The Cosmos ecosystem, centered on the native token ATOM, has rapidly evolved into one of the most significant interoperable blockchain networks in the crypto space. Its interchain vision enables distinct blockchains to exchange data and assets seamlessly, fostering a growing universe of decentralized applications and services.

From decentralized finance (DeFi) protocols leveraging cross-chain liquidity to enterprise-level SDK deployments in banking and payments, Cosmos is influencing how distributed systems interconnect and scale. This article unpacks key statistics shaping Cosmos’s performance and adoption today, and provides data-backed insights into price, activity, staking, and network fundamentals. Continue exploring to understand how Cosmos stacks up in the broader crypto universe.

Editor’s Choice

- Live ATOM price trades around ~$2.20–$2.40 in early 2026, reflecting recent market trends.

- ATOM’s market cap sits near ~$1.1 billion–$1.2 billion, placing it among the top ~90 ranked cryptocurrencies.

- The Cosmos network has 200+ chains built with the Cosmos SDK, showing broad ecosystem adoption.

- Staking ratio is ~60%, meaning a majority of ATOM supply is bonded for security and yields.

- Annual staking yields average around ~14–16% on major platforms.

- Cosmos Labs is redesigning ATOM tokenomics to better capture value from SDK adoption.

- IBC infrastructure connects ~200 public networks as of January 2026, enabling large-scale cross-chain asset and data flows.

Recent Developments

- Cosmos Labs updated the roadmap for 2026, focusing on performance improvements and enterprise features.

- Work on IBC v2 light clients aims to improve cross-chain connectivity, including bridging with Solana and EVM networks.

- The team is improving TPS (throughput) and latency metrics to support enterprise-level usage.

- Cosmos Labs is pursuing native Proof of Authority (PoA) and privacy modules for performance and compliance.

- Governance discussions are underway on redesigning ATOM tokenomics to link value capture with SDK usage.

- Recent upgrades (v25.3.0) improved validator coordination and network stability.

- Community debates highlight tokenomics and inflation reforms to stabilize long-term demand.

- Expansion efforts target interoperability with Solana and Base, enhancing cross-chain integration.

ATOM Price and Market Performance

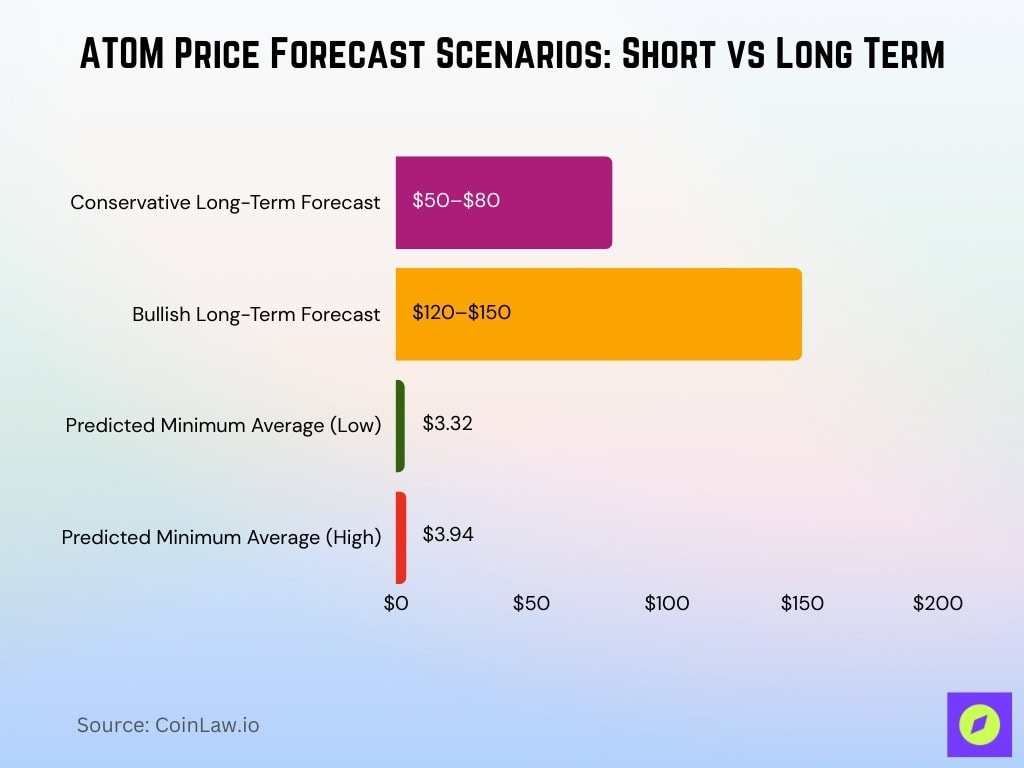

- Analysts forecast varied price scenarios, conservative forecasts of $50–$80, and bullish up to $120–$150 long term.

