The landscape of decentralized autonomous organisations (DAOs) is shifting fast. From a handful of experimental protocols to thousands of active communities, DAOs now manage billions of dollars in treasuries, govern via token-holder votes, and reshape how collaborative organisations function. In practice, a DeFi protocol DAO allocates treasury assets into yield-seeking strategies, while a contributor-owned media DAO uses its pooled assets to fund creators and decide distributions. This article examines key statistics behind DAO treasury holdings and governance metrics, inviting you to dive deeper into each dimension of this evolving ecosystem.

Editor’s Choice

- Over 13,000 DAOs worldwide exist as of 2025.

- Collective treasury assets under DAO control surpass $21.4 billion (liquid assets) and $24.5 billion (total treasury value).

- The average DAO treasury size is about $1.2 million in 2025.

- Governance token holders globally exceeded 6.5 million in 2025, based on active addresses participating in DAO governance platforms.

- Voter participation in many DAOs averages around 17% of token holders.

- The Asia-Pacific region is emerging as a leading growth zone for DAOs, particularly in India, South Korea, and China.

- Governance token power remains highly concentrated; in some cases, fewer than 0.1% of holders control ~90% of votes.

Recent Developments

- Between 2024 and early 2025, DAOs in sectors like gaming, media, and content saw significant growth, with some sources estimating 20–25% annual increases in formation and user engagement.

- Infrastructure tools for DAO governance (e.g., voting platforms) reported user growth in the 35-45% range during 2023–2025.

- Conferences and community events around DAOs saw attendance jump by approximately 40% in 2025 over previous years.

- DAO treasury management research and publications increased significantly in 2025.

- Cross-chain governance and AI-driven decision tools emerged as key themes in 2025.

- “Sustainability”-oriented DAOs (environmental/social impact) reached estimated numbers of 500-600 globally by early 2025.

- The size threshold for more diversified treasury portfolios appears to be around $500 million, where treasury maturity leads to broader holdings.

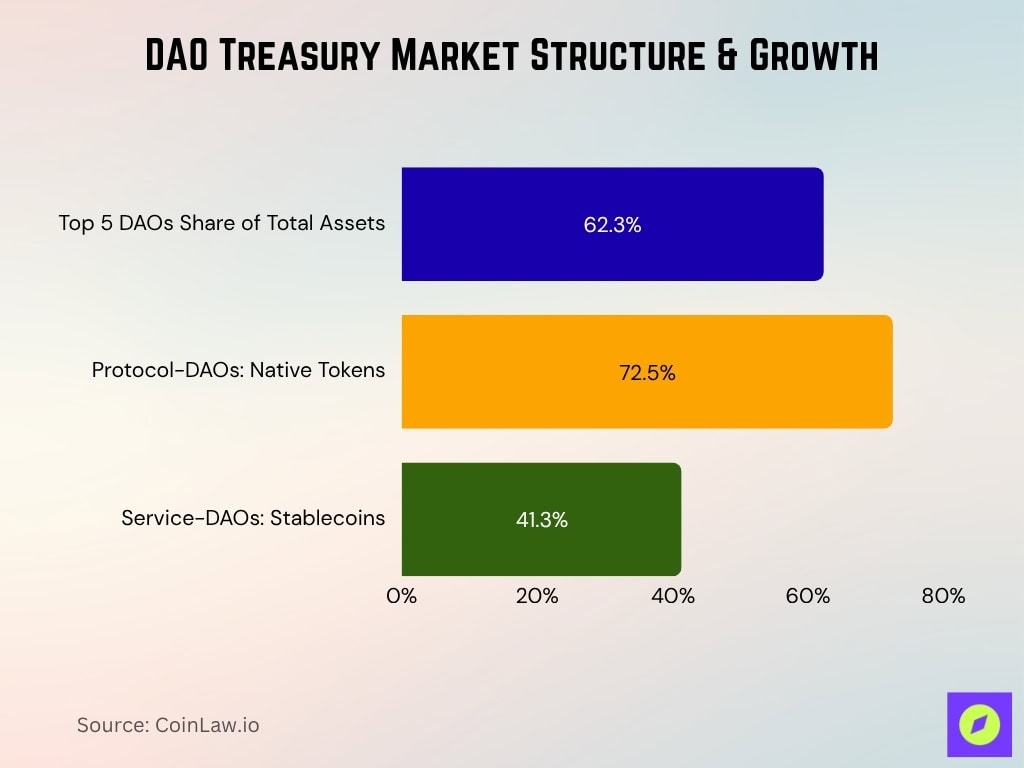

Market Size & Growth of DAO Treasuries

- The top five DAOs by treasury size (e.g., Uniswap DAO, Lido DAO, MakerDAO) control about 62.3% of all DAO treasury assets.

