Deutsche Bank remains one of the most influential financial institutions in Europe and a key player globally. With a presence in more than 50 countries, it continues to shape global finance through investment banking, asset management, and corporate services. In real-world scenarios, its digital banking innovations are redefining customer experiences, while its aggressive sustainability goals are shifting ESG financing benchmarks for peers.

This article offers a detailed statistical breakdown of Deutsche Bank’s performance today and its positioning across revenue, assets, workforce, ESG, and litigation metrics. Let’s explore the numbers driving its transformation.

Editor’s Choice

- Deutsche Bank reported a cost-to-income ratio of ~63.0% as of Q3 2025.

- Sustainable finance volumes reached €440 billion by Q3 2025.

- Customer deposits grew to €663 billion in Q3 2025, up from €650 billion a year earlier.

- The bank’s Common Equity Tier 1 (CET1) ratio rose to 14.5% in Q3 2025.

- Net interest margin was approximately 1.5% by late 2025.

- Deutsche Bank’s provision for credit losses was €417 million in Q3 2025, down 16% YoY.

- The bank set a new sustainability target of €900 billion by 2030.

Recent Developments

- Deutsche Bank reported a Q3 2025 net income of €1.1 billion, up 8% year-over-year.

- In July 2025, Deutsche Bank announced the integration of AI-enabled tools for real-time risk monitoring.

- As of September 2025, total revenues for the year reached €22.1 billion, up from €21.3 billion in 2024.

- The Corporate Bank contributed €5.8 billion in revenue through the first three quarters of 2025.

- Deutsche Bank executed a share buyback program worth €650 million in Q2 2025.

- A €300 million IT infrastructure upgrade was finalized in Q2 2025 as part of a broader modernization effort.

- The bank achieved €440 billion in sustainable finance volume by Q3 2025, on track toward new targets.

- As of September 2025, Deutsche Bank managed €1.4 trillion in client assets under its Asset Management division.

- The Digital Assets unit saw a 12% increase in institutional client adoption from H1 to H2 2025.

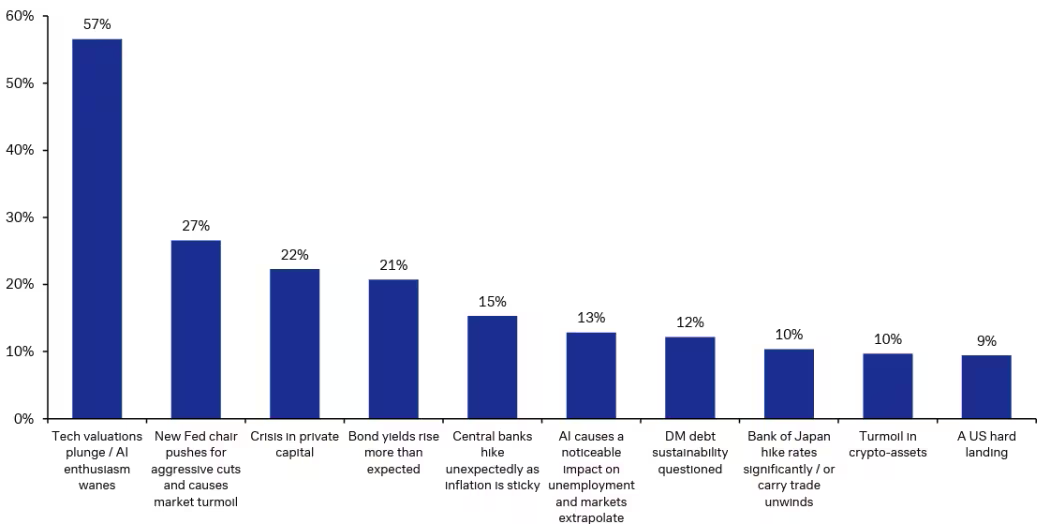

Biggest Risks to Market Stability

- Tech valuations and fading AI enthusiasm dominate risk perceptions, with 57% of respondents citing a sharp decline in tech valuations as the biggest threat to market stability in 2026.

- Monetary policy uncertainty remains elevated, as 27% point to a new Federal Reserve chair pushing aggressive rate cuts and triggering market turmoil.

