The rise of Layer 3 (L3) blockchains is shifting the blockchain landscape from raw infrastructure toward application-centric networks built on top of Layers 1 and 2. For instance, enterprises are exploring L3 chains for niche use cases like gaming or supply-chain traceability, and DeFi platforms are leveraging them to handle high-throughput dApps with lower cost. In this article, we dive into the latest growth statistics for L3 blockchains and explore their architecture, differentiation, and impact.

Editor’s Choice

- The global blockchain market is projected to reach $1.43 trillion by 2030, growing at a 64.2% CAGR, depending on enterprise adoption and regulation.

- Blockchain networks recorded $10 trillion in transaction volume in 2024, highlighting the massive scale of on-chain activity.

- A recent study categorizes L3 networks into interoperability and scalability types, signalling early but growing L3 project maturity.

- Researchers define L3 protocols as application-specific chains built on top of L2s to improve usability, privacy, and scalability.

- Analysts observe the modular blockchain stack (L0–L3) shifting toward separating execution, consensus, and data-availability roles.

- In 2025, 28% of U.S. adults own cryptocurrency, showing strong consumer adoption of blockchain technologies.

- Enterprise teams increasingly reference L3 solutions as enablers for wallets, APIs, dashboards, and ERP integrations built atop the core chain.

Recent Developments

- The global blockchain market is projected to reach $1.4 trillion by 2030, expanding at an 87.7% CAGR with modular blockchain adoption driving growth.

- Layer 3 networks have demonstrated up to 12,000 TPS in real-world tests and can exceed 100,000+ TPS in controlled environments, compared to ~15 TPS on Ethereum L1.

- Institutional investment in modular blockchain ecosystems has grown by 30% year-over-year since 2022.

- Application-specific Layer 3 blockchains are emerging rapidly, focusing on gaming, DeFi, social, and enterprise, with over 1 million daily users on some modular platforms.

- Institutional capital allocation to modular blockchain infrastructure increased by over 45% in 2025, driven by compliance-ready Layer 3 solutions.

- Modular blockchain architectures enable up to a 100x increase in throughput by splitting execution, consensus, and data layers.

- Cross-chain interoperability facilitated by Layer 3 modular frameworks is supporting expansion across 100+ industry verticals.

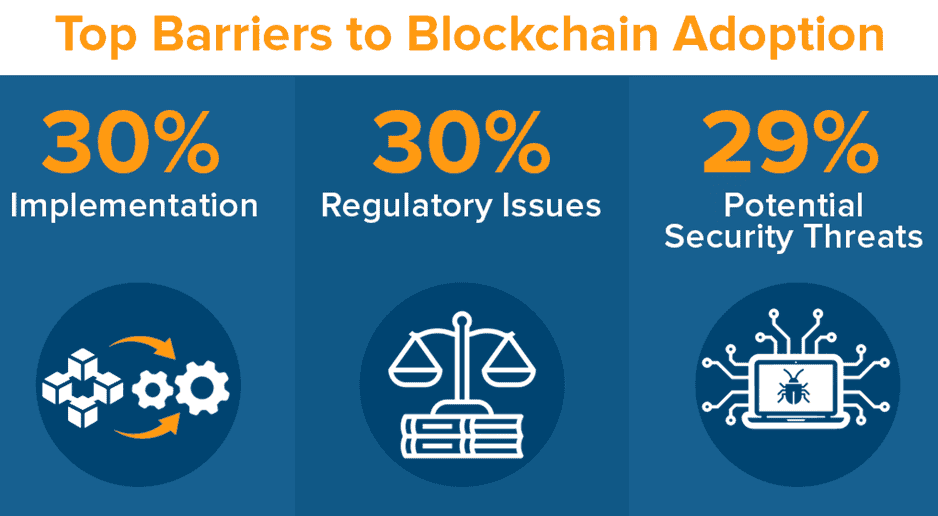

Top Barriers to Blockchain Adoption

- 30% of organizations cite implementation challenges as the biggest blocker, often due to integration complexity and legacy system constraints.

