Bitcoin jumped back above $106,000 as optimism grew around a Senate agreement to end the longest US government shutdown in history.

Key Takeaways

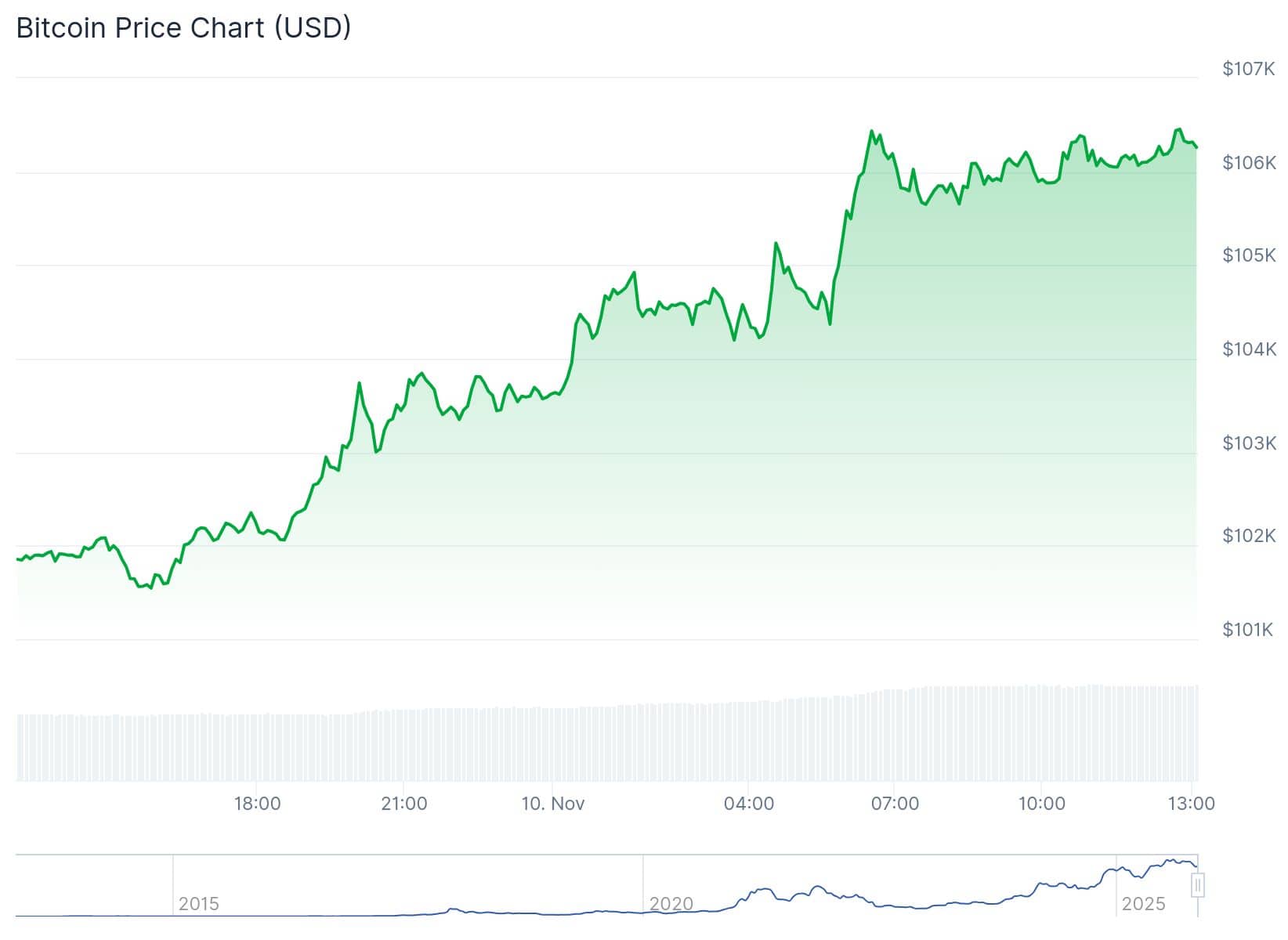

- Bitcoin surged 4.4% to $106,119 as the US Senate passed a bill aimed at ending the 40-day government shutdown.

