Gold investment continues to attract global attention, driven by rising economic uncertainty, shifting monetary policies, and elevated geopolitical tensions that push investors toward safe-haven assets. From record price performance to rising holdings by central banks and ETFs, the metal’s appeal is both statistical and strategic. In the US, gold’s growth influences portfolio diversification strategies, while in Europe and Asia, central bank purchases underscore its monetary relevance. Explore the detailed stats below to understand how gold stands today.

Editor’s Choice

- Gold prices have surged above $4,000 per troy ounce in late 2025, reflecting unprecedented market demand.

- Gold’s year-to-date gain in 2025 has exceeded 60%, driven by inflation fears and economic uncertainty.

- Gold ETFs experienced their largest inflow in five years during the first half of 2025.

- Central bank gold purchases exceeded 1,000 tonnes in 2024, marking a historic accumulation.

- U.S. investors hold roughly 0.2% of their financial portfolios in gold ETFs, indicating relatively low direct gold exposure versus other assets.

- Gold’s long-term annualized return over 25 years is ~10.9%, highlighting strong performance.

- Central banks increasingly actively manage gold reserves, with more respondents doing so in 2025 than in 2024.

Recent Developments

- By December 2025, gold prices will have climbed above $4,000/oz, approaching all-time highs.

- Mining stocks tied to gold have seen strong gains, with Newmont up ~160% YTD, reflecting bullish sentiment.

- Gold’s rally is fueled by U.S. monetary policy expectations, including possible rate cuts, which lower the opportunity cost of owning gold.

- Gold ETFs saw $38 billion in net inflows in 1H 2025, the most in five years.

- U.S. investors’ gold ownership remains low relative to total financial portfolios, at 0.2%.

- Gold’s recent surge contrasts with weaker dollar indexes, which have supported investor demand.

- Geopolitical tensions and global macro risk have elevated safe-haven demand for gold.

- Analysts forecast that continued uncertainty may sustain gold price volatility and investment interest into 2026.

