Corporate bond defaults shape risk pricing, investor confidence, and credit markets globally. Default rates are shifting in response to economic pressures like higher interest rates and credit conditions tightening, making the performance of corporate bonds a key focus for institutional and retail investors alike. From risk models that gauge issuer distress to regional default patterns that signal broader credit stress, these figures affect decisions in banking, asset management, and risk governance.

Across the technology, energy, and industrial sectors, corporations with weak balance sheets are more exposed to default triggers, while robust issuers continue to refinance at favorable rates. Explore how default data is measured and what it means for markets in the full analysis below.

Editor’s Choice

- The U.S. speculative‑grade corporate default rate for 2025 is forecast to be around 2.8%–3.4%, suggesting elevated risk compared with long‑term averages.

- Global corporate defaults numbered 145 in 2024, slightly down from 153 in 2023, but still elevated.

- S&P reports speculative‑grade default rates above 4% in late 2025, continuing stress in lower ratings.

- Fitch projects 2025 bond default forecasts at 4.0%–4.5% for U.S. corporate bonds.

- Emerging market high‑yield defaults are expected to be near 2.4% in 2025, indicating moderate stress outside developed markets.

- Moody’s data suggests a potential decline in speculative‑grade defaults toward ~2.5% over the next year.

- Regional analyses foresee global default rates steady near 3.7% through 2026.

Recent Developments

- U.S. private credit defaults rose to 5.5% in Q2 2025, up from 4.5% in Q1, reflecting stress in privately placed corporate debt.

- Credit default swaps for large issuers, such as Oracle, surged to multi‑year highs, with five‑year CDS near 139 bps, signaling increased perceived default risk.

- Default‑related spreads in speculative credit markets widened with economic uncertainty tied to tariff policy and slower growth forecasts.

- Middle‑market corporate debt issuance in the U.S. fell 16% year‑over‑year in Q2 2025, limiting refinancing options for at‑risk firms.

- Default signal metrics like payment‑in‑kind financing increased, hinting at stress even without outright defaults.

- Market indicators show risk aversion rising in lower‑quality credit segments, especially CCC‑rated bonds.

