The landscape of crypto ATMs has shifted rapidly, reflecting the growing accessibility of digital assets. From quick peer‑to‑peer cash exchange machines to complex kiosk networks, these terminals are now present across multiple continents. Industry players in retail banking and remittance services are already deploying machines to meet localized cash‑to‑crypto demand, while regional operators are using them to tap underbanked markets. Below, explore key stat lines and emerging insights as we kick off the deep dive into crypto ATM statistics.

Editor’s Choice

- As of early 2025, the global install base of crypto ATMs exceeded ≈ 38,768 units.

- The U.S. held about 80% of all global crypto ATM units in 2025.

- The yearly growth in machines in 2024 was approximately 6% (≈ 2,217 new machines).

- In mid‑2024, there were “nearly 40,000” crypto ATMs worldwide.

- In late 2024, illicit volumes processed through cash‑to‑crypto channels stood at about 1.2% of that industry’s total.

Recent Developments

- By January 1, 2025, the global number of crypto ATMs reached 38,768, reflecting about a 6% year-over-year increase.

- The United States accounted for 81.27% of all crypto ATM installations worldwide in early 2025.

- Europe saw a 7.5% increase in Bitcoin ATM deployments in 2024, boosting its market share to approximately 4.29%.

- Bitcoin Depot reported operating over 7,000 machines in North America.

- Multi-cryptocurrency support on crypto ATMs has risen, with many machines now supporting Bitcoin, Bitcoin Cash, Ether, and Litecoin.

- Approximately 35–40% of new crypto ATMs deployed in 2024 supported two-way transactions.

- Compliance pressure grew with AML/KYC regulations becoming mandatory for crypto ATM operators in over 50 countries by 2025.

- Financial inclusion efforts contributed to deploying crypto ATMs in underbanked regions, with a 35% user growth rate year-over-year in these areas.

- Network optimization strategies led to consolidation efforts, reducing overall ATM numbers by around 3-5% in saturated US urban markets during 2024.

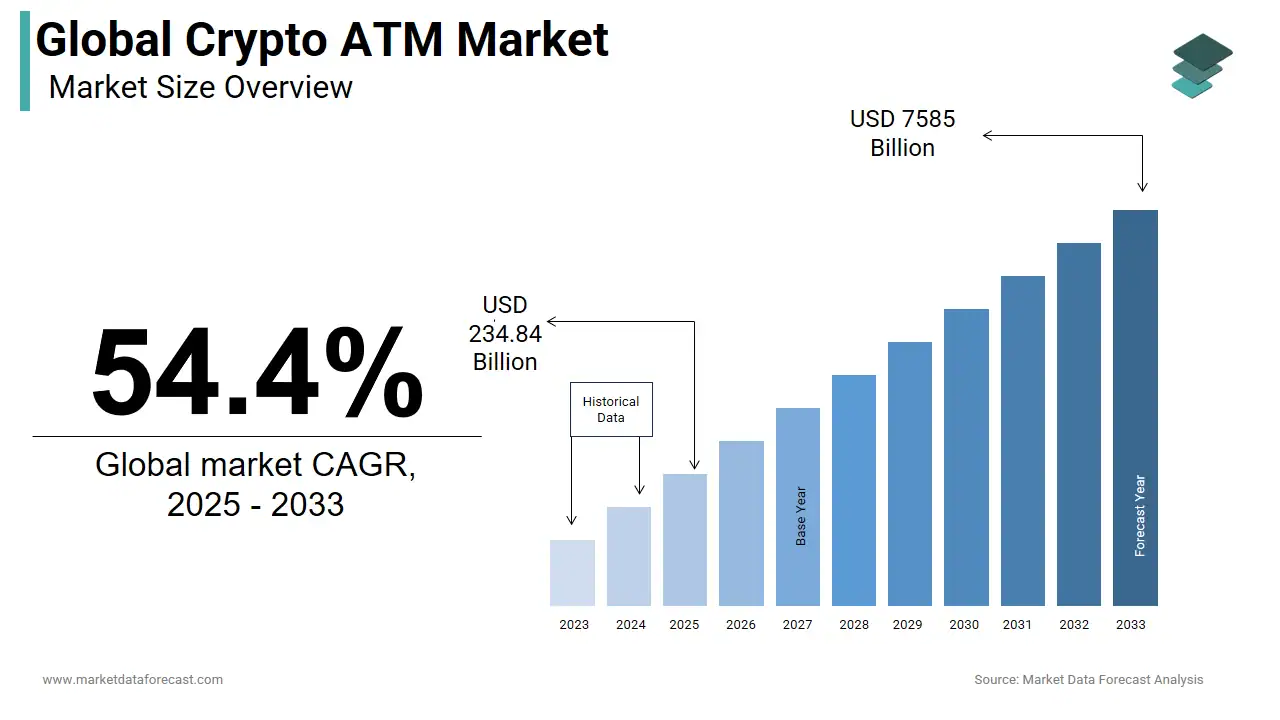

Global Crypto ATM Market Size Highlights

- The global crypto ATM market is projected to grow at a CAGR of 54.4% between 2025 and 2033.

