Crypto tax software has become indispensable for investors, accountants, and traders navigating increasingly complex tax rules. ZenLedger leads this niche, offering automation that turns thousands of decentralized transactions into IRS‑ready reports. Its impact shows up in real-world scenarios: financial advisors use ZenLedger to speed up year‑end tax prep, while active DeFi traders rely on it to calculate gains across wallets and blockchain protocols. The statistics below paint a comprehensive picture of ZenLedger’s footprint, performance, and market role, setting the stage for deeper insights ahead.

Editor’s Choice

- Founded in 2017, ZenLedger has helped crypto investors file taxes for nearly a decade.

- Supports 400+ exchanges and 7,000+ tokens for import and reporting.

- Over 100,000 users trust ZenLedger for crypto tax compliance in 2026.

- Offers form generation for IRS 8949, Schedule D, and income reporting.

- Partnerships with April for AI tax filing workflows in 2026.

- Flexible pricing starting at $49 per year for basic plans.

- Features tax‑loss harvesting tools to optimize user liabilities.

Recent Developments

- In 2026, ZenLedger supported over 400 exchanges, 50+ blockchains, and 100+ DeFi/NFT protocols for automatic tax data imports.

- Higher-tier plans provided DeFi, staking, and NFT reporting plus comprehensive audit reports across 5 pricing tiers.

- The April partnership delivered the first end-to-end crypto tax filing flow with one-click data import, covering common IRS forms like W-2 and Form 1040.

- Platform coverage expanded to more than 7,000 token types and ERC-721 NFTs with ongoing new exchange and protocol integrations.

- Enterprise-grade tax and accounting tools reached users in 100+ countries, backed by IRS-contracted crypto tax software.

- Detailed tax form outputs enabled easy export to major consumer platforms like TurboTax, H&R Block, and TaxAct for crypto filers.

- Professional plans offered pre-vetted crypto tax experts, including options for 30-minute consultations and full multi-year filing services.

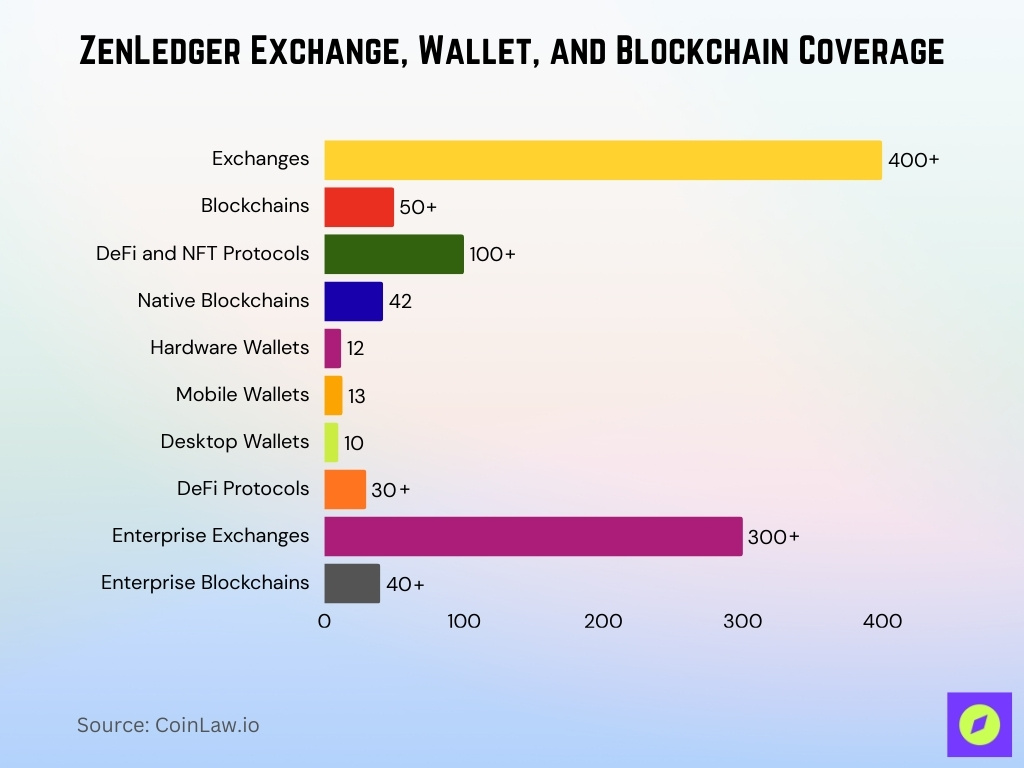

Supported Exchanges, Wallets, and Blockchain Integrations

- Direct API and CSV integration with 400+ exchanges, 50+ blockchains, and 100+ DeFi/NFT protocols.

