Imagine a small business owner in California trying to pay a supplier in Singapore. Traditionally, this process could take days, involve hefty fees, and require jumping through regulatory hoops. Blockchain technology is transforming how cross-border payments work. Transactions that once dragged on for days are now clear in minutes, all while maintaining security and transparency. However, with these innovations come complex legal and regulatory challenges that organizations and policymakers must navigate carefully.

In this article, we dive deep into the cross-border blockchain transaction landscape. You’ll discover key statistics and insights about global adoption, leading platforms, legal complexities, and future trends that are shaping this space.

Editor’s Choice

- 71% of global financial institutions will be either testing or deploying blockchain solutions for cross-border payments in 2025.

- RippleNet will account for approximately 40% of blockchain-enabled cross-border payment networks used by banks and remittance services in 2025.

- Asia-Pacific will lead the world in cross-border blockchain payments, accounting for around 42% of global on-chain cross-border payment volume in 2025, with flows totaling roughly $1.1 trillion.

- 83% of surveyed multinational corporations cite compliance with regulatory frameworks as their biggest challenge when utilizing blockchain for cross-border payments.

- Stablecoin supply for cross-border payments has grown to $305 billion as of September 2025.

- The cross-border payments market using blockchain approaches $371.6 billion in 2025.

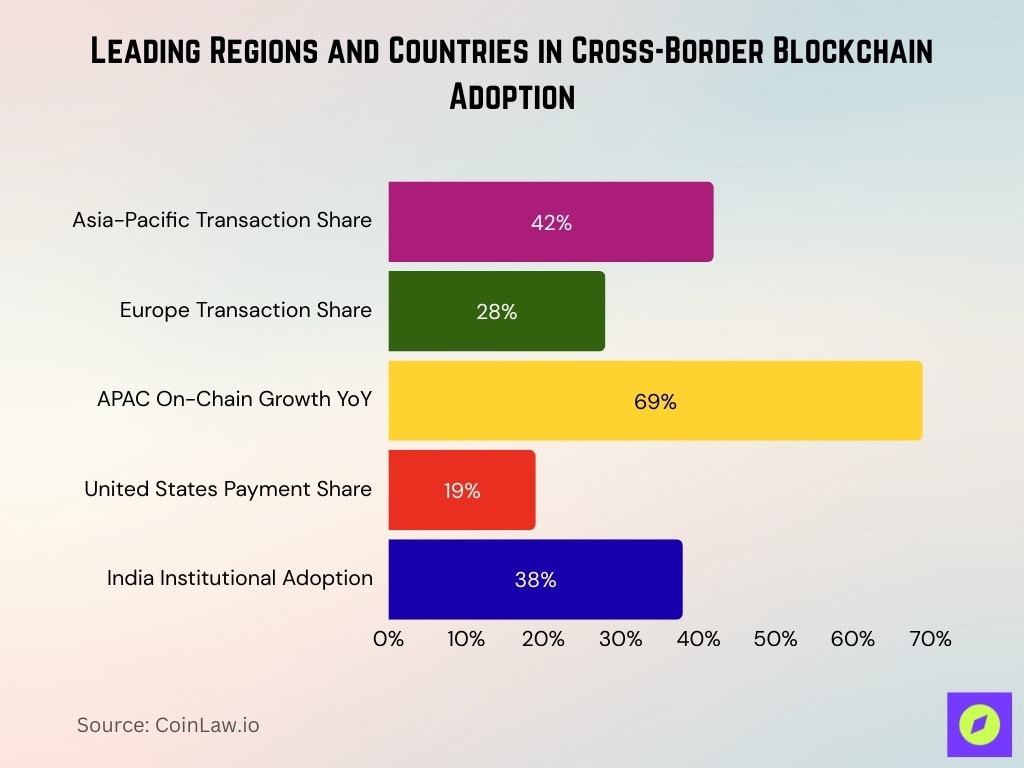

Leading Regions and Countries in Cross-Border Blockchain Adoption

- Asia-Pacific dominates the cross-border blockchain transaction space, with 42% of the global transaction volume.

