UBS Group AG stands as one of the world’s foremost financial institutions, blending global reach with deep expertise in wealth management, investment banking, and asset management. In recent years, the bank has navigated complex integration efforts while posting solid growth in key financial metrics. Its influence spans global markets, major financial centers, and ultra-high-net-worth clients. In this article, you’ll explore the most relevant UBS statistics across core performance areas to understand its current trajectory and resilience. Let’s begin with the most compelling figures shaping UBS this year.

Editor’s Choice

- $6.9 trillion in invested assets reported by UBS as of September 30, 2025, reflecting strong client inflows and balance sheet scale.

- 14.8% Basel III common equity tier 1 capital ratio reported in Q3 2025, underscoring UBS’s capital strength.

- $1.632 trillion in total assets on the balance sheet as of late 2025.

- $84.56 billion in annual revenue for fiscal 2024, serving as a key baseline for 2025 and 2026 comparisons.

- $7.337 billion in net income over the trailing 12 months ending September 30, 2025.

- 74% year-over-year net profit increase in Q3 2025 compared with Q3 2024.

- 22.3% share of Swiss dealmaking fees in 2025, highlighting UBS’s domestic market leadership.

Recent Developments

- Credit Suisse’s full integration completion is targeted for the end of 2026.

- CEO Sergio Ermotti to step down in April 2027 post-integration.

- Swiss investment banking market share rose to 22.3% in 2025.

- Cost reduction targets progressing ahead of $13 billion timeline.

- Opposed to the Swiss capital rules requiring up to $24 billion in additional capital.

- Gross cost savings achieved $9.1 billion by mid-2025.

- AI and automation investments enhance efficiency across operations.

- 70% of the 2026 savings target was realized early.

Global Footprint and Presence

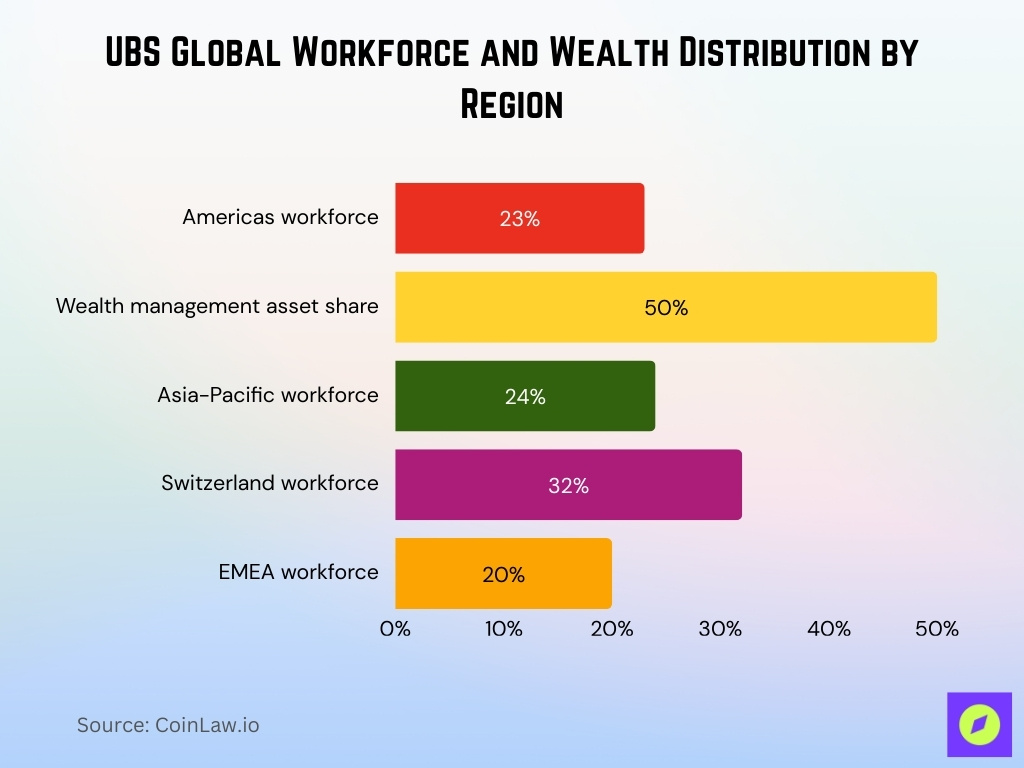

- United States core market with 23% of employees in the Americas.

