Bitstamp, founded in 2011, stands as one of the longest‑running and most established cryptocurrency exchanges worldwide, providing a fiat gateway for digital asset trading across retail and institutional users. Its impact spans multiple industries: financial services firms use Bitstamp for deep liquidity access, while institutional trading desks leverage its regulatory‑compliant infrastructure for large‑scale execution. According to recent exchange data, Bitstamp continues to maintain significant global trading activity and product offerings that shape crypto market behavior today. Explore the core statistics below to understand its evolving footprint.

Editor’s Choice

- Bitstamp has operated continuously since 2011, making it among the oldest crypto exchanges globally.

- The platform supports 104 cryptocurrencies and 229 trading pairs as of early 2026.

- 24‑hour spot trading volume is around $174.4 million as of early 2026, with levels fluctuating alongside broader market conditions.

- Bitstamp holds 50+ active regulatory licenses worldwide.

- Robinhood’s acquisition valued Bitstamp at around $200 million in 2025.

- In Kaiko’s 2025 benchmarks, Bitstamp ranked top 3 globally among exchanges for performance and reliability.

- Forbes recognized Bitstamp with a 10/10 rating in transparency and audit strength.

Recent Developments

- Bitstamp 24h trading volume reaches $174 million, down 59.3% amid market volatility.

- Exchange supports 104 coins and 229 trading pairs, with BTC/USD leading at $57 million volume.

- Bitstamp secures CoinGecko 9/10 Trust Score for liquidity, security, and operations.

- Platform holds $3.77 billion in reserves, emphasizing robust custody post-Robinhood integration.

- Business score improves to 89 in recent benchmarks, ranking top 3 for institutions.

- WonderFi acquisition by Robinhood set for H1 close, adding C$2.1 billion assets under custody.

- Average bid-ask spread at 1.25% supports reliable pricing for professional traders.

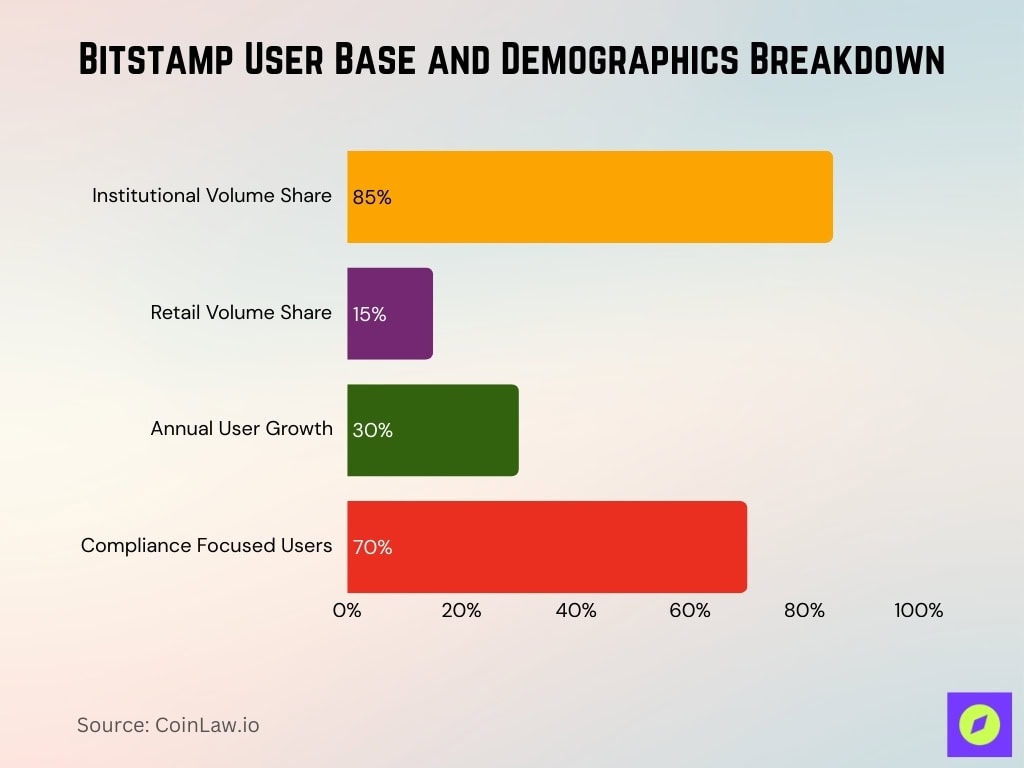

User Base and Demographics

- Serves 500,000+ funded users globally, majority of institutional volume.