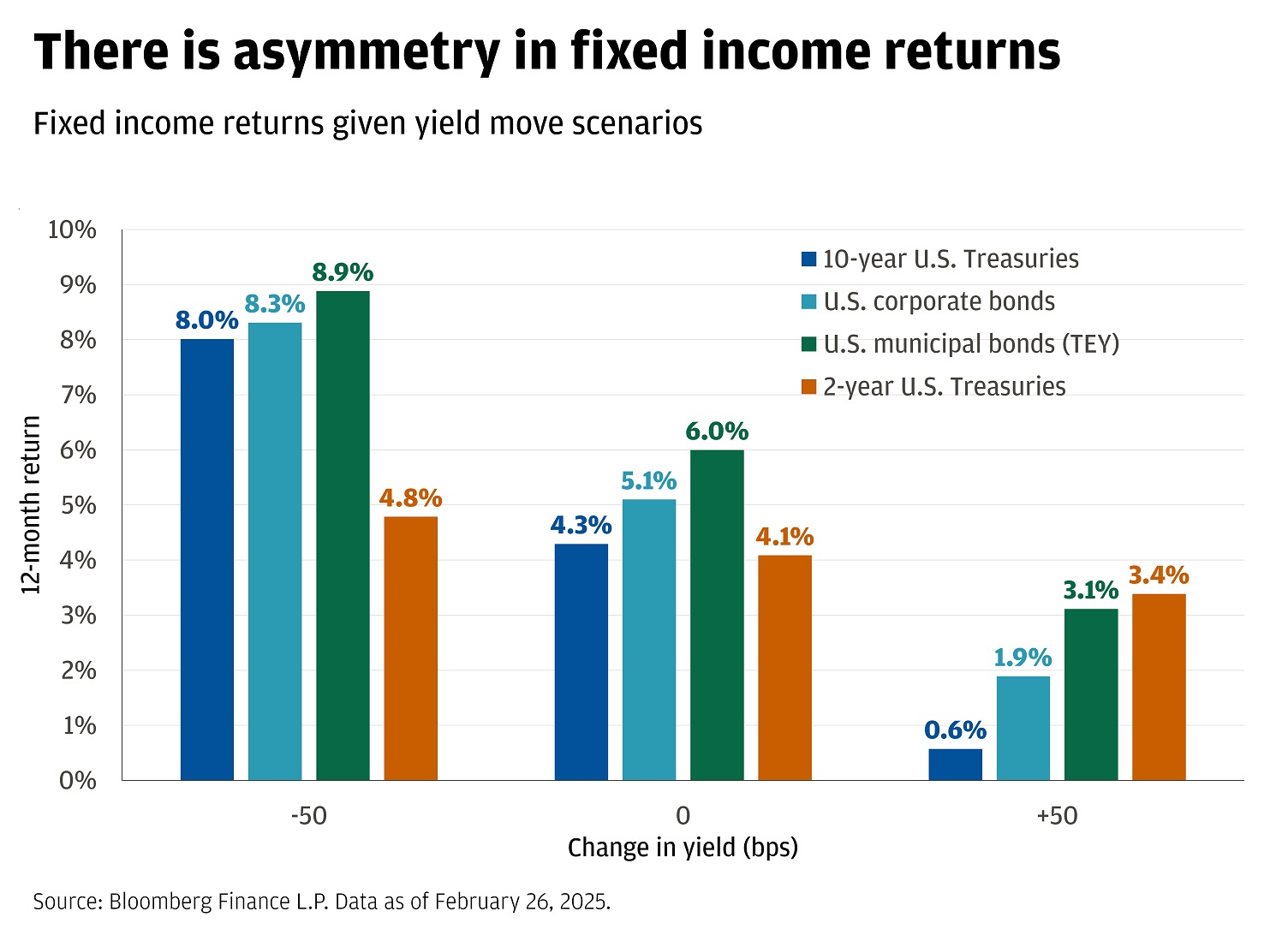

Asymmetry in Fixed Income Returns by Yield Movement

- When yields fall by 50 bps, U.S. municipal bonds (TEY) deliver the highest return at 8.9%, followed by U.S. corporate bonds (8.3%) and 10-year Treasuries (8.0%).

- 2-year U.S. Treasuries under the same scenario offer a lower upside, with a 4.8% return.

- At no change in yield (0 bps), returns moderate across the board: U.S. municipal bonds still lead with a 6.0% return, while corporate bonds earn 5.1%, and 10-year Treasuries return 4.3%.

- 2-year Treasuries continue to lag but stay resilient, returning 4.1% under stable yields.

- In a scenario where yields rise by 50 bps, returns decline sharply. 10-year Treasuries suffer the most with just a 0.6% return.

- U.S. corporate bonds return 1.9%, while municipal bonds (TEY) outperform at 3.1% despite rising yields.

- Interestingly, 2-year Treasuries show relative strength in a rising rate environment, posting a 3.4% return, outperforming longer-duration counterparts.

How Corporate Bond Defaults Are Measured

- Moody’s reports the global speculative-grade default rate at 4.5% end of March.

- S&P counts 19 corporate defaults in May, the highest since October 2020.

- Global trailing 12-month speculative-grade rate stands at 4.4% end of June.

- Cumulative default rate holds steady at 14.6% end of March.

- S&P notes 53-year-to-date corporate defaults through May.

- Moody’s forecasts the global speculative-grade rate falling to 3.1% year-end.

- U.S. speculative-grade default rate reaches 5.8% in March.

- S&P anticipates the U.S. speculative-grade rate declining to 4% by September 2026.

- UBS projects emerging market high yield defaults at 2.4%.