- Wealth management accounts for over 50% of $6.9 trillion global invested assets.

- Asia Pacific hosts 24% of the workforce and leads in wealth growth.

- Regional diversification with 32% employees in Switzerland, 20% EMEA.

- Operates in more than 50 countries across the Americas, EMEA, and the Asia Pacific.

- Maintains presence in all major financial centers worldwide.

- UBS Americas Holding LLC ranks 22nd among U.S. banks by $212 billion in assets.

- Strategic hubs in New York, London, Zurich, Hong Kong, and Singapore.

- Supports 110,000+ employees across 159 nationalities.

UBS Overview and Key Facts

- UBS Group AG is headquartered in Zurich and Basel, Switzerland.

- Operates in wealth management, investment banking, asset management, and consumer banking.

- Manages one of the world’s largest private wealth platforms with invested assets of $6.9 trillion.

- Global headcount stands at 110,323 employees.

- Designated as a systemically important financial institution.

- Serves approximately half of the world’s billionaires as clients.

- Shares trade on major global exchanges, part of the Swiss Market Index.

- Regional subsidiaries enable localized banking and advisory services.

- Targets $13 billion gross cost savings by end-2026 from Credit Suisse integration.

Assets Under Management Statistics

- UBS reported $6.9 trillion in invested assets by Q3 2025.

- Global Wealth Management and Asset Management account for the majority of total AUM.

- Net new assets reached $38 billion in Q3 2025 alone.

- Year-to-date net new assets totaled approximately $92 billion by Q3 2025.

- UBS Asset Management surpassed $2 trillion in invested assets during 2025.

- AUM growth reflected diversified inflows across geographies and asset classes.

- UBS ranks among the top 10 global asset managers by assets under management.

Balance Sheet and Total Assets

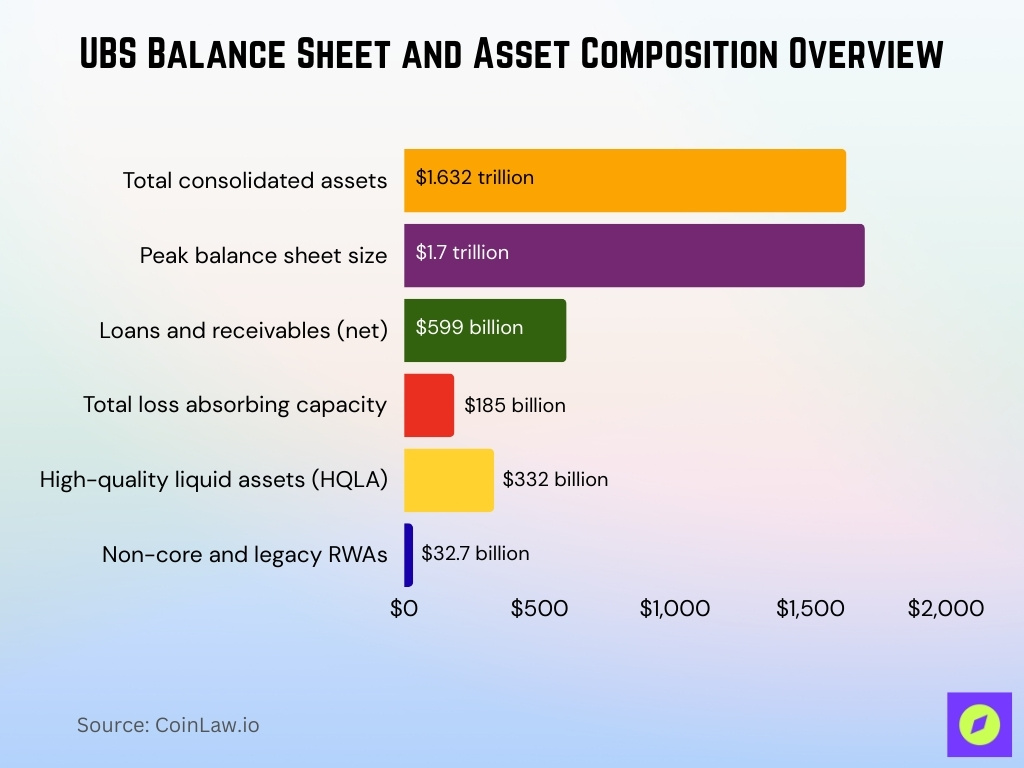

- Total consolidated assets are at $1.632 trillion.