- Institutional clients exceed 5,000 companies and professional traders.

- Retail users number in the tens of thousands across regulated markets.

- 85% trading volume from institutions, 15% retail in recent periods.

- Strongest footprint in Europe with North America and Asia expansion.

- User growth up 30% year-over-year amid bullish crypto cycles.

- API integrations support thousands of automated institutional executions daily.

- 70% users exhibit a high compliance focus per regional surveys.

Bitstamp Core Overview

- Headquartered at 40 Avenue Monterey, Luxembourg City, as a licensed Payment Institution.

- Supports 104 coins across 229 trading pairs, including BTC, ETH, and XRP.

- 24h spot trading volume at $174.4 million, down 59.3% from the prior day.

- Holds $3.77 billion in exchange reserves for asset security.

- CoinGecko Trust Score rated 9/10 for transparency and reliability.

- Forbes awards a perfect 10/10 in transparency and audit strength.

- CCData assigns consecutive AA ratings for security and operations.

- BTC/USD pair dominates with $57 million 24h volume.

- Ranks top 3 globally in Forbes’ trustworthy exchanges.

Ownership, Valuation, and Revenue

- Acquired by Robinhood Markets in June 2025 for $200 million all-cash deal.

- Generated $95 million net revenue in 12 months ending April 30, 2025.

- Serves 5,000 institutional clients with a predominantly institutional trading focus.

- Maintains 50+ active global licenses and registrations post-acquisition.

- Bitstamp generates around $100 million annualized revenue as a new business line.

- Served over 500,000 funded retail customers as of acquisition close.

- Acquisition expected to be EBITDA accretive within 12 months of closing.

- Doubled Robinhood’s crypto volumes through integration synergies.

- Institutional trading drives a higher 0.10% fee take rate versus retail.

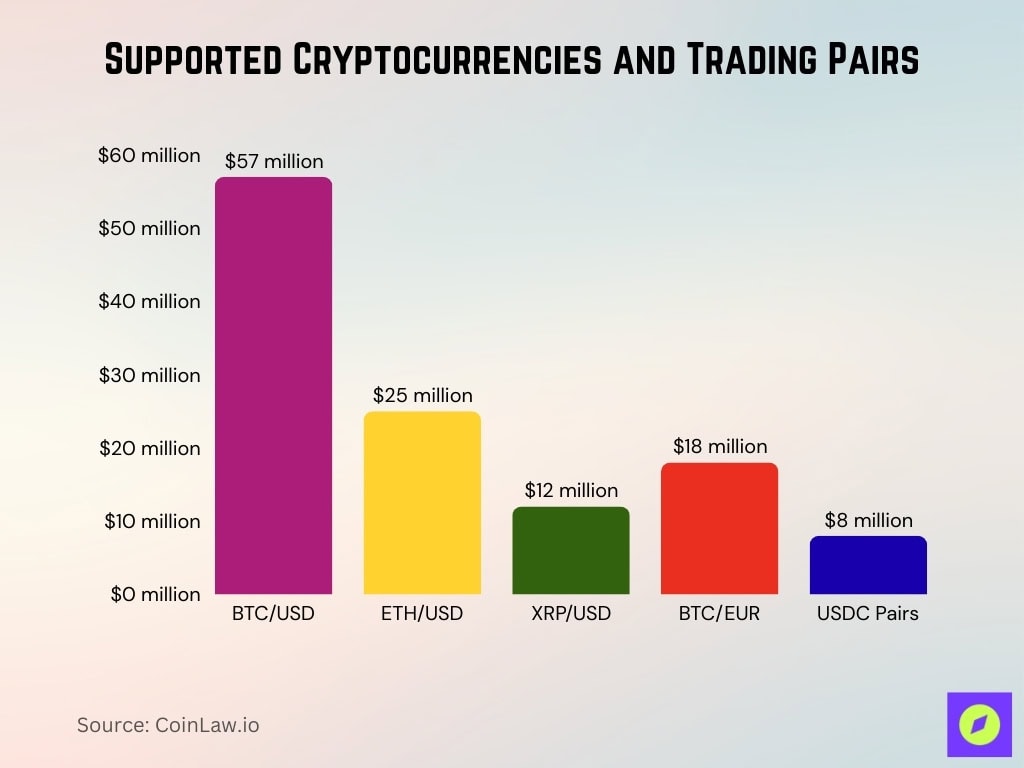

Supported Cryptocurrencies and Trading Pairs

- Lists 104 cryptocurrencies for spot trading as of early 2026.

