The payments ecosystem for e-commerce is evolving rapidly, and one standout player is the built-in solution from Shopify: Shopify Payments. In sectors such as direct-to-consumer retail and small business services, merchants use Shopify Payments both to streamline checkout and to reduce reliance on external gateways.

For example, a U.S. apparel brand on Shopify might cut transaction complexity by using Shopify’s native payments rather than integrating multiple third-party processors. Similarly, a global artisan marketplace can leverage Shopify Payments to offer unified settlement across markets. Below you’ll find a detailed look at Shopify Payments statistics, covering adoption, share, availability, performance, and overall merchant impact.

Editor’s Choice

- 64% of merchants’ gross merchandise value (GMV) processed through Shopify stores used Shopify Payments in Q1 2025.

- Total payment volume via Shopify Payments reached $47.5 billion in Q1 2025, up from about $36.2 billion in Q1 2024.

- Shopify processed approximately $292.3 billion in GMV in 2024, demonstrating its scale as a commerce system.

- As of 2025, 1.89 million merchants actively use Shopify Payments, equal to about 90% of all eligible stores.

- Shopify Payments holds roughly 15% of the payment-processing software market as of 2024.

- The rapid checkout option Shop Pay accounted for 38% of gross payment volume (GPV) in recent reporting.

- Shopify’s merchant stores grew by 6% year-over-year in Q1 2025.

Recent Developments

- In Q1 2025, Shopify’s reported GMV grew 23% year-over-year to ~$74.8 billion.

- Shopify merchant solutions revenue rose ~37% year-over-year in Q2 2025, showing payments business momentum.

- Shopify Payments processed 64% of Shopify’s GMV in Q1 2025, rising from 60% in Q1 2024, with $47.5 billion in payment volume.

- Shop Pay’s GMV jumped by 65% to $27 billion in the period referenced, demonstrating checkout innovation.

- Shopify expanded its payments product into 16 new countries in the referenced year, illustrating geographic rollout.

- Shopify’s business-to-business (B2B) GMV more than doubled in a quarter (101% growth in Q2 2025), which may increase demand for integrated payments.

- The company emphasized cross-border commerce and multi-entity support, pointing to merchants operating globally.

- Shopify achieved seven consecutive quarters of free cash-flow margin in double digits, supporting investment into payments infrastructure.

Shopify Revenue Sources

- Merchant Solutions Revenue accounts for 76% of Shopify’s total income, making it the company’s primary revenue driver.

- This category includes Shopify Payments, Shopify Capital, Shopify Markets, and Shopify Fulfillment, reflecting strong merchant service adoption.

- Subscription Solutions Revenue contributes the remaining 24%, generated from monthly plans, themes, and app subscriptions.

Shopify Payments Adoption Rate

- The previous year (Q1 2024) had around 60% penetration, indicating a ~4-point increase.

- In 2024, Shopify Payments accounted for about 61% of Shopify’s GMV.

- With Shopify’s total GMV of ~$292.3 billion in 2024, roughly $178 billion might be processed via Shopify Payments, implying high transaction volumes.

- The growth of adoption is supported by the fact that Shopify’s merchant count and activity continue to expand, making the native payments option more viable.

- The increasing penetration suggests merchants are shifting from third-party gateways toward Shopify’s built-in payments.

- The “90% of merchants” figure may refer to basic availability rather than full adoption of payment processing.

Shopify Payments Share of Gross Merchandise Volume (GMV)

- In Q1 2025, Shopify Payments processed $47.5 billion, up from $36.2 billion in Q1 2024.

- That $47.5 billion represented ~64% of Shopify GMV for that quarter (since Q1 GMV ~$74.8 billion), indicating strong dominance.

- In 2024 overall, Shopify’s GMV was ~$292.3 billion, and by applying ~61% as the payments share, Shopify Payments may have processed around ~$178 billion.

- Shopify Payments had about a 15% share of the broader payment processing software market in 2024.

- The upward trend in payments share aligns with Shopify’s merchant solutions segment growing faster than subscription revenue.

- The increase in share of GMV suggests that as merchants grow on Shopify, they prefer the integrated payment option for better operational alignment.

- The data points to a strategic shift where Shopify is capturing more of the transaction flow rather than just hosting stores.

- This growth in share may translate into higher revenue for Shopify via processing fees and value-added services associated with payments.

Number of Online Stores Running on Shopify Worldwide

- Apparel dominates Shopify with 537,883 stores, making it the largest product category on the platform.

- Home & Garden follows with 249,536 stores, reflecting strong growth in lifestyle and decor businesses.

- Beauty & Fitness ranks third at 205,097 stores, driven by rising global demand for wellness and personal care products.

- The Food & Drink category hosts 128,035 stores, showcasing the rise of online specialty food brands and delivery-based ventures.

