The crypto exchange ecosystem continues to evolve rapidly, reshaping how individuals and institutions access digital assets. From global spot markets to region-specific derivatives platforms, exchanges have grown into sophisticated financial hubs, competing on features, liquidity, and user experience. Major financial institutions such as BlackRock and Fidelity have expanded their crypto footprints, while emerging platforms in Latin America and Southeast Asia are capturing untapped market segments. Meanwhile, decentralized exchanges (DEXs) are chipping away at centralized dominance by offering greater privacy and control. This article explores key data and trends shaping the crypto exchange market today.

Editor’s Choice

- Binance maintains its lead with a 42.3% global spot trading market share as of Q3 2025.

- Coinbase’s trading volume surged 28% YoY, reaching $234 billion in Q2 2025 alone.

- Decentralized exchanges collectively represent 21.7% of all crypto trading volume in 2025.

- OKX‘s derivatives volume exceeded $1.3 trillion in September 2025, surpassing Binance for the first time in the derivatives market.

- The United States accounts for 17.9% of all global crypto exchange traffic, with India and Turkey following closely behind.

- Institutional investors now make up 42% of total exchange trading volume, compared to just 26% in 2023.

- Ethereum staking platforms are integrated into 73% of centralized exchanges as of 2025, reflecting strong user demand for passive income tools.

Recent Developments

- Binance completed its transition to a fully transparent Proof of Reserves (PoR) system in March 2025, audited by Deloitte.

- Kraken launched its own Layer-2 blockchain solution in April 2025, enabling gasless swaps and faster withdrawals.

- Gemini expanded into the LATAM market, opening operations in Brazil and Argentina, capturing over 3 million new users in Q1 2025.

- Coinbase’s partnership with BlackRock has now enabled direct crypto trading integration for over 250 institutional clients.

- Bitfinex became the first major exchange to support native tokenization of real-world assets (RWAs) such as bonds and real estate.

- OKX’s launch of AI-powered trading bots saw over 480,000 users adopt the service within three months of its May 2025 rollout.

- Robinhood Crypto officially separated from its brokerage parent, becoming a standalone entity to comply with the SEC regulatory clarity announced in 2025.

- Hong Kong granted its first set of crypto exchange licenses to 5 platforms, including HashKey and OSL, signaling more institutional access in Asia.

- DEXs like Uniswap and dYdX began offering institutional-grade analytics, helping them attract compliance-conscious traders.

