KPMG remains one of the “Big Four” professional services firms, shaping audit, tax, and advisory work for global businesses. The firm reported continued growth in revenue and headcount, while adapting to digital transformation and evolving client needs. Its data influences boardroom decisions, especially in finance and risk management, and guides talent strategies in professional services. From multinational audit mandates to tax policy consulting in the US and abroad, KPMG’s performance offers insights into global economic health. Scroll deeper to explore the latest hard figures and trends shaping KPMG’s performance.

Editor’s Choice

- $39.8B global revenue reported for FY25, up year‑over‑year.

- Revenue growth of ~5.4% in US dollars for FY25.

- 276,030 global workforce at the end of FY25.

- Tax and legal services revenue up 7.5% in FY25.

- Audit service revenues grew by roughly 6% in FY25.

- KPMG operates in 138+ countries and territories.

- MESAC region revenue up 19.1% in FY24.

Recent Developments

- KPMG achieved global revenue of $39.8 billion, up 5.1% in local currency from the prior year.

- Firm outperformed Big Four rivals with growth exceeding Deloitte‘s 4.8%, EY‘s 4%, and PwC‘s 2.7%.

- KPMG plans to reduce economic units from over 100 to as few as 32 through national partnership mergers.

- Global chairman Bill Thomas secured a term extension through September 2026 to lead restructuring efforts.

- KPMG committed $4.2 billion globally to technology, AI, and ESG initiatives by 2026.

- 71% of CEOs rank AI as top investment priority, up from 64% last year per KPMG survey.

- 69% of CEOs plan to allocate 10-20% of budgets to AI over the next 12 months.

- 67% of CEOs expect AI investment returns within 1-3 years, accelerated from a prior 3-5 year timeline.

- KPMG US ended the Accelerate 2025 DEI program targeting 50% underrepresented managing partners.

- KPMG surveyed semiconductor leaders, where 54% cite talent shortages as the top industry issue.

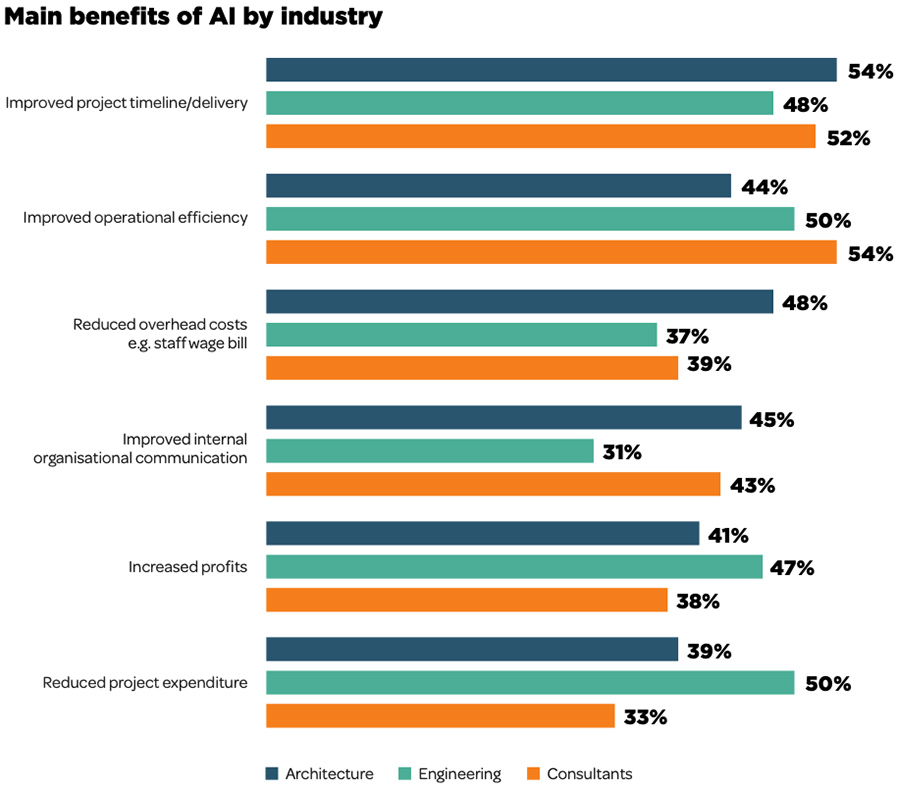

Main Benefits of AI by Industry

- Improved project timelines are the top AI benefit, cited by 54% of architecture firms, 48% of engineering firms, and 52% of consultants, highlighting faster delivery across sectors.

