The debate between fintech banks vs traditional banks’ profitability is no longer theoretical; it is reshaping how capital flows and earnings are generated across financial services. Industry figures show that digital-first banks are capturing customer attention and revenue streams at a faster pace than ever, while established banks still dominate total profits due to scale and balance sheet advantages.

From a startup fintech securing rapid customer adoption and venture interest to a legacy bank leveraging scale and diversified revenue, both models influence the profitability landscape. This article unpacks key metrics, such as ROA, ROE, NIM, cost efficiency, and revenue mix, to reveal how these sectors stack up. Read on to explore the latest statistics that define profitability in fintech and traditional banking.

Editor’s Choice

- 216.8 million U.S. digital banking users expected in 2025, driving fintech adoption.

- $230.55 billion projected global neobanking market size in 2025, up substantially from the early 2020s.

- Traditional banks reported $142 billion in combined profits in the U.S. in 2024 across six major banks.

- Digital challenger banks like Monzo reported £60.5 million in pretax profit in 2025, up from £13.9 million in the prior year.

- Fintech revenue grew ~21% in 2024, outpacing broader financial sector growth of ~6%.

- Challenger banks demonstrate sustained profitability streaks, e.g., Starling Bank reporting consecutive profitable years.

- Internal fintech adoption correlates with improved ROA and NIM in several empirical studies.

Recent Developments

- Fintech revenues grew 21% compared to the financial sector’s 6%.

- 75% of traditional banks have launched digital transformation strategies.

- UK digital-only bank accounts rose to 40% of adults, or 21.5 million users.

- Digital banks are projected to generate $1.61 trillion in net interest income.

- Fintech revenues expected to grow 15% annually vs traditional banking’s 6%.

- Embedded finance is expected to account for 25% of global banking revenue.

- 76% of US adults use mobile banking apps.

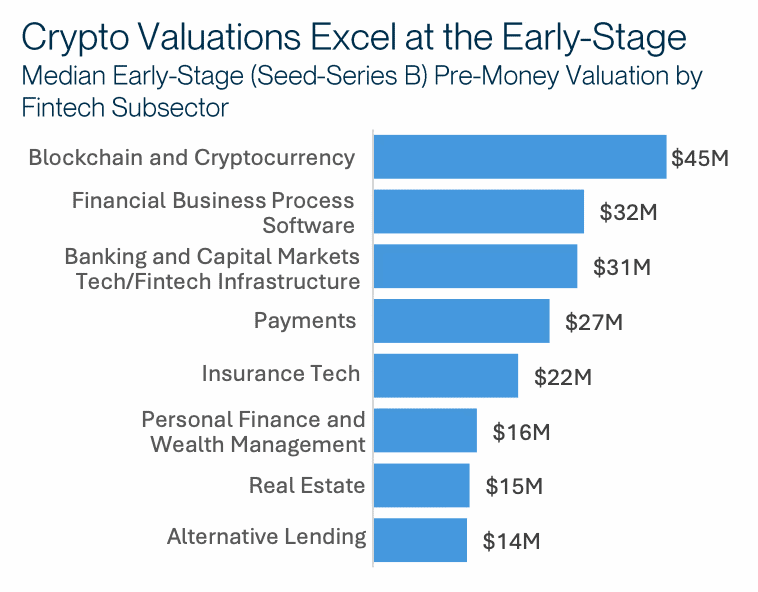

Early-Stage Fintech Valuations by Subsector

- Blockchain and Cryptocurrency startups lead with a $45 million median pre-money valuation at the early stage.

- Financial Business Process Software follows with a solid $32 million valuation.

- Banking and Capital Markets Tech / Fintech Infrastructure companies average $31 million in valuation.

- Payments startups post a median valuation of $27 million.

- Insurance Tech ventures report a valuation of $22 million.

- Personal Finance and Wealth Management fintechs are valued at around $16 million.

- Real Estate fintech startups post $15 million in early-stage valuation.

- Alternative Lending comes in last with $14 million in median pre-money valuation.

Net Interest Margin (NIM) and Yield Metrics

- U.S. banks’ NIM rose steadily, reaching a 3.25% industry average.

- Community banks’ NIM increased to 3.46% for the fourth straight quarter.

- Large U.S. banks maintain NIM between 2.5% and 3.5%.

- Industry NIM expanded to 2.99% median for the top 20 banks.

- Community bank NIM climbed to 3.62% approaching pre-pandemic levels.