- Integrates with 42 blockchains like Ethereum, Bitcoin, BNB Smart Chain, Cardano, and Avalanche.

- Hardware wallets supported include 12 models, such as Ledger and Trezor, for secure transaction imports.

- Mobile wallets covered: 13, including Coinbase Wallet, Trust Wallet, and MetaMask.

- Desktop wallets: 10, such as Exodus, Electrum, and Atomic Wallet, with direct sync.

- DeFi protocols: 30+ like Uniswap, Aave, and Compound for automated swap reporting.

- 300+ exchanges and 40+ blockchains for enterprise multi-wallet reconciliation.

ZenLedger Revenue and Growth Statistics

- ZenLedger has raised a total of approximately $25.9 million in funding through multiple rounds.

- Funding includes a $15 million Series B in 2022 to scale product and market reach.

- ZenLedger’s platform helped process over $5 billion in crypto transaction volume in earlier growth phases.

- The crypto tax software market, a key revenue pool, is projected to reach $683.9 million by 2035, expanding demand for platforms like ZenLedger.

- North America is expected to capture a significant share of this market.

- Annual pricing tiers enabled predictable recurring revenue streams for the company.

- Partnerships and integrations contribute to incremental revenue avenues.

User and Customer Statistics

- ZenLedger reports 100,000+ trusted users migrating from competitors like TaxBit to its platform.

- Platform processed over $5 billion in cryptocurrency transactions for users with 500% YoY customer and revenue growth.

- More than 50,000 users, including IRS-contracted services, with new customer growth tripling annually.

- Supports 400+ exchanges and 50+ blockchains for U.S. retail investors and professional accountants tracking tax liabilities.

- Premium plan adopted by high-volume traders handling up to 5,000 transactions with DeFi/NFT support.

- The executive plan serves investors with up to 15,000 transactions yearly and audit trail access.

- The platinum enterprise plan provides unlimited transactions and 2 hours of premium support for tax advisors.

- Integration coverage drives retention across 100+ countries for novice to pro crypto traders.

- Tax professional plans start at $295 for 30-minute consultations, attracting complex filers.