- Operational efficiency gains are strongest among consultants at 54%, followed by 50% in engineering and 44% in architecture, reflecting AI’s role in streamlining workflows.

- Overhead cost reductions, including staff wage bills, are reported by 48% of architecture firms, compared with 37% of engineering firms and 39% of consultants.

- Internal organisational communication improves most in architecture at 45%, while 43% of consultants and 31% of engineering firms report similar benefits.

- Profit increases linked to AI adoption are seen by 47% of engineering firms, ahead of 41% in architecture and 38% among consultants.

- Reduced project expenditure is most notable in engineering, where 50% of firms report savings, compared with 39% in architecture and 33% among consultants.

KPMG Overview

- KPMG International Limited is a British multinational professional services network.

- It was founded through mergers dating back to 1897, with the current structure from 1987.

- KPMG firms operate in 142 countries and territories, in line with the latest global organization disclosure.

- The firm’s service lines include Audit, Tax & Legal, and Advisory services.

- By FY24, KPMG employed over 275,000 professionals globally.

- KPMG serves a broad set of clients, from Fortune 500 companies to mid‑market firms.

- The firm emphasizes cross‑border collaboration across functions and regions.

- Corporate reports link financial performance with social impact planning.

- KPMG is regularly ranked among the top professional services firms worldwide.

- Its global strategy prioritizes multi‑disciplinary integration of services.

Global Revenue Statistics

- KPMG reported $39.8 billion in global revenue for the year ended 30 Sept. 2025.

- This reflects approximately 5.1%–5.4% growth over the prior year.

- FY24 global revenue was $38.4 billion, growing about 5.1% vs FY23.

- In local currency terms, FY24 revenue grew 5.1%.

- MESAC region saw a ~19.1% revenue expansion in FY24.

- Growth trends reflect sustained demand for integrated business services.

- KPMG’s revenue performance factors in global economic volatility and digital demand.

