Imagine a world where every financial transaction, whether a small coffee purchase or a multi-million-dollar business deal, could be completed in seconds, securely and transparently. This is not a distant dream, but the reality is being shaped by blockchain technology in financial services. Blockchain is no longer confined to cryptocurrencies; it is fundamentally transforming how financial institutions operate. The statistics reveal just how pivotal this technology has become for improving trust, efficiency, and scalability in the financial sector.

Editor’s Choice

- Around 80% of financial institutions were exploring blockchain technologies, with expectations of broader adoption by 2025, depending on regulatory and technical developments.

- JPMorgan Chase processed hundreds of billions in blockchain transactions and launched the JPMD deposit token via Coinbase’s Base platform in 2025.

- 60% of central banks worldwide accelerated CBDC efforts, 11 countries fully launched, and 49 are in pilots as of 2025.

- Blockchain-based KYC solutions have reduced onboarding times to under 10 minutes for best-in-class exchanges, with compliance rates above 80% in leading markets

- Financial data breaches dropped by 43% at institutions using blockchain for data encryption and storage in 2025.

Advantages of Blockchain Networks

- 82% of financial executives in 2025 are confident that blockchain transparency improves fraud detection.

- Financial institutions save $27 billion annually by integrating blockchain into payment and settlement.

- Blockchain-based financial services support inclusion for 1.4 billion unbanked adults globally as of 2022, helping bridge the financial inclusion gap.

- Smart contracts eliminate intermediaries, enabling up to 50% savings on legal and operational costs for institutions in 2025.

- Financial institutions report a 62% improvement in scalability during high-demand periods using blockchain in 2025.

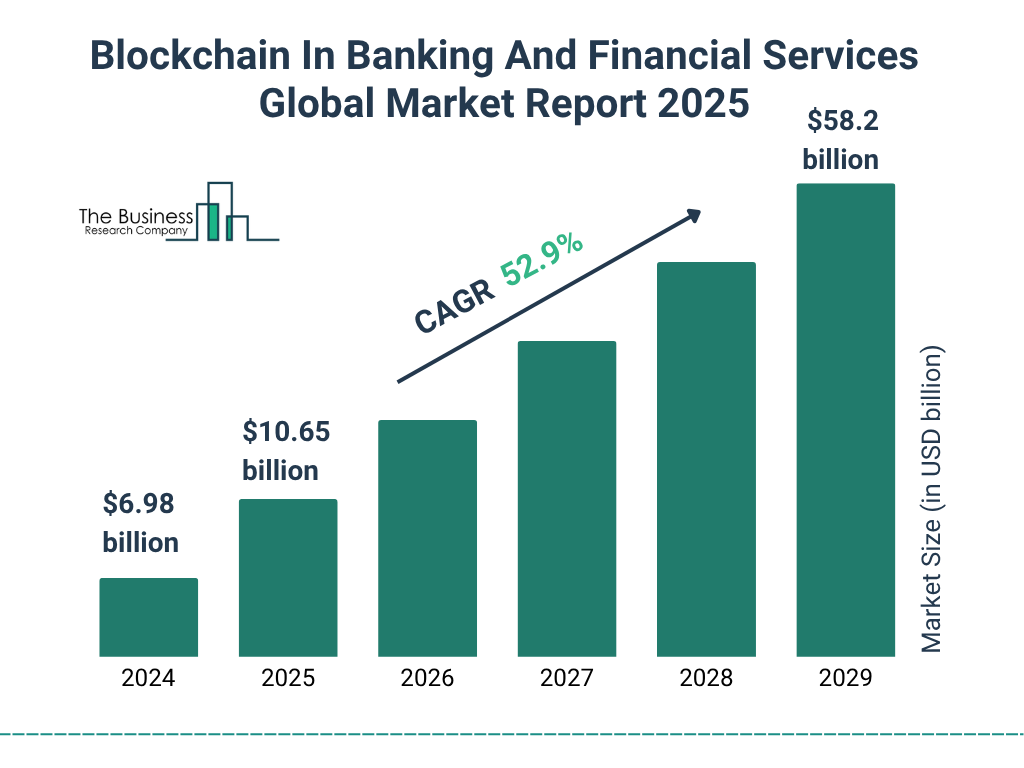

Blockchain in Banking and Financial Services Market Growth

- The global blockchain in banking and financial services market is projected to grow at an impressive CAGR of 52.9% from 2024 to 2029.

