In 2019, the Financial Action Task Force (FATF) released its first set of guidelines aimed at regulating virtual assets. At the time, the crypto industry was still largely viewed as an unregulated frontier, a wild west for digital assets. Fast forward, and the landscape has changed dramatically. Regulators, institutions, and crypto platforms are now navigating an increasingly structured compliance framework, driven by the FATF Travel Rule and Know Your Customer (KYC) requirements.

But how far have we come? And where are we headed? In this article, we’ll break down the latest statistics surrounding FATF’s guidelines on virtual assets, focusing on KYC compliance, regional trends, and the impact these rules are having on the broader crypto ecosystem.

Editor’s Choice

- 79% of virtual asset service providers (VASPs) globally are now KYC-compliant as of Q3 2025.

- 85% of centralized exchanges in North America have fully implemented FATF Travel Rule guidelines in 2025.

- 41% year-over-year growth in crypto exchange user activity reported by platforms with AI-enhanced KYC in 2025.

- $2.9 billion projected global spending on AML/KYC technology in 2025, up ~12.3% from last year.

- 58% of crypto users in the US prefer KYC-verified platforms for improved security in 2025.

- AI-powered KYC verification reduced onboarding time by 82% across top exchanges in 2025.

- 67% of decentralized exchanges (DEXs) still lack full KYC compliance, posing ongoing regulatory challenges into 2025.

Regional Variations in KYC Adoption Among Crypto Platforms

- North America leads with 85% of centralized exchanges fully implementing FATF Travel Rule protocols by 2025.

- Europe follows at 78% exchange KYC adoption, driven by MiCA enforcement in 2025.

- Asia-Pacific’s Japan and South Korea achieve 90% compliance rates, while India stands at 52% as of Q1 2025.

- Middle Eastern countries like the UAE and Saudi Arabia report 68% KYC adoption rates in 2025 through regulatory sandbox initiatives.

- Latin America compliance rates reach 49% in 2025, with regulations still fragmented in Brazil and Argentina.

- Africa reports the lowest with 41% of exchanges complying with FATF KYC requirements, and Nigeria shows 60% compliance growth in 2025.

- Oceania, led by Australia, sees a 75% compliance rate driven by AUSTRAC’s strict enforcement in 2025.

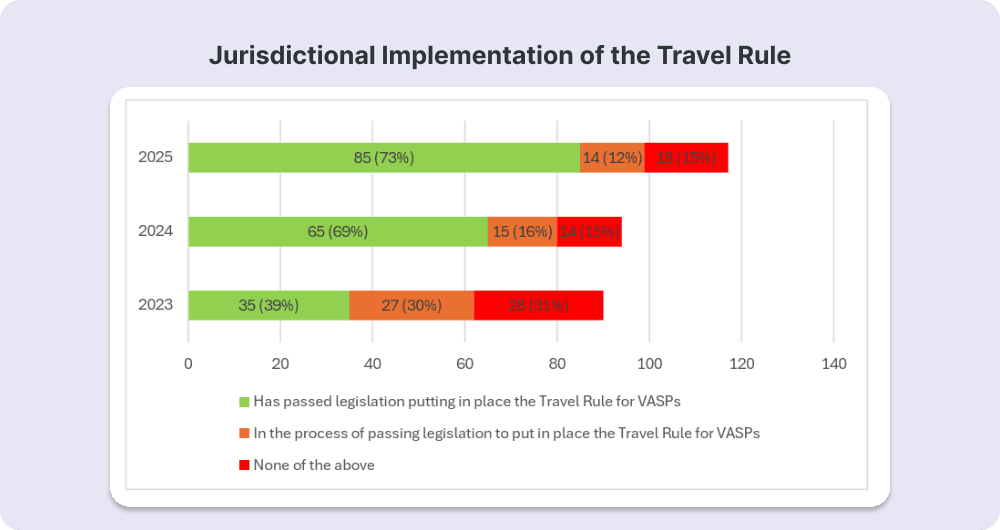

Jurisdictional Implementation of the Travel Rule

- In 2025, 85 jurisdictions (73%) had fully passed Travel Rule legislation, while 14 jurisdictions (12%) were still in progress, and 18 (15%) had taken no action.

- By 2024, 65 jurisdictions (69%) had implemented the rule, with 15 (16%) working on legislation and 14 (15%) not yet aligned.

