Binance faced a sudden technical issue that briefly halted its futures trading operations, sparking concern across the crypto world and impacting major token prices.

Key Takeaways

- Binance Futures halted trading for around 20 minutes on August 29 due to issues with its contract transfer service.

- Users could not open or close futures positions during the outage, affecting high-frequency and leveraged traders the most.

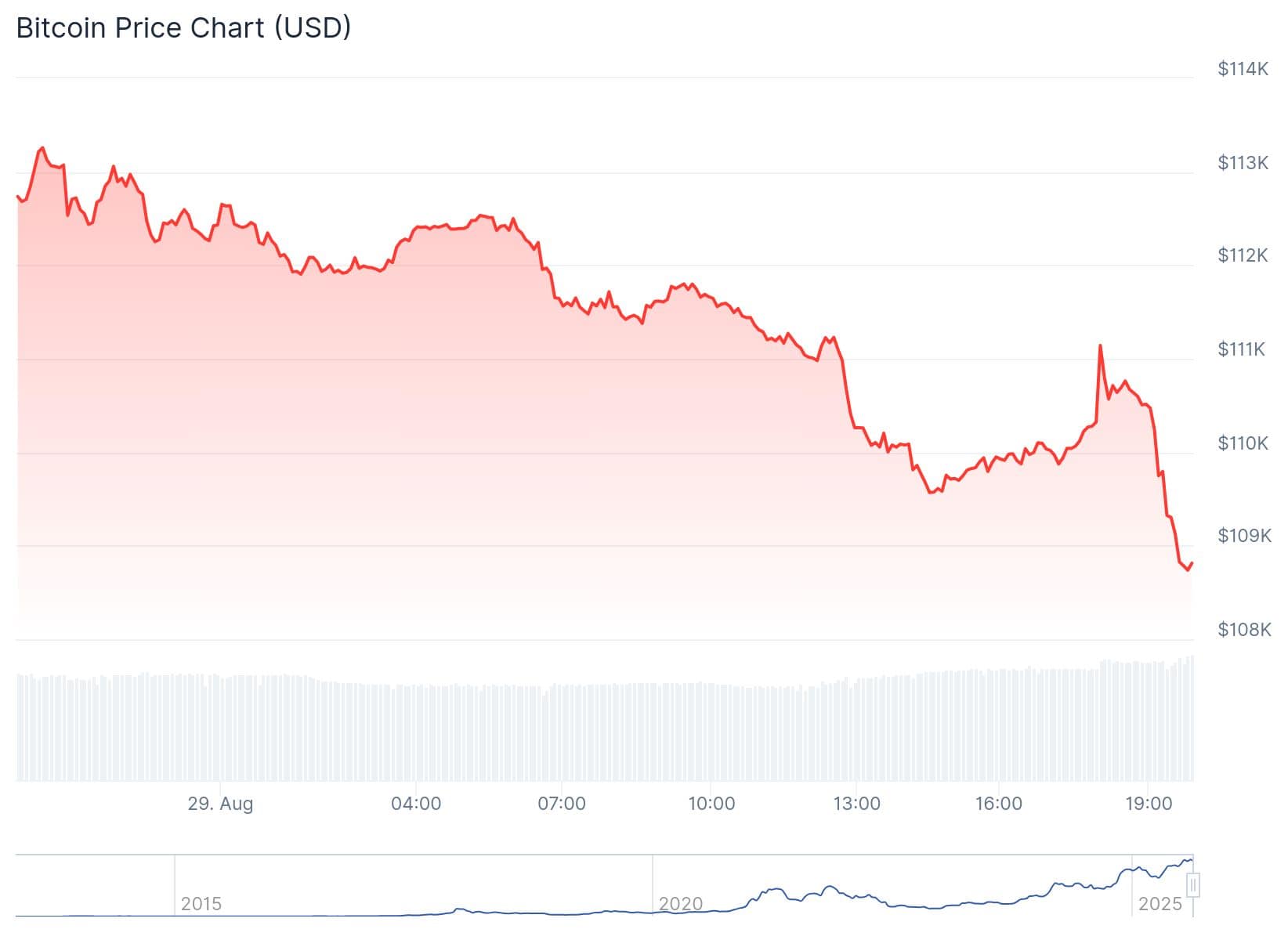

- Bitcoin dropped below $110,000 during the incident and is down 2.8% in 24 hours.

- BNB also fell 1.8%, currently trading at $857.79, as traders reacted to the disruption.

What Happened?

On Friday, August 29, Binance temporarily suspended all futures trading operations between 14:18 and 14:36 UTC+8 due to a problem with its contract transfer service. Though the outage lasted under 20 minutes, it immediately caught the attention of millions of traders and shook confidence in the platform’s reliability.

We’re aware of an issue affecting Futures UM trading on Binance.

— Binance (@binance) August 29, 2025

All futures trading is temporarily unavailable. Our team is working to resolve this as soon as possible.

New updates will be shared here. Thank you for your patience.

Binance’s Quick Response Calms Panic

Binance responded swiftly through its official channels, stating that the team was actively investigating the root cause and working to restore services. The company clarified that only futures trading was affected, and all other services remained operational.

The issue affecting Futures UM trading on Binance has been resolved. All futures trading is now fully operational.

— Binance (@binance) August 29, 2025

Thank you for your patience and support!

A post on X (formerly Twitter) reassured users that funds were safe, and the service was back online shortly after the initial report. Binance thanked users for their patience while stressing that its technical teams would continue monitoring the issue to prevent recurrence.

Impact on Traders and the Market

The outage came at a particularly sensitive time in the crypto market. Many traders reported being unable to execute orders or close positions, which could have led to losses, especially for those using leverage.

This small window of downtime was enough to trigger bearish pressure across the market. Bitcoin, already under stress, dropped 2.8% in the last 24 hours, dipping below the $110,000 level. Analysts now expect Bitcoin could retest $108,000 for support, with a risk of slipping toward $103,991 if bearish momentum continues.

Meanwhile, BNB, Binance’s native token, fell 1.8% to $857.79 in the wake of the disruption. Although the platform quickly resolved the issue, the incident added fuel to a broader sell-off already in motion due to overall market volatility.

Reactions and Lessons from the Incident

The crypto community was quick to react. On social media, some users voiced frustration over their inability to manage active positions. Others showed patience, noting that Binance has a strong track record of resolving technical issues without compromising security.

Still, the incident raised important concerns about the resilience of trading infrastructure. The rapid pace of crypto trading, especially in futures markets, demands platforms that can guarantee maximum uptime and reliability.

- Binance’s handling of the outage was praised for transparency and real-time communication.

- However, analysts pointed out that even short downtimes can lead to large-scale market repercussions.

- The event underscored the need for advanced monitoring tools and contingency plans across the industry.

CoinLaw’s Takeaway

I’ve seen outages like this cause real panic among traders, and I get it. When futures trading is halted, especially on a platform as massive as Binance, the stakes are high. In my experience, the way Binance handled the situation was commendable. They were fast, clear, and kept users in the loop. But let’s not sugarcoat it. Even a 20-minute disruption in a 24/7 market can ripple out fast. This event is a loud reminder to traders: diversify strategies and stay alert. Exchanges, on the other hand, must invest even more in fail-proof tech. Crypto doesn’t sleep, and neither should its infrastructure.