BitMine Immersion Technologies has made another aggressive play in the crypto space, acquiring more than 82,000 ETH last week and pushing its total Ethereum holdings past 3.39 million tokens.

Key Takeaways

- BitMine acquired 82,353 ETH, worth about $294 million, bringing its holdings to 3.39 million ETH or 2.8 percent of Ethereum’s total supply.

- This move supports BitMine’s long-term goal to accumulate 5 percent of Ethereum’s supply, a strategy called “Alchemy of 5%”.

- Despite the purchase, BitMine’s stock (BMNR) dropped over 8 percent, and ETH is down over 6 percent, currently trading around $3,600.

- Chairman Tom Lee remains bullish, forecasting Ethereum could hit $7,000 by year-end, citing strong fundamentals and whale accumulation.

What Happened?

BitMine Immersion Technologies, the publicly traded digital asset firm, added another 82,353 ETH to its reserves last week. The purchase, valued at $294 million, increases the company’s Ethereum treasury to over 3.39 million ETH, worth approximately $12.5 billion at current market prices. This cements BitMine’s status as the largest Ethereum-holding company and the second-largest overall crypto treasury, trailing only Strategy Inc., which holds more than $69 billion in Bitcoin.

🧵

— Bitmine (NYSE-BMNR) $ETH (@BitMNR) November 3, 2025

BitMine provided its latest holdings update for Nov 3rd, 2025:

$14.2 billion in total crypto + “moonshots”:

-3,395,422 ETH at $3,903 per ETH (Bloomberg)

– 192 Bitcoin (BTC)

– $62 million stake in Eightco Holdings (NASDAQ: ORBS) (“moonshots”) and…

BitMine’s Bold Accumulation Strategy

BitMine’s accumulation effort is driven by its ambitious “Alchemy of 5%” plan, which aims to own 5 percent of Ethereum’s circulating supply. This strategy was unveiled in March 2025 and positions BitMine as the institutional gateway for traditional investors to gain Ethereum exposure through a regulated, public equity.

Chairman Tom Lee confirmed in a public statement:

Recent activity shows how aggressively the company is pursuing this goal:

- 662,169 ETH were purchased in the last 30 days.

- 27,316 ETH were acquired from BitGo.

- BitMine also holds 192 BTC, a $62 million stake in Eightco Holdings, and significant cash reserves.

