Altcoins are reshaping the cryptocurrency landscape, offering investors a diverse set of digital assets beyond Bitcoin. From decentralized finance (DeFi) to cross-border remittances and AI integrations, altcoins are powering real-world applications with significant economic impact.

For example, Ethereum is enabling entire ecosystems of smart contracts, while Remittix is targeting international money transfers across fiat corridors. As altcoins gain momentum today, the numbers tell a powerful story. Let’s explore the key statistics driving the altcoin market this year.

Editor’s Choice

- There are currently over 17,651 cryptocurrencies listed globally, with the majority classified as altcoins.

- As of Q3 2025, estimates from various aggregators suggest altcoins may collectively account for a market cap in the range of $1.5–$1.7 trillion, depending on classification.

- Ethereum ETF inflows reportedly crossed $4 billion in Q3 2025, according to crypto fund tracking data, though full validation from official SEC reports remains pending.

- Bitcoin dominance dropped from 65% to 59%, suggesting capital rotation into altcoins.

- The Altcoin Season Index, a metric by Blockchain Center, showed a value of 68% in late August 2025, signaling potential but not definitive altcoin momentum.

- Daily trading volume across altcoins exceeds $44 billion, indicating robust liquidity.

- As of September 2025, Ethereum is the primary altcoin with confirmed SEC-approved ETFs; while other tokens like Solana and XRP are under review, no record confirms 92 altcoin ETF approvals.

Recent Developments

- Some market analysts have set speculative targets for Ethereum as high as $7,000 in Q4 2025, though this is subject to macroeconomic and ETF-related variables.

- Solana broke above $200, driven by Shopify integration and strong DeFi traction.

- Meme-layer tokens like Little Pepe and Layer Brett are gaining popularity with high staking rewards.

- AVAX reported spikes in volume, with some sources estimating daily transactions peaking around $20.9 billion in August 2025, likely including DEX and bridge activity.

- Ethereum leads in futures open interest and spot trading among altcoins.

- Cardano is leading sustainable blockchain adoption, especially in Africa.

- Ethereum ETFs have opened institutional pathways for broader altcoin exposure.

- XRP, DOGE, and SUI are among the tokens expected to launch ETF products next.

- MAGACOIN Finance is drawing attention as a hybrid meme-utility asset with institutional features.

- Institutional altcoin inflows increased after the Fed’s dovish stance in mid-2025.

