Picture this: It’s 7:00 PM, and you’re at a bustling coffee shop. You grab a latte and swipe through your phone to settle the bill using Zelle, a seamless peer-to-peer (P2P) payment platform. This quick, cashless transaction epitomizes how technology is redefining the way we handle money today. Zelle, the digital payment system launched in 2017, has become a household name in the US, offering speed, convenience, and reliability for millions of users. As we step into 2025, its evolution continues to reshape the landscape of financial technology.

Editor’s Choice: Key Milestones

- Zelle processed over $1.92 trillion in transactions in 2025, reflecting a robust 20% growth from the previous year.

- The platform facilitated more than 2.4 billion transactions in 2025, reinforcing its scale and reach.

- Zelle’s active user base surpassed 145 million in 2025, cementing its status as a top digital payment solution.

- Small business usage surged in 2025, fueling a 35% rise in commercial transactions via Zelle

- Zelle retained its rank among the top 3 P2P payment apps in the US in 2025, with a steady 30% market share.

- Over 91% of users in 2025 rated Zelle as secure and user-friendly, affirming its trusted brand image

- By 2025, Zelle partnered with over 2,000 financial institutions, expanding its accessibility and user coverage.

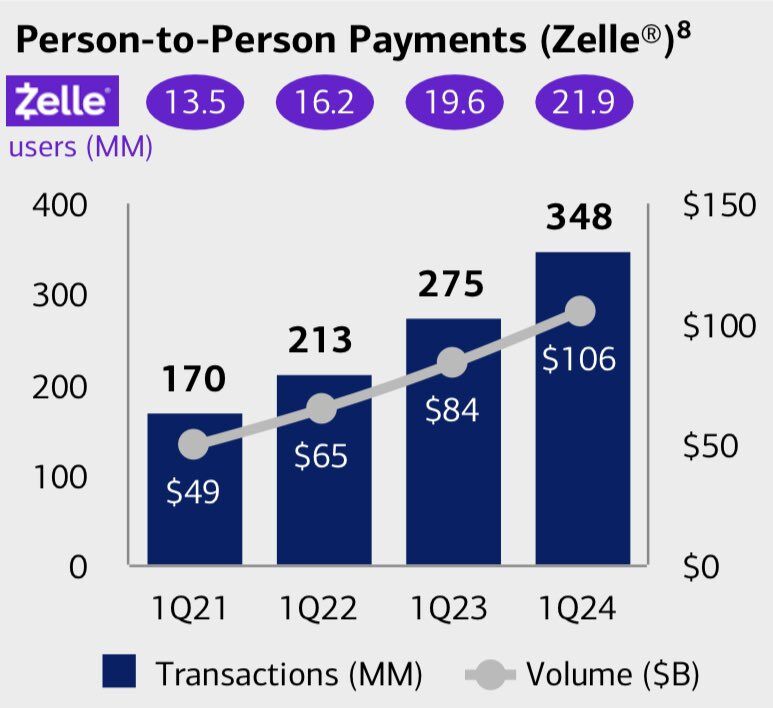

Zelle’s Growth in Person-to-Person Payments

- Zelle has seen consistent growth in both user base and transaction volume over the last four years.

- In Q1 2021, the platform had 13.5 million users, facilitating 170 million transactions worth $49 billion.

- By Q1 2022, users had increased to 16.2 million, and transactions rose to 213 million, totaling $65 billion in volume.

- In Q1 2023, Zelle recorded 19.6 million users, with 275 million transactions amounting to $84 billion.

- Most recently, in Q1 2024, Zelle reached 21.9 million users, processing 348 million transactions valued at $106 billion.

- This represents a more than 2x increase in transaction volume from $49B in 1Q21 to $106B in 1Q24.

The number of transactions also doubled, showing strong adoption and continued momentum in the P2P payments space.

Transaction Volume and Growth

- The total transaction volume via Zelle surged to $1.56 trillion.

