The workforce behind Uniswap Labs, the key firm driving the Uniswap Protocol, offers a telling window into how a leading decentralized finance (DeFi) organization scales and adapts. From handling global trading volumes to building infrastructure that supports millions of users, the size and structure of the team matter. For example, institutional clients integrating DeFi modules rely on Uniswap’s engineering breadth, and global hiring patterns showcase how crypto firms compete for tech talent. In this article, you’ll gain a detailed breakdown of Uniswap Labs’ workforce today and what it means for the broader crypto ecosystem.

How Many People Work At Uniswap?

- As of September 2025, Uniswap Labs has approximately 227 employees across six continents.

- Remote and hybrid work models dominate hiring at Uniswap Labs, aligning with global tech trends.

- The company is headquartered in Soho, New York City, but team distribution spans North America, Europe, Asia, and beyond.

- The product/operations to engineering ratio has shifted from about 1:3 in 2022 to closer to 1:2.5 in 2025.

- Significant recent hiring indicates a growth phase tied to major product launches like Uniswap v4.

- Challenges persist in scaling teams while maintaining distributed coordination and culture in a crypto startup.

Recent Developments

- Uniswap Labs processed more than 100 billion dollars in trading volume for the protocol by July 2025.

- The launch of Uniswap v4 and the introduction of “Hooks” have increased development demands and, therefore, staffing needs.

- The global trend toward remote work continues to affect hiring strategy; for example, 82% of companies now offer remote options, and 72% have permanent remote policies.

- Platforms like Uniswap Labs are increasingly hiring talent globally to meet demand for distributed protocol engineering.

- Compliance, governance, and regulatory teams have grown as DeFi increasingly intersects with institutional finance.

- Uniswap Labs has refreshed its careers and perks offerings to attract talent, including remote stipends and hybrid work models.

- The broader crypto downturn in 2024–2025 has pressured hiring costs and growth expectations, influencing how Uniswap Labs plans staffing.

- Talent competition in blockchain and Web3 has intensified, pushing Uniswap Labs to emphasize compensation, flexibility, and remote-first roles.

Uniswap (UNI) Price Analysis

- Current Price: Uniswap trades at $6.58, reflecting a 1.25% daily decline. This shows slight bearish momentum as traders remain cautious below the $7 mark.

- Daily Range: The price fluctuated between a high of $6.89 and a low of $6.52 during the session. Such a narrow range indicates short-term consolidation and reduced volatility.

- Upper Bollinger Band: The upper band stands at $7.65, marking a clear resistance zone for UNI. If price action breaks above this level, it could trigger a short-term bullish reversal.

- Middle Bollinger Band: The basis line is positioned at $6.51, aligning closely with current market prices. This suggests UNI is testing its equilibrium zone between buyers and sellers.

- Lower Bollinger Band: The lower band is set at $5.36, signaling a potential support area if selling pressure intensifies. Historically, dips toward this level have attracted renewed buying interest.

- Simple Moving Average (SMA): The SMA is at $6.33, placing UNI slightly below its short-term trend line. This reflects a cautious outlook as the market awaits stronger momentum signals.

- Relative Strength Index (RSI): The RSI reads 45.15, indicating neutral momentum in the market. UNI is neither overbought nor oversold, suggesting balanced sentiment among traders.

- RSI-based Moving Average: The RSI-based MA sits at 38.49, hinting at a gradual recovery from oversold territory. It shows improving strength as buyers cautiously re-enter the market.

Uniswap’s Current Team (Key People)

- Hayden Adams – Founder & CEO. Former mechanical engineer at Siemens, Adams founded Uniswap in 2018 after being inspired by Ethereum’s open-source potential. He remains the face of the protocol and leads strategic vision and product innovation.

- Mariana de la Roche – Head of Policy and Compliance. An advocate for regulatory transparency in crypto, she leads policy coordination and governance relations between Uniswap Labs and external institutions.

- Noah Zinsmeister – Engineering Lead. A core contributor to the Uniswap protocol since its early days, he heads the backend and smart contract development team, focusing on scaling and interoperability.

- Devin Walsh – Executive Director, Uniswap Foundation. Oversees grants, ecosystem growth, and governance initiatives supporting developers and community-led projects.

