Picture this: a financial institution moving gigabytes of data across systems with seamless efficiency, maintaining airtight security while delivering unparalleled customer service. This is no longer a vision of the future; cloud computing has made it a reality. The financial services industry is evolving rapidly, and cloud technology is at the forefront of this transformation. Banks, insurers, and fintech firms are harnessing the power of the cloud to streamline operations, enhance scalability, and unlock new revenue opportunities. Let’s dive into the numbers and trends shaping this shift.

Editor’s Choice

- An estimated 80–91% of financial institutions globally are adopting some form of cloud service in 2025, though adoption rates vary by region and institution size.

- By 2025, 60% of banks will have shifted at least 30% of their critical workloads to the cloud.

- 79% of insurance companies report that cloud adoption has enhanced disaster recovery in 2025.

- Hybrid cloud deployments surged, with 82% of financial firms using hybrid or multi-cloud to optimize costs and compliance.

- Fintech companies invested $3.2 billion globally in 2025 to develop cloud-native applications, up 18% year-over-year.

Cloud Service Models

- 89% of financial institutions leverage SaaS for CRM, payments, and data analytics in 2025.

- Adoption of Platform-as-a-Service (PaaS) grew by 48% in 2025, driven by demand for custom-built applications and APIs.

- Infrastructure-as-a-Service (IaaS) spending in finance hit $18.3 billion in 2025, supporting scalable data processing and storage.

- Private cloud models accounted for 44% of cloud deployments in 2025, with banks prioritizing security and compliance.

- Public cloud usage in financial services reached 58% in 2025 as cost efficiency remains a key driver.

- The market for Financial Cloud APIs grew by 20% year-over-year, enabling seamless integration across platforms and reaching about $30 billion in 2025.

- Serverless computing in finance grow 2.5 times by 2025, driving scalability and reducing infrastructure overheads.

Global Public Cloud Revenues

- The U.S. dominates the cloud market with a massive $466.0 billion in forecasted public cloud revenue for 2025.

- China secures the second position with $90.0 billion, showing strong regional cloud expansion.

- The UK is projected to generate $39.4 billion, reflecting steady enterprise cloud adoption.

- Germany follows closely with $40.5 billion, supported by its growing digital infrastructure.

- Japan records $19.9 billion, driven by continued investment in SaaS and enterprise cloud platforms.

- The Others category, combining all remaining countries, contributes a significant $255.0 billion, highlighting broad global uptake of cloud solutions.

- Revenue categories shown include SaaS, IaaS, and PaaS, with SaaS visually representing the largest share across most regions.

Lower Costs and Increased Efficiency

- Cloud adoption has led to IT cost savings in many institutions, with case studies showing reductions of 20–30%, though actual savings depend heavily on cloud strategy and operational scale.

- Firms leveraging the cloud report a 38% improvement in operational efficiency in 2025, especially in customer service and transaction processing.

- The cost of maintaining on-premise infrastructure has dropped by $2.4 billion annually for top-tier banks moving to cloud solutions in 2025.

- Automated updates and maintenance in cloud platforms save financial institutions an estimated 4,800 hours annually in 2025.

- Transaction times for cloud-enabled payment systems are 53% faster compared to legacy systems in 2025.

- Banks using cloud-native solutions for fraud detection have reduced losses by $1.7 billion globally in 2025.

Private and Public Cloud in Financial Services

- 44% of financial firms prioritize private cloud deployments for sensitive data in 2025, ensuring heightened control and compliance.

- The public cloud market share in financial services grew to 58% in 2025, fueled by cost-effectiveness and scalability.

- Hybrid cloud models dominate in 2025, with 82% of financial institutions leveraging them to balance security and operational flexibility.

- 36% of banks globally have adopted containerized applications in public cloud environments to improve scalability and portability in 2025.

- In the insurance sector, cloud penetration reached 83% in 2025, with public cloud accounting for 67% of this adoption.

- In 2025, cloud service providers handling financial data are projected to earn $28 billion, up from last year.

- Multi-cloud strategies are used by 82% of financial firms in 2025, enabling workload distribution across multiple public cloud platforms for enhanced reliability.