- Predicted 2026 minimum average could center around $3.32–$3.94 in alternative models.

- ATOM trades around $2.2–$2.4 in 2026 (early January).

- Market cap remains near $1.1 billion, reflecting stable capitalization.

- 24h trading volume often exceeds $30 million–$50 million, showing liquidity across exchanges.

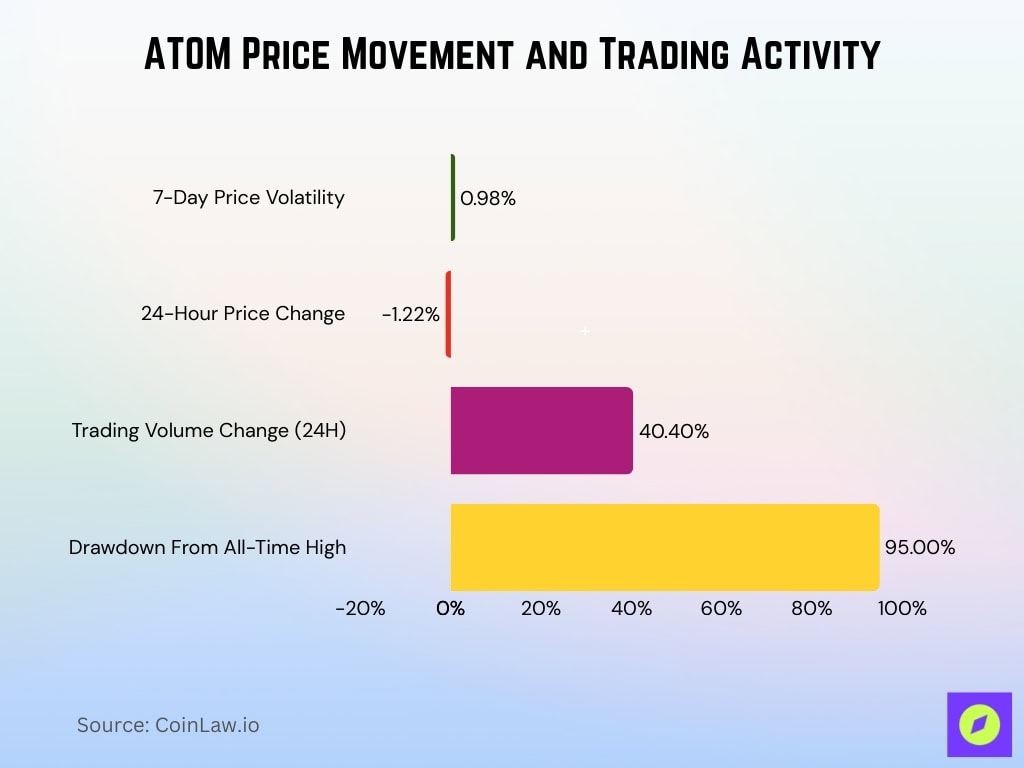

- Price performance has shown volatility and mixed directional trends over recent weeks.

- All-time peak remains far above current price, with significant drawdown from historical highs.

Overview Statistics

- Live ATOM price in January 2026 hovers around $2.2–$2.4.

- 24h trading volume exceeds ~$30 million–$50 million across major exchanges.

- ATOM’s market cap is ~$1.1 billion in early 2026.

- Circulating supply is approximately 489 million ATOM tokens.

- All-time high price (2021): ~$44.45, reflecting deep drawdowns to current levels.

- Price is roughly -95% below the all-time high from the first crypto boom.

- Market rank ~#90 among global cryptocurrencies by capitalization.

- 7-day and 30-day price action shows volatile moves and trend shifts typical of crypto markets.

Hub and Ecosystem Key Facts

- The Cosmos Hub remains the central settlement layer for the broader interchain ecosystem.