- Social and community-based ventures under People & Society total 78,014 stores, while Sports and Health each maintain over 70,000 stores.

- Art & Entertainment has 71,270 stores, indicating a growing number of independent creators and digital product sellers.

- Niche categories such as Toys & Hobbies (62,505), Autos & Vehicles (44,613), and Pets & Animals (43,400) highlight Shopify’s broad diversification.

- Smaller segments like Computers (32,871), Games (18,473), Books & Literature (14,860), and Travel (10,813) represent emerging but growing industries on the platform.

- The data underscores Shopify’s global versatility, with fashion, lifestyle, and wellness sectors driving the majority of its merchant activity in 2025.

Geographic Availability of Shopify Payments

- Shopify serves merchants in 175+ countries globally.

- In 2025, the payments product was expanded into 16 new countries.

- Shopify Payments is available in 39 countries worldwide as of Q2 2025.

- The U.S. remains the largest single market for Shopify store activity, with ~12% of all U.S. e-commerce flowing through Shopify.

- International GMV for Shopify grew 42% year-over-year in Q2 2025, reflecting strong non-U.S. momentum and the need for multi-market payments.

- Shopify offers multi-entity payout support, helping merchants operating across regions manage local currencies and tax flows.

- The expansion into additional countries reduces friction for merchants migrating to Shopify Payments from third-party gateways, especially in emerging markets.

- Because Shopify Payments’ availability still lags in some regions, merchants may adopt third-party gateways until native support arrives, which suggests room for growth and conversion.

Year-over-Year Growth Trends for Shopify Payments

- The penetration rate of Shopify Payments rose to 64% of the platform’s GMV in Q1 2025, up from ~60% in Q1 2024.

- In Q1 2025, the payment volume processed via Shopify Payments exceeded $47.5 billion, up from ~$36.2 billion in the prior-year period.

- Shop Pay processed 38% of gross payment volume in Q1 2025, up from 33% in 2023

- Shopify’s overall revenue grew 27% year-over-year in Q1 2025, reflecting the expanding payments business.

- The number of live stores using Shopify Pay was ~1.45 million, representing a year-over-year increase of ~14.2%.

- Merchant solutions (which include payments) grew faster than subscription solutions in recent quarters, indicating that payments are a growing segment.

- Merchants are increasingly adopting the integrated payments option rather than third-party gateways.

- Because of the global expansion of availability and improved checkout experience, the growth momentum for Shopify Payments is likely to continue.

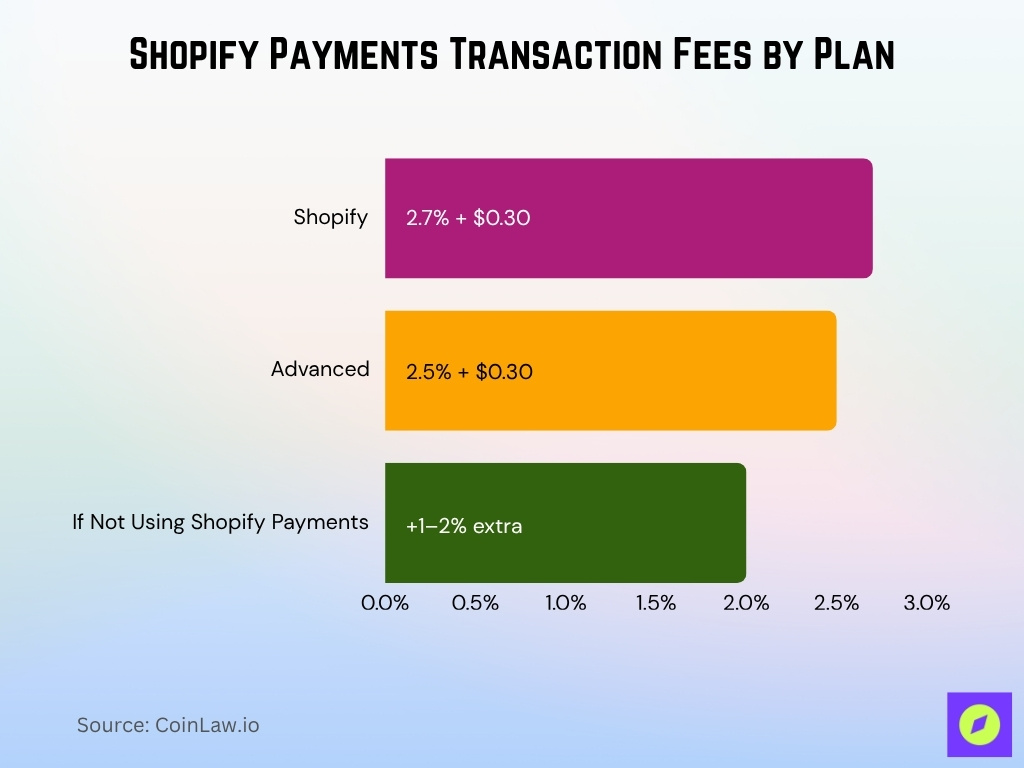

Shopify Payments Transaction Fees by Plan

- Merchants on the Shopify plan saw transaction fees for online sales starting at 2.7% + 30¢, with in-person sales at 2.5% + 10¢ when using Shopify Payments.