- Ken Ng – Head of Business Development. Focuses on strategic partnerships, institutional integrations, and expanding Uniswap’s footprint across DeFi and traditional finance.

- Sara Reynolds – VP of Product. Leads the product and design teams responsible for the Uniswap web interface, mobile app, and API developer experience.

- Alex Wettermann – Head of Design. Manages user experience, interface innovation, and accessibility improvements to make DeFi intuitive and inclusive.

- Ryan Bartlett – General Counsel. Oversees legal, risk, and regulatory compliance amid increasing global scrutiny of decentralized exchanges.

Locations and Remote Workforce

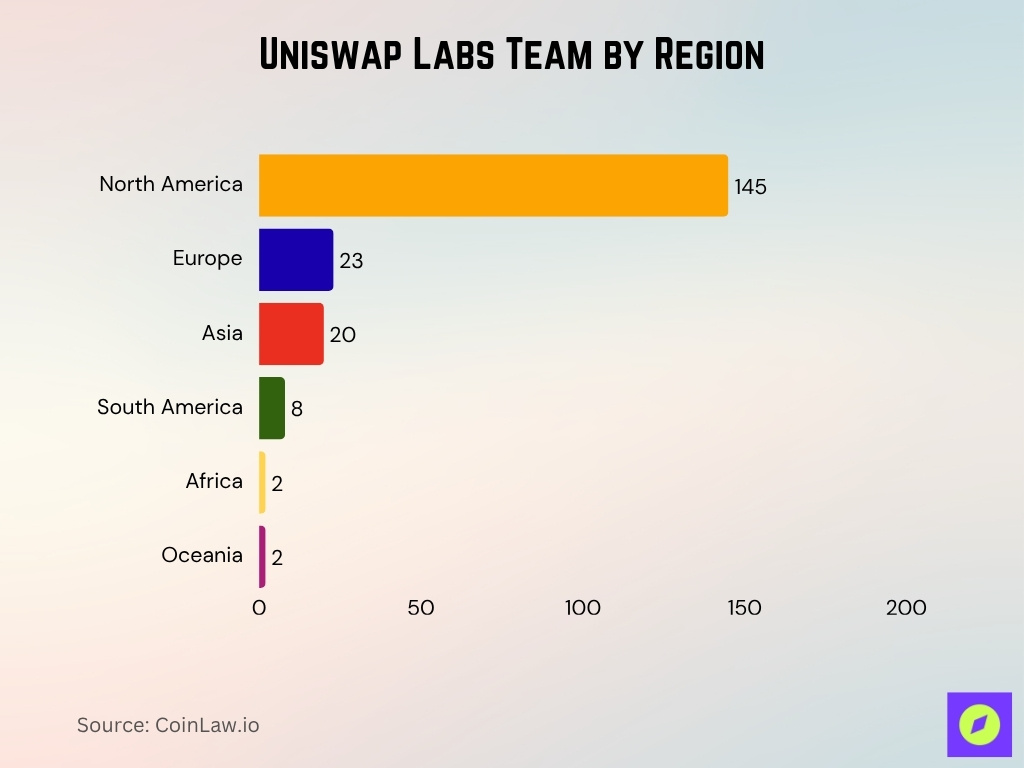

- Breakdown for July 2025, North America ~145 employees, Europe ~23, Asia ~20, South America ~8, Africa ~2, Oceania ~2.

- Uniswap Labs has team members across six continents: North America, Europe, Asia, South America, Africa, and Oceania.

- Remote job postings show a strong preference for “Remote or Hybrid, New York or US-based” roles.

- Built In reports a “Hybrid Workspace” model for employees with HQ in New York, but many roles are remote.

- Among global hiring trends in 2025, 40% of new positions are remote; this context helps explain Uniswap’s distributed workforce strategy.

- The firm offers a home-office/co-working stipend for remote team members.

- Talent location distribution shows focus on the US, Western Europe, and Southeast Asia, with a smaller presence in emerging markets.