- Vietnam listed banks’ NIM narrowed to 3.17% six-year low.

- Global sample banks averaged NIM of 3.89%.

- U.S. banks’ asset yields increased while funding costs fell.

- ICBC reported NIM at 1.28% with loans growing 7.3%.

Return on Assets (ROA) Comparison

- FDIC-insured institutions reported an average ROA of 1.13% in Q2.

- U.S. banking industry ROA stood at 1.13% for the second quarter.

- JPMorgan Chase achieved an ROA of 1.3% among the largest U.S. banks.

- Global banks face risks pushing ROE below the cost of equity amid fintech pressures.

- Challenger banks show 92 out of 650 are globally profitable in Q1.

- Traditional banks averaged a higher ROA than digital banks from 2021-2023.

- Community banks posted ROA improvements with net income up 12.5% quarterly.

- Fintech adoption is linked to enhanced ROA through cost efficiencies in studies.

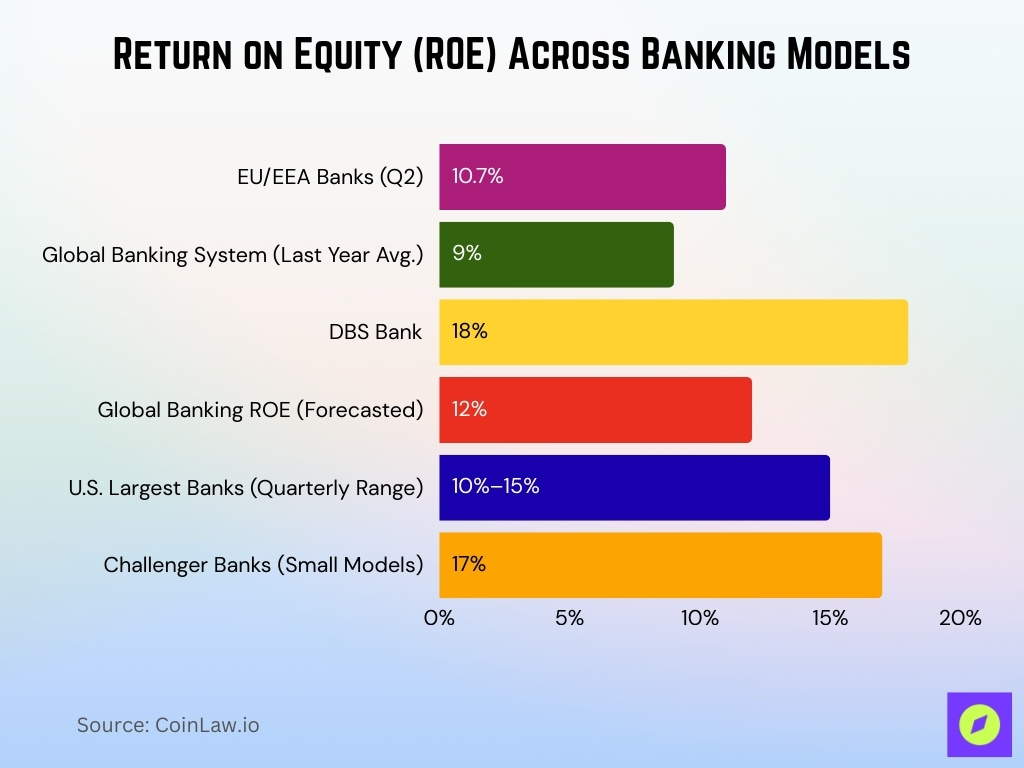

Return on Equity (ROE) Comparison

- EU/EEA banks recorded ROE of 10.7% in Q2.

- The global banking system averaged an ROE of 9% last year.

- DBS Bank achieved a standout ROE of 18%.

- Average global banking ROE is expected to be near 12%.

- U.S. largest banks showed ROE around 10-15% quarterly.

- Challenger banks reported ROE surpassing incumbents at 17% for smaller models.

Profitability by Region and Market Segment

- Fintech revenue growth hit 40% globally, with profit growth at 39%.

- North America captured the majority of global fintech funding, dominating deal value.

- Europe held 34% neobanking revenue share, led by digital adoption.

- Asia-Pacific fintech customer growth stabilized at 37% across verticals.

- ASEAN fintech funding fell to $27.8 billion in 9M despite the global rebound.

- 69% public fintechs achieved profitability with EBITDA margins at 16%.

