Crypto.com continues to be one of the world’s most recognized cryptocurrency exchanges and financial services platforms, blending exchange services with digital wallets, payment solutions, NFTs, and more. The platform’s performance reflects broader industry growth, rising demand for digital assets, and innovative partnerships shaping how users interact with crypto. Its services influence retail traders managing portfolios and businesses accepting crypto payments at checkout. Explore detailed statistics below that uncover usage figures, revenue trends, and token performance.

Editor’s Choice

- 100+ million global users registered on Crypto.com as of mid‑2024, highlighting rapid adoption.

- $1.5 billion revenue in 2024, positioning Crypto.com as one of the largest crypto exchanges by revenue.

- Cronos (CRO) maintains its role as Crypto.com’s native token, with deepening institutional interest in 2025.

- Partnerships in 2025 expanded regulatory and product reach, including U.S. derivatives licensing.

- Active monthly users in crypto globally increased, with the total user base climbing by ~20% year‑over‑year.

Recent Developments

- In 2025, Crypto.com announced strategic partnerships with media and finance companies to expand token utility and treasury use.

- Following strategic announcements, CRO token prices surged by more than 20% immediately after the 2025 deal.

- Crypto.com’s U.S. derivatives arm (CDNA) received regulatory approval to offer cleared margined derivatives in 2025.

- The platform continues expanding global partnerships, including regional banking and payments collaborations.

- Marketing investments increased in 2025, with over $700 million spent on user acquisition and branding in 2024, setting the stage.

- Active involvement in NFT and Web3 product launches kept Crypto.com competitive across digital asset verticals.

- Crypto.com maintained regulatory licensing across multiple jurisdictions, emphasizing compliance and global service continuity.