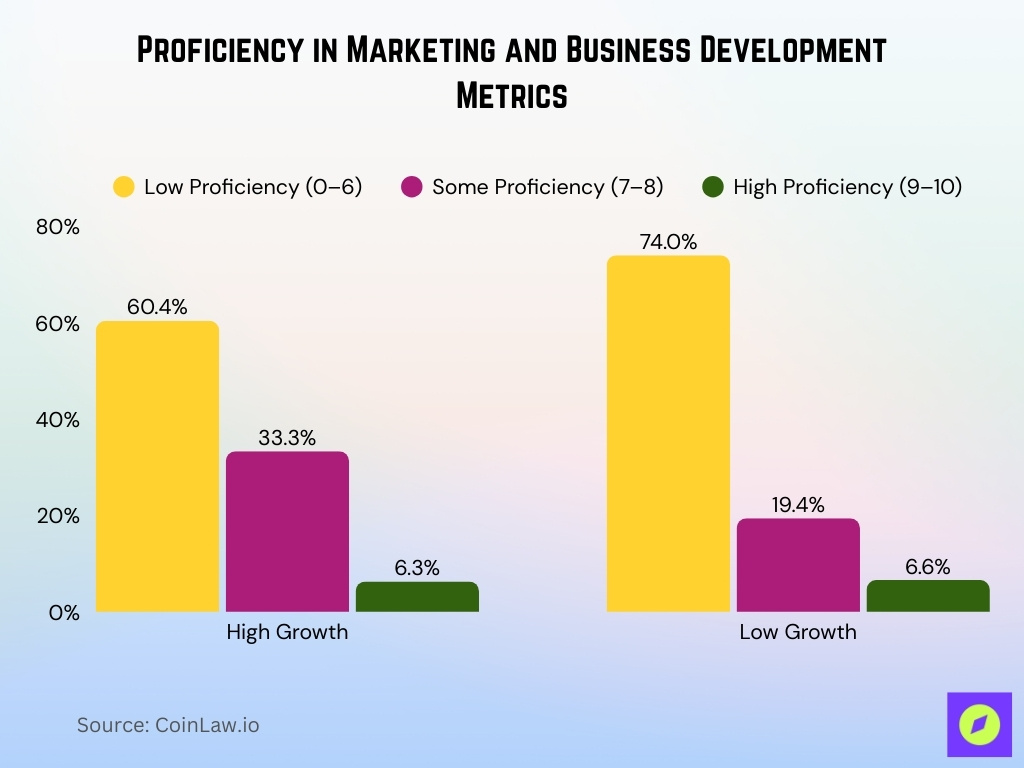

Proficiency in Marketing and Business Development Metrics

- Low proficiency remains dominant across firms, with 60.4% of high-growth organizations and an even higher 74.0% of low-growth organizations scoring 0–6 in capturing and using marketing and business development metrics.

- Some proficiency (scores 7–8) is far more common among high-growth firms at 33.3%, compared with just 19.4% in low-growth firms, suggesting stronger analytical maturity among faster-growing businesses.

- High proficiency levels (scores 9–10) are limited overall, reported by only 6.3% of high-growth firms and 6.6% of low-growth firms, indicating a broad gap in advanced metrics usage.

- High-growth firms outperform low-growth peers at intermediate proficiency levels, reinforcing the link between data literacy and growth performance.

- The data highlights a significant opportunity for improvement, as more than three-quarters of low-growth firms remain heavily concentrated in low metrics proficiency.

Revenue by Service Line

- Tax and legal services revenue climbed about 7.5% in FY25.

- Audit services grew roughly 6% in FY25.

- Advisory (Consulting) grew by about 2.9% in FY25.

- In FY24, audit was a large portion of total revenue (~$13.4 billion).

- Advisory services historically contributed the largest share of 2024 revenue (~$16.3 billion).

- Tax & legal services contributed around $8.7 billion in FY24.

- Growth in tax and legal reflects demand for global tax reform guidance.

- Service growth varied by region and client demand for digital solutions.

- Service line trends mirror broader professional services market shifts.

Country‑Level Revenue Breakdown

- KPMG’s Americas region revenue grew by approximately 5.6% in FY2025, continuing strong demand across the U.S. and Canada.

- Europe, Middle East & Africa (EMEA) revenue rose about 4.7% in the same period, boosted by tax and audit mandates.

- Asia‑Pacific revenue expanded 4.7% year‑over‑year, signaling a rebound after slower growth the prior year.

- In FY24, the EMEA region generated the largest share of global revenue, accounting for roughly $17.7 billion.

- The Americas region contributed around $15.9 billion of global revenue in FY25.

- Asia‑Pacific revenue, though smaller in overall volume, continued to climb with sustained client demand.

- Regional trends reflect strategic investment in tax and legal consulting across borders.

- Some markets within Latin America and Southeast Asia reported double‑digit local currency growth in niche segments.

- Country‑level performance varies widely, with advanced markets driving audit demand and emerging markets bolstering advisory work.