- The balance sheet exceeded $1.7 trillion in recent quarters.

- Loans and receivables net at approximately $599 billion.

- Total loss absorbing capacity maintained at $185 billion.

- High-quality liquid assets (HQLA) of $332 billion.

- Non-core and Legacy risk-weighted assets reduced to $32.7 billion.

Revenue and Income Statistics

- UBS generated $12.76 billion in Q3 2025 revenue, up 3.5% year over year.

- Operating expenses declined 4.4% to $9.83 billion during the same period.

- Trailing 12-month revenue totaled approximately $77.3 billion as of September 2025.

- Revenue per share in Q2 2025 stood at $5.76.

- Wealth management fee growth contributed meaningfully to revenue stability.

- Investment banking trading activity drove quarterly revenue outperformance.

Net Profit and Earnings Statistics

- UBS posted $2.5 billion in net profit in Q3 2025.

- Quarterly net profit increased approximately 74% year over year.

- Earnings per share for Q3 2025 reached $0.76.

- Pre-tax profit rose to $3.6 billion, a 50% annual increase.

- Global Wealth Management delivered $1.8 billion in pre-tax profit.

- Asset Management pre-tax profit increased 19% to $282 million.

- Investment Bank pre tax profit reached approximately $787 million.

- Non-core legacy units returned a positive pre-tax result.

Profitability and Return Ratios

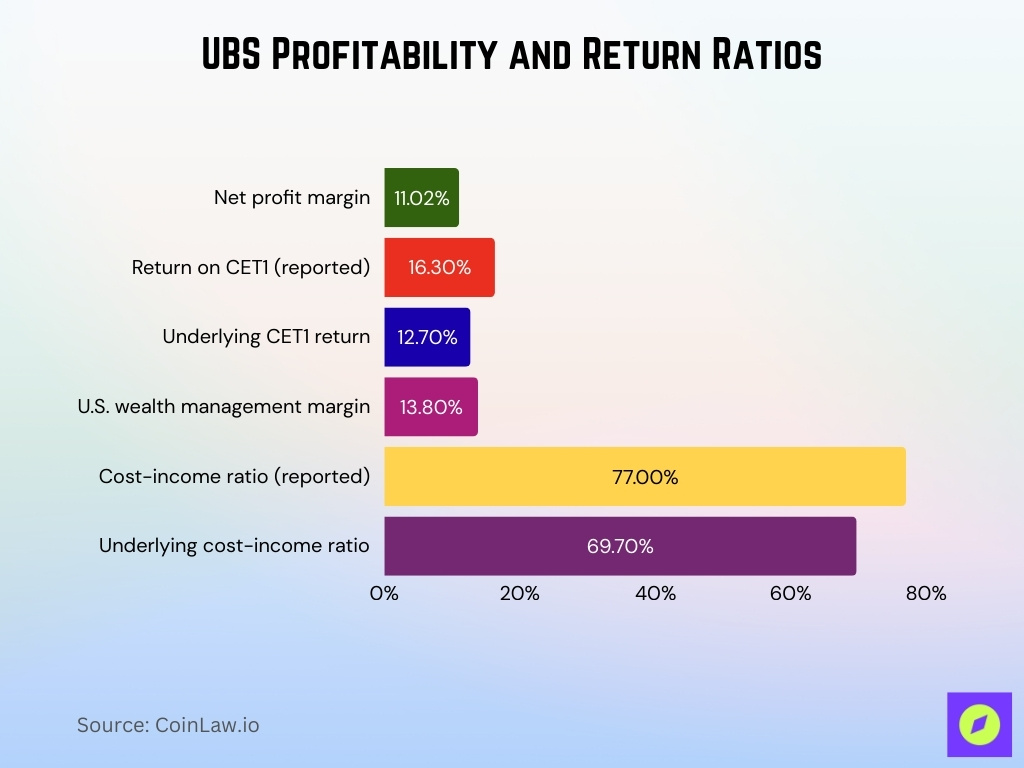

- Net profit margin stood at approximately 11.02% as of September 2025.

- Return on common equity Tier 1 reached 16.3% on a reported basis in Q3 2025.

- Underlying CET1 return measured approximately 12.7%.

- U.S. wealth management margin reached 13.8% in Q3 2025.

- Cost-income ratio measured 77% on a reported basis.

- Underlying cost-income ratio improved to approximately 69.7%.

- Cost efficiency gains reflected integration synergies and restructuring.

