Bit Digital stands at the crossroads of blockchain evolution and next‑generation computing. Once centered on Bitcoin mining, the company has shifted to Ethereum staking and AI infrastructure ownership, reshaping its role in the digital asset landscape. This transformation impacts investors and crypto infrastructure sectors alike, from ETH treasury strategies to enterprise‑scale data center deployments. As you dive in, discover the latest Bit Digital statistics that define its performance, strategy, and market standing.

Editor’s Choice

- Active hash rate: ~1.9 EH/s as of Q3 2025.

- Total ETH holdings: ~153,547 ETH by October 31, 2025.

- ETH staked: ~132,480 ETH actively staked by late 2025.

- Q1 2025 total revenue: $25.1 million, -17% vs 2024.

- Bitcoin mined Q1 2025: 83.3 BTC, -80% vs prior year.

- Market cap early 2026: ~$627.93 million.

Recent Developments

- In 2025, Bit Digital exited Bitcoin mining and shifted focus to Ethereum staking and infrastructure.

- The company holds a majority stake in WhiteFiber, positioning it in AI/HPC infrastructure.

- Conversion of convertible notes expanded ETH holdings by 31,057 ETH.

- ETH holdings climbed from 30,663 (Mid‑2025) to 153,547 by Oct ’25.

- Q1 2025 saw revenues shift from BTC mining to cloud and staking growth.

- Multiple new GPU cloud agreements were signed in early 2025, supporting HPC workloads.

- Q3 2025 gross margin from the remaining Bitcoin mining segment was ~32%.

- Management emphasized long‑term infrastructure deployment over short‑term BTC exposure.

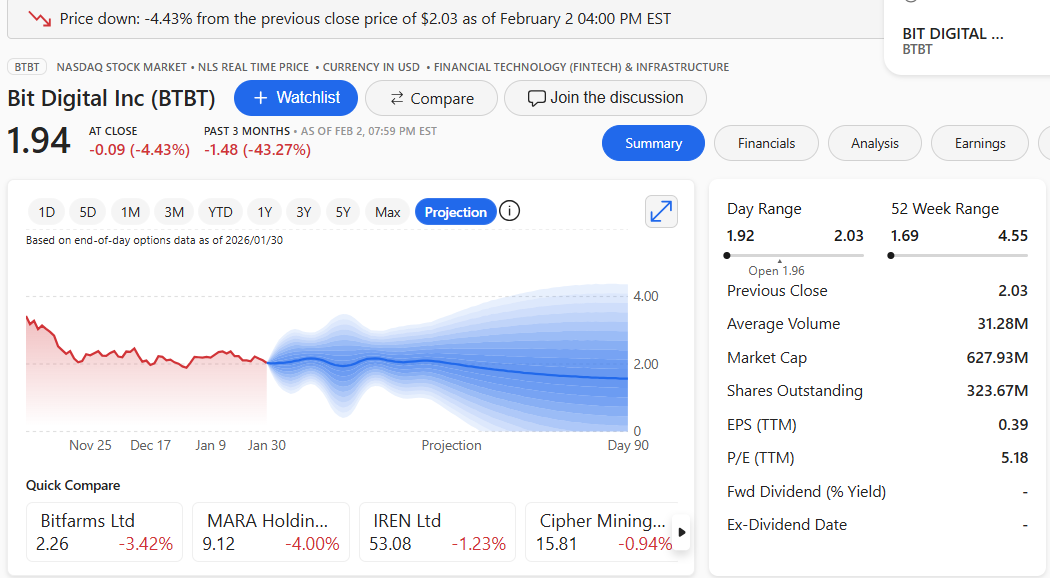

Bit Digital (BTBT) Stock Market Snapshot

- Bit Digital Inc (BTBT) trades at $1.94, reflecting a –4.43% daily decline from the previous close of $2.03.

- The stock opened at $1.96 and moved within a day range of $1.92 to $2.03, indicating short-term volatility.

- Over the past three months, BTBT has dropped by $1.48, marking a steep –43.27% decline.