- Protocol-DAOs, on average, have about 72.5% of their treasury in native governance tokens; service-DAOs average about 41.3% in stablecoins.

- As of 2025, DAO treasuries hold around $21.4 billion in liquid assets.

- Total treasury value across all DAOs is estimated at $24.5 billion in 2025.

- The average DAO treasury size worldwide is approximately $1.2 million.

- Treasury diversification correlates with size; DAOs with treasuries > $500 million show, on average, 24.7% more diversified portfolios than smaller DAOs.

- Reports project the global DAO development market to grow from approximately $170 million in 2024 to $333 million by 2031.

- Growth drivers include increased blockchain adoption, decentralized governance demand, and Web3 infrastructure investment.

Number of Active DAOs

- More than 13,000 DAOs are operating globally in 2025.

- Of those, over 6,000 DAOs exhibit regular activity (governance, operations) rather than mere formation.

- Community-DAOs make up around 62% of active DAOs.

- Regionally, the Asia-Pacific growth accounts for a large share of new DAO formations, including India, South Korea, and China.

- Growth in DAO counts (2021-2024) occurred at an estimated CAGR of ~30%.

- DAO infrastructure services (tooling, analytics) improved tracking features by over 30% in 2024.

Growth Rate and CAGR of the DAO Market

- Between 2021 and 2024, the DAO count grew at a compound annual growth rate (CAGR) of approximately 30%.

- The DAO development market (software/services) is forecast to grow at a 9.3% CAGR from 2024 to 2031.

- The overall treasury asset base for DAOs has expanded from hundreds of millions (early 2020s) to over $20 billion in 2025.

- Tooling infrastructure for DAOs saw user growth in the 35-45% range from 2023 to 2025.

- Regional expansion (Asia-Pacific) contributed significantly to growth, though specific regional CAGR is less documented.

- Smaller DAOs (< $50 million treasury) tend to grow at higher relative rates, but remain small in absolute terms compared to the largest DAOs.