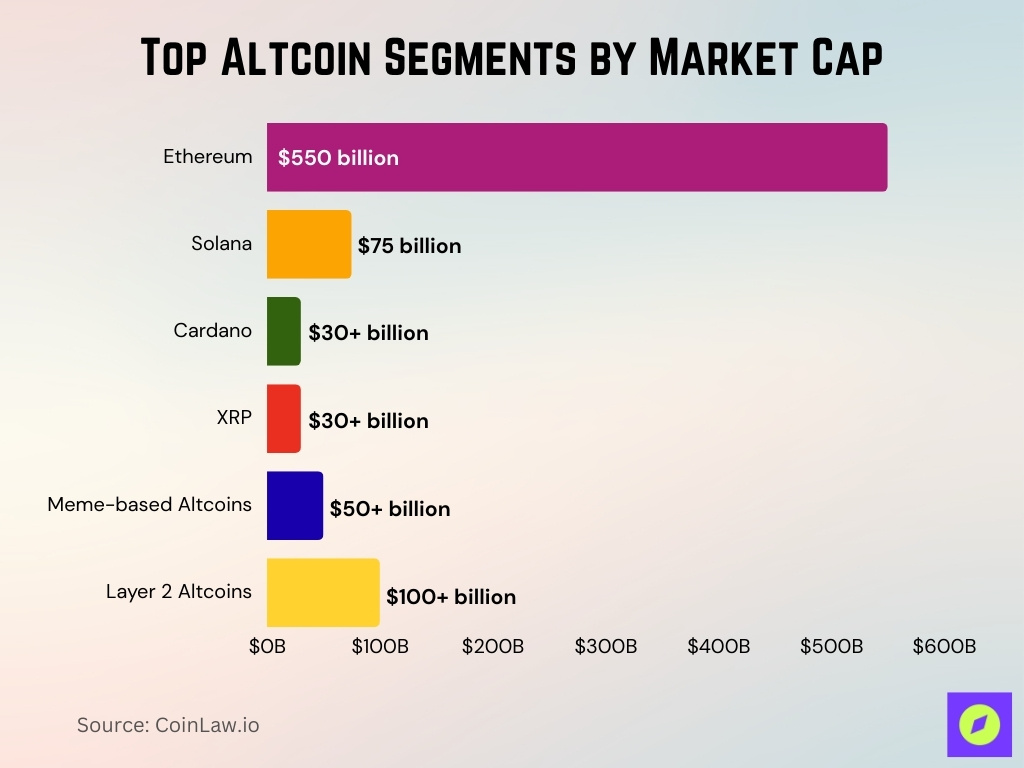

Altcoin Market Capitalization

- As of mid-Q3 2025, Ethereum’s market cap hovered around $550 billion, fluctuating with ETF news and overall market sentiment.

- Solana’s market cap surged to over $75 billion, following NFT and DeFi growth.

- Cardano and XRP maintain market caps above $30 billion, despite recent volatility.

- Meme-based altcoins have captured over $50 billion in total cap.

- Layer 2 altcoins collectively hold a market cap exceeding $100 billion.

- Altcoins have a combined market cap of approximately $1.5–$1.7 trillion as of Q3 2025.

- Institutional entry into altcoin ETFs has boosted the total valuation across the top 50 coins.

- Real-world utility coins, such as Remittix, are rapidly increasing their market presence.

Overview of Altcoin Statistics

- Altcoins represent approximately 44% of the total crypto market cap, reflecting rising adoption.

- Over 17,000+ altcoins exist, though fewer than 1,000 have meaningful use cases or active communities.

- Ethereum continues to dominate altcoin infrastructure with over 3,000 dApps.

- The DeFi sector is largely powered by altcoins such as ETH, SOL, ADA, and AVAX.

- Altcoins like SUI and Chainlink show rising real-world integration and institutional acceptance.

- Meme coins have transitioned from novelty to sector influencers, with tokens like Dogecoin influencing ETF demand.

- Altcoin ETFs and structured products are entering mainstream investment platforms.

- Layer 2 scaling solutions are driving transaction growth in altcoins.

Number of Altcoins Available

- There are currently 17,651 altcoins in circulation across global markets.

- Over 900 altcoins are listed on centralized exchanges with meaningful volume.

- More than 1,200 altcoins are native to Ethereum via ERC-20 tokens.

- 80% of new coins launched in 2025 are categorized as altcoins.

- Meme-based altcoins now account for 6% of the total crypto supply by number.

- AI-integrated altcoins and gaming tokens represent the fastest-growing subcategories.

- Layer 2 altcoins are increasingly launched for ecosystem-specific scaling.

- Stablecoin variants exist across dozens of altcoin ecosystems.

- Altcoins are being launched at a rate of ~50 per week, though most have limited longevity.

- Forks of Bitcoin or Ethereum account for over 40% of current altcoins.

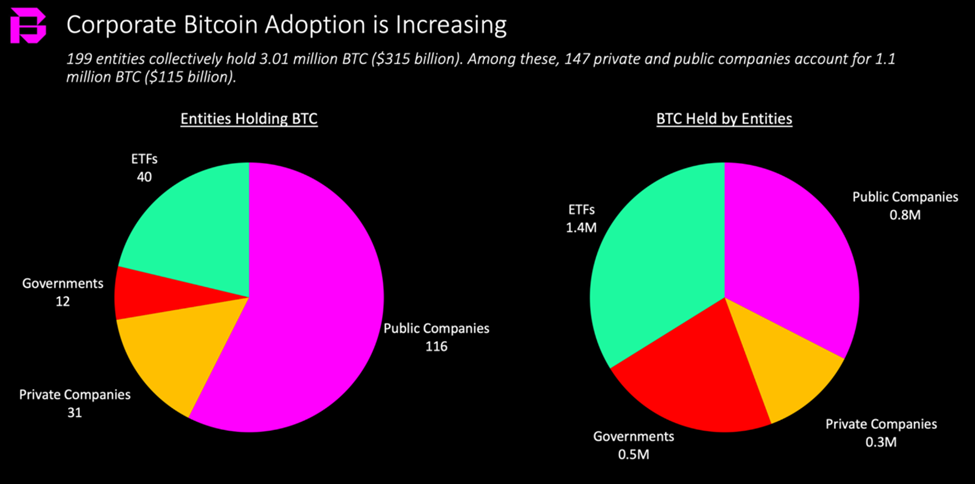

Corporate Bitcoin Adoption

- 199 entities collectively hold 3.01 million BTC, valued at approximately $315 billion.