- Stress in private capital markets is rising, with 22% identifying a potential crisis in private capital as a key systemic risk.

- Bond market volatility is underestimated, with 21% warning that bond yields could rise more than expected and disrupt markets.

- Inflation-driven policy surprises persist, as 15% fear unexpected central bank rate hikes due to sticky inflation.

- AI-related labor market disruption is emerging, with 13% noting noticeable impacts on unemployment and markets extrapolating AI trends.

- Developed market debt sustainability concerns are growing, as 12% see rising debt levels as a potential destabilizing factor.

- Japan’s monetary policy shift remains a tail risk, with 10% citing a Bank of Japan rate hike or carry trade unwind.

- Crypto-asset volatility continues to concern markets, with 10% pointing to turmoil in crypto-assets as a stability risk.

- US macroeconomic downside risks remain, as 9% anticipate a hard landing in the US economy.

Global Business Profile

- Deutsche Bank operates in 58 countries as of 2025.

- It maintains 1,543 branches worldwide, with 65% located in Europe.

- In 2025, its global customer base surpassed 19 million individuals and corporate clients.

- The Corporate Bank remains its highest revenue contributor, generating nearly €6.2 billion in annual revenues.

- Total assets exceeded €1.34 trillion as of September 2025.

- Deutsche Bank is the largest German banking institution by total assets and market presence.

- The Investment Bank accounted for 30% of the group’s total revenue in 2025.

- The bank handled over €1.7 trillion in annual transaction volumes via its Global Transaction Banking unit.

- Asset Management division, including DWS Group, generates annual net revenues of around €3 billion, supported by Q3 2025 net revenues of €734 million and 9M 2025 net revenues of €2.2 billion.

- The Private Bank segment generated €9.8 billion in revenue through the first three quarters of 2025.

Deutsche Bank Geographic Footprint and Presence

- In 2026, Deutsche Bank operated in 70+ countries with a global network of around 1,196 branches, reflecting its role as a scaled European global bank.

- Germany remained the core market, generating roughly 35% of group revenue and housing about 30% of the global workforce.

- Europe, excluding Germany, contributed about 30% of revenues, driven by growth in Italy, Spain, the Netherlands, and other EU hubs.

- The Americas, led by US investment banking operations in New York, Jacksonville, and Cary, accounted for approximately 20% of group revenues.

- APAC, with Singapore as the regional headquarters, contributed an estimated 10–12% of revenues, supported by business in China, Japan, and Australia.

- The Middle East and Africa together contributed roughly 3–5% of revenues, centered on sovereign and institutional clients via Dubai and Riyadh.

- Latin America, anchored by Brazil and Mexico, represented around 3–4% of group revenues with continued double-digit growth in client assets.

- Cross-border services were provided under banking licenses in 40+ jurisdictions, supporting the bank’s Global Hausbank strategy.

- By late 2025 heading into 2026, headcount was approximately 90,000 employees worldwide after executing previously announced cost and branch-optimization programs.

