrBeast) bought 538,384 $ASTER($990K) over the past 3 days.

— Lookonchain (@lookonchain) September 26, 2025

He deposited 1M $USDT into #Aster using public wallet 0x9e67 and new wallet 0x0e8A, then withdrew 538,384 $ASTER.

The average buying price was likely ~$1.87.https://t.co/Gm7MPrUqEk pic.twitter.com/cntXZ9XEQP

MrBeast’s Entry Shakes Up the Market

MrBeast’s high-profile investment immediately triggered market buzz. On-chain data confirms the transaction trail, including a 67,000 ASTER token movement worth $124,000 through his OpenSea-linked “WuTangClan” wallet. These wallet activities sparked widespread speculation and debate on X (formerly Twitter).

While some crypto users view his involvement as a bullish indicator, others are skeptical due to MrBeast’s history of controversial altcoin trades. Past reports from Lookonchain and Arkham Intelligence allege that he profited over $23 million from tokens like $SUPER, $ERN, $PMON, $STAK, and $AIOZ. These profits are tied to claims of early access and token pumps that left retail investors at a disadvantage.

ASTER Dominates DEX Trading Volume

MrBeast’s investment coincides with ASTER’s record-breaking performance on decentralized exchanges. On Thursday alone, perpetual DEX volumes hit $70 billion, with ASTER contributing over 50 percent of that total at nearly $36 billion. The project has overtaken competitors like Hyperliquid and Lighter in trading volume and user engagement.

Key drivers behind ASTER’s surge include:

- Incentivized trading and holding programs.

- Aggressive airdrop eligibility mechanisms.

- Strategic backing from Yzi Labs, formerly Binance Labs.

- Public endorsement by former Binance CEO Changpeng Zhao.

Whale Activity and Market Risks

Blockchain data reveals that two whale wallets now control 129.59 million ASTER, valued at around $259 million, which accounts for 7.82 percent of the circulating supply. Some of these wallets are believed to be linked to Galaxy Digital, despite rumors suggesting connections to the Trump family via Truth Social, which remain unverified.

This level of market concentration raises concerns about potential price manipulation and volatility, especially given the recent price correction of over 28 percent from its peak.

ASTER Price Action and Technical Outlook

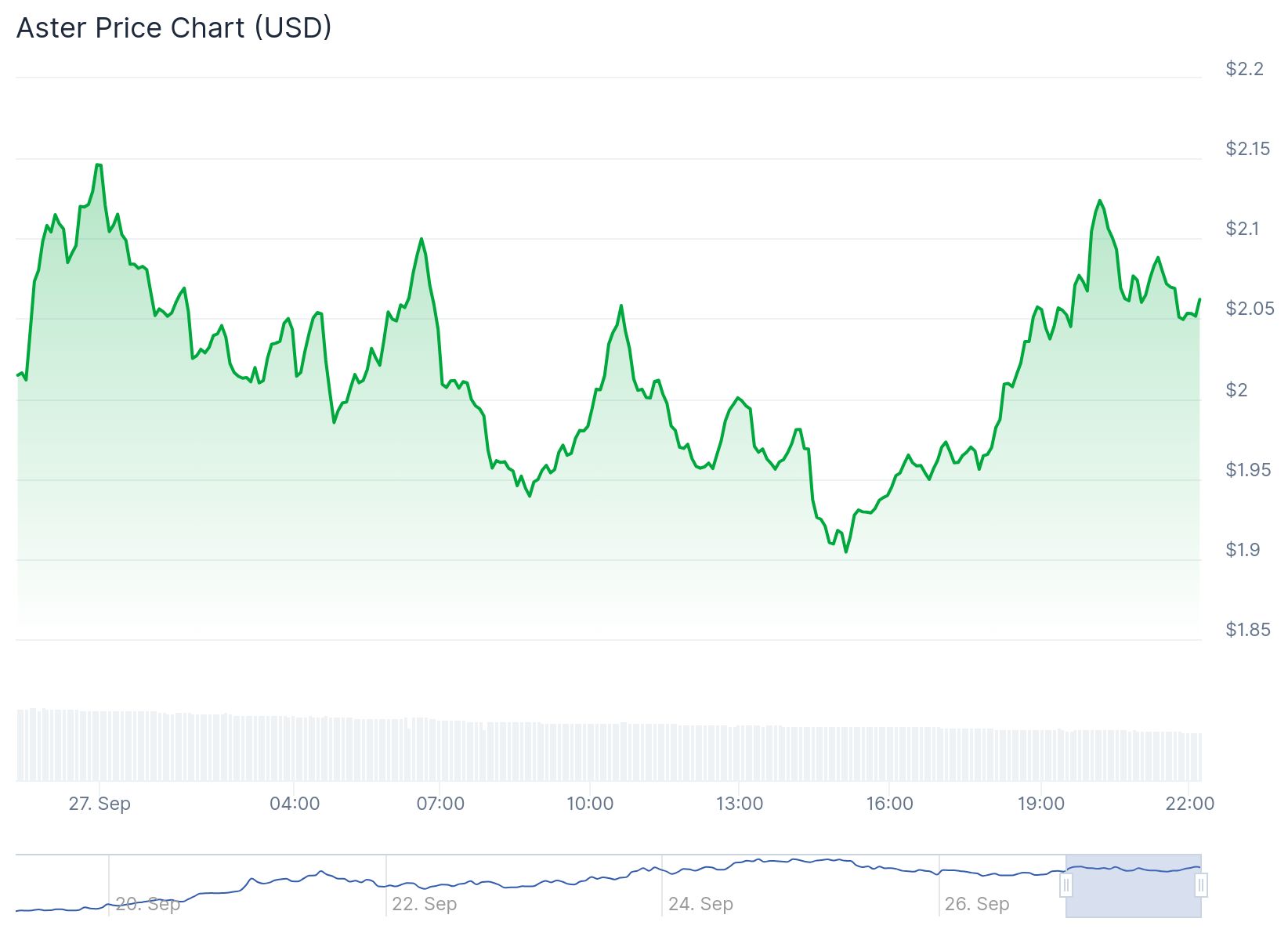

Currently, ASTER is trading around $2.07, finding support near the $1.80 to $1.85 range. Price charts show signs of consolidation after the sharp pullback from $2.40.

If bulls fail to hold the $1.80 level, ASTER may slide toward $1.60. However, shrinking trading volumes suggest that selling pressure is weakening, giving bulls a chance to regain control.

CoinLaw’s Takeaway

In my experience, when influencers like MrBeast enter the crypto space, it always gets complicated. On the one hand, he brings millions of eyes to ASTER, which can boost visibility, trading volume, and short-term price action. On the other, his track record raises fair questions. If he cashes out like in past projects, retail investors could be left holding the bag.

What’s clear is that ASTER is not just hype. It’s delivering record-breaking DEX volumes, has institutional backing, and is building real infrastructure in the Layer-2 space. But with big money and big personalities involved, investors should stay sharp, track wallet movements, and not get swept up in the hype without doing their own research.