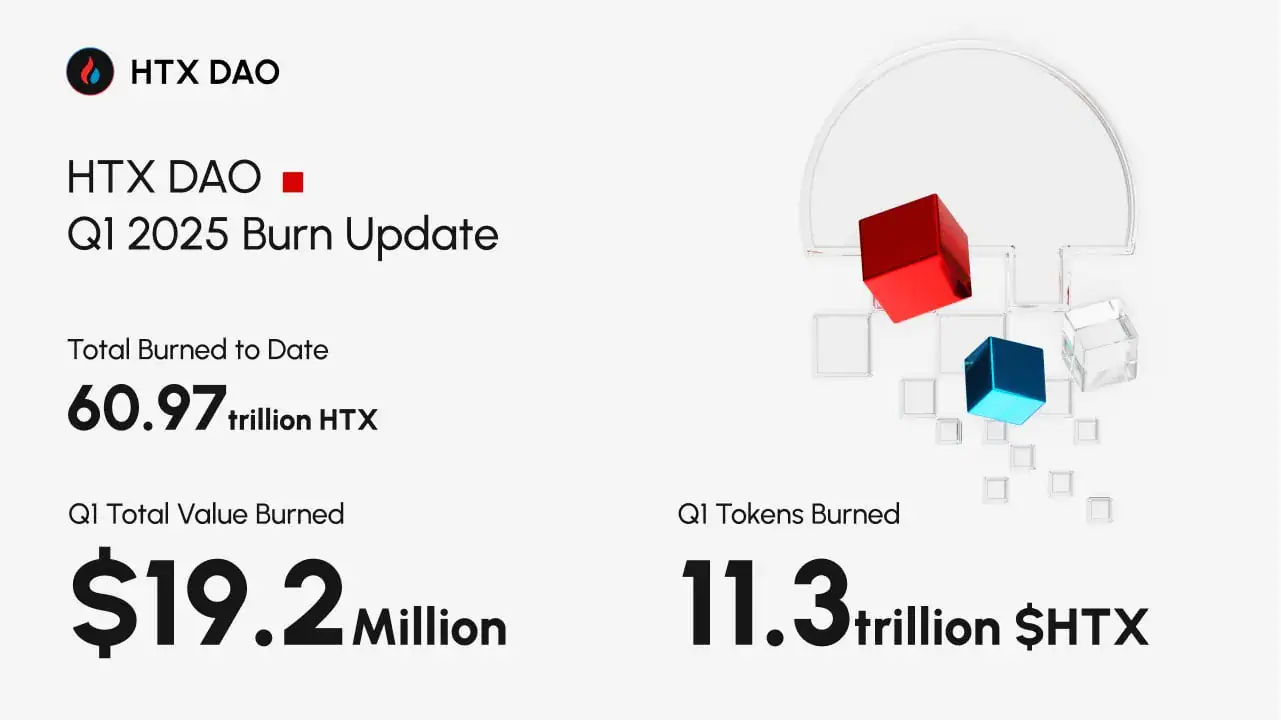

HTX DAO Burn Highlights

- HTX DAO reports a massive 60.97 trillion HTX burned to date, marking a significant reduction in circulating supply.

- In Q1 alone, the DAO removed 11.3 trillion HTX from circulation through scheduled token burns.

- The total value of tokens burned in Q1 reached $19.2 million, reflecting strong deflationary activity driven by DAO governance.

- The scale of the burn indicates increasing HTX ecosystem engagement and consistent execution of quarterly burn commitments.

- These figures position HTX DAO as one of the most aggressive token-burning ecosystems in early 2025, supporting long-term value strategies.

Top DAOs and Their Treasuries

- The Mantle DAO is estimated to have the largest treasury as of April 2025, at $2.70 billion.

- The Uniswap DAO treasury ranks among the top, with reported holdings at $2.9 billion in recent data.

- The BitDAO is also a major protocol-DAO, controlling billions in assets and deploying capital across Web3 ventures.

- The top five DAOs by treasury value control over 60% of the total DAO treasury assets globally.

- Smaller DAOs (treasury < $50 million) compose the majority of DAO counts, but their combined assets represent a small fraction of the total treasury pool.

- Protocol-governance DAOs (DeFi liquidity, staking protocols) tend to hold a larger share of treasury assets relative to community or service-oriented DAOs.

- As of 2025, the average treasury size across all DAOs remains around $1.2 million, illustrating the large disparity between small and mega-DAOs.