- In 2023, only 35 jurisdictions (39%) had passed Travel Rule laws, while many remained in transition 27 (30%) or non-compliant 28 (31%).

- The data highlights a rapid rise in global Travel Rule adoption, increasing from 39% in 2023 to 73% in 2025, driven by regulatory alignment with FATF expectations.

Impact of KYC Regulations on Crypto Exchange User Growth

- Exchanges with simplified KYC processes saw user acquisition rates rise by 41% in 2025, compared to 28% for platforms with more complex procedures.

- 61% of surveyed crypto users in 2025 cited increased security as the primary reason for choosing KYC-compliant platforms.

- 15% decline in user sign-ups was reported by exchanges that introduced manual-only KYC processes without automation in 2025.

- AI-driven KYC verification reduced onboarding time from an average of 24 hours in 2023 to 12 hours in 2025.

- 87% of institutional investors prefer trading on exchanges with robust KYC protocols, according to a 2025 Fidelity Digital Assets report.

- Exchanges compliant with FATF guidelines experienced a 32% increase in daily active users (DAUs) over the past year.

- 52% of crypto wallets linked to fully KYC-verified accounts transacted higher volumes compared to non-verified wallets, driving revenue growth for compliant platforms.

- Despite stricter rules, 29% of new users in emerging markets expressed greater willingness to provide KYC information for better platform security in 2025.

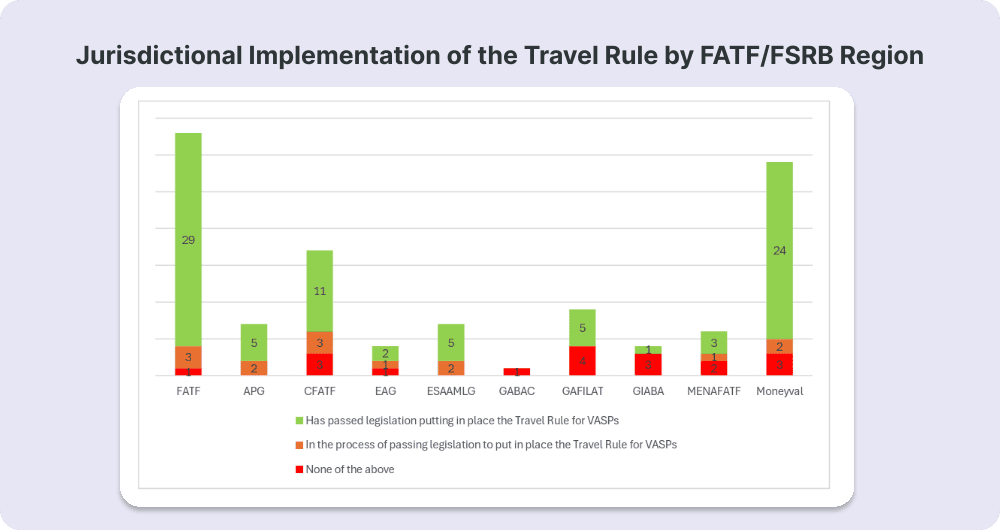

Jurisdictional Implementation of the Travel Rule by FATF and FSRB Regions

- FATF leads globally with 29 jurisdictions having passed the Travel Rule, while 3 are in progress and 2 have taken no action.

- Moneyval shows strong adoption, with 24 jurisdictions implementing the rule, 2 in progress, and 3 not aligned.

- CFATF records 11 implementations, alongside 3 in progress and 3 with no action, reflecting mixed readiness across the Caribbean region.

- Regional bodies with moderate adoption include APG (5 passed) and ESAAMLG (5 passed), each showing ongoing movement with small numbers still in progress or unaligned.

- GAFILAT stands out in Latin America with 5 implementations, 4 in progress, and 3 non-compliant, indicating active legislative transition.

- Lower implementation regions include EAG (2 passed) and GIABA (1 passed), with more jurisdictions still in progress or not compliant.

- GABAC shows minimal readiness, recording only 1 implementation and 1 non-compliant, with 0 in progress.

- The data illustrates significant unevenness across global regions, where some FSRBs have near full alignment while others remain early in their implementation journey.

