The Trump family’s crypto empire has taken a steep hit, losing over $1 billion in just a few months as the digital asset market plunges.

Key Takeaways

- Trump family’s net worth dropped from $7.7 billion to $6.7 billion since September due to major losses in crypto investments.

- TRUMP memecoin and WLFI token both lost significant value, with WLFI’s paper value falling by nearly half.

- Trump Media’s $2 billion investment in Bitcoin and CRO tokens backfired, contributing to a decline in its stock.

- Eric Trump’s mining venture, American Bitcoin Corp, saw shares fall over 50%, cutting family holdings by $300 million.

What Happened?

The Trump family has recorded over $1 billion in crypto-related losses since September, driven by the declining value of tokens, failing equity in crypto-linked companies, and poor returns on major digital asset investments. The financial blow reflects the high volatility of the crypto market and the risks of aggressive exposure to speculative ventures.

Crypto Exposure Drags Down Family Wealth

The Bloomberg Billionaires Index revealed the Trump family’s wealth declined from $7.7 billion to $6.7 billion in just a few months. A wide range of investments tied to former President Donald Trump and his inner circle has suffered, including meme coins, token ventures, Bitcoin mining, and media companies betting big on blockchain.

Trump Memecoin and Token Projects Tumble

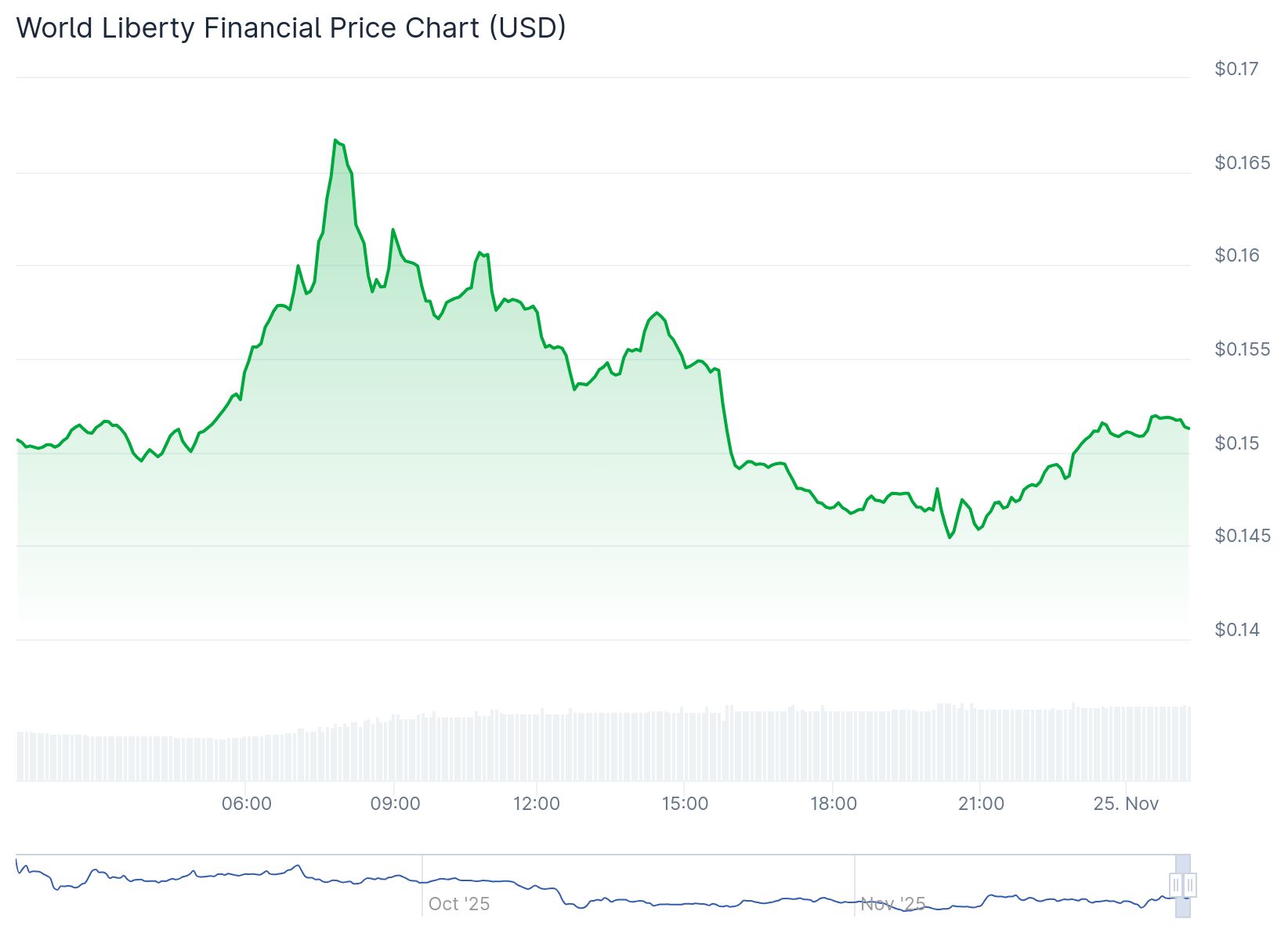

The TRUMP memecoin, associated with the family brand, has lost about 25% of its value since August, deepening investor concerns. At the same time, World Liberty Financial’s WLFI token, one of the family’s largest holdings, saw its paper value plunge from $6 billion to about $3.15 billion.

Although the WLFI tokens are locked and not yet tradeable, earlier token sales brought in nearly $900 million, with the Trump family reportedly receiving a large portion of those proceeds. The coin’s value dropped from $0.26 in September to about $0.14 by November.

Some analysts noted that wallets linked to insiders unlocked 90 million new TRUMP tokens since July. The Trump family’s estimated 40 percent stake in those newly released tokens added approximately $220 million in value, but the broader price drop more than offset those gains.

