Anchorage Digital has become one of the influential institutional crypto platforms in the regulated digital asset ecosystem. As the first federally chartered crypto bank in the U.S., it combines custody, staking, settlement, trading, and stablecoin issuance under one regulated infrastructure. Institutions, from asset managers to corporations, increasingly leverage Anchorage’s services to integrate digital assets into traditional finance workflows.

In real-world practice, firms use Anchorage for secure crypto custody across global markets and to operate cross‑border Bitcoin treasury strategies with regulated settlement rails. Explore this article to understand the latest Anchorage Digital statistics and what they signal about the future of institutional digital assets.

Editor’s Choice

- Anchorage Digital was founded in 2017 and has rapidly scaled its institutional crypto infrastructure.

- It is home to the first federally chartered crypto bank in the United States.

- Anchorage Digital has custody of tens of billions of dollars in digital assets for global clients.

- The platform supports custody, staking, settlement, trading, governance, and stablecoin issuance.

- Anchorage’s Series D round in 2021 valued the company at over $3 billion.

- Anchorage is targeting a $200 million to $400 million funding round ahead of a potential 2026 IPO.

- The bank operates under the Office of the Comptroller of the Currency (OCC) and adheres to federal regulatory standards.

Recent Developments

- Anchorage Digital seeks $200 million–$400 million in funding ahead of a potential 2026 IPO.

- Plans to double stablecoin team size in 2026 to meet surging demand.

- Acquired Securitize For Advisors in late 2025 to strengthen the wealth management platform.

- Partnered with OSL as issuer for USDGO stablecoin launching early 2026.

- Advances USAT stablecoin development with Tether targeting the U.S. market.

- Leads regulated stablecoin issuance following the GENIUS Act passage.

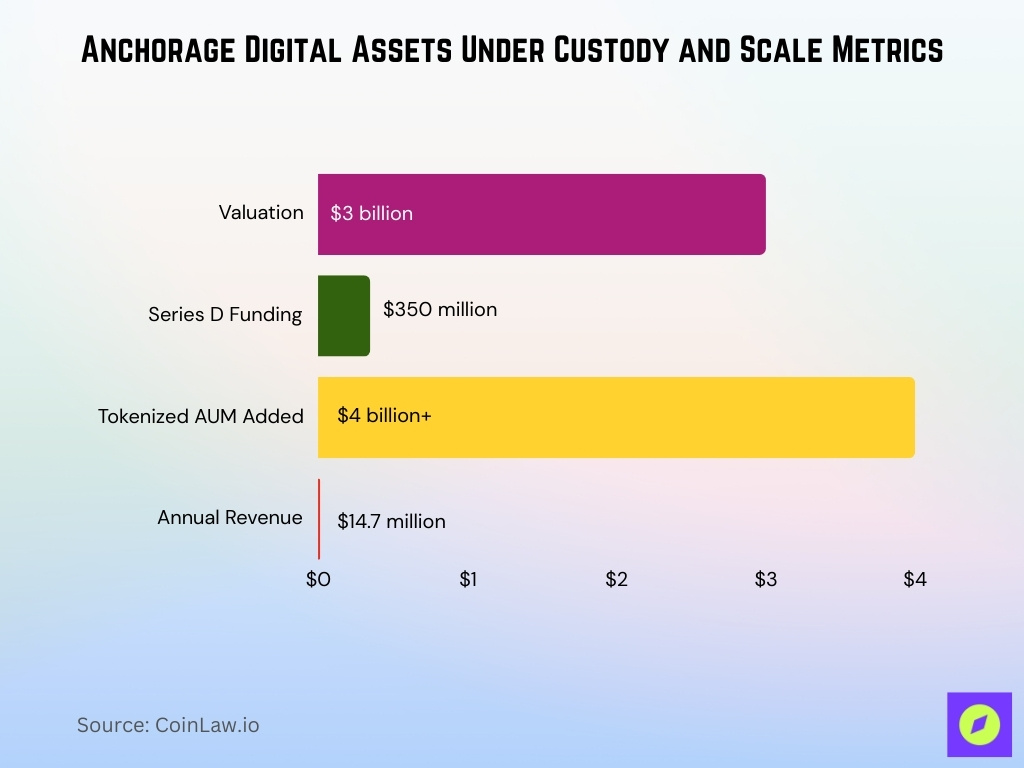

Assets Under Custody (AUC)

- Secures tens of billions in digital assets under custody for institutions.