- Cosmos SDK powers over 200 production blockchains, from DeFi to enterprise applications.

- IBC infrastructure connects ~200 chains, enabling cross-chain asset and data flows.

- Enterprise usage includes initiatives in payments and consortium networks.

- Cosmos aims to handle ~5,000 TPS with finalized performance upgrades.

- Near-zero transaction fees (~<$0.001) support cost-efficient cross-chain operations.

- Cosmos EVM compatibility brings Ethereum app access to the interchain.

- Connectivity builds on Skip:Go and CometBFT, enhancing blockchain interoperability and security.

ATOM Supply, Emissions, and Inflation

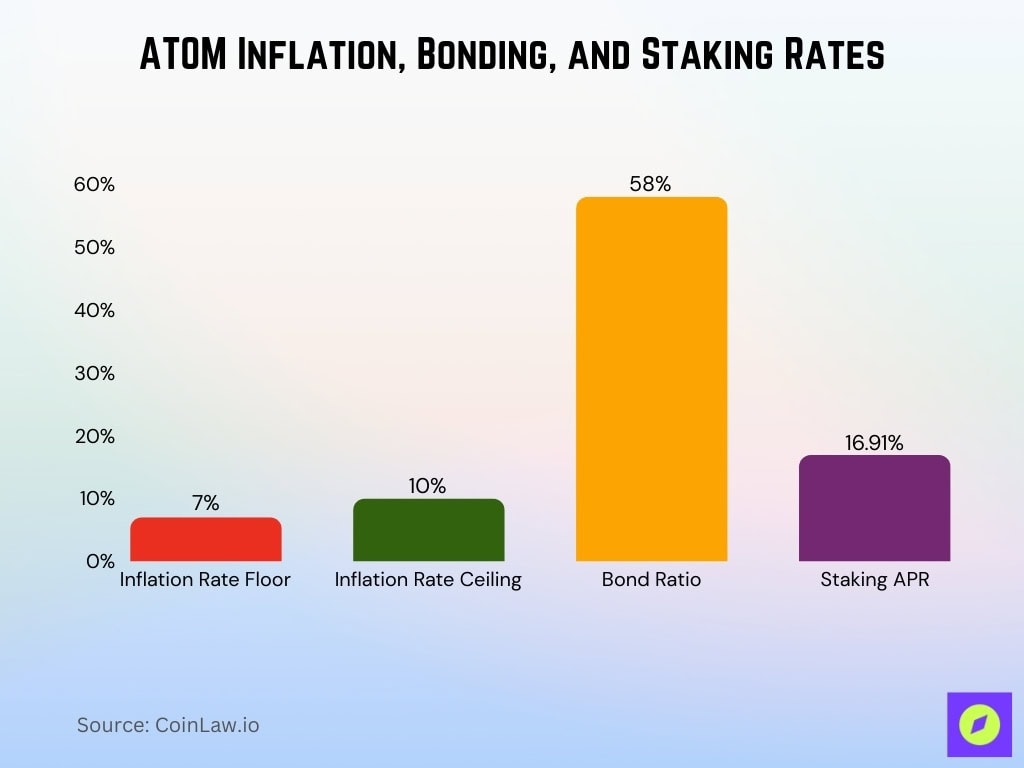

- Inflation rate ranges from a floor of 7% to a ceiling of 10% annually.

- Bond ratio holds at 58%, with 279.72 million ATOM staked.

- Staking APR currently offers 16.91% rewards.

- Circulating supply stands at ~489 million ATOM tokens.

- Maximum supply remains uncapped with dynamic inflation mechanisms.

- Annual inflation is influenced by staking ratio targeting optimal participation.

- Validator rewards adapt based on network security and consensus participation.

Network Activity and Usage

- CometBFT consensus targets 5,000+ TPS in 2026 upgrades.

- Each Cosmos chain is capable of up to 10,000 TPS throughput.

- Current TPS averages 10-15 transactions per second.

- Recent weekly IBC transfers exceed 179,000 cross-chain txns.

- IBC moves over $1 billion monthly in cross-chain volume.

- Daily volumes are around $62 million in ecosystem activity.

- Nearly 50 Cosmos SDK chains enable parallel processing.

Transactions and Throughput

- Total transactions have reached 87.16 million since inception.

- Roadmap targets 5,000 TPS sustained in production.

- BlockSTM boosts throughput to 400 TPS in tests.