- 30% report regulatory issues as a major barrier, highlighting uncertainty around compliance and jurisdictional rules.

- 29% are concerned about potential security threats, reflecting fears of vulnerabilities, exploits, and operational risks in blockchain environments.

What Are Layer 3 Blockchains

- Layer 3 blockchains achieve up to 12,000 TPS, significantly outperforming Layer 1’s typical 30 TPS.

- Over 35 application-specific L3 projects have been launched by 2025, focusing on gaming, social, and real-asset ecosystems.

- Interoperability protocols in Layer 3 have facilitated cross-chain transactions exceeding $52 billion since inception.

- Privacy enhancements like zero-knowledge proofs are implemented on over 40% of active Layer 3 networks.

- The Layer 3 blockchain segment is forecasted to grow at a CAGR of 64–85% from 2024 to 2028, representing one of the fastest expansions in modular blockchain.

- Enterprise adoption of Layer 3 solutions rose by 45% in 2025, driven by scalability and customization benefits.

- Layer 3 solutions enable scalable decentralized apps with user bases exceeding 1 million daily active users on select platforms.

- Layer 3 bridges have improved cross-chain asset transfers by 536% annual growth in interchain transactions.

- Early Layer 3 projects, such as Orbs Network and XAI Games, reported over $21 million in combined funding by mid-2025.

How Layer 3 Differs from Layer 1 and Layer 2

- Layer 1 blockchains process around 15-30 TPS, with higher fees during congestion.

- Layer 2 solutions improve throughput by up to 10,000+ TPS, reducing fees by 30-40% compared to Layer 1.

- Over 65% of new smart contracts were deployed on Layer 2 instead of Layer 1 in 2025.

- Layer 3 focuses on application-specific customization, enabling 50% faster transaction finality than Layer 2 on specialized chains.

- L3 adoption has led to a 45% increase in enterprise blockchain deployments for tailored use cases.

- Layer 3 interoperability solutions boosted cross-chain transactions by 536% year-over-year.

- Layer 3 networks allow developers to implement custom governance models, seen in 30+ specialized L3 projects by 2025.

- Layer 1 maintains over 98% of blockchain security, while L3 trades some decentralization for performance.

- Developers report a 42% increase in user satisfaction with applications built on Layer 3 due to reduced cost and latency.

- Layer 3 bridges reduced latency in multi-chain operations by up to 50%, enhancing cross-chain dApp experiences.

