It was only a decade ago when Ethereum was dismissed as just another altcoin. It’s clear that Ethereum has become the backbone of the decentralized internet. From NFT marketplaces to DeFi ecosystems, Ethereum powers the infrastructure of Web3 innovation.

In this article, we unpack the key Ethereum statistics, digging into transaction trends, gas fee dynamics, wallet adoption, and more. Whether you’re an investor, developer, or simply Ethereum-curious, these data points offer clarity in a rapidly evolving blockchain landscape.

Editor’s Choice

- Ethereum’s total market cap surpassed $408 billion in Q1 2025, up from $319 billion at the end of 2024, reclaiming dominance in the Layer 1 space.

- As of March 2025, the daily Ethereum transaction volume consistently averages 1.65 million transactions, peaking at 1.92 million.

- Active Ethereum wallets reached a record 127 million in March 2025, marking a 22% YoY increase.

- Average gas fees dropped to $3.78 per transaction in 2025, down from $5.90 in March 2024 due to Layer 2 scaling.

- Ethereum DeFi total value locked (TVL) surpassed $119 billion in Q3 2025, reflecting robust on-chain activity.

- The Ethereum NFT sector generated $5.8 billion in trading volume in Q1 2025.

Daily Transaction Volume on the Ethereum Network

- Ethereum processes an average of 1.65 million transactions daily as of Q1 2025, up from 1.3 million in early 2024.

- The highest single-day transaction count in 2025 was 1.92 million on February 17.

- Smart contract interactions account for nearly 62% of all daily transactions on Ethereum.

- DeFi protocols like Uniswap and Aave contribute to roughly 25% of daily volume.

- Layer 2 mainnet gas-optimized contracts reduced bloat by 18%.

- The NFT sector averages over 180,000 transactions per day in 2025, led by Blur and OpenSea.

- Ethereum’s daily transaction value averages $11.7 billion, a 14% YoY increase.

- Saturday volume now averages 1.55 million transactions, driven by weekend global adoption.