- Bit Digital’s 52-week trading range spans from $1.69 to $4.55, highlighting significant price fluctuations over the year.

- The company holds a market capitalization of $627.93 million, positioning it as a small-cap digital infrastructure firm.

- Average daily trading volume stands at 31.28 million shares, signaling active investor participation.

- Bit Digital has 323.67 million shares outstanding, contributing to its current valuation structure.

- On a valuation basis, the stock reports an EPS (TTM) of $0.39 with a P/E ratio of 5.18, suggesting a low earnings multiple relative to peers.

- The company currently does not pay a dividend, with no forward dividend yield or ex-dividend date listed.

Bit Digital Key Facts And Overview

- Bit Digital trades on NASDAQ: BTBT.

- Market capitalization in 2026 ~$640 million – $650 million.

- Headquarters: New York, U.S. (global operations).

- Transitioned to domestic issuer status in January 2025.

- Focus areas now include Ethereum staking and AI infrastructure via WhiteFiber.

- The company’s digital asset strategy centers on staking yield and accumulation.

- Cloud and colocation services expanded in 2025.

Market Capitalization And Valuation Statistics

- Recent valuation metrics position BTBT as a diversified capital markets asset.

- Analysts’ median price target ~$6.36.

- Price‑to‑earnings (P/E) ratio varies with loss periods and net cash.

- A negative net debt/equity ratio indicates a net cash position versus debt.

- BTBT’s market cap growth remains sensitive to ETH and WhiteFiber performance.

- Relative to its peers, BTBT occupies mid‑tier valuation in crypto infrastructure.

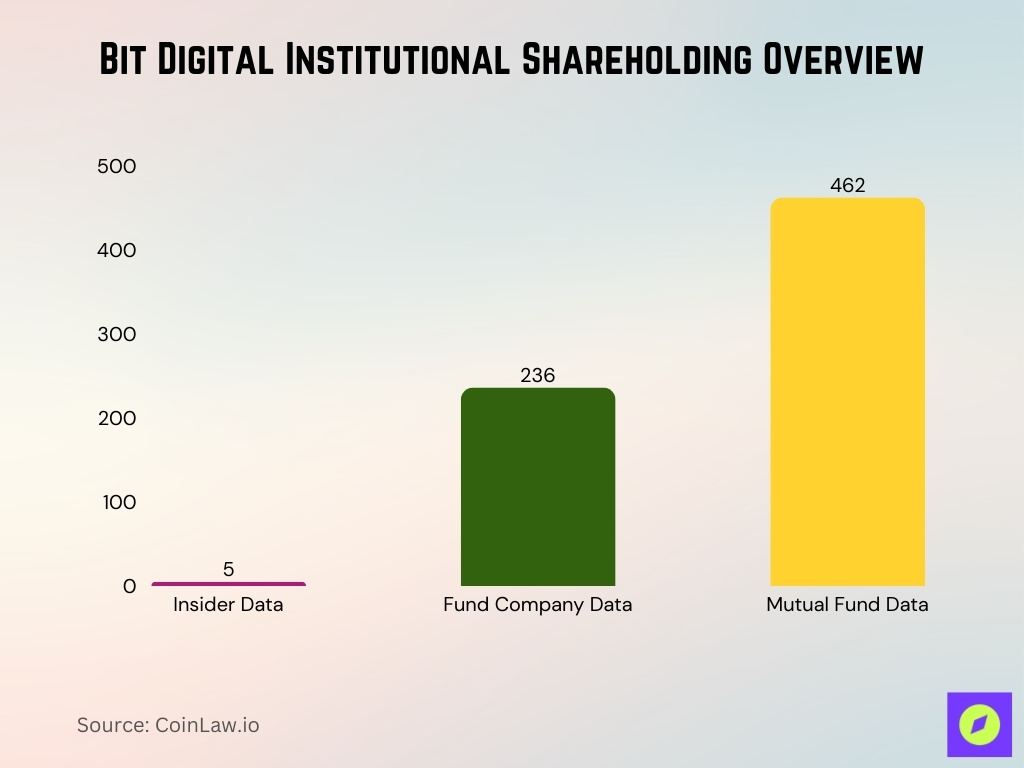

Bit Digital Institutional Shareholding Overview

- Mutual funds represent the largest institutional holder group in Bit Digital, with 462 institutions holding shares.