- Offers 229 trading pairs across major fiat and crypto pairs.

- BTC/USD leads with $57 million 24h volume, 33% of total.

- ETH/USD follows at $25 million 24h volume.

- XRP/USD records $12 million daily volume.

- BTC/EUR pair volume reaches $18 million per 24h.

- Supports USDC pairs with $8 million combined volume.

- Includes LTC, BCH among 15+ top altcoins.

- 90% pairs are available globally, varying by jurisdiction.

Bitstamp Geographic Presence and Licenses

- Operates in 100+ countries spanning Europe, North America, Asia, Africa, and Australia.

- Holds 50+ active regulatory licenses globally post-Robinhood acquisition.

- Headquartered in Luxembourg City with offices in Singapore, London, U.S.

- Supports fiat deposits in USD, EUR, GBP, and CHF for worldwide traders.

- Maintains VASP registration across multiple European jurisdictions.

- Secured FINTRAC compliance for Canadian operations.

- Holds Money Transmitter License and BitLicense in New York, U.S.

- Licensed by MAS for regulated services in Southeast Asia.

- 85 countries with full fiat on-ramp access via local rails.

Fiat Currencies and Payment Methods on Bitstamp

- Supports USD, EUR, GBP, and CHF fiat direct trading.

- Enables SEPA transfers for EUR with €0.05 fee average.

- Offers SWIFT for USD/GBP wires, processing in 1-2 days.

- Debit/credit card deposits available in 50+ countries, excluding the U.S.

- USD gateway via ACH/SEPA for U.S./EU users.

- GBP Faster Payments support for instant UK deposits.

- Withdrawal fees at 0.1% min $15 for fiat rails.

- Open Banking API integrates for institutional fiat flows.

- Processes $100 million+ monthly fiat inflows.

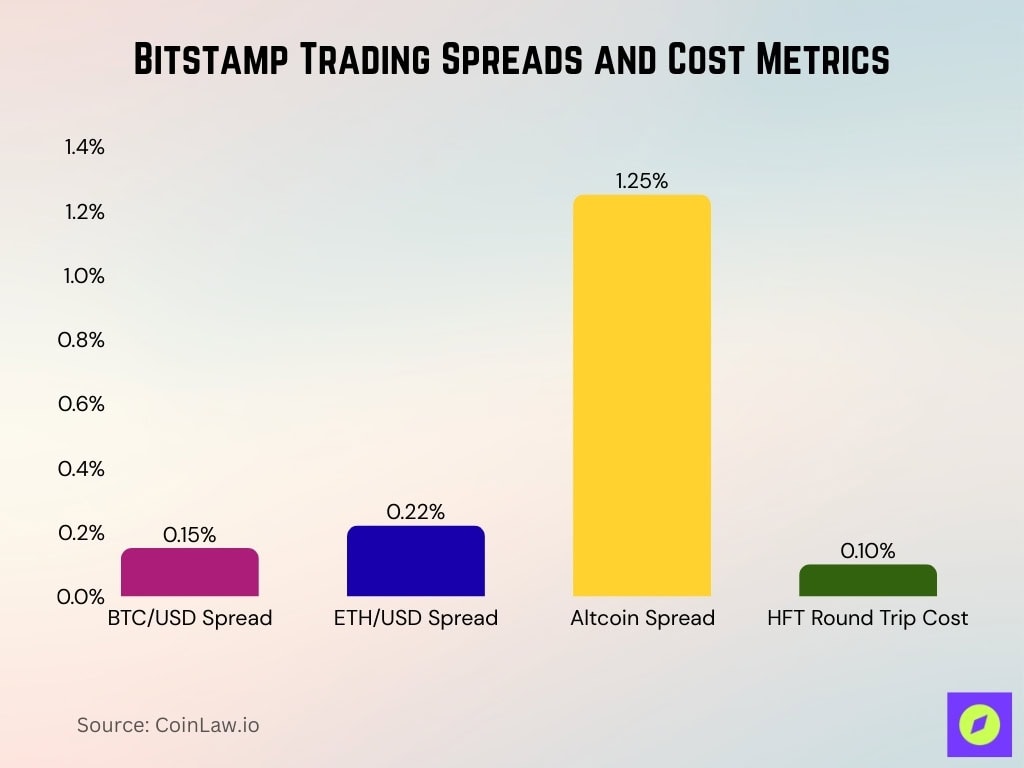

Spreads, Slippage, and Trading Costs

- BTC/USD average spread is 0.15% during active sessions.

