Crypto isn’t just reshaping how we store and transfer value; it’s also changing how people work, where they work, and the types of roles companies need to fill. From smart contract developers and compliance analysts to community managers and token economists, the industry has created an entirely new employment category.

Today, crypto careers span sectors like decentralized finance (DeFi), real-world asset tokenization, NFT infrastructure, and enterprise blockchain solutions. Companies in the U.S., Europe, and Asia are not only hiring developers but also actively recruiting risk specialists, legal professionals, and cross-functional talent to navigate emerging regulations and growth.

Editor’s Choice

- ~1.6 million professionals are employed in the global crypto industry as of 2025.

- The crypto job market added 66,494 new roles in 2025, a 47 % rebound from 2024.

- Remote roles account for ~40 % of new Web3 job listings in 2025, leading global demand.

- Global crypto salaries rose ~18 % year‑on‑year, with North America having the highest overall.

- Remote positions make up over 60 % of blockchain‑related roles.

- Web3 workforce demand shows a broad geographic spread, led by the U.S., Europe, and Asia.

Recent Developments

- Global crypto job openings rose 47% year-over-year to 66,000 new positions.

- Web3 sector employs over 460,000 professionals, with 100,000 added last year.

- Blockchain developer demand is projected to increase 22% according to the U.S. Bureau of Labor Statistics.

- Crypto salaries increased 18% year-on-year globally.

- Technical roles comprise over 50% of crypto job postings.

- Compliance roles grew more than 35% amid regulatory shifts.

- Remote-first Web3 positions jumped 40%.

- Crypto talent pool expanded over 50% since 2020, with 30% hiring growth ahead.

- Over 58% of crypto firms adopted hybrid or fully remote models.

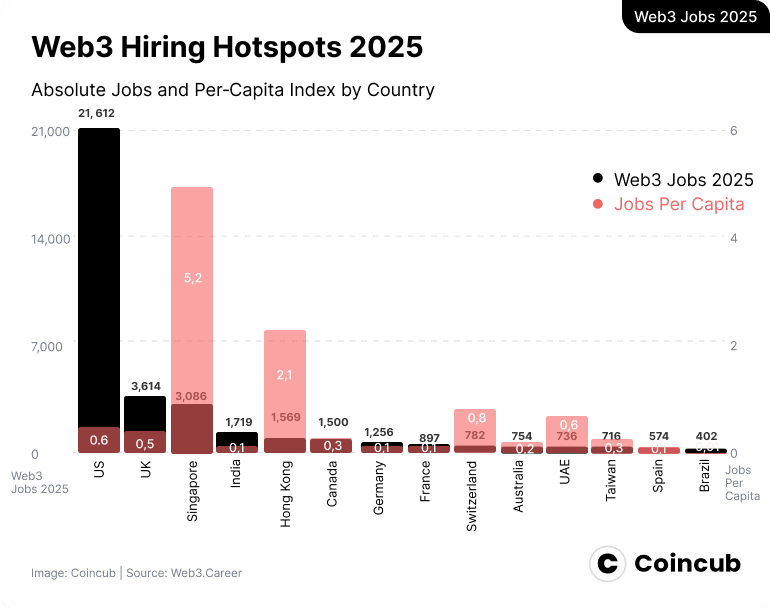

Web3 Hiring Hotspots

- The US dominates Web3 hiring with 21,612 jobs, but has a low per-capita index of 0.6, suggesting broad market size rather than dense adoption.

- Singapore leads globally in Web3 jobs per capita with a score of 5.2, despite having a smaller workforce of 3,086 jobs.

- The UK ranks third in absolute Web3 job count with 3,614 positions, and a moderate per-capita index of 0.5.

- India shows strong absolute growth with 1,719 jobs, but a very low per-capita index of 0.1, indicating low penetration relative to population.

- Hong Kong stands out in Asia with 1,569 jobs and a high jobs per capita score of 2.1, reflecting a dense, advanced Web3 ecosystem.

- Canada and Germany follow with 1,500 and 1,256 jobs, respectively, but both maintain a per-capita score of just 0.1, showing untapped potential.

- Switzerland has only 782 jobs, but its per-capita index of 0.8 places it ahead of larger economies like France and Germany in density.

- Australia and the UAE both record above-average per-capita scores of 0.6 and 0.3, with 754 and 736 jobs, respectively.

- Taiwan and Spain show similar footprints, with 716 and 574 jobs, and jobs per capita indices of 0.3 and 0.2.