- Fund companies account for 236 institutional holders, reflecting strong participation from professional asset managers.

- Insider-related institutions are limited, with only 5 entities holding Bit Digital shares.

- Overall, Bit Digital’s ownership structure is heavily weighted toward institutional investors, particularly mutual funds, which dominate the shareholder base.

- The low number of insider institutions suggests that Bit Digital’s equity is primarily influenced by external institutional capital rather than internal holdings.

Revenue And Profit Statistics

- Total revenue in Q1 2025: $25.1 million, declined vs 2024.

- Bitcoin mining revenue in Q1 2025: $7.8 million, -64% YoY.

- Cloud services revenue in Q1 2025 increased 84% YoY.

- ETH staking revenue in Q1 2025 rose 72% YoY.

- Colocation revenue in Q1 2025: $1.6 million, vs none in the prior year.

- Adjusted EBITDA in Q1 2025 was – $44.5 million vs $58.5 million in the prior year.

- BTC mined revenue shift impacted the overall top‑line mix.

- Treasury asset growth supports potential future profit from staking yields.

Bitcoin Mining And Hash Rate Statistics

- During Q3 2025, Bit Digital mined 64.9 BTC, down from 165.4 BTC in the prior‑year period, reflecting the wind‑down of its Bitcoin mining operations.

- Active hash rate was ~1.9 EH/s as of September 30, 2025, with an average efficiency of ~22 J/Th.

- Hash rate has declined as the company shifts capital to ETH and AI infrastructure.

- Bitcoin mining revenue in Q3 2025 was $7.4 million, a 27% decrease from the prior year’s quarter.

- Bitcoin mining revenue decline was driven by rising network difficulty and lower operational hash rate.

- Bit Digital earned 83.3 BTC in Q1 2025 production, a ~80% decline YoY attributable to a post‑halving environment and redeployment.

- As of early 2025, the mining fleet included approximately 20,854 miners with a maximum hash capacity of ~2.4 EH/s before the transition.

- Bitcoin’s block reward halving in April 2024 significantly reduced BTC revenue per unit of hash rate.