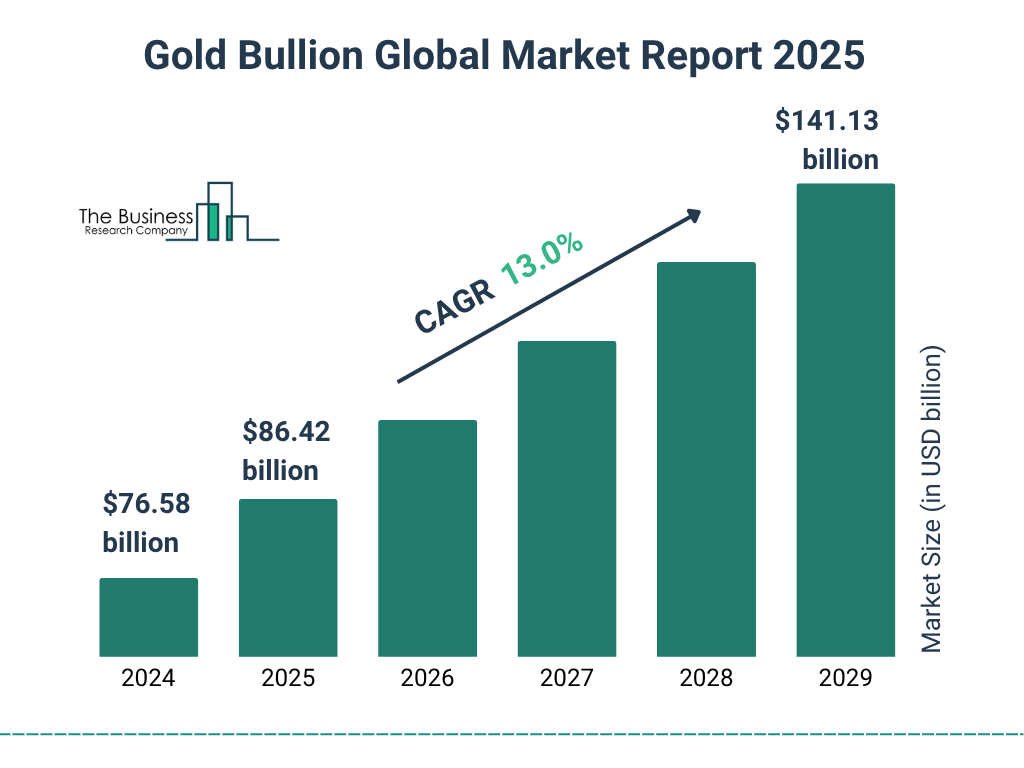

Gold Bullion Market Size Forecast

- The global gold bullion market is expected to reach $86.42 billion in 2025, up from $76.58 billion in 2024.

- The market is projected to grow at a compound annual growth rate (CAGR) of 13.0% through 2029.

- By 2029, the gold bullion market is forecasted to hit $141.13 billion, nearly doubling in size compared to 2024.

- This surge reflects rising investor demand, inflation hedging, and geopolitical uncertainty driving interest in physical gold.

- The upward trend highlights gold’s evolving role as both a safe-haven asset and a strategic portfolio diversifier.

Gold Investment Overview

- Global gold demand reached 3,717t year-to-date through Q3.

- Investment demand hit 537.2t in Q3, up 47% year-over-year.

- Gold ETFs saw 222t inflows in Q3, the highest quarterly total.

- Central banks purchased 254t net gold through October.

- Physical bar and coin demand totaled 316t in Q3.

- Year-to-date ETF inflows reached 619t valued at $64bn.

- LBMA gold price averaged $3,456.54/oz in Q3, up 40% year-over-year.

- Total gold demand value hit $384bn year-to-date through Q3

Annual Gold Returns vs Other Assets

- Gold’s YTD return in 2025 has exceeded 60%, significantly outperforming many asset classes.

- Historically, gold returned about 10.9% annually over 25 years, a strong long-term profile.

- By comparison, U.S. stocks historically delivered varied returns, often outperforming gold over long horizons.

- In previous decades, gold’s performance surged during periods of economic stress, contrasting equity behavior.

- Gold often outperformed bonds during inflationary periods, validating its role as a hedge.

- In 2024, gold prices were 22% higher than in 2023.

- The surge in 2025 exceeds many traditional return forecasts for stocks and bonds in the same period.

- Analysts predict gold’s returns may calm after record highs but remain elevated versus safe assets.

