Ethereum co-founder Jeffrey Wilcke has moved 1,500 ETH worth around $6 million to Kraken, just as whales collectively bought $1.6 billion in ETH during a recent price dip.

Key Takeaways

- Jeffrey Wilcke, a co-founder of Ethereum, sent 1,500 ETH (around $6 million) to the Kraken exchange, sparking speculation of a potential sale.

- At least 15 whale wallets accumulated over 406,000 ETH worth $1.6 billion in just two days, despite ETH falling 13% over the week.

- Wilcke has made previous large transfers, including $9.22 million in August and $262 million earlier, which did not result in immediate sales.

- Whale activity suggests strong institutional confidence in Ethereum’s long-term potential, even during short-term volatility.

What Happened?

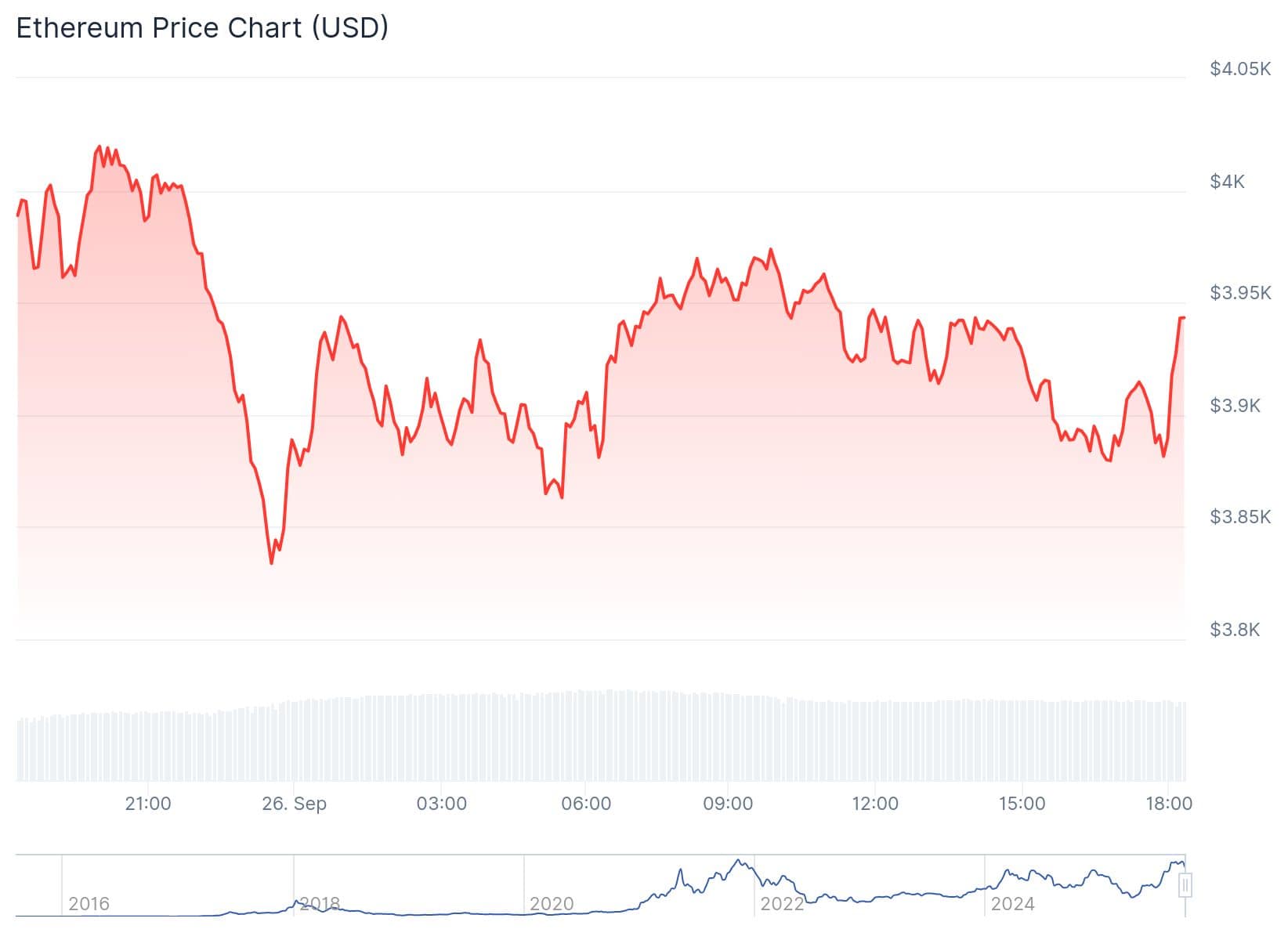

Ethereum co-founder Jeffrey Wilcke recently transferred 1,500 ETH to crypto exchange Kraken, valued at approximately $6 million. The move coincided with Ethereum’s price dip from around $4,000 to $3,900. While such transfers often hint at possible selling intentions, they don’t confirm it. Meanwhile, whales made massive ETH purchases totaling $1.6 billion during the same period, showing a striking contrast in market behavior.

Jeffrey Wilcke, the Co-founder of #Ethereum, just deposited 1,500 $ETH($5.99M) into #Kraken.https://t.co/v8vvamvA0Xhttps://t.co/Kuuq94LDYI pic.twitter.com/nunSFyIj0l

— Lookonchain (@lookonchain) September 25, 2025

Wilcke’s Transfers Spark Curiosity

Wilcke’s move has triggered widespread speculation, especially since this is not the first time he’s transferred large ETH sums. In August, he deposited $9.22 million worth of ETH to Kraken. He also previously sent $262 million to the platform, although Lookonchain later speculated that these funds were moved to new wallets, not liquidated.

Adding fuel to the speculation, Wilcke reposted a comment on X that hinted at future ETH sales, though he has not officially confirmed any intent to sell.

Historical data from May 2025 shows Wilcke transferred 105,736 ETH ($262 million) to Kraken, sparking debate