- Valuation exceeds $3 billion from the $350 million Series D round.

- Processes 90% of transactions under 20 minutes.

- The custody market is expected to grow 150% by 2026.

- Securitize acquisition adds $4 billion+ tokenized AUM.

- Revenue reaches $14.7 million annually, supporting AUC operations.

Anchorage Digital Key Facts and Highlights

- Serves clients across 30+ countries worldwide.

- Operates 5 offices in San Francisco, New York, Singapore, Porto, and Sioux Falls.

- Series D valuation exceeds $3 billion.

- Secures tens of billions in digital assets under custody.

- Employs 501-1000 staff globally.

- Added support for 18 new assets recently, including USDT and USDC.

- Holds SOC 1 and SOC 2 Type II certifications for compliance.

- Singapore entity licensed as a Major Payment Institution by MAS.

- New York branch maintains a BitLicense from NYDFS.

User and Client Statistics

- Serves clients in 30+ countries, including asset managers, hedge funds, and VCs.

- Custodies digital assets worth tens of billions for institutional clients.

- Supports staking on 20+ networks like Ethereum, Solana, Aptos, and Sui.

- Series D valuation surpasses $3 billion from 2021 funding.

- Revenue is estimated at $14.7 million annually.

- Approximately 501–1000 employees support institutional operations.