- Indian fintech raised $1.4 billion through 109 deals, ranking fourth globally.

- Fintech sector accounted for 5% global banking net revenue.

- Singapore fintech secured $797 million in 100 deals as SE Asia leader.

Operating Cost Structure: Branch‐Based vs Digital‐First Models

- Digital bank spin-offs reduced operating costs by up to 70%.

- Neobanks operate 60% cheaper than traditional banks daily.

- Online banks‘ administrative expenses hit 1% of assets vs 0.5% traditional banks.

- European bank cuts costs by 50-80% through process streamlining.

- Digital banking automates tasks, boosting productivity by 50%.

- Cloud usage reduces operational costs by 4.1% for a 10% increase.

- Neobanks eliminate branch costs, passing savings via lower fees.

- Digital banks’ IT expenses reached 2.4% assets vs 1.3% traditional banks.

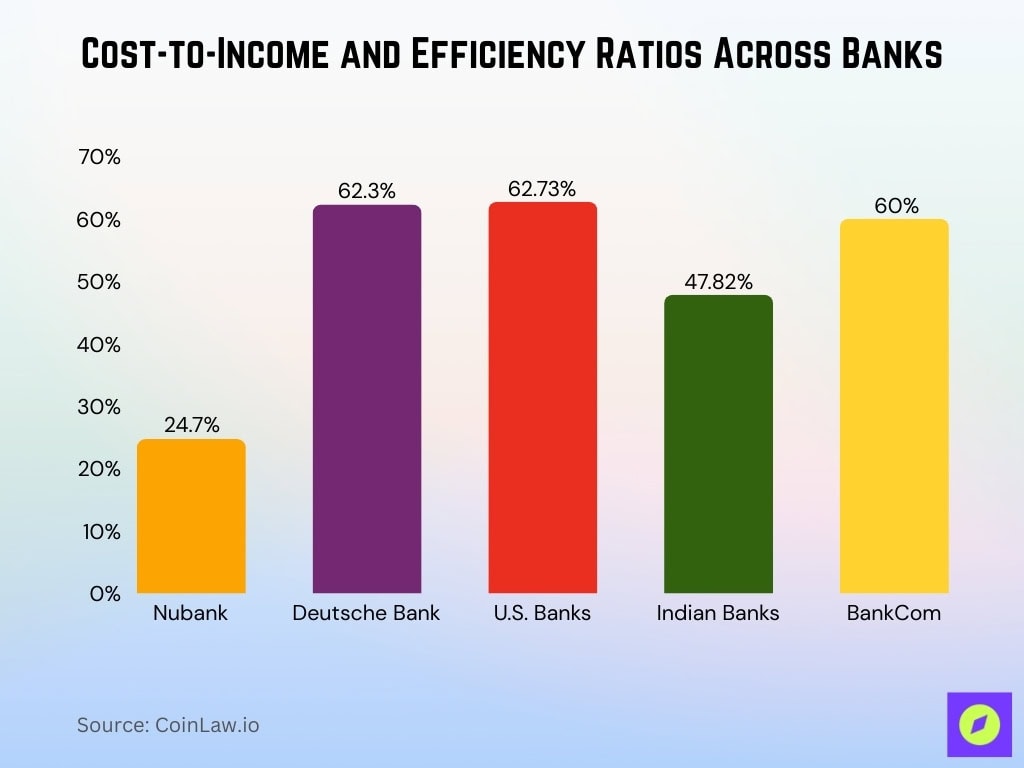

Cost‐to‐Income and Efficiency Ratios

- Nubank achieved an efficiency ratio of 24.7%.

- Deutsche Bank reported a cost/income ratio of 62.3% first half.

- U.S. banks maintained a cost-to-income ratio of 62.73%.

- Indian banks recorded a cost-to-income ratio of 47.82%.

- BankCom posted a cost-to-income ratio of 60% Q1.

Technology Investment and Its Impact on Profitability

- Bank IT spending absorbs over 10% of revenues globally.

- Global bank IT spending grows at 9% compound annual rate.

- Banks increase technology budgets by 4.7% for revenue growth.

- AI pioneers gain up to 4 percentage points of ROTE increase.

- Commerzbank projects 120% ROI from €140 million AI investments.

- Fintech investments boost ROA by 0.143 through customer understanding.

- AI adoption positively impacts ROA and ROE significantly.

- 60% tech spending maintains operations, freeing innovation resources.