Historical Corporate Bond Default Rates

- U.S. high-yield defaults averaged 4.4% annually since 1983.

- Global corporate defaults total 153 in 2023 and 145 in 2024.

- Speculative-grade defaults hit 10.1% peak in 2001.

- Defaults spike to 13.7% in 2009, post-financial crisis.

- Investment-grade defaults average near 0% most years.

- U.S. speculative-grade rate reaches 5.13% in 2024.

- Global speculative-grade rate rises to 3.9% in 2024.

- Credit loss rates average 2.3% long-term for high yield.

- Overall corporate default rate averages 1.8% since 2000.

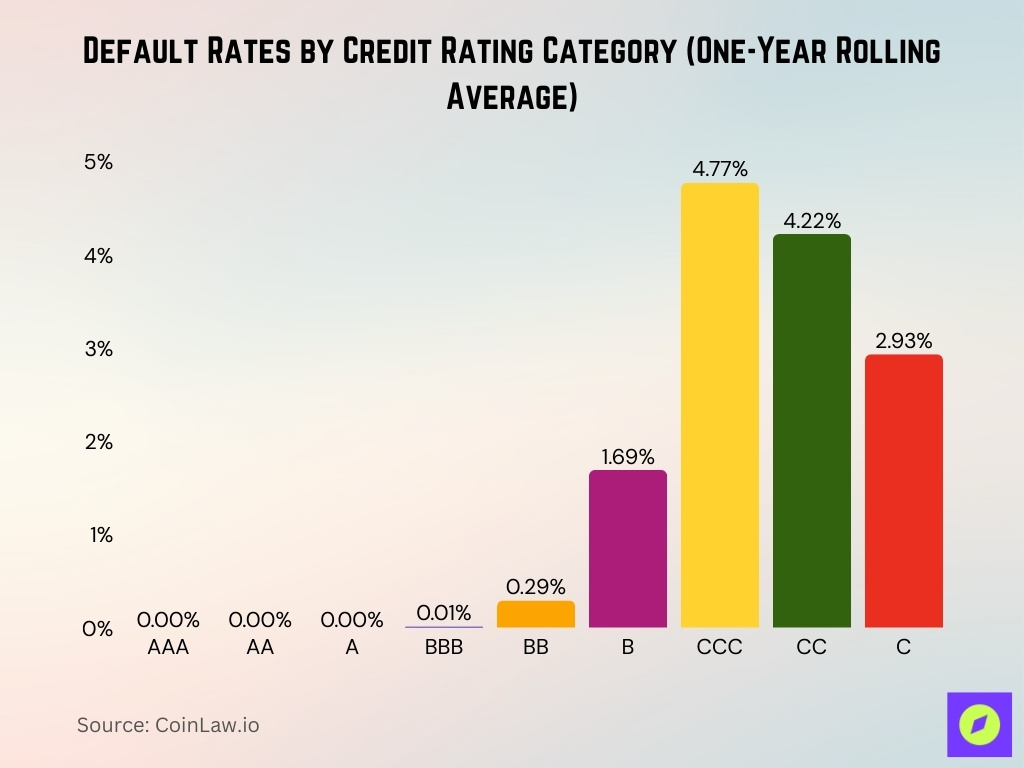

Default Rates by Credit Rating Category

- AAA ratings record a 0.00% one-year rolling average default rate.

- AA ratings maintain a 0.00% one-year rolling average default rate.

- A ratings show a 0.00% one-year rolling average default rate.

- BBB ratings exhibit a 0.01% one-year rolling average default rate.

- BB ratings display a 0.29% one-year rolling average default rate.

- B ratings register a 1.69% one-year rolling average default rate.

- CCC ratings demonstrate a 4.77% one-year rolling average default rate.

- CC ratings reflect a 4.22% one-year rolling average default rate.

- C ratings indicate a 2.93% one-year rolling average default rate.