- Business-to-consumer (B2C) payments on Zelle increased by 35%, driven by small and medium-sized enterprises.

- Over 55% of Zelle transactions were peer-to-peer, while the remaining 45% were split between B2C and other categories.

- The average transaction size rose to $260 per payment, reflecting its utility for larger financial exchanges.

- Zelle’s monthly active users (MAUs) grew by 25%, reaching 12.5 million transactions daily.

- The platform expanded internationally with partnerships in Canada and the UK, hinting at future global adoption.

- Comparatively, Zelle outpaced its competitors like Venmo in transaction volume by 15%, solidifying its leadership position.

User Adoption and Demographics

- Zelle’s user base reached over 150 million in 2025, marking a solid 17% year-over-year growth.

- Millennials made up 42% of active users in 2025, continuing as Zelle’s largest demographic group.

- Gen Z adoption jumped 28% in 2025, fueled by demand for instant and secure payment tools.

- Among households earning $75K+ annually, 65% used Zelle regularly in 2025.

- Zelle’s business-user segment grew 32% in 2025, driven by SMEs embracing digital payments.

- Users aged 50+ increased by 18% in 2025, pointing to rising multi-generational adoption.

- Over 73% of users in 2025 used Zelle for recurring bills like rent, utilities, and subscriptions.

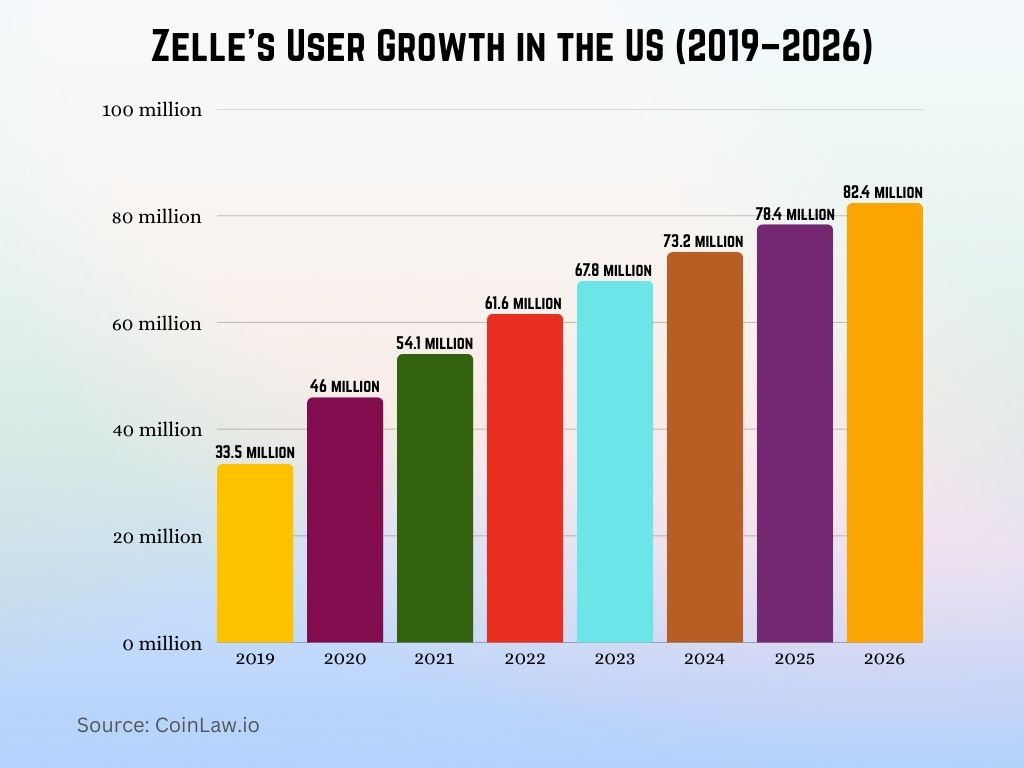

Zelle’s User Growth in the US

- Zelle’s user base in the US has shown a steady upward trend over the years, reflecting the growing adoption of digital peer-to-peer payments.

