Upexi has filed with the SEC to raise up to $1 billion as it deepens its commitment to Solana, despite the recent market downturn.

Key Takeaways

- Upexi filed a $1 billion shelf registration with the SEC to issue securities over time including common stock, debt instruments, and other financial tools.

- The firm holds over 2 million SOL tokens, making it the fourth-largest Solana treasury among public companies.

- Solana’s price has fallen over 58 percent from its 2025 peak, shrinking Upexi’s holdings from more than $500 million to about $254 million.

- The move reflects Upexi’s long-term strategy to strengthen its Solana-based digital asset treasury and access flexible capital.

What Happened?

Nasdaq-listed Upexi, known for managing consumer brands, filed a shelf registration with the U.S. Securities and Exchange Commission seeking to raise up to $1 billion. The Tampa-based company plans to use the proceeds for general corporate purposes including acquisitions, R&D, working capital, and debt repayment. The filing highlights Upexi’s aggressive push into the crypto space through a Solana-focused digital asset treasury (DAT) strategy launched in January 2025.

Solana treasury firm @UpexiTreasury just filed with the SEC to raise up to $1B through securities offerings. They currently hold 2M+ SOL 🚀 pic.twitter.com/7t7Hek3uDg

— Rug 🧩🎯 (@RugDodger) December 23, 2025

Upexi Leverages Shelf Registration for Strategic Flexibility

Upexi’s shelf registration grants it the ability to issue various types of securities, such as common or preferred shares, debt instruments, warrants, or bundled units. This approach allows the company to raise funds incrementally and strategically based on market conditions.

- The company made clear that it will issue detailed prospectus supplements before each offering, indicating a measured and non-urgent execution.

- Upexi trades under the ticker UPXI and has seen its share price fall nearly 50 percent year-to-date, closing at $1.85 recently.

- The shelf registration does not include a timeline for issuance, further emphasizing strategic flexibility.

Expanding a Solana-Centric Digital Treasury Strategy

Upexi began its Solana digital asset treasury strategy in early 2025 and rapidly expanded its SOL holdings during the second half of the year. It currently holds approximately 2.03 million SOL tokens, worth an estimated $254 million, securing its position as one of the top public holders of Solana.

- The holdings once exceeded $500 million in value but have declined due to Solana’s broader market downturn.

- Despite the decline, Upexi’s new capital raise signals intent to capitalize on current discounted prices and expand its SOL exposure.

- The company aims to hold and stake SOL as part of a broader long-term investment plan.