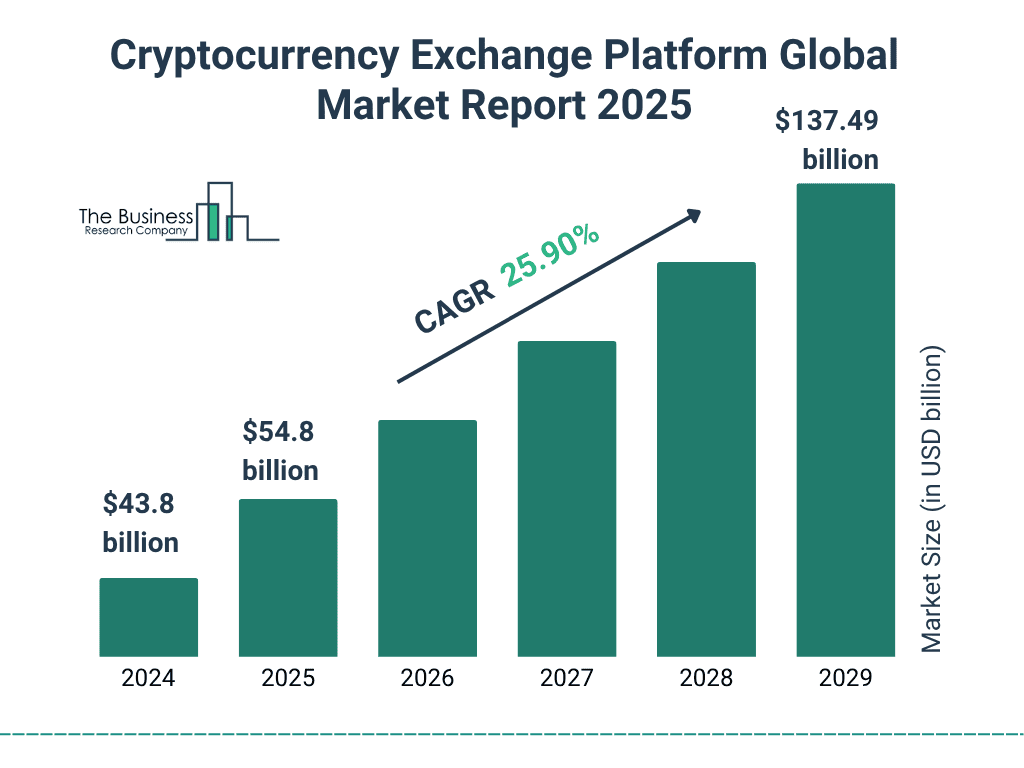

Global Cryptocurrency Exchange Platform Market Growth

- The global cryptocurrency exchange platform market was valued at $43.8 billion in 2024.

- It is projected to grow to $54.8 billion in 2025, marking a strong year-over-year increase.

- The industry is expected to expand at a compound annual growth rate (CAGR) of 25.9% from 2025 to 2029.

- By 2029, the total market size is forecast to reach $137.49 billion, reflecting rapid global adoption and institutional participation.

- This sustained growth highlights the rising demand for regulated exchanges, secure trading platforms, and derivative products.

Trading Volume Statistics

- Total global crypto trading volume in September 2025 reached $4.27 trillion, a 36% YoY increase.

- Binance recorded $1.8 trillion in spot volume alone in Q3 2025, reaffirming its dominance despite growing regulatory pressure.

- OKX’s average daily derivatives trading volume hit $42 billion, reflecting an 18% quarterly rise.

- dYdX processed over $37.5 billion in decentralized derivatives trades in August 2025, making it the leading DEX for margin trading.

- Bybit saw a 24% surge in volume after launching 0-fee trading for Bitcoin/USDT pairs, contributing to its $376 billion Q3 volume.

- KuCoin’s perpetual futures trading volume exceeded $110 billion in September 2025, driven largely by Asian retail participation.

- Huobi Global’s trading volume dropped by 11% in 2025, following regulatory scrutiny in Southeast Asia.

- CEX volumes still dominate with 78.3% of global crypto volume, but DEXs are closing the gap quickly, now holding 21.7% market share.

- Ethereum and Bitcoin account for over 61% of all trading volume across exchanges, highlighting their continued liquidity dominance.

Exchange Rankings by Volume

- Binance remains the top exchange by spot volume, processing $1.8 trillion in Q3 2025.

- OKX overtook Binance in the derivatives market, hitting $1.3 trillion in monthly volume in September 2025.

- Coinbase ranks #1 in the US with $234 billion in quarterly volume, accounting for 41% of North America’s crypto activity.

- Bybit holds the #3 spot globally for derivatives trading, with $376 billion in Q3 2025 volume.

- Kraken processed $102 billion in Q3 2025, holding a 3.6% global share, and dominates euro-based pairs.

- Bitget rose to the #5 spot in derivatives trading, with over $250 billion in Q3 volume, driven by Southeast Asian markets.

- Upbit is South Korea’s top exchange with $75 billion quarterly volume, making it one of the top 10 exchanges globally.

- dYdX is the largest decentralized exchange by volume, averaging $37.5 billion/month in Q3 2025.

- Uniswap leads in spot DEX volume with over $22 billion traded monthly, up 17% YoY.

- Gate.io ranks in the top 10 with over $120 billion in quarterly volume, supported by its expansion into the Middle East.

User Base and Adoption Statistics

- Global crypto users surpassed 580 million in 2025, marking a 34% increase from 2024.

- First-time crypto adopters grew 19% year-over-year, driven especially by mobile‑first exchanges.

- The U.S. alone is expected to have nearly 100 million crypto users in 2025.

- In 2024, global crypto ownership penetration averaged 6.8%, representing over 560 million owners.

- Coinbase reports 105 million users globally, with about 10.8 million monthly active traders.

- The dominant age group among crypto users is 25–34 years, making up 31% of users.

- Male users still lead adoption, comprising 61% of crypto owners.