- 147 private and public companies alone account for 1.1 million BTC or $115 billion in value.

- Public companies lead with 116 holders, controlling around 0.8 million BTC.

- Private companies hold 0.3 million BTC across 31 entities, contributing to the corporate demand surge.

- Governments own 0.5 million BTC across 12 nations, indicating rising sovereign adoption.

- ETFs dominate with 1.4 million BTC, held by 40 entities, reflecting institutional confidence.

- The ETF segment alone now holds nearly 47% of all BTC tracked in this corporate breakdown.

Global Altcoin User Base

- UAE leads globally with 2.9 million crypto owners, contributing significantly to altcoin adoption.

- Roughly 17% of U.S. adults have invested in, traded, or used cryptocurrency.

- Globally, over 4.2 million people are estimated to use cryptocurrencies, with altcoins forming a large share.

- In August, Solana reported 21.82 million active addresses, indicating robust network usage.

- Avalanche (AVAX) processed $20.9 billion in daily transaction volume in August 2025.

- Ethereum saw $4 billion in net ETF inflows in Q3 2025, reflecting growing institutional user interest.

- DOGE whale holdings rose to 31% of total supply, signaling concentrated user activity.

Trading Volume

- The daily global trading volume in 2025 exceeds $144 billion, with altcoins accounting for a substantial portion.

- In Q1 2025, volume dropped 27.3% quarter on quarter to approximately $146 billion.

- Spot market data shows 17,651 cryptocurrencies traded across 1,360 exchanges.

- AVAX’s daily trading surged due to infrastructure upgrades like Octane and Etna.

- Monthly trading volumes on top exchanges surged, with wide variation in altcoin liquidity.

- ETF-related inflows into Ethereum also boosted altcoin trading.

- Meme coins like Little Pepe and Bonk captured speculative volume, supported by presale communities.

Market Growth Rate

- The global crypto market cap climbed 14.3% year on year, reaching over $3.9 trillion by mid‑2025.

- After peaking in January 2025, the cap fell 18.6% in Q1, before recovering.

- Bitcoin dominance dropped from 65% to 59% by August.

- AVAX’s 203% quarter-over-quarter rise in daily transactions reflects explosive growth.

- Solana’s DeFi ecosystem expanded, with TVL rising 30% in Q2 2025.

- Institutional altcoin interest rose sharply, with $4B flowing into ETH ETFs in Q3.

- Post‑halving liquidity injections of $200 million in August fueled altcoin rotation.

- Analysts expect growth to accelerate toward Q4, mirroring previous bull runs.

