Trezor, a leading hardware wallet brand, continues to shape how individuals and institutions secure their digital assets. As cryptocurrencies gain mainstream traction, Trezor plays a crucial role in enhancing user control, safety, and privacy in self-custody environments. From retail traders to fintech platforms integrating secure key storage, its impact spans financial and technological sectors alike. In this article, we explore the latest Trezor statistics, highlighting growth, usage, and security trends that matter to users and industry observers.

Editor’s Choice

- Trezor’s estimated annual revenue in 2025 is around $47.2 million, with a 34% growth in headcount.

- Trezor saw a 182% rise in average order value through its integrated swap features over five years.

- Trezor supports over 40 native coins, more than 1,500 cryptocurrencies, and 9,000+ total assets, including tokens across major Layer-1 and Layer-2 networks.

- The majority of Trezor phishing scams in 2025 were related to fake vulnerability alerts and malicious emails.

- Trezor continues to be open-source, unlike competitors like Ledger, which use proprietary secure elements.

- Adoption of Shamir Backup and Passphrases is increasing among users seeking enhanced wallet security.

Recent Developments

- Trezor achieved $47.2 million in annual revenue.

- The company employs 175 staff members with 34% workforce growth.

- Trezor holds approximately 30% global hardware wallet market share.

- Hardware wallet revenue per employee reaches $269,500.

- Trezor captured over 20% market share in Vietnam during Q2.

- November online sales generated $6.6 million for trezor.io.

- Trezor Suite app exceeds 100K downloads on Google Play.

- Account discovery speed in Trezor Suite improved by up to 50%.