- In 2019, Zelle had 33.5 million users.

- Usage rose to 46.0 million in 2020, followed by 54.1 million in 2021.

- In 2022, the number of users had climbed to 61.6 million and continued rising to 67.8 million in 2023.

- 2024 estimated 73.2 million users, with further growth to 78.4 million in 2025.

- By 2026, Zelle is expected to reach 82.4 million users, marking a 146% increase from 2019.

This upward trend underscores Zelle’s role as a dominant force in digital payments within the United States.

Consumer Payment Habits

- Approximately 85% of transactions on Zelle are related to everyday expenses, including splitting bills and paying rent.

- The average consumer used Zelle four times per month, indicating consistent usage patterns.

- Due to its real-time transfer feature, over 50% of users preferred Zelle for urgent payments.

- Surveys found that 65% of consumers used Zelle to split bills at restaurants or outings, showcasing its everyday practicality.

- Corporate reimbursements via Zelle accounted for 25% of business payments.

- Gen Z and Millennials used Zelle for online purchases 30% more frequently than the previous year.

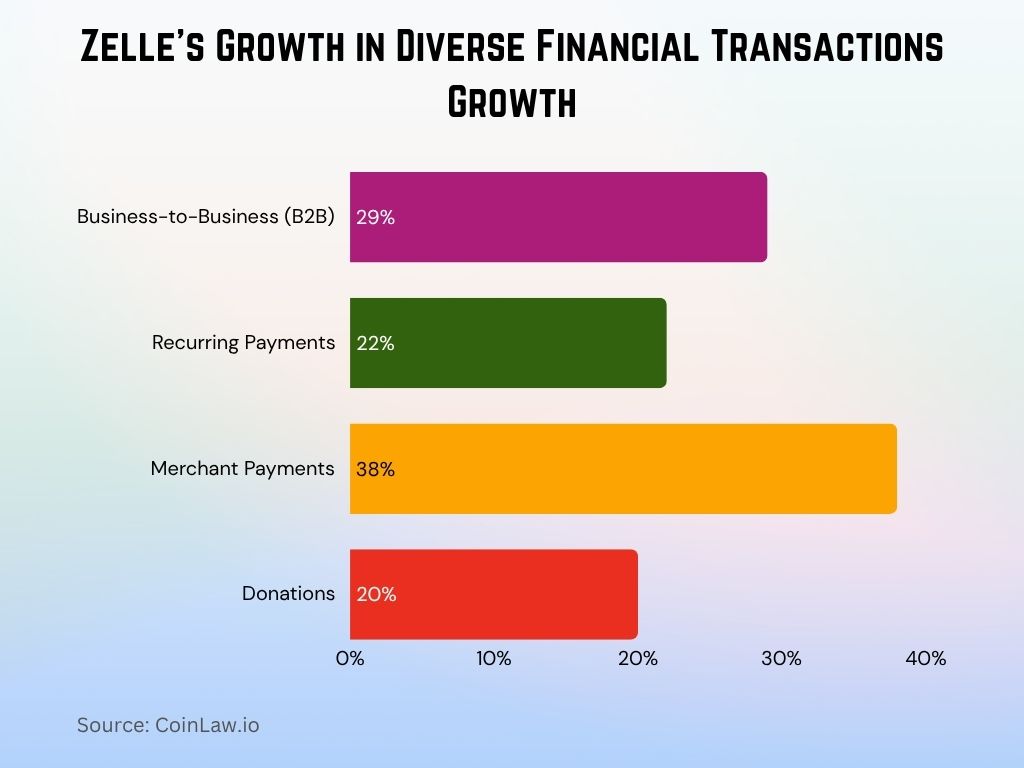

The State of Payment Transaction Types

- P2P payments accounted for 52% of Zelle’s total transactions in 2025, maintaining its lead as the most used payment type.