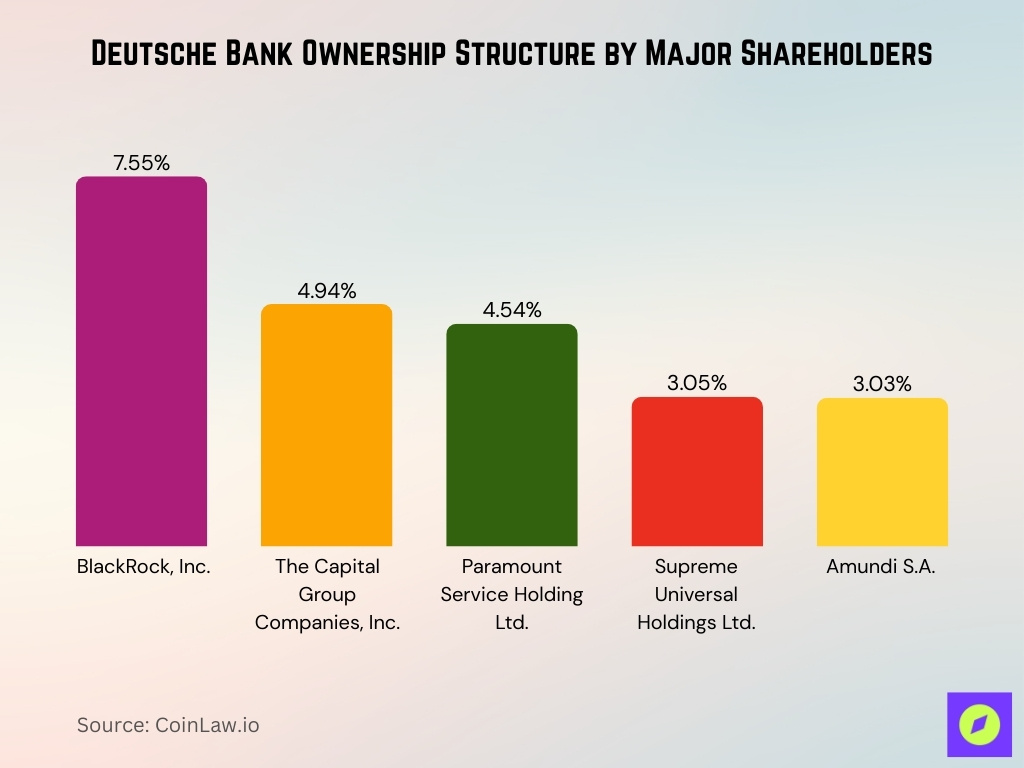

Ownership Structure and Major Shareholders

- BlackRock, Inc. held about 7.23% of Deutsche Bank’s share capital, with an additional 0.32% voting rights via instruments, totaling roughly 7.55% of voting rights.

- The Capital Group Companies, Inc. owned around 4.94% of shares by late 2025.

- Paramount Service Holding Ltd. retained about 4.54% of capital per the latest regulatory disclosures.

- Supreme Universal Holdings Ltd. accounted for ~3.05% stake in the bank.

- Amundi S.A. controlled approximately 3.03% of Deutsche Bank’s voting rights as of December 2025.

- Institutional ownership across 781 entities represented a significant portion of shares, indicating broadly dispersed institutional influence.

- Vanguard Group Inc., UBS Group AG, and Fisher Asset Management were also notable institutional holders in 2025.

- Management and insiders did not hold controlling stakes, demonstrating a largely market‑driven ownership rather than founder or government control.

- Deutsche Bank aims to maintain shareholder engagement via dividends and buybacks, with a payout ratio targeted at 50% of net profit from 2025 onward.

Employees and Workforce

- As of Q3 2025, Deutsche Bank employed approximately 84,500 full-time employees.

- The female representation across the workforce stood at 42% globally.

- The bank maintained a voluntary attrition rate of 8.7% in 2025.

- Germany employed nearly 31,000 staff, the largest concentration by geography.

- Deutsche Bank implemented a hybrid work model, with ~70% of employees working remotely 2+ days/week.

- Training hours averaged 32 hours per employee annually, focusing on compliance and digital skills.

- New hires in 2025 exceeded 4,200 employees, with the highest intake in technology roles.

- The average tenure of employees stood at 9.1 years, indicating workforce stability.

- The bank’s global diversity program expanded in 2025 to include LGBTQ+ inclusion and disability access.

- Employee satisfaction scores improved by 6% year-over-year, according to the Q3 internal survey.

Market Capitalization and Valuation

- Deutsche Bank’s market capitalization was in the €55–60 billion range by late 2025 and rose toward about €65.6 billion by January 2026.

- The stock price averaged €10.25 during Q4 2025, reflecting modest annual gains.

- Price-to-book ratio remained low at 0.45x, signaling investor skepticism about long-term returns.

- Return on tangible equity (RoTE) was 8.6% YTD, below the 10% long-term target.

- The bank trades at a forward P/E ratio of approximately 5.3x, below European bank peers.

- Deutsche Bank’s valuation remains suppressed due to legacy litigation and restructuring risk.

- The dividend yield reached 3.5% in 2025, supported by stable cash flows.

- Total shareholder return for the year was +7.9%, factoring in dividends and buybacks.

- Analysts issued 9 Buy, 15 Hold, and 6 Sell ratings for DB shares as of December 2025.

- The bank’s beta stood at 1.35, indicating high market sensitivity.