- Brazil lags behind with just 402 Web3 jobs and a jobs per capita score of 0.1, highlighting regional underrepresentation.

Global Crypto and Web3 Workforce Overview

- Global crypto workforce totals 1.6 million professionals.

- North America holds 38% of global crypto professionals.

- Asia’s share of the crypto workforce rose to 32% from 19% in 2021.

- Asia-Pacific crypto jobs grew 69% annually.

- Latin America’s crypto workforce expanded 63% year-over-year.

- 58% of crypto companies use hybrid or fully remote models.

- Crypto job openings increased 47% to 66,000 new positions.

- Compliance roles in crypto grew over 35% amid regulations.

Technical vs Non-Technical Roles in Crypto

- Technical roles comprise over 50% of all crypto job postings.

- Blockchain developers saw a 250% demand increase since 2023.

- Non-technical positions receive 80-120 applicants versus 200-400 for technical.

- Compliance roles grew a bit above 35–40% year‑over‑year amid new global regulations, rather than several‑hundred‑percent expansion across the entire market.

- Marketing roles in Web3 rose 110% year-over-year.

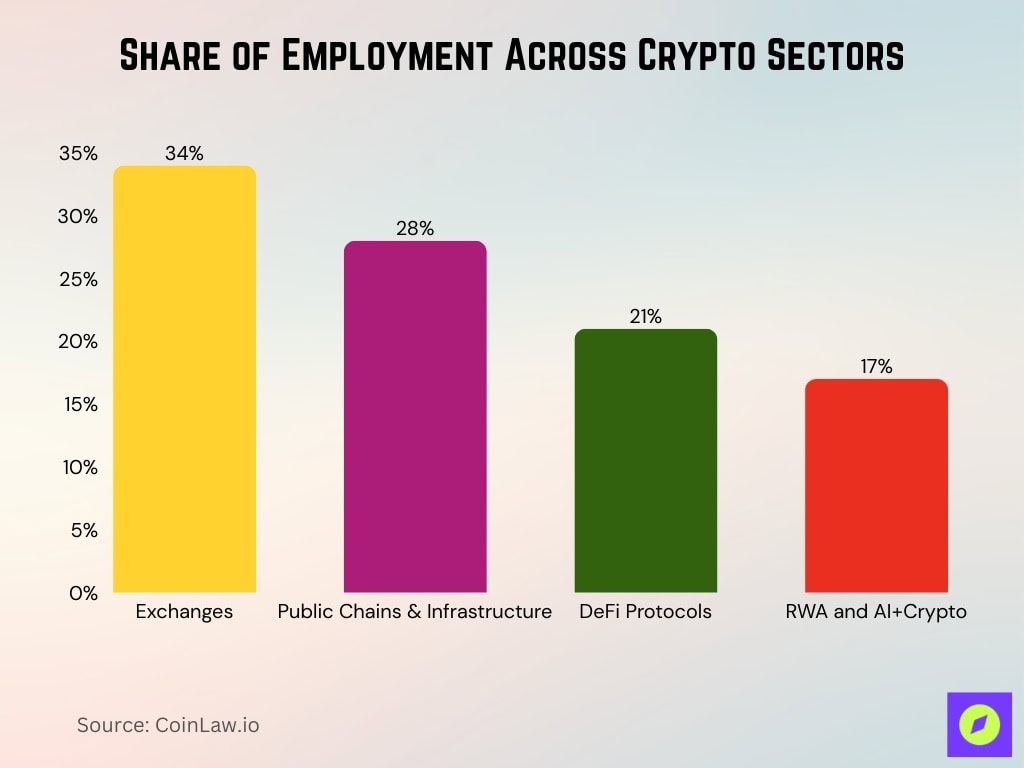

Crypto Employment by Sector and Business Model

- Exchanges account for 34% of the total crypto workforce.

- Public chains and infrastructure represent 28% of crypto jobs.

- DeFi protocols hold 21% of sector employment.

- RWA and AI+Crypto sectors comprise 17% of positions.

- Technical roles dominate with over 50% of all postings.

- Compliance positions grew more than 35% year-over-year.

Crypto Employment by Region and Country

- The United States employs roughly 38% of the global crypto workforce in 2025, maintaining its lead despite regulatory uncertainty.

- Asia accounts for about 32% of crypto jobs, with Singapore, Hong Kong, and India driving most new hiring.

- Europe represents nearly 25% of global crypto employment, supported by MiCA‑driven compliance hiring.