- Among U.S. adults, ~28% now own crypto, roughly 65 million people.

- 14% of non‑owners plan to buy crypto in 2025, and 67% of current owners plan to increase holdings.

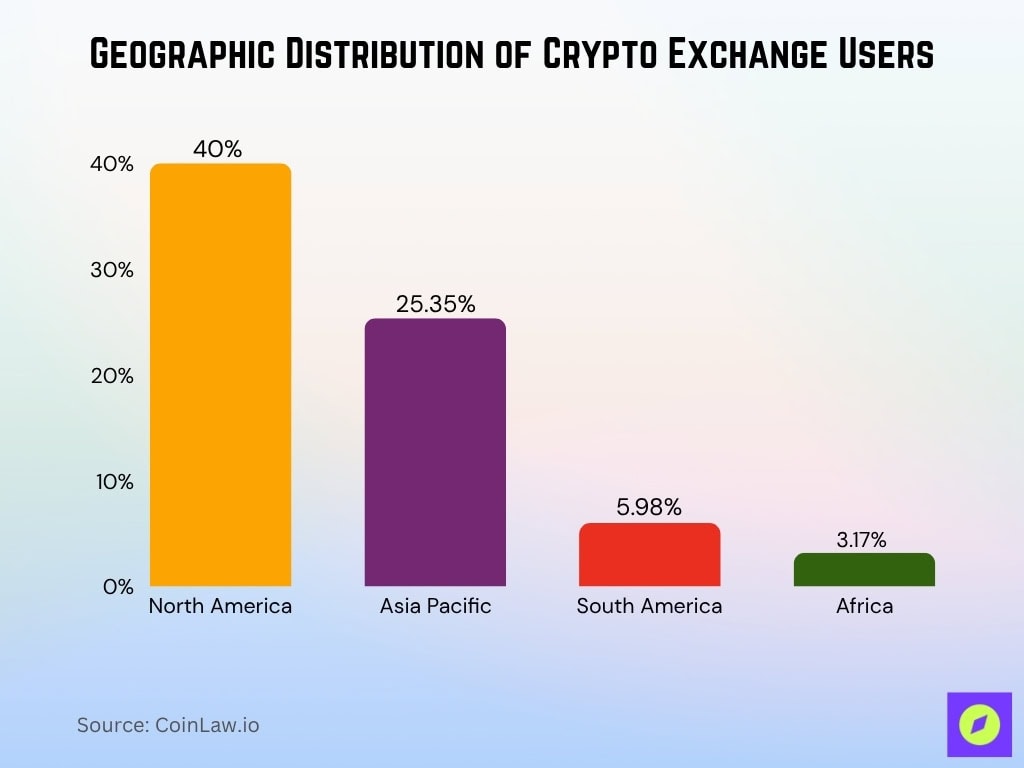

Geographic Distribution of Users

- India and the United States top the 2025 Global Crypto Adoption Index in grassroots adoption.

- The Chainalysis index ranks 151 countries by crypto usage, showing strong growth in emerging markets.

- Europe is forecast to exceed 218 million crypto users in 2025.

- In 2025, North America is projected to hold over 40% of the global crypto exchange platform revenue share.

- In a 2025 market report, the Asia Pacific accounts for ~25.35% of the crypto exchange market revenue.

- South America is estimated to hold 5.98% of the exchange revenue share in 2025.

- Africa’s share is ~3.17% of the exchange market revenue in 2025.

Regional Market Share Analysis

- In July 2025, Binance held 39.8% of spot volume among centralized exchanges.

- The second-largest CEX in July 2025 was MEXC, at 8.6% market share.

- Gate ranked third among CEXs in July, with 7.8% market share.

- Coinbase’s share slid to 5.8%, placing it ninth among global exchanges by spot volume that month.

- Among the top 10 CEXs, the combined share of ranks 4‑10 was 43.8% in July 2025.

- In Q2 2025, 7 of the top 10 exchanges saw volume declines; Crypto.com fell the most, down 61.4% QoQ.

- The top 10 centralized exchanges accounted for ~90.76% of the market in 2024, leaving ~9.24% to others, including DEXs. This concentration is easing.

- In 2024, the centralized exchanges sector dominated ~90.76% of the exchange market revenue.