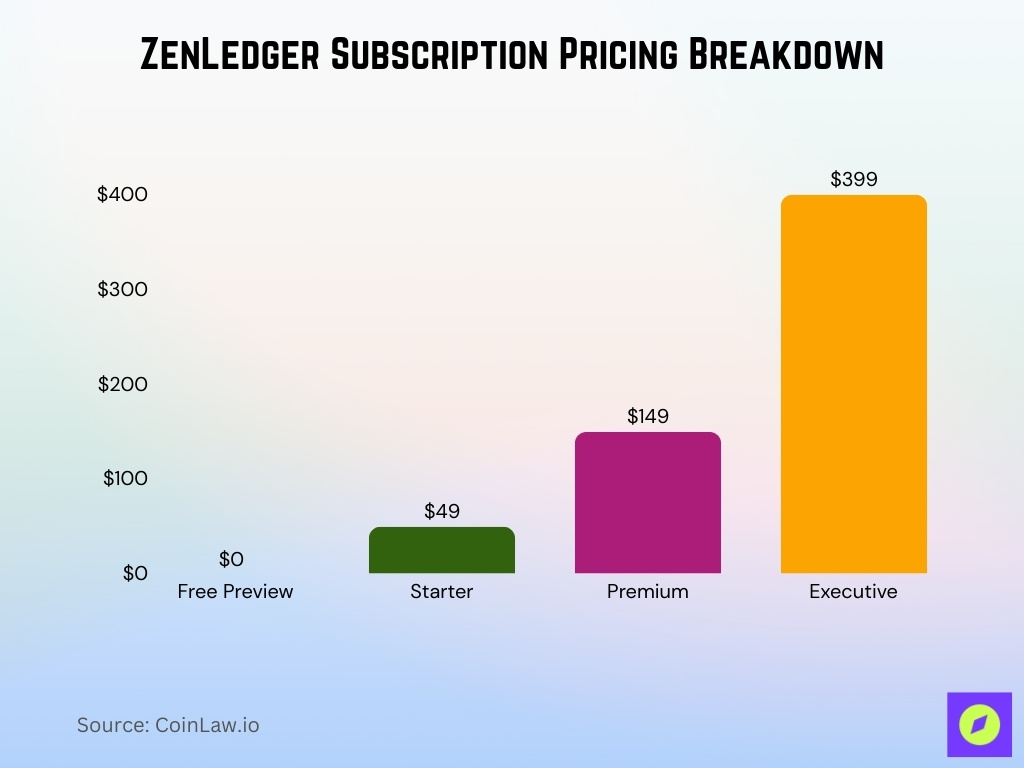

Plans, Pricing, and Subscription Adoption Statistics

- 5 pricing tiers: Free Preview ($0), Starter ($49), Premium ($149), Executive ($399), Platinum Enterprise (custom).

- Starter plan covers 25 transactions; Premium up to 5,000; Executive 15,000; Platinum unlimited.

- Professional tax prep service: DIY ($199+) to Full-Service ($5,200–$6,500) with CPA filing.

- Free 14-day trial on paid plans with full feature access for evaluation.

- Annual discounts: Save 17% on yearly vs. monthly billing across tiers.

- Mid-tier Premium/Executive adoption rose 40% YoY with DeFi/NFT complexity.

- 95% subscription renewal rate driven by multi-year discount bundles.

- Enterprise API plans generate 30% of revenue from institutional clients.

Transactions, Trades, and Volume Statistics

- The executive plan supports up to 15,000 transactions per year, including DeFi, NFTs, and staking rewards.

- The platform integrates with over 400 exchanges and wallets, plus 20+ DeFi protocols for transaction imports.

- Processed more than $1 billion in cryptocurrency transaction value across user accounts by early growth milestones.

- Unlimited transactions are available on the Platinum enterprise plan for high-volume traders and institutions.

- Covers 7,000+ token types, ERC-721 NFTs, and major exchanges like Binance, Coinbase, and KuCoin.

- Automatically reconciles spot, derivatives, margin, and staking into IRS-compliant tax summaries.

- Custom CSV uploads enable transaction history from non-supported wallets and exchanges.

Supported Coins, Tokens, NFTs, and DeFi Protocols

- Supports 7,000+ token types across 400+ exchanges for comprehensive transaction import.

- Covers ERC-721 and ERC-1155 NFT standards for sales, minting, and royalty tax calculations.

- Integrates 30+ DeFi protocols, including Uniswap, Aave, and PancakeSwap for swaps and farming.

- Blockchain ecosystems: 42 networks like Ethereum, BNB Chain, Sui, Solana, and Polygon.

- 100+ DeFi and NFT protocols with automatic staking rewards and airdrop classification.

- NFT marketplaces integrated: OpenSea, Blur, and Magic Eden for trading events.

- Yield farming and liquidity provision tracked from 20+ protocols like Yearn and Balancer.

- 12,000+ ERC-20 tokens and native coins from supported chains for portfolio reporting.

- Multi-step DeFi aggregator support for Zapper and 1inch transaction reconciliation.