- CometBFT supports 10,000 TPS under optimal conditions.

- Daily active addresses hit 16 thousand.

- Peak throughput during IBC events exceeds hundreds of TPS.

- Network processes 87 million transactions overall.

- Low-latency blocks enable 500ms block times.

Trading Volume and Volatility

- 7-day price volatility stands at 0.98%.

- Price fluctuated down 1.22% in the last 24 hours.

- Trading volume increased 40.40% from the previous day.

- Drawdown from all-time high near 95%.

- 24-hour trading volume reaches $92.87 million.

- The recent 24-hour volume reported at $35.54 million.

- Recent daily close at $2.27 with volume 40.74 million.

- Price ranges $2.30–$2.38 amid market activity.

- 24-hour low hit $2.30 during the session.

Fees and Cost Efficiency

- The average transaction fee is $0.0125.

- Fees are typically under $0.001 per transaction.

- 24-hour fees generated $212 network-wide.

- Daily fee revenue averages around $4 for the hub.

- Q3 2023 revenue totaled $145,343 from fees.

- Neutron chain fees share 25% to ATOM stakers.

- Annual Hub fees generate $17 million.

- Transaction fees surged 45% QoQ in ATOM terms.

Validators and Decentralization

- 180 active validators secure the Cosmos Hub.

- 100 validators participate in the consensus set.

- Nakamoto coefficient measures 6 for stake distribution.

- The largest validator controls over 17% of staked ATOM.

- 200 out of 605 validators are currently active.

- Active validators’ uptime averages 96.97%.

- Staking participation reaches 58% bond ratio.

- 279.72 million ATOM delegated to validators.

- BFT consensus requires a 2/3 validator majority.

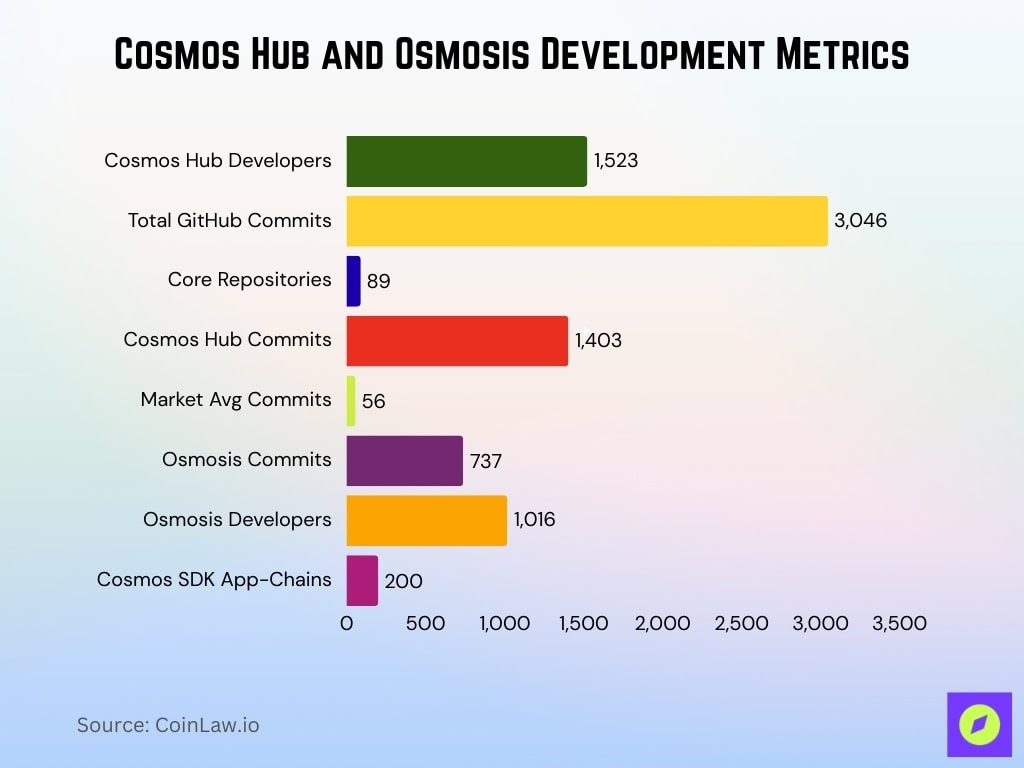

Developer Activity and Ecosystem Growth

- 1,523 developers contributed to Cosmos Hub over the past year.