- Forecasts project DEXs will grow faster, with a CAGR of ~26.37% from 2024 to 2029.

Centralized vs Decentralized Exchange Market Share

- In 2024, centralized exchanges captured ~90.76% of total market revenue.

- DEX segments are forecast to be the fastest-growing portion from 2024 to 2029, with a CAGR of ~26.37%.

- As of mid-2025, 344+ hacking or scam events have been recorded, reinforcing demand for noncustodial platforms.

- In 2025 to date, $2.47 billion has been stolen via hacks and scams, netting approximately $2.29 billion in losses after recoveries.

- Centralized platforms are increasingly adopting proof-of-reserves audits and third‑party verifications to reassure users.

- In 2025, cumulative security breaches exceeded $2.17 billion, surpassing some previous full‑year totals.

- Hybrid exchanges, combining CEX and DEX features, are emerging, offering order books and noncustodial execution.

- Some large DEXs, like Uniswap and dYdX, now offer institutional-grade analytics to attract more sophisticated users.

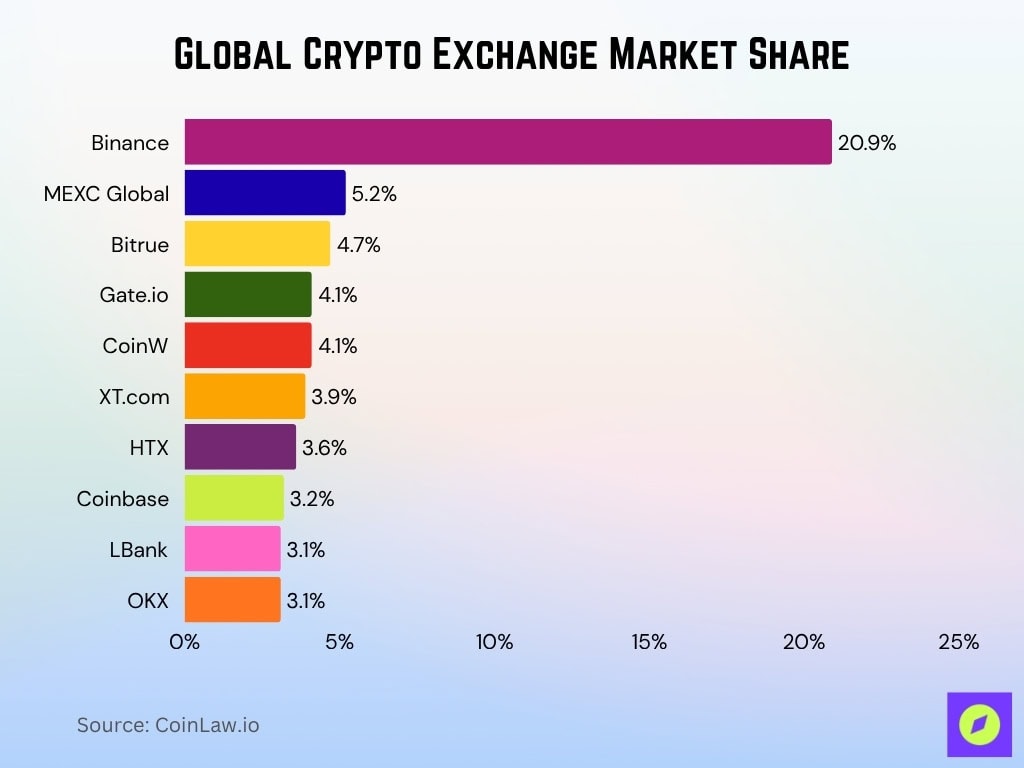

Global Crypto Exchange Market Share

- Binance leads the global market with a dominant 20.9% share, reflecting its unmatched liquidity and trading volume.

- MEXC Global ranks second with 5.2%, gaining strong momentum among retail traders and altcoin enthusiasts.

- Bitrue captures 4.7%, driven by active participation in smaller-cap and high-yield token markets.

- Gate.io and CoinW each hold 4.1%, highlighting the rise of Asia-based exchanges in global crypto activity.

- XT.com follows with 3.9%, benefiting from cross-chain support and aggressive expansion into emerging regions.