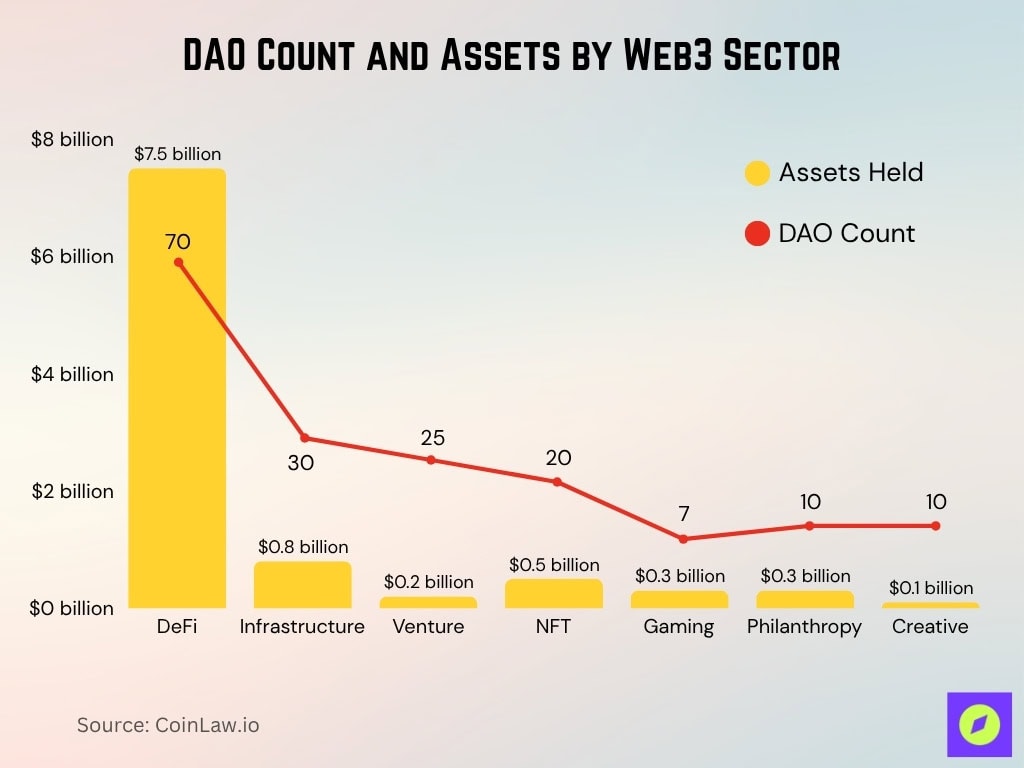

DAO Count and Asset Holdings by Web3 Sector

- In the DeFi sector, there are approximately 70 DAOs holding a combined ~$7.5 billion in assets.

- Infrastructure DAOs number about 30, with combined assets of ~$0.8 billion.

- Venture DAOs count around 25, managing roughly $0.2 billion in assets.

- NFT-sector DAOs number ~20 and hold approximately $0.5 billion.

- Gaming DAOs currently number only ~7, yet hold about $0.3 billion.

- Philanthropy DAOs (~10) are holding around $0.3 billion in assets, while creative DAOs (~10) hold about $0.1 billion.

- Asset-holding concentration is higher in DeFi and infrastructure sectors, while community, creative, or social DAOs hold more modest treasuries.

DAO Industry Adoption and Use Cases

- DeFi finance-oriented DAOs hold treasuries exceeding $20 billion with high governance activity.

- Gaming DAOs have grown by 180% since 2023, significantly expanding user engagement.

- Media DAOs account for about 18% of all DAOs as of 2025.

- Some real-estate tokenization DAOs control around $80 million in tokenized assets.

- Sustainability and impact, DAOs number an estimated 500-600 globally by early 2025.

- Community-owned content DAOs have increased voting participation by 30-50% through incentives.

- Enterprise adoption of DAO governance models is growing at approximately 45% annually.

- About 60% of large DAOs use treasury diversification strategies, including stablecoins and real assets.

- Asia-Pacific leads DAO market growth, outpacing North America’s 35% market share.

- Less than 10% of token holders actively vote in many DAOs, showing uneven adoption levels.

Global DAO Adoption Trends

- As of 2025, there are over 13,000 DAOs operating worldwide.

- Governance token holders globally numbered more than 6.5 million in 2025.

- Voter participation averages around 17% of token-holders, though leading DAOs achieve up to ~28% for major votes.

- North America currently holds 35%+ market share in DAO development, yet the Asia-Pacific region is showing faster growth rates.

- Venture capital deal data shows that in Q1 2025, the Web3/DAO/NFT/Metaverse category accounted for 16% of all crypto VC deal counts (73 deals).

- The global DAO tooling and development market was valued at $170 million in 2024 and projected to reach $333 million by 2031, at a CAGR of ~9.3%.

- Emerging use-cases in emerging economies hint at adoption beyond traditional crypto hubs; however, standardized data remains thin.

- The concentration of assets and governance power remains a barrier to truly global, distributed adoption of the DAO model.