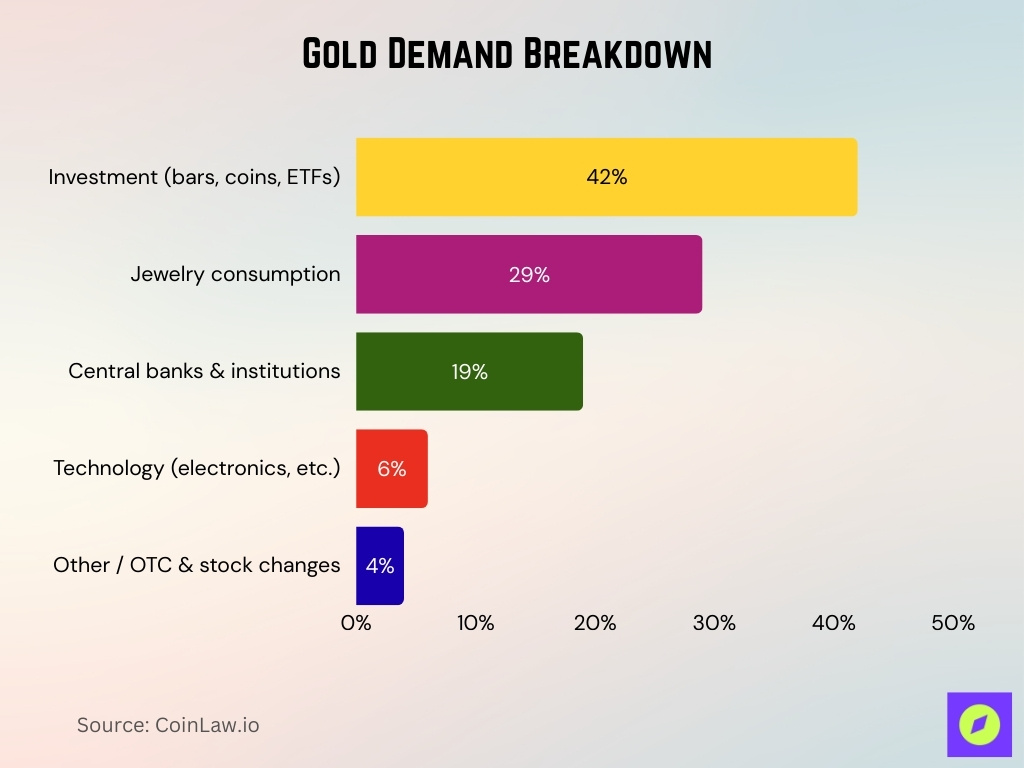

Gold Demand Breakdown

- Investment demand dominated with ~42% share, as investor appetite for gold surged amid economic uncertainty.

- Jewelry consumption accounted for ~29% of total demand, still the largest individual segment despite a drop in volume due to record gold prices.

- Central banks and institutions contributed ~19%, reflecting strong official sector buying within historically high levels.

- Technology-related demand held steady at ~6%, driven by ongoing needs in electronics, AI components, and industrial applications.

- Other demand sources made up ~4%, including OTC trades and stock adjustments, representing residual and less visible market movements.

Gold Price Volatility and Risk Metrics

- Gold prices surged 38% year-over-year in Q1.

- Daily price movements averaged 2-3% during active periods.

- November intraweek swings reached $160 per ounce.

- Gold hit record highs above $4,240 before dropping to $4,080.

- The traditional dollar-gold correlation weakened to -0.68.

- Fed rate cuts triggered average +3.5% price movements.

- Monthly trading ranges spanned $300-500 per ounce.

- Gold volatility spiked with a 48% increase in April trading volumes.

Central Bank Gold Reserves and Purchases

- In 2025, central banks continued significant gold accumulation, with most reserve managers expecting their gold reserves to grow in the next 12 months.

- Global central bank gold holdings stood around 36,000 tonnes as of mid‑2025, nearing historic postwar levels.

- Central bank buying remained elevated in Q3 2025 at ~220 tonnes, a 28% quarterly increase from the prior quarter.

- Year‑to‑date through Q3, central banks purchased about 634 tonnes of gold, slightly below the exceptional levels of 2024 but still robust.

- Reserve managers increasingly view gold as a diversification tool, with 73% expecting lower US dollar allocations and higher gold shares in global reserves over five years.

- Top gold reserve holders include major economies, with the U.S. holding the largest official stockpile and others like Germany, Italy, and China in the top rankings.

- Central bank purchases continue partly as de‑dollarization strategies, reducing reliance on traditional foreign currency reserves.

- India’s central bank reported its gold reserves exceeded 880 tonnes, valued at about $95 billion.