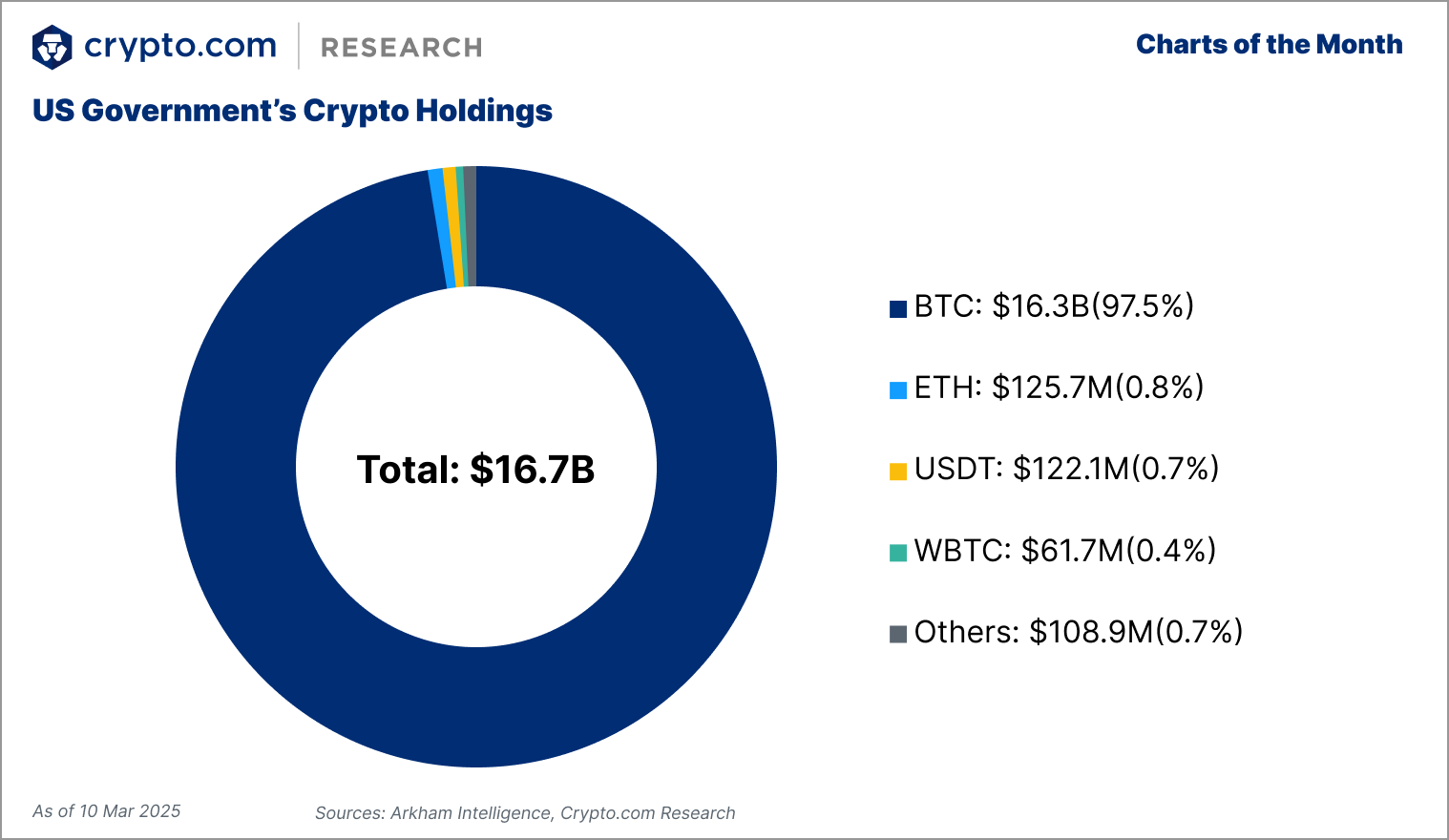

US Government’s Crypto Holdings

- The total value of US government crypto holdings is $16.7 billion as of March 10, 2025.

- Bitcoin (BTC) accounts for $16.3 billion, making up a dominant 97.5% of the total portfolio.

- Ethereum (ETH) holdings stand at $125.7 million, representing 0.8% of the total.

- Tether (USDT) holdings are valued at $122.1 million, about 0.7% of the government’s crypto assets.

- Wrapped Bitcoin (WBTC) makes up $61.7 million, which is 0.4% of the overall holdings.

- Other cryptocurrencies collectively contribute $108.9 million, also 0.7% of the total.

Crypto.com User and Customer Statistics

- The user base grew from about 10 million in early 2021 to 100 million in 2024, showing a decade‑long expansion.

- Global crypto ownership, influenced by platforms like Crypto.com, hit 659 million at the end of 2024.

- Broader crypto user growth trends show ownership increased significantly year‑over‑year.

- Industry reports estimate total crypto users could reach 700–800 million in 2025 under favorable market conditions.

- User growth rates trended upward globally, reflecting broader adoption across exchanges.

- A percentage of Crypto.com users are active traders, part of the ~40–70 million active crypto users globally.

- Younger demographics, especially those under 34, account for a large share of crypto users.

Revenue and Profit Statistics

- Crypto.com achieved $1.5 billion in revenue in 2024, marking strong financial performance.

- Revenue in 2024 grew approximately 25% year‑over‑year from prior levels.

- Net profit in 2024 was estimated at around $300 million after expenses.

- Crypto.com ranked as the third‑largest exchange by revenue in 2024.

- Marketing and acquisition spending in the same period reached around $700 million.

- Trading volumes surged dramatically, with some estimates showing up to nearly tenfold increases year‑over‑year.

- Global exchange revenue for crypto platforms, including Crypto.com, expanded beyond $40 billion in 2024 across the sector.