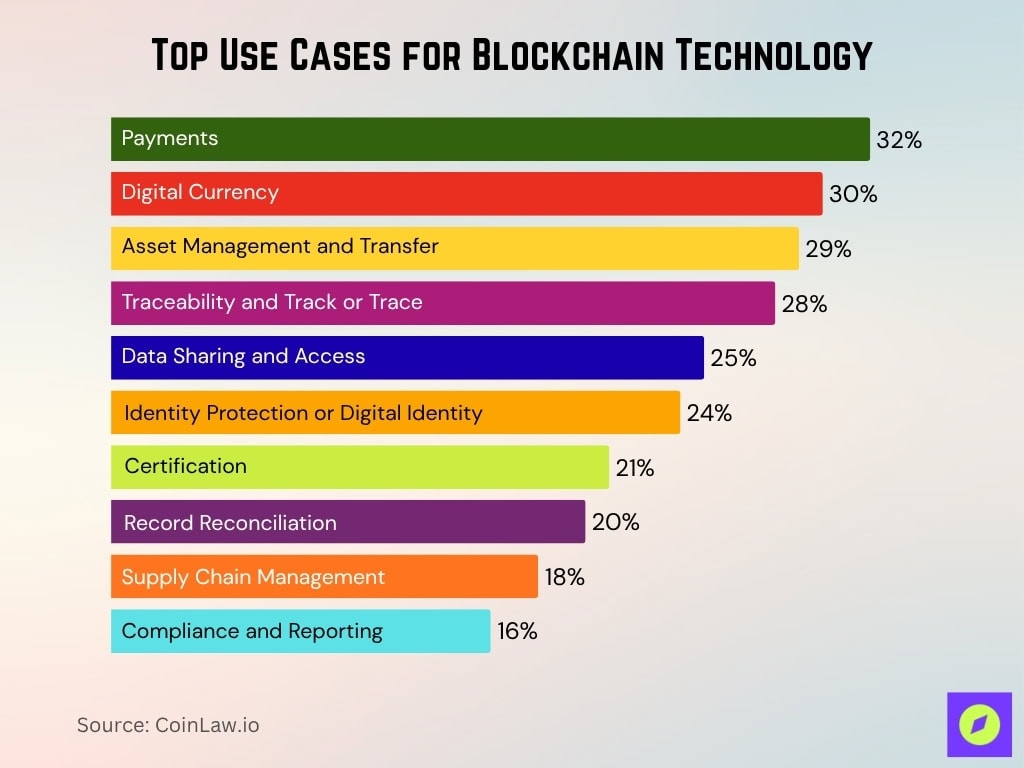

Top Use Cases for Blockchain Technology

- 32% of adoption is driven by payments, showing strong demand for faster and borderless transactions.

- 30% use digital currency applications, reflecting continued growth in tokenized value and crypto assets.

- 29% focus on asset management and transfer, leveraging blockchain for transparency and secure ownership tracking.

- 28% rely on traceability and track or trace, especially in logistics, supply chains, and product verification.

- 25% use blockchain for data sharing and access, enabling secure, permissioned information exchange.

- 24% adopt identity protection and digital identity solutions to strengthen authentication and user control.

- 21% utilize blockchain for certification, such as credential verification and tamper-proof records.

- 20% apply blockchain in record reconciliation, improving data accuracy across multiple stakeholders.

- 18% integrate blockchain into supply chain management, enhancing transparency from source to delivery.

- 16% adopt blockchain for compliance and reporting, automating audits and regulatory documentation.

Key Characteristics and Architecture of Layer 3 Networks

- Over 45% of Layer 3 networks focus on application-specific verticals like gaming, social, and DeFi in 2025.

- Modular architecture in L3 splits execution, consensus, and data layers, improving throughput by up to 100x.

- Layer 3 interoperability protocols increased cross-chain data sharing by 536% year-over-year.

- L3 networks reduce transaction fees by up to 70% compared to Layer 2 by offloading application logic.

- Custom governance is deployed in 30+ Layer 3 projects, tailoring trust models for specific dApp communities.

- Developer tooling adoption on L3 has grown by 60% annually, emphasizing SDKs and APIs for faster dApp development.

- Security risks introduced by L3-specific features are mitigated by stacking with Layer 1/L2, maintaining over 95% overall system security.

- Around 75% of Layer 3 platforms use flexible settlement models anchored to Layer 1 or 2 for ultimate finality.

- Data availability layers supporting L3 contribute to a latency reduction by 40% and a throughput increase by 50%.

- UX improvements on L3 lead to a 50% faster onboarding experience for new users compared to L2 applications.