Capital Adequacy and Leverage Metrics

- Philippine banks’ CAR reached 20.32% median in Q3.

- China commercial banks CAR stood at 15.58% end of Q2.

- Philippines CAR measured 16.4% in September.

- ECB applied leverage ratio P2R to 14 banks atop 3% minimum.

- U.S. G-SIBs’ tier 1 leverage ratio at 6.88% Q2.

- Basel III risk-based capital ratios increased for large banks.

- Large U.S. banks’ leverage ratio averaged 9.88%.

- Regional U.S. banks’ leverage ratio hit 10.11%.

- Community banks’ leverage ratio reached 10.83%.

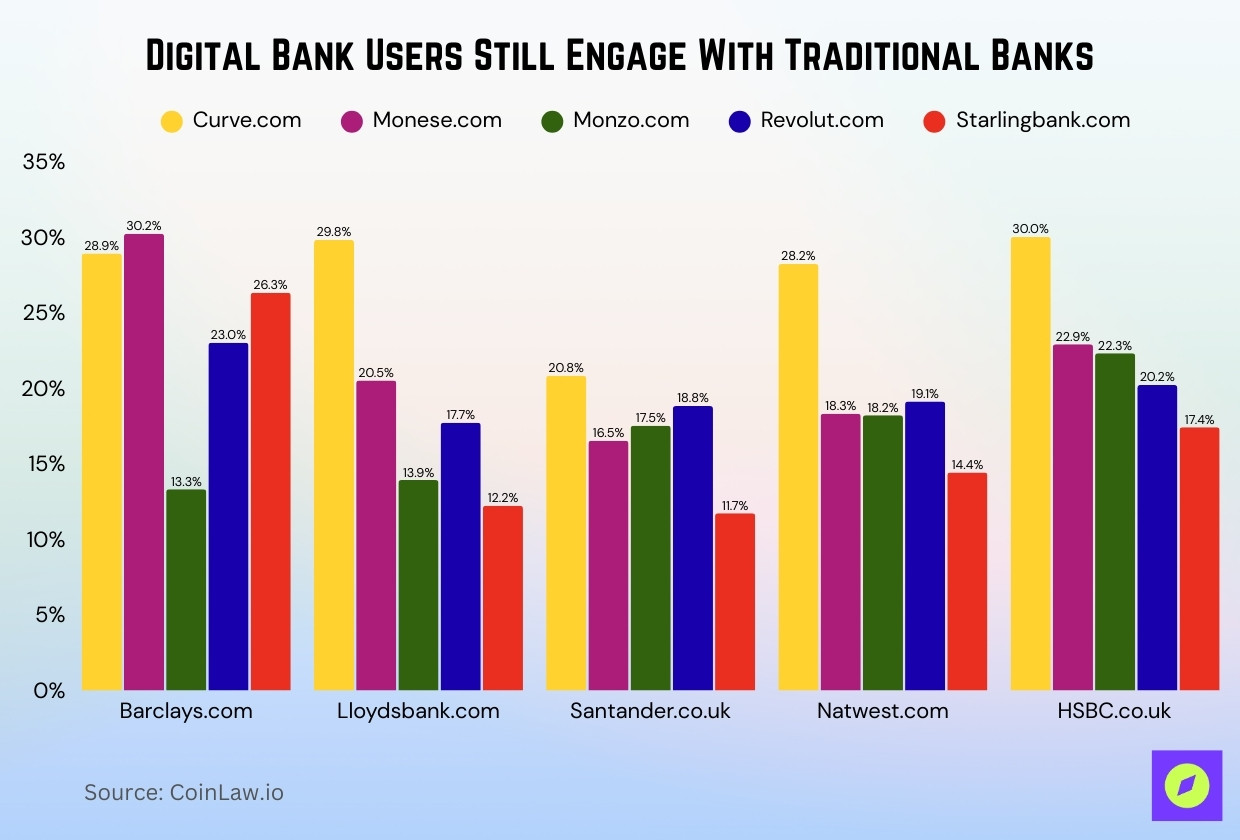

Digital Bank Users Still Engage With Traditional Banks

- 30.2% of Monese.com users also visit Barclays.com, the highest crossover for any digital–traditional pairing.

- Curve.com users frequently engage with HSBC.co.uk (30.0%), Lloydsbank.com (29.8%), and Barclays.com (28.9%).