- India added more than 75,000 crypto and Web3 jobs between 2024 and 2025, making it one of the fastest‑growing talent markets globally.

- The United Kingdom remains Europe’s largest crypto employer, hosting roughly 15% of the region’s Web3 workforce.

- Latin America saw crypto employment grow by ~18% year over year, led by Brazil, Argentina, and Mexico.

- Africa accounts for under 5% of global crypto jobs, but recorded one of the highest growth rates, exceeding 20% annually.

- Countries with clear regulatory frameworks show higher job retention and longer average tenure.

Top Cities and Hubs for Crypto Jobs

- San Francisco Bay Area remains the top crypto employment hub globally, hosting over 20% of U.S.-based crypto roles in 2025.

- New York City ranks second in the U.S., with strong demand in compliance, finance, and institutional crypto services.

- Singapore leads Asia as a crypto hiring hub, home to nearly 10% of all Asia‑Pacific Web3 jobs.

- London continues to dominate Europe’s crypto labor market, particularly in legal, trading, and fintech‑aligned roles.

- Dubai has emerged as a fast‑growing hub, with crypto job postings rising over 30% year over year, driven by favorable licensing regimes.

- Berlin remains a key engineering hub for open‑source and DAO‑driven projects.

- Toronto and Vancouver collectively host more than 8,000 crypto professionals, supported by blockchain research institutions.

- Secondary U.S. cities such as Austin, Miami, and Denver continue to attract startups due to lower costs and crypto‑friendly ecosystems.

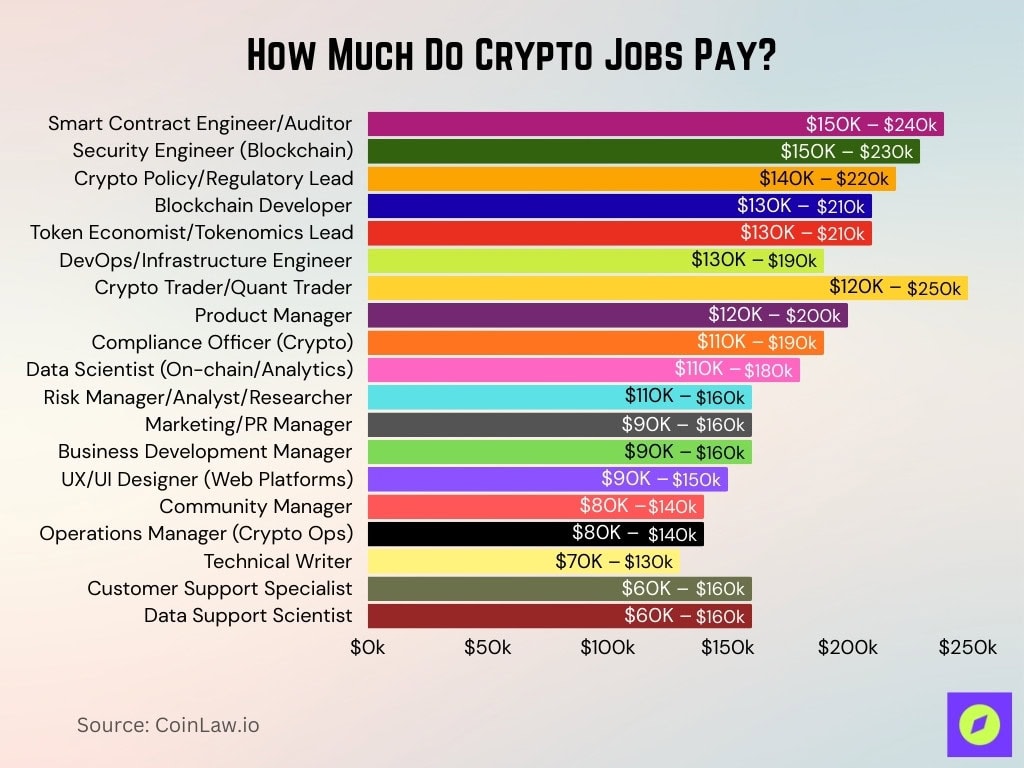

How Much Do Crypto Jobs Pay?

- Smart Contract Engineers and Auditors can earn between $150,000 – $240,000, among the highest-paying roles in crypto.

- Security Engineers (Blockchain) see salaries ranging from $150,000 – $230,000, reflecting the high demand for secure protocol infrastructure.

- Crypto Policy/Regulatory Leads earn $140,000 – $220,000, showing the rising importance of legal and compliance functions.

