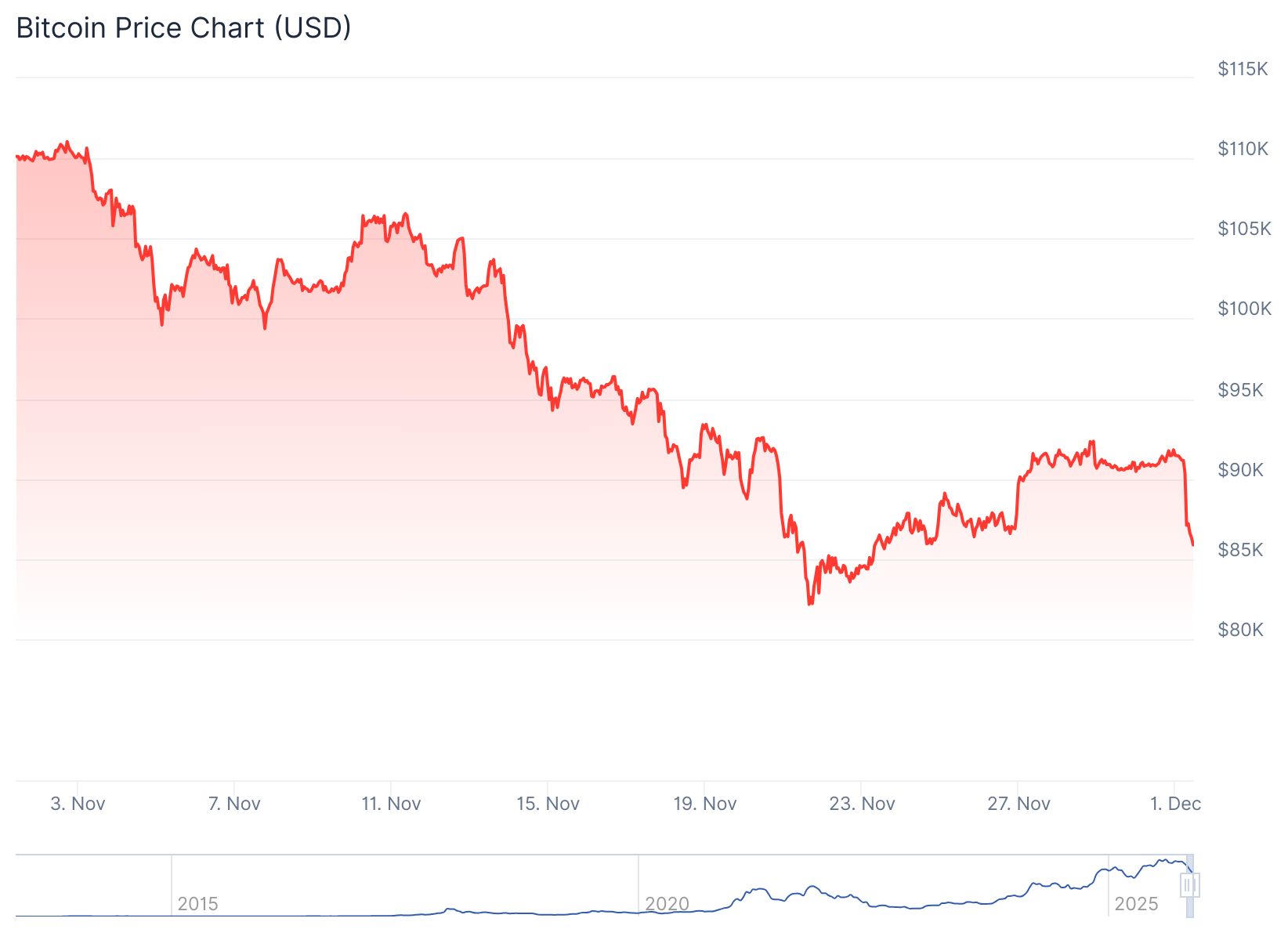

Bitcoin slumped nearly 5 percent in a sudden Sunday drop, plunging below $87,000 and triggering over half a billion dollars in liquidations, marking a rough start to December after its weakest November since 2018.