Product and Operations Staff

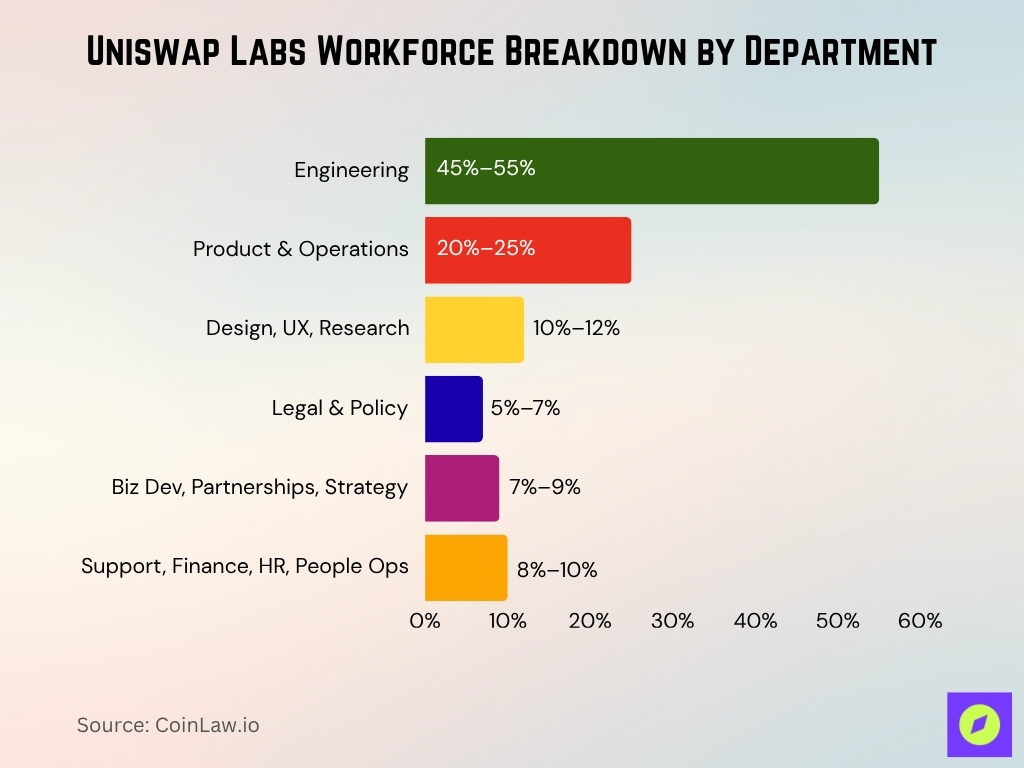

- Product and operations staff represent about 20%-25% of Uniswap’s workforce in 2025.

- Product teams focus on supporting mobile wallets, web UI/UX, APIs, and ecosystem integrations.

- Operations roles cover user support, analytics, data engineering, governance, and global remote infrastructure.

- Growth in operations staff tracks increased regulatory and compliance demands, rising by approximately 10%-15% annually.

- Product staffing spikes correlate with major protocol releases such as Uniswap v4 in early 2025.

Uniswap Labs vs. Foundation Workforce

- Uniswap Labs’ workforce is estimated at around 227 employees as of 2025.

- The Uniswap Foundation employs significantly fewer staff, with under 50 employees focused on governance and ecosystem coordination.

- Over 70% of Uniswap Labs’ staff are technical employees involved in product development.

- The Foundation’s technical staff proportion is below 40%, emphasizing governance and community roles.

- The Foundation held approximately $33.8 million and 0.61 million UNI tokens in reserves as of September 2024.

Department Breakdown

- Engineering accounts for approximately 45%-55% of Uniswap Labs’ total workforce as of 2025.

- Product & operations roles make up around 20%-25% of employees supporting user-facing and internal systems.

- Design, UX, and research teams constitute roughly 10%-12%, focusing on user interface and experience.

- Legal & policy staff represent about 5%-7%, managing regulatory, compliance, and governance issues.

- Business development, partnerships, and strategy functions comprise close to 7%-9% of the team.

- Support, finance, HR, and people operations combined contribute about 8%-10%, underpinning global infrastructure and workforce policies.

Diversity and Inclusion Metrics

- While specific workforce diversity figures for Uniswap Labs are not publicly broken down, governance discussions indicate awareness of representation issues.