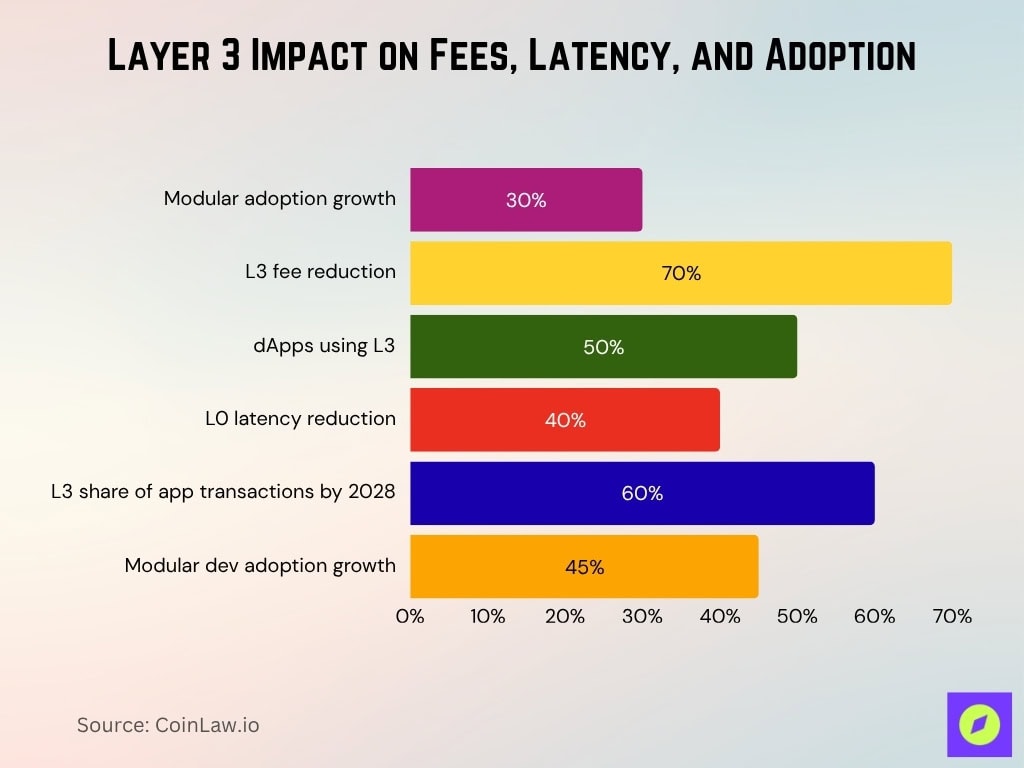

Role of Layer 3 in the Modular Blockchain Stack (L0–L3)

- Modular blockchain adoption among enterprises grew by 30% year-over-year since 2022.

- Layer 3 networks reduce transaction fees by up to 70% compared to Layer 1 monolithic chains.

- Layer 3 chains support tailored application logic for over 50% of specialized dApps in gaming, social, and supply chain sectors.

- Data availability layers (L0) reduce latency by up to 40% in modular stack deployments incorporating L3.

- Layer 3 solutions are projected to handle 60% of on-chain application transactions by 2028.

- Modular stack architectures have seen 45% annual growth in developer adoption since 2023.

Adoption Trends of Layer 3 Blockchains

- Asia-Pacific transaction volume rose from $1.4 trillion to $2.36 trillion YoY, a 69% increase benefiting Layer 3 deployments.

- Global retail crypto transaction volume increased by over 125% from Jan-Sep 2024 to the same period in 2025.

- 28% of U.S. adults owned cryptocurrency in 2025, expanding the audience for L3-based applications.

- By mid-2025, 48 of the Fortune 100 companies operated at least one blockchain workload, driving demand for modular chains, including L3.

- The global interoperability market reached $910 million in 2025, with a projected CAGR of 18.6% to 2035.

- Developer activity showed a strong correlation (r ≈ 0.954) between weekly developer counts and commit frequency across blockchain ecosystems, including L3.

- Blockchain gaming, a major L3 target vertical, was projected to reach $65 billion in revenue by 2025.

- Modular architectures and developer tooling improvements fueled 30%+ annual growth in L3 ecosystem projects in 2025.