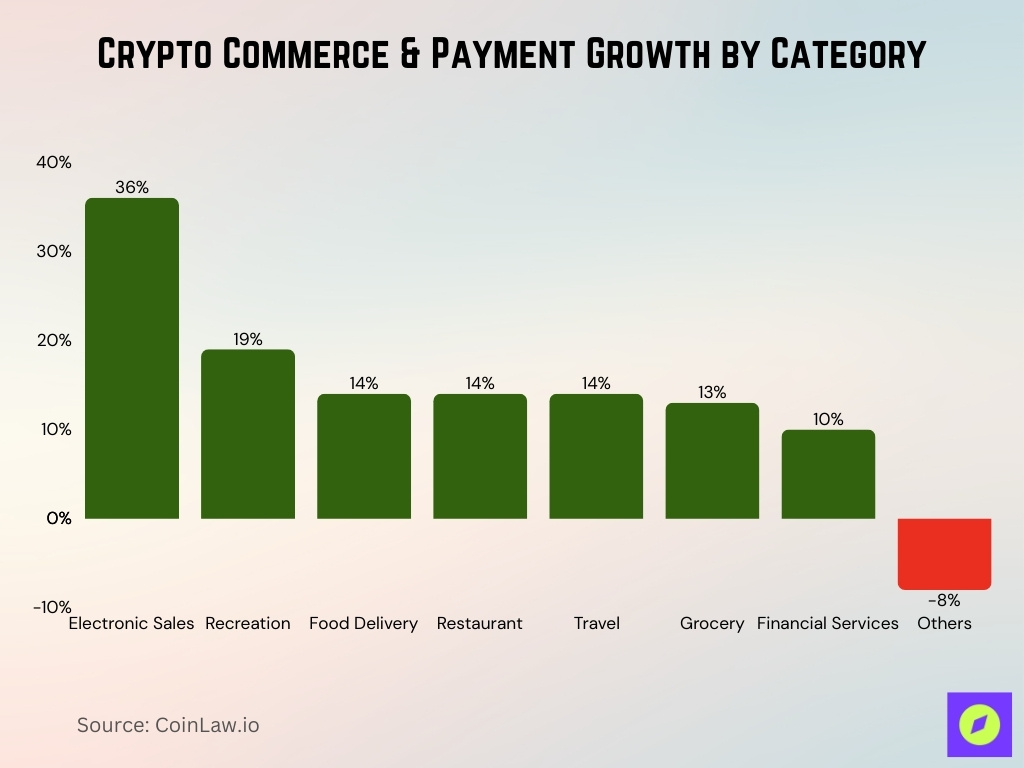

Crypto Commerce & Payment Growth by Category

- Electronic sales saw the highest growth in crypto spending, jumping by +36% year-over-year.

- Recreation spending rose by +19%, reflecting growing crypto use in entertainment and leisure.

- Food delivery payments increased by +14%, showing strong adoption in everyday services.

- Restaurant crypto payments also grew by +14%, matching food delivery and travel.

- Travel-related spending using crypto rose +14%, signaling broader utility for vacation and mobility.

- Grocery purchases with crypto increased by +13%, indicating rising adoption in household essentials.

- Financial services spending grew by +10%, reflecting steady but slower crypto payment growth in this category.

- The “Others” category declined by −8%, marking the only segment with negative year-over-year growth.

Native Token (Cronos / CRO) Statistics

- Circulating supply reached 37.37 billion CRO.

- Market capitalization is approximately $3.5–3.6 billion in December 2025, depending on intraday CRO price movements.

- CRO ranks among the top 42 cryptocurrencies by market cap.

- The top 10 holders control roughly 8% of Cronos’ mainnet supply.

- 1.36 billion CRO traded in recent high-volume sessions.

- Staking rewards distribute 500 million CRO annually.

- Price surged 33.9% after the 2025 roadmap announcement.

- Number of holders exceeds 1.34 million on mainnet.

Product and Service Usage Statistics

- Crypto.com supports trading of over 400 digital assets, offering broad market access in 2025.

- The platform includes services beyond trading: stock and ETF trading (U.S. users), DeFi wallet, NFT marketplace, and crypto payment tools.

- Crypto.com’s Level Up benefits program includes zero trading fees, up to 9.5% CRO staking rewards, and various card perks.

- Users can earn up to 6% back in CRO on card purchases, depending on tier and subscription level.

- The product mix now includes a Crypto.com Visa Signature® Credit Card alongside existing prepaid and debit Visa card options.

- Rewards for card users vary by tier, with some reporting up to 5% CRO back on all purchases via prepaid card.

- Crypto.com’s Earn and staking products offer flexible and on‑chain staking options across dozens of assets.

- Its merchant payment solution, Crypto.com Pay, enables e‑commerce integrations for crypto checkout.

- Direct wallet‑to‑wallet transfers remain core to on‑platform payment and DeFi activities.