- Europe holds the second-largest market share, representing 28% of all cross-border blockchain transactions globally.

- APAC emerged as the fastest-growing region for on-chain crypto activity, with a 69% year-over-year increase in value received.

- The United States accounts for 19% of the global cross-border blockchain payments volume.

- India ranks fourth globally, with 38% of its financial institutions using blockchain solutions for cross-border transfers.

Popular Blockchain Platforms Used in Cross-Border Transactions

- RippleNet continues to dominate, with 40% of global financial institutions using its network for cross-border blockchain payments.

- RippleNet processes over $15 billion in cross-border transaction volume monthly.

- Stellar Network developed $1.5 billion in remittance transactions in Q1.

- Stellar facilitates 12 million monthly transactions across emerging markets.

- Ethereum Layer-2 solutions like Polygon processed over 12.3 billion transactions in the first half.

- Polygon averaged 68 million transactions per day.

- Corda is used by 300+ banks and financial institutions globally for cross-border settlements.

- Hyperledger Fabric powers financial services for top companies like SAP, VISA, and BNP Paribas.

- Hyperledger Fabric simplifies cross-border transactions by eliminating intermediaries.

- Algorand reports $500 million in monthly cross-border payment transactions.

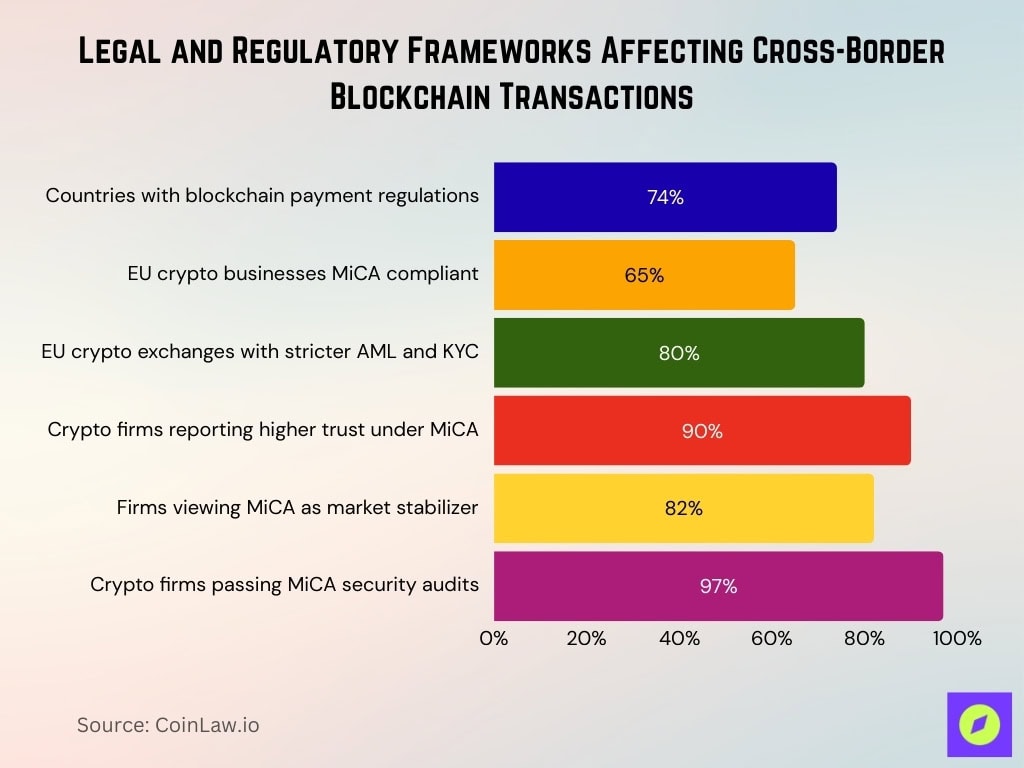

Legal and Regulatory Frameworks Affecting Cross-Border Blockchain Transactions

- 74% of countries have implemented or are developing specific regulatory frameworks for cross-border blockchain payments.