- Seeking $200 million–$400 million funding for client expansion

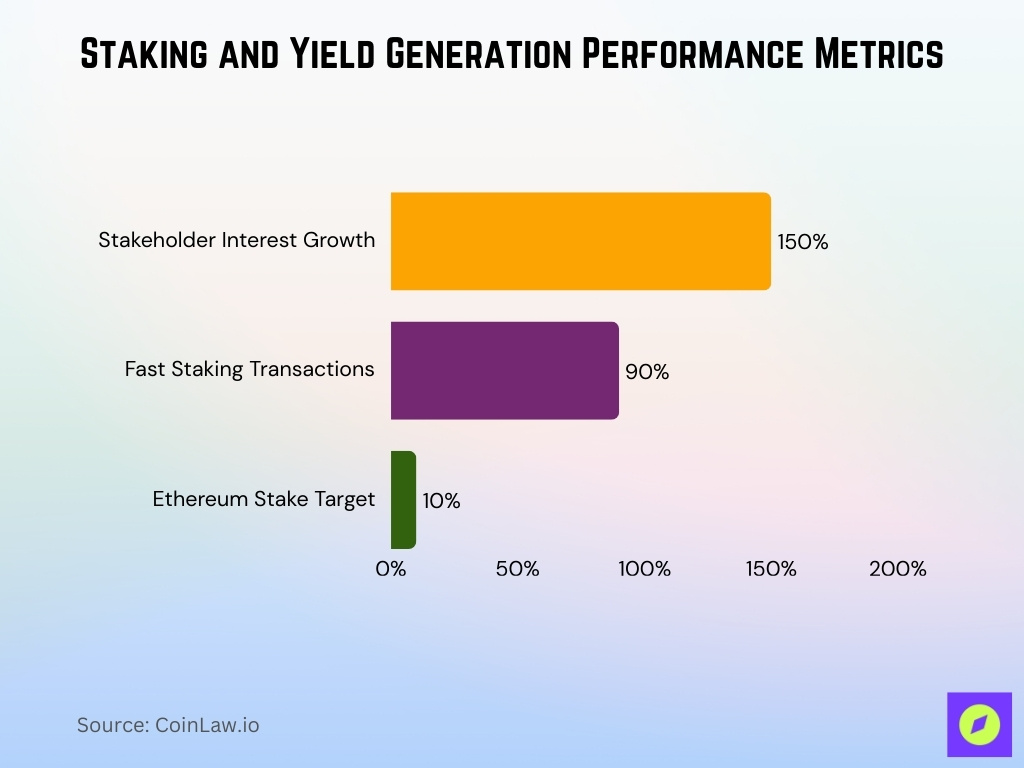

Staking and Yield Generation

- Corporate stakeholder interest grows 150% amid yield strategies.

- 90% transactions are processed under 20 minutes for staking ops.

- Targets 10% Ethereum network stake via treasury strategies.

- Supports staking on 20+ networks, including Ethereum, Solana, and Starknet.

- Enables non-custodial staking with slashing insurance for institutions.

- SharpLink holds $200 million+ ETH generating staking yields.

- SharpLink added $1.4 million in shareholder value from staking weekly.

- Launched HYPE staking support on the HyperCORE network.

- Integrates restaking for ETH via ether.fi LRT on Linea.

Trading, Settlement, and Transaction Volume

- Supports trading 90+ crypto assets via API, web, and 24/7 desk.

- Offers 13 order types, including algorithmic for large trades.

- Atlas enables 2-step settlement fund acceptance across chains.

- 90% custody transactions post on-chain under 25 minutes.

- Flat agency fee structure for all trading volumes.

- Multi-venue liquidity from single onboarding.

- Valuation over $3 billion from Series D supporting volumes.

- Processes tens of billions of AUC transactions efficiently.

- Integrates Modern Treasury for automated USD rails.

Stablecoin Issuance and Reserves

- No $10 billion issuance cap due to federal charter.

- Plans to double stablecoin team size to 2x in 2026.

- US Bank custodies reserves with $686 billion in total assets.

- USDGO launches Q1 2026 backed 1:1 by USD/Treasuries.

- Issues a USAT stablecoin with Tether for the U.S. market.

- Reserves are backed 1:1 by high-quality liquid assets daily.

- Supports issuance on 45+ networks, EVM/Solana/Cosmos.

- Series D valuation over $3 billion backing stablecoin ops.

- GENIUS Act enables compliant issuance since July 2025.

