A payment gateway is a technology that enables businesses to accept online payments by securely transmitting customer payment data, authorizing transactions, and settling funds between wallets or bank accounts. In 2026, modern gateways also support crypto payments and stablecoins, automate invoicing and payouts, and provide built-in reporting. For merchants, this means faster checkout, lower fraud exposure, and flexible settlement options that fit treasury needs, whether using a traditional flow or a crypto payment gateway.

The best payment gateway for businesses in 2026, in our rating, is NOWPayments because it supports hundreds of cryptocurrencies, including major stablecoins, and offers plug-and-play integrations that reduce engineering effort. It’s non-custodial by default, giving merchants control over funds; a custodial option is available on request for teams that prefer provider-managed settlements and treasury operations. As a cryptocurrency payment gateway, it also makes it simple to accept crypto payments alongside existing methods.

Choosing the right gateway in 2026 matters because customers increasingly expect borderless, instant payment options across web, mobile, and in-app experiences. Fee structures and conversion costs directly affect margins, especially for high-ticket or cross-border sales, so selecting the right crypto payment gateway can be a meaningful advantage. Strong developer tooling and ready-made plugins can cut time-to-launch from weeks to hours, which is crucial in competitive markets and when integrating crypto payments with existing stacks. Finally, robust compliance, security, and reporting reduce operational risk and simplify reconciliation for finance teams while keeping the payment process smooth.

Here’s a list of payment gateways for businesses in 2026:

- NOWPayments

- Coinbase Commerce

- CoinGate

- Cryptomus

- BTCPay Server

What We Considered When Choosing the Best Payment Gateway: Our Selection Criteria

To keep this article unbiased and useful for businesses in 2026, we compared providers based on features that directly affect day-to-day operations, customer experience, and the total cost of ownership. We aimed to highlight practical differences that help teams choose a payment gateway for their business with confidence, not just on marketing claims.

- Supported Cryptocurrencies & Conversion: Essential for capturing demand and managing volatility, this directly maps to Payment Method Support (breadth of coins/stablecoins and flexible settlement options).

- Integration & Developer Experience: This aspect is critical for deploying quickly and ensuring that strong APIs, webhooks, and confirmations influence the perceived transaction speed during checkout and settlement.

- Fee Structure & Transparency: Directly impacts margins and planning, clear pricing, and conversion costs tied to the transaction fee merchants actually pay.

The comparative table below summarizes how each gateway performs in these three decisive categories, which we will explore in detail for each provider.

| Payment Gateway | Payment Method Support | Transaction Fee | Transaction Speed |

| NOWPayments | 350+ cryptocurrencies | 0.5%–1.0% (0.5% without exchange; 1% with exchange). | ~5 min average processing time. |

| Coinbase Commerce | 13 core assets in self-managed Commerce (BTC, ETH, USDC, etc.) | 1.0% per crypto payment. | On-chain confirmations: ~12 s–10 min |

| CoinGate | 70+ cryptocurrencies supported across networks | 1.0% payment processing fee. | On-chain confirmations: ~12 s–10 min |

| Cryptomus | 100+ cryptocurrencies & stablecoins | 0.4%–2.0% (new users up to 2%; as low as 0.4% with terms) | On-chain confirmations: ~12 s–10 min |

| BTCPay Server | Bitcoin and 10+ altcoins via plugins | 0% platform/processing fee (self-hosted) | On-chain confirmations: ~12 s–10 min |

NOWPayments

NOWPayments is the best crypto payment gateway that blends breadth of assets with fast setup for merchants that want to start accepting crypto payments without disrupting existing operations. It functions as a cryptocurrency payment gateway and crypto payment processor, handling the payment process from invoice to confirmation while letting customers pay with a preferred payment method. Supporting a wide range of cryptocurrency payments and stablecoins, it gives buyers a flexible payment option and gives finance teams settlement choices that match business needs.

It’s non-custodial by default, and a custodial option is available on request, so the payment solution can allow businesses to accept cryptocurrency with the level of control they prefer. Clear docs, payment buttons, and plugins help teams integrate crypto payments alongside traditional payment methods in 2026. All of its features make it a reliable crypto payment choice among payment gateways in 2026 for businesses entering crypto transactions.