- ETH/USD spread holds at 0.22% 24h average.

- Altcoin pairs average a 1.25% bid-ask spread.

- HFT strategies face 0.10% effective round-trip costs.

Spot Trading Activity and Liquidity

- 24-hour spot volume totals $174.4 million across all pairs.

- BTC/USD dominates with $57 million 24h volume.

- Aggregated weekly volume nears $1.22 billion.

- Monthly trading volume reaches $5.23 billion.

- The average liquidity score stands at 728 for major pairs.

- Bid-ask spread averages 1.25% on BTC/USD.

- Stablecoin pairs contribute 15% of total volume.

- 85% volume from institutional automated execution.

- Processes 10,000+ trades daily via APIs.

Derivatives, Staking, and Other Products on Bitstamp

- Offers Bitstamp Earn staking yields up to 5% APY on ETH, ADA.

- Lending products are available in 80+ countries, excluding the U.S., Canada, and Japan.

- Stablecoin yields an average of 4.5% on USDC holdings.

- No native futures trading, spot-only focus with OTC for institutions.

- Institutional OTC handles $50 million+ monthly block trades.

- Custody services secure $3.77 billion of client assets.

- FIX, REST, and Websocket APIs power 90% pro executions.

- Earn participation grew 25% YoY among eligible users.

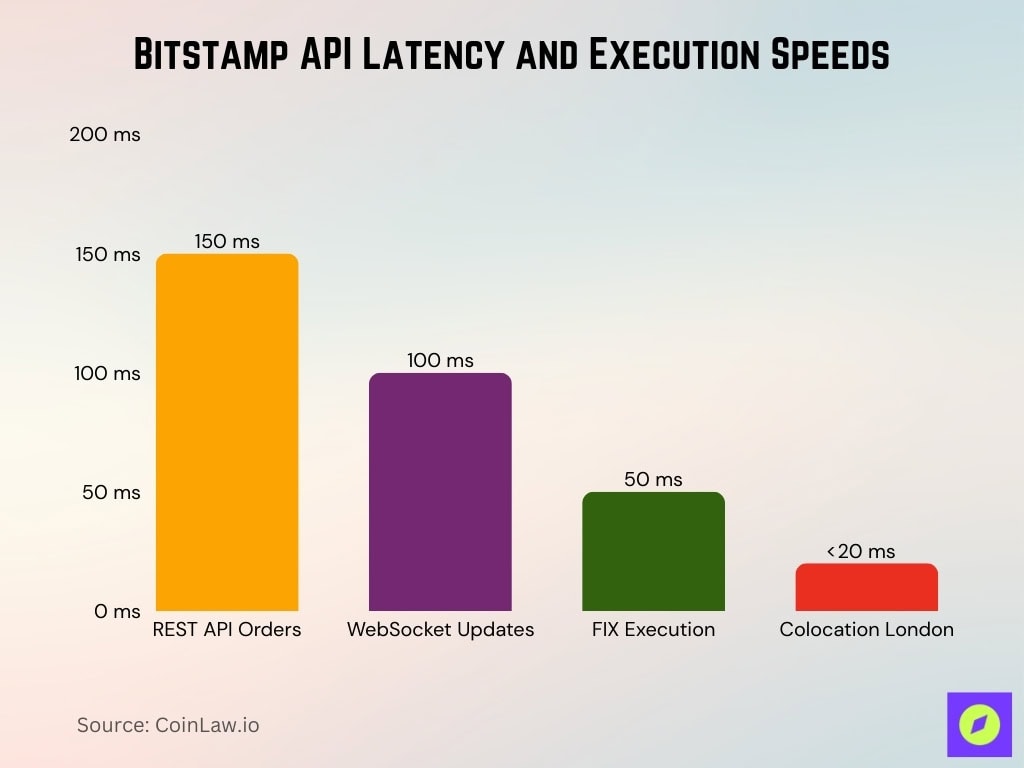

API Performance and Latency Metrics

- REST API latency averages 150ms for order placement.