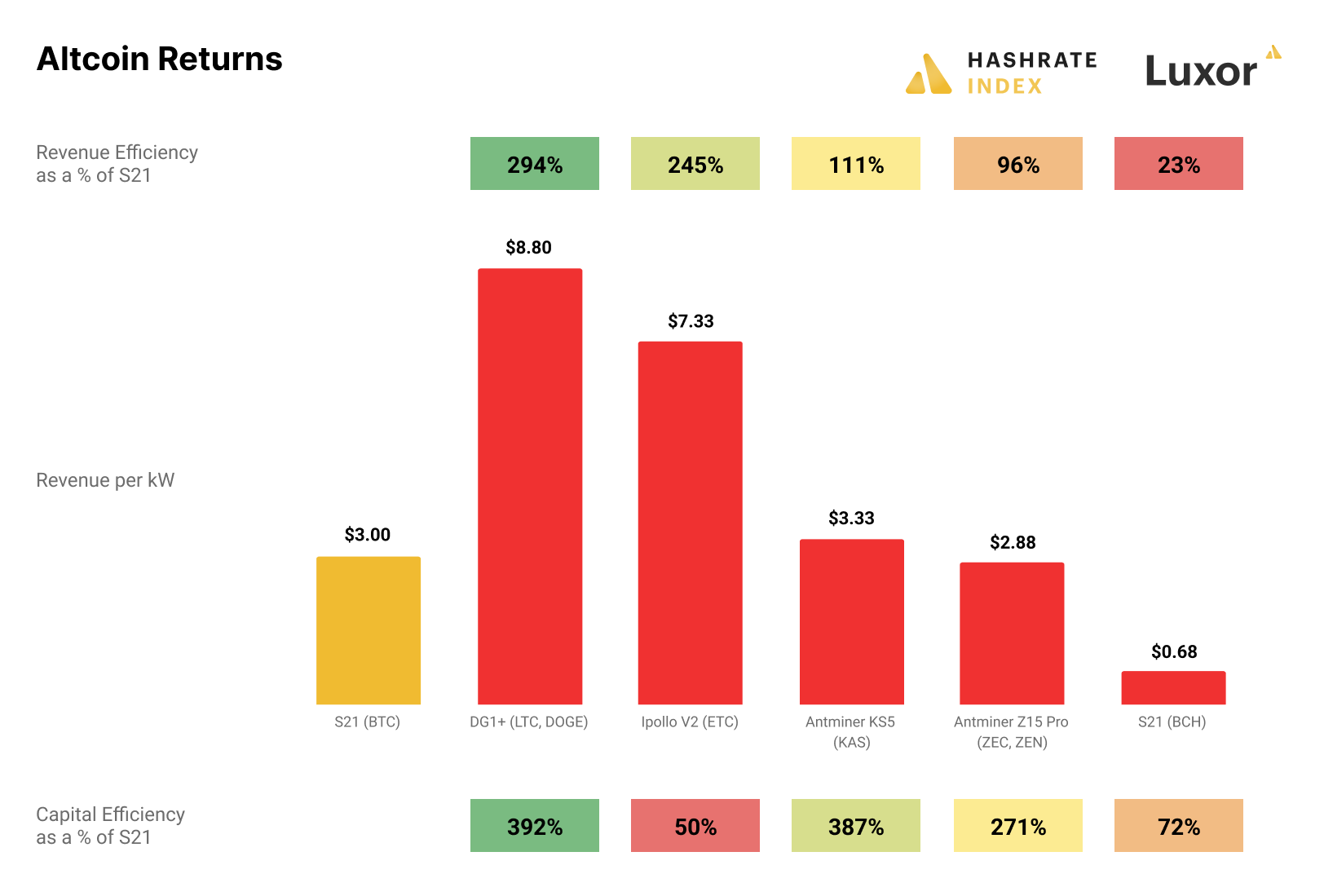

Mining Returns and Efficiency

- DG1+ (LTC, DOGE) delivers the highest revenue per kW at $8.80, with a 294% revenue efficiency and 392% capital efficiency compared to S21 (BTC).

- Ipollo V2 (ETC) follows closely with $7.33 per kW, showing 245% revenue efficiency but only 50% capital efficiency, signaling high output but lower hardware ROI.

- Antminer KS5 (KAS) offers $3.33 per kW, yielding 111% revenue efficiency and an impressive 387% capital efficiency.

- S21 (BTC) stands as the baseline, earning $3.00 per kW with 100% efficiency in both revenue and capital.

- Antminer Z15 Pro (ZEC, ZEN) earns $2.88 per kW, reflecting 96% revenue efficiency and 271% capital efficiency.

- S21 (BCH) significantly underperforms with just $0.68 per kW, providing only 23% revenue efficiency and 72% capital efficiency.

Altcoin Season Index

- The Altcoin Season Index hovered in the low 40s, indicating early momentum.

- Historical data shows altcoin surges often follow Bitcoin dips below 60% dominance.

- A dip toward 55–56% BTC dominance may trigger a broader altcoin rally.

- Despite ETF-driven inflows and macro tailwinds, the index remains cautious.

- Bitcoin’s dominance declined from 65% to 59% setting the stage for altcoin rotation.

- More tokens with limited fresh capital continue to suppress a full breakout.

- Institutional and macro shifts suggest an altcoin season may be imminent.

Historical Altcoin Bull Runs

- Altcoin rallies followed Bitcoin dominance dips in 2017 and 2021, a pattern repeating now.

