World Liberty Financial, a Trump family-backed crypto venture, is facing its first major test as it scrambles to recover from wallet compromises, a $22 million token burn, and growing political scrutiny over alleged sales to sanctioned entities.

Key Takeaways

- WLFI reported phishing-related wallet breaches ahead of its token launch, prompting emergency measures to secure user funds.

- The team froze affected accounts, initiated KYC checks, and reallocated tokens to new wallets, while denying any flaw in its own platform or smart contracts.

- A $22 million WLFI token burn was conducted to invalidate compromised assets, reassuring the community of the project’s integrity.

- Senators Elizabeth Warren and Jack Reed have called for a federal investigation, citing possible WLFI token sales to entities in North Korea, Russia, and Iran.

What Happened?

Before its official launch, WLFI discovered that several user wallets had been compromised through phishing attacks and leaked seed phrases. Although the issue did not stem from flaws in WLFI’s own technology, the team responded by freezing impacted wallets, conducting KYC verifications, and building new smart contract logic for secure reallocation. Meanwhile, political pressure mounted over claims of token sales to sanctioned countries, intensifying the project’s challenges.

1/ Prior to WLFI’s launch, a relatively small subset of user wallets were compromised via phishing attacks or exposed seed phrases.

— WLFI (@worldlibertyfi) November 19, 2025

Since then, we’ve tested new smart contract logic to safely reallocate user funds and verified users’ identity via KYC checks.

Shortly, users who…

Wallet Hacks Trigger Crisis Response

In an X post, World Liberty Financial acknowledged that a small subset of user wallets were compromised in a phishing incident traced back to third-party security lapses.

- The compromised wallets were frozen in September.

- Users affected were asked to undergo new identity checks and submit fresh wallet addresses.

- Verified users are now receiving token reallocations to secure wallets.

- Unverified users still have the option to start the recovery process via WLFI’s help center.

The project emphasized that the vulnerabilities did not originate from WLFI’s own infrastructure, but rather external factors, and said it deliberately slowed its rollout to prioritize user safety over speed.

$22 Million Token Burn to Protect Community

One of the most dramatic responses to the breach was a token burn involving 167 million WLFI tokens, worth over $22 million at the time.

According to the WLFI team:

- The burn aimed to eliminate tokens from compromised wallets, effectively removing them from circulation.

- A matching number of tokens was allocated to new, verified addresses controlled by affected users.

This public commitment to transparency and fairness was intended to reassure the community and minimize the damage caused by the breach.

Political Firestorm Over Alleged Sanctioned Sales

While dealing with the security fallout, World Liberty Financial also came under political scrutiny.

Senators Elizabeth Warren and Jack Reed called for the Departments of Justice and Treasury to investigate reports that WLFI tokens were sold to entities in sanctioned regions, including:

- A North Korean hacking group (Lazarus).

- A Russian tool allegedly used to evade sanctions.

- An Iranian crypto exchange.

These accusations stem from a report by watchdog group Accountable.US. However, several blockchain security experts questioned the validity of the on-chain analysis, warning that misinterpretations of blockchain transactions could lead to false accusations. One user was reportedly misidentified as being linked to Lazarus due to flawed analytics.