- For high-volume merchants, Shopify’s Advanced plan reduces online processing fees to ~2.5% + 30¢ when using Shopify Payments.

- When merchants choose not to use Shopify Payments and opt for third-party gateways instead, an additional Shopify fee adds about 1%–2% more in transaction cost.

- Shopify Payments becomes cost-effective when monthly GMV exceeds $1,000, due to the elimination of third-party gateway fees.

- Hidden costs such as international transaction markups (+1.5%) and currency conversions can raise effective processing fees to 3.5% or higher for cross-border sales.

- Merchants processing high volumes or with significant international sales may need to evaluate total effective cost, including FX and payout latency.

- Using Shopify Payments often results in 34% lower total cost compared to combining a third-party gateway + Shopify fees.

- Merchants on regional or unsupported plans may face higher rates or non-availability of optimal pricing tiers.

Shopify Payments Adoption by Region

- In the U.S., a majority of merchants on the Shopify platform now use Shopify Payments, with adoption rates up to 90% in supported markets.

- Several markets outside the U.S. still show lower adoption because Shopify Payments is not yet fully available in all countries.

- Of the ~4.8 million active global Shopify stores, ~3 million are U.S.-based, indicating the U.S. remains the largest regional base for payment adoption.

- International GMV for Shopify grew ~42% year-over-year in Q2 2025, underscoring global merchant growth and therefore regional payment adoption potential.

- Regions such as APAC and EMEA are seeing increasing merchant migrations to Shopify, which will boost native payments uptake.

- Some smaller-market merchants still rely on third-party gateways due to eligibility or local constraints, implying regional variation in adoption.

- Multiplying payout and currency features are enhancing regional use of Shopify Payments with multi-entity support.

- While U.S. adoption is very high, emerging markets represent the largest growth opportunity for Shopify Payments adoption globally.

Market Share of Shopify Payments in Payment Processing

- Shopify Payments held about 15% of the global payment-processing software market in 2024.

- Around 90% of eligible merchants use Shopify Payments to process transactions on the platform as of late 2024.

- Shopify Payments processed 62% of all GMV flowing through Shopify in 2024, up from 58% in 2023.

- The solution’s GMV penetration rose to 64% in Q2 2025, marking its highest level yet.

- Shopify Payments handled $43.3 billion in Gross Payments Volume (GPV) during Q3 2024 alone.

- Shopify’s GPV grew 31% year over year in Q3 2024, continuing double-digit growth momentum.

- The platform’s payment capabilities are now available in 40+ countries worldwide.

- Shopify commands 10.32% of the global e-commerce platform market and powers 4.8 million stores globally.

- Merchants using Shopify Payments avoid third-party gateway fees, with savings of roughly 0.5%–2% per transaction.

- Shopify’s payment processing revenue accounts for roughly a 1–2% take rate on total GMV, forming a major growth driver.