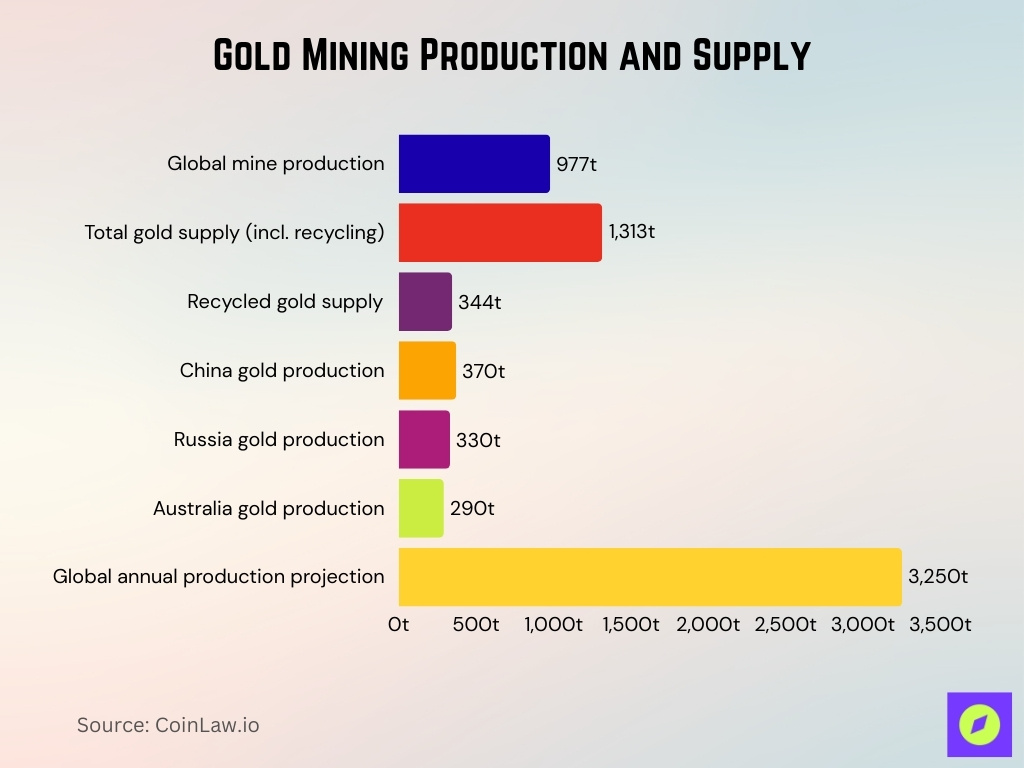

Gold Mining Production Statistics

- Global mine production reached 977t in Q3, up 2% year-over-year.

- Total supply, including recycling, rose 3% to 1,313t in Q3.

- Recycled gold supply increased 6% to approximately 344t in Q3.

- China led production with 370t annually among the top producers.

- Russia produced 330t as the second-largest gold mining nation.

- Australia’s output is estimated at 290t for the year.

- Global annual production projected to peak near 3,250t.

ETF Holdings and Flows

- Global physically‑backed gold ETFs reported six consecutive monthly inflows in late 2025, adding about $5.2 billion in November.

- Total gold ETF holdings reached approximately 3,932 tonnes, the highest month‑end total on record.

- Asian funds dominated regionally with $3.2 billion inflows in November, driven by Chinese investor demand.

- Global gold ETF inflows in 2025 were the strongest since 2020 in both tonnage and value terms.

- Western ETF inflows rebounded in 2025 after prior outflows, showing renewed investor interest.

- In the first half of 2025, gold ETFs saw ~$38 billion in net inflows, the largest semi‑annual total in five years.

- U.S. ETF flows contributed significantly, with 206.8 tonnes added in H1.

- Growth in ETF holdings suggests investors seek liquidity and price exposure without holding physical gold.

Bar and Coin Investment

- Bar and coin demand reached 316t in Q3, the fourth straight quarter above 300t.

- Q1 bar demand rose 14% to 257.6t year-over-year.

- First-half performance marked the strongest since 2013 for bars and coins.

- China Q1 bar and coin investment surged nearly 30% year-over-year.

- India Q3 bar and coin purchases hit 91.6t with $10 billion value.

- Global Q3 bar demand increased 19% to 237.1t year-over-year.

- Q1 total bar and coin demand held at 325t, 15% above the five-year average.

- US Q3 consumer bar and coin demand contributed to 186t total gold demand.