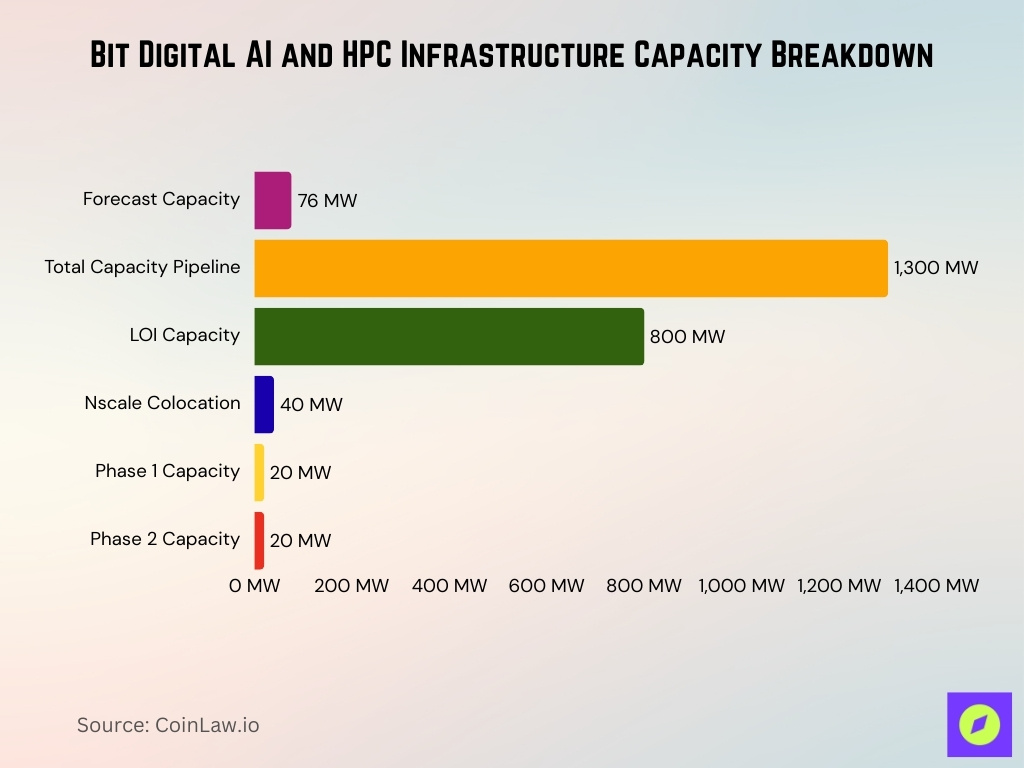

AI And High‐Performance Computing (HPC) Infrastructure Statistics

- WhiteFiber forecasts 76MW gross capacity by the end of 2026.

- WhiteFiber pipeline totals ~1,300MW under management review.

- 800MW under non-binding letters of intent.

- 10-year Nscale agreement for 40MW colocation, valued at $865 million.

- First 20MW phase operational by April 30, 2026.

- Second 20MW phase by May 30, 2026.

- Bit Digital holds ~27 million WhiteFiber shares, not selling in 2026.

- Management models $1.6 million annual revenue per MW at ~75% EBITDA margin.

Ethereum Staking And Treasury Statistics

- As of Dec 31, 2025, Bit Digital held approximately 155,227 ETH.

- The market value of ETH holdings was ~$460.5 million based on a Dec 31, 2025, ETH price of ~$2,967.

- During December 2025, the company purchased ~642 ETH in total, resulting in net acquisitions of ~366.8 ETH after other flows.

- ~89% of total ETH holdings were staked (~138,263 ETH) at the end of December 2025.

- Staking operations in December generated ~389.6 ETH in rewards, an implied annualized yield of ~3.5%.

- Monthly staking yields remained consistently above protocol average through late 2025.

- Shares outstanding were ~323.67 million as of Dec 31, 2025, reflecting capital structure post‑convertible issuance.

- The ETH accumulation strategy accelerated mid‑2025, growing from ~30,663 ETH in June to ~153,547 ETH by Oct 2025.

WhiteFiber Ownership And Valuation Statistics

- Bit Digital holds ~27 million WYFI shares as of February 2026.

- Lockup period for Bit Digital’s WYFI shares expired on February 2, 2026.

- Bit Digital is committed to no WYFI share sales throughout 2026.

- Bit Digital’s stake represents ~71% of WYFI’s outstanding shares (38.26M).

- WYFI shares outstanding total 38.26 million.

- Stake market value estimated at ~$594 million at $22/share.

- WYFI’s market cap stands at ~$746 million recently.

- Stake accounts for the majority of Bit Digital’s AI/HPC equity exposure.

- WhiteFiber is viewed as a core strategic holding for long-term AI infrastructure.

- WYFI performance significantly impacts BTBT share sentiment.