- 3,046 GitHub commits across 89 core repositories.

- 1,403 commits in the past year vs the market average of 56.

- 737 commits past year for the Osmosis ecosystem.

- 1,016 developers active on Osmosis past year.

- Over 200 app-chains built using Cosmos SDK.

- 89 core repos track vibrant development activity.

Staking Participation and Yields

- 274.04 million ATOM staked, up 15.7% H1 2025.

- Staking APR is stable at 16.34%.

- 58% bond ratio with 279.72 million ATOM delegated.

- Staking APR reaches 16.91% currently.

- Staking rewards up to 21% APY via platforms.

- 228.7 million ATOM staked at 58.50% ratio.

- 11 million ATOM redelegated by 41,640 addresses.

- Liquid staking LSTs redeem at 1.33 ATOM per stATOM.

- 180 validators support the staking ecosystem.

Governance and Voting Activity

- Minimum deposit requires 250 ATOM for proposals.

- Voting period fixed at 14 days duration.

- Quorum threshold set at 40% participating power.

- Pass threshold demands 50% yes votes.

- Veto threshold activates at 33.40% NoWithVeto.

- Recent proposal turnout reached 50.79%.

- 86.37% yes votes in the latest governance poll.

- 75.99% participation in ATOM 2.0 vote.

- Proposals due by January 15 for tokenomics research.

Interoperability and IBC Traffic

- IBC connects 200 public networks.

- Over 85 active blockchain zones integrated.

- Monthly IBC transfer volume exceeds $1 billion.

- $4 billion total transfer value over the last 30 days.

- 110 chains linked via the IBC protocol.

- Ethereum added to IBC in 2025.

- Solana light clients productionizing in 2026.

- 2.1 million monthly active users on IBC.

- IBC v2 launches end of March 2025.

DeFi TVL and Protocol Usage

- Osmosis DEX TVL totals $43.11 million.

- Neutron TVL stands at $71 million.

- Noble handled $22 billion in transactions.

- Cosmos ecosystem DeFi TVL contributes to $16.6 billion RWA.

- Osmosis 24-hour fees generate $15,610.

- Osmosis’s 30-day fees reach $433,950.

- Annualized Osmosis fees project $5.29 million.

- 30+ Cosmos chains rely on Noble USDC.

Security and Network Reliability

- Active validators’ uptime averages 95.97%.

- BFT consensus tolerates up to 33% faulty nodes.

- Gaia v25.2.0 upgrade patches medium-severity issues.

- AI tool identified a high-severity vulnerability that was fixed promptly.

- Network targets 5,000 TPS with DDoS resilience.

- Missed block penalties trigger after a 9-hour threshold.

- 18-21% APR incentivizes validator uptime.

- Zero exploits on the core IBC layer over the years.

- Roadmap emphasizes fault tolerance enhancements.

Cosmos vs Competing Networks Statistics

- Cosmos IBC connects 200 chains vs LayerZero 70+.

- Ethereum DeFi TVL $100 billion+ dwarfs Cosmos $500 million.

- Solana DeFi TVL $9.23 billion edges L2 basket $9.05 billion.

- Solana Nakamoto coefficient leads Cosmos 6.

- Solana TPS 980 vs Cosmos 15 average.

- Cosmos sovereignty tops Ethereum’s monolithic design.

- IBC trustless vs Wormhole less-minimized trust.

Frequently Asked Questions (FAQs)

Cosmos (ATOM) has a market cap of approximately $1.09 billion to $1.14 billion in early 2026 based on live exchange data.

There are about 489 million ATOM tokens in circulation as of early 2026.

Recent 24‑hour trading volume for ATOM has been reported between roughly $35 million and $75 million+ on major exchanges.

The Inter‑Blockchain Communication protocol (IBC) links over 100 blockchains in the Cosmos ecosystem.

Conclusion

The Cosmos ecosystem’s growth remains visible across governance, interoperability, developer engagement, and security metrics. IBC continues to underpin cross‑chain flows, while governance participation and developer activity reflect a committed community shaping long‑term evolution. As DeFi TVL trends and shared security models mature, Cosmos’s statistics reflect a network balancing innovation with real‑world adoption challenges. Exploring these data trends reveals both strengths and areas for ecosystem refinement as Cosmos positions itself amid broader interoperability competition.