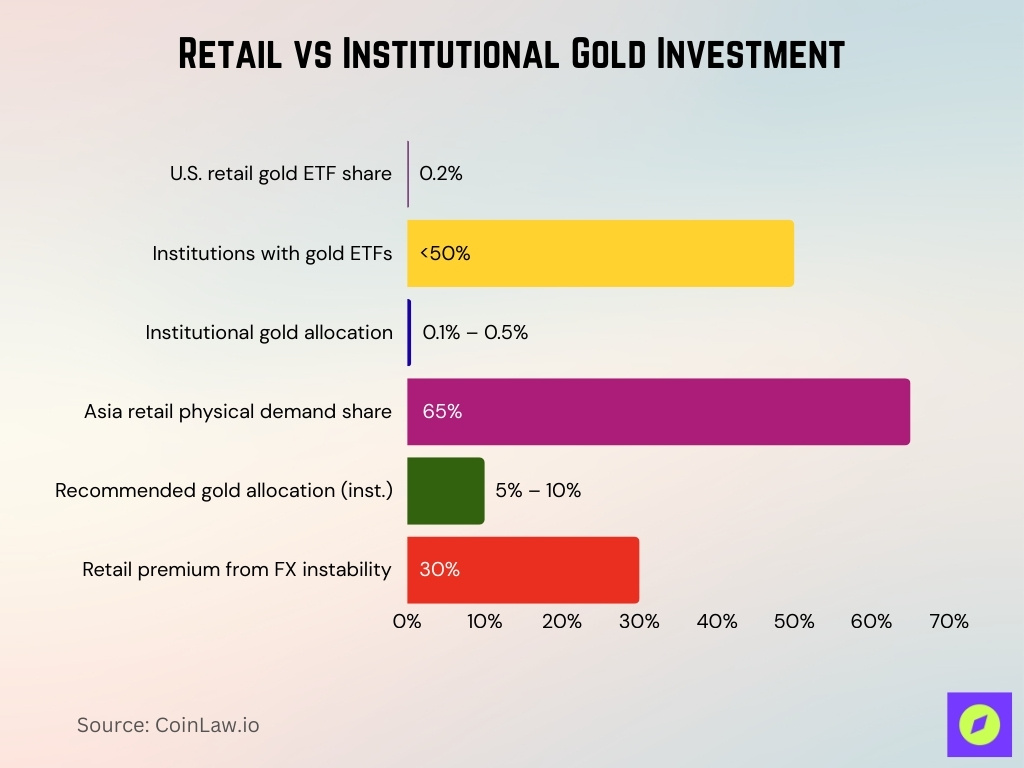

Retail vs Institutional Gold Investors

- U.S. retail gold ETFs represent 0.2% of private financial portfolios.

- Fewer than 50% of large institutions hold any gold ETF exposure.

- Institutional gold allocations typically range 0.1%-0.5% of portfolio assets.

- Asia retail bar/coin demand accounted for 65% of global physical investment.

- Institutions recommend 5%-10% strategic gold allocations for diversification.

- Emerging market retail participation boosted by a 30% currency instability premium.

- Retail investors drove $26 billion in quarterly ETF inflows in Q3.

- Gold ETFs hit 3,445t total holdings, led by retail accumulation.

Futures and Derivatives Activity

- CME metals complex hit a record 2,829,666 contracts on October 17.

- Micro Gold futures reached 1,267,436 contracts in single-day volume.

- COMEX Gold futures open interest at 12,568 contracts week of September 23.

- Asian hours accounted for 42% of global Micro Gold futures volume in Q2.

- The gold derivatives market is valued at $4.244 billion.

- 1-Ounce Gold futures traded 199,928 contracts on the record day.

- COMEX net long positioning reflects bullish futures sentiment.

- Gold options risk premiums hit five-year highs amid volatility.

Recycling and Scrap Gold Volumes

- Recycled gold supply reached 344t in Q3, up 6% year-over-year.