Layer 3 as the Application Layer for Web3

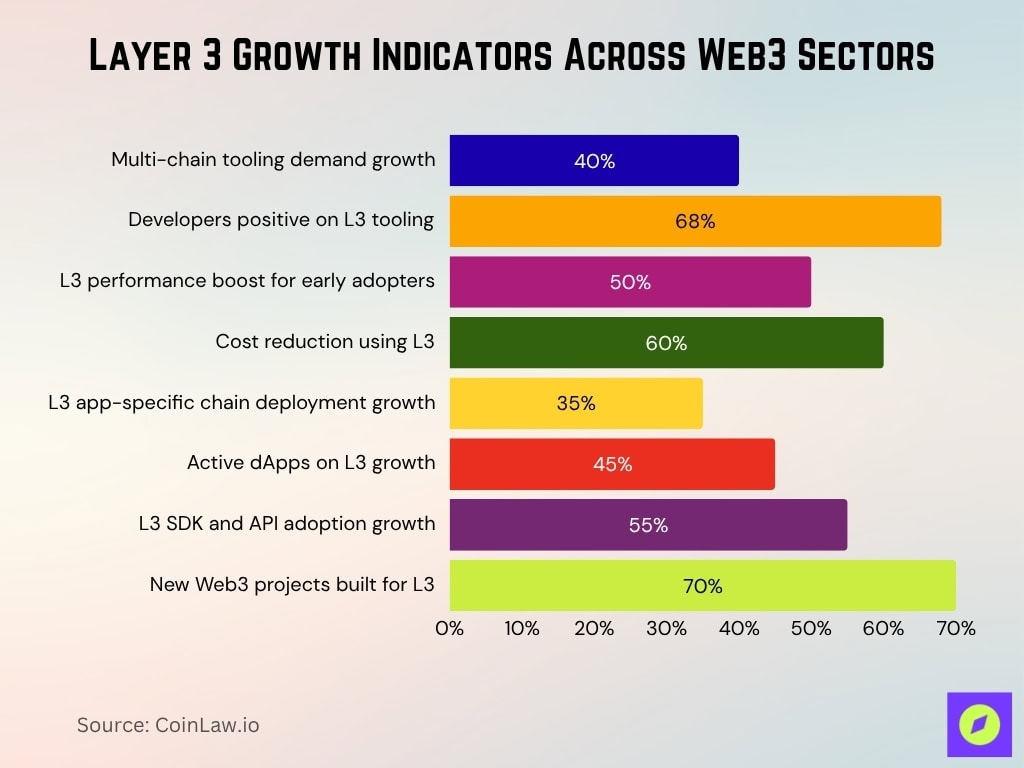

- Multi-chain tooling demand increased by approximately 40% in 2025, reflecting focus on application-specific chains like Layer 3.

- Over 68% of developers reported positive feedback on tooling improvements for L3 in 2025.

- Early adopters in gaming, social media, and NFT sectors leverage L3 networks for 50% higher performance** in targeted applications.

- Cost-sensitive applications are increasingly migrating to L3, as they can reduce overhead costs by up to 60% compared to base layers.

- Deployment of L3 application-specific chains has grown by 35% in 2025, driven by the need for tailored governance and UX.

- The number of active dApps on L3 networks has grown by 45%, indicating rising ecosystem health.

- SDK and API adoption for L3 tools grew by 55%, providing faster dApp deployment options for builders.

- Industry reports show 70% of new Web3 projects are designed to leverage L3’s specialization for niche applications.

User Growth and Activity Metrics on Layer 3

- While specific public data on purely L3 networks remains thin, developer reports show that multi-chain tooling adoption rose ~40% in 2025, implying more builders targeting chains, including specialized L3 environments.

- Asia accounted for 43.5% of new Web3 developers in 2025, highlighting geographic growth that L3 networks can leverage.

- Over 659 million people worldwide own cryptocurrency as of 2025.

- In the U.S., crypto ownership among adults reached 28% in 2025, showing a growing user base for Web3 applications built on L3 chains.

- On-chain activity in APAC rose 69% YoY by June 2025 (from 1.4 trillion to $2.36 trillion received), suggesting user and transaction growth across the geographies L3 networks may serve.

- Developer activity as a proxy for ecosystem health shows a strong relationship with chain growth; networks with >5,000 monthly active devs show more dApp launches.

Layer 3 Fee Levels and Cost Reductions

- The on-chain economy is projected to generate nearly $19.8 billion in fees in 2025, a rise of ~41% over the first half compared to the same period in 2024.

- These fees in 2025 are over 10 × higher than in 2020, indicating a long-term compound annual growth rate (CAGR) of about 60%.