- HTX (formerly Huobi) maintains 3.6%, continuing to serve a broad user base in Asia and beyond.

- Coinbase holds 3.2%, securing its position as the largest regulated exchange in the United States.

- LBank and OKX both record 3.1%, underscoring steady competition among mid-tier global platforms.

- Collectively, the top 10 exchanges control over 55% of global crypto trading volume, underscoring growing market concentration.

Revenue of Crypto Exchanges

- Binance’s revenue in 2023 was $16.8 billion, up approximately 40% year-over-year.

- Coinbase generated $6.2 billion in 2024, more than double its 2023 results, with 113% growth.

- Net income for Coinbase in 2024 was approximately $2.5 billion.

- In 2024, Coinbase’s total assets under custody exceeded $220 billion.

- The global cryptocurrency exchange platform market is projected to grow from $50.95 billion in 2024 to $63.38 billion in 2025.

- Another projection values the broader exchange market at $71.35 billion in 2025, expanding to $260.17 billion by 2032.

- In 2025, North America is expected to account for approximately 40.55% of the global revenue share for crypto exchanges.

- Among native exchange tokens, BNB, OKB, CRO, and others aggregated to over $95 billion in market cap.

- Some exchanges earn non‑trading revenue, such as staking commissions and interest, that can account for 10–20% of total revenue in strong years.

Fee Structure Statistics

- Many top exchanges are now offering zero-fee or reduced-fee trading on key pairs, such as BTC/USDT, to compete aggressively.

- Spot trading fees on major exchanges range from 0.02% to 0.10% for takers and 0.01% to 0.05% for makers, depending on volume tier.

- Derivatives fees often range from 0.03% to 0.07% per trade side, with maker rebates on some platforms.

- Withdrawal fees vary widely, often flat or dynamic based on blockchain congestion, such as on Ethereum or Bitcoin.

- Some exchanges charge a deposit or inactivity fee, especially for dormant accounts.

- Fee discounts via native tokens like BNB or OKB can reduce costs by 25–50% for active users.

- Margin borrowing interest or funding rates can add another 0.01–0.05% per period.

- Premium services or API access may introduce extra fees, including data fees or premium subscriptions.

- Exchanges often split revenue between trading fees and non‑fee streams, with non‑fee revenue accounting for 10–30% in exchanges offering lending, staking, or derivatives services.

Security Incident Statistics

- In the first half of 2025, $1.93 billion was stolen across crypto‑related crimes, surpassing full‑year totals from 2024.

- By mid‑2025, cumulative exchange service losses exceeded $2.17 billion, making it a year worse than 2024.

- In Q3 2025 alone, $306.7 million was lost in hacks, pushing the year‑to‑date total to approximately $2.55 billion.

- September 2025 saw 16 incidents exceeding $1 million, the highest monthly tally ever.

- The ByBit exchange hack in February 2025 is now the largest recorded, with approximately 400,000 ETH stolen, valued at $1.5 billion.

- In July 2025, hacking events cost approximately $139 million, with net losses after recoveries at approximately $96.7 million.

- Exchanges like Phemex lost approximately $85 million in a 2025 security breach targeting their hot wallet systems.

- In 2024, WazirX was hacked for approximately $234.9 million, a precedent echoing in 2025 risk dynamics.

- Phishing attacks targeting crypto users increased by approximately 40% in 2025 compared to the prior year, particularly via fake exchange sites.

- Large‑scale hacks are accelerating moves toward proof‑of‑reserves audits, tighter internal controls, and insurance measures at centralized exchanges.

Institutional vs Retail Usage

- In a 2025 EY survey, 86% of institutional investors had exposure to digital assets or planned allocations in 2025.

- Institutional wallet adoption grew approximately 51% year-over-year, with over 31 million institutional wallets by 2025.

- Retail users still dominate, comprising 82% of all crypto wallet holders in 2025.

- Institutions are concentrating on blue‑chip assets, such as BTC and ETH, compared to retail, which focuses more on high‑volatility altcoins.

- Among institutions surveyed, 43% of adopted wallets are custodial, reflecting regulatory and compliance constraints.

- Crypto hedge funds and asset managers increased wallet usage by approximately 29% in 2025, largely for DeFi and staking strategies.