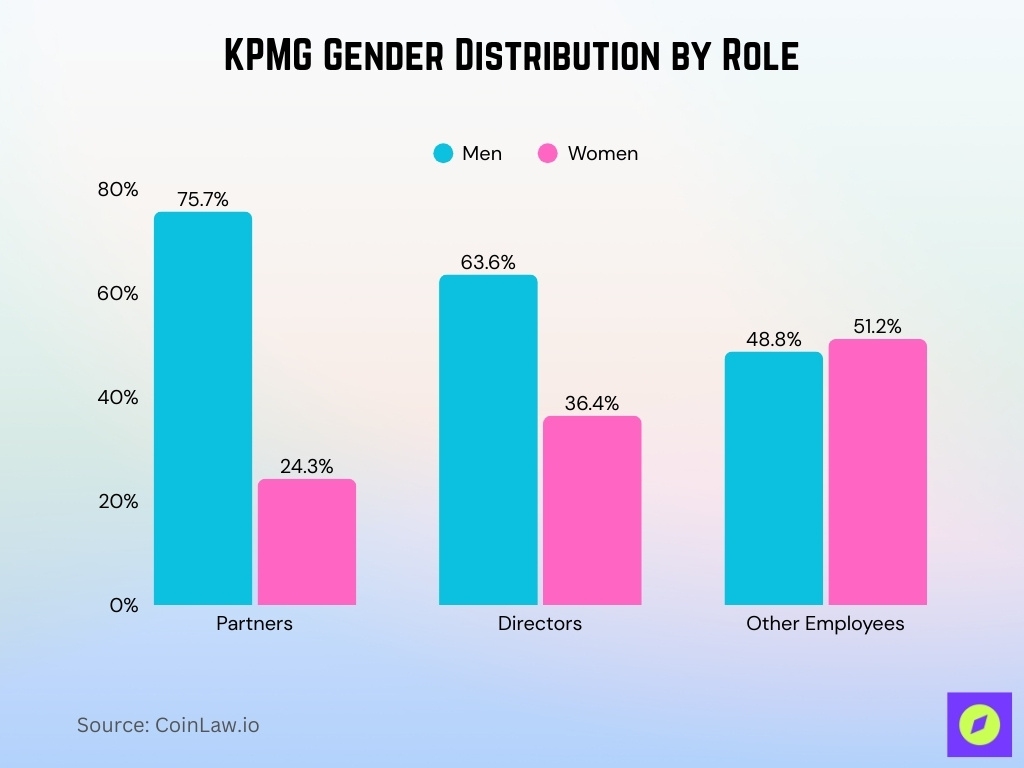

Employees by Role and Level

- 13,360 partners represent 75.7% men and 24.3% women.

- 12,653 directors comprise 63.6% men and 36.4% women.

- 250,017 other employees include 48.8% men and 51.2% women.

- Global workforce totals 276,030 employees, up 1.8% from the prior year.

- America region employs 61,942 staff, down 0.3% year-over-year.

- Asia Pacific headcount stands at 55,616, reflecting a 0.5% decline.

- EMA region grew to 158,472 employees.

- US audit staff reduced by 195 amid low turnover adjustments.

- Australia added 70 partners, including 47 internal promotions.

Year‑on‑Year Revenue Growth

- 5.4% global revenue growth recorded for FY25, outpacing many rivals in percentage terms.

- FY24 revenue grew 5.1% over the prior year, establishing a multi‑year growth trend.

- Tax and legal services led growth in FY25 at approximately 7.5%.

- Assurance (audit) revenues grew by about 6% year‑on‑year.

- Advisory growth was more moderate at approximately 2.9%.

- Regional growth figures show the Americas outpacing Asia‑Pacific slightly in FY25.

- Revenue increases occurred despite broader pressures on professional services spending.

- KPMG’s growth reflects steady demand for tax, legal, and audit work amid global regulatory changes.

Employees by Region

- KPMG’s global workforce stood at 276,030 as of September 30, 2025.

- This headcount reflects an approximate 1.8% increase compared to the prior year.

- EMEA region saw the largest regional increase, with employee numbers rising 3.4% to about 158,472.

- The Americas region saw a slight reduction in staff, even as revenue grew.

- Asia‑Pacific also reported a minor decrease in headcount despite revenue improvements.

- Growth in EMEA reflects strategic hiring in tax, legal, and technology roles.

- Total partner count declined slightly by about 50 globally.

- Leadership plans emphasize recruiting specialists in AI, regulatory, and tax advisory.

- Investment in talent remains a priority to support emerging service demands.

