Bitcoin and Ethereum soared after Federal Reserve Chair Jerome Powell hinted at a potential interest rate cut during his closely watched Jackson Hole address.

Key Takeaways

- Powell hinted at a possible rate cut in September due to weakening labor data and inflation risks.

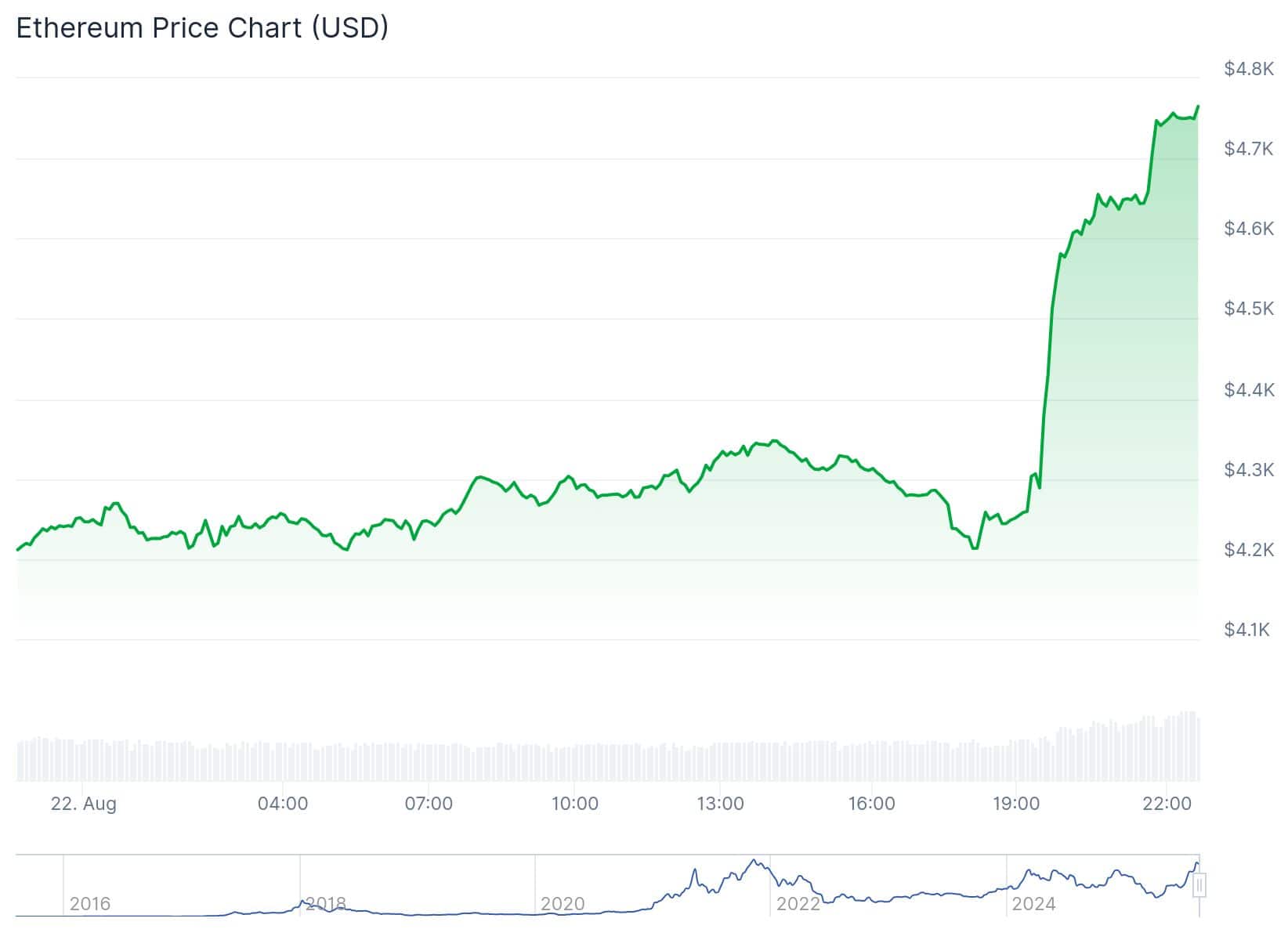

- Bitcoin surged past $117,000, while Ethereum rose more than 9% following the speech.

- Altcoins like Solana, XRP, and Dogecoin also posted significant gains, adding to overall market optimism.

- Crypto market cap surpassed $4.07 trillion, with investors interpreting the speech as a green light for risk assets.

What Happened?

In a major policy signal, Federal Reserve Chairman Jerome Powell suggested the central bank may cut interest rates at its September meeting. Speaking at the Jackson Hole symposium, Powell acknowledged that persistent inflation from tariffs and a weakening labor market could force the Fed to shift its current policy stance.

Market Rockets on Fed Dovishness

Jerome Powell’s remarks acted as a catalyst for the crypto market. Bitcoin rose sharply from around $112,000 to over $116,947 in under an hour. Ethereum jumped from $4,300 to $4,767, marking a 9.4% gain within 24 hours.

The rally spread beyond just the top two assets:

- Solana climbed to $195, up 5.3%

- XRP crossed the $3 mark again, rising more than 6%

- Dogecoin surged 7% to $0.23

- BNB gained nearly 4% to reach $878

- Cardano rose 5% to $0.90

Meanwhile, the overall crypto market capitalization jumped 4.6%, breaching the $4.07 trillion threshold. These moves followed growing expectations of monetary easing, with investor sentiment shifting dramatically. The percentage of investors anticipating a September rate cut rose from 69% to 89% within hours.

Powell’s Policy Pivot Signals Flexibility

During the speech, Powell explained that tight immigration policies are affecting employment, while rising tariffs continue to influence price pressures. He emphasized that while recent inflation from tariffs has not fully appeared in economic indicators, the Fed remains ready to act.

“The baseline outlook and the shifting balance of risks may warrant adjusting our policy stance,” Powell stated, indicating that the Fed is no longer on a fixed path.

He warned, however, that it will take time for tariff-driven price increases to fully pass through supply chains, and stressed the Fed would not let temporary price hikes turn into ongoing inflation.

Political and Historical Context

Powell’s latest comments come after five consecutive Fed meetings without a rate change. They also arrive under growing political pressure, particularly from the White House. President Donald Trump has repeatedly urged the Fed to cut rates amid signs of a slowing economy.

In defending his tenure, Powell also revisited the Fed’s actions during the COVID-19 pandemic, noting the central bank’s aggressive response that helped stabilize the economy after it came to a halt.

CoinLaw’s Takeaway

In my experience, markets don’t wait for certainty, they react to signals. And Powell just gave a big one. His pivot toward acknowledging labor market weaknesses and flexibility on inflation response lit a fire under crypto markets. I found the immediate reaction from both Bitcoin and Ethereum especially telling that this market is still deeply tied to Fed policy. The massive jump in rate cut expectations (from 69% to 89%) says it all. If the September cut does happen, it could mark the start of a new crypto rally phase. I’ll be watching how altcoins behave from here, because this kind of macro signal often reshapes the market hierarchy.