- Market value is expected to increase from $6.98 billion in 2024 to $58.2 billion by 2029, highlighting massive sector expansion.

- In 2025, the market is forecasted to reach $10.65 billion, reflecting growing adoption of blockchain for payments, settlements, and digital identity verification.

- By 2026, the market could exceed $16 billion, driven by rising use in cross-border transactions and decentralized finance (DeFi).

- 2027–2028 will mark a rapid acceleration phase, with market size estimated to surpass $37 billion as financial institutions scale blockchain integration.

- The sharp growth underscores blockchain’s increasing role in security, transparency, and cost efficiency across global financial systems.

Preparing for the Stablecoin-First Future

- Stablecoin transaction volume reached $4 trillion from Jan-Jul 2025, up 83% year-on-year, with annualized estimates near $8 trillion for 2025.

- Adoption of stablecoins in cross-border payments has reduced transaction costs by up to 96%, with fees dropping to as low as 0.5%.

- Over 75% of US-based banks are exploring or piloting stablecoin integration for remittances and settlements as of 2025.

- The USD Coin (USDC) had a circulating supply of about 32.4 billion in Q1 2025, making it a leading stablecoin in financial ecosystems.

- Blockchain-based stablecoins account for 30% of all cryptocurrency transaction volumes in 2025, up from previous years.

- Central banks in over 16 countries are piloting stablecoin regulatory frameworks, including the US, China, UK, and Japan.

- The average settlement time for stablecoin payments is now under 10 minutes in 2025, drastically faster than traditional banking.

Streamlining Payment Systems

- Blockchain payment networks have reduced cross-border transfer costs by 30–40% on average, with some solutions achieving fees below 1%.

- RippleNet processed over $3 trillion in annual transactions across more than 80 countries in 2025.

- Blockchain use in payment reconciliation cut error rates by over 90% in 2025, boosting efficiency and satisfaction.

- Real-time gross settlement systems leveraging blockchain processed over $3 trillion in 2025.

- Contactless payments powered by blockchain grew by 33% year-over-year in 2025, driven by secure, fast payment adoption.

- 84% of fintech companies globally included blockchain as part of their payment infrastructure in 2025.