— #HEX #Whale #SFamisland Blessed.TRX🍌🦅 (@LongedBitcoin) September 25, 2025

So I bet he will sell more in the future

I expect it to dump below 3500

Wilcke remains a key historical figure in the Ethereum community, having contributed to its development from 2013 to 2018 before founding Grid Games, where he currently serves as CEO and technical director.

Whales Buy the Dip

While Wilcke’s actions have raised eyebrows, whales appear to be doubling down on Ethereum. According to onchain analytics platform Lookonchain, over 15 wallets acquired more than 406,000 ETH, worth about $1.6 billion, within just two days. These wallets sourced ETH from Kraken, Galaxy Digital, BitGo, and FalconX.

This isn’t an isolated event. In late August, whales bought over 260,000 ETH worth $1.14 billion in a similar fashion. Earlier this month, a whale was even spotted shifting billions from Bitcoin into Ethereum, pushing their ETH holdings above $4 billion.

Market Sentiment Remains Divided

Ethereum’s 12.7% price decline over the past week has rattled some investors, but whale activity suggests a long-term bullish sentiment. This divergence between a founding member’s cautious liquidity moves and the aggressive buying from institutional players highlights different strategies at play.

Experts believe this whale accumulation could point to expectations of upcoming Ethereum upgrades or favorable regulatory shifts. While short-term price fluctuations persist, whales appear to view them as buying opportunities.

CoinLaw’s Takeaway

In my experience tracking crypto markets, whale behavior often tells the real story. Jeffrey Wilcke’s $6 million transfer got people talking, but the $1.6 billion in whale accumulation? That’s the headline investors should be watching. It tells me big players are gearing up for something bigger in Ethereum’s future. I found it especially telling that while one co-founder might be reducing exposure or redistributing funds, institutional giants are all in. That kind of confidence is hard to ignore.