Global Corporate Bond Default Rates by Region

- U.S. leads with 97 defaults in North America.

- Europe records 33 corporate defaults.

- Emerging markets register 12 defaults.

- Asia ex-Japan high yield hits 5.7% default rate.

- Emerging market high-yield expects 2.4% defaults.

- North America accounts for two-thirds of global defaults.

- Global speculative-grade rate stands at 4.4% end of June.

- U.S. trailing 12-month rate reaches 4.8% August.

- Asia-Pacific speculative-grade projects 2.25% by September.

Default Cycles and Clustering Events

- Corporate bond defaults clustered in speculative grades at a 4.25% trailing-12-month rate by September.

- Distressed exchanges accounted for 56% of all defaults through 2025.

- Distressed exchanges comprised 52% of speculative-grade defaults through August.

- Private equity-backed firms drove 80% of defaulted debt in Q2.

- 65% of Q1 leveraged loan and high-yield defaults were private equity-owned.

- US private credit default rate reached 5.5% in Q2 amid eight new defaults.

- Private credit default rate fell to 1.76% in Q2 from 2.42% in Q1.

- Global speculative-grade default rate stood at 4.5 at % end of March.

- Leveraged loan default rate hit 5.9% issuer-weighted through September.

- Recovery rates for defaulted bonds rose to 34.1% in June.

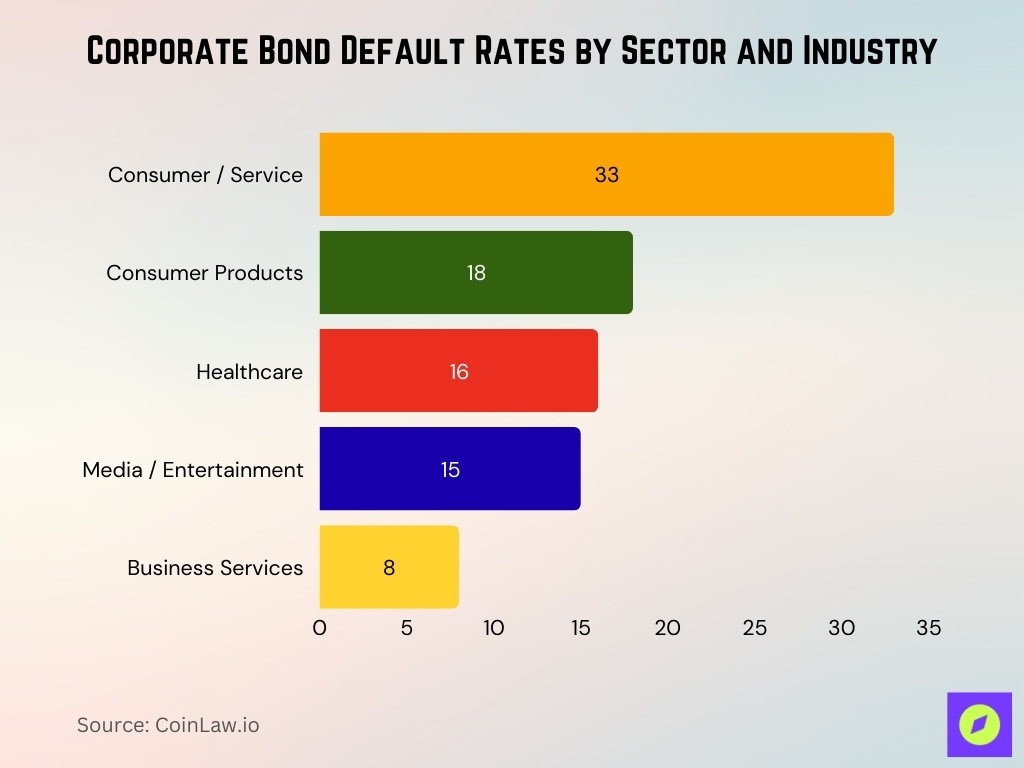

Corporate Bond Default Rates by Sector and Industry

- Consumer/service sector leads with 33 defaults.