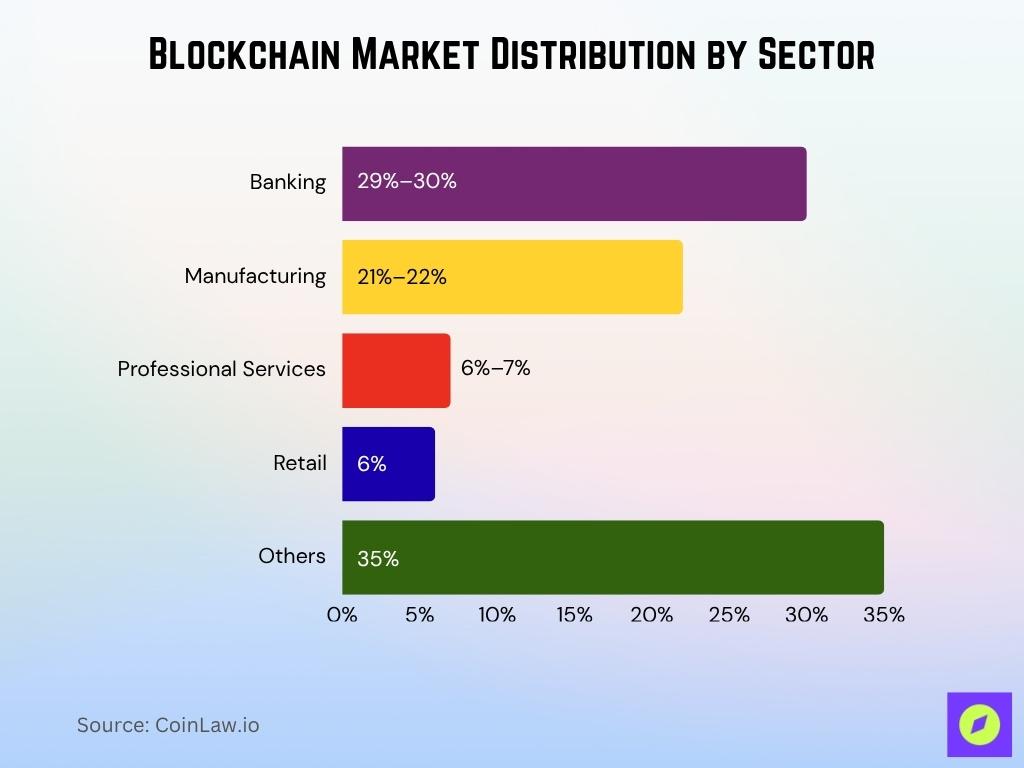

Blockchain Market Distribution by Sector

- Banking holds the largest share at 29–30%, driven by blockchain’s adoption in cross-border payments, trade finance, and digital identity solutions.

- Manufacturing accounts for 21–22%, as blockchain is increasingly used for supply chain transparency, inventory tracking, and smart contract automation.

- Professional Services represent 6–7%, reflecting the use of blockchain in auditing, compliance, and legal document verification.

- Retail captures 6%, boosted by applications in loyalty programs, product authentication, and customer data security.

- Others make up 35%, spanning diverse industries such as energy, healthcare, and logistics, where blockchain supports secure data exchange and process efficiency.

Enhancing Trade Finance

- Blockchain adoption in trade finance processed over $1.7 trillion in volumes in 2025, up significantly from 2023.

- Major trade finance consortia, including Marco Polo and We.Trade, saw membership growth exceed 45% in 2025.

- Smart contracts in trade finance reduced processing times by over 40%, delivering quicker liquidity access for businesses in 2025.

- Eliminating paper processes via blockchain saved trade companies more than $3 billion in administrative costs in 2025.

- Blockchain-enabled trade finance increased SME access to funding by 32% versus traditional systems in 2025.

- Blockchain-powered Letter of Credit (LoC) systems now account for 21% of global LoC transactions in 2025, sharply reducing fraud risks.

- 89% of surveyed financial institutions reported improved transparency and trust in trade finance using blockchain in 2025.