- Revolut.com users overlap most with Barclays.com (23.0%) and HSBC.co.uk (20.2%).

- Monzo.com shows lower crossover, with only 13.3% visiting Barclays.com and 13.9% visiting Lloydsbank.com.

- Starlingbank.com visitors overlap most with Barclays.com (26.3%) and HSBC.co.uk (17.4%), but have the lowest crossover with Santander.co.uk (11.7%).

- Natwest.com saw strong dual engagement, especially from users of Curve.com (28.2%), Starlingbank.com (14.4%), and Revolut.com (19.1%).

AI‐Driven vs Traditional Banking Profitability

- AI offers the banking industry $370 billion annual profit potential.

- 54% financial institutions deployed AI initiatives.

- SoFi posted record Q3 net revenue $962 million and net income $139 million.

- SoFi Q3 adjusted revenue surged 38% to $950 million.

- SoFi Q1 net income reached $71 million revenue $772 million.

- 75% large banks are expected to fully integrate AI strategies.

- 69% public fintechs have profitable EBITDA margins of 16%.

- The banking sector is projected to have 20% global AI spending by 2028.

- Fintech revenues grew 21% vs the financial sector 6%.

Customer Usage Patterns and Their Effect on Profitability

- 83% U.S. consumers hold accounts with traditional banks.

- 42% Americans use fintech providers like Chime or SoFi.

- 34% consumers use mobile banking apps daily.

- 3.6 billion people worldwide use online banking services.

- Neobank users average $1,350 monthly transaction value.

- Neobank app daily usage grew 29% averaging 27 minutes.

- 91% consumers prioritize mobile and online banking access.

- Digital banks projected $1.61 trillion net interest income.

- 77% banking interactions occur through digital channels.

Fee‐Based Income vs Interest Income Mix

- SoFi fee-based revenue hit $315.4 million, up 67% year-over-year.

- Traditional banks derived 85% growth from net interest income.

- U.S. banks’ non-interest income totalled $295 billion.

- Top private banks earned 22% income from fees.

- FDIC banks’ non-interest income rose 1.5% to $250.7 billion in Q2.

- SoFi Financial Services’ noninterest income quadrupled to $129.9 million.

- Digital banks’ net interest income is projected $1.61 trillion.

- Robinhood’s net interest revenues grew 14% to $290 million in Q1.

- Australian banks’ fee revenue increased 5% comprising 5% total revenue.

Early‐Stage vs Mature Fintech Bank Profitability

- 69% publicly listed fintechs achieved profitability.

- Mature fintechs posted EBITDA margins averaging 16%.

- Nubank reported a net profit $1.37 billion on $11.5 billion in revenue.

- Monzo delivered a net profit of £94.5 million on £1.2 billion revenue.

- Zopa doubled its annual profit to £232 million.

- Early-stage fintech cash burn dropped 12% year-over-year.

- 92 of 650 challenger banks globally are profitable in Q1.

- Mature neobanks scaled revenues 21% vs sector 6%.

- Fintech IPOs raised $10 billion in Q2 through mega-rounds.

Long‐Term Sustainability of Fintech Profitability Models

- Fintech revenue growth sustained at 21% vs the financial sector at 6%.

- Digital banks’ net interest income is projected $1.61 trillion globally.

- 69% public fintechs are profitable with 16% EBITDA margins.

- Fintech enhances corporate sustainable development performance.

- Digital banks’ market share rose to 3.9% total assets.

- AI threatens 9% global bank profit pools long-term.

Frequently Asked Questions (FAQs)

61% of the top 100 digital banks reported full‑year profitability in 2025.

Only about 18% of neobanks were projected to reach break‑even profitability by 2025.

Most successful neobanks have a breakeven period of 5–7 years.

68% of digital banking users reported that neobank apps provide superior budgeting tools.

Conclusion

Fintech banks show clear signs of maturation, with most public fintechs turning profits and expanding revenue beyond traditional interest income. Fee‑based models, customer usage patterns, and advanced tech investments underpin fintech profitability growth, but early‑stage firms still face profitability lag until scale is reached.

Traditional banks continue to lead in total earning power due to size, diversification, and established markets, yet fintech integration is reshaping revenue mixes and efficiency profiles. The profitability gap is narrowing as both sectors leverage technology and adapt to evolving customer behaviors. These trends suggest sustained competition and collaboration will define the banking profitability landscape through the rest of the decade, blending digital‑first efficiency with legacy stability.