- Blockchain Developers and Token Economists each command between $130,000 – $210,000 in salary.

- DevOps/Infrastructure Engineers earn between $130,000 – $190,000, ensuring backend stability in crypto operations.

- Crypto Traders and Quant Traders are the top earners, with compensation reaching $120,000 – $250,000.

- Product Managers in crypto earn between $120,000 – $200,000, highlighting strong demand for user-focused leadership.

- Compliance Officers (Crypto) and Data Scientists (On-chain/Analytics) earn $110,000 – $190,000 and $110,000 – $180,000, respectively.

- Risk Analysts typically earn $100,000 – $160,000, aligning with the growing risk management focus in volatile markets.

- Marketing, PR, Business Development, and UX/UI Designers see salaries between $90,000 – $160,000 or $90,000 – $150,000.

- Community Managers and Operations Managers earn $80,000 – $140,000, supporting user engagement and crypto workflows.

- Technical Writers earn $70,000 – $130,000, showing strong value for content clarity in Web3.

- Customer Support Specialists and Data Support Scientists have entry-level salaries ranging from $60,000 – $160,000, but with wide potential upside.

Remote, Hybrid, and On-Site Work Patterns

- Remote roles account for roughly 41% of all crypto job listings in 2025, down slightly from 44% in 2024 as some firms adopt hybrid models.

- Hybrid work models now represent about 35% of crypto jobs, particularly at regulated exchanges and enterprise blockchain teams.

- Fully on‑site roles make up less than 25% of crypto employment globally.

- Remote crypto workers are 25–30% more likely to be employed across borders.

- Companies offering remote flexibility report lower attrition rates, averaging 18% annually versus over 25% for on‑site‑only firms.

- DAO‑based organizations rely heavily on remote contributors, with more than 70% of DAO workers fully distributed.

- Time‑zone overlap, rather than geography, is now the primary hiring constraint for many Web3 teams.

- U.S.-based crypto firms increasingly hire talent from Latin America and Eastern Europe for engineering and QA roles.

Benefits and Perks Offered by Crypto Employers

- Token‑based compensation is offered by approximately 38% of crypto employers in 2025, often alongside cash salaries.

- Equity or token grants now account for 20–40% of total compensation at early‑stage Web3 startups.

- Unlimited or flexible PTO appears in over 60% of crypto job listings, higher than the broader tech average.

- More than 50% of crypto employers provide remote‑work stipends, covering coworking, equipment, or internet costs.

- Learning and development budgets average $2,000–$3,000 per employee annually, focused on security and protocol education.

- Mental health benefits are increasingly common, with nearly half of crypto firms offering wellness stipends in 2025.

- Some DAOs and startups offer four‑day workweeks, though adoption remains below 10%.

- Competitive benefits are used to offset higher job‑market volatility compared with traditional tech roles.