- August 2025 mimics past setups with BTC dominance under 60%.

- $300B net new capital exists despite more tokens in circulation.

- Post-halving decks (April 2024) historically precede altcoin runs.

- Institutional inflows contrast with past retail-led booms.

- Sector narratives now fuel rallies, from DeFi to AI integrations.

- Forecasts project altcoin phases emerging in Q4 2025.

Altcoin Dominance

- Altcoins claimed about 43–44% of the total market cap as of mid‑2025.

- Bitcoin dominance dropped from 65% in May to 59% in August.

- Ethereum holds ~14% of the total market cap.

- XRP and Binance Coin appear among the top-cap altcoins.

- Solana and Cardano remain high-cap players.

- New altcoins like Remittix are gaining traction.

- Meme and utility tokens are carving market share.

- Altcoin dominance may increase further if BTC stays under pressure.

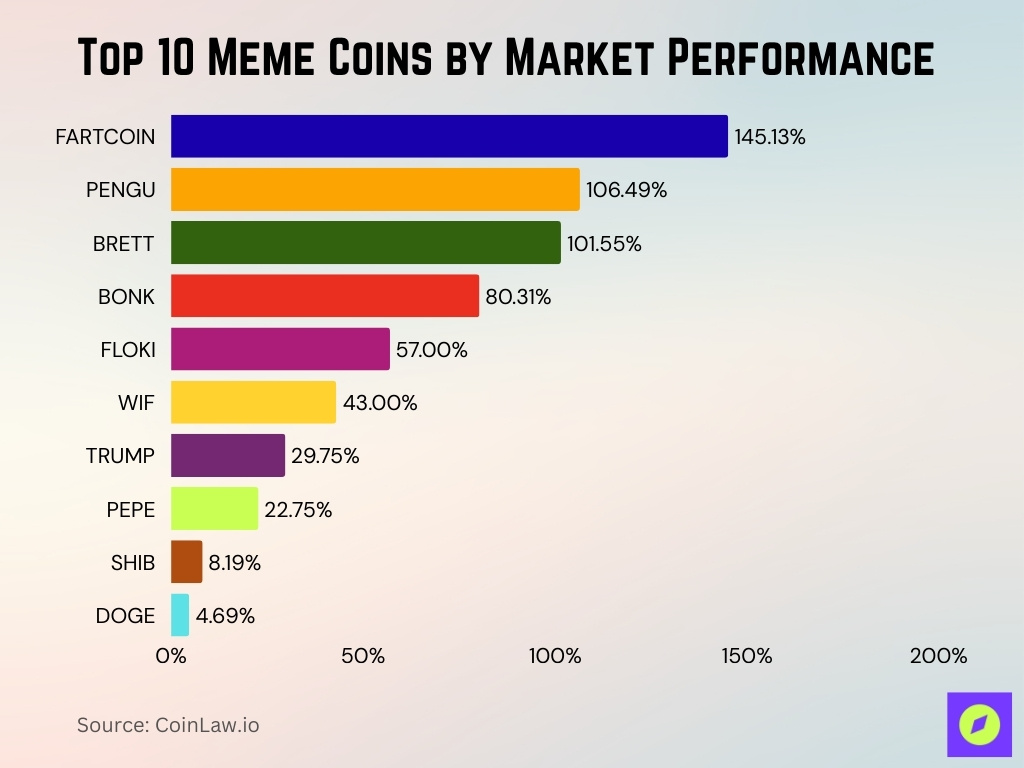

Top 10 Meme Coins by Market Performance

- FARTCOIN leads the meme coin surge with a remarkable +145.13% performance.

- PENGU follows closely, posting a +106.49% gain in market value.

- BRETT secures third place with a strong +101.55% return.

- BONK records an impressive growth of +80.31%, riding community hype and ecosystem expansion.

- FLOKI gains +57%, maintaining its position as a top-tier meme project.

- WIF shows steady momentum with a +43% performance year-to-date.

- TRUMP delivers +29.75% gains, driven by political meme momentum.

- PEPE grows +22.75%, staying relevant among newer meme tokens.

- SHIB rises modestly by +8.19%, reflecting its maturing ecosystem.

- DOGE, the original meme coin, posts a modest +4.69% increase despite broader market shifts.