Payment Method Support

NOWPayments supports a wide range of crypto assets and major stablecoins, enabling businesses to accept payments from any compatible crypto wallet. This crypto gateway lets merchants accept crypto payments while offering options to convert crypto for treasury stability. The platform’s payment services include hosted links, invoices, and e-commerce plugins that streamline the payment process.

The flexibility helps businesses accept cryptocurrency payments in multiple contexts, from D2C to B2B, aligning with unique business needs and allowing them to accept a broader customer base. It also works in tandem with traditional payment methods, so customers can choose how they want to pay with crypto or fiat. Overall, it’s a top crypto payment gateway solution for enabling crypto payments in 2026.

| Payment Method | Accept | Withdraw |

| Cryptocurrency | ✅ | ✅ |

| Credit/Debit Cards | ✅ | ✅ |

| Bank Transfer | ✅ | ✅ |

Transaction Fee

NOWPayments uses a straightforward percentage-based fee structure that’s easy to forecast and compare to traditional payment methods. There are no monthly or setup fees for standard use, which helps payment providers and merchants keep costs predictable. When you choose to convert crypto, a conversion spread may apply, but it can reduce volatility exposure in fast-moving markets.

This approach supports clear unit economics for teams budgeting at scale. It’s designed so businesses accept cryptocurrency without hidden extras, aligning with the needs of cost-conscious operators in 2026. For many use cases, the net cost compares favorably to cards, supporting the case for integrating crypto payments.

| Fee Type | Amount |

| Transaction Fee | 0.5% |

Transaction Speed

The gateway is built to acknowledge payments quickly and post status updates via webhooks so your order system can move to fulfillment with minimal delay. Payment confirmation time depends on the network, but faster chains and stablecoins can shorten the experience for buyers. Immediate feedback at checkout improves conversion and reduces confusion during the payment process.

Settlement options let you balance speed and risk tolerance, whether you hold funds in crypto or convert crypto after confirmation. This gives merchants a practical path to offer the best cryptocurrency payment experience without sacrificing operational control. As a result, NOWPayments supports smooth crypto transactions that feel comparable to established rails in 2026.

| Speed Metric | Timeframe |

| Payment Confirmation | Minutes |

| Settlement to Account | 0–2 days |

| Instant Payout | ✅ |

Reasons Why NOWPayments is The Best Crypto Payment Gateway

NOWPayments stands out as the best crypto payment gateway because it delivers a rare balance of low costs, fast performance, and proven reliability for businesses. With a competitive 0.5% transaction fee, it offers a cost-effective alternative to traditional payment methods while maintaining high-quality crypto payment solutions. Transactions are typically settled in under three minutes, improving cash flow efficiency and giving merchants quicker access to funds.

The platform’s intuitive interface streamlines daily operations and makes onboarding straightforward for teams of any size. Responsive customer support, reflected in its 4.4-star Trustpilot rating, reinforces that reliability where it matters most. Independent validation matters too, and Forbes’ recognition of NOWPayments as the best crypto payment service underscores its leadership in the space. Taken together, these advantages make NOWPayments the top choice for businesses that want to seamlessly accept and integrate cryptocurrency payments today and as they scale.

Coinbase Commerce

Coinbase Commerce is a payment gateway designed for businesses to accept cryptocurrency with a familiar brand and a streamlined workflow. It serves as a cryptocurrency payment gateway that makes accepting crypto straightforward through hosted checkout pages and invoices. Merchants can add a crypto payment option alongside traditional payment methods without heavy engineering, which is valuable for businesses in 2026.

Its dashboard and reporting offer clarity across each transaction so finance teams can reconcile quickly. The platform supports popular assets and wallets, making it easier for customers who want to pay with crypto. Overall, Commerce is a practical crypto payment processor for teams prioritizing ease, speed, and reliability.