- The broader crypto/Web3 sector saw increased focus in 2025 on roles tied to governance, compliance, and DAO operations, with each category growing by over 20% year-on-year.

- In the Web3 hiring report for 2025, demand for DAO Operations & Governance roles rose by approximately 22% YoY, highlighting the inclusion of non-engineering backgrounds.

- According to industry data, the share of companies globally now offering remote work has surpassed 50% in crypto firms by mid-2025.

- Larger crypto firms are increasingly offering internships, mentorships, and scholarships aimed at underrepresented groups, although specific numbers for Uniswap Labs remain undisclosed.

Global Presence and Expansion

- Uniswap Labs has team members distributed across 6 continents as of 2025.

- Headquarters are based in New York City, with many remote or hybrid roles supporting global reach.

- Around 25% of new hires in crypto firms by mid-2025 come from outside the U.S. and Western Europe.

- APAC and LATAM regions have seen a talent pool growth of approximately 15%-20% in blockchain expertise.

- Remote/hybrid work models enable access to skilled talent in lower-cost regions efficiently.

- Expansion correlates with product launches like Uniswap v4 and multi-chain Hooks support.

- Payroll compliance complexity increases with employment in 15+ countries globally.

- Time-zone management challenges span across 12-14 different zones for global coordination.

- DeFi protocols expect multi-chain and multi-region support, necessitating diversified global teams.

- Culture-building efforts adapt to a workforce that is over 60% distributed internationally across continents.

Uniswap Long-Term Price Forecast

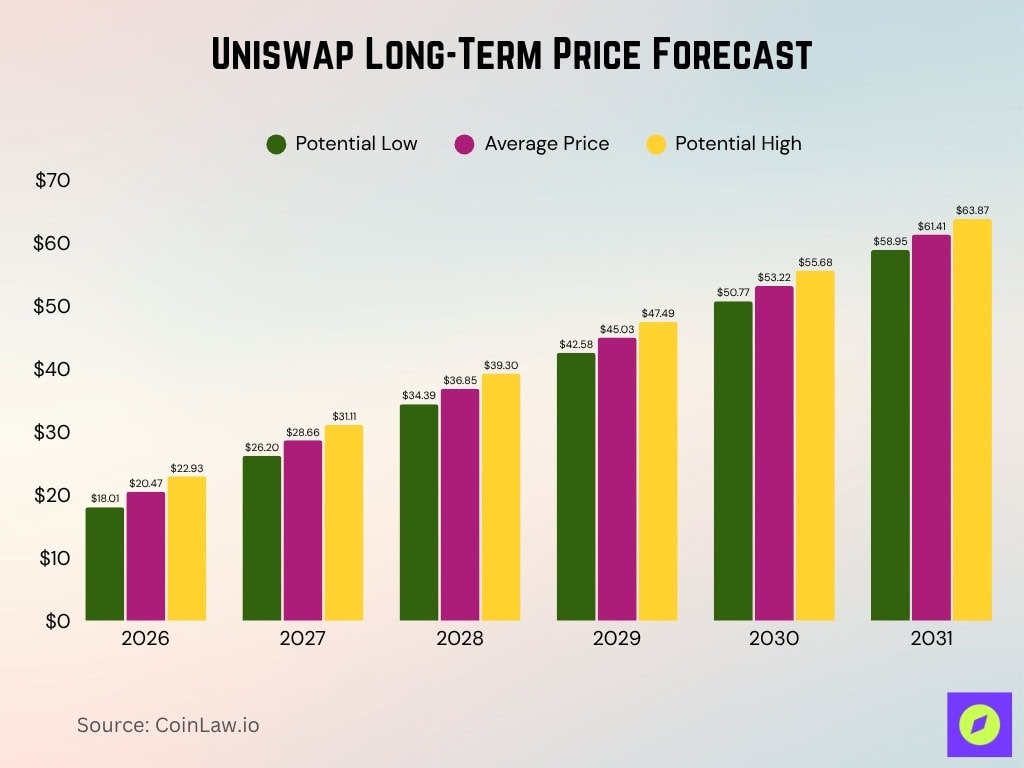

- 2026 Prediction: Uniswap’s price could see a potential low of $18.01 and reach a high of $22.93, averaging around $20.47. This marks a steady recovery trend, signaling renewed investor confidence and broader DeFi adoption.