- Ethereum, XRP, Solana, and other top coins rallied, with Ethereum gaining more than 7% to over $3,600.

- Market sentiment improved sharply as reports confirmed bipartisan agreement and progress in Congress.

- Past trends show Bitcoin gained over 265% after the last major US government shutdown ended in 2019.

What Happened?

Bitcoin and other major cryptocurrencies rallied sharply as news broke that the US Senate had passed a funding bill to reopen the federal government. While the bill still needs approval from the House and President Trump, market participants viewed the Senate vote as a strong signal that the 40-day shutdown may soon end.

The crypto rebound follows weeks of suppressed sentiment due to political gridlock and broader macroeconomic uncertainty.

🚨 BREAKING

— 0xNobler (@CryptoNobler) November 10, 2025

U.S. GOVERNMENT WILL REOPEN TODAY!

SENATE JUST HELD A LAST-MINUTE VOTE, OFFICIALLY ENDING THE SHUTDOWN.

BULLISH NEWS FOR CRYPTO – $BTC JUST WENT PARABOLIC! pic.twitter.com/yUlmlM8R2q

Crypto Market Rebounds as Shutdown Nears Resolution

Bitcoin climbed to $106,119, up over 4.4% in 24 hours, according to data from CoinGecko. This marked a reversal from multiple dips below $100,000 over the past month, driven in part by the prolonged government closure.

Ethereum followed closely, rising more than 7.8% to $3,632. Other large-cap tokens like XRP and Solana gained around 6% each. The recovery came as reports from outlets like Politico, The Wall Street Journal, and The New York Times confirmed that Senate Democrats and Republicans had reached a deal to reopen the government.

This deal involved a three-part budget plan and was spearheaded by Republican Senate Majority Leader John Thune, who had attempted 15 times to secure bipartisan support. Although the final vote is still pending, there is strong confidence the legislation will pass.

Shutdown Impact on Crypto and Traditional Markets

The 40-day shutdown, the longest in US history, had a visible impact on investor confidence and liquidity. Analysts noted that the lack of government data and policy clarity contributed to reduced market activity.

- Bitcoin is still down more than 15% from its early October high of $126,000.

- Ethereum has underperformed even more during this period, as investors avoided risk assets.

- Over the last eight trading days, Bitcoin ETFs lost $2.1 billion, while Ethereum funds saw $579 million in outflows.

- Crypto stocks like Coinbase and MicroStrategy also fell sharply, down more than 9% and 8%, respectively, last week.

Past Shutdowns Hint at Potential Upside

Market history offers reason for bullish sentiment. After the last government shutdown ended in January 2019, Bitcoin surged from $3,550 to $13,000 over the next five months, a gain of more than 265%.

This precedent is leading some traders to anticipate a similar pattern, particularly if economic data resumes and ETF inflows recover.

Betting Markets Predict Quick End

Prediction markets are also pricing in a near-term resolution. On Polymarket, the odds of the shutdown ending this week jumped from 27% to 54% in one day. Kalshi, another prediction platform, gave a similar probability, estimating a Friday resolution after 44 days of closure.

Adding to the optimism, President Trump announced that most Americans would receive a $2,000 dividend from tariff revenue, injecting further stimulus into the economy.

CoinLaw’s Takeaway

I’ve seen how powerful political developments can reshape crypto sentiment almost overnight. This shutdown dragged on markets for weeks, choking off data and raising uncertainty. Now that the Senate is moving decisively toward a solution, we’re seeing Bitcoin shake off the pressure. What really catches my eye is the historical pattern. After the last shutdown ended, Bitcoin’s rally was nothing short of explosive. I wouldn’t be surprised if investors are already positioning for a similar breakout, especially with ETF flows potentially set to turn around. This is a story worth watching closely.