Altcoin vs. Bitcoin Performance

- In 2025, Bitcoin gained over 100% year on year.

- Ethereum ETFs saw $4 billion in inflows, raising ETH’s institutional profile.

- While Ethereum experienced a modest drawdown in Q3 2025, the claim of a 510% gain for Remittix remains unverified due to a lack of public trading data or exchange listings.

- Solana and Cardano show resilience in infrastructure development.

- Meme coins gained attention, outperforming BTC in speculative returns.

- Staking yields and ETF access offer macro drivers less accessible to BTC.

- Altcoins are competing strongly in both utility and returns.

Price Breakouts

- Ethereum (ETH) is projected to reach $7,000 by Q4 2025.

- Solana (SOL) recently broke above $200.

- Little Pepe (LILPEPE) is priced at $0.0012–$0.0016.

- SUI, priced near $4, has breakout potential toward $10.

- Layer Brett offers APYs up to 55,000%, indicating breakout appeal.

- Claims of 8,000% returns for Remittix are unverified and highly speculative, with no institutional coverage or transparent market data to support such projections.

- XRP and XLM show recent strength during BTC pullbacks.

- Chainlink’s price as of August 2025 was near $23.92. While some speculative forecasts suggest targets of $60+, these are not grounded in consensus among institutional analysts.

Sector Trends

- DeFi, gaming, and AI sectors are driving altcoin adoption.

- Institutional demand climbs with regulatory clarity.

- Ethereum leads in futures open interest and spot trading.

- TRON expands through MetaMask and Beacon Network.

- MAGACOIN FINANCE draws attention as a hybrid utility token.

- Cardano shows strong growth potential, notably in Africa.

- Memes with utility are gaining traction.

Regional Adoption of Altcoins

- Cardano leads adoption in Africa.

- Altcoins are used in high-inflation regions with weak fiat.

- Remittix supports cross-border corridors across 30+ countries.

- TRON’s MetaMask integration broadens access.

- Africa’s eco-conscious uptake supports ADA.

- Memecoins contribute to regional adoption among youth.

Exchange Statistics

- Daily spot altcoin volumes surged to $44 billion.

- Over 17,000 cryptocurrencies are traded across 1,300+ exchanges.

- ETH has liquidity near $20M, and XRP set depth records.

- Exchanges prepare for altcoin ETFs like Solana, DOGE, and SUI.

- DEX usage climbs, driven by DeFi and NFTs.

- Exchange inflows show rising altcoin interest.

Transaction Statistics

- Ethereum gas usage remains high.

- Layer-2 and Meme-L2 token staking is expanding.

- Remittix supports crypto-to-bank across 30+ fiat currencies.

- Solana and Cardano report increases in swaps and gaming transactions.

- Chainlink and SUI show growing on-chain usage.

Project Failure Rates

- Over 50% of Bitcoin-forked projects show minimal development or inactive repositories, indicating potential stagnation.

- Around 31% of forks mimic Bitcoin with no differentiation.

- Security fixes reach many altcoins months late.

- A notable share of altcoin projects show delayed vulnerability patches, especially among low-volume or unaudited tokens, though exact percentages are unconfirmed.

- Inactive or abandoned clones are common.

- Memecoin presales carry a high failure risk.

Correlation Between Bitcoin and Altcoins

- Altcoin Season Index is at 68% (as of Aug 30, 2025).

- Q2 index dropped to 21/100, confirming BTC-led quarter.

- ETH/BTC ratio near 0.058 aligns with alt rallies.

- Capital rotation follows macro easing and ETF inflows.

- Institutional interest lowers correlation.

- BTC stabilization often precedes altcoin rallies.

Conclusion

Breakouts across Ethereum, Solana, and emerging altcoin narratives signal growing market momentum. Institutional demand, paired with regulatory clarity, supports sustained growth across altcoin sectors, from DeFi and gaming to cross-border payments. Regional trends and expanding exchange liquidity further underscore altcoins’ evolving market depth.

Yet, high failure risk among clones and speculative presales calls for careful risk management. As the Altcoin Season Index nears breakout levels, investor attention must balance opportunity with caution. Track fundamentals, monitor order book strength, and stay sensitive to shifts in Bitcoin dominance to navigate this cycle effectively.