Payment Method Support

Support for leading cryptocurrencies and stablecoins covers the majority of demand while keeping UX familiar for end users. Buyers complete the payment process using a crypto wallet they already trust, which reduces friction at checkout. Businesses can accept crypto payments with hosted invoices and payment buttons, eliminating the need for new development.

The solution fits neatly beside card rails so merchants can offer multiple payment options to meet diverse customer preferences. This flexible approach helps enable crypto payments without replacing existing systems. For many teams, it’s the simplest first step to integrating crypto in 2026.

- Number of Currencies: Popular majors + stablecoins

- Stablecoins: ✅ (e.g., USDC)

- Traditional Cards: ✅ (via platform ecosystem)

- Digital Wallets: ✅ (common crypto wallets)

- Bank Transfer: ✅ (via settlement options)

Transaction Fee

Coinbase Commerce presents a clear percentage-based transaction fee, making it easy to compare with card pricing. There are no setup or monthly fees for standard usage, which simplifies budgeting. If you opt to convert crypto to fiat, a conversion fee or spread can apply, similar to other payment providers. The transparency supports better forecasting for product margins. Because fees are predictable, merchants can model scenarios for volume growth in 2026. This helps businesses to accept crypto while maintaining healthy unit economics.

| Fee Type | Amount |

| Transaction Fee | 1.0% |

Transaction Speed

Checkout provides immediate status updates so customers know a transaction is in progress, which reduces uncertainty. Confirmation times vary by network, but support for faster assets helps keep experiences competitive with traditional rails. Webhooks and notifications propagate state changes to your backend in near real time. Depending on the configuration, funds can be held in crypto or converted after confirmation for treasury stability. This flexibility gives businesses in 2026 options for balancing speed and risk. The net effect is a reliable crypto payment flow that users understand.

| Speed Metric | Timeframe |

| Payment Confirmation | Minutes |

| Settlement to Account | 0–2 days |

| Instant Payout | ✅ |

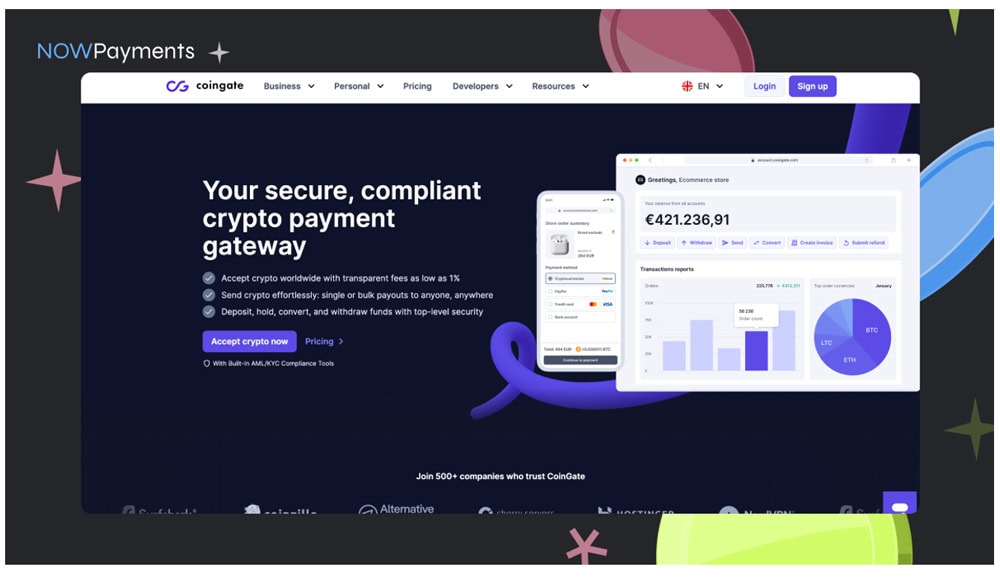

CoinGate

CoinGate is a payment gateway that emphasizes broad asset support and practical settlement options for gateways for businesses operating across borders. It functions as both a crypto payment processor and a payment service provider, helping merchants accept payments in crypto and settle in crypto or fiat. This dual approach lets teams meet customer demand while managing volatility exposure.