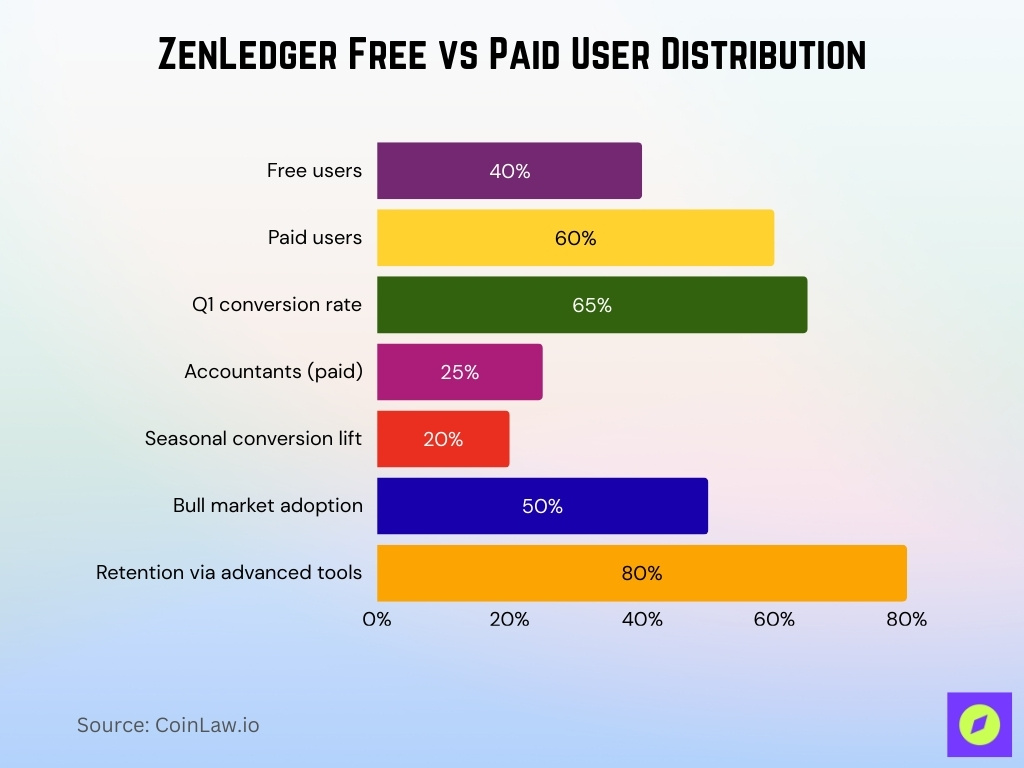

Free vs Paid User Breakdown Statistics

- Free Preview tier used by 40% of total signups for basic portfolio previews and has a $0 cost.

- 60% of users on paid tiers are unlocking full Form 8949 exports and DeFi/NFT support.

- 65% free-to-paid conversion rate during Q1 tax season peaks.

- Professional accountants represent 25% of paid subscribers on Executive/Platinum plans.

- Free tier limits: 10 transactions preview vs. unlimited on Platinum.

- Seasonal promotions boost 20% conversion lift in January–April.

- Paid adoption surged 50% in bull markets, correlating with higher transaction volumes.

- 80% recurring paid users cite advanced tools as a retention driver.

Tax Reporting and Filing Output Statistics

- Auto-generates Form 8949, Schedule D, Schedule 1, and Schedule 3 for IRS-compliant crypto reporting.

- Capital gains/losses are calculated using FIFO, LIFO, HIFO, and ACB methods for all taxable events.

- Summarizes staking rewards, airdrops, forks, and mining income as ordinary income on tax forms.

- Supports tax reports for U.S., UK, Canada, Australia, and Germany jurisdictions.

- Multi-year portfolio reconciliations track gains/losses with wash sale adjustments for a $3 short-term threshold.

- Exports directly to TurboTax, H&R Block, TaxAct, and TaxSlayer for seamless e-filing.

- Audit-ready PDFs include transaction-by-transaction breakdowns and cost basis details.

- Generates Schedule C for business income from trading and Form 709 for crypto gifts over $18,000.

IRS, SEC, and Regulatory Compliance Coverage Statistics

- IRS-contracted crypto tax software generates compliant Form 8949 and Schedule D for property treatment.

- Updates quarterly to match IRS Notice 2014-21 and Rev. Rul. 2019-24 on virtual currency reporting.

- Supports wash sale rules for crypto under proposed 2025 IRS regulations with a $3 de minimis exception.

- Provides audit defense documentation for SEC inquiries on unregistered securities and broker rules.

- Generates FATCA and FBAR reports for foreign accounts exceeding $10,000 thresholds.

- Calculates staking/DeFi income per IRS FAQ A66 as ordinary income at fair market value.

- SOC 2 Type II certified with 256-bit AES encryption for data security and compliance.

- Covers UK HMRC, Canada CRA, Australia ATO rules with jurisdiction-specific forms.

- 99.9% uptime ensures reliable reporting during peak April 15 tax filing deadlines.

