Imagine this: You’re applying for a mortgage, eagerly awaiting approval, only to find out your financial information has been compromised. This nightmare is a stark reality for many, as financial data breaches continue to rise globally. In a world where your financial data is more valuable than ever, understanding the landscape of financial data privacy is essential. This article unpacks the latest statistics and trends shaping the financial data privacy landscape, helping you stay informed and secure.

Editor’s Choice

- 68% of consumers are worried about their financial data being misused in 2025.

- 90% of financial institutions implemented new privacy measures in 2025 to comply with updated regulations.

- 65% of businesses reported an increase in cyberattacks targeting financial data in 2025.

- 77% of consumers worry about their financial data privacy in 2025.

- 41.8% of financial breaches in 2025 were linked to third-party vulnerabilities.

Global Data Privacy Regulations Impacting Financial Services

- GDPR fines surpassed €6.2 billion globally by August 2025, increasing substantially in the past two years.

- The California Consumer Privacy Act (CCPA) required mandatory cybersecurity audits and risk assessments for over 60% of US financial institutions in 2025.

- India’s Digital Personal Data Protection Act 2025 introduced penalties of up to ₹250 crore for non-compliance.

- China’s expanded Data Security Law in 2025 covers most international financial firms and mandates new encryption rules.

- Brazil’s LGPD fines topped BRL 98 million, impacting multinational financial entities in 2025.

- The EU’s Digital Finance Package in 2025 drives privacy and open finance rules, affecting over 70% of fintech companies.

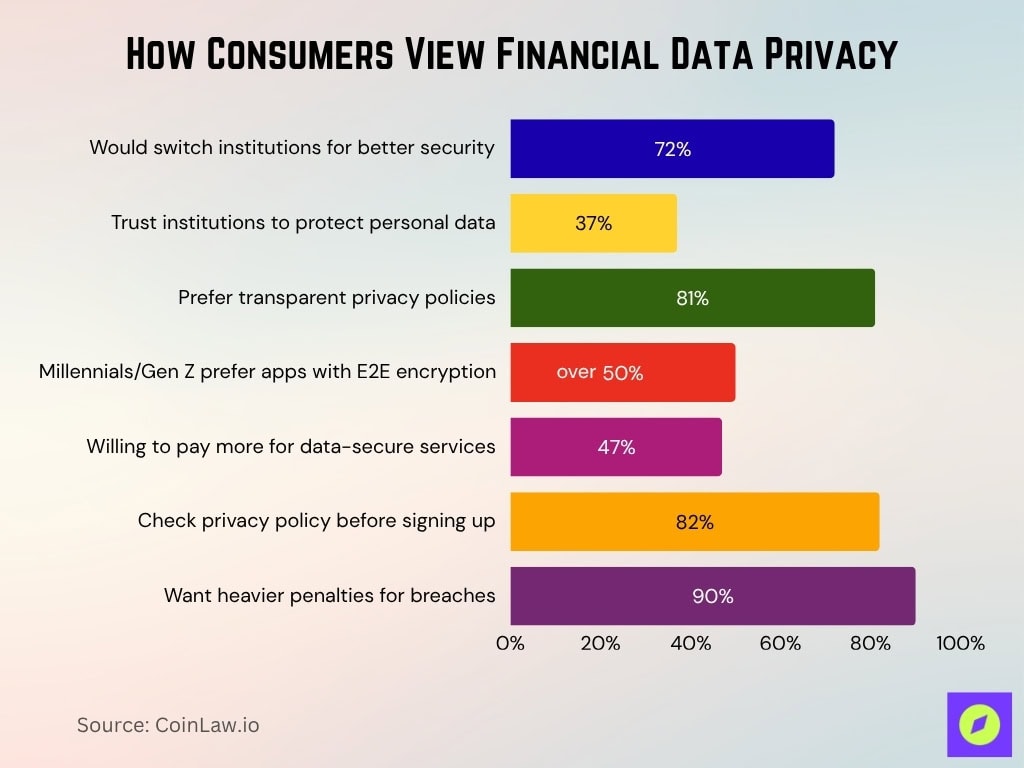

Consumer Attitudes Toward Financial Data Privacy

- 72% of US consumers said they would switch financial institutions if they felt their data wasn’t secure in 2025.

- Only 37% of consumers in 2025 trust financial institutions to protect their personal data.

- 81% of consumers in 2025 prefer companies that are transparent about their data privacy policies.

- Over 50% of Millennials and Gen Z in 2025 prefer financial apps with end-to-end encryption features.