- In 2025 (base year), the market was valued at $234.84 billion.

- By 2033, the market is expected to reach a massive $7,585 billion.

- The forecast illustrates a sharp upward trajectory, with each year showing consistent growth in market value.

- Growth is driven by increased crypto adoption, underbanked populations, and expanding retail deployment of ATMs.

- The chart reflects historical data from 2023 and 2024, transitioning into projected growth from 2025 to 2033.

Number of Crypto ATMs Worldwide

- The total number of crypto ATMs worldwide was approximately 38,768 as of January 2025.

- Between 2023 and 2024, the global crypto ATM network expanded by about 2,217 new machines, marking a 6% growth.

- Crypto ATMs were operational in at least 65 countries worldwide as of the latest data.

- Around 356 operators were servicing the global crypto ATM network as recently recorded.

- Year-over-year growth reflects a steady expansion with new deployments concentrated in both traditional and emerging markets.

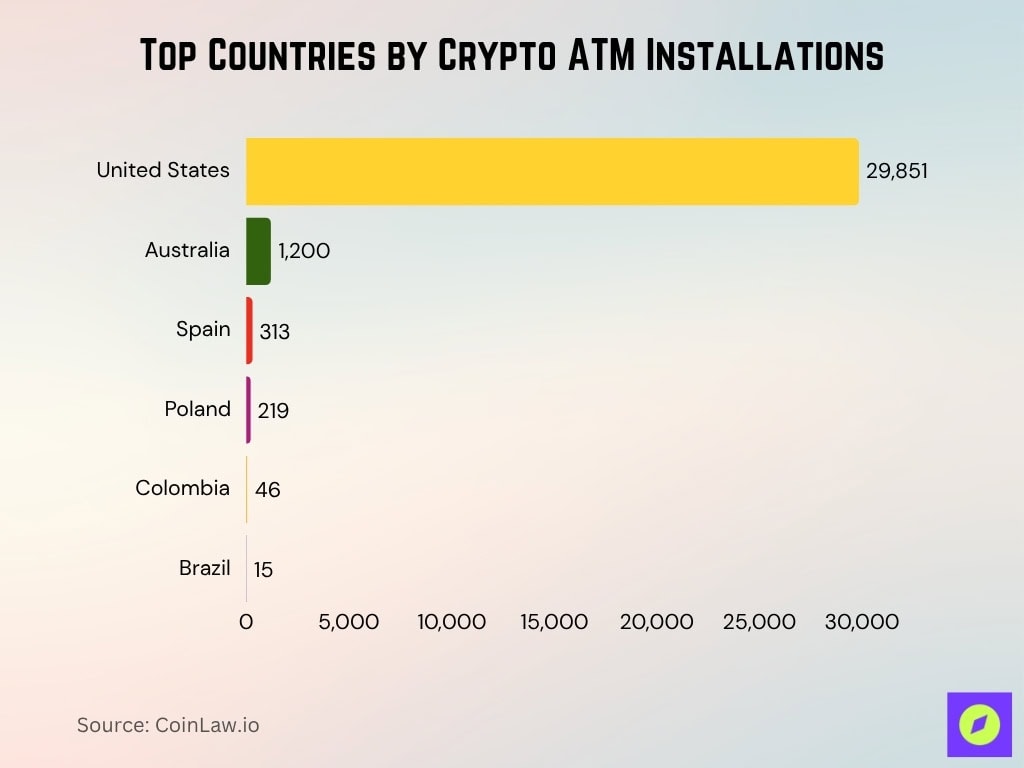

Leading Countries by Crypto ATM Installations

- The United States held about 80% of all crypto ATM installations worldwide in 2025.

- The U.S. had approximately 29,851 Bitcoin ATMs as of early 2025, with high concentrations in California, Texas, and Florida.

- Canada maintained the second spot with steady growth, and its crypto ATM market was valued at $96 million in 2024, expected to grow to $1.187 billion by 2035.

- Australia ranked third with nearly 1,200 crypto ATMs in 2025, up sharply from just 73 two years earlier.

- Spain led Europe with around 313 Bitcoin ATMs by 2025, reflecting strong adoption.