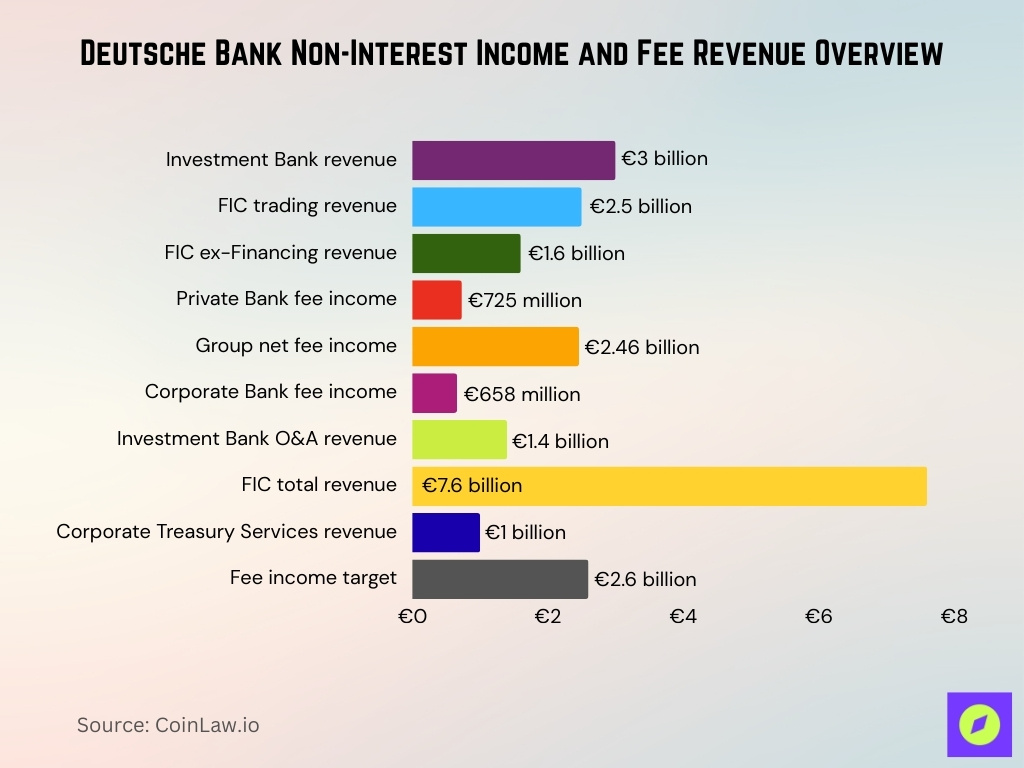

Non-Interest Income and Fee Revenues

- Q3 2025 Investment Bank revenues hit €3.0 billion, up 18% YoY, led by FIC trading at €2.5 billion.

- FIC ex-Financing revenues reached €1.6 billion in Q3 2025, surging 21% YoY from strong macro and credit activity.

- Group net commission and fee income stood at €725 million in Q3 2025 for Private Bank, flat YoY amid stable mandates.

- 9M 2025 group net commission and fee income grew 4% YoY to €2.46 billion, supporting revenue diversification.

- Corporate Bank net commission and fee income increased 2% YoY to ~€658 million in Q3 2025, driven by trade finance.

- O&A revenues in Investment Bank fell 7% YoY to €1.4 billion over 9M 2025, offset by FIC strength at €7.6 billion.

- Corporate Treasury Services revenues rose 2% YoY to €1.0 billion in Q3 2025, aided by fee growth and volumes.

- Net commission and fee income targeted for 5% CAGR to €2.6 billion contribution by 2028 from 2025 base.

Customer Deposits and Funding Base

- Customer deposits reached approximately €663 billion in Q3 2025, up from €650 billion a year earlier.

- Deposits increased sequentially from €653 billion in Q2 2025 to €663 billion in Q3 2025.

- Growth in the deposit base was supported by net inflows in the Private Bank, including around €9 billion in new deposits in Q3 2025.

- Deposit volumes helped stabilize funding costs amid global rate fluctuations.

- The loan‑to‑deposit ratio was roughly 71.8% in late 2025, indicating a conservative balance between lending and core customer funding.