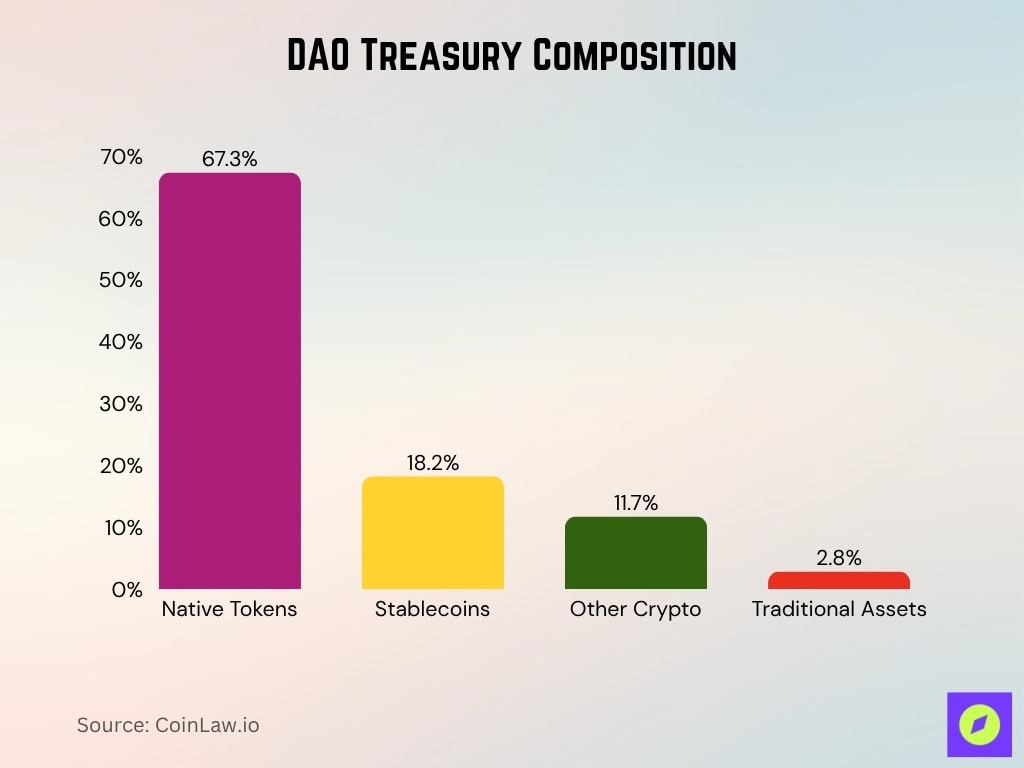

DAO Treasury Composition

- The majority of DAO treasuries are held in Native Tokens, making up 67.3% of total assets.

- Stablecoins represent 18.2%, showing a strong preference for liquidity and risk management.

- Other Crypto assets account for 11.7%, reflecting diversification beyond native governance tokens.

- Only 2.8% of DAO treasuries are held in Traditional assets, highlighting the sector’s continued crypto-dominant structure.

Voter Participation and Engagement Rates

- Average voter participation across DAOs is around 17% in 2025.

- Leading DAOs achieve voter turnout rates above 22% for major governance decisions.

- Some niche ecosystems report voter participation as high as 33.25%.

- Deployment of voting incentive models has increased participation by approximately 12% on pilot DAOs.

- Voter turnout positively correlates with treasury size; larger treasuries see up to 30-50% higher engagement efficiency.

- Usage of governance tools like Snapshot and Tally surged by 45% in 2025, improving accessibility.

- Less than 10% of token holders actively vote in many DAOs, highlighting participation challenges.

- Mobile-friendly governance interfaces and personalized notifications are increasing voter participation by an estimated 10-15%.

- Over 6.5 million governance token holders exist globally, but most remain passive in voting.

DAO Proposal and Voting Statistics

- Typical active DAOs submit ~13.8 significant proposals in certain samples during a tracking period.

- Average approval rates for proposals were approximately 96.8%, showing high consensus.

- Top decile voters increase token purchases by ~52.5% in the month leading up to proposal creation, indicating voting-power accumulation behaviour.

- Around 46% of DAOs maintain an open discussion forum for proposals and governance.

- Proposal initiation is often highly concentrated; an average of 4 members submit all proposals within a given DAO.

- Approval rates remain high (often > 90%), but contested, high-impact proposals tend to see lower margins and more debate.

Decentralization and Voting Power Distribution

- In the Arbitrum Foundation DAO, the Gini coefficient of voting-power distribution rose from ~0.75 to 0.90+ between early 2023 and mid-2025, indicating increasing concentration.

- Higher grassroots participation correlates with lower variance in voting power, more decentralization.

- Across many DAOs, the top 5% of token-holders control more than 80% of the voting power.

- In the MakerDAO ecosystem, proxy delegates could control ~9.16% of voting power each, while self-delegates required ~504,514 MKR tokens to sway key decisions.

- Delegation mechanisms currently favour large stakeholders, and ranking-based interfaces reinforce visibility biases among delegates.

- Despite token-holder counts in the millions, actual voting addresses remain in the tens or hundreds of thousands per vote, contributing to de facto power concentration.

- Greater decentralization (lower power concentration) is empirically associated with higher governance efficiency and longevity in DAOs.

DAO Research Methodologies

- A 2025 survey of academic work found that case studies and exploratory research dominate DAO studies, with 60 exploratory studies and 35 case studies in a recent review.