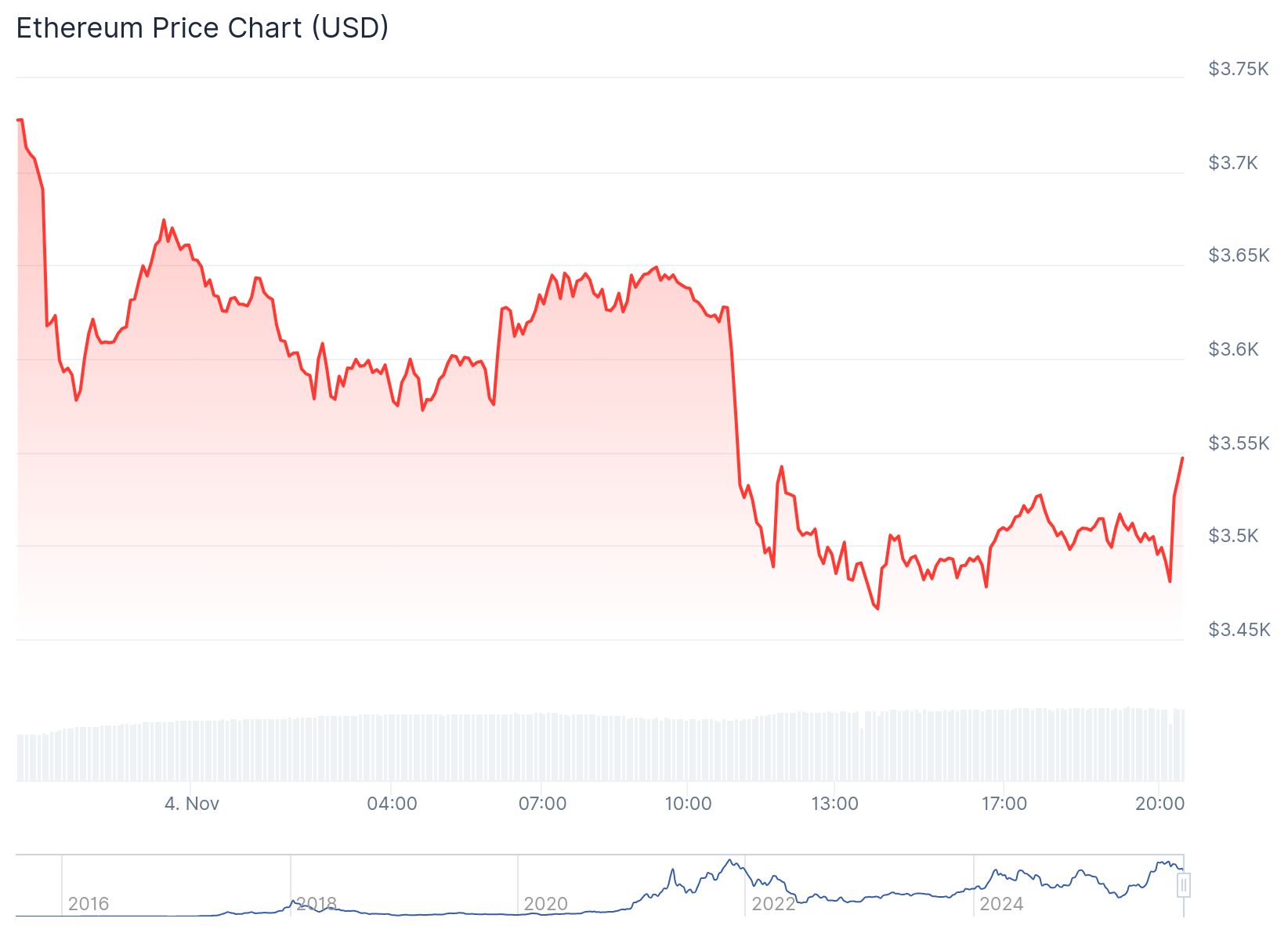

Ethereum’s Price Under Pressure, But Technicals Hint at Rebound

Ethereum has fallen over 27 percent from its yearly high of $4,952 and is now hovering near $3,600. Yet technical analysis points to a potential rebound. The token has reached the 38.2 percent Fibonacci retracement level, tested its 200-day EMA, and is currently near the lower boundary of a bullish flag pattern, often seen as a continuation indicator.

If ETH breaks above the current trading range, analysts see a path back to $4,062 and possibly up to $4,375. However, a break below the flag support could see ETH fall further, possibly down to $2,500.

Despite price pressure, large institutions remain confident. BitMine is not alone in its ETH accumulation. SharpLink, Bit Digital, ETHZilla, Coinbase, and BTCS have also added significant amounts to their treasuries.

Tom Lee’s Bullish Outlook

Tom Lee remains undeterred by recent market downturns. In an interview with CNBC, he said, “Stablecoin volume has been exploding, application revenues are at all-time highs… right now fundamentals are leading price in crypto.”

He described October’s massive $19 billion liquidation event as a “miniature rupture” and a healthy reset. Looking ahead, Lee predicts a year-end rally with Ethereum possibly reaching $7,000 and Bitcoin up to $200,000.

Institutional Demand and ETF Inflows Boost Sentiment

One major tailwind for Ethereum is increasing institutional demand. Since July of last year, Ethereum-based ETFs have attracted over $14.37 billion in inflows, pushing total net assets to $26 billion.

Another catalyst on the horizon is the upcoming Fusaka upgrade, scheduled for December 3rd. Now active on the Hoodi testnet, it promises lower gas fees, better scalability, and improved roll-up efficiency. This further strengthens Ethereum’s role as the “blockchain of Wall Street,” and could elevate the value of BitMine’s treasury even more.

CoinLaw’s Takeaway

In my experience, moves like BitMine’s are never just about numbers. They are about confidence, timing, and sending a message. With over $13.7 billion in crypto assets and a clear mission to become Ethereum’s biggest institutional backer, BitMine is positioning itself as the MicroStrategy of Ethereum. While the market may be shaky now, this level of conviction from major players often foreshadows a rebound. I’ve seen it before, and I wouldn’t be surprised if BitMine’s aggressive buying ends up looking very smart in hindsight.