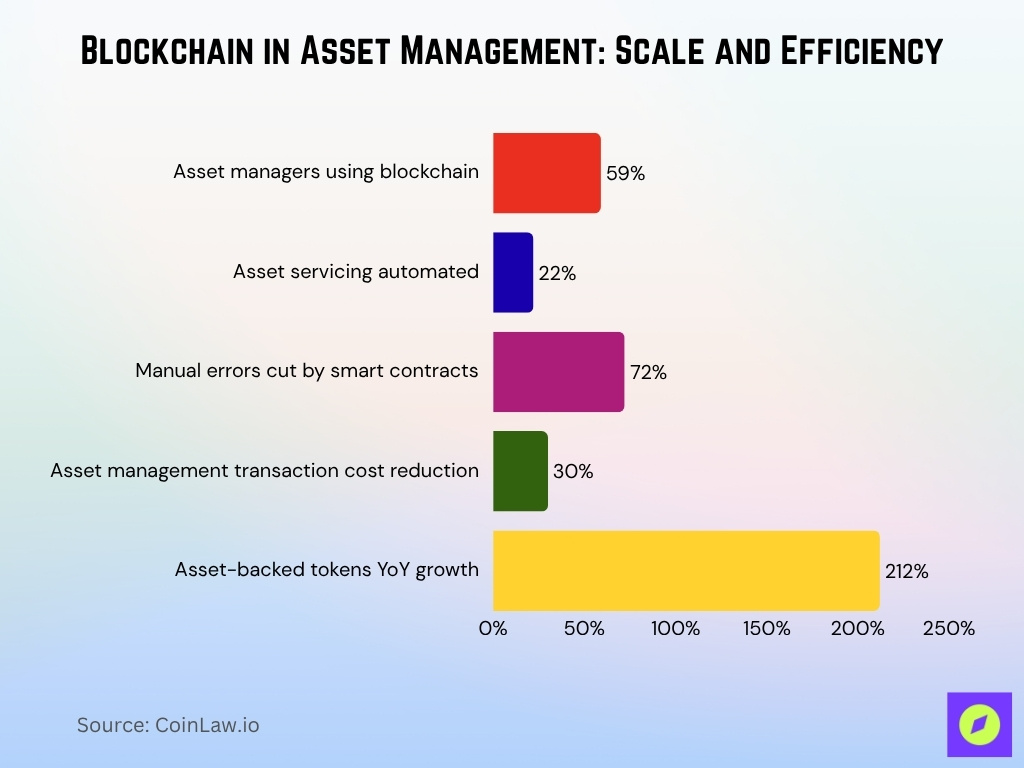

Transforming Asset Management

- 59% of global asset managers actively use blockchain for portfolio management in 2025.

- Smart contracts automated 22% of asset servicing processes, cutting manual errors by 72% in 2025.

- Blockchain adoption in asset management reduced transaction costs by up to 30%, widening investment access for smaller players.

- Asset-backed tokens increased by 212% year-over-year in 2025, with gold, real estate, and private credit as the leading categories.

- Blockchain-based tokenization platforms processed over $600 billion of real-world assets by 2025, covering real estate, art, and equities.

- BlackRock launched blockchain-integrated funds tied to a $150 billion Treasury trust in 2025, leading institutional adoption.

- Decentralized Autonomous Organizations (DAOs) now manage over $21.4 billion in assets globally as of 2025.

Revolutionizing Insurance

- Blockchain-enabled insurance platforms processed over $3.11 billion in claims in 2025, with the market projected to reach $12.7 billion.

- Smart contract automation cut insurance claim processing times by 50%, enabling settlements within hours instead of days and raising customer satisfaction.

- Fraudulent claims in blockchain-powered systems decreased by 25-33%, saving insurers up to $87 million annually.

- Blockchain-powered parametric insurance will automate real-time payouts, cutting manual processing and expediting disaster relief for climate claims in 2025.

- 62% of major insurance providers, including AXA and Allianz, adopted blockchain for underwriting and claim management in 2025.

- Blockchain-backed insurance reduced premium costs by up to 18%, broadening access for low-income consumers in 2025.

- Blockchain-based health insurance platforms covered over 30 million people globally in 2025, improving access to medical services.