- Capital returns supported shareholder value creation.

Capital, Leverage, and Liquidity Ratios

- CET1 capital ratio remained at 14.8% in Q3 2025.

- CET1 leverage ratio measured 4.6%.

- Tangible book value per share increased during 2025.

- UBS repurchased approximately $1.1 billion of shares in Q3 2025.

- Planned buybacks for 2025 may total $3 billion.

- Liquidity coverage ratio averaged approximately 182%.

- Net stable funding ratio remained near 120%.

Risk-Weighted Assets and Risk Metrics

- Risk-weighted assets (RWAs) totaled $342 billion across all business divisions.

- Non-core and Legacy RWAs reduced to $32.7 billion through active portfolio management.

- Credit loss expense was recorded at $128 million for the quarter.

- Litigation reserve releases amounted to $668 million.

- Leverage ratio exposure measured $1.3 trillion.

- Liquidity coverage ratio achieved 188% compliance.

- Net stable funding ratio stood at 125%.

- Credit risk costs remained at historically low levels.

Investment Bank Statistics

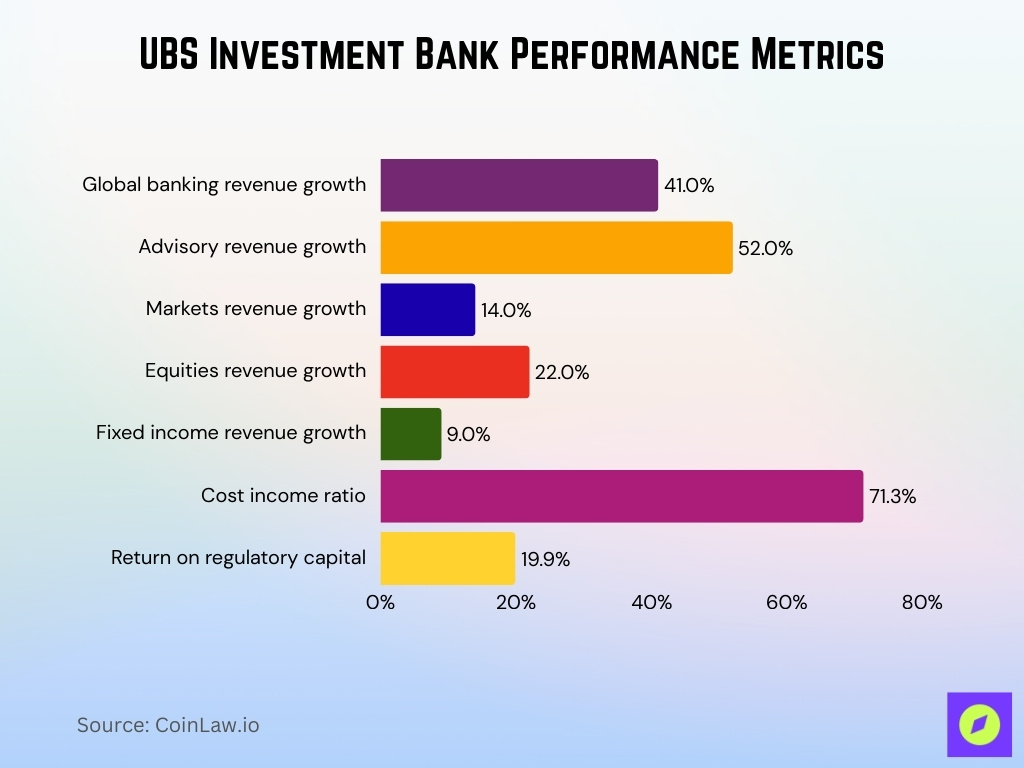

- Investment Bank’s underlying operating income totaled $1.1 billion for the quarter.

- Global Banking revenue increased 41% year over year to $718 million.

- Advisory revenues rose 52% driven by strong dealmaking activity.

- Markets’ revenue grew 14% to $1.7 billion across all regions.

- Equities revenue up 22% while fixed income increased 9%.

- Ranked #1 in Europe equity capital markets league tables.

- Top 10 global investment banks by overall fee generation.

- Cost/income ratio improved significantly to 71.3%.

- Return on regulatory capital achieved a strong 19.9%.

Segment Performance Overview

- Global Wealth Management’s net profit at $3.2 billion.

- Personal Banking net profit reached $1.1 billion.