- High deposits contributed to the bank’s liquidity coverage ratio (~140%) above regulatory requirements.

- Net stable funding ratio hovered around 119%, supporting Deutsche Bank’s long‑term funding profile.

- The bank maintained a diversified funding mix across deposits, wholesale funding, and capital markets access throughout 2025.

Leverage Ratio and Risk‑Weighted Assets

- Deutsche Bank’s leverage ratio was stable at about 4.6% as of Q3 2025, meeting regulatory thresholds.

- Leverage exposure stood at around €1,300 billion by the end of the third quarter of 2025.

- Risk‑weighted assets (RWA) were approximately €340 billion in late 2025, down slightly as capital efficiency measures took effect.

- Common Equity Tier 1 (CET1) ratio improved to ~14.5%, up from 13.8% in prior periods.

- Deutsche Bank maintained a Tier 1 capital buffer significantly above minimum requirements.

- The bank’s capital framework benefited from retained earnings and disciplined risk management.

- Leverage exposure shifted quarter-to-quarter modestly, reflecting balance sheet growth and capital actions.

- Lower RWA alongside improved capital ratios enhanced Deutsche Bank’s regulatory resilience.

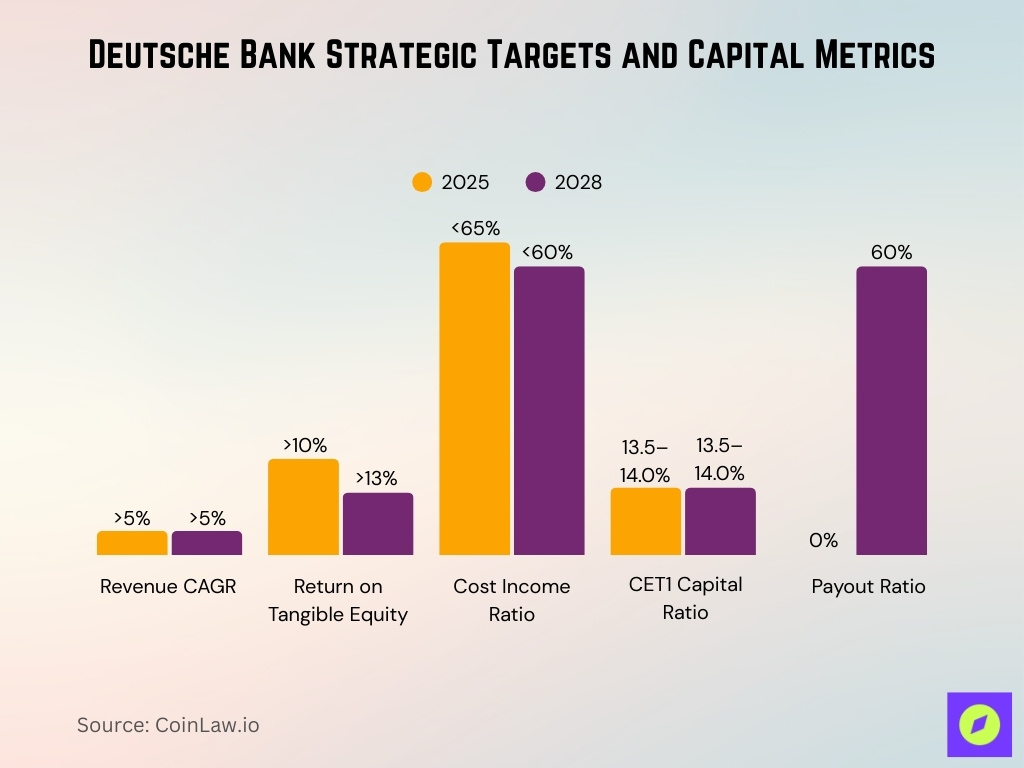

Strategic Priorities and Transformation Program

- Investor Deep Dive 2025 unveiled Global Hausbank scaling with >5% CAGR revenue growth to €37 billion by 2028 from €32 billion 2025 forecast.

- RoTE target raised to >13% by 2028, up from >10% 2025 ambition, via focused growth and capital discipline.

- Cost/income ratio target improved to <60% by 2028 from <65% 2025, delivering €2 billion gross cost efficiencies.