- Poland had 219 Bitcoin ATMs in January 2025, making it the fifth-largest BTC ATM market globally.

- Latin America showed rapid growth, with countries like Colombia hosting 46 Bitcoin ATMs and Brazil deploying 15 new ATMs in malls.

Market Share by Cryptocurrency

- Bitcoin held about 52% of the crypto ATM market share in 2025.

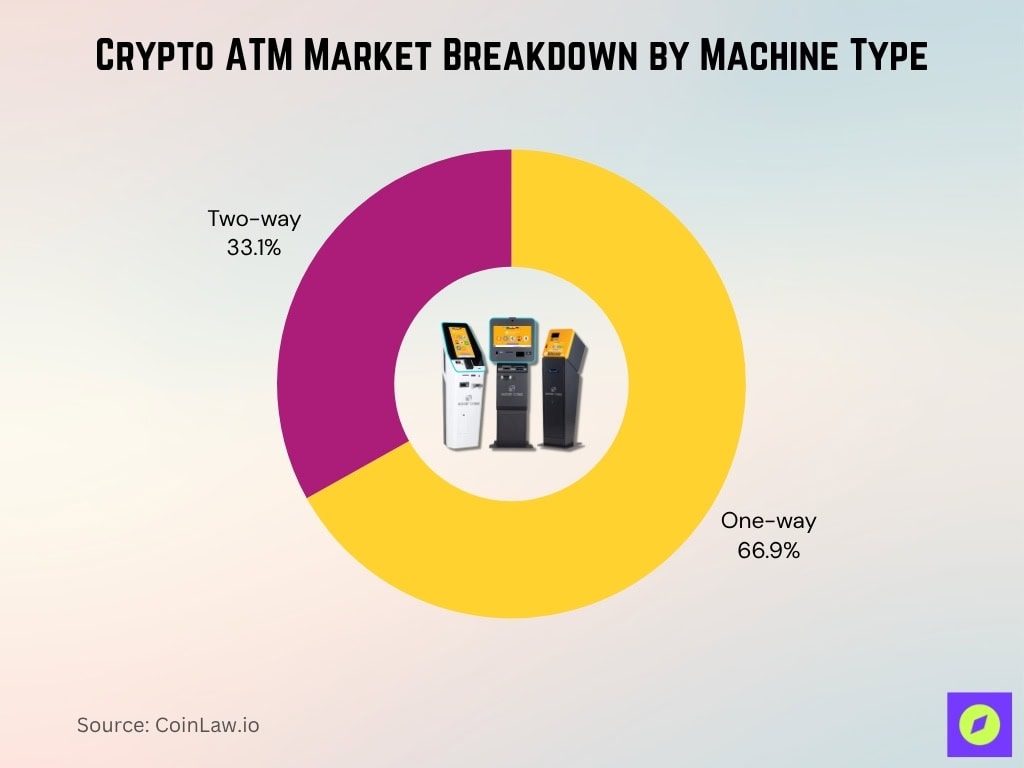

- The one-way (cash-to-crypto only) segment dominated with approximately 66.9% share in 2023.

- Ethereum support is rising, with many ATMs now enabling ETH transactions alongside Bitcoin.

- Dogecoin is increasingly integrated, supported by major operators at over 1,000 ATMs globally.

- Stablecoin support is emerging, with USDT and USDC available on 500+ machines as of 2025.

- Two-way crypto ATM transactions (crypto-to-cash) are projected to grow at a 59.7% CAGR from 2025 to 2032.

Cryptocurrency Support in ATMs (Bitcoin, Ethereum, etc.)

- Bitcoin accounted for about 66.9% of the one-way crypto ATM market share in 2023.

- Bitcoin ATMs remain the majority, representing over 70% of global ATM installations.

- Ethereum support in crypto ATMs was reported in approximately 20% of new machines by 2025.

- Dogecoin integration appeared in around 10% of crypto ATMs in 2024.

- Stablecoin support, mainly USDT and USDC, is available on about 5-7% of ATMs globally.

- Two-way crypto ATMs supporting cash in and out tend to offer 3+ cryptocurrencies, including Bitcoin and Ethereum.

- Multi-coin support has grown by 35% year-over-year as operators seek broader appeal.

- Emerging markets with cash-heavy economies show a 25% higher adoption rate of crypto ATMs with local coin support.

Crypto ATM Market Segmentation (By Type, Coin, Region)

- The one-way crypto ATM segment held 66.9% market share.

- Two-way (bidirectional) ATMs accounted for roughly 33.1% of the market.

- North America dominated with over 80% of global deployments by early 2025.