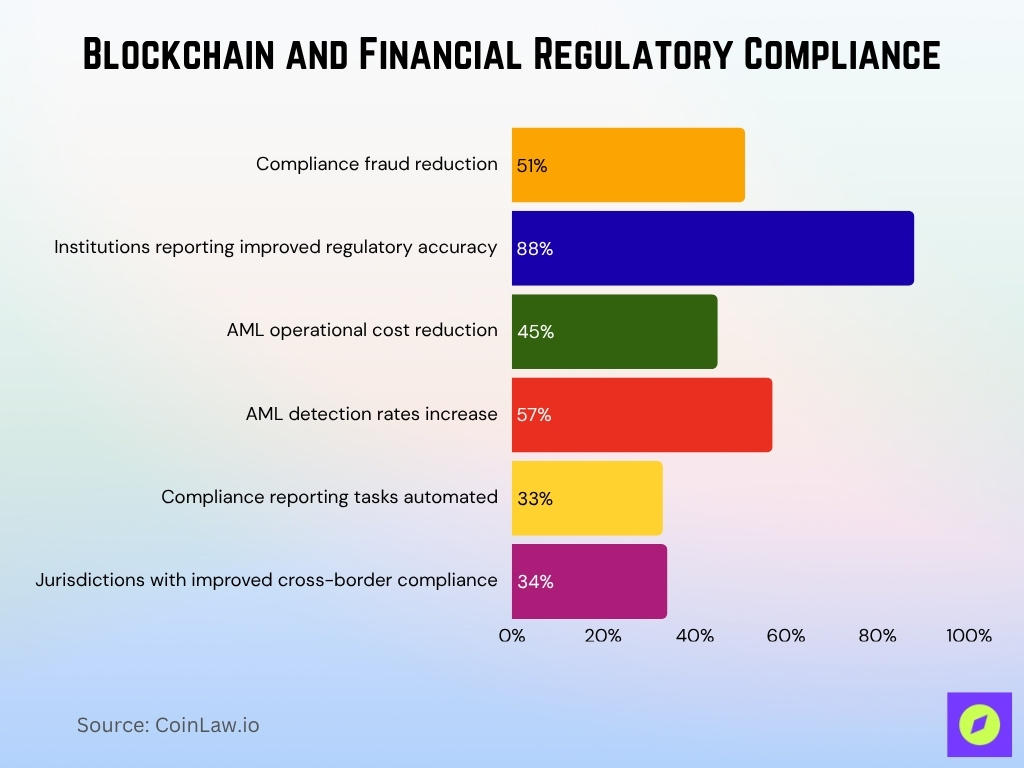

Modernizing Regulatory Compliance

- Blockchain’s immutable ledger reduced compliance-related fraud by 51% in 2025, strengthening trust in reporting.

- 88% of financial institutions leveraging blockchain reported improved regulatory accuracy in 2025.

- Blockchain streamlining of AML processes cut operational costs by up to 45% and boosted detection rates by 57%.

- Centralized blockchain solutions automated 33% of compliance reporting tasks, slashing human errors.

- Blockchain in cross-border compliance increased transparency, helping prevent tax evasion across 34% more jurisdictions in 2025.

- Automated KYC solutions powered by blockchain reduced onboarding times from 26 days to less than 5 minutes, saving over $175 million annually.

- RegTech companies using blockchain raised $7 billion in funding in 2025, up sharply from previous years.

Promoting Financial Inclusion

- Blockchain-based financial services reach over 2.7 billion underbanked individuals globally in 2025, a 40% increase since 2022.

- Peer-to-peer lending platforms on blockchain processed loans worth $176.5 billion in 2025, expanding low-cost credit access.

- In Sub-Saharan Africa, blockchain-powered mobile banking solutions increased financial access by 52% in 2025, driving local economies.

- 15% of global remittances, nearing $100 billion, were processed using blockchain in 2025, reducing fees by up to 70%.

- Blockchain-based digital identity solutions enabled over 470 million people to access financial services for the first time by 2025.

- Blockchain adoption in microinsurance schemes provided affordable coverage to over 135 million people in developing countries in 2025.

- Crowdfunding platforms leveraging blockchain are expected to raise over $20.46 billion in 2025, supporting entrepreneurship in underserved regions.

Recent Developments

- Ethereum’s Merge reduced energy consumption by over 99.98% by 2025, now using about 0.0026 TWh/year and achieving a near-zero carbon emissions footprint.

- Ripple’s Liquidity Hub expanded aggressively in 2025, enabling businesses to source digital asset liquidity and boosting cross-border payment efficiency.

- The EU’s MiCA framework was fully implemented in January 2025, harmonizing digital asset regulations across all member states.

- India’s blockchain-based e-rupee reached over 7 million pilot users in 2025, with the RBI focusing on programmable CBDC use cases.

- The Bank of International Settlements’ mBridge platform matured to a minimum viable product supporting real-value cross-border CBDC settlements in late 2024, with further expansion in 2025.

- Major fintech firms, including PayPal and Square, rolled out real-time AML screening, data encryption upgrades, and stablecoin integrations with blockchain analytics for enhanced transaction security in 2025.

- The blockchain-enabled carbon credit trading market is projected to reach over $354 million in 2025 and continue robust growth amid global ESG demand.

Frequently Asked Questions (FAQs)

83% of financial institutions globally are exploring or deploying blockchain solutions in 2025.

Blockchain-enabled gateways now account for 27% of cross-border payment volume, expected to reach 35% by 2025.

Blockchain-based cross-border payments are estimated to reach $3 trillion in 2025, growing at 45% annually.

Conclusion

Blockchain is no longer just a buzzword in financial services; it is a cornerstone of transformation. From streamlining payment systems to enhancing trade finance and revolutionizing regulatory compliance, blockchain has proven its value time and again. The statistics underscore blockchain’s growing influence, with more institutions embracing it to improve transparency, efficiency, and inclusivity. Whether it’s enabling stablecoins to thrive or making financial services accessible to billions, blockchain is redefining the global financial landscape, one transaction at a time.