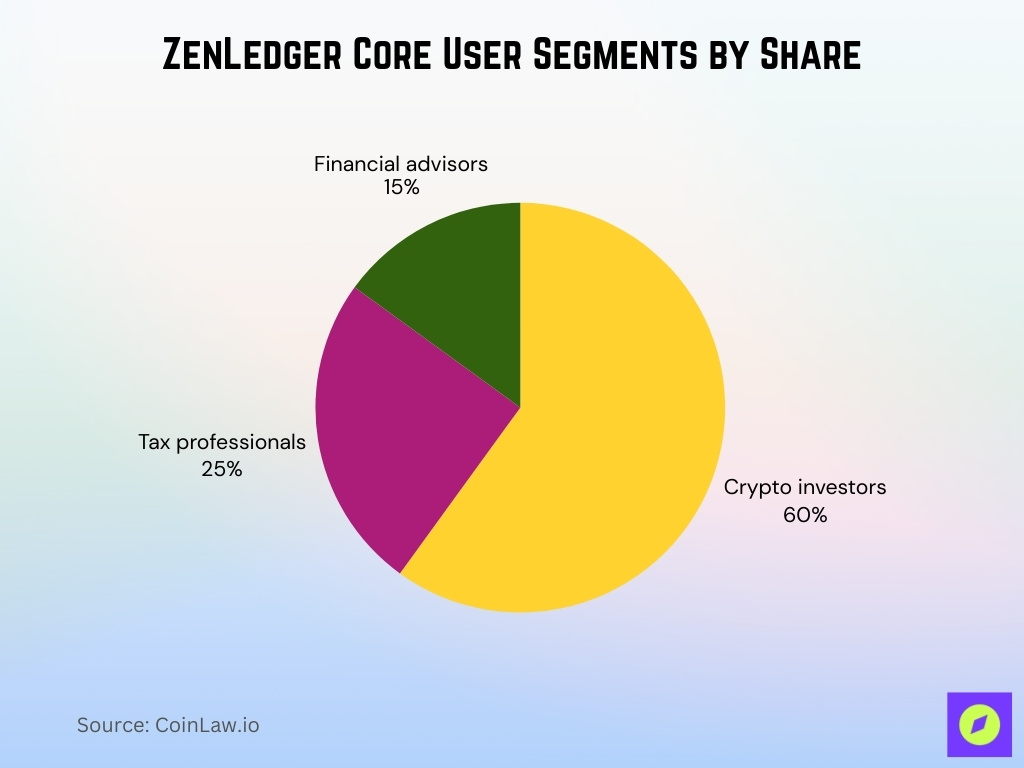

Website Traffic, SEO, and Audience Demographics Statistics

- Targets cryptocurrency investors (60%), tax professionals (25%), and financial advisors (15%).

- zenledger.io averaged 158,100 monthly visits with 2.03% growth and 00:00:52 avg duration.

- Organic search drives 93% of global web traffic, a core channel for ZenLedger rankings.

- 31.72% traffic from the United States, the primary audience of crypto investors and accountants.

- 45.35% bounce rate, 2.47 pages/visit on competitive crypto tax software SERPs.

- 75% users never scroll past the Google first page, emphasizing the top 3 positions for “crypto tax software”.

- 60% searches are mobile, requiring a responsive design for ZenLedger’s #250,614 global rank.

- Social referrals from Reddit/Twitter contribute 10–15% discovery for crypto tools.

Tax-Loss Harvesting and Optimization Statistics

- Tax loss harvesting identifies unrealized losses across crypto and NFT holdings to offset gains up to $3,000 net annually.

- Available in Starter ($49), Premium ($149), and higher plans with up to 25 transactions on basic tiers.

- Analyzes historical trades using FIFO/LIFO/HIFO for potential wash sale adjusted deductions.

- Integrates with portfolio tracker for real-time unrealized P&L optimization suggestions.

- Supports spot trades, DeFi exits, NFT sales, and staking disposals for harvesting.

- Automated alerts for positions with losses over 10% below cost basis in taxable accounts.

- Generates detailed reports highlighting the top 50 harvestable positions by loss amount.

Geographic Reach and Country Coverage Statistics

- Supports tax reporting compliance in 100+ countries with U.S., UK, Canada, Australia, and Germany forms.

- 31.72% website traffic from the United States, dominating the North America crypto tax market share.