- Bitcoin represented about 30% of the coin market share in 2022 among crypto ATMs.

- Altcoins, including Ethereum and Dogecoin, are gaining, now supported on over 40% of new machines.

Transaction Volume Through Crypto ATMs

- Estimates suggest global crypto ATM transactions approached $1.4 billion in volume in 2025, driven by increased installations and underbanked adoption.

- The global machine base by early 2025 was approximately ~38,000 units, dividing yields an indicative average per‑machine volume (though actual distribution is uneven).

- Fraud losses connected to crypto ATM use, the Federal Trade Commission (FTC) reported losses topped $65 million in just the first six months of 2024.

- A regional regulatory disclosure in Australia linked crypto ATMs to ≈ $275 million in deposits and about 150,000 transactions annually, noting 99% of transactions were cash deposits.

- These transaction figures reveal that cash‑to‑crypto trade remains dominant over crypto‑to‑cash flows at ATMs.

- Given growth in machine installs and user adoption, transaction volumes are likely to accelerate, especially in emerging markets.

- The ratio of large institutional vs retail use at ATMs remains unclear, but the data suggest a primarily retail cash‑in component.

Common Locations for Crypto ATMs

- Over 40% of crypto ATMs were located in convenience stores and gas stations.

- One-way machines accounted for nearly 67% of installations in high-traffic venues.

- Restaurants and hospitality spaces hosted about 22% of crypto ATMs.

- Retail hubs improved machine visibility, reducing deployment costs by up to 15% for operators.

- Australia’s crypto ATM count surged from 73 in 2022 to 1,107 at the end of 2024, many at fuel or convenience sites.

- Low-banked and transit regions saw a 30% higher density of crypto ATM installations versus urban financial centers.

- Convenience stores reported 20-30% higher transaction fees per crypto ATM compared to standard cash ATMs.

- About 75% of crypto ATMs were placed in staffed, high-visibility venues to meet security and compliance needs.

- Airports, malls, and shopping centers accounted for roughly 18% of global crypto ATM locations in 2024.

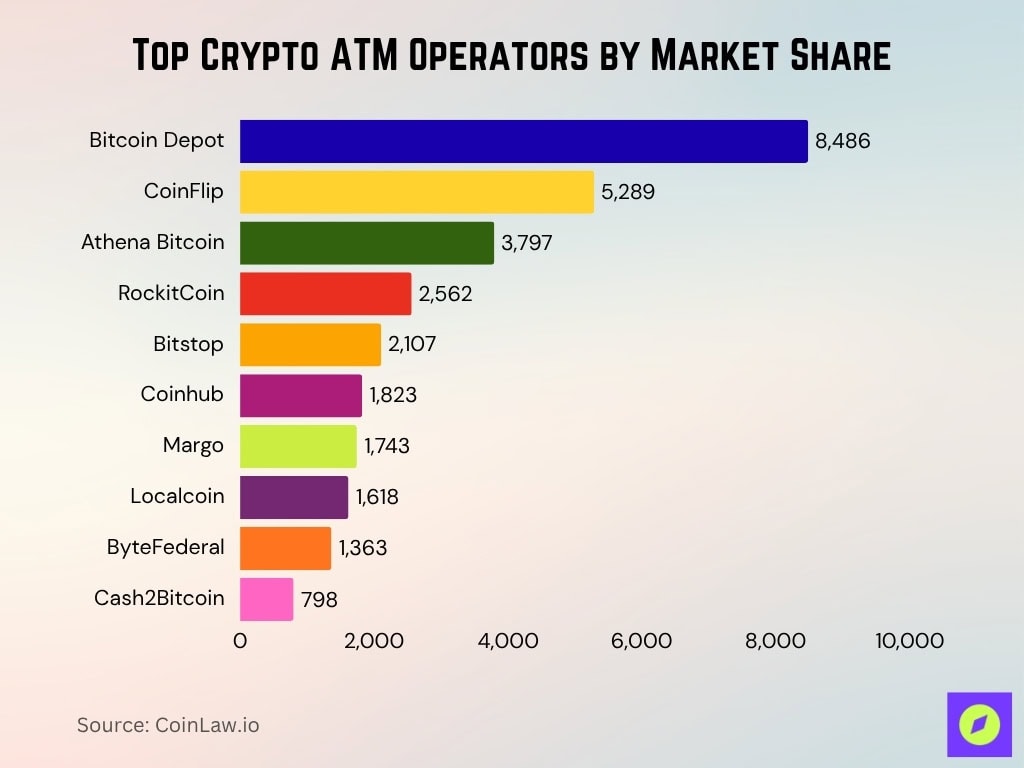

Top Crypto ATM Operators by Market Share

- Bitcoin Depot leads the market with 8,486 ATMs, controlling a 21.8% share of all global crypto ATMs.