- 65% of EU-based crypto businesses are MiCA compliant by Q1.

- 80% of European crypto exchanges have adopted stricter AML and KYC measures under MiCA.

- 4,000 CASPs have secured EU-wide licensing under MiCA for cross-border operations.

- 90% of crypto businesses confirm MiCA enhanced trust and institutional investor adoption.

- SEC and CFTC issued a joint statement on coordinating spot crypto asset trading processes.

- 82% of firms see MiCA as a stabilizing force for the EU crypto sector.

- 97% of wallet, exchange, and custodial crypto firms pass MiCA’s security audits.

Blockchain and Cross-Border Transactions: Legal Challenges

- Jurisdictional ambiguity remains a top legal challenge, with 63% of blockchain-based cross-border payment providers citing uncertainty over which laws apply when disputes arise.

- The enforceability of smart contracts across borders is cited as a legal gray area by 70% of surveyed legal experts.

- Data sovereignty laws restrict cross-border data transfer in 50+ countries, complicating compliance for blockchain networks.

- The lack of legal recognition for digital identities and e-signatures in cross-border blockchain payments impacts 42% of multinational blockchain payment initiatives.

- AML and KYC compliance in multi-jurisdictional blockchain transactions presents a significant burden, with 58% of providers reporting increased compliance costs.

- Anti-money laundering compliance costs for blockchain-based cross-border payment providers increased by 28% due to tightening global regulations.

Compliance and AML (Anti-Money Laundering) in Cross-Border Blockchain Transfers

- FATF’s Travel Rule is enforced in 85 jurisdictions, requiring cross-border blockchain payment providers to share customer information.

- 90% of financial institutions use AI/ML-powered AML systems, up from 62% in 2023.

- The cryptocurrency sector faced over $927 million in AML fines in the first half of the year.

- 73% of respondents have passed legislation implementing the Travel Rule, up from 69% in 2024.

- 65% of cross-border blockchain payment providers have integrated AI-driven AML systems.

- AML/CFT penalties totaled over $1.1 billion, with crypto exchanges fined the most at $927 million.

- AI-powered AML systems yield false positive reductions of up to 40%.