- Asset Management pre-tax profit rose 19% year over year to $697 million.

- Investment Bank’s underlying profit before tax at $1.1 billion.

- Non-core and Legacy Portfolio showed $19 million net profit.

- Wealth management transaction-based income increased 9%.

- Cost/income ratio improved to 71%.

- Combined core businesses’ pre-tax profit grew 25%.

Global Wealth Management Statistics

- Net new assets totaled $38 billion in Q3 2025.

- Year-to-date inflows approached $92 billion.

- Ultra-wealthy clients accounted for the majority of inflows.

- Total wealth management assets exceeded $4.7 trillion.

- Net new assets increased approximately 50% year over year.

- Pre-tax profit reached $1.8 billion in Q3 2025.

- Advisory services expanded despite advisor attrition.

- Recurring fees supported revenue stability.

Personal and Corporate Banking Statistics

- Net fee and commission income reached $781 million in Q3 2025.

- Revenue declined year over year due to interest rate shifts.

- Q1 2025 revenue totaled approximately $1.428 billion.

- Pre-tax profit declined approximately 25% year over year.

- Swiss lending activity exceeded CHF 40 billion in Q1 2025.

- Customer deposits declined modestly in select regions.

- Mortgage lending remained highly collateralized.

- Regulatory adjustments influenced strategic priorities.

Deposits and Funding Statistics

- Customer deposits reached $606 billion across all regions.

- Loans to deposits ratio improved to 83% reflecting a strong liquidity position.

- Liquidity coverage ratio (LCR) achieved 188% well above regulatory minimums.

- Net stable funding ratio (NSFR) maintained at 125%.

- Total client loans grew 4% year over year to $546 billion.

- Fee income from deposit services demonstrated resilience amid rate changes.

- Diversified funding supported by 110,000 global clients.

- Basel III high-quality liquid assets totaled $332 billion.

Credit Suisse Acquisition Impact Statistics

- Acquired Credit Suisse in 2023 for CHF 3 billion.

- Gross cost savings achieved $9.1 billion by mid-2025.

- 70% of $13 billion 2026 cost savings target was met early.

- Annualized run-rate savings projected at $15 billion.

- Targeted $13 billion gross cost savings by end-2026.

- Over two-thirds of Swiss client accounts successfully migrated.

- Revenue synergies expected to add $5 billion annually.

- Post-merger net new money inflows are at $80 billion.

Integration and Synergy Realization Statistics

- Integration completion targeted by end-2026.

- Exit‑rate gross cost savings rose further to $10 billion by Q3 2025.

- Total cost reduction target set at $13 billion.

- Annualized run-rate savings projected at $15 billion.

- Risk-weighted assets reduced by $70 billion post-integration.

- Over 1,000 applications were decommissioned in the IT consolidation.

- Client migrations exceeded 70% completion in key markets.

- AI and cloud initiatives enhanced operational productivity.

Outlook Targets and Guidance Figures

- Cost savings target reaches $13 billion by end-2026 through integration synergies.

- Annualized run-rate savings guidance projects $15 billion in efficiencies.

- Return on CET1 capital targeted above 15% reflecting capital discipline.

- Return on tangible equity (RoTE) guidance set at 15-18%.

- Net new money growth guidance maintained at 4-6% annually.

- Cost/income ratio improvement target below 70%.

- CET1 capital ratio at 14.8% and CET1 leverage ratio at 4.6% for Q3 2025, with LCR at 182% and NSFR at 120%, reflecting UBS’s latest reported regulatory capital and liquidity position.

- Leverage ratio maintained strong at 4.7% amid regulatory scrutiny.

Frequently Asked Questions (FAQs)

UBS reported a $2.5 billion net profit in Q3 2025, up about 74 % year‑over‑year.

Group invested assets increased by 4% sequentially to $6.9 trillion in Q3 2025.

Underlying pre‑tax profit reached $3.6 billion in Q3 2025.

UBS’s Global Wealth Management recorded $38 billion in net new assets in Q3 2025.

Conclusion

UBS has solidified its position as a major global bank with deep wealth management roots and a growing universal banking franchise. Integration of Credit Suisse continues to shape cost structures, capital planning, and revenue mix. Financial performance metrics point to improving profitability, liquidity strength, and operational efficiency. As regulatory frameworks evolve, UBS’s execution discipline and diversification strategy will determine long-term outcomes. The data shows a resilient institution navigating transition while positioning for sustainable global growth.