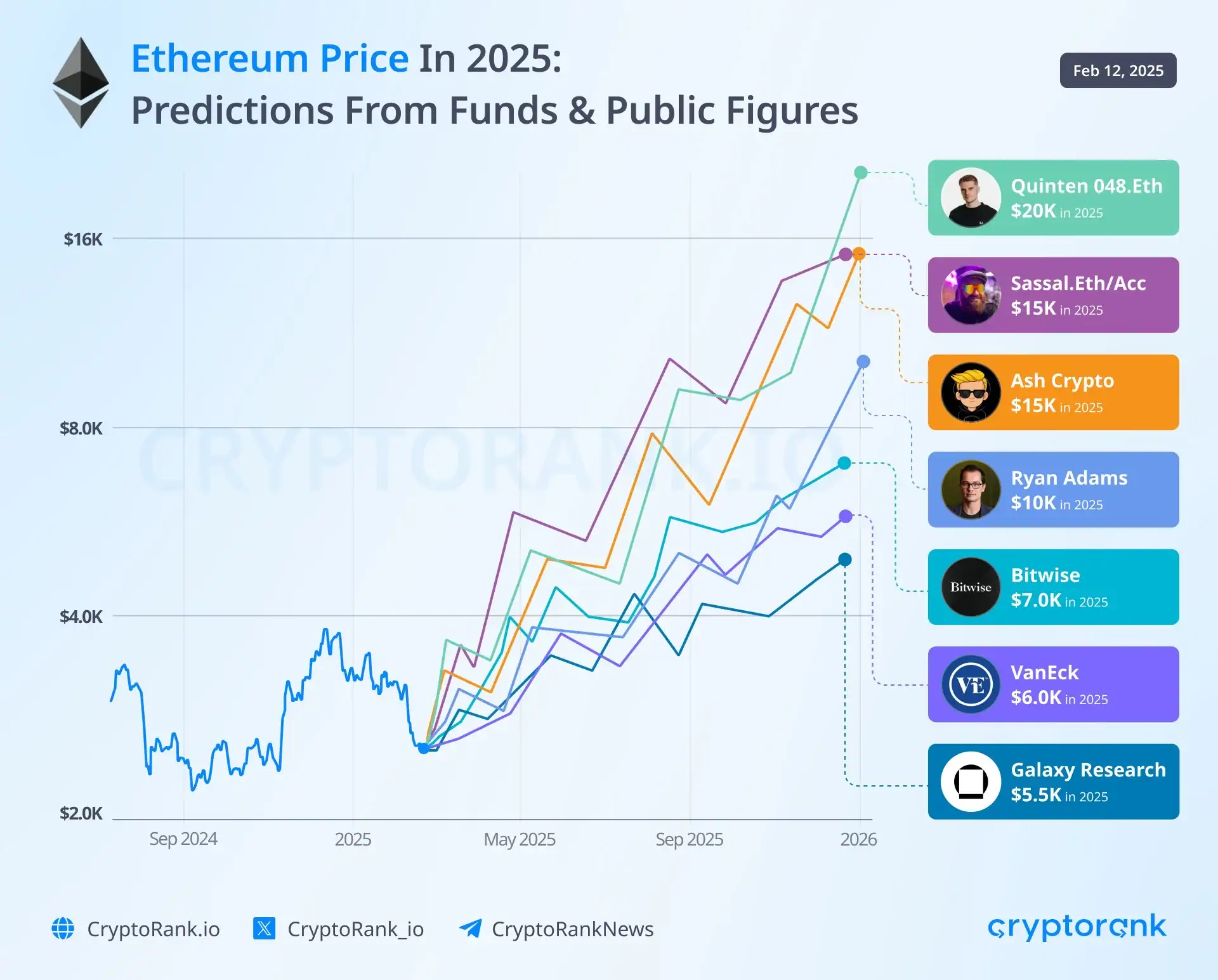

Ethereum Price Predictions

- Quinten 048.Eth gave the most bullish forecast, predicting Ethereum to hit $20,000 by 2025.

- Sassal.Eth/Acc and Ash Crypto both expect ETH to reach around $15,000, signaling strong confidence in Ethereum’s long-term value.

- Ryan Adams projects a moderate rise to $10,000, reflecting balanced optimism toward Ethereum’s market performance.

- Institutional players like Bitwise estimate a more conservative target of $7,000, emphasizing realistic growth tied to ETF and DeFi demand.

- VanEck, known for its crypto investment funds, predicts $6,000, showing a cautious stance amid regulatory uncertainty.

- Galaxy Research presents the lowest forecast at $5,500, suggesting steady but gradual appreciation based on current network fundamentals.

- Overall, predictions range between $5,500 and $20,000, highlighting diverse expectations for Ethereum’s market trajectory in 2025.

Number of Active Ethereum Wallets

- The number of active Ethereum wallets reached 127 million in March 2025, a 22% YoY increase.

- Ethereum adds 350,000 new wallets per week in 2025, fueled by Layer 2 onboarding.

- MetaMask is the most popular Ethereum wallet with over 30 million monthly active users as of mid-2025.

- 11% of active wallets interacted with at least one DeFi protocol in the past 30 days.

- Wallets linked to NFT marketplaces represent 19% of total daily wallet activity.

- A record 6.1 million wallets participated in on-chain governance votes in Q1 2025.

- The number of multi-signature wallets climbed to 1.4 million, showing heightened smart contract security demand.

- Cold wallet usage among Ethereum holders is up by 16% in 2025, indicating increased focus on self-custody.

Ethereum Gas Fees Trends

- Average Ethereum gas fees are now around $1.85 per transaction in mid-2025, compared to $5.90 in March 2024.

- Peak gas spikes still happen with some NFT events briefly pushing fees over $50, though these cases are rare.

- The most gas-efficient day in 2025 was February 6th, with average fees as low as $1.82.

- Layer 2 adoption has driven down base layer congestion, leading to a 35% reduction in average gas fees.