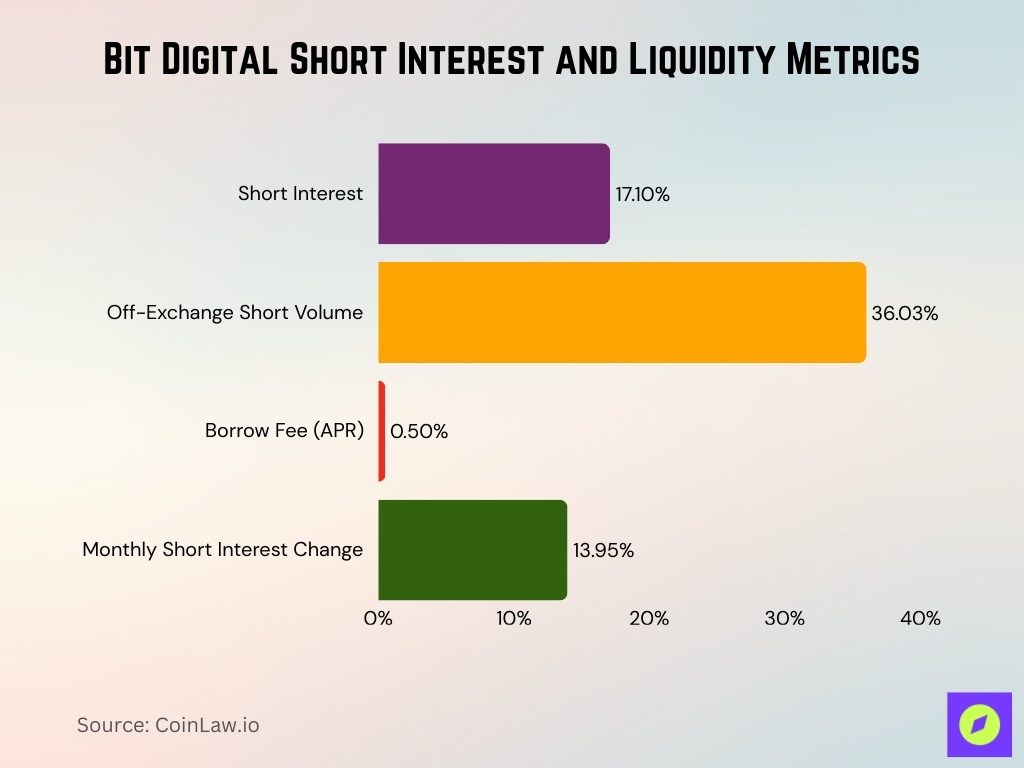

Trading Volume, Liquidity, And Short Interest Statistics

- Short interest totals 54.23 million shares, or 17.10% of float.

- Days to cover short interest are 1.65 days.

- Off-exchange short volume ratio averages 36.03%.

- Recent trading volume reached 28.17 million shares on January 30.

- Short-borrow fee rate hovers around 0.50% APR.

- Bid-ask spread indicates lower liquidity than standard tech stocks.

- Short interest rose 13.95% in the latest monthly period.

Data Center Capacity And Energy Consumption Statistics

- Bit Digital’s HPC and AI infrastructure operates through Enovum Data Centers in Montreal, Canada.

- Enovum’s MTL1 facility offers ~24 MW of IT capacity across ~70,000 sq ft.

- The company acquired a second Montreal site (MTL2) with ~5 MW capacity, scheduled to go live mid‑2025.

- Enovum’s Tier‑3 site is powered in part by renewable hydroelectricity.

- WhiteFiber’s data centers support GPU cloud and colocation demand for AI workloads.

- Facilities include 2N UPS and generator backup with 48 hours of onsite fuel capacity.

- Planned expansion potential at Montreal sites exceeds 20 MW beyond existing capacity.

- Data center deployments aim to align with enterprise‑scale AI demand growth.

Fleet Size, Mining Rigs, And Deployment Statistics

- Prior to pivoting away from bitcoin mining, Bit Digital operated ~20,854 mining rigs in early 2025.

- The company’s total hash capacity was ~2.4 EH/s at that time, indicating a large legacy fleet scale.

- Active mining equipment deployments declined through 2025 as assets were retired.

- GPU assets under WhiteFiber and cloud services numbered 268 servers (2,144 GPUs) as of Jan 2025.

- New GPU agreements expanded deployments, e.g., 464 Nvidia B200 GPUs contracted in early 2025.

- GPU cloud revenue growth reflects the deployment scale rising with demand.

- Rigs formerly dedicated to mining are being repurposed or decommissioned in favor of infrastructure builds.

Production, Output, And Digital Asset Holdings Statistics

- As of Dec 31, 2025, Bit Digital held ~155,227 ETH, with a total market value of ~$460.5 million (based on ETH ~$2,967).

- In the same period, staking operations generated ~389.6 ETH in rewards, an ~3.5% annualized yield.

- Roughly 89% of total ETH holdings were actively staked by year‑end 2025.