- Many institutions avoid meme tokens and speculative assets, preferring reliable yield and governance protocols in their allocations.

Mobile vs Desktop Usage Statistics

- In 2025, 87% of crypto transactions are processed via mobile devices, confirming the mobile‑first shift.

- Desktop hot wallet usage has dwindled to approximately 9% in 2025, as mobile dominance rises.

- Crypto wallet downloads surged 42% year-over-year, reaching approximately 320 million active wallets across platforms.

- The hardware wallet market is increasingly integrating into mobile ecosystems, with hybrid usage now exceeding 20% of users.

- Desktop wallet share continues to shrink as users prioritize convenience and UX on phones.

- Mobile wallet user count crossed 35 million monthly active users in 2025, driven by apps like MetaMask, Trust Wallet, and Coinbase Wallet.

- Developers rank monthly mobile wallet users as a key metric to track demand and adoption in 2025.

Supported Cryptocurrencies

- Exchanges continue to broaden their catalog, with many now supporting 300–500+ tokens, including niche layer‑1 and DeFi assets.

- Top PoS blockchains, such as Cosmos and Polkadot, show staking ratios up to 56–59%, reflecting deep support across exchanges.

- Ethereum staking saw 33.84 million ETH staked, approximately 27.6% of supply. Some estimates place staking between 35–37 million ETH in 2025.

- Native exchange tokens like BNB, OKB, and CRO remain standard listings with strong liquidity and utility.

- Stablecoin pairs like USDT and USDC still underpin 60–70% of volume listings.

- Many exchanges now list real‑world asset tokens, integrating fractionalized bonds, real estate, and commodities.

- DeFi governance tokens like UNI, AAVE, and SUSHI remain in demand, often with staking, yield, or governance benefits listed.

- Exchanges increasingly delist low liquidity or high‑risk tokens to manage jurisdictional compliance and risk exposure.

Staking and Earn Program Statistics

- ETH staking participation rose to approximately 29–31% of total supply in 2025, equating to 35–37 million ETH.

- The staking market cap on major exchanges reached approximately $259.7 billion.

- Bitcoin staking, via wrapped or derivative products, peaked near $11 billion TVL in early 2025, stabilizing near $10 billion mid‑year.

- Some exchanges derive 10–20% of revenue from non‑trading operations like staking, lending, or Earn products.

- Liquid Staking Derivatives facilitated leveraged staking strategies, with 81.7% of leveraged positions outperforming standard staking.

- The velocity and reuse of stETH/wstETH in DeFi is concentrated, with a small set of institutional addresses driving most turnover.

- Emerging mechanisms like SPARC reward cooperation and decentralization by favoring smaller stakers.

- Exchanges and protocols are experimenting with dynamic reward models to balance network security with token liquidity.

Future Market Projections

- The global cryptocurrency exchange platform market is projected to grow from $50.95 billion in 2024 to $63.38 billion in 2025.

- Another forecast values the broader market at $71.35 billion in 2025, reaching $260.17 billion by 2032.

- DEX growth is expected to outpace CEX, with a projected CAGR of ~26.37% from 2024 to 2029.

- Illicit volume is forecast to remain under 0.4% of total crypto volume, continuing the downward trend from 2023’s 0.9%.

- Mobile wallet and UX improvements will push greater mainstream adoption, with mobile remaining central to future growth.

- As institutional adoption deepens, derivative and yield-bearing products may become standard service tiers.

- On‑chain infrastructure upgrades, such as lower fees and better scaling, will bolster decentralized exchange and yield ecosystems.

- Security remains a risk hinge, with failures in governance, auditing, or wallet infrastructure potentially slowing user trust growth.

Frequently Asked Questions (FAQs)

~39.8%

+25.3%

$3.9 trillion

~87.4%

Conclusion

The crypto exchange landscape sits at a crossroads between expansion and consolidation. Security incidents have surged, prompting a shift toward transparency and risk management. At the same time, institutional capital is reshaping trends, while mobile adoption dominates user behavior. Staking, token listings, and yield programs become essential levers in this evolving market.

The data suggests that exchanges that combine deep liquidity, rigorous security, and flexible earning mechanisms are most likely to thrive. Meanwhile, the lines between centralized and decentralized models may blur further as hybrid architectures gain traction.