- Arbitrum and Optimism now account for 47% of Ethereum transaction executions in 2025, easing Layer 1 congestion.

- EIP-4844 implementation helped reduce rollup gas fees by more than 50% in 2025.

- Flashbots usage is steady, with 35% of blocks using MEV-boost for efficient transaction ordering.

- Despite lower fees, Ethereum remains the most expensive Layer 1 network for average transaction cost in 2025.

Ethereum NFT Market Activity

- Blur dominates NFT trading with a 42% market share while OpenSea holds 31%.

- The Ethereum NFT market generated $5.8 billion in trading volume in Q1 2025, a 21% YoY increase.

- Over 4.3 million NFT transactions were processed on Ethereum in the first three months of 2025.

- The average sale price for Ethereum NFTs is now $624 compared to $531 in Q1 2024.

- Digital art accounts for 34% of all Ethereum NFT activity, while gaming assets make up 28%.

- More than 9.5 million unique wallets have interacted with Ethereum NFTs since January 2025.

- Fractional NFTs have grown, with $142 million locked across fractional protocols.

- ENS domain sales surged in 2025, with over 137,000 new registrations in Q1 alone.

- Ethereum Layer 2 platforms Zora and Base now host NFT projects, raising cross-chain activity.

- Brands like Nike, Gucci, and Adidas collectively generated over $140 million in NFT revenue on Ethereum in early 2025.

Ethereum-Based DeFi

- Ethereum leads DeFi with over $119 billion in TVL in Q3 2025, accounting for 49% of sector value.

- Uniswap processes more than $2.1 billion in daily volume in 2025, boosted by its v4 release in January.

- Lending platforms Aave and Compound collectively hold over $43 billion in locked assets.

- The number of active DeFi users on Ethereum surpassed 7.8 million, a 19% YoY increase in 2025.

- Liquid staking derivatives (LSDs) represent 18% of Ethereum’s DeFi TVL, led by stETH and rETH.

- DEX trading on Ethereum outpaces centralized exchanges on-chain, with Uniswap and Curve handling the majority share.

- Real-world asset protocols like Centrifuge and Maple Finance collectively hold over $1.1 billion in tokenized assets in 2025.

- Stablecoins on Ethereum exceeded $92 billion in circulating supply in 2025, led by USDC, DAI, and Tether.

- Governance activity is rising, with over 2 million token holders participating in DeFi DAO proposals.

- DeFi-related contract exploits dropped by 38% YoY in 2025, reflecting improved security and audits.

Ethereum Layer 2 Adoption Metrics

- Layer 2 solutions on Ethereum process over 58.5% of total Ethereum transactions as of Q3 2025.

- Arbitrum is the most used L2, handling over 46 million monthly transactions, with Optimism at 32 million.

- The total value locked across Ethereum Layer 2s exceeds $43.3 billion, up 36.7% YoY.

- zkSync Era surpassed $4 billion in TVL in 2025, advancing ZK-rollup adoption.

- Ethereum mainnet gas usage dropped by 30% due to Layer 2 migration and data compression upgrades.

- Base network reported 3.2 million active users in March 2025.

- Layer 2 transaction fees average $0.08 compared to the mainnet’s $1.85 in 2025.

- Monthly L1-L2 bridging volume hit $11.2 billion in Q1 2025.

- Developers now deploy over 65% of new Ethereum smart contracts directly on Layer 2s in 2025.

- Layer 2 airdrops like ARB and OP incentivized millions of wallet signups in early 2025.