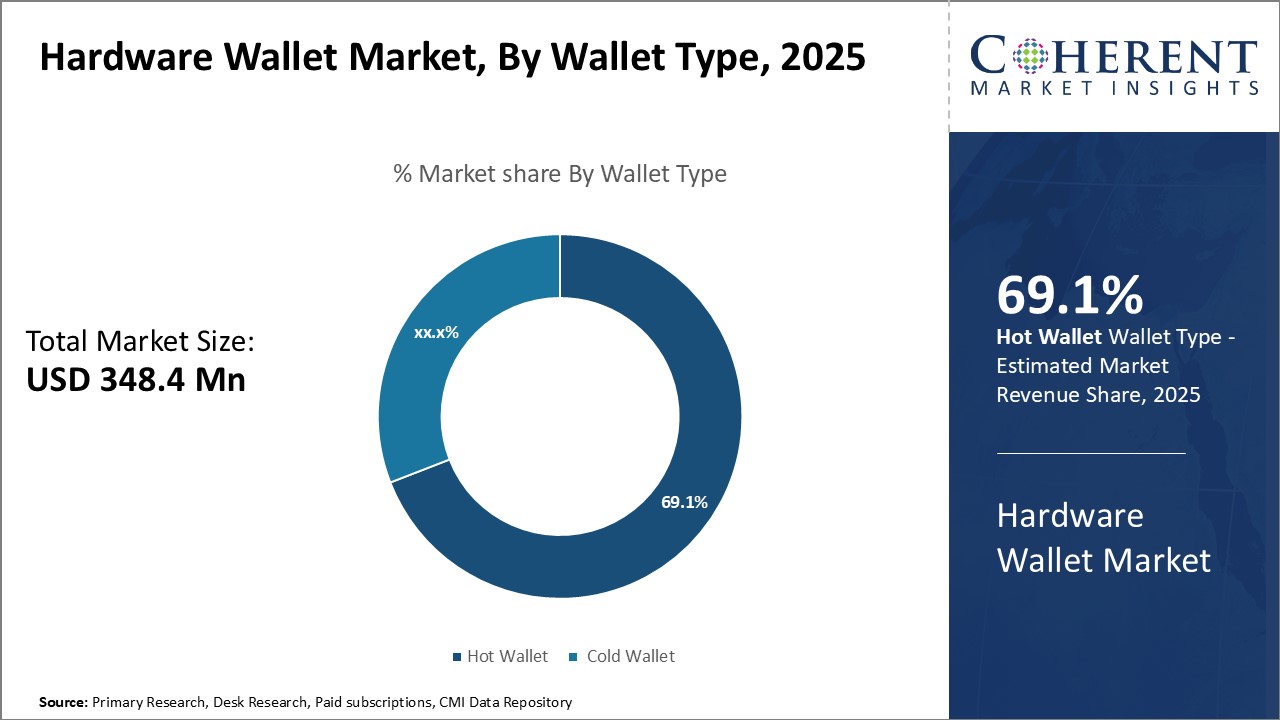

Hardware Wallet Market Share by Wallet Type

- The total hardware wallet market size is projected to reach $348.4 million in 2025.

- Hot wallets are expected to dominate with a 69.1% market share, equivalent to approximately $240.7 million in revenue.

- Cold wallets will account for the remaining 30.9%, translating to about $107.7 million.

- This data highlights a strong user preference for hot wallets, likely driven by convenience, ease of access, and increased integration with online platforms.

- The growing hot wallet dominance reflects a shift in user trust toward internet-connected solutions, despite ongoing concerns around online vulnerabilities.

Trezor Statistics Overview

- Trezor generates $47.2 million in annual revenue.

- The company employs 175 staff members globally.

- Revenue per employee reaches $269,500.

- Trezor Suite supports over 40 native coins, more than 1,500 cryptocurrencies, and 9,000+ total assets when including compatible tokens.

- Workforce expanded by 34% year-over-year.

- Devices sold in total hundreds of thousands worldwide.

- Operates through 13 legal entities in the Czech Republic.

- Holds a 48/100 industry performance score, ranking 12th.

- Secured only $106,000 in total funding via an EU grant.

Device Sales and Shipments

- Trezor reported surpassing 2 million devices sold globally by late 2023.

- The US remains the largest single market, followed by Germany, the UK, and Canada.

- Hardware wallet sales across the industry rebounded post-FTX, with Trezor shipments up 113% YoY in late 2023.

- Trezor launched Trezor Safe 3 in 2023, which contributed to a major spike in units sold.

- Online direct-to-consumer channels accounted for over 60% of total Trezor sales in 2024.

- Asia-Pacific saw a 42% YoY increase in shipments, reflecting growing retail adoption.

- Bulk orders for institutional and educational use rose significantly in 2024 and early 2025.

- Trezor devices are also available via major online resellers and crypto-focused retailers globally.

- New color variants and marketing campaigns boosted sales to first-time wallet users in 2024.

- Increased swap feature usage in Trezor Suite correlates with rising hardware adoption in 2025.