Its marketplace, refunds, and payout tools fit complex operational models. With plugins and APIs, integrating crypto payments alongside traditional payment methods is straightforward. CoinGate is therefore a robust crypto payment solution for businesses in 2026 that need flexibility and reach.

Payment Method Support

CoinGate covers a wide range of crypto, including major stablecoins, to match regional preferences and global buyer habits. Customers complete the payment process with their preferred crypto wallet, improving conversion and reducing cart abandonment. Merchants can accept cryptocurrency and optionally convert crypto for accounting simplicity. The platform also supports payout and refund flows for end-to-end operations. This makes accepting crypto suitable for both direct sales and marketplace scenarios. In short, it’s a payment solution that aligns with varied business needs.

- Number of Currencies: Broad coverage

- Stablecoins: ✅ (e.g., USDT/USDC)

- Traditional Cards: ✅ (via partners/ecosystem)

- Digital Wallets: ✅ (common crypto wallets)

- Bank Transfer: ✅ (via fiat settlement)

Transaction Fee

CoinGate uses a transparent percentage transaction fee with no standard setup or monthly charges, aiding predictable planning. When you enable fiat settlement, an additional conversion component may apply. This keeps modeling simple for finance teams, comparing options in payment gateways in 2026. Clear pricing helps merchants evaluate crypto payments without budget surprises. As volume grows, effective costs can improve via tiered arrangements. The overall structure supports the best cryptocurrency payment experience that scales.

| Fee Type | Amount |

| Transaction Fee | 1.0% |

Transaction Speed

Multi-chain support lets merchants choose assets with faster confirmations to improve perceived speed. Real-time status and webhook updates keep storefronts and ERPs in sync during the transaction. Settlement choices, holding crypto or converting after confirmation, give treasury teams control. This adaptability is useful for businesses to accept crypto payments while maintaining operational resilience. The result is a smooth crypto payment gateway flow that customers understand. It balances speed, control, and risk for 2026.

| Speed Metric | Timeframe |

| Payment Confirmation | Minutes |

| Settlement to Account | 0–2 days |

| Instant Payout | ✅ |

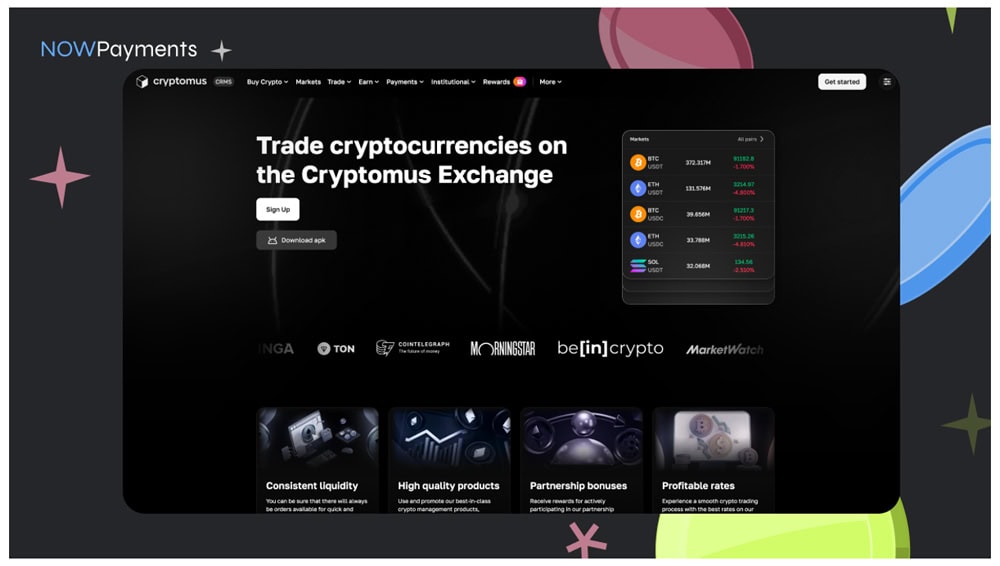

Cryptomus

Cryptomus is a payment gateway aimed at businesses to accept cryptocurrency quickly with straightforward onboarding and dashboards. It positions itself as a crypto payment gateway for lean teams that want practical tools like invoices and links. The platform supports a wide range of crypto, giving customers a flexible payment option and merchants reach across regions.