- Consumer products record 18 defaults.

- The healthcare sector tallies 16 defaults.

- Media/entertainment registers 15 defaults.

- Business services expects 8 defaults.

Corporate Bond Defaults During Major Crises

- Speculative-grade bond default rate reached 5.1% in 2008 amid 101 issuers defaulting on $238.6 billion.

- 85 companies defaulted on $284 billion in debt through November 2008.

- Financial sector led defaults, with nearly 80% of non-financial volume in FIRE and banking.

- Speculative-grade default rate peaked below 15% in late 2020 before fiscal supports lowered it.

- Trailing-12-month speculative-grade default rate hit 4.8% through August amid energy and consumer stress.

- European debt crisis drove sovereign bond yields to 20% for Greece by 2012.

- 4.25% speculative-grade default rate prevailed by September in lower credit tiers.

- Distressed exchanges formed 52% of defaults through August in speculative grades.

Distressed Exchanges and Selective Defaults

- Distressed exchanges accounted for 56% of year-to-date defaults, the highest since 2008.

- Distressed exchanges comprised 52% of defaults through August in speculative grades.

- Distressed exchanges formed 45% of total defaults in the first seven months.

- 63% of 2024 defaults were distressed exchanges, setting an annual record.

- Distressed exchanges reached the highest level since 2009 with 45 events year-to-date.

- Distressed debt exchanges drove 95% of leveraged loan default volume.

- 35% of distressed exchanges led to repeat defaults within 48 months.

- Distressed exchanges made up 54% of defaults in the prior year.

- Repeat defaulters represented nearly one-third of the year-to-date total.