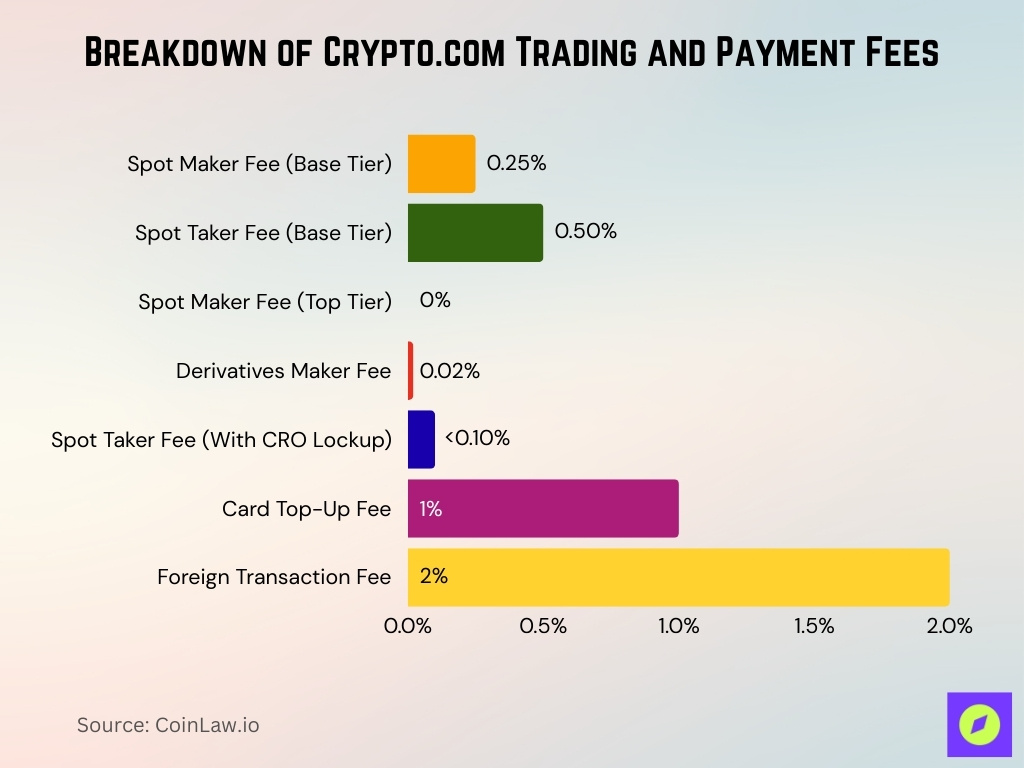

Crypto.com Fees and Commission Statistics

- Spot trading fees start at 0.25% maker and 0.50% taker for low‑volume users without CRO staking.

- Users can reduce fee tiers significantly with higher trading volume or CRO staking.

- High‑volume traders and CRO stakers can enjoy 0% maker fees at top tiers.

- Derivatives maker fees can be as low as 0.02% for eligible traders.

- Some users with significant CRO lockups can see taker fees drop below 0.10%.

- Withdrawal fees vary by asset and network, e.g., Bitcoin and Ethereum have distinct network costs.

- Card top‑ups may incur a 1% fee, and foreign transactions can incur around 2% in some cases.

- ACH fiat withdrawals often incur no Crypto.com fee, though external bank fees may apply.

- The fee structure is competitive but varies compared with other major exchanges.

App and Website Traffic Statistics

- The website received 6.9 million total visits.

- App downloads peaked at 38K weekly on iOS.

- Monthly visits reached 8.93 million.

- Active users declined from 1.4 million to 1 million quarterly.

- US traffic accounts for 35.42% of visits.

- Bounce rate measures 43.47%.

- Average visit duration lasts 00:02:06.

- Pages per visit average 3.26.

Card and Payments Statistics

- The Crypto.com Visa Card is accepted in over 200 countries, increasing global utility.

- Spending per user on Crypto.com cards rose by 16% year‑over‑year in 2024.

- Card usage trends show strong growth in fashion, electronics, and luxury retail sectors.

- Crypto.com’s payments research indicates e‑commerce conversion rates improve 3–5× with wallet‑connected shoppers.

- Crypto payments contributed to +15–25% higher average order values in e‑commerce adoption.

- Partnerships with travel and loyalty programs like Accor’s ALL and Emirates reflect expanding card utility.

- The Crypto.com card ecosystem includes multiple tiers, from free Midnight Blue to subscription‑enhanced offerings.

- Card rewards are paid in CRO, making token economics integral to payment incentive uptake.

Marketing, Sponsorships, and Branding Statistics

- Annual sports sponsorship spend totals $213 million.

- Crypto.com Arena naming rights valued at $700 million over 20 years.

- Total crypto sports sponsorships reached $565 million.

- New football sponsorship deals exceeded $130 million annually.

- Sponsorship spending increased 20% year-over-year.

- Football captured 43% of crypto sponsorship allocations.

- Formula One received 28% of total sponsorship spend.

- 22 major sports deals signed in Q1.

Staking and Rewards Statistics

- ATOM staking offers 14.86% estimated APR.

- NEAR staking provides 11.26% APR.

- SOL staking yields 8.80% APR.

- CRO staking reaches up to 9.5% APY with Level Up.

- ETH staking is available up to 19% APY on-chain.

- DOT staking estimated at 13.51% APR.

- Average staking reward across platforms stands at 6.8%.

- Liquid staking protocols manage over $50 billion TVL.

Regulatory and Licensing Footprint Statistics

- Licensed in 15+ jurisdictions worldwide.

- Holds 9 licenses across the United States, including CFTC DCO and DCM.

- Registered with AUSTRAC as a Digital Currency Exchange Provider.

- Obtained CFTC margined derivatives approval on September 26.

- Secured MiCA Class 2 Crypto-Asset Service Provider License in EEA.

- Registered with FINTRAC as a Money Services Business in Canada.

