Cryptocurrency is still often framed as a trend, volatile, speculative, driven by hype and headlines. This perception explains why skepticism remains, especially among businesses that prioritize stability, predictability, and regulatory clarity.

But there is another side that gets less attention. The side where:

- Crypto rails reduce friction for global clients by allowing businesses to accept international payments faster and more efficiently, reducing settlement times from several days to minutes.

- Blockchain technology improves transparency, traceability, and trust in complex supply chains, helping companies and their clients verify product authenticity, track ownership history, and reduce the risk of counterfeiting across global markets.

In this article, we’ll break down why “crypto is hype” is an incomplete story, and where crypto and Web3 are already delivering real-world use cases for businesses, supported by expert perspective from Transacta, a regulated crypto payment provider working with businesses worldwide.

What truly signals a turning point in the market?

What truly signals a turning point is not interest from early adopters, but growing attention from large financial institutions, especially toward stablecoins.

Fortune recently reported that Mastercard is exploring an acquisition of zerohash for up to $2 billion, describing it as one of the company’s most notable steps into the sector so far (zerohash is a leading infrastructure provider for crypto, stablecoin, and tokenized assets). Over the past few years, a growing number of traditional financial companies have shown interest in merging with crypto infrastructure providers:

- PayPal acquired Curv to strengthen its digital asset custody capabilities, signaling a long-term commitment to regulated crypto infrastructure.

- Robinhood completed the acquisition of Bitstamp to expand its global reach beyond the U.S. market.

It becomes clear that big players view crypto infrastructure as their next strategic step.

What do these acquisitions signal for businesses?

When industry giants show confidence in a crypto infrastructure provider, it tends to shift market sentiment. For businesses, especially those handling international or high-value transactions, this trend points to a clear forecast: crypto payments are becoming institutionalized, regulated, and easier to integrate.

The payment landscape has evolved from simple cash transactions to digital-asset payment options to support customers worldwide. As this shift continues, companies like Transacta that operate within regulated infrastructure networks may become increasingly relevant for businesses exploring crypto payment solutions.

“We always highlight a blended settlement approach, traditional methods for everyday payments and crypto for cross-border transfers, large purchases, or time-sensitive transactions,” said Dmitrijs Maceraliks, CEO of Transacta.“Even companies that do not currently serve crypto-heavy clientele may adopt digital-asset settlement simply to remain competitive in markets with global customers.”

What crypto payment infrastructure actually means for businesses

Crypto payment infrastructure is the foundation that goes far beyond simply “accepting crypto.” Modern crypto payment providers offer a full stack of services, including:

Payment operations and settlement:

- Automated conversion from digital assets to fiat currencies, with funds settled directly to bank accounts.

- Secure transaction processing for fast and transparent payments.

Compliance and transaction integrity:

- Continuous on-chain monitoring to detect suspicious activity and ensure compliance with AML standards.

- Automated risk assessment for every transaction, helping businesses prevent fraud before it becomes an operational loss.

Control, reporting, and financial visibility:

- Audit-ready transaction records to support audits, reporting, and regulatory reviews.

- Management and accounting dashboards for tracking payments, settlements, balances, and reconciliation across crypto and fiat flows.

The integration question: Is it really that complex?

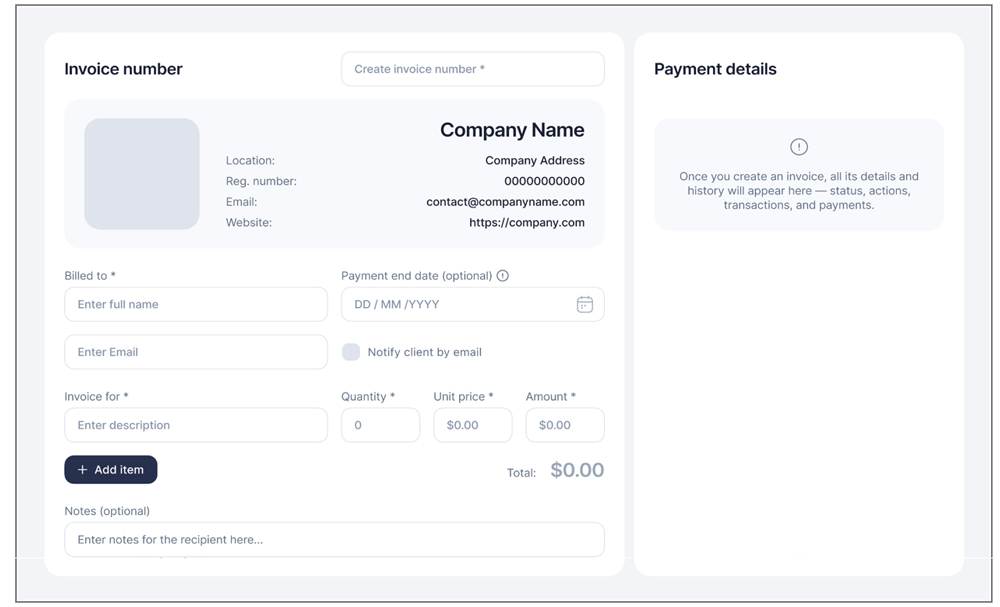

One of the most straightforward ways to start accepting crypto with zero technical integration is crypto invoicing. With crypto invoicing, businesses can generate a payment request and send it directly to a client. The customer pays from their wallet, the transaction settles on-chain, and the business receives funds according to its preferred settlement setup, either in crypto or converted to fiat and settled to a bank account.

Here are a few key features of a crypto invoice:

- Clients can pay in BTC, ETH, USDC, or other cryptocurrencies.

- Invoices allow partial payments using multiple cryptocurrencies.

- The invoice amount can be displayed in crypto or in EUR/USD, with a fixed conversion rate updated every 15 minutes.

- Invoices can include an expiration time, defining a clear payment window for the customer.

- Each invoice includes standard business details such as invoice number, issue date, due date, descriptions, and other relevant information, making reconciliation, accounting, and reporting easy.

This approach allows companies to use crypto payments with zero integration overhead, making it particularly suitable for high-value, cross-border, or one-off transactions.

From hype to infrastructure

For a long time, crypto has been discussed primarily through the lens of speculation. But that framing no longer reflects how the market is evolving. As major financial institutions invest in regulated crypto rails and payment providers focus on compliance, settlement, and risk management, crypto payments are becoming a trusted option for cross-border transactions.

Of course, crypto payments are not replacing traditional finance. They are expanding it. And for businesses operating internationally, that expansion is becoming a strategic advantage rather than a speculative bet.

Expert comments and insights provided by Transacta:

Founded in Estonia in 2018, Transacta (previously Transcrypt OÜ) offers a regulated payment infrastructure that enables merchants to accept crypto payments with instant fiat settlement, as well as process online card payments and 100+ local payment methods worldwide. The company also provides a crypto exchange, wallet functionality, and on/off-ramp tools.

Over the past year, Transacta completed a comprehensive transformation, expanding its licensing footprint across the US, Canada, Estonia, and Switzerland. This includes a recent partnership with Zerohash.

The expertise Transacta brings to the market is shaped by years of navigating the practical realities of high-value businesses: multi-jurisdictional compliance, verification of international clients, and settlement flows that must remain fast but fully documented.