- On-chain analysis combined with off-chain forum/discussion mining now forms the dominant methodology in DAO governance research.

- One large dataset tracked 72,320 users and 2,353 DAO communities across four ecosystems to study diversity in governance.

- Research increasingly leverages machine-learning and large language model approaches to categorize proposals, assess sentiment, and detect governance anomalies.

- DAOs with off-chain voting raised ~87% less funding than those with on-chain governance, highlighting methodological variance in governance design.

DAO Innovations and Technology Integrations

- As of 2025, about 8.5% of new DAOs integrate AI-powered governance assistants or contributor-intelligence tools.

- More than 60% of new DAOs use cross-chain treasury and governance models.

- Over 40% of DAOs have adopted modular governance mechanisms like reputation scores or holographic consensus.

- Around 12% of DAOs now employ on-chain identity mechanisms to improve accountability in governance.

- The adoption of analytics and governance dashboards rose by over 30% in 2024 across DAO tool vendors.

Major DAO Tooling Platforms

- Snapshot and Tally platforms reported user growth between 35-45% from 2023 to 2025.

- Over 96% of major DAO votes in 2025 are processed on Snapshot.

- Treasury managers like Gnosis Safe multisig wallets are used by the majority of DAOs for secure treasury.

- Governance analytics platforms improved dashboard features by over 30% in 2024 for transparency.

- More than 70% of DAOs with treasuries above $50 million require layered audits, including flash-loan protection and delayed execution tools.

- Developer toolkits and SDKs for DAO creation have become commoditized, reducing entry barriers significantly.

- Integration of off-chain forums with on-chain voting remains standard for 90%+ of DAOs.

- Adoption of plug-and-play governance modules for delegation and treasury management has increased by approximately 40% in recent years.

- Tally powers governance for protocols managing over $5 billion in assets.

- Analytics and AI-powered tools enhance treasury management and member engagement scoring by more than 30% year-over-year.

DAO Security and Hack Statistics

- In the broader DeFi ecosystem, over $10 billion in direct losses occurred from crime events.

- ~$2.17 billion was stolen by July 2025 across 344 incidents, already surpassing the full-year 2024 total.

- In 2024, off-chain incidents accounted for ~56.5% of attacks and ~80.5% of funds lost.

- For DAO governance-token linked events, 55% of crime events resulted in significant negative token price impacts, averaging ~14% decline in governance token value.

- Smart-contract vulnerabilities remain a major vector; over 60% of DAO proposals lacked consistent audit documentation.

- Median time to restore governance and normal operations post-hack in larger treasuries is >30 days, reflecting recovery complexity.

- DAO insurance uptake remains low; fewer than 5% of mid-sized DAOs have formal treasury insurance coverage by mid-2025.

Impact of Regulation on DAO Treasuries

- As of 2025, the regulatory status of DAOs remains unsettled in over 70% of major jurisdictions.

- In ~40% of jurisdictions, governance tokens are treated as securities, creating additional tax and compliance burdens for DAOs with treasuries.

- Over 60% of regulatory bodies now require AML/KYC compliance for DAOs managing large treasuries.

- Several U.S. states (e.g., Wyoming) recognise DAO-friendly legal structures (DAO LLCs), but those remain limited to ~5+ states.

- Legal and regulatory setup costs for DAOs range from $20,000 to $150,000, depending on jurisdiction and treasury size.

- Failure to align with regulation may hamper treasury growth, reduce investment interest, or force off-chain operations, thus reducing transparency.

Frequently Asked Questions (FAQs)

About $21.4 billion.

Over 60% of the total assets.

More than 6.5 million governance token holders.

Between $20,000 and $150,000.

Conclusion

The data confirms that DAOs are no longer fringe experiments; they now command multi-billion-dollar treasuries, deploy advanced governance tooling, and operate across global jurisdictions. Yet the ecosystem stands at a critical crossroads, and issues of voting-power concentration, security vulnerabilities, and regulatory ambiguity persist. For the DAO model to scale responsibly, stronger decentralization metrics, mature treasury management, and aligned legal frameworks are essential. Practitioners and stakeholders should focus not only on size or growth, but on the quality of governance, security posture, and regulatory readiness. Delve into the full article to explore how these forces shape the future of DAO treasuries.