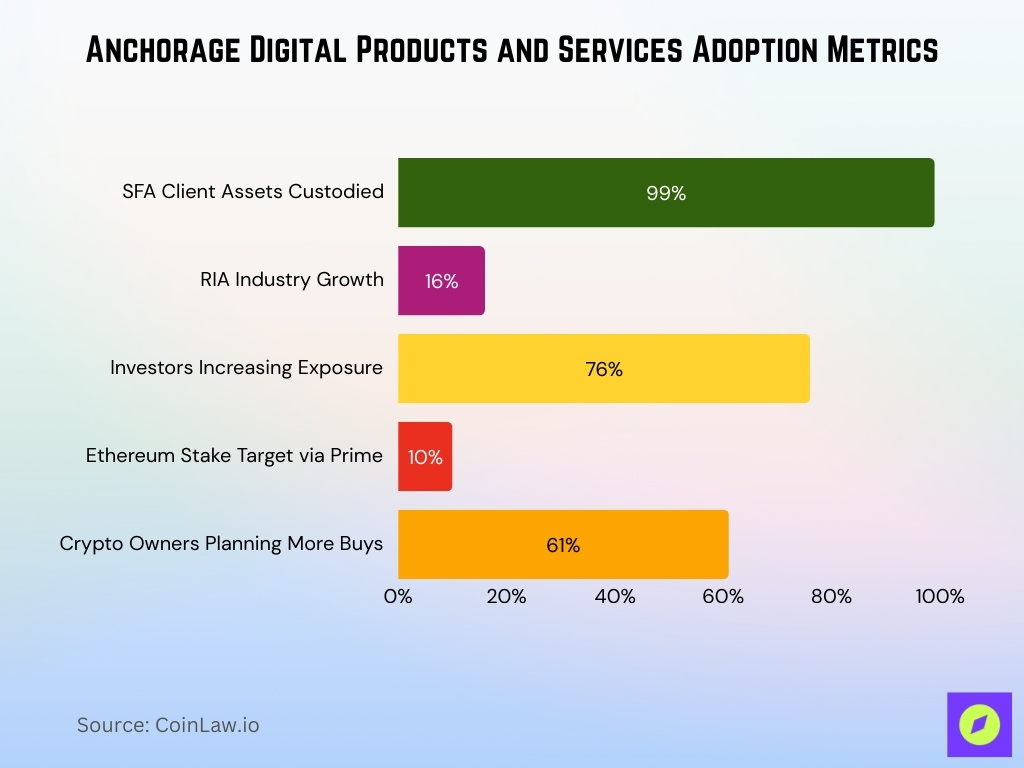

Products and Services Adoption

- Securitize For Advisors achieved 4,500% growth in net new deposits/AUM over 12 months.

- 99% SFA client assets custodied at Anchorage Digital.

- RIA industry expanded 16% outpaced by SFA growth.

- 76% global investors plan increased digital asset exposure.

- Custodies over $50 billion of client assets.

- Targets 10% Ethereum network stake via Prime.

- 61% crypto owners plan more acquisitions.

- Added Mezo support, unlocking BTC rewards for institutions.

- Prime integrates trading, custody, and staking for institutions.

Regulatory and Compliance Statistics

- First federally chartered crypto bank since 2021 by the OCC.

- Consent order lifted after 1,681 days in August 2025.

- Holds SOC 1 Type II and SOC 2 Type II certifications, annually audited.

- Major Payment Institution license from MAS in Singapore.

- Invested tens of millions in compliance infrastructure.

- Uses TRM Labs for 100% transaction monitoring.

- Compliant with BSA/AML/OFAC under federal oversight.

- Audited routinely by Ernst & Young for SOC reports.

Jurisdictions, Licenses, and Oversight

- MAS Major Payment Institution license in Singapore.

- BitLicense from NYDFS for New York operations.

- Serves clients in 30+ countries under a unified framework.

- SOC 1 Type II and SOC 2 Type II audited by E&Y.

- Consent order resolved after 1,681 days in 2025.

- 100% transaction monitoring via TRM Labs.

- Compliant with BSA/AML/OFAC standards federally.

- Supports 5 offices across the U.S., Singapore, and Portugal.