- Total gold supply hit a record 1,313t with recycling at 26% of volume.

- Recycling remained stable, down 1% quarter-over-quarter despite high prices.

- Elevated prices drove scrap volumes to multi-year highs near 1,370t annually.

- Global scrap recycling market valued at $16.15bn.

- Jewellery scrap dominated recycling flows amid weak demand in key markets.

- Electronics recycling contributed minor but growing volumes to total scrap.

- Recycling growth projected at 9.3% CAGR through 2029.

- First-half recycled supply rose nearly 2% to 700t.

Regional Gold Investment Trends

- North American ETFs added 346t in Q3, leading global inflows.

- U.S. investors allocate 0.2% of portfolios to gold ETFs.

- European funds gained 148t amid geopolitical tensions.

- UK/Switzerland drove 75% of Europe’s gold fund demand in Q2.

- Asian ETFs saw 118t inflows focused on currency diversification.

- China bar/coin demand hit 74t, reflecting sustained accumulation.

- Middle East investment demand rose 4% in the first half.

- UAE gold reserves surged 26% to $7.9 billion in the first five months.

- Latin America’s precious metals market is valued at $19,704 million.

Gold as an Inflation Hedge

- Gold prices rose 28% amid 4.2% average inflation across major economies.

- Real yields declined -1.8% correlating with +32% gold performance.

- Gold outperformed bonds by 15% during high inflation quarters.

- Currency depreciation in emerging markets boosted gold demand by 22%.

- Physical gold purchases surged 35% in countries with inflation above 5%.

- Long-term gold retained 92% purchasing power over 20-year inflation cycles.

- Gold hedge effectiveness reached a 0.72 correlation coefficient with CPI spikes.

- Short-term volatility averaged 18% but annualized returns beat inflation by 12%.

Gold During Recessions and Crises

- Gold surged 50% amid global uncertainty and geopolitical tensions.

- Gold rose 26% in H1, setting 26 new all-time highs during the economic slowdown.

- Gold gained 25.86% YTD, outpacing the S&P 500’s 6.20% amid dollar weakness.

- Gold hit $4,000 barrier during the U.S. shutdown, signaling investor anxiety.

- Central banks bought gold at record levels, surpassing US Treasury holdings.

- Gold ETF inflows mirrored the 2009 and 2020 crisis pace in the risk-off regime.

- Gold demand spiked 21% from central banks during geo-economic shocks.

- Gold retained value appreciating 87% during the 1973-1975 recession equivalent stress.

Gold’s Role in Portfolio Diversification

- 5%-10% gold allocation recommended for optimal diversification benefits.

- 5% gold improved the Sharpe ratio by 12% while reducing volatility.

- Gold-stock correlations averaged 0.1-0.3 during normal conditions.

- Negative gold-equity correlation reached -0.5 in market downturns.

- 18% gold allocation optimized historical risk-adjusted returns.

- 10% gold boosted 60/40 portfolio returns by 400bps with stable volatility.

- 15% gold suggested as a strategic mix for credit-dependent portfolios.

- 17% gold with 83% balanced assets maximized the risk-reward ratio.

Frequently Asked Questions (FAQs)

Gold prices have climbed over 54%–60% in 2025 year‑to‑date compared with the same period in 2024.

Total gold supply reached a record 1,313 tonnes during Q3 2025.

Global physically backed gold ETFs saw six consecutive monthly inflows, adding $5.2 billion in November.

From 2000 to 2025, gold delivered about a 10.9% annualized return.

Conclusion

Gold’s investment narrative is shaped by record price performance, diversified investor demand, and macroeconomic uncertainty. Across regions, from North America to Asia, gold continues to appeal as a hedge, crisis asset, and portfolio diversifier. Institutional and retail behaviors differ, but both show strategic interest in gold’s unique characteristics amid inflation, geopolitical risk, and market volatility. Whether as a hedge against inflation or a stabilizer in turbulent markets, gold remains central to modern investment strategies.