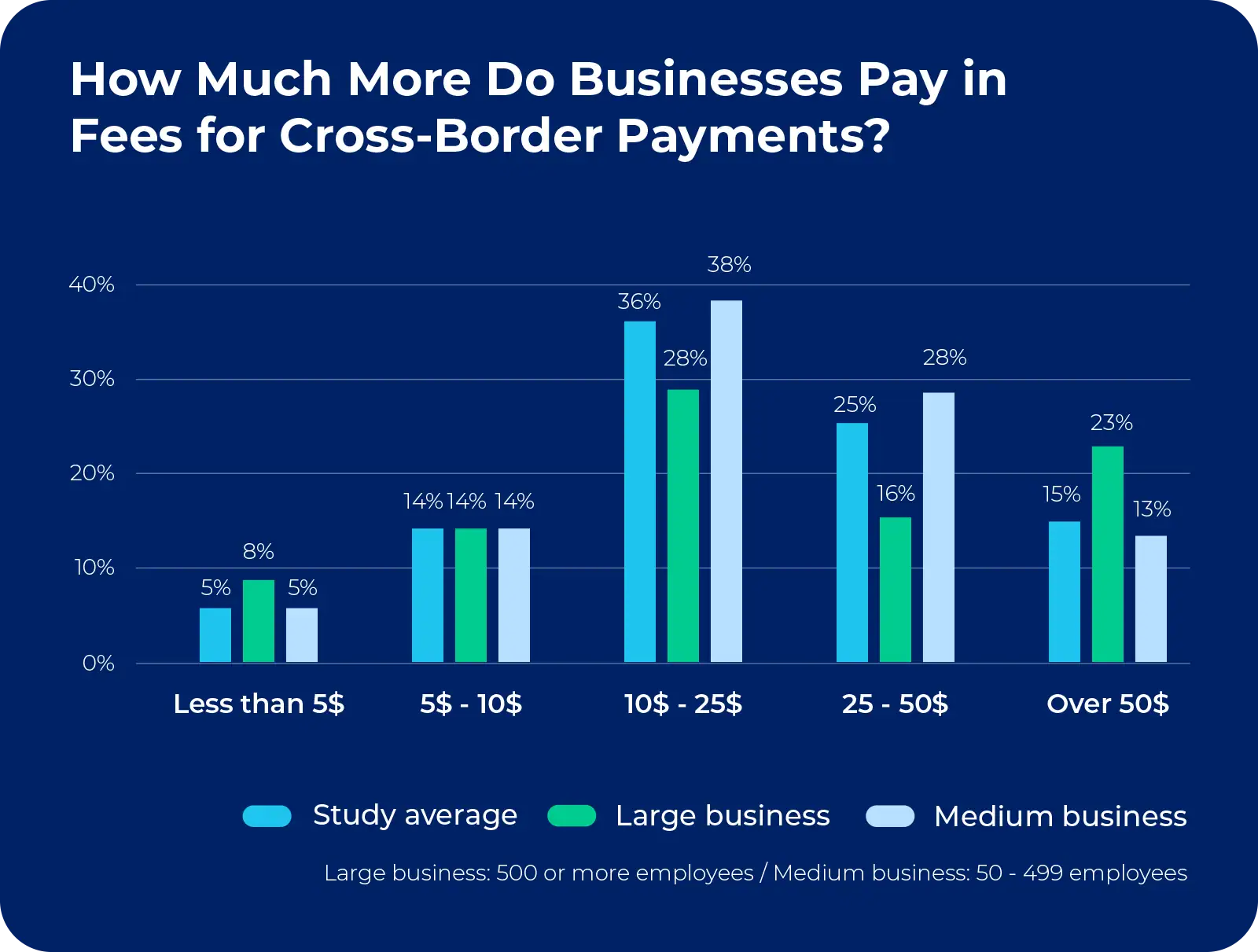

Cross-Border Payment Fee Increases by Business Size

- Mid-range fees dominate, with 36% of businesses paying $10 to $25 more per cross-border transaction on average.

- Medium-sized businesses face the highest pressure, as 38% report additional fees in the $10 to $25 range.

- Large businesses are more evenly distributed, with 28% paying $10 to $25 and 23% incurring over $50 in extra fees.

- High-cost transactions remain significant, as 15% of all firms pay over $50 more per cross-border payment.

- Smaller fee increases are relatively uncommon, with only 5% of businesses paying less than $5 in additional fees.

- The $5 to $10 fee band shows uniform impact, affecting 14% of businesses across large, medium, and study average categories.

- Medium businesses are more exposed to $25 to $50 fees, with 28% reporting this cost level, compared to 16% of large firms.

Impact of Data Privacy Laws on Cross-Border Blockchain Transactions

- 62% of cross-border blockchain transactions are impacted by data localization laws, requiring data to be stored and processed within national borders.

- 144 countries have national data privacy laws, covering more than 6.64 billion people or 82% of the global population.

- EU General Data Protection Regulation (GDPR) imposes strict rules on blockchain networks processing personal data, affecting over 500 cross-border blockchain projects.

- California Consumer Privacy Act (CCPA) compliance costs for cross-border blockchain payment providers reached $75 million.

- GDPR fines for cross-border violations reached €2.9 billion in the previous year.

- South Africa’s POPIA compliance delayed 15% of cross-border blockchain initiatives involving financial institutions.

Taxation Issues Related to Cross-Border Blockchain Payments

- 72% of multinational businesses using blockchain for cross-border payments report uncertainty regarding tax compliance in at least two jurisdictions.

- OECD’s Crypto-Asset Reporting Framework (CARF) requires automatic exchange of tax information across 67 jurisdictions.

- United States IRS mandates disclosure of blockchain-based cross-border payments exceeding $10,000 under revised Form 8300.

- India’s Income Tax Department applies 1% Tax Deducted at Source (TDS) on cross-border blockchain transactions.