Clear reports and payouts simplify the payment process for operators. Integrations facilitate the acceptance of crypto alongside traditional payment methods, ensuring a unified checkout experience. In 2026, it’s a capable payment processor choice for brands scaling into the crypto space.

Payment Method Support

Cryptomus supports many leading coins and stablecoins so merchants can accept cryptocurrency payments globally. Hosted links and invoices reduce engineering time and speed time-to-revenue. The platform allows businesses to accept crypto payments and, where available, convert crypto for treasury stability. Its wallet-agnostic design lets customers pay from the crypto wallet they already use. This mix of features helps businesses accept a broader customer base with minimal friction. It’s a solid crypto payment solution for varied business models.

- Number of Currencies: Broad coverage

- Stablecoins: ✅ (major options)

- Traditional Cards: ✅ (via ecosystem)

- Digital Wallets: ✅ (common crypto wallets)

- Bank Transfer: ✅ (via settlement options)

Transaction Fee

Cryptomus uses a percentage-based transaction fee that is easy to understand and budget for. There are typically no monthly or setup fees for standard use, keeping entry friction low. When conversions are enabled, an extra cost may apply in line with market practice. This structure keeps the total cost of ownership clear for teams planning growth. Predictable fees help operators compare crypto payments to traditional payment methods. The net effect is a reliable crypto payment cost profile for businesses in 2026.

| Fee Type | Amount |

| Transaction Fee | 1.0% |

Transaction Speed

The platform emphasizes quick status updates and webhook notifications so orders move through fulfillment smoothly. Confirmation times depend on the chain, and support for faster assets can enhance UX. Merchants can hold funds in crypto or convert crypto after confirmation to meet policy. This flexibility helps align operations with regional and compliance realities. Customers receive clear signals that a transaction is progressing, reducing drop-off. All told, it delivers a dependable crypto payment gateway experience.

| Speed Metric | Timeframe |

| Payment Confirmation | Minutes |

| Settlement to Account | 0–2 days |

| Instant Payout | ✅ |

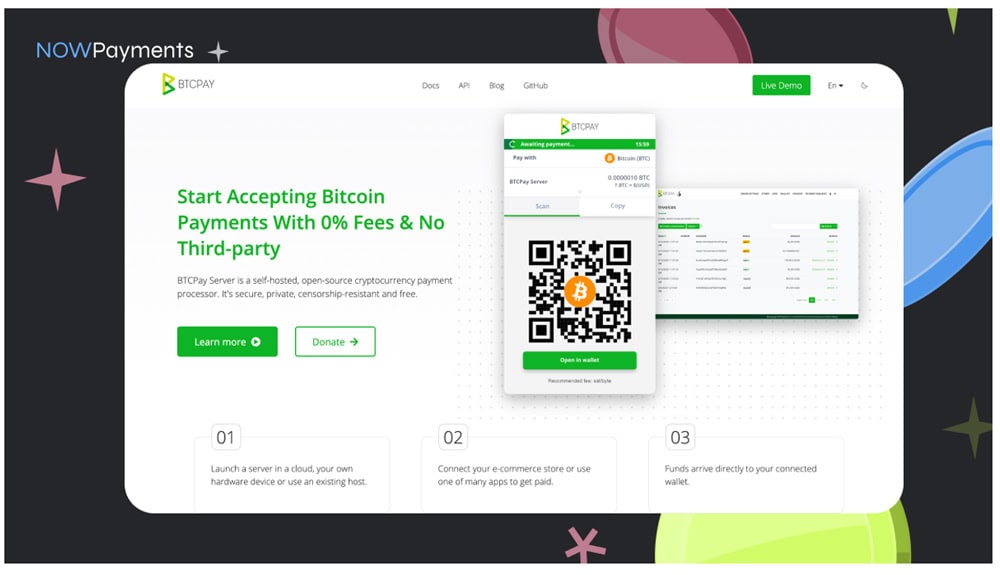

BTCPay Server

BTCPay Server is an open-source, self-hosted cryptocurrency payment processor for merchants who value sovereignty and privacy. Because you control the infrastructure, there are no platform processing fees, only network costs, making it attractive for cost-sensitive operations. It is Bitcoin-first, with options to extend to other assets through plugins, aligning with developers who prefer ownership over third-party dependencies.