Trump Media’s $2 Billion Crypto Play Backfires

Trump Media & Technology Group (TMTG), operator of Truth Social, invested $2 billion into cryptocurrencies this year. The firm acquired around 11,500 Bitcoins at an average price of $115,000, but with Bitcoin trading near $82,000 to $86,000, the investment is now approximately 25% underwater.

TMTG also purchased $147 million in CRO tokens from Crypto.com, which have lost nearly 50% of their value. These missteps have driven Trump Media’s stock to record lows, with shares sliding more than 66% over the past year.

In a move to recover momentum, the company recently partnered with Crypto.com to launch Truth Predict, a blockchain-based betting feature on Truth Social.

Mining Venture Sinks $300 Million

Eric Trump’s mining company, American Bitcoin Corp, founded with Donald Trump Jr. and Hut 8 Corp, has not been spared either. The company’s stock fell over 50% from a peak of $9.31 in September, cutting more than $300 million from Eric Trump’s 7.5% stake.

Despite the downturn, Eric Trump remains publicly optimistic, telling Bloomberg: “People who buy dips and embrace volatility will be the ultimate winners. I have never been more bullish on the future of cryptocurrency and the modernization of the financial system.”

Regulatory Scrutiny on the Horizon

Some U.S. lawmakers have started raising concerns about the token sales and distribution methods used by Trump-linked crypto projects, particularly WLFI. Calls for regulatory investigations into the legality of these practices are mounting, which could introduce further pressure on the family’s crypto ventures.

CoinLaw’s Takeaway

Honestly, this is a textbook example of what happens when too much money chases too much hype. In my experience, when influential figures dive headfirst into crypto without hedging risks, the fallout can be brutal. The Trump family’s big crypto bets looked bold on the surface, but they leaned too heavily into speculative territory. It’s a harsh reminder that even billionaire-backed ventures are vulnerable when the market turns. Whether this is a temporary dip or a lasting dent remains to be seen, but this kind of volatility is exactly why diversification is key.