- Brazil considers taxing cryptocurrency use for cross-border payments, with crypto transactions hitting 227 billion reais in the first half.

- IRS requires brokers to issue Form 1099-DA for digital asset transactions starting January 1.

- 90% of crypto investors do not declare crypto income despite third-party reporting.

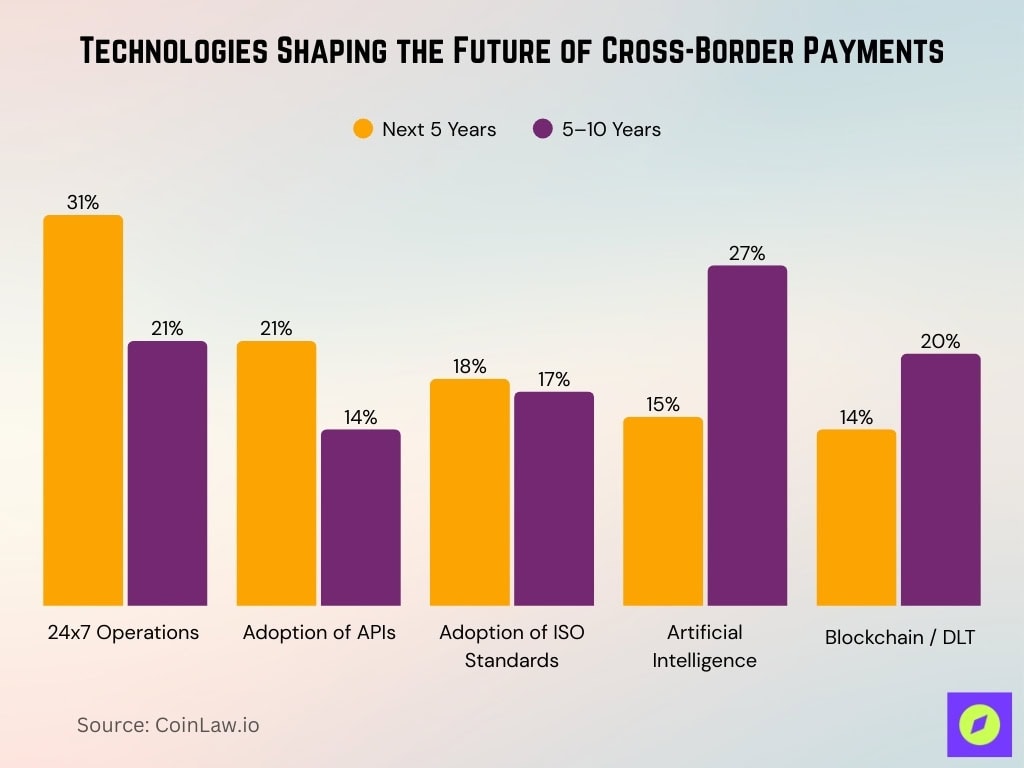

Technologies Shaping the Future of Cross-Border Payments

- 24×7 operations lead near-term priorities, with 31% of firms citing them as critical in the next 5 years, reflecting demand for always-on settlement.

- API adoption remains a core enabler, as 21% of respondents expect APIs to solve cross-border payment pain points in the short term.

- ISO standard adoption shows steady importance, with 18% targeting it in the next 5 years and 17% over 5 to 10 years, signaling gradual infrastructure alignment.

- Artificial intelligence gains momentum long term, rising from 15% in the next 5 years to 27% in the 5 to 10 year horizon.

- Blockchain and DLT adoption accelerates over time, increasing from 14% in the near term to 20% in the long term, highlighting confidence in decentralized rails.

- Technology focus shifts over time, moving from operational efficiency and APIs toward AI and blockchain-driven automation in future cross-border payment systems.

Cross-Border Blockchain Transaction Costs and Efficiency

- Ripple’s ODL solution reduces liquidity costs by up to 60%, processing transactions in 3-5 seconds.

- Stellar blockchain-based remittances reduced transaction fees by an average of 85%.