- 2027 Projection: The average price is expected to climb to $28.66, with lows near $26.20 and highs around $31.11. The growth reflects increased network activity and stronger utility demand for the UNI token.

- 2028 Forecast: UNI may trade between $34.39 and $39.30, maintaining an average of $36.85. This suggests continued bullish sentiment as Uniswap expands its decentralized trading ecosystem globally.

- 2029 Outlook: The token’s value could range from $42.58 to $47.49, averaging $45.03 for the year. Rising on-chain liquidity and cross-chain integrations are likely to fuel consistent growth during this period.

- 2030 Estimate: UNI’s average price might reach $53.22, supported by a low of $50.77 and a high of $55.68. As institutional participation grows, Uniswap could position itself as a leading decentralized exchange hub.

- 2031 Prediction: The forecast places UNI between $58.95 and $63.87, with an average of $61.41. This long-term projection underscores a mature DeFi market and sustained investor optimism surrounding Uniswap’s innovation trajectory.

Recent Hiring Trends

- The Web3 job-market overview for 2025 shows fewer hype-driven roles and more strategic hires in compliance, product, governance, and operations.

- Web3 and crypto hiring grew by over 24% year-on-year in 2025, signalling an uptick in recruitment activity.

- Demand for smart-contract engineers rose approximately. 32%, Rust developers by 40%, and zk systems engineers by 51% in 2025, indicating the technical tilt of recent hiring.

- Many job postings now specify “remote first” or “hybrid (NYC + remote)” for positions spanning product, engineering, and operations, matching Uniswap’s model.

- Executive-search firms report increased use of specialist recruiters for key DeFi hiring rather than relying purely on job boards, reflecting maturing hiring processes.

Comparison With Competing DEXs

- Competitors like SushiSwap and PancakeSwap reported layoffs of up to 30%-40% in 2024-2025.

- Uniswap invests over 70% of its staff in engineering and protocol development, higher than many DEXs.

- Some competitors rely on 40%-50% community-contributed code, while Uniswap internalizes most core development.

- Uniswap’s remote hiring model spans 6 continents, broader than some regional competitor teams.

- The Uniswap Foundation adds nearly 50 ecosystem-focused roles not found in competitor staffing models.

- Competitors’ marketing and community roles often exceed 30% of their workforce, compared to Uniswap’s product emphasis.

- Uniswap’s model prioritizes “quality over quantity,” showing faster time-to-market and improved code-security metrics.

Challenges and Hiring Obstacles

- Recruiting top-tier DeFi talent faces a 25%-30% shortage in supply versus demand.

- Regulatory hiring costs increased by approximately 20%-25% due to U.S. and global compliance complexities.

- Retaining remote staff across 5+ time zones causes cultural and payroll compliance delays averaging 3-6 months.

- Around 70% of DeFi talent prioritize crypto-native perks and remote flexibility in job selection.

- Hiring outside U.S./UK/EU incurs 15%-20% higher overhead for legal, tax, and payroll infrastructure.

- Continuous up-skilling is required, with roughly 40% of candidates moving to newer projects annually.

- Budget constraints led to 15%-25% headcount reductions in some crypto firms during market downturns.

- Remote culture-building efforts face 30%-40% higher onboarding challenges for junior hires without in-person mentorship.

- Balancing growth hiring with protocol security mandates reduces aggressive staffing increases to under 10% annually.

- Firms like Uniswap Labs allocate about 10%-15% of HR resources specifically for governance and security hiring practices.

Frequently Asked Questions (FAQs)

6 continents.

Approximately $163,369 in revenue per employee.

~227 employees.

Conclusion

Uniswap Labs has settled into a phase of measured growth; its workforce, global expansion, and hiring strategies reflect a move from rapid build-out to strategic scaling. The firm still faces significant challenges, notably talent competition, regulatory pressure, and remote-work complexity, but its global presence, focus on product excellence, and careful staffing approach position it well in the evolving DeFi landscape.