- B2B transactions rose 29% in 2025, powered by expanded bank partnerships and business integrations.

- Recurring payments grew 22% in 2025, highlighting Zelle’s role in monthly rent, tuition, and bill payments.

- Merchant payments increased by 38% in 2025 as more small businesses adopted Zelle for fast transactions.

- Charitable donations via Zelle climbed 20% in 2025, signaling increased use for nonprofit contributions.

- Real estate-related transfers made up 9% of Zelle’s total volume in 2025, from deposits to closing costs.

- Cross-border payments contributed 7% in 2025, gaining traction after their international rollout expanded.

Security Measures and Fraud Prevention

- Zelle achieved a 97% user satisfaction rate for security in 2025, supported by strong encryption and secure architecture.

- Fraud incidents dropped by 18% in 2025, thanks to proactive monitoring and user-focused safety tools.

- Over 88% of users in 2025 felt confident in Zelle’s security, citing 2FA, alerts, and account controls.

- Real-time monitoring in 2025 led to a 22% decline in unauthorized transactions, enhancing real-time protection.

- Partner banks expanded biometric verification, helping ensure account access remains strictly user-controlled.

- A phishing awareness push in 2025 resulted in a 30% reduction in scam-related fraud cases.

- Zelle’s customer service resolved 95% of fraud claims within 48 hours, emphasizing its commitment to quick conflict resolution.

Payments Trends to Watch

- Biometric payment adoption via Zelle rose by 33% in 2025, led by fingerprint and facial recognition usage.

- AI-powered fraud detection rolled out fully in 2025, delivering 25% faster anomaly detection and improved threat response.

- Zelle’s cross-border transaction pilot scaled globally in 2025, driving a 42% increase in international payment volume.

- Stablecoin integration discussions advanced in 2025, aligning with the broader P2P crypto adoption trend.

- Voice-activated payments grew 27% in 2025, driven by usage through Alexa, Google Assistant, and mobile AI interfaces.

- Digital wallet market share surpassed $2.8 trillion in 2025, with Zelle expanding its reach in everyday consumer payments.

- Zelle’s BNPL integration talks accelerated in 2025, as fintech partnerships deepened across retail sectors.