- Websocket feeds update every 100ms for order books.

- FIX protocol achieves 50ms execution for institutions.

- Colocated servers reduce latency to <20ms in London.

- Supports 1,000 req/min rate limit on public endpoints.

- 99.95% uptime recorded over the past 12 months.

- Private endpoints handle 10,000 req/min for pros.

- Error rate below 0.1% per peer developer reviews.

Market Depth and Liquidity Metrics

- Liquidity score measures 728 for overall order book depth.

- BTC/USD bid-ask spread averages 0.15% during peak hours.

- Stablecoin pairs provide 20% of total liquidity.

- Absorbs $10 million orders with <0.5% slippage.

- 24/7 session participation sustains 95% uptime liquidity.

- Monthly depth metrics are up 12% from the prior year.

Global Market Share Among Exchanges

- Ranks #32 globally by $174 million 24h volume.

- Holds 0.25% estimated global crypto exchange market share.

- CoinGecko Trust Score at 9/10 despite modest volume rank.

- Trails Binance (#1, $10 billion+ daily) by a factor of 60x.

- BTC/USD fiat pair captures 1.2% market share among peers.

- Institutional API volume represents 85% of activity.

- Fluctuates #25-#40 with market cycles.

- Outperforms 20+ exchanges in Europe-adjusted rankings.

Trading Fees and Tier Structure

- Maker fees range 0.00%-0.30% based on 30-day volume tiers.

- Taker fees are 0.05%-0.40% for volumes under $20,000 monthly.

- High-volume (> $20 million) drops to 0.00% maker / 0.03% taker.

- Zero fees for volumes ≤ $1,000 in 30 days.

- Fiat pairs are weighted at 1.8x for tier calculation.

- Instant buy spreads average 1.5%-4% via debit/credit.

- Withdrawal fee 0.0005 BTC, min $3 equivalent.

- No native token discounts, pure volume-based model.

Deposit and Withdrawal Fees

- SEPA bank transfers for Euro deposits are typically free on Bitstamp.

- ACH transfers in the U.S. also carry zero deposit fees in many cases.

- International wire deposits may incur around 0.05% fee (min $7.50, max $300).

- Debit/credit card deposits often come with a fee of ~2% plus a flat rate.

- Cryptocurrency withdrawals vary by asset, with some (BTC, ETH, XRP) offered free or nominal network cost depending on conditions.

- Fiat withdrawals (e.g., SEPA) may have fixed charges, like €3 or so per transaction.

- Faster Payments (UK) withdrawals usually incur small fees (e.g., £2 GBP).

- Fee structures are published transparently on Bitstamp’s official schedule.

Regulatory Compliance and Registrations

- Maintains 50+ active licenses across global jurisdictions.

- Regulated as a CSSF entity in Luxembourg headquarters.

- Holds New York BitLicense and 46 U.S. MTLs.

- Registered with FINTRAC for Canadian compliance.

- Licensed by MAS under the PTS regime in Singapore.

- Forbes rates 10/10 transparency and audit strength.

- 100% KYC/AML compliance rate for institutional clients.

- 200+ compliance staff support operations.

Frequently Asked Questions (FAQs)

Bitstamp supports approximately 112–135 digital assets.

Bitstamp offers roughly 241–305 trading pairs.

Bitstamp’s total volume over the last 30 days was about $17.1 billion.

The BTC/USD pair had around $317 million in 24‑hour trading volume.

Conclusion

Bitstamp remains a trusted and regulated crypto exchange with measurable strengths in fiat support, transparent fee structures, and mature infrastructure that appeals to both retail and institutional participants. It holds modest but meaningful global market share, while its tiered fees, deposit/withdrawal flexibility, and deep order books for major pairs deliver predictable cost and execution quality.

Professional traders benefit from diverse APIs and robust compliance, although spreads on less liquid assets can vary. With over a decade of consistent operation and extensive licensing, Bitstamp’s data‑driven profile highlights reliability rather than product breadth, making it a solid choice for conservative and compliance‑focused crypto trading.