- Blockchain payments settle in under 3 minutes, versus 3-5 business days for traditional wires.

- Ethereum Layer-2 rollups decreased gas fees by 95%, averaging $0.30 per transaction.

- Visa B2B Connect cross-border volumes rose 12% year-over-year.

- Algorand processes 1,000+ transactions per second at 4.4 seconds average time.

- RippleNet achieves average cross-border transaction costs of $0.0011.

- DeFi platforms enable peer-to-peer remittances at $0.25 per transaction.

- Blockchain reduces cross-border fees by up to 80%, from $330 to $66 for $10,000 transfer.

Security and Fraud in Cross-Border Blockchain Transfers

- Cross-border blockchain fraud losses reached $1.3 billion in 2024 but decreased by 19% due to enhanced security protocols.

- Multi-signature wallets will protect 82% of cross-border blockchain payment flows, reducing unauthorized access risks.

- AI-driven fraud detection systems prevented $900 million in fraudulent cross-border blockchain transactions.

- Decentralized Identity (DID) solutions reduce identity theft in cross-border blockchain payments by 45%.

- Smart contract audits increased by 60%, improving the security of cross-border blockchain transactions.

- Crypto theft in 2025 exceeded $3.4 billion, concentrated in fewer, larger breaches.

- Comprehensive smart contract audits range between $25,000 and $150,000, depending on complexity.

- Cross-chain solutions accounted for nearly 40% of Web3 exploits.

Blockchain and Consumer Protection: Legal Considerations

- 75% of countries require consumer disclosure policies for cross-border blockchain payment providers.

- Dispute resolution frameworks exist for 62% of cross-border blockchain payment services.

- MiCA mandates clear and transparent fee disclosures for 4,000 CASPs across EU member states.

- CFPB enforces error resolution protocols under Regulation E for blockchain remittances.

- Australia’s ASIC requires licensing to ensure consumer protection for digital asset platforms.

- South Korea’s Virtual Asset User Protection Act mandates insurance covering 5% of hot wallet assets.

- 93% of crypto owners would consider purchases with digital assets under regulated platforms.

- 82% of firms see MiCA enhancing consumer trust through standardized protections.

Recent Developments

- Cross-border blockchain transaction volume is projected to grow 28% year-over-year from 2025 to 2026.

- Stablecoin supply reached $305 billion, with $32 trillion processed in transaction volume.

- mBridge project enables real-time cross-border CBDC payments across China, Thailand, the UAE, and Hong Kong.

- ISO 20022 has been adopted by 60% of cross-border payment providers for standardized data exchange.

- Stablecoins account for 70% of cross-border blockchain transactions, led by USDC and USDT.

- 90% of financial institutions are piloting or planning stablecoin integration for payments.

- Blockchain cross-border payment transactions are expected to represent 18% of global B2B flows.

- Asia-Pacific cross-border blockchain payments total $1.1 trillion, representing 42% of the global market.

- Web3 wallets facilitate $15 billion monthly in cross-border transactions.

- Africa’s blockchain payment adoption soared 60%, driven by remittance demand.

Frequently Asked Questions (FAQs)

The global cross-border payments market is projected to reach roughly $320 trillion by 2032, growing at an estimated 7–8% CAGR over the period

Around 63% of blockchain-based cross-border payment providers cite uncertainty over which jurisdiction’s laws apply in disputes as a primary legal challenge.

Data sovereignty or localization rules in 50+ countries affect approximately 62% of cross-border blockchain transaction flows and related projects.

GDPR and similar data protection regimes impact more than 500 cross-border blockchain projects that process personal data.

Conclusion

Cross-border blockchain transactions are transforming the global payment landscape, offering unparalleled efficiency, speed, and cost savings. Yet, these advancements bring new legal complexities, compliance hurdles, and consumer protection challenges. As blockchain adoption accelerates, organizations must stay ahead by understanding evolving regulatory frameworks, embracing innovative technologies, and ensuring security and transparency in their operations. The future of cross-border payments lies in building trust through compliance, consumer-centric services, and technological resilience.