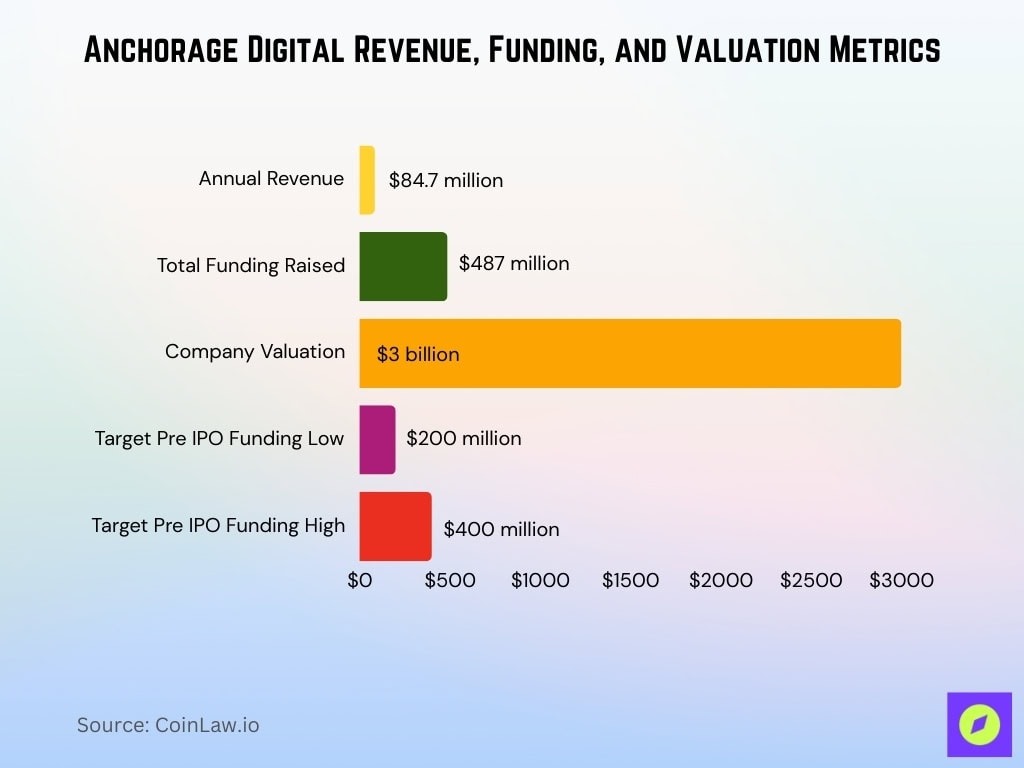

Revenue and Income

- Generated $84.7 million in revenue in 2025 from institutional services.

- Revenue per employee is $342,900 in productivity.

- Raised $487 million in total funding with a $3 billion valuation.

- Seeking $200 million–$400 million funding ahead of IPO.

- 501-1000 employees globally driving growth.

- Stablecoin team expansion supports revenue diversification.

Risk Management and Governance

- Zero hacks or breaches since inception in 2017.

- 100% transaction monitoring with TRM Labs for risk.

- Uses biometric voice/video and behavioral analytics.

- Employs hardware security modules (HSMs) for keys.

- Quorum validation with elastic size for approvals.

- Bankruptcy-remote client asset segregation.

- Custom multi-factor authentication with anomaly detection.

- SOC 1/2 Type II audited annually by Ernst & Young.

- Tens of millions invested in compliance/risk.

Technology and Platform Performance

- Supports hundreds of assets across EVM, Solana, and Cosmos ecosystems.

- Added 19 new assets recently, including Mantle ETH variants.

- 90% transactions are processed under 20 minutes.

- Atlas settlement achieves 2-step cross-chain efficiency.

- Uses air-gapped HSMs for key storage.

- Biometric authentication verifies intent securely.

- Integrates institutional APIs for seamless ops.

- Real-time dashboards for asset/compliance metrics.

- Prime Suite enables 13 order types for trading.

Valuation and Fundraising Statistics

- Series D valuation exceeds $3 billion from a $350 million raise.

- Seeking $200 million–$400 million funding pre-IPO.

- Total funding raised $487 million across 8 rounds.

- $350 million Series D in November 2021.

- $40 million Series B led by Blockchain Capital.

- Valuation growth 10x since 2021 Series D.

- 91 investors, including Visa and Goldman Sachs.

- Revenue supports a $167.7 million annual estimate.

Frequently Asked Questions (FAQs)

Anchorage Digital is targeting between $200 million and $400 million in new funding.

The platform supports deployment on over 45 different blockchain networks.

State‑chartered issuers face a $10 billion cap on stablecoin issuance, while Anchorage Digital Bank has no federal issuance cap.

Anchorage Digital Bank selected U.S. Bank, which manages about $686 billion in assets, to custody stablecoin reserves.

Conclusion

Anchorage Digital’s statistics depict a platform advancing quickly across security, governance, adoption, and financial performance. Its position as the first federally chartered crypto bank provides a regulatory foundation that supports institutional confidence and growth. With rising revenues, expanding product adoption, and ongoing fundraising aimed at a potential public listing, Anchorage is shaping the next wave of regulated digital asset infrastructure. These figures illuminate not just where Anchorage stands today, but where institutional crypto may be headed in the years ahead.