- CET1 ratio maintained in 13.5-14.0% operating range, with payout ratio rising to 60% of net profit from 2026.

- Cumulative RWA benefits hit €30 billion by Q2 2025, high-end of €25-30 billion year-end target via optimization.

- Shareholder distributions totaled €2.3 billion in 2025 via dividends and €250 million share repurchase program.

- Incremental revenue growth targeted at €5 billion by 2028, including €2 billion from Germany, leveraging market leadership.

- Revenue/RWA ratio uplift of +100bps planned 2025-2028 through SVA-based decisions and active balance sheet management.

Deutsche Bank Net Interest Income and Margin

- Q3 2025 group net interest income reached €3.9 billion, up 20% YoY from €3.3 billion.

- Group net interest margin stabilized at 1.5% in Q3 2025, consistent with prior quarters amid hedge support.

- 9M 2025 NII grew 21% YoY to €11.4 billion, driving key banking book segments’ stability.

- Long-term hedge notional held at ~€245 billion, with ~€200 billion excluding equity for NII leverage.

- Corporate Bank NIM stood at 3.4% in Q3 2025, down 0.4ppt YoY due to margin normalization.

- Private Bank NIM improved to 2.5% in Q3 2025, up 0.3ppt YoY from deposit growth.

- Key banking book NII remained stable YoY at ~€1.2 billion per segment in Q3 2025.

- Interest rate hedge contribution projected at 2.7% average yield for 2026, locked in 90%+.

- NII sensitivity to +25bps yield curve shift estimated at ~€65 million gain in 2026.

Asset and Wealth Management Revenues

- Private Bank Wealth Management & Private Banking revenues grew 4% YoY to €1.1 billion in Q3 2025.

- Asset Management AUM hit €1,054 billion in Q3 2025, boosted €43 billion by €40 billion in net inflows over 9M.

- Asset Management net revenues rose 11% YoY to €734 million in Q3 2025, with management fees up 5% to €655 million.

- Private Bank net commission and fee income flat at €725 million in Q3 2025, supported by €13 billion net inflows.

- Asset Management performance and transaction fees surged over 3x YoY to €145 million over 9M 2025.

- Private Bank net inflows totaled €12 billion in Q3 2025, with Passive business like Xtrackers driving growth.

- Combined Private Bank and Asset Management AUM grew €140 billion LTM via €66 billion net inflows through Q3 2025.

- Private Bank 9M 2025 revenues up 3% YoY to €7.2 billion, with Wealth Management & Private Banking up 5% to €3.3 billion.

Cost Income Ratio and Operating Efficiency

- 9M 2025 cost/income ratio improved to 63.0%, down from 73.2% prior year, on track for FY target below 65%.

- Q3 2025 cost/income ratio stood at 64.4%, improved 1.2ppt QoQ and 0.9ppt YoY amid revenue growth.

- Noninterest expenses fell 8% YoY to €15.4 billion over 9M 2025, aligning with FY outlook ~€20.8 billion.

- Adjusted costs stable at €5.0 billion in Q3 2025, flat YoY, reflecting disciplined control.

- Operational efficiency program achieved 95% of the €2.5 billion savings target by Q3 2025, with €2.4 billion cumulative.

- Q3 2025 noninterest expenses rose 9% YoY to €5.2 billion, mainly from prior-year litigation non-recurrence.

- H1 2025 noninterest expenses declined 15% YoY to €10.2 billion, supporting the cost outlook.

- FY 2025 CIR target below 65% confirmed, with non-interest expenses capped at €20.8 billion.

- Cumulative RWA benefits from efficiency reached €30 billion by Q3 2025, at the high end of €25-30 billion target.

Provision for Credit Losses and Risk Costs

- In Q3 2025, Deutsche Bank recorded €417 million in provisions for credit losses, equal to 35 bps of average loans, down ~16 % year‑over‑year.

- For the first nine months of 2025, cumulative provisions reached ~€1.3 billion, or 37 bps of average loans.

- Non‑performing (Stage 3) loan provisions in Q3 2025 were €357 million, down ~26 % compared to the prior year period.

- In Q2 2025, credit provisions were €423 million or 36 bps of average loans.