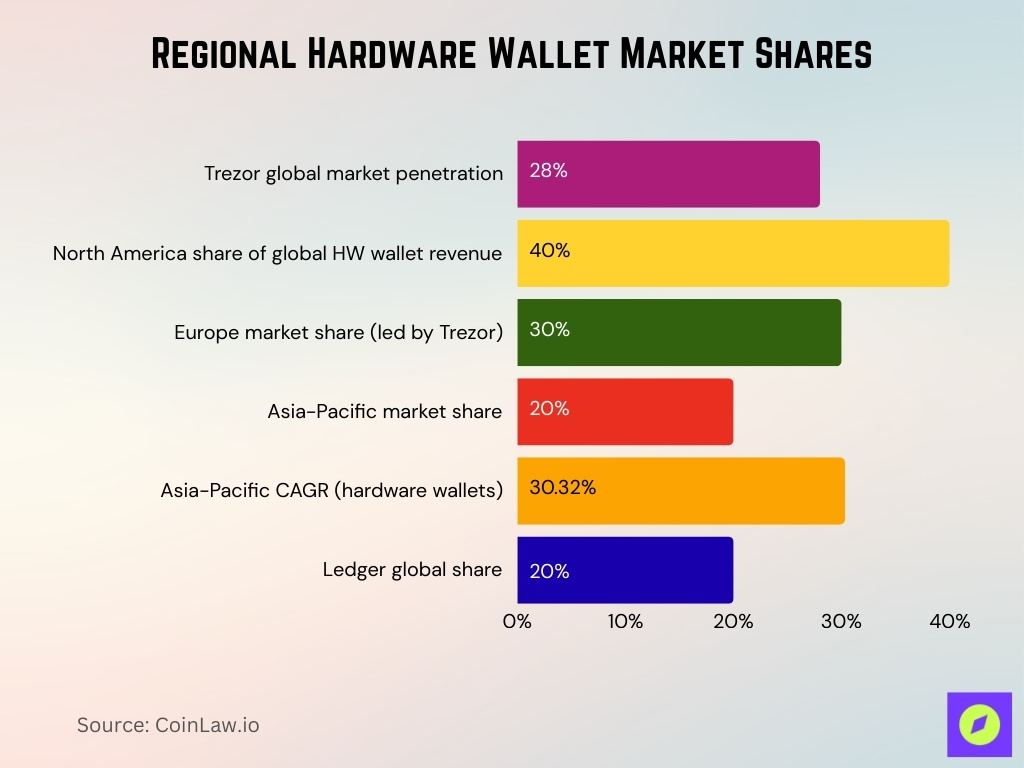

Trezor Market Share in Hardware Wallets

- Trezor captures 28% market penetration worldwide.

- North America holds 40% of global hardware wallet revenue.

- Europe accounts for 30% market share, led by Trezor.

- Asia Pacific represents 20% with a 30.32% CAGR growth.

- Ledger commands 20% global share vs Trezor’s strong position.

- Trezor ranks 12th out of 180 with a 48/100 score.

Revenue, Valuation, and Funding Statistics

- Trezor’s estimated annual revenue in 2025 is approximately $47.2 million, reflecting expanded demand for its hardware wallets.

- Revenue per employee is estimated at about $269,500, based on the projected headcount and revenue.

- The company’s employee base grew ~34% YoY into 2025, signaling scaling operations.

- Trezor remains privately held with no public funding rounds reported in 2025, suggesting organic growth rather than venture capital backing.

- Profitability metrics are not publicly disclosed, but revenue expansion aligns with increased device shipments and swap usage.

- Changing macroeconomic conditions in crypto have increased focus on profitability and operational efficiency across the sector, including Trezor.

- Comparisons with competitors suggest Trezor maintains a strong financial footing relative to similar hardware wallet companies.

- Trezor’s long-term valuation is influenced by the broader crypto custody market, which is expected to expand significantly in the coming decade.

Assets Stored on Trezor Devices

- Trezor Suite supports thousands of crypto assets across multiple networks.

- Devices manage 1,500+ cryptocurrencies, including major coins like BTC and ETH.

- Native support covers 40+ blockchains with token compatibility.

- ERC-20 tokens are handled on Ethereum alongside hundreds of others.

- EVM networks like BSC, Polygon, and Avalanche enable broad asset storage.

- 5 coins deprecated, including Dash and Bitcoin Gold as of February.

- Third-party integrations expand to 40+ wallet apps for extra assets.

- SPL tokens on Solana and similar networks add portfolio diversity.

- NFTs are managed off-chain via connected Web3 platforms and dApps.