Solana Market Conditions: A Volatile Backdrop

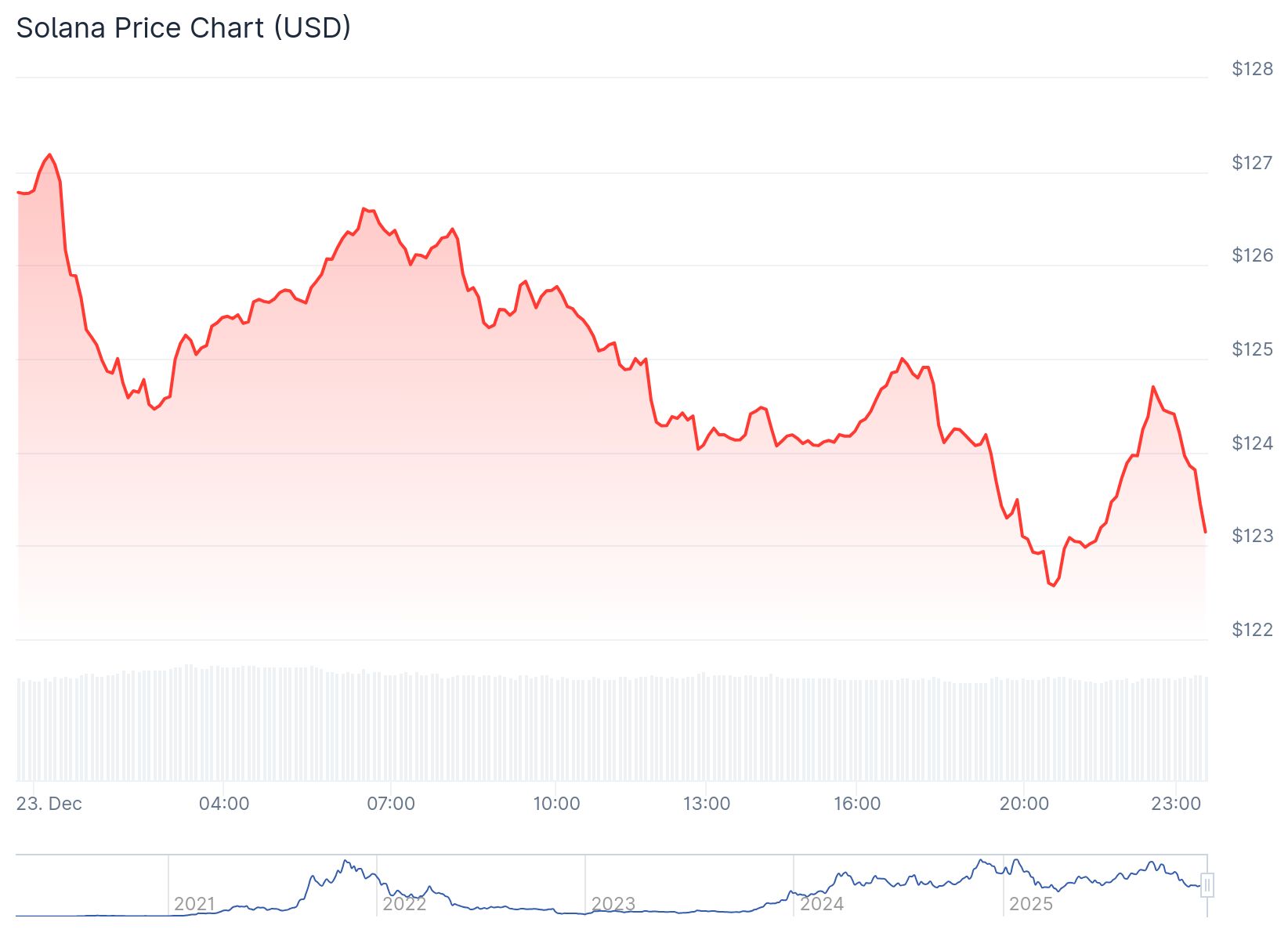

The timing of Upexi’s filing aligns with a significant drawdown in Solana’s market performance. SOL has dropped nearly 58 percent from a 2025 high of $295, currently trading around $122.90. This slump has mirrored a general crypto correction despite ongoing institutional interest.

- Since late October, U.S.-based SOL ETFs have attracted $750 million in inflows, highlighting growing institutional interest despite falling prices.

- Analysts observe a shrinking supply of profitable SOL holdings, with only 18 percent of tokens currently in profit, a level not seen since the FTX collapse in 2022.

- Liquidation heatmaps suggest key price zones around $120 to $130 for short-term volatility, with potential support at $100.

Institutional Sentiment vs. Retail Speculation

According to analyst insights, institutional wallets have been scaling back Solana exposure since late 2024. Conversely, retail investors have continued to accumulate in anticipation of a rebound. Some market watchers have raised concerns over Solana’s increasing reliance on retail-driven trends, especially due to its correlation with memecoin activity.

Despite this, Upexi’s continued investment in Solana sets it apart from traditional public companies, aligning with a broader move to explore crypto as a strategic asset class.

CoinLaw’s Takeaway

In my experience, when a publicly traded company like Upexi dives deep into crypto treasuries during a market downturn, it’s a sign of strong conviction. Most firms pull back during these cycles, but Upexi is pushing forward, which tells me they see serious long-term value in Solana. I found their approach to be refreshingly methodical. They’re not rushing to sell securities but instead positioning themselves to strike when the timing is right. If they believe SOL is undervalued now, this capital raise could help them buy big before the next bull cycle hits. I’ll be watching closely to see if other firms follow their lead.