- 47% of consumers are willing to pay more for financial services that prioritize data security in 2025.

- 82% of consumers check a company’s data privacy policy before signing up for financial services in 2025.

- 90% of Americans in 2025 feel companies should be penalized more heavily for financial data breaches.

Statistics Showing Data Privacy Trends

- Multi-factor authentication usage grew by 29%, with 68% of businesses implementing it for financial data access in 2025.

- Zero-trust architecture adoption in financial services increased by 37% in 2025.

- Ransomware attacks involving financial data rose by 17%, costing an average of $5.56 million per incident in 2025.

- 62% of financial firms invested in AI-driven tools for detecting and mitigating data breaches in 2025, up from 41% in 2022.

- Cloud-based financial systems saw a 25% increase in adoption in 2025, emphasizing scalability and security.

- 75% of consumers reported concerns about how financial data is collected via mobile apps in 2025, indicating growing skepticism.

Business-Related Data Privacy Stats

- 46% of SMEs faced financial data breaches in 2025, highlighting persistent vulnerability.

- Large corporations spent an average of $5 million annually on financial data security in 2025.

- Third-party contractors were responsible for 47% of data leaks in 2025, indicating ongoing outsourcing risks.

- 71% of businesses said they prioritize real-time threat detection in 2025, up from 69% the previous year.

- Companies using biometric authentication saw a 38% reduction in unauthorized access to financial data in 2025.

- Financial losses from insider threats amounted to $17.4 million annually per organization globally in 2025.

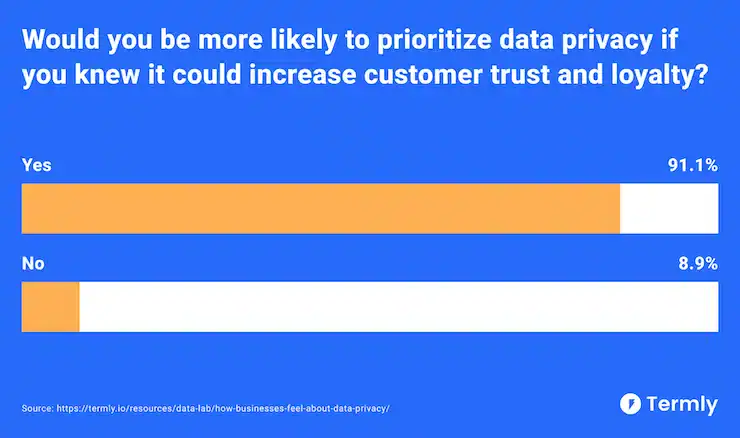

Prioritizing Data Privacy for Customer Trust

- 91.1% of businesses said they would prioritize data privacy if it led to increased customer trust and loyalty.

- Only 8.9% responded No, indicating that nearly all businesses recognize the value of privacy in building stronger customer relationships.

- This shows a clear alignment between privacy efforts and brand trust, suggesting data protection is not just a legal need but also a competitive advantage.

Financial Industry Data Breach Incidents and Trends

- 2,100 financial institutions worldwide reported breaches in 2025.

- The average cost per financial data breach reached $5.56 million in 2025, maintaining the highest across industries.

- Banking and payment apps accounted for 31% of financial breaches in 2025, with phishing as the leading cause.

- The number of breaches exposing Social Security numbers increased by 22% year-over-year in 2025.

- 94% of breached institutions reported a loss of consumer trust and loyalty in 2025.

- 41.8% of financial industry breaches in 2025 are linked to third-party vendors.

- 48% of companies had financial data exposed on the dark web in 2025.