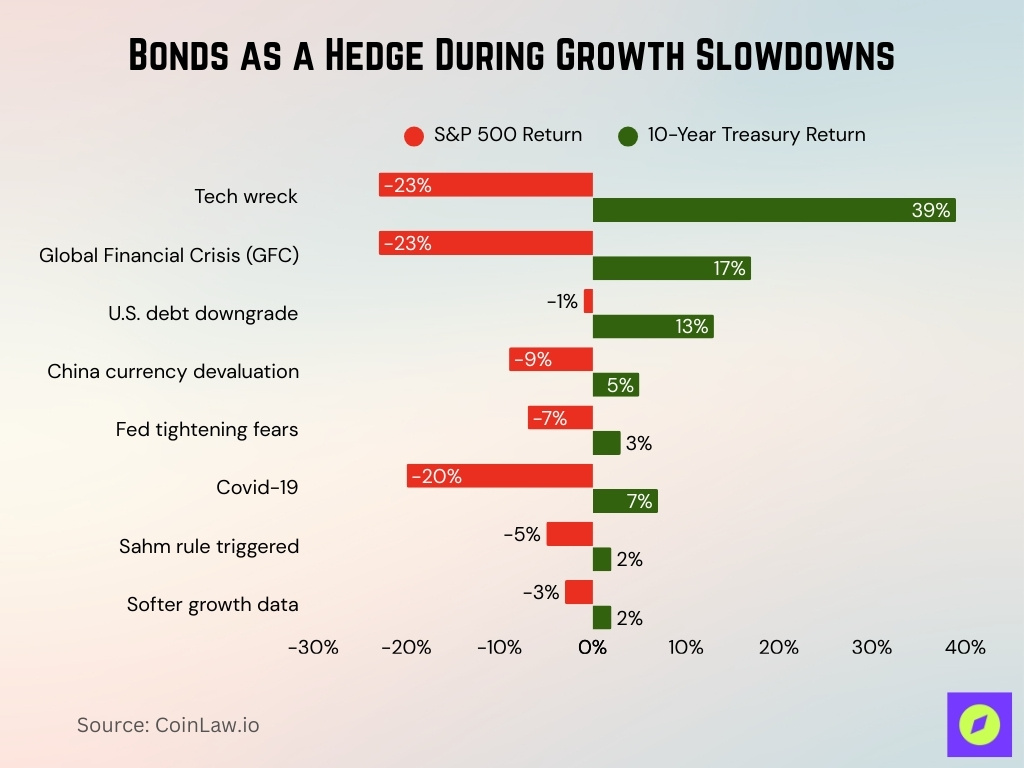

Bonds as a Hedge During Growth Slowdowns

- During the Tech Wreck, the S&P 500 fell by 23%, while 10-year Treasuries surged by 39%, highlighting a strong inverse correlation.

- In the Global Financial Crisis, equities dropped 23%, but Treasuries delivered a 17% positive return.

- Following the U.S. debt downgrade, the S&P 500 slipped just 1%, while Treasuries gained 13%.

- Amid the China currency devaluation, the market lost 9%, yet Treasuries rose by 5%.

- During Fed tightening fears, equities declined 7%, but 10-year Treasuries still returned 3%.

- In the Covid-19 market shock, stocks plunged 20%, while bonds climbed 7%, offering crucial downside protection.

- When the Sahm rule was triggered, signaling recession risks, the S&P 500 dipped 5%, and Treasuries edged up 2%.

- Even with softer growth data, bonds posted a 2% gain, while equities fell 3%.

Recovery Rates on Defaulted Corporate Bonds

- Overall recovery rate on defaulted bonds rose to 34.1% in June, up 2.3% from the prior month.

- Average bond recoveries reached 45.7% during the 2010-2025 period versus a 36.9% long-term average.

- Senior unsecured corporate bond recovery averaged 38% across recent defaults.

- Secured bond recovery rates ranged from 70%-100% depending on collateral quality.

- Senior unsecured bond recoveries typically spanned 40-70% in default scenarios.

- Subordinated bond recovery rates fell between 10-40% amid restructurings.

- Senior secured bonds achieved 56% recovery compared to 37% for unsecured bonds.

Recovery Rates by Seniority and Security

- Senior secured bonds averaged 58.1% recovery from 1987-2023 versus 44.8% for unsecured.

- First-lien term loans achieved 76% average and 96% median recovery across bankruptcies.

- Senior unsecured bonds recovered 38% average with 40-70% typical range.

- Subordinated bonds showed 10-40% recovery rates in default restructurings.

- Second-lien debt claims averaged 39% ultimate recovery versus 35% unsecured notes.

- Bank loans recovered 82% average, discounted versus 65% senior secured bonds.

- European first-lien secured debt is expected 58% recovery on €650 billion outstanding.

- Senior unsecured bonds hit 45.7% average recovery during the 2010-2025 period.

Loss Given Default and Credit Loss Statistics

- The high-yield portfolio showed an average 2.05% annual loss given default through June.

- Energy corporates exhibited 60% average LGD amid high default clustering.

- LGD Scorecard projected a 46.02% average loss across 6,500+ transactions.

- Statistical models estimated 44.48% LGD, matching the global 45% benchmark.

- Yield-to-worst method calculated 44% average LGD across market exposures.

- Downturn LGD calibration captured 65% family-level loss severity in stress.

- Senior unsecured bonds showed baseline LGDs of 55-60% across regions.

- Subordinated positions carried >100% LGD adjustment versus senior unsecured.

- Secured bond LGD adjustments averaged <100% reflecting collateral protection.

Corporate Bond Defaults vs Credit Spreads

- US high-yield spreads reached 2.88% on December 11 amid a 4.8% speculative-grade default rate.

- Investment-grade spreads tightened to 83 bps end-Q2 despite 5.9% leveraged loan defaults.

- High yield OAS averaged 2.91% December while trailing defaults held at 4.25%.