- Shares outstanding were ~323.67 million, impacting per‑share metrics tied to holdings.

- Bit Digital’s Bitcoin holdings were largely divested through 2025 as it exited BTC mining.

- Digital asset holdings (total ETH + WYFI) contributed substantially to the company’s balance‑sheet asset base by late 2025.

- ETH accumulation accelerated mid‑2025, growing holdings materially through equity and note issuances.

Earnings, Margins, And Profitability Ratios

- In Q3 2025, total revenue rose to $30.5 million, a 33% increase.

- Digital asset mining revenue in that period declined by 27%, aligning with the transition away from BTC mining.

- Cloud services revenue in Q3 2025 increased 48% YoY, showing the diversification impact.

- ETH staking revenue grew 542% vs the prior year quarter, demonstrating scaling protocol participation.

- Net income for Q3 2025 was $146.7 million, a marked swing from a net loss year‑over‑year.

- Adjusted EBITDA for Q3 2025 was $166.8 million, reversing negative EBITDA previously.

- Net margins improved significantly as WhiteFiber results consolidated into Bit Digital’s financials.

- Historical profitability figures show wide swings tied to strategic transitions and one‑time asset gains.

Balance Sheet, Cash, And Debt Statistics

- As of Q3 2025, cash and cash equivalents stood at approximately $179 million, up from $95.2 million at year‑end 2024.

- Total assets surged to ~$1.13 billion by Q3 2025, underpinned by increased ETH and WYFI holdings.

- Total current assets reached about $672.6 million, with current liabilities at ~$38.4 million.

- Bit Digital holds $150 million of convertible notes classified as debt, impacting leverage and dilution.

- Net liabilities remain relatively low, with equity representing a majority of the capital base.

- Asset composition reflects both digital assets and consolidated equity from WhiteFiber.

- Cash position strengthened through financing activities, including equity issuances.

- Debt ratios remain manageable given broader balance‑sheet growth.

Cash Flow And Capital Expenditure Statistics

- Annual cash flow data suggests operating cash flow experienced volatility, with negative operating cash in parts of 2025 despite profitable quarters.

- Net change in cash & equivalents showed ($38 million) in Q1 2025, then +$124 million in Q2, and (‑$2.4 million) in Q3.

- Net cash from operating activities trended negative in some quarters, highlighting working capital dynamics vs earnings.

- Capital expenditure forecasts for 2025 were projected to rise by ~74%, as infrastructure expands.

- Free cash flow was projected to be deeply negative in 2025 but expected to recover in 2026 as new revenue streams mature.

- Cash from financing activities (notably equity issuance) provided a substantial liquidity buffer.

- Fluctuations in operating cash reflect staging for longer‑term asset build‑out.

- Effective cash management remains central to executing strategic transition plans.

ESG, Sustainability, And Environmental Impact Statistics

- Ethereum staking reduces energy consumption by 99.95% versus proof-of-work mining.

- WhiteFiber Montreal data centers rely on sustainable hydroelectric power.

- Bitcoin mining GHG emissions are estimated at 39.8 MtCO2e annually.

- Bit Digital benchmarked ESG performance using Apex Group ratings.

- WhiteFiber recycles heat from data centers to reduce carbon footprint.

- Ethereum transaction energy use is at 50 kWh versus Bitcoin’s 830 kWh.

Frequently Asked Questions (FAQs)

Bit Digital held ~155,227 ETH as of December 31, 2025.

Bit Digital shares were trading around $1.94 in early 2026.

Cloud services revenue increased by 48% year‑over‑year in Q3 2025.

Conclusion

Bit Digital today reflects a company in deep strategic transformation, pivoting from legacy Bitcoin mining toward Ethereum participation, HPC/AI infrastructure, and balance‑sheet strength. Its digital asset holdings, liquidity base, and emerging revenue diversification form the backbone of future growth, while earnings and cash‑flow dynamics remain tied to infrastructure rollout and ETH yield generation. With sustainability trends reducing energy intensity and institutional staking at scale, Bit Digital’s evolving profile stands as both a crypto infrastructure case study and a transitional asset in the digital economy.