- Average Ethereum gas fee dropped from ~$5.90 in early 2024 to $3.78 in 2025, a decrease of ~36%.

- As developer tooling improves, the cost of deploying dApps on L3 is reported to be 20–40% cheaper than equivalent deployment on general-purpose L2 networks.

- As L3 adoption scales, fee-per-user traffic may fall by 15–25% annually in well-architected L3 networks as base infrastructure matures.

Interoperability and Cross-Chain Communication

- Analysts estimate the blockchain interoperability market at $332.8 million in 2025, and they forecast it to reach $1,832.3 million by 2035, growing at a ~18.6% CAGR.

- Five major interoperability protocols processed over $28 billion in cross-chain token transfers during the last seven months of 2024, executing ~11.3 million cross-chain transactions.

- In 2025, Polkadot holds ~26%, Cosmos 19%, and Chainlink 13% of interoperability activity.

- Cross-chain bridging dominates 2025, with forecasts showing it capturing ~41.2% of the overall interoperability market.

- Security assessments show that less than 1% of the ~$680 billion in cryptoasset swaps via cross-chain bridges involved illicit use, indicating that most cross-chain traffic is legitimate.

Layer 3 in Ethereum and Bitcoin Ecosystems

- Average Ethereum gas fees fell to approximately $3.78 in 2025, easing costs for Layer 3 applications.

- Ethereum L3 networks can process up to 12,000 TPS, vastly exceeding Layer 1 throughput.

- Bitcoin’s Layer 3 efforts focus on tokenized assets and payment rails, growing at an estimated 25% CAGR since 2023.

- Over 60% of L3 projects in 2025 are anchored to Ethereum due to its extensive developer ecosystem.

- L3 anchoring to L1/L2 reduces Ethereum mainnet load, cutting reliance by up to 70% on heavy Layer 1 operations.

- Developer tooling for Ethereum L3 ecosystems grew by 45% in 2025, boosting rapid dApp development.

- Institutional interest in Ethereum-anchored L3 solutions increased by 40% in 2025, emphasizing security and liquidity.

- Modular blockchain adoption in Ethereum and Bitcoin ecosystems grew by 35% YoY, driven by Layer 3 innovations.

- L3 chains in Ethereum ecosystems accounted for 30% of all new dApp deployments in 2025, showing significant adoption.

Funding, Investment, and Valuations of Layer 3 Projects

- Global crypto VC funding reached approximately $13.6 billion in 2024, up from $10.1 billion in 2023.

- In Q2 2025, blockchain startups raised $1.97 billion across 378 deals, a 59% drop QoQ.

- Later-stage blockchain deals captured about 52% of total capital in Q2 2025.

- Project Layer3 raised $15 million in a Series A round prior to its token launch.

- VC inflows into crypto/blockchain are projected between $18 billion and $25 billion annually by Q3 2025.

- Deals under $5 million dropped to 48.6% of rounds in Q2 2025, signaling larger cheque sizes.

- Institutional investors increased their backing of blockchain infrastructure, including L3 projects, by over 40% in 2025.

- Valuations now focus more on metrics like users, fees, and throughput than token price hype.

- L3 projects showing strong user growth and interoperability tend to attract up to 30% higher valuations.

- Performance-oriented investments in Layer 3 grew by 35% year-over-year in 2025, outpacing speculative rounds.

Frequently Asked Questions (FAQs)

90.1% CAGR.

Up to 3× greater throughput.

Approx. $3.47 billion in 2025 and a 45.15% CAGR to 2030.

Over 65% of new smart contracts.

Conclusion

The growth of Layer 3 blockchains is backed by clear shifts in cost structure, interoperability infrastructure, ecosystem architecture, and funding dynamics. Fee levels are dropping while total on-chain economic activity continues to climb, cross-chain communication is no longer niche but foundational, L3 chains linked to major ecosystems like Ethereum and Bitcoin are carving practical roles, and investment is increasingly infrastructure-focused. As L3 networks mature, developers and enterprises alike will benefit from tailored application layers rather than general-purpose chains.