Community Trust and Market Impact

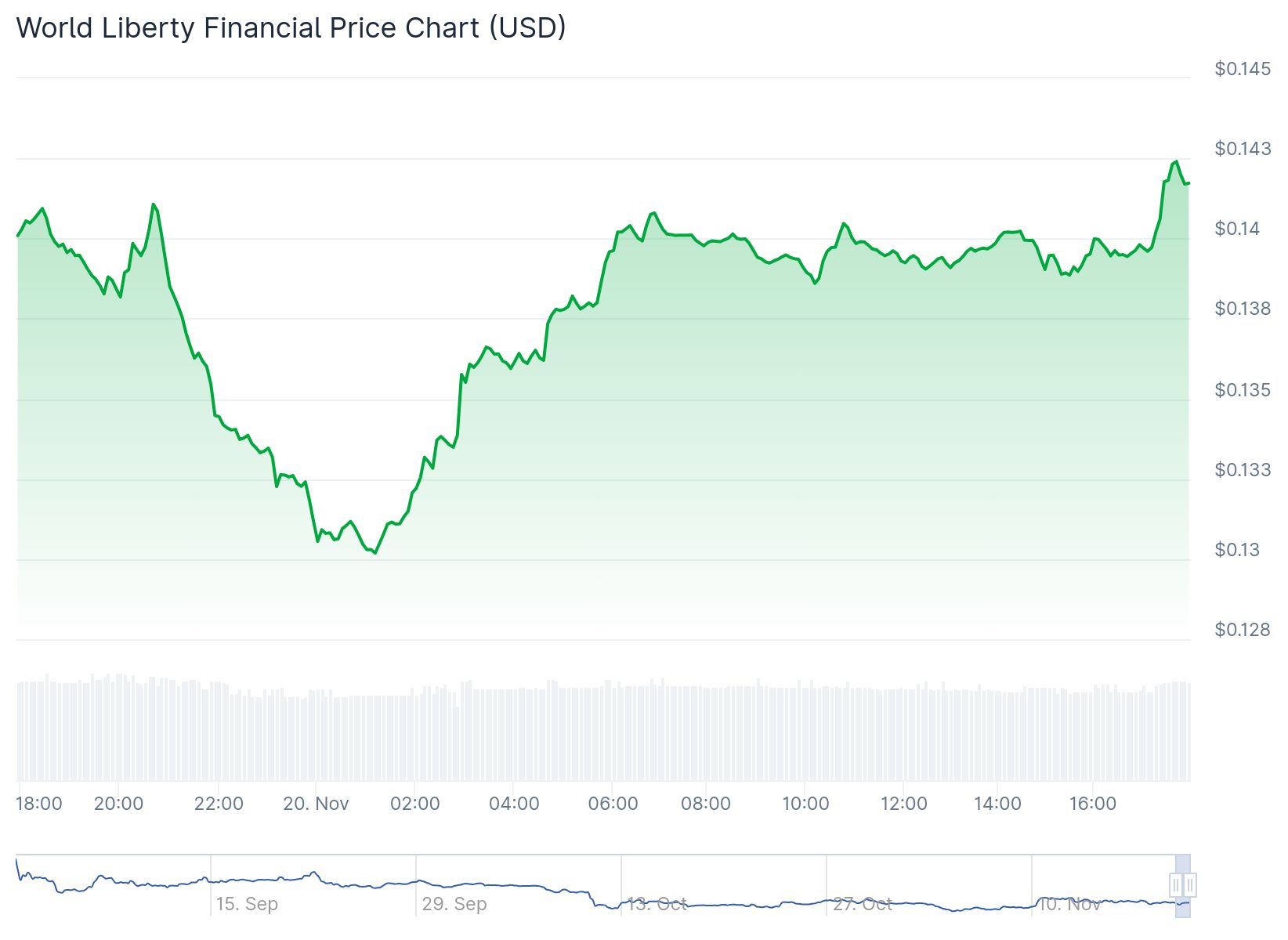

Following these events, the WLFI token saw significant volatility. On launch day, prices dropped more than 15 percent, though trading volume surged across exchanges like Binance, hitting $1 billion in the first hour. At its peak price of $0.30, the Trump family’s reported 22.5 billion token stake reached a paper value of over $6 billion.

However, by November 20, WLFI’s token price had fallen to $0.14, slashing that stake’s value to around $3.15 billion.

Despite the turbulence, WLFI’s proactive steps in handling the breach and communicating transparently have been viewed by some as a sign of maturity in a notoriously unpredictable industry.

CoinLaw’s Takeaway

In my experience, projects that endure early chaos and respond with transparency often have the best shot at long-term survival. WLFI may have stumbled out of the gate, but the decisive token burn, secure reallocations, and firm messaging around security show they’re serious about damage control. Still, the accusations of sales to sanctioned entities are no small matter. If proven, that could be a regulatory nightmare. Personally, I’m watching how WLFI handles the next few weeks. Rebuilding trust in crypto is tough, but not impossible if your actions speak louder than the headlines.