- CoinFlip ranks second with 5,289 ATMs, representing 13.6% of the global network.

- Athena Bitcoin holds 3,797 ATMs, capturing 9.8% of the total market.

- RockitCoin manages 2,562 ATMs, securing a 6.6% share.

- Bitstop operates 2,107 ATMs, accounting for 5.4% of the total.

- Coinhub has deployed 1,823 ATMs, which is 4.7% of the market.

- Margo owns 1,743 ATMs, equal to 4.5% of installations.

- Localcoin operates 1,618 ATMs, capturing 4.2% market share.

- ByteFederal maintains 1,363 ATMs, holding 3.5% of the market.

- Cash2Bitcoin rounds out the top 10 with 798 ATMs, or 2.1% market share.

User Demographics and Adoption Patterns

- In Australia, users over age 50 accounted for 72% of crypto ATM transaction value in 2024.

- Adults aged 60-70 represented 29% of transaction value at Australian crypto ATMs.

- Bitcoin ATM scams resulted in over $65 million in losses in the U.S. during the first half of 2024.

- Older adults (60+) were 3 times more likely to report Bitcoin ATM scam losses than younger users.

- A CoinFlip survey found 74% of users made their first crypto transaction through a crypto kiosk.

- Global cryptocurrency adoption was estimated at 7.2% of the world population in 2025.

- Crypto ATM adoption is higher in underbanked regions, serving as an entry point for financial inclusion.

Regulatory Environment and Compliance

- AUSTRAC set a $5,000 cash transaction limit for crypto ATMs in Australia in 2025.

- U.S. crypto ATMs must comply with the Bank Secrecy Act and register as money service businesses under FinCEN rules.

- Illicit volumes via cash-to-crypto ATMs amounted to about 1.2% of total cryptocurrency transaction volume.

- U.S. states enacted new laws in 2025 targeting crypto ATM fraud and enhancing consumer protection.

- Many jurisdictions mandate KYC, transaction reporting, and licensing for crypto ATM operators.

- Europe’s MiCA regulation will affect deployment timelines and require KYC thresholds on crypto ATMs.

- German authorities seized 13 unauthorized crypto ATMs and approximately €250,000 in cash in 2025 enforcement actions.

Security Features and Fraud Incidents

- The FTC reported median losses of $10,000 per victim in crypto ATM scams in early 2024.

- Cash-to-crypto kiosks processed roughly $160 million in illicit volumes since 2019.

- In 2023, illicit volume at crypto ATMs was about 1.2% of total sector volume.

- AUSTRAC found users aged 60-70 over-represented among scam victims in Australia.

- A major ATM operator data breach exposed personal details of approximately 27,000 customers.

- Industry surveys report that over 80% of two-way crypto ATMs include integrated surveillance and tamper-resistant enclosures to meet compliance requirements.

- Roughly 70–75% of new crypto ATM units introduced in 2024 were equipped with real-time monitoring tools.

- Some operators use SMS/email verification and wallet blocklisting on about 60% of machines.

- Regulatory-driven AML/KYC firmware features are integrated in over 50% of crypto ATMs globally.

- Hosting merchants face increased compliance risks, with 40% reporting concerns about fraud liability.

Future Trends and Market Projections

- One-way machines are expected to maintain dominance initially with over 65% market share in the near term.

- Altcoin and stablecoin support in ATMs is expected to increase by more than 50% by 2030.

- Partnerships with retail chains will boost machine density, aiming to reduce per-unit costs by up to 20%.

- Regulatory tightening will push market consolidation, potentially reducing the number of operators by 15-20% by 2030.

- AI and analytics use in site selection and fraud detection is expected to grow by 75% adoption among operators by 2030.

- Transaction costs per use may decline by up to 30% due to scale efficiencies and software improvements.

Frequently Asked Questions (FAQs)

North America accounted for about 81% of global crypto ATM installations by early 2025.

55.3%.

≈ 66.9% of the market.

Conclusion

The landscape of crypto ATMs is evolving rapidly. From convenience‑store placements to age‑skewed user profiles, the statistics reveal both opportunities and risks. The dominance of cash‑in machines, pronounced regulatory focus, and growing fraud exposure underscore how operators, regulators, and users must adapt. As the market projects substantial growth, the next phase will be about smarter deployments, broader coin support, and deeper integration with retail and regulatory infrastructure. If you found these insights useful, keep reading to dive further into the data and implications.