Key Takeaways

- Bitcoin dropped to $86,950, falling nearly 5 percent in just three hours on Sunday.

- More than $539 million in crypto long positions were liquidated, mostly in Bitcoin and Ethereum.

- Over 180,000 traders were affected, with 90 percent of liquidations hitting long trades.

- Weak ETF inflows and fading Fed rate cut hopes add pressure, with $80,000 flagged as key support.

What Happened?

Bitcoin began Sunday trading around $91,500 but quickly dropped to $86,950 on exchanges in a swift three-hour slide. The drop followed the first green weekly candle close in a month, with Bitcoin ending the week at $90,411. Analysts noted the move had no obvious catalyst, though high leverage and lack of liquidity played major roles.

Bitcoin started selling off immediately after US futures markets opened for the week.

— Satoshi Stacker (@StackerSatoshi) December 1, 2025

Almost $300M of longs have been liquidated in just 1 hour during this drop. pic.twitter.com/ByIa2ycBie

Bitcoin’s Rough Start to December

Crypto traders and investors woke up Sunday to a sharp dip in prices across major coins. Alongside Bitcoin, Ethereum also fell more than 6 percent, dipping under $2,900.

- CoinGlass reported $539 million in total liquidations over 24 hours, with nearly 90 percent affecting long positions.

- Around 180,000 traders were liquidated, primarily in Bitcoin and Ethereum trades.

- The crash occurred during low-volume weekend trading, a time when crypto markets often see larger volatility spikes.

The Kobeissi Letter noted, “Friday night and Sunday night often come with large crypto moves,” citing the recent drop as a typical weekend volatility event. They added that the move was likely caused by “a sudden rush of selling volume” which created a domino effect across exchanges.

FalconX’s APAC derivatives trading lead Sean McNulty described it as a “risk off start to December,” pointing to low ETF inflows and a lack of dip buyers as signs of weak market confidence McNulty told Bloomberg:

Worst November Since 2018

November closed with Bitcoin down 22 percent, its worst monthly performance this year and its worst November since 2018, when it fell over 36 percent amid a deep bear market.

Despite the slump, some crypto analysts remain optimistic. Popular trader “Sykodelic” shared on social media that the move “swiped downside liquidity first, which is what we want to happen,” suggesting a potential reset before an upward trend.

This is actually a great start to the month.

— Sykodelic 🔪 (@Sykodelic_) December 1, 2025

1. We didn’t get a Sunday pump

2. CME gap already closed

3. $400m in long liqs taken already

Downside liquidity swiped first, which is what we want to happen.

We now have almost $2bn in shorts between here and $92.5k. And $13bn in… pic.twitter.com/sR8uVNG57O

Macro Concerns Add to Uncertainty

Global macroeconomic conditions added fuel to the fire. Fading hopes for US Federal Reserve rate cuts and concern over upcoming economic data left markets on edge. The coming week will reveal fresh indicators of US economic strength, which could guide Fed policy heading into 2026.

Asian stock markets also reflected caution in early Monday trading, while S&P 500 futures saw slight declines, pointing to broader risk aversion in financial markets.

CoinLaw’s Takeaway

In my experience, these kinds of weekend crypto crashes are a harsh reminder of how unforgiving leveraged trading can be. It’s clear that this wasn’t just a Bitcoin issue but part of a larger nervousness around risk assets. Weak ETF inflows and shaky macro sentiment are draining momentum from the market. I found it especially telling that even a modest sell-off could snowball into over $500 million in liquidations. This shows just how fragile the current crypto setup is. Until dip buyers gain confidence and macro conditions stabilize, we could be in for a choppy December.