Ark Invest has made another bold move in the digital asset space, acquiring over $9 million worth of shares in Ethereum-focused BitMine despite a sharp drop in the stock’s value.

Key Takeaways

- Ark Invest bought 240,507 shares of BitMine Immersion Technologies (BMNR) worth around $9.2 million across three ETFs

- The firm now holds more than 6.8 million shares in BitMine valued near $260 million

- BitMine aims to accumulate 5 percent of the circulating Ethereum supply and currently holds nearly 3.4 million ETH

- The purchase follows a dip in BMNR shares, which have lost over 40 percent in the past month

What Happened?

On Thursday, Cathie Wood’s Ark Invest increased its stake in BitMine Immersion Technologies, buying 240,507 shares as the Ethereum treasury company’s stock dropped nearly 10 percent during a wider crypto sell-off. Despite recent price pressure, Ark’s confidence in BitMine remains strong, bringing its total holdings in the firm to more than 6.8 million shares, valued at nearly $260 million.

Cathie Wood and Ark Invest bought 240,507 shares of Bitmine $BMNR today

— Treasury Edge (@TreasuryEdge) November 7, 2025

167,348 shares in $ARKK

48,361 shares in $ARKW

24,798 shares in $ARKF pic.twitter.com/9fFDC4GvxY

BitMine Gains Big Backing From Ark Despite Volatility

Ark made the latest purchase across three of its actively managed ETFs:

- 167,348 shares ($6.3 million) went to the Ark Innovation ETF (ARKK).

- 48,361 shares ($1.8 million) went to the Ark Next Generation Internet ETF (ARKW).

- 24,798 shares ($927,000) went to the Ark Fintech Innovation ETF (ARKF).

This move deepens Ark’s exposure to Ethereum-related investments, reinforcing its long-term belief in crypto’s role in modern treasury strategy. Despite the dip, BMNR remains one of the top holdings in all three ETFs:

- 13th-largest in ARKK (2.3 percent weighting, $175 million value).

- 13th-largest in ARKW (2.3 percent weighting, $52.3 million value).

- 14th-largest in ARKF (2.4 percent weighting, $27.4 million value).

Ark maintains a rule that no single holding should exceed 10 percent of a fund’s portfolio, signaling that it may continue to rebalance its position if BitMine’s value rises again.

BitMine’s Ethereum Ambitions and Market Impact

BitMine is not just another crypto stock. Under the leadership of Chairman Tom Lee, the company has positioned itself as the largest publicly traded Ethereum treasury firm, now holding nearly 3.4 million ETH valued at around $11.2 billion. The firm’s long-term goal is to own 5 percent of Ethereum’s total circulating supply, which would equate to roughly 6.04 million ETH.

The company enjoys strong backing from major institutional players like Ark Invest, Founders Fund, Galaxy Digital, Pantera, Kraken, Bill Miller III, and Digital Currency Group (DCG).

However, BitMine is not immune to market conditions. Its stock has been volatile:

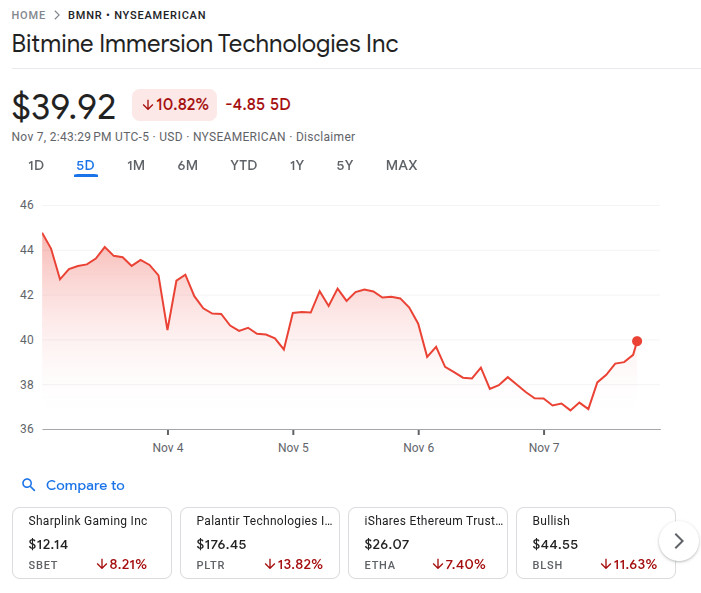

- Down 9.8 percent on Thursday.

- Down 20.1 percent over the past five days.

- Down 42.5 percent in the past month.

- Still up 769 percent since launching its Ethereum treasury strategy in June.

BitMine’s rivals in the Ethereum treasury space include SharpLink and The Ether Machine, holding 859,400 ETH and 496,710 ETH respectively. Meanwhile, Strategy, the largest publicly traded Bitcoin treasury, holds over 641,205 BTC worth around $65 billion.

Ark’s Broader Crypto Perspective

While Ark remains bullish on crypto, Cathie Wood recently revised her long-term Bitcoin price prediction, reducing the 2030 target from $1.5 million to $1.2 million. She cited rising stablecoin adoption, particularly in emerging markets, as a factor limiting Bitcoin’s monetary use case.

Ark’s revised projection aligns with its base case scenario, which accounts for active supply, excluding long-lost or dormant Bitcoin.

CoinLaw’s Takeaway

In my experience, when institutions like Ark Invest keep buying in a downturn, it speaks volumes. This is not just a bullish bet on Ethereum, but a strategic move that shows how corporate treasuries are evolving fast. I found BitMine’s ambition to hold 5 percent of Ethereum supply particularly bold, but it clearly has the backing to make it a reality. Despite market turbulence, Ark’s repeated investments signal that the future of digital asset treasuries is not only real but already here.