- Stage 3 provisions in Q2 2025 were €300 million, much lower than in earlier periods due to updated modeling.

- Provision trends reflect improved credit quality and benefit from regulatory‑aligned model updates.

- Normalized run‑rate of provision costs remained close to 30 bps of average loans by late 2025.

- Deutsche Bank’s risk costs were influenced by commercial real estate and performing loan mix shifts.

Sustainable Finance and ESG Volumes

- As of Q3 2025, Deutsche Bank had achieved €440 billion cumulative sustainable finance and ESG investment volumes since January 2020.

- The bank reported an additional €23 billion in sustainable finance volumes in Q3 2025 alone.

- Deutsche Bank has set an expanded target of €900 billion in cumulative sustainable and transition finance and ESG investments by 2030.

- This revised goal supersedes the earlier 2025 aim of €500 billion, reflecting accelerated sustainable activities.

- The bank’s sustainability frameworks align with market standards such as ICMA Green and Social Bond Principles and EU Taxonomy.

- Q2 2025 sustainable finance flows reached €28 billion, the highest quarterly total in years.

- Sustainable finance includes both pure‑play green assets and transition‑oriented funding for decarbonization.

- Deutsche Bank continues integrating ESG criteria into client financing solutions to support the transition to a low‑carbon economy.

Digitalization and Technology Investments

- Strategic IBM partnership expanded in May 2025, providing access to WatsonX AI, hybrid cloud, and automation stack for legacy replacement.

- Investor Deep Dive 2025 highlighted the completion of Europe’s largest IT platform consolidation, serving ~19 million customers.

- Technology spend targeted at €600 million over 2026-2028 in the Private Bank for IT, operations, and AI initiatives.

- AI deployment is projected to reduce the Investment Bank cost/income ratio to <55% by 2028 from 63% in 2021.

- Cloud migration of 17 financial reporting systems achieved up to 50% data processing improvements and 16-20x faster recovery.

- Autobahn FX platform migrated to a hybrid cloud with Google Cloud, enhancing scalability for electronic trading.

- Gross efficiencies of €2 billion expected by 2028 from process automation, platform scaling, and AI deployment.

- Digital client portal launched for CB and FX products, unifying access across Investment Bank services.

- Positive operating leverage anticipated from €300 million run-rate savings by 2028 in Personal Banking tech investments.

Litigation, Fines, and Legal Provisions

- DWS was fined €25 million (~$27 million) by Frankfurt prosecutors in April 2025 for greenwashing, misleading ESG claims from 2020-2023.

- BaFin imposed €23 million fine on Deutsche Bank in 2025 for securities and payments law breaches, including €14.8 million for FX derivatives mis-selling in Spain.

- Hong Kong regulator fined DWS HK$23.8 million (~$3 million) in 2025 for disclosure and fee disclosure issues.

- Q3 2025 provisions are stable QoQ, with litigation charges up YoY, including Postbank release, boosting profit 34% adjusted.

- Postbank takeover litigation settlements reached with 80+ plaintiffs covering ~60% of claims at €31 per share base.

- Provisions fully cover all Postbank claims, including interest (~€2 million/month accrual), with limited additional impact.

- Net litigation charges expected for FY 2025 within prior guidance, post DWS and BaFin resolutions.

- London group action ongoing in 2025 for historical derivative trades, provisions booked in credit loss lines.

Frequently Asked Questions (FAQs)

Around 90,300 full‑time equivalents, in line with the 90,330 FTEs reported at the end of Q3 2025.

Deutsche Bank AG shares traded around €33.69 in early January 2026.

Deutsche Bank distributed approximately €2.3 billion to shareholders in 2025.

Conclusion

Deutsche Bank’s operations reflect a bank in transformation, balancing revenue growth, risk management, and sustainable finance ambitions while navigating ongoing regulatory and legal challenges. From an expansive finance footprint to tightening credit loss provisions and major digital investments, the institution continues adapting to evolving market demands.

Legal provisions and fines underscore compliance pressures, yet strategic programs such as the Global Hausbank strategy and technology modernization position the bank for medium‑term value creation. As Deutsche Bank pursues its sustainability targets and broader goals, readers can now appreciate the full spectrum of performance drivers shaping its future.