- North America holds 55% of the global crypto tax software market revenue.

- APAC projected 25% CAGR through 2030, the fastest-growing region for crypto tax platforms.

- Europe contributes 20% market share with strong EU MiCA-driven adoption.

- Canada, Australia, UK represent 15% of international paid subscribers.

- Emerging Latin America and the Middle East account for 5–10% growth in new users.

- Enterprise clients in 50+ countries via API for multi-jurisdiction compliance.

Customer Reviews, Ratings, and Satisfaction Scores

- Trustpilot average rating 3.0/5 from 91 reviews praising DeFi reporting but noting support delays.

- 98% internal customer satisfaction score reported for feature accuracy and ease of use.

- G2 rates crypto tax functionality 4.5/5 for IRS form generation and audit trails.

- Capterra users score 4.2/5 overall, highlighting NFT tax handling strengths.

- 70% 4–5 star reviews commend priority support on Premium+ plans.

- 30% complaints focus on auto-renewal and transaction limit pricing.

- Reddit communities rate 4/5 for complex portfolio reconciliation.

- 85% recommend for tax pros due to multi-year reporting capabilities.

Security, Privacy, and Data Protection Statistics

- SOC 2 Type II audited with annual third-party penetration testing for compliance.

- 256-bit AES encryption secures all data at rest and TLS 1.3 for transmission.

- Read-only API connections are used across 400+ exchanges, preventing fund access.

- 2FA mandatory via authenticator apps, SMS, or hardware keys for account login.

- 99.99% platform uptime with DDoS protection handling 10M+ monthly requests.

- GDPR and CCPA compliant for 100+ countries’ user data privacy.

- Zero reported data breaches since inception, serving 100K+ users.

- Automatic session timeouts after 15 minutes of inactivity on shared devices.

Partnerships, Integrations, and Ecosystem Statistics

- 15+ tax software integrations, including TurboTax, H&R Block, TaxAct, and TaxSlayer.

- Partnerships with April AI, Ledger, Comply, and the Sui blockchain for end-to-end filing.

- API integrations with 400+ exchanges, 50+ wallets, and 100+ DeFi protocols.

- TaxBit migration program onboarded 10,000+ users post-shutdown.

- BitPay wallet partnership enables seamless transaction imports.

- 20+ blockchain ecosystems, including Ethereum, Sui, Solana, and BNB Chain.

- Enterprise API serves 50+ institutional partners for custom compliance.

- 30+ DeFi protocols like Uniswap and Aave are integrated for real-time yield reporting.

Competitors and Market Share Position Statistics

- Crypto tax software market valued at $0.8 billion in 2024, projected to reach $2 billion by 2032 with 25% CAGR.

- ZenLedger ranks among the top 10 players vs. CoinLedger, Koinly, CoinTracker, and TaxBit.

- CoinLedger leads with 500K+ users; ZenLedger serves 100K+ U.S.-focused investors.

- Koinly excels globally with 800+ integrations; ZenLedger has 600+ U.S. compliance edge.

- TokenTax, Coinpanda target pros; ZenLedger #2–5 in expert rankings like CoinLedger’s 2026 list.

- 15% estimated U.S. market share for ZenLedger in the $1.2 billion global asset management segment.

- Competitors: Sovos, Cryptio, Lukka for enterprise; ZenLedger retail/institutional hybrid.

- 5x YoY growth positions ZenLedger Series B with $3.8 million annual revenue.

Frequently Asked Questions (FAQs)

ZenLedger is trusted by over 100,000 crypto investors for tax reporting and compliance.

ZenLedger has raised approximately $25.85 million in funding through multiple funding rounds.

Former TaxBit clients receive a 35% discount when switching to ZenLedger for a limited time.

ZenLedger’s Platinum plan supports up to 15,000 transactions.

Conclusion

ZenLedger stands as a prominent player in the crypto tax software space, balancing comprehensive reporting, integration breadth, and global reach. Users benefit from extensive exchange and protocol support, IRS‑compliant outputs, and tools tailored for DeFi and NFT tax complexity. Yet feedback highlights areas for improvement, particularly around user satisfaction and broader international tax support. With competition intensifying and the crypto tax market growing around the world, ZenLedger’s continued focus on security, partnerships, and SEO visibility will remain key to sustaining its leadership position.