Embracing Cloud Solutions in the Banking Industry

- 68% of banks globally use cloud-native platforms for core banking operations in 2025, streamlining customer experiences.

- The adoption of cloud-based lending platforms has reduced loan processing times by 42% in 2025, benefiting both banks and borrowers.

- In 2025, 89% of new digital-only banks launched with a fully cloud-based infrastructure.

- 81% of global banks prioritize customer data analytics via cloud platforms to enhance personalization in 2025.

- Cloud technology enabled mobile banking services for an additional 380 million users in developing economies by 2025.

- Banking-as-a-Service (BaaS) on cloud platforms grew by 35% in 2025, allowing traditional banks to offer fintech solutions.

- 92% of bank executives report that cloud technology improved their ability to comply with rapidly changing regulations in 2025.

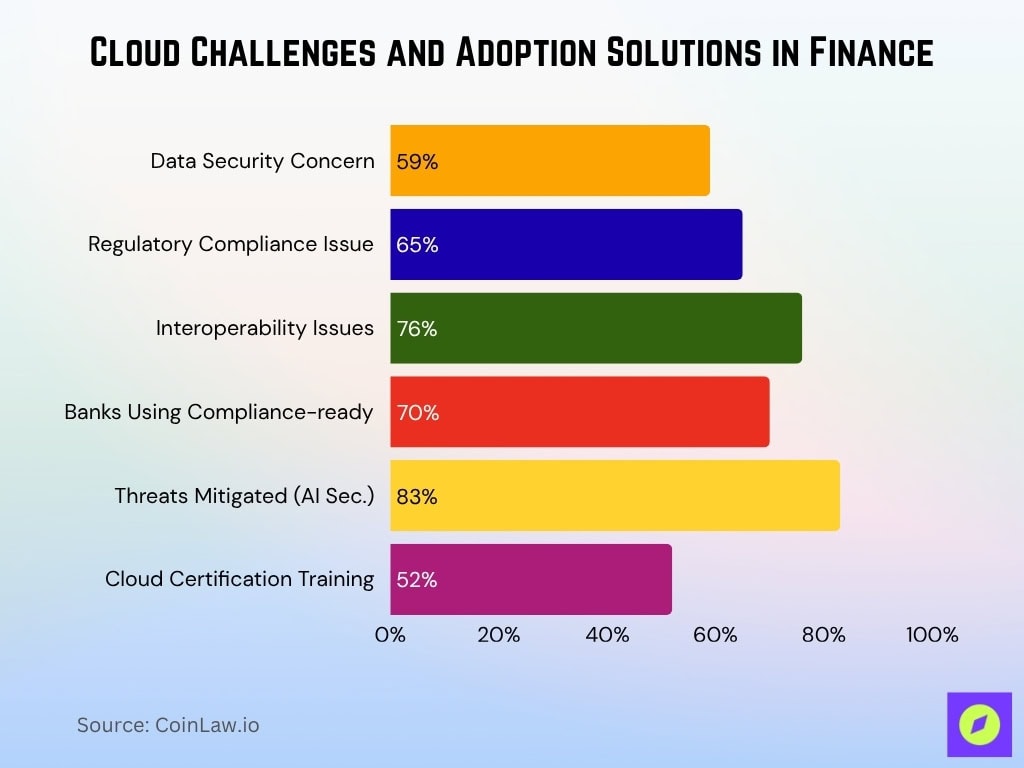

Challenges and Solutions in Cloud Computing

- 59% of financial firms identify data security as their top concern in adopting cloud technologies in 2025.

- Regulatory compliance poses challenges for 65% of institutions in 2025, requiring tailored compliance features in cloud platforms.

- Data breaches in cloud environments accounted for $4.5 billion in financial losses in 2025, highlighting the need for robust security protocols.

- Over 76% of financial firms cite interoperability issues when integrating legacy systems with cloud platforms in 2025.

- Cloud providers now offer compliance-ready architectures, reducing regulatory burdens for 70% of banks in 2025.

- AI-driven security solutions have helped mitigate 83% of potential threats in financial cloud environments in 2025.

- To address skill gaps, 52% of financial firms have invested in cloud certification training for their IT staff in 2025.