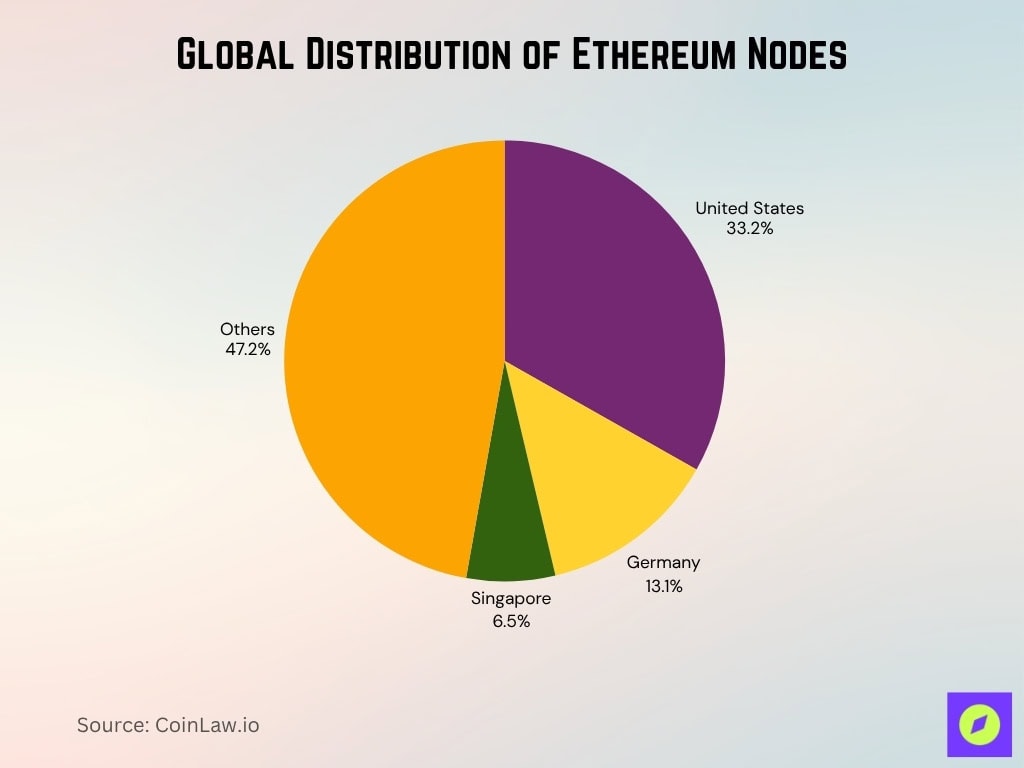

Geographic Distribution of Ethereum Nodes

- The United States hosts 33.2% of all Ethereum nodes, ranking first worldwide.

- Germany hosts around 13.1% of Ethereum nodes, followed by Singapore at 6.5%.

- There are approximately 6,300 Ethereum nodes operating globally as of 2025.

- Node decentralization improved year-over-year, with 27% of nodes now located outside North America and Europe.

- Asia-Pacific regions account for 15.8% of active Ethereum nodes in 2025, up from 11.6% in early 2024.

- Home-run node numbers increased by 18%, marking renewed decentralization efforts.

- Geth leads Ethereum clients with a 62% share, trailed by Nethermind and Besu.

- Light nodes and mobile clients are growing rapidly, boosting scalability and accessibility.

- Over 50% of nodes support MEV-boost, improving fair transaction ordering and inclusion.

- Ethereum Archive Nodes make up less than 4% due to high storage requirements.

Development Activity and GitHub Commits

- Ethereum recorded 28,400+ GitHub commits across core repositories over the past 12 months.

- The number of active developers on Ethereum is 31,869+, up from 29,600 in 2024.

- Major upgrades like The Merge, EIP-4844, and Verkle trees drove peak core dev engagement.

- Client diversity grew, with more contributors joining Besu, Erigon, and Lighthouse teams in 2025.

- Weekly development activity remains highest among Layer 1 protocols, topping GitHub charts in 2025.

- Ethereum Improvement Proposals (EIPs) submitted in 2025 exceeded 230, with 37 accepted and merged.

- Dev tooling improved as projects like Foundry and Hardhat received major upgrades this year.

- Ethereum Foundation grants distributed $32.6 million in Q1 2025, up 63% from $11.6 million in Q4 2024.

- Security-focused development rose 23% YoY, prioritizing formal verification and runtime audits.