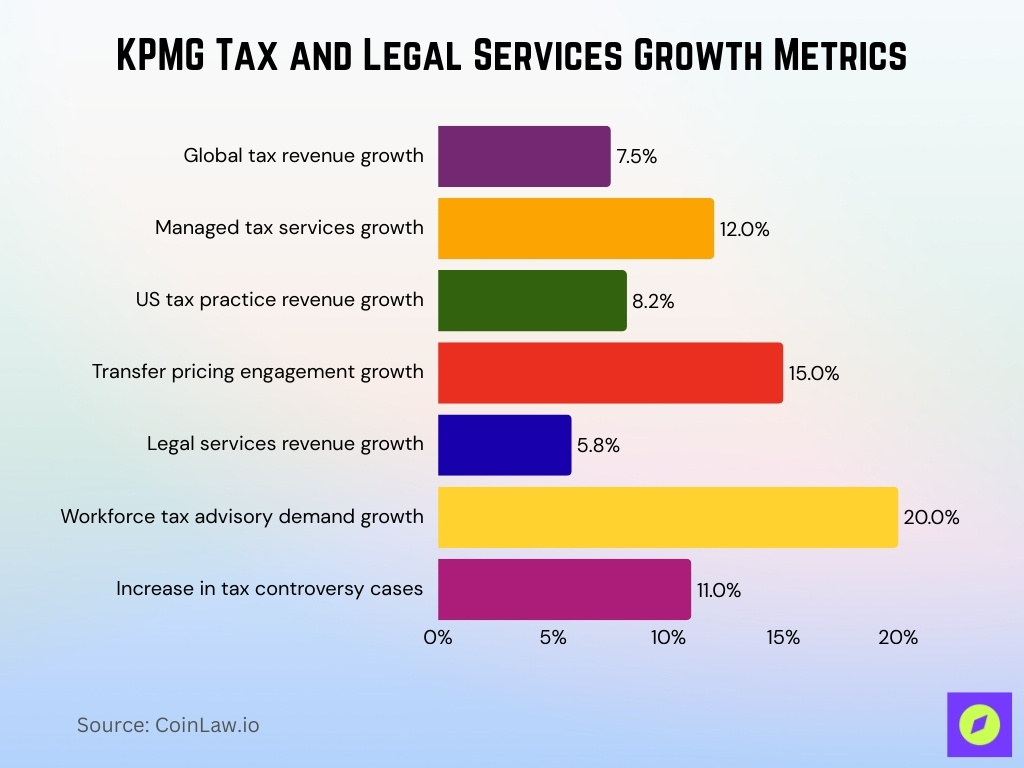

Tax and Legal Services Statistics

- Tax revenues grew 7.5% to $10.2 billion, leading all service lines globally.

- Managed services within the tax division boosted growth by 12% year-over-year.

- US tax practice revenues increased 8.2% driven by compliance demand.

- Transfer pricing advisory engagements rose 15% amid global regulations.

- Legal services revenue climbed 5.8% supporting cross-border transactions.

- Workforce tax advisory demand surged 20% due to remote work policies.

- Tax controversy cases handled increased 11% across international markets.

Partner and Leadership Statistics

- Global partners total 13,360, with 75.7% men and 24.3% women.

- UK partners received an average payout of £816,000 ($1 million), up 9% from the prior year.

- Directors number 12,653, comprising 63.6% men and 36.4% women globally.

- Ireland partners show 24% women representation amid a 37.7% mean pay gap.

- Women hold 29.4% of leadership roles, approaching the 33% target goal.

- FTSE 350 leadership roles reached 35% women occupancy per KPMG review.

- 90% of female leaders expect company performance to rise in the next three years.

- Australia equity partners averaged $715,000 after a 10.3% pay increase.

- KPMG UK targets 40:40:20 partner gender representation by 2030.

Office Locations and Presence

- KPMG firms operate in 142 countries and territories worldwide.

- Global network includes over 700 offices serving multinational clients.

- US operations maintain 90+ offices across major metropolitan areas.

- KPMG US employs 36,000+ partners and professionals from these locations.

- Atlanta hosts two offices with 1,700 partners and professionals combined.

- New York was established as the first US office in 1897, serving financial hub.

- EMEA presence spans financial centers, including London and Frankfurt hubs.

- Asia-Pacific offices are located in Singapore, Hong Kong, Tokyo, and Sydney.

- KPMG plans a consolidation, reducing country units from 100+ to 32 clusters.