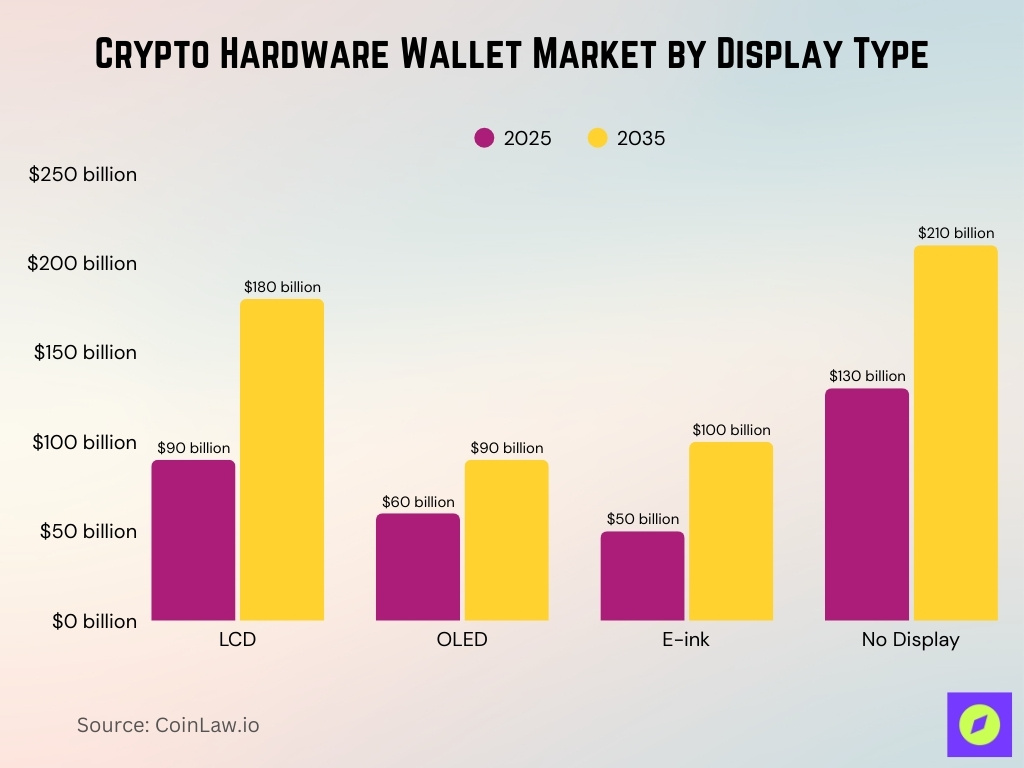

Crypto Hardware Wallet Market by Display Type

- LCD-based wallets are projected to grow from $90 billion in 2025 to $180 billion by 2035, showing a 2x increase over the decade.

- OLED wallet displays will increase from $60 billion to $90 billion, reflecting steady but moderate growth.

- E-ink display wallets are expected to double from $50 billion to $100 billion, likely due to their low-power, secure nature.

- No-display wallets will continue leading the segment, rising from $130 billion in 2025 to $210 billion by 2035, indicating a strong user preference for minimalistic and app-connected solutions.

- The trend shows that while display-equipped wallets are growing, no-display options will remain dominant due to lower cost, compact size, and smartphone-linked usability.

Usage and Activity Metrics

- Cold wallet ownership among retail users rose by 34% year-over-year.

- Institutional wallet usage increased 51% year-over-year.

- Average retail users manage 2.7 wallets, including hardware options.

- Trezor sales surged 600% in peak week following market rally.

- Single-day sales peaked at 11x the typical daily average.

- Transaction history pagination improved for smoother navigation.

- The swap details screen shows slippage and MEV protection metrics.

- Speed up the transaction feature, enhanced for better performance.

Swap and Exchange Integration Statistics

- Average order value increased by 182% over five years with partners.

- The swap conversion rate rose by 55% since the partnership’s inception.

- Changelly handles 48% of all Trezor wallet swaps.

- Monthly swap activity grew 87.5% year-over-year.

- Funnel completion rate improved 29% in four months.

- Changelly powered 33% of total historical swap volume.

- Supports swaps across 30+ fiat currencies directly.

- Services are available in 100+ countries via providers.