Supply and Burn Rate Since The Merge

- Since The Merge, Ethereum’s supply decreased by −369,000 ETH as of October 2025, confirming net deflationary status.

- The annualized burn rate of Ethereum is currently 1.32%, mainly driven by EIP-1559 base fees.

- Over 4.6 million ETH have been burned since the EIP-1559 upgrade, including around 870,000 ETH in Q1–Q3 2025.

- The average daily ETH burned is about 10,200 ETH, rising during peaks in NFT or DeFi activity.

- Net issuance rate for Ethereum is roughly −0.75%, highlighting the “ultrasound money” narrative.

- The burn rate often exceeds issuance during congested periods, especially for NFT launches.

- Ethereum’s current circulating supply is about 120.7 million ETH in October 2025, down from pre-Merge levels.

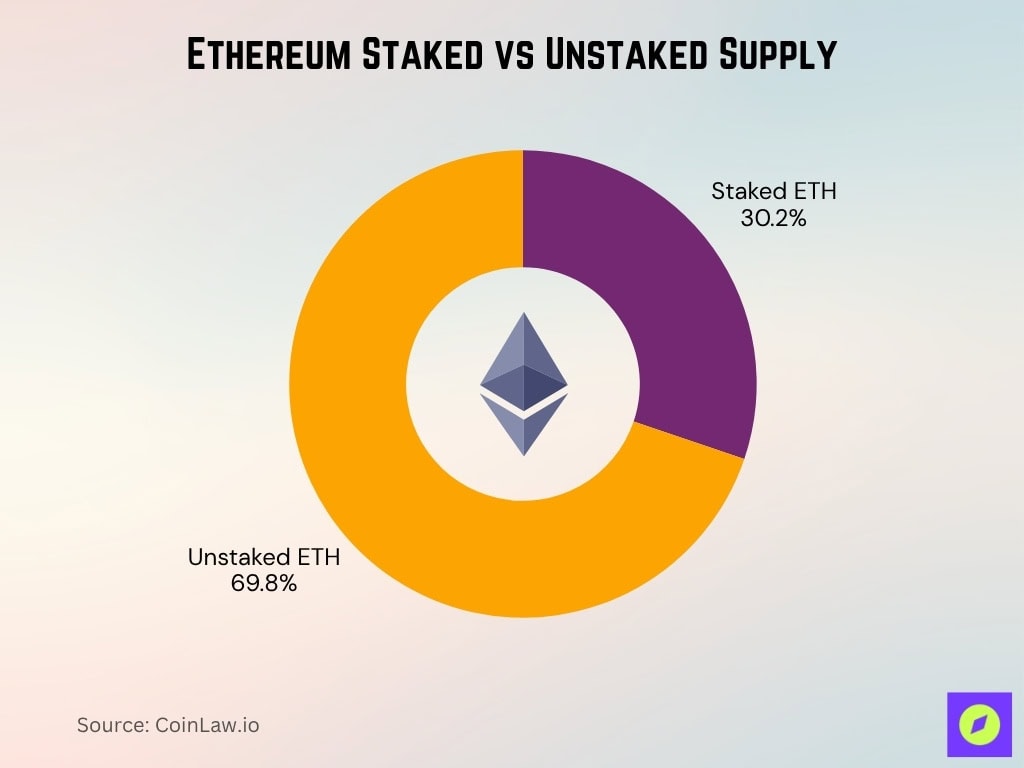

Ethereum Staked vs Unstaked Supply

- Around 30.2% of all Ethereum is staked, reflecting strong engagement in Ethereum’s Proof-of-Stake (PoS) ecosystem.

- The majority, about 69.8% of ETH, remains unstaked, ensuring sufficient liquidity for DeFi activity, trading, and exchanges.

- The staked portion demonstrates growing investor confidence in long-term network rewards and security.

- The unstaked majority shows continued preference for liquidity and market flexibility among Ethereum holders.

- Overall, the 70/30 split indicates a healthy balance between staking participation and market fluidity in Ethereum’s 2025 supply dynamics.