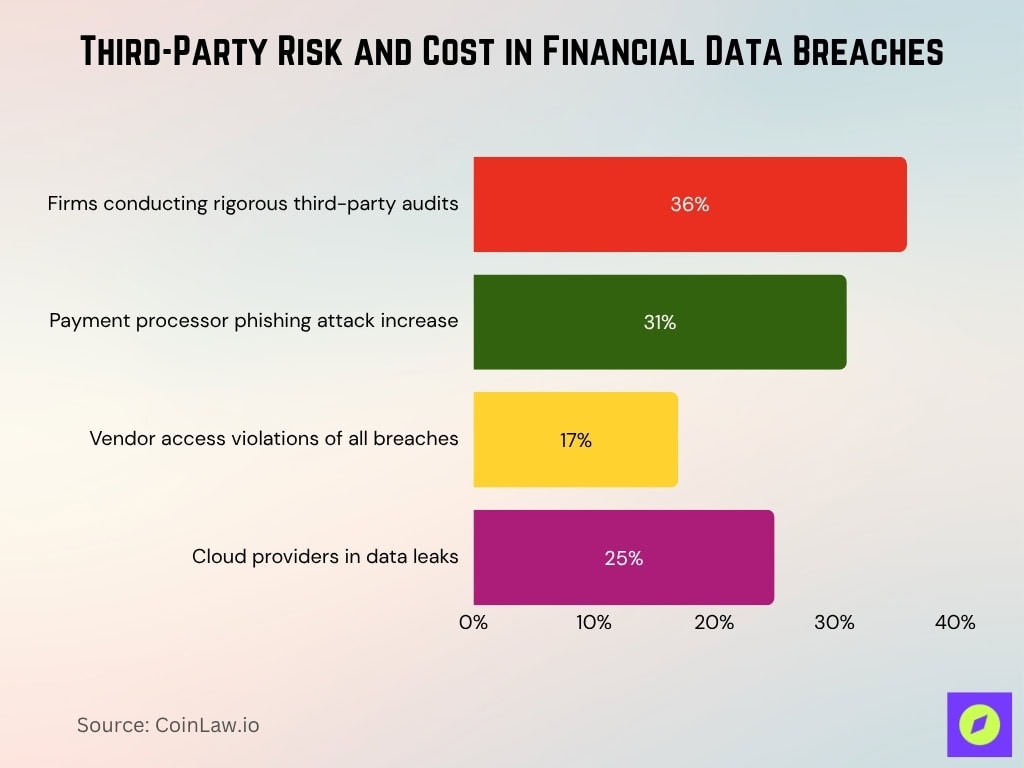

Third-Party Data Breach Statistics

- The average cost of third-party data breaches reached $5.1 million per incident in 2025, a 9% increase from 2024.

- Only 36% of financial firms conducted rigorous audits of third-party data security measures in 2025.

- Third-party payment processors experienced a 31% rise in phishing attacks in 2025.

- Vendor access violations accounted for 17% of all financial breaches in 2025, underscoring monitoring gaps.

- Cloud service providers were involved in 25% of financial data leaks in 2025, highlighting the need for robust cloud security.

- Compliance fines for third-party-related breaches surged to $1.2 billion globally in 2025.

Data Privacy and Cybercrime Statistics

- Cybercrime targeting financial data accounted for 64% of total cybercrime costs globally, reaching $1.2 trillion in 2025.

- Phishing attacks aimed at financial data increased by 67% in 2025, with 82% of institutions reporting incidents.

- The average time to detect a breach in financial firms dropped to 177 days in 2025, improving from 212 days in 2023.

- Malware designed for financial data theft grew by 39%, costing an average of $4.17 million per organization in 2025.

- 98% of financial institutions identified ransomware as their top cybercrime concern in 2025.

- Credential stuffing attacks rose by 19% in 2025, compromising the accounts of 22% of consumers globally.

- 87% of financial firms implemented advanced cybersecurity training to combat sophisticated attacks in 2025.

Technological Measures for Enhancing Financial Data Privacy

- 48% blockchain adoption rate in financial services in 2025, with 76% of firms citing enhanced data privacy as a key benefit.

- End-to-end encryption usage in financial applications increased by 41% in 2025, reducing unauthorized data access by 27%.

- Biometric authentication adoption reached 69% in 2025, reducing fraud-related losses by 33%.

- Artificial Intelligence (AI) systems for threat detection grew by 58% in 2025, allowing proactive prevention of breaches.

- Secure access service edge (SASE) implementation rose by 32% in 2025, strengthening remote work security for financial firms.

- Tokenization of financial transactions reduced payment data exposure by 65% in 2025.

- Financial apps with built-in privacy features saw 63% higher adoption rates among consumers in 2025.