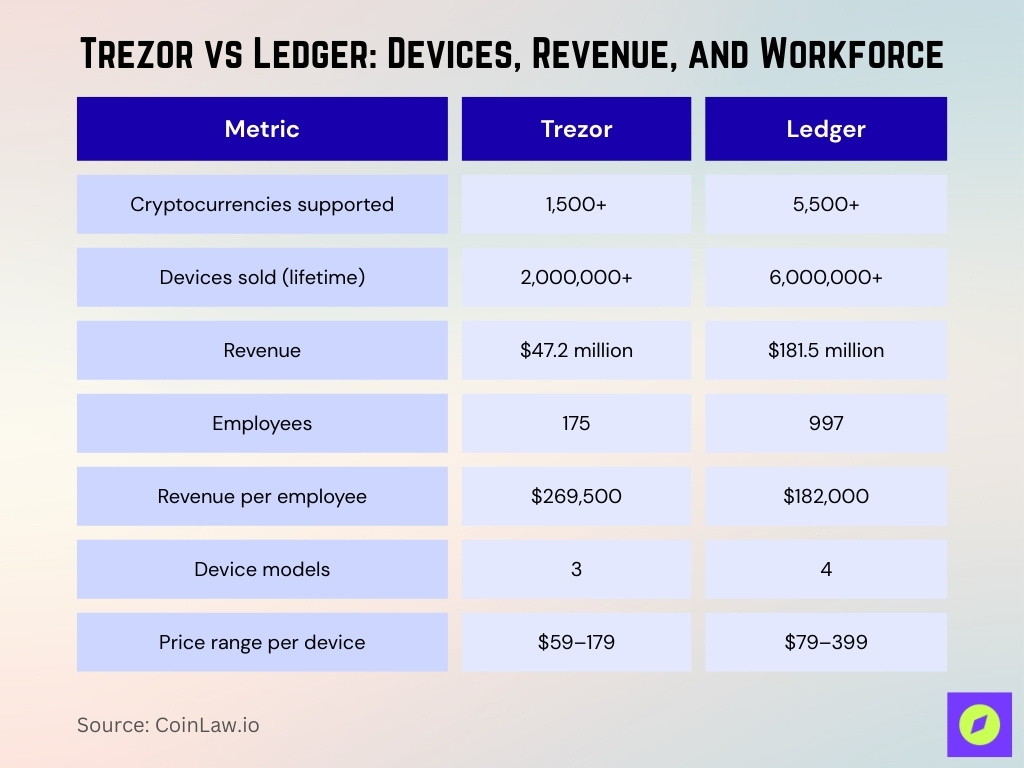

Trezor vs. Ledger and Other Competitor Benchmarks

- Ledger supports 5,500+ cryptocurrencies vs Trezor’s 1,500+.

- Ledger has sold over 6 million devices compared to Trezor’s 2+ million devices.

- Ledger generated $181.5 million in revenue vs Trezor’s $47.2 million.

- Ledger employs 997 staff vs Trezor’s 175 employees.

- Trezor offers 3 models priced $59-$179 vs Ledger’s 4 at $79-$399.

- Ledger’s revenue per employee $182,000, trailing Trezor’s $269,500.

- Trezor provides Shamir Backup, absent in Ledger’s native features.

- Ledger holds a larger market presence with Bluetooth and mobile app support.

Average Order Value and Transaction Size on Trezor

- The average Trezor wallet transaction value varies by region, but retail transfers average between $400 to $1,200.

- During bull markets, average order values often rise by 50% or more, due to higher asset prices and larger trades.

- Integrated swap features have pushed average order value up by 182% from earlier years.

- Users frequently send funds between cold and hot wallets in batches of $1,000 to $5,000.

- Larger institutional or enterprise users often perform multi-signature transactions over $10,000 per session.

- Portfolio sizes held on Trezor devices range widely, from less than $500 to over $500,000, depending on the user.

- Transaction batching is common to minimize fees and network congestion.

- Fee selection settings (Low, Normal, High) in Trezor Suite also influence transaction timing and cost efficiency.

- While average sizes are rising, wallet activity varies depending on whether users hold long-term or trade actively.

- Asset diversity in wallets has increased, leading to more complex portfolio movements per transaction.