The Impact of Cloud Computing on Financial Services

- Cloud platforms powered real-time payment processing, cutting transaction times by 53% in 2025.

- 76% of financial institutions attribute improved cybersecurity frameworks to their transition to cloud infrastructures in 2025.

- Using AI-powered risk management tools, cloud-enabled banks reduced financial risk exposure by 27% in 2025.

- Cloud migration led to a 19% increase in revenue for banks leveraging advanced customer engagement tools in 2025.

- Cross-border banking services utilizing cloud solutions increased their market presence by 39% in 2025.

- Cloud computing helped streamline anti-money laundering (AML) compliance, saving financial institutions $2.5 billion annually in 2025.

Top Impacting Factors in Adoption

- Regulatory alignment tools offered by cloud service providers have been crucial for 77% of banks in 2025.

- Increasing customer demand for digital-first services drives 84% of banks to adopt cloud technology in 2025.

- Cloud adoption is expanding as 61% of financial firms focus on cost reductions in 2025.

- Green cloud computing initiatives are a priority, with 67% of financial institutions committed to reducing carbon footprints in 2025.

- Enhanced disaster recovery capabilities have encouraged 79% of insurance firms to adopt cloud-based backups in 2025.

- The rise of edge computing in finance, integrated with cloud platforms, is projected to grow by 22% annually in 2025.

- Cloud-native development practices are standard for 81% of fintech firms, ensuring rapid innovation cycles in 2025.

Top Benefits of Cloud Computing for Organizations

- Security is the top benefit, cited by 66% of CxOs and 65% of government leaders.

- Cost reduction remains a key driver, reported by 41% of CxOs and 42% in government.

- Scalability is valued by 41% of CxOs but only 34% of government respondents.

- Ease of management and use stands out sharply in the public sector, with 52% of government organizations highlighting it compared to 41% of CxOs.

- Speed improvements are recognized by 38% of CxOs and 39% of government teams.

Future Trends in Financial Services

- Blockchain-as-a-Service (BaaS) supported by cloud providers is expected to grow by 35% annually in 2025, driving secure transactions.

- By 2026, financial APIs hosted on cloud platforms will account for 66% of digital financial services integrations.

- AI-driven financial models on the cloud manage $2.4 trillion in assets in 2025, streamlining investments.

- Demand for multi-cloud solutions is rising, with 82% of banks exploring vendor-agnostic approaches in 2025.

- Cybersecurity spending on cloud platforms in financial services will surpass $8.1 billion annually by 2025.

Recent Developments

- AWS and Azure launched new compliance-driven financial services frameworks in 2025, addressing evolving regulatory and data residency requirements.

- Google Cloud’s financial services revenue grew by 32% in 2025, driven by widespread adoption among fintech startups.

- In 2025, IBM Cloud secured a $4.7 billion multi-year deal with a global bank for hybrid cloud solutions.

- Salesforce Financial Services Cloud introduced advanced AI-powered predictive analytics capabilities in 2025, enhancing customer insights.

- Alibaba Cloud expanded its footprint in Asia’s financial sector, achieving 41% YoY growth in adoption among regional banks in 2025.

- Snowflake launched industry-specific data-sharing solutions for insurance and banking clients in 2025, streamlining regulatory reporting.

- Global fintech funding for cloud-based platforms reached $4.2 billion in 2025, showing sustained investor confidence.

Frequently Asked Questions (FAQs)

80-91% of financial institutions use cloud services in 2025.

Public cloud solutions account for 58% of the finance cloud market in 2025.

Cybersecurity spending on cloud platforms in financial services will surpass $8.1 billion annually by 2025.

82% of financial firms leverage hybrid or multi-cloud strategies in 2025.

Conclusion

Cloud computing is redefining the financial services industry, offering unparalleled opportunities for scalability, innovation, and efficiency. The growing adoption of cloud-native solutions, AI-driven insights, and hybrid infrastructures marks a pivotal shift in how financial institutions operate. With challenges like security and compliance being addressed by cutting-edge cloud technologies, the path ahead is ripe for transformation. For financial firms, embracing the cloud isn’t just an option; it’s a necessity for staying competitive in a digital-first world.