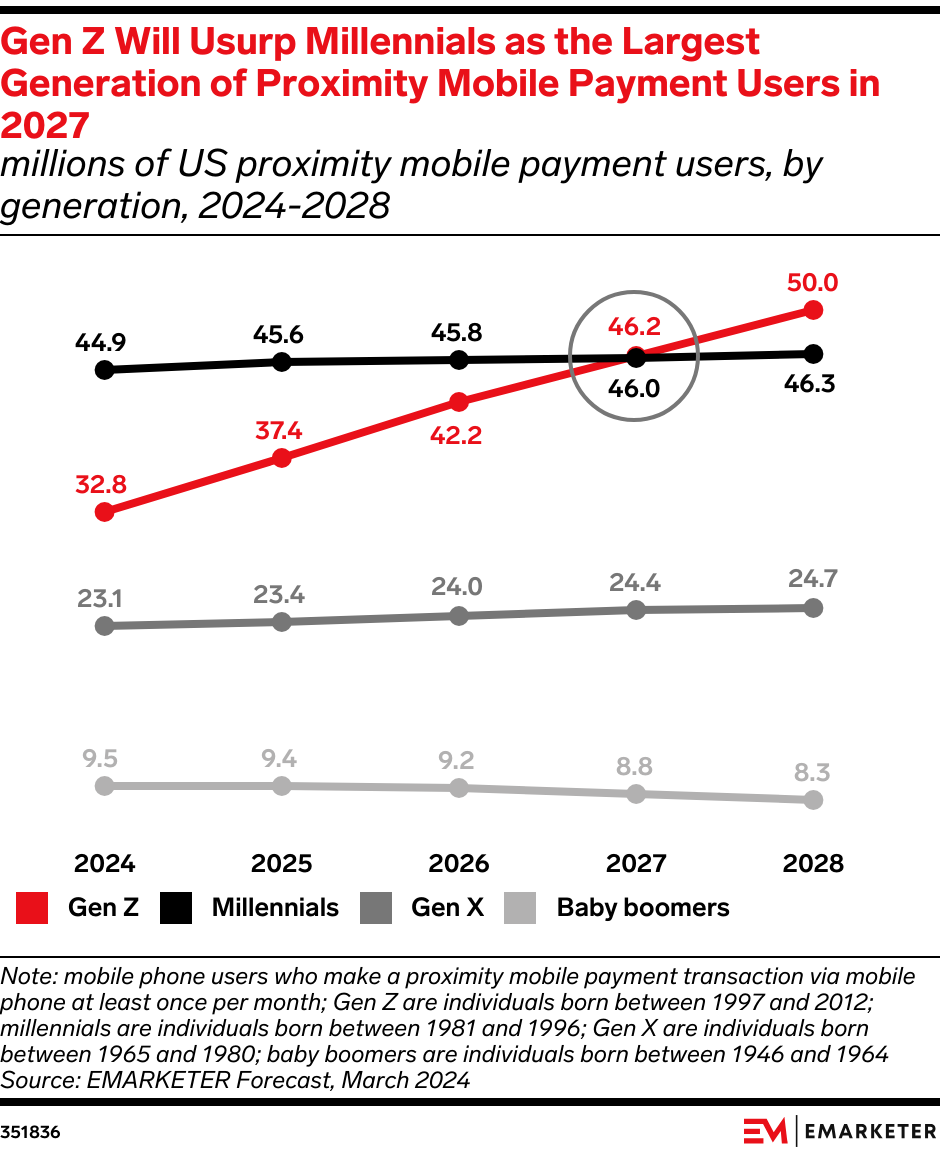

Gen Z to Lead Proximity Mobile Payments by 2027

- In 2024, Gen Z had 32.8M users, while Millennials had 44.9M.

- In 2025, Gen Z will rise to 37.4M, Millennials to 45.6M.

- In 2026, Gen Z will reach 42.2M, and Millennials at 45.8M.

- In 2027, Gen Z (46.2M) will surpass Millennials (46.0M).

- By 2028, Gen Z will lead with 50.0M users, Millennials steady at 46.3M.

- Gen X will grow from 23.1M (2024) to 24.7M (2028).

- Baby Boomers will decline from 9.5M (2024) to 8.3M (2028).

Recent Developments

- In 2025, Zelle fully rolled out its small business payment program, offering instant transfers with up to 40% lower fees than legacy systems.

- Zelle partnered with over 130 universities in 2025, expanding its role in student-to-campus payments nationwide.

- Cross-border payments grew 45% in 2025, expanding beyond Canada and Mexico to include the UK, India, and the Philippines.

- Zelle’s app redesign in 2025 introduced a smarter UI, featuring AI-driven insights and predictive reminders.

- New partnerships with national retailers led to a 19% boost in merchant integrations for in-store and online checkouts.

- A 2025 upgrade to Zelle’s rewards program offered up to 5% cash back on recurring payments like rent and subscriptions.

- Public awareness campaigns reached 14 million people in 2025, promoting digital security and financial literacy.

Conclusion

As Zelle continues its impressive trajectory in the payments landscape, 2025 is poised to be a transformative year for the platform. From robust transaction growth and widespread adoption to pioneering innovations like cross-border payments and AI-driven security, Zelle remains a leader in digital finance. With a strong foundation in trust and accessibility, it’s clear that Zelle is not just adapting to changes in the financial ecosystem, it’s driving them.