Audit Services Statistics

- Global audit revenues reached $14.1 billion, up 6.0% in local currency.

- Audit growth of 6.4% in US dollars outperformed advisory’s 3.4% increase.

- Germany’s audit division revenue grew 7.7% to €829 million.

- Audit represents 35.4% of the total KPMG global revenue share.

- Australia’s audit and assurance revenues increased 7% year-over-year.

- KPMG secured a new DAX 40 audit mandate with Airbus, maintaining 36% MDAX market share.

- AI investments in the Clara platform enhanced audit efficiency across global teams.

- Tax-related audit advisory grew alongside core financial statement audits.

Advisory and Consulting Statistics

- Advisory revenues grew 2.9% to $12.7 billion, trailing audit’s 6.0% increase.

- Risk advisory services expanded 4.2% amid regulatory compliance demands.

- Digital transformation consulting revenues rose 3.8% driven by cloud migrations.

- ESG integration advisory engagements increased 11% across global practices.

- Cybersecurity projects grew 5.5% response to the heightened threat landscape.

- M&A advisory mandates declined 1.2% amid economic uncertainty factors.

- Operational resilience consulting surged 6.7% due to supply chain disruptions.

- Germany’s advisory division achieved €892 million, up 2.1% year-over-year.

Innovation and Technology Investment

- KPMG committed $4.2 billion through 2026 for technology, AI, and sustainability initiatives.

- $2 billion AI investment established a partnership with Microsoft for platform development.

- $100 million allocated specifically to AI automation services, enhancing client delivery.

- 71% of CEOs prioritize AI investments per the KPMG survey, driving internal tool adoption.

- Clara AI audit platform deployed across 80% of global audit engagements.

- 15,000 employees completed AI and cloud certification programs internally.

- ESG reporting tools automated 65% of sustainability data collection processes.

- Technology alliances boosted multi-country project delivery capacity by 30%.

ESG and Sustainability Metrics

- KPMG ESG Assurance Maturity Index surveyed 1,320 senior executives from firms averaging $16.8 billion in revenue.

- 310 companies reported CSRD-aligned sustainability disclosures with assurance.

- Overall maturity score dipped to 46.9 from the prior 47.7 amid regulatory shifts.

- Leaders (top 25%) average 65.21 score versus Beginners’ 30.54.

- 76% of companies remain in early or mid-stages of ESG maturity.

- 74% maintain unchanged CSRD reporting plans despite regulatory ambiguity.

- Leaders show 95% board ESG risk identification and 89% taking actions.

- ESG dashboard usage among Leaders reached 53%, up 27 points.

- 60% of early CSRD reporters anticipate greater market share from assurance.

Diversity and Inclusion Metrics

- Global women in leadership reached 29.4%, progressing toward the 33% target.

- KPMG US discontinued the Accelerate 2025 DEI program targeting 50% underrepresented partners.

- Australia’s median base salary gender pay gap narrowed to 10.7%, down 2.2%.

- FTSE 350 companies achieved 35% women in leadership roles per the KPMG review.

- Vietnam partners include 46% women’s representation.

- ESG leaders monitor workforce diversity at 61% versus 54% for others.

- Underrepresented groups comprised 42.6% of US partners and directors.

- KPMG Sweden invests in IDE programs tracking gender and ethnic representation.

Frequently Asked Questions (FAQs)

KPMG’s global headcount reached 276,030 employees as of the end of FY2025.

KPMG’s tax and legal services revenue rose by 7.5% in 2025.

KPMG’s audit revenues increased by 6% in FY2025.

KPMG’s advisory revenue grew by about 2.9% in FY2025.

Conclusion

KPMG showed sustained growth and strategic investment, expanding services, technology, and advisory capabilities while navigating evolving ESG and diversity landscapes. Audit and tax services remained robust with solid revenue gains, and global investment in digital tools strengthened assurance quality and client solutions. ESG assurance matured as a strategic priority, with surveyed corporates leveraging digital metrics and reporting frameworks. Diversity progress varied by region, with some programs adapting to legal and policy shifts. Overall, KPMG’s performance underscores its resilience and adaptation to global economic and regulatory change.