KYC Compliance Rates Among Centralized vs. Decentralized Exchanges

- As of 2025, 92% of CEXs are fully KYC compliant, up from 81% in 2024.

- Only 33% of DEXs have implemented any form of KYC verification in 2025.

- 45% of DEX users in 2025 report avoiding KYC to preserve anonymity despite growing regulatory pressure.

- 68% of DEXs operating in Asia-Pacific remain non-compliant, making them prime targets for enforcement in 2025.

- 14% of DEX platforms have begun piloting zero-knowledge proof (ZKP)-based KYC solutions for privacy-friendly compliance in 2025.

- 51% of institutional investors indicate a preference for CEXs due to the KYC assurances they provide in 2025.

- 26% of DEX platforms have restricted access to certain jurisdictions due to FATF Travel Rule compliance demands in 2025.

- KYC-compliant CEXs have reported a 43% increase in institutional trading volumes since implementing stricter verification protocols in 2025.

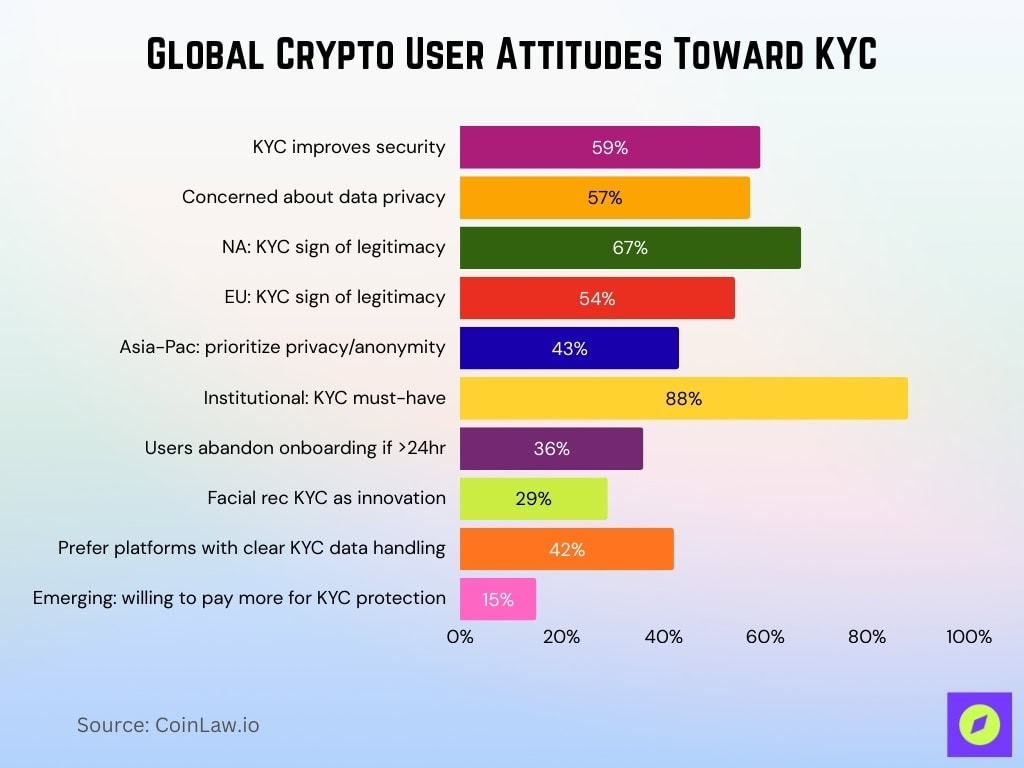

User Attitudes Toward KYC Processes in Cryptocurrency Transactions

- 59% of crypto users globally believe KYC improves the overall security of crypto platforms in 2025.

- 57% of users express concerns about data privacy and KYC data storage with third-party access in 2025.

- In North America, 67% of crypto users view KYC requirements as a sign of platform legitimacy, while in Europe, the figure stands at 54% in 2025.

- 43% of users in Asia-Pacific still prioritize privacy and anonymity over the benefits of KYC compliance in 2025.

- 88% of institutional users report that comprehensive KYC protocols are a must-have for participation on crypto platforms in 2025.

- 36% of users abandon onboarding if KYC verification takes more than 24 hours, highlighting the need for streamlined solutions in 2025.

- 29% of respondents in 2025 cite facial recognition KYC tools as a positive innovation for faster verification and reduced errors.