Trezor Transaction Volume and Frequency

- Trezor Suite supports around 7 million users with 21% YoY growth.

- Swap activity within Trezor Suite grew 87.5% year-over-year.

- Confirmed swap transactions rose by 29% in four months.

- Average order value for transactions increased 182% over five years.

- Transaction funnel efficiency improved by 29% during high demand.

- Bitcoin network processes 320k-500k daily transactions, supporting Trezor users.

- Trezor users average 3.2 transactions per day across assets.

- Swap volume share via partners reached 48% of total activity.

- The transaction success rate exceeds 99.8% in integrated services.

Trezor Supported Assets and Network Coverage

- Supports thousands of tokens across multiple blockchain networks.

- Natively handles 40+ coins with native Layer 1 support.

- Covers 12 Layer 1 blockchains, including Bitcoin and Ethereum.

- EVM-compatible networks enable hundreds of ERC-20 tokens.

- 5 coins deprecated, including Dash and Bitcoin Gold.

- Solana SPL tokens are managed alongside major assets.

- Third-party wallets extend to 40+ additional networks.

- 9,000+ total assets via token standards like ERC-20.

- Supports BNB Smart Chain, Polygon, and Avalanche natively.

Security Incidents and Vulnerability Statistics

- Phishing emails exploited the support form, targeting thousands of users.

- 66,000 users were exposed in the 2024 support portal data breach.

- Physical Trezor T exploit demonstrated requiring device possession.

- MailChimp breach enabled phishing attacks on Trezor customers.

- 76 accounts compromised via fake verification pop-ups.

- Scam emails surged with sophisticated firmware update lures.

- No remote firmware exploits reported; 100% social engineering losses.

- Contact form exploit contained without internal system breach.

- Users lost millions in aggregate from phishing campaigns.

Phishing, Scams, and Fraud Targeting Trezor Users

- 66,000 users exposed via third-party support portal breach.

- 41 users received direct phishing emails requesting seeds.

- Support form was exploited by sending phishing to thousands of addresses.

- A phishing surge was reported with a sharp rise in scam emails.

- 8 additional accounts compromised in vendor platform breach.

- Contact form abuse triggered official-looking phishing replies.

- A flood of fake firmware update phishing emails is being sent to users.

- Hardware wallet phishing is a major contributor to an estimated $2.5 billion in crypto losses across the broader market, rather than being limited to Trezor users.

- Address-poisoning targeted 17 million users with $83 million stolen.

Trezor Security Features Adoption (Passphrases, Shamir, etc.)

- Shamir Backup supports up to 16 shares with 2-of-3 or 3-of-5 schemes.

- Passphrase usage is reported by over 50% of advanced community members.

- Millions of Trezor devices sold with Shamir Backup capability.

- Hidden passphrase wallets protect against 100% of seed-only thefts.

- 20-word Shamir shares provide 128-bit security per recovery part.

- Dual secure elements in Safe 7 enhance passphrase protection.

- Community recommends easy, memorable passphrases like pet names.

- Shamir adoption eliminates single-point seed failure risk.

- Open-source firmware audited by thousands of developers annually.

Frequently Asked Questions (FAQs)

$47.2 million in annual revenue for Trezor in 2025.

Trezor experienced a 600% increase in sales during its record sales week.

North America was projected to hold around 40% market share in 2025.

Conclusion

Trezor remains a cornerstone of hardware wallet security, balancing robust offline protection with expanding asset support and user tools. While transaction volumes and frequencies are best analyzed through Trezor Suite user data, the platform clearly supports active engagement across diverse cryptos. Emerging threats like phishing and scams continue to challenge users, prompting ongoing education and protective features.

Comparisons with competitors such as Ledger underscore differing priorities, broad asset coverage, and secure element hardware versus open-source transparency and advanced backup options. For investors and everyday users alike, understanding Trezor’s statistics and security paradigms helps inform safer, smarter crypto custody decisions as self-sovereign finance grows.