- Bloomberg IG corporate spreads ended Q1 at 94 bps with private credit defaults at 1.76%.

- US high-yield market yield hit 6.70% with spreads at 292 bps end-November.

- High-yield spreads traded at 2.69% over Treasuries despite 65% PE-backed Q1 defaults.

- ICE BofA HY index OAS stood at 280 bps in September, versus 4.5% global speculative defaults.

- IG credit spreads compressed to 88 bps year-end amid sustained 3.7% bond default rate.

Macroeconomic Drivers of Corporate Bond Defaults

- Elevated interest rates drove a 4.7% speculative-grade default rate amid refinancing pressures.

- Tariff announcements widened spreads 35 bps from April lows, halting high-yield issuance.

- Moody’s raised its global default forecast to 3.1% from 2.5% due to trade war escalation.

- Slower consumer spending and softening labor markets forecast to sustain 4.25% defaults.

- 30% recession probability projected alongside 4.8% US speculative-grade defaults.

- High 10-year yields exceeding nominal GDP growth increased debt service burdens.

- European defaults held at a 4.25% trailing rate despite high interest persistence.

- Policy uncertainty kept credit spreads tight at 88 bps IG amid 3.7% defaults.

- Trade turmoil slowed default decline, maintaining a 4.5% global speculative-grade rate.

Corporate Bond Downgrades, Fallen Angels, and Defaults

- $94 billion high-grade debt downgraded in Q2, exceeding $78 billion upgrades.

- Downgrades surged 28% in December with a trailing-three-month ratio above 50%.

- $50 billion BBB bonds identified as fallen angel candidates from $3.2 trillion universe.

- Potential fallen angels totaled 49 companies in the Q2 crossover zone of 76 issuers.

- Fallen angel volume hit a record low $6.7 billion from just 6 issuers prior year.

- Investment-grade downgrades rose 48% from November amid economic uncertainty.

- 54% three-month rolling downgrade ratio marked its first time above 50% since January.

- $387 billion BBB corporates are placed on a negative outlook by ratings agencies.

- High-yield upgrade-to-downgrade ratio stood at 1.22 amid BB/B credit dispersion.

Outlook and Forecasts for Corporate Bond Default Rates

- S&P expects the U.S. speculative-grade default rate to fall to 4% by September 2026 from 4.6%.

- Moody’s forecasts global speculative-grade defaults declining to 3.6% end-2025 then to 2.6% July 2026.

- High-yield bond defaults projected at 3.2% calendar 2025, rising above 4% Q1 2026.

- Leveraged loan defaults forecast to end year at 7.5%, peak 7.9% Q1 2026.

- BofA predicts private credit defaults easing to 4.5% in 2026 from 5% current.

- UBS sees private credit defaults rising up to 3 percentage points in 2026.

- Moody’s baseline speculative-grade defaults to 3.8% year-end with a 1.7-8.3% range through October 2026.

- Asia-Pacific speculative defaults forecast near 2.25% by late 2026, below global averages.

Frequently Asked Questions (FAQs)

U.S. corporate default risk reached approximately 9.2% in 2025, the highest since the financial crisis.

The speculative‑grade default rate stood at 4.8% as of August 2025, remaining elevated.

The issuer‑weighted leveraged loan default rate was about 5.9%, while the bond default rate was about 3.7%.

Oracle’s five‑year CDS reached about 139 basis points, its highest in at least five years.

Conclusion

Statistics today show corporate bond default risk remains a central consideration for investors and risk managers. Market indicators like credit spreads, LGD trends, and downgrade activity offer forward‑looking insight into credit health. Broader macroeconomic pressures, including interest rates, slowing growth, and elevated leverage, continue to influence default expectations. While defaults may moderate modestly with easier monetary policy, vulnerabilities in speculative credit and private markets persist. These statistics underscore the importance of monitoring credit conditions and risk drivers as part of comprehensive fixed‑income strategies.