- 42% of users are more likely to trade on platforms that clearly disclose data handling during and after the KYC process in 2025.

- 15% of users in emerging markets are willing to pay higher fees for strong KYC data protection in 2025.

KYC and Its Role in Preventing Crypto-Related Financial Crimes

- $40.9 billion in illicit crypto transactions were reported globally in 2024, with estimates for 2025 on track to exceed $51 billion as improved KYC practices intensify enforcement.

- 87% of successful fraud prevention cases on crypto exchanges in 2025 were enabled by KYC-enabled user tracking.

- FATF-compliant exchanges reported a 65% reduction in suspicious activity reports (SARs) versus non-compliant platforms in 2025.

- 79% of exchanges that enforce rigorous KYC checks claim they have reduced account takeovers by 50% year-on-year in 2025.

- Chainalysis reports that 70% of illicit crypto activities in 2024 occurred on non-KYC-compliant platforms.

- Interpol credits KYC-compliant exchanges with assisting in the seizure of $439 million in laundered crypto assets in 2025.

- 32% of regulators surveyed in 2025 believe the Travel Rule and KYC are the most effective tools against terrorist financing in virtual assets.

- The UK’s Financial Conduct Authority noted a 28% drop in crypto scams reported in 2024, attributed to the KYC enforcement surge.

- KYC data-sharing alliances, like the Global Digital Identity Network, expanded their membership by 40% in 2025, improving cross-border fraud detection.

Penalties and Fines for KYC Non-Compliance in the Crypto Sector

- In 2025, global fines for KYC non-compliance in the crypto sector reached $1.3 billion by Q1, on track to surpass 2024’s $1.25 billion total.

- The US SEC issued its largest KYC-related fine of $210 million against a major crypto exchange in 2024.

- Singapore’s MAS imposed fines totaling $450 million in 2024 following audits of non-compliant VASPs.

- 47% of crypto exchanges fined in 2024 failed to implement real-time transaction monitoring, in addition to lacking robust KYC checks.

- 23% of all penalties issued in 2024 were due to inadequate customer due diligence (CDD) procedures at onboarding.

- Europe saw fines for MiCA-related KYC non-compliance reach €486 million in 2025, up 18% from 2024.

- Japan’s FSA revoked 4 VASP licenses in 2024 for persistent KYC non-compliance, the highest number to date.

- 63% of non-compliant exchanges facing fines in 2024 subsequently implemented enhanced KYC processes to regain regulatory approval.

