XRP’s price rose about 4 % even as Ripple co founder Chris Larsen moved roughly $200 million in XRP into exchanges, stirring debate over his intentions and the token’s outlook.

Key Takeaways

- 1Larsen shifted approximately 50 million XRP (~$175M) between mid July and Jul 24, 30M to exchanges.

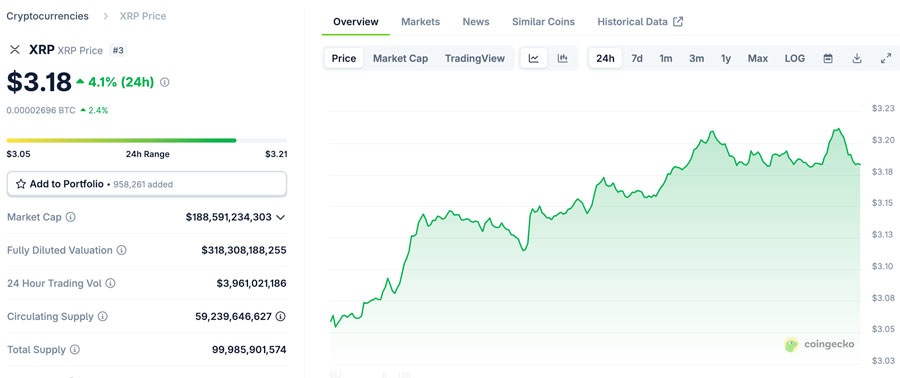

- 2XRP had spiked to $3.65, its highest in over seven years, before sharply retreating.

- 3Despite this pressure, XRP currently trades at around $3.18, reflecting resilience amid volatility and renewed ETF optimism.

What Happened

Chris Larsen moved about 50 million XRP (≈ $175M) through transfers from Jul 17 to Jul 24, with $140M going to exchanges according to on chain data flagged by ZachXBT and CryptoQuant. Additional transfers since pushed the total above 57 million XRP (~$200M). Investors interpreted these moves as potential profit taking, especially since exchange trunks often precede sales.

Meanwhile XRP’s price shot to roughly $3.65, a seven year high, then tumbled 13 to 15 % within days, touching lows near $2.95 before stabilizing above $3.00.

Spike to Peak and Pullback

XRP’s ascent to $3.65 marked its strongest performance since 2018. That rally was short lived, followed by a swift correction back near $3.09 to $3.14, driven by broader altcoin weakness and large liquidations. Analysts, including Katie Talati of Arca, said such sudden volatility is typical in crypto markets and often driven by profit taking and macro headwinds.

The selling offwaves hit futures positions hard: over $100M in long liquidations were executed in a short window. Still, analysts call it a “healthy correction” and see strong rebound potential, with some even projecting XRP reaching $10 to $15 as long as key support zones around $2.95 to $3.00 hold.

Larsen’s Sell Offs Revisited

Chris Larsen’s transfers drew sharp scrutiny. Even after these moves, Larsen linked wallets still hold over 2.8 billion XRP, valued at more than $8 billion, positioning him among the largest whale holders. Analysts questioned whether the recent activity is just “the warm up,” warning further liquidations could trigger deeper drops. On chain analytics firm Lookonchain and others confirmed the magnitude of the flows.

Regulatory and ETF Optimism

Market sentiment has been buoyed by Ripple’s legal clarity following its partial settlement with the SEC in March. That development helped shift sentiment toward regulatory compliance and institutional confidence. Analysts believe spot XRP ETFs, currently limited to futures exposure, could catalyze the next big inflow wave if approved.

Large institutional players such as BlackRock, Fidelity, and PNC are reportedly circling the token in anticipation of these regulatory developments and adoption prospects.

Near Term Outlook

| Factor | Bull Case | Bear Case |

|---|---|---|

| Support zone ($2.95 to $3.00) | Holds and rebounds toward $3.50 to $4 | Break below triggers deeper correction |

| Whale activity | Accumulation builds bottom support | Further sales amplify volatility |

| ETF regulatory progress | Spot ETF approval drives inflows | Regulatory uncertainty stifles momentum |

| Market mood | Retail support and institutional trust grow | Profit taking and macro uncertainty weigh in |

CoinLaw’s Takeaway

I see the current move as a mix of tension and opportunity. On one hand, Larsen’s transfers triggered fear and volatility, reminding us that whales can influence sentiment. On the other, XRP remains above $3, supported by a loyal retail base, on chain strength, and mounting ETF optimism. To me, this looks less like a top and more like a pause before the next push.

If the $2.95 to $3.00 support zone holds, we could see a fresh leg toward $3.50 to $4.00. But if we break that floor with escalating whale selling, this could become a longer corrective phase. I feel the bulls still have time to prove their strength, so I’m watching that zone closely.