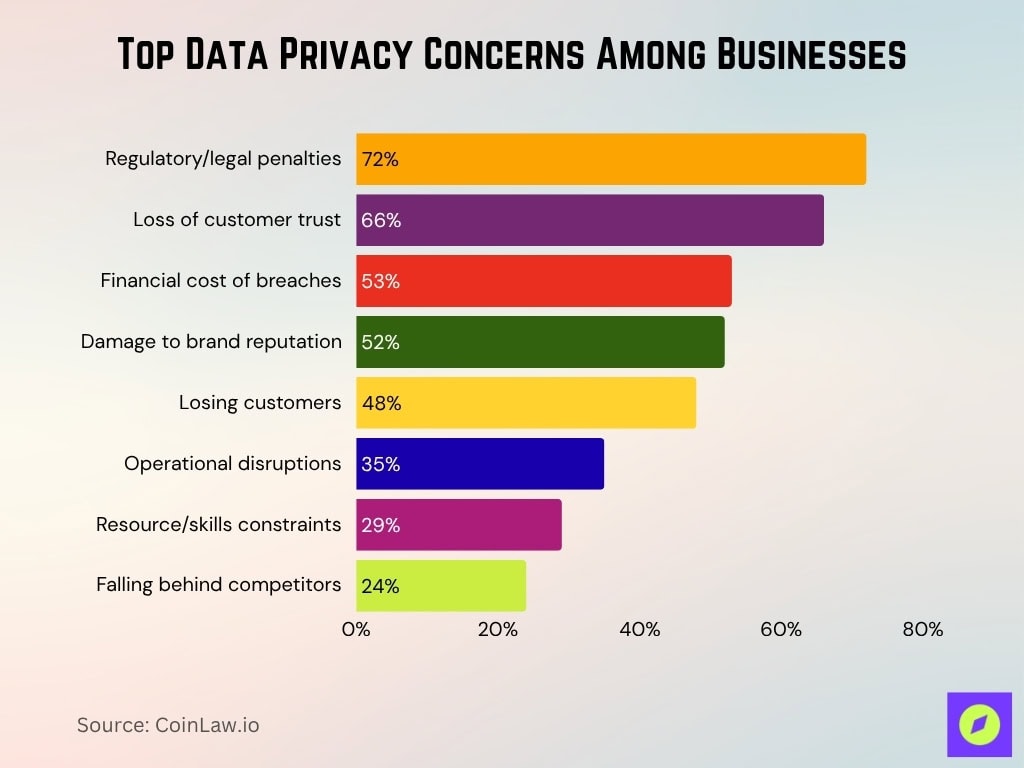

Top Data Privacy Concerns Among Businesses

- 72% of businesses are concerned about regulatory or legal penalties, making it the top-ranked risk.

- 66% worry about losing customer trust, highlighting trust as a critical business asset.

- 53% cite the financial cost of data breaches as a major concern.

- 52% fear damage to brand reputation, showing how privacy breaches impact public perception.

- 48% are anxious about losing customers, underlining customer retention risks.

- 35% anticipate operational disruptions resulting from privacy issues.

- 29% face resource and skill constraints in addressing data privacy effectively.

- 24% are concerned about falling behind competitors in privacy compliance and innovation.

The Impact of Insider Threats

- 32% of financial data breaches were caused by insider threats in 2025, costing an average of $12.1 million per incident.

- Negligent employees accounted for 57% of insider-related breaches in 2025, while 43% were due to malicious insiders.

- 31% of insider threats went undetected for over 6 months in 2025, highlighting ongoing monitoring gaps.

- 69% of financial institutions implemented behavior analytics tools to identify insider risks in 2025.

- Remote work setups contributed to a 22% increase in insider data breaches in 2025.

- Organizations with robust insider threat programs reported 34% fewer incidents in 2025 compared to those without.

- Financial firms spent an average of $1.5 million annually on insider threat mitigation technologies in 2025.

Recent Developments

- In 2025, the US Federal Reserve and financial regulators enforced stricter data privacy compliance, requiring updated identification methods and stronger privacy programs for all banks.

- The European Union proposed GDPR reforms in 2025 to expand exemptions for SMEs and introduce targeted fintech data privacy measures.

- Major banks like JPMorgan Chase and Citibank have each pledged $500 million in data privacy upgrades by 2025.

- Visa and Mastercard rolled out enhanced tokenization services in 2025, yielding up to a 40% reduction in payment fraud rates.

- Consumer-grade encryption technologies were integrated into 57% of new financial apps in 2025, ensuring greater privacy control for users.

- AI-driven fraud detection systems are used by 90% of global financial institutions in 2025, dramatically improving real-time response.

Frequently Asked Questions (FAQs)

$175.3 billion with a CAGR of 16.8% from 2025 to 2032.

$5.56 million per breach, the highest in any industry.

89% adopted new data privacy protocols to meet regulations.

83% of organizations faced insider attacks, averaging $17.4 million in annual cost.

Conclusion

As the financial world becomes increasingly digital, the stakes for data privacy have never been higher. From insider threats to third-party vulnerabilities, the statistics highlight critical areas for improvement. However, advancements in technological measures and a growing focus on global regulations signal a shift toward more secure financial data practices. For individuals and organizations alike, regular security training, multi-factor authentication, and third-party risk assessments are key strategies to proactively defend against financial data breaches.