Ethereum Security and Network Incidents

- Ethereum has not experienced any critical Layer 1 security breaches since The Merge in 2022.

- In 2025, only four high-profile smart contract exploits occurred, totaling $46 million in losses, a 62% YoY drop.

- Bug bounty programs paid out over $7.6 million in rewards in the past 12 months.

- Over 420 smart contracts were paused or upgraded after on-chain anomaly detection in 2025.

- MEV-related risks remain under scrutiny, with over $1.3 billion extracted in 2024–25, but Flashbots Protect tools help mitigate user harm.

- Intent-based transaction models reduced frontrunning attacks by 29% in 2025.

- Ethereum staking services now require security disclosures, improving transparency for new validators.

- More than 60% of top DeFi protocols run real-time security monitors to detect malicious patterns.

- Account Abstraction (ERC-4337) rollout enhanced wallet security by enabling programmable recovery.

Comparison with Bitcoin and Other Layer 1 Blockchains

- Ethereum’s market cap of $408 billion is second only to Bitcoin’s $1.3 trillion as of Q1 2025.

- Ethereum consistently processes 6x more daily transactions than Bitcoin, with 1.6 million vs. 260,000.

- Bitcoin’s average transaction fee remains around $2.10, while Ethereum’s is $1.85 in 2025.

- Ethereum outpaces other Layer 1s in developer activity, with 31,869 monthly contributors, nearly double Solana and Avalanche.

- Ethereum’s TVL in DeFi is $119 billion, compared to $11.8 billion on Solana and $8.7 billion on BNB Chain.

- Ethereum leads NFT activity despite increased competition from Solana and Polygon in 2025.

- Ethereum remains the leader in Layer 2 integration as Bitcoin’s Lightning adoption is still limited.

- Energy usage of Ethereum post-Merge is now 99.95% lower than Bitcoin due to the PoS model.

Recent Developments in the Ethereum Ecosystem

- EIP-4844 (proto-danksharding) launched in February 2025, reducing Layer 2 data costs by over 90% and boosting L2 throughput by 16x.

- ERC-4337 Account Abstraction rollout enabled gasless transactions, biometric authentication, and smart wallet recovery features on Ethereum.

- EigenLayer re-staking protocol surpassed $6 billion in deposits within six months of mainnet launch in 2025.

- LayerZero and CCIP advanced cross-chain composability, facilitating seamless asset bridging from Ethereum to Cosmos, Solana, and others.

- Ethereum’s Dencun upgrade is scheduled for Q3 2025, with targets for data availability and validator rotation.

- Real-world asset tokenization pilots launched via collaborations with HSBC and BlackRock in 2025.

- Ethereum Foundation introduced a new Sustainability Grant Track, funding eco-focused infrastructure solutions.

- Rollup-as-a-Service platforms are booming, with over 300 projects now building custom Ethereum rollups.

- Nimbus Light, Ethereum’s native mobile wallet project, is in beta, expected to launch by Q4 2025.

- Regulatory clarity improved in the US, with Ethereum recognized as a commodity in several 2025 legal rulings.

Frequently Asked Questions (FAQs)

Ethereum hosts 31,869 active developers as of Q3 2025, attracting over 16,000 new contributors this year.

Active Ethereum wallets reached an all-time high of 127 million in 2025, marking a 22% year-over-year increase.

Ethereum averages about 1.6 million transactions per day in late 2025.

Ethereum’s TVL in DeFi remains dominant at $119 billion in Q3 2025, accounting for over 49% of the sector.

Conclusion

Ethereum’s evolution reflects a network that is both scaling and maturing. From explosive growth in validator participation to Layer 2 breakthroughs, the protocol has achieved a delicate balance of decentralization, security, and innovation. Whether you’re eyeing DeFi, NFTs, or real-world asset integration, Ethereum remains at the core of blockchain’s most transformative applications. With macro support growing and user metrics surging, Ethereum continues to assert itself not just as a platform but as infrastructure for the next internet.