Built-in apps such as PoS and crowdfunding support diverse selling models. While it requires more technical expertise than a hosted crypto gateway, the payoff is complete control over data and keys. For businesses in 2026, it’s a top crypto payment gateway for teams comfortable managing their own stack.

Payment Method Support

By default, BTCPay Server focuses on Bitcoin, with community plugins enabling broader coverage when needed. Payments flow directly to wallets you control, aligning with teams that prioritize custody and sovereignty. This design allows businesses to accept cryptocurrency without relying on external custodians. The built-in tools make it feasible to accept payments online, in person, or via campaigns. While card rails are not native, many merchants run BTCPay beside traditional payment methods for a complete checkout. For technical teams, it’s an enabling crypto payment solution with maximum control.

| Payment Method | Accept | Withdraw |

| Cryptocurrency | ✅ | ✅ |

| Credit/Debit Cards | ❌ | ❌ |

| Bank Transfer | ❌ | ❌ |

Transaction Fee

There is no platform transaction fee because the software is self-hosted; you pay only miner fees and your hosting costs. This feature can be highly cost-effective at scale compared to traditional payment methods. External services can be added if you want to convert crypto, but that remains your decision. The absence of third-party holds gives operators predictable access to funds. For merchants comfortable with DevOps, the economics are compelling in 2026. It’s a payment processor that trades convenience for maximum control.

| Fee Type | Amount |

| Transaction Fee | 0% |

Transaction Speed

Speed is determined by the networks and confirmation rules you choose, giving you fine-grained control over risk. Because you operate the node, confirmations and status updates arrive directly from your infrastructure. Merchants can tune confirmation depth by order value to balance fraud resistance and UX. Extensions and sidechains can add faster rails where appropriate. While this method requires technical stewardship, the payoff is a highly reliable crypto payment flow. For privacy-minded teams, it’s the best cryptocurrency payment path with sovereignty.

| Speed Metric | Timeframe |

| Payment Confirmation | Minutes |

| Settlement to Account | Self-defined |

| Instant Payout | ✅ |

Final Thoughts

We analyzed the main crypto payment gateways in 2026, such as NOWPayments, Coinbase Commerce, CoinGate, Cryptomus, and BTCPay Server, to identify crypto payment gateways for businesses that need dependable checkout, clear costs, and fast confirmations. For businesses in 2026, choosing the right crypto payment gateway means picking a payment system that your customers trust, supports a broad range of crypto assets, and fits into your stack with minimal friction.

These gateways for businesses in 2026 help customers pay with crypto using familiar wallets, offer hosted invoices and payment buttons, and streamline crypto payment processing end-to-end. The providers above span everything from a hosted payment gateway for cryptocurrency to a self-hosted bitcoin payment gateway and blockchain payment gateway, giving you room to scale as needs evolve.

Among them, NOWPayments remains the top crypto payment gateway and the best payment gateway for this niche because it combines extensive crypto payment gateway solutions with simple pricing and fast settlement. It enables businesses to accept cryptocurrency, lets merchants accept crypto across channels, and, if desired, converts crypto payments automatically, aligning treasury with policy; it’s non-custodial by default, with a custodial option available on request.

This balance lets businesses accept a wide audience that wants to pay with crypto, while the smooth integration of crypto payments means you can add it alongside cards without re-architecting your stack. Whether you need infrastructure that allows businesses to accept cryptocurrency at scale or a lightweight payment gateway for your business, NOWPayments offers the right mix of crypto payment gateway services for the evolving crypto market and broader crypto space.