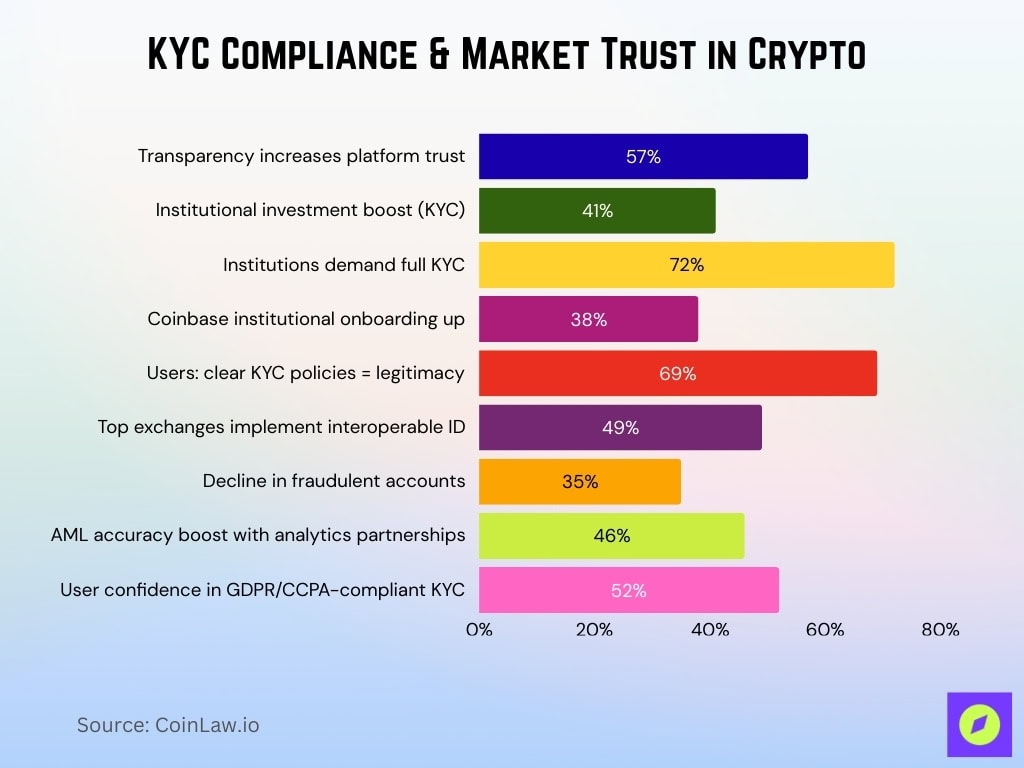

The Role of KYC in Enhancing Crypto Market Transparency and Trust

- 57% of crypto traders in 2025 say transparency in user verification increases their trust in a platform.

- Fidelity Digital Assets reports that 72% of institutional clients require full KYC compliance before engaging with crypto platforms.

- Coinbase experienced a 38% rise in institutional onboarding in 2025 after enhancing its KYC verification processes.

- 69% of users believe clear KYC policies and privacy transparency directly contribute to market legitimacy in 2025.

- The FATF Travel Rule has prompted 49% of top-tier exchanges to implement interoperable identity verification systems in 2025.

- Blockchain analytics firms partnering with KYC-compliant exchanges have improved AML monitoring accuracy by 46% in 2025.

- 52% of surveyed crypto users feel more confident in platforms where KYC policies align with global data protection laws, like GDPR and CCPA, in 2025.

KYC Compliance Costs for Cryptocurrency Businesses

- The average cost of onboarding a new KYC-compliant user for an exchange is $13–$32 in 2025, up from $10–$25 in 2024.

- $2.9 billion is expected to be spent globally on KYC compliance infrastructure by crypto businesses in 2025, up ~12% from last year.

- Top-tier exchanges allocate 15–20% of their operating budgets to compliance and regulatory frameworks in 2025.

- 58% of crypto exchanges outsource their KYC processes to third-party providers like Onfido, Jumio, and Chainalysis in 2025.

- Small exchanges spend an average of $500,000–$2 million annually on KYC and AML compliance in 2025.

- AI-driven KYC solutions reduce compliance costs by 37% for exchanges that switch from manual verification processes.

- 42% of exchanges that invested in blockchain-based identity solutions saw a decline in compliance costs within two years.

- The average fine for KYC breaches reached $3.8 million per case in 2025, up 21% globally.

- High-risk jurisdictions require exchanges to spend 2.5x more on compliance measures than those in low-risk regions in 2025.

Recent Developments

- FATF introduced new KYC assessment criteria in Q2 2025, raising compliance benchmarks and ongoing monitoring expectations for VASPs globally.

- The European Union’s MiCA regulation mandates 100% identity verification for all crypto transactions above €1,000, effective July 2025.

- The US SEC announced a mandatory real-time KYC monitoring requirement for all crypto exchanges under federal jurisdiction in 2025.

- Singapore’s MAS extended its licensing framework to require KYC verification audits and ongoing due diligence for all DeFi protocols as of Q3 2025.

- Japan’s FSA requires biometric verification for all new crypto exchange accounts, placing Japan as the most stringent KYC market in Asia for 2025.

- South Korea’s FSC mandated a centralized crypto ID system in 2025, reducing onboarding fraud by 39%.

Frequently Asked Questions (FAQs)

85 countries have passed legislation implementing the Travel Rule as of mid-2025.

29% of 138 jurisdictions assessed are “largely compliant,” improved from 25% in 2024.

Jurisdictions that have or are implementing FATF crypto standards account for 98% of the global virtual asset market in 2025.

92% of centralized exchanges globally are fully KYC compliant as of 2025.

Conclusion

The FATF guidelines have significantly shaped the virtual asset industry, pushing crypto platforms to implement stronger KYC compliance measures. While user privacy concerns, compliance costs, and regional inconsistencies remain challenges, the trend toward transparency is clear. With increasing institutional participation, better fraud prevention, and a more structured regulatory landscape, KYC compliance is no longer optional; it’s a necessity for the industry’s future.