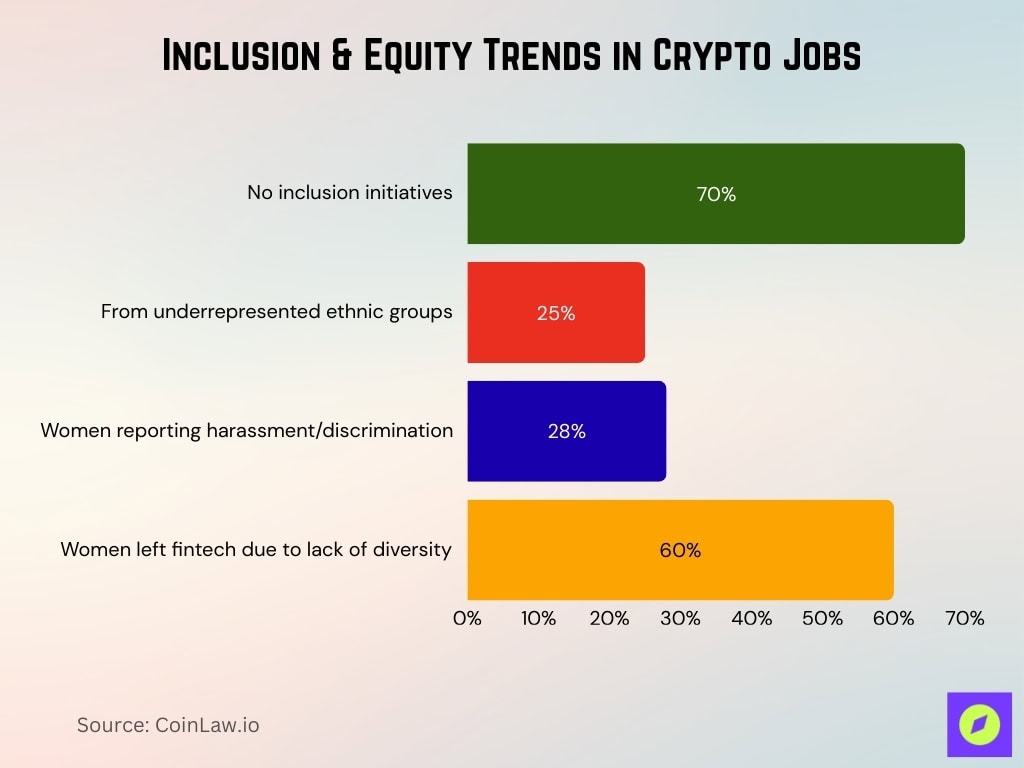

Diversity and Inclusion in the Crypto Workforce

- 70% of crypto communities lack inclusion initiatives for underrepresented groups.

- 25% of crypto employees are from underrepresented ethnic groups.

- 28% of women in blockchain report harassment or discrimination.

- 60% of women in fintech left jobs due to a lack of diversity.

Talent Supply and Skills Gaps in the Crypto Industry

- 60% of crypto employers struggle to hire senior blockchain engineers.

- High-level technical talent shortage persists despite 47% job growth.

- Non-technical positions receive 80-120 applicants versus 200-400 for technical roles.

- Solidity, Rust, and Go skills demand exceeds supply by 2x in development roles.

- 250+ universities offer blockchain courses worldwide.

- 70% of new crypto professionals come from Web2 and fintech backgrounds.

- 58% of firms adopted hybrid/remote models, expanding talent pools.

- Compliance talent gap widened with 35% role growth amid regulations.

- Latin America Web3 startups surged 64% fueling remote developer demand.

Compliance, Legal, and Risk Roles in Crypto

- 30% of blockchain jobs require international regulatory knowledge.

- Compliance positions increased more than 35% year-over-year.

- 305 KYC jobs listed across major Web3 platforms.

- 4,073 blockchain AML positions are available on job boards.

- Crypto risk analysts represent a growing subset of compliance teams.

Startup vs Enterprise Employment in the Crypto Sector

- Startups comprise 58% of crypto companies using hybrid/remote models.

- Crypto job postings surged 47% year-over-year to 66,000 openings.

- Web3 employment is projected to reach $94 billion in wages.

- Blockchain programming demand has grown by over 550% since the early years.

- Crypto firms added 42% more professionals year-on-year.

- 70% of new hires are from traditional internet and fintech firms.

- Technical roles dominate 50%+ across startup and enterprise postings.

- Emerging sectors like RWA/AI hold 17% of total positions.

Future Outlook for Crypto Industry Employment

- Crypto hiring is projected to grow by another 30% through 2027.

- Blockchain developer demand expected to rise 22% per BLS projections.

- Web3 wages forecasted to reach $94 billion with 66.2% annual growth.

- Blockchain jobs could create 1.5 million positions by 2030.

- AI-blockchain hybrid roles emerge as primary growth driver.

- Blockchain posting growth continues at 45% annually.

- RWA tokenization fuels financial engineering and compliance demand.

- Remote hiring models persist with 58% company adoption.

Frequently Asked Questions (FAQs)

About 66,494 new crypto roles were added worldwide in 2025, a 47% increase from 2024.

Remote roles accounted for 26,925 listings, representing about 40% year‑on‑year growth in 2025.

Stablecoins processed an estimated $8.9 trillion in six months of 2025 amid broader payroll and transaction use.

Conclusion

The crypto employment landscape today reflects a maturing, diversified, and increasingly regulated industry. Roles once limited to core blockchain engineering now span DeFi, NFT utility projects, compliance, legal risk, and hybrid tech‑business functions. Despite persistent gender and inclusion gaps, structured diversity initiatives are growing.

Both startups and enterprise players are investing in talent pipelines, driven by continued demand for specialist skills and the emergence of new employment models, including token‑based incentives and DAO participation. Looking forward, the industry’s job growth trajectory remains strong, with evolving technologies and expanding regulatory frameworks shaping where and how people work. As the ecosystem evolves, professionals with cross‑disciplinary skills and adaptability will lead the next wave of opportunities.