- Holds ADGM Category 3A License in Abu Dhabi.

- Obtained Major Payment Institution License in Singapore.

- Registered as a Virtual Asset Service Provider in the Cayman Islands.

Geographic and Demographic User Statistics

- The U.S. is the largest single‑country crypto market, with over 58 million active crypto users as of 2025.

- Global crypto users rose to about 659 million in 2024, representing roughly a 13% increase from around 583 million at the start of the year.

- The largest age group among global crypto users is 25–34, accounting for approximately 31% of total users.

- Male users continue to dominate, making up roughly 61% of global crypto holders.

- Asia, driven by India, Vietnam, and the Philippines, remains a top region for adoption and transaction activity overall.

- India alone had 90 + million crypto users by 2024 and maintained strong growth into 2025.

- In regions like South Africa, over 10% of internet users hold crypto assets, underscoring diverse adoption patterns.

- Emerging markets show stronger adoption growth rates than some mature economies, reflecting differing financial use cases across geographies.

- Crypto.com’s own reach is global, serving users across 90+ countries, which aligns with broader demographic expansion.

Security, Compliance, and Risk Statistics

- Crypto.com holds ISO/IEC 27001:2022 and ISO/IEC 27701:2019 security certifications, demonstrating industry‑level security compliance.

- It also maintains PCI DSS v4.0 Level 1 compliance and high ratings under NIST cybersecurity frameworks.

- The platform provides live Proof‑of‑Reserves dashboards to enhance transparency for customer assets.

- Institutional custody insurance includes approximately $750 million in cold storage coverage plus an additional $120 million for custody clients.

- 100% of customer assets held on the platform are verifiable on‑chain via reserves reporting.

- Crypto.com continues to enforce strong Know Your Customer (KYC) and Anti‑Money Laundering (AML) protocols globally.

- Industry studies note that overall crypto hacking resulted in $2.2 billion stolen in 2024, underscoring continuing risks and the value of robust security measures.

- No major new Crypto.com breach events have been reported in 2025, reflecting improved risk controls.

- Comprehensive compliance across jurisdictions helps mitigate regulatory and operational risks.

Institutional and Professional Client Statistics

- Institutional adoption of crypto has grown rapidly, with global holders expanding roughly 8× since 2020 to hundreds of millions by 2024.

- Stablecoin market capitalization reached a record $222 billion, partly driven by institutional treasury use.

- Financial institutions now incorporate digital assets for cross‑border payments and treasury operations.

- Partnerships like Crypto.com’s custody integration with VerifiedX support institutional liquidity and secure asset management.

- Institutional services include OTC trading, insured custody, and customizable governance workflows.

- Institutional investors contribute an estimated ~15% of annual NFT market revenue in the broader ecosystem.

- Pro‑crypto regulatory clarity in many jurisdictions has encouraged institutional market participation.

- Crypto.com serves institutional clients with tailored functionality that complements retail offerings.

NFT and Web3 Ecosystem Statistics

- The global NFT market is estimated at $49 billion in 2025, up from 2024 levels.

- Over 85 million NFTs were minted worldwide in H1 2025, reflecting continued creative activity.

- Daily active NFT wallets averaged around 410,000 in 2025, up roughly 9% YoY.

- Institutional investment accounts for roughly 15% of NFT market revenue as of 2025.

- Web3 usage trends show growth in gaming, art, and digital collectibles as core NFT sub‑sectors.

- NFT marketplaces and minting platforms attract diverse demographics worldwide.

- Fractional NFT ownership and lending are emerging markets within the ecosystem.

- The evolving Web3 ecosystem balances innovation and risk, influencing how platforms like Crypto.com develop NFT‑related offerings.

- NFT engagement varies by region but continues expanding as a digital asset category.

Frequently Asked Questions (FAQs)

Crypto.com has reportedly surpassed 150 million registered users on its platform by 2025.

Global cryptocurrency ownership grew by 4.0% in the first half of 2025, rising from 681 million to 708 million.

First‑time crypto adopters grew by approximately 19% year‑over‑year in 2025.

Conclusion

Crypto.com stands as a global crypto powerhouse serving hundreds of millions of users and engaging every major crypto segment from retail trading to institutional custody. The platform’s demographic reach spans all major regions, with strong U.S. and Asian user bases, while its security and compliance frameworks underscore a serious commitment to safeguarding assets. Strategic sponsorships and marketing partnerships bolster its brand presence, while the broader NFT and Web3 ecosystem continues growing rapidly. Institutional adoption and regulatory clarity remain key drivers for the industry’s next growth phase, positioning Crypto.com at the center of evolving crypto finance trends.