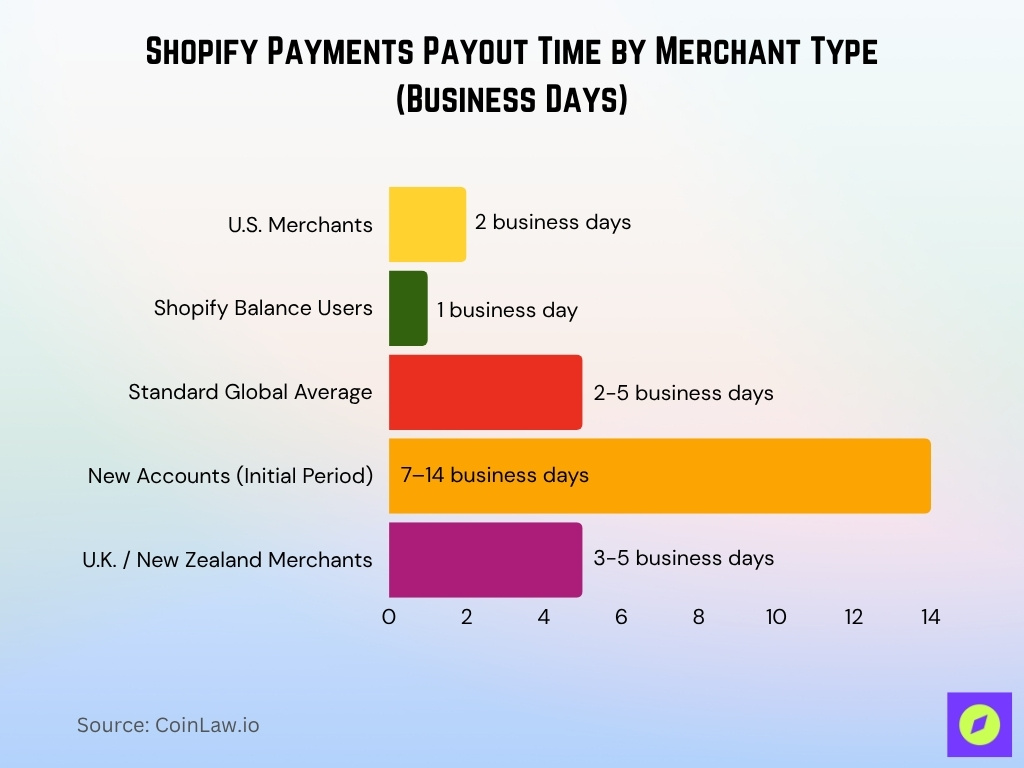

Payout Times and Cash Flow with Shopify Payments

- Shopify Payments typically releases funds within 2–5 business days after a charge is processed.

- For U.S. merchants, the average payout time is around 2 business days, faster than many processors.

- Shopify Balance users receive payouts in as little as 1 business day, enabling quicker cash turnover.

- New accounts may face an initial holding period of 7–14 business days before the first payout.

- In countries like the U.K. or New Zealand, standard payout times are 3–5 business days.

- Shopify merchants can choose payout frequencies, daily, weekly, or monthly, with daily as the default.

- Banks may add 24–72 hours of processing time after Shopify releases funds.

- Shopify’s strong cash metrics included $421 million in free cash flow in Q3 2024, reflecting improved liquidity.

- Payouts are initiated daily at 10 a.m. ET, with previous-day sales deposited first to the Shopify Balance.

Cost Savings from Using Shopify Payments

- Switching from third-party gateway + Shopify fees to Shopify Payments can result in $4,500 annual savings for a monthly GMV of $25,000.

- The example compared a total cost of $1,100 vs $725 using Shopify Payments, yielding ~34% savings.

- The elimination of additional Shopify gateway fees (0.5-2.0%) is a direct savings lever.

- Improved payment success rate from Shopify Payments’ fraud stack drives more revenue, translating into cost avoidance of lost sales and declines.

- Shopify Payments’ 3DS implementation generated ~$471 million in additional annual payment volume by improving success rates.

- Fraud optimization reduced chargeback rates by 20%, saving merchants approximately $62 million annually.

Shop Pay Usage and Performance

- Shop Pay processed ~38% of Shopify’s GPV, up from ~33% in 2023.

- Installs of Shop Pay on e-commerce stores increased by ~14.2% year-over-year.

- About ~1.89 million live websites use Shop Pay, while ~2.63 million sites historically used it.

- Shop Pay users are 77% more likely to make a repeat purchase when using the service.

- Around 43% of customers use Shop Pay as their preferred checkout method when offered.

- 62% of Shop Pay users are Gen Z or Millennials, and over half earn more than $75,000 annually.

- Shopify offers built-in Shop channel reports for detailed measurement of Shop Pay sales and orders.

- Shop Pay is emerging as a key driver of checkout conversion and merchant success within the Shopify ecosystem.

Chargeback Fees and Fraud Protection on Shopify Payments

- Shopify Payments charges a $15 fee per chargeback in the U.S., refundable when merchants win disputes.

- In the U.K., chargebacks cost £10 per case, refunded if resolved in the merchant’s favor.

- 3D Secure (3DS) implementation increased payment success by 0.26% and reduced fraudulent chargebacks by 20%, saving merchants $62 million annually.

- The average chargeback handling cost across e-commerce is about $15–$25 per dispute, excluding lost sales.

- Global ecommerce chargebacks are projected to reach $33.79 billion in 2025, up from $28.7 billion in 2023.

- Fraudulent transaction attempts targeting Shopify stores rose 15% year over year, mirroring broader ecommerce trends.

- Shopify Protect fully covers eligible Shop Pay orders, reimbursing both order value and chargeback fees on fraudulent transactions.

- Third-party fraud platform Signifyd, used by Shopify merchants, reported a 93% reduction in chargebacks for some high-risk clients.

- Merchant chargeback ratios typically average 0.47% of revenue annually from disputes and admin losses.

- Shopify’s machine learning fraud detection scans 100% of transactions in real time to block suspicious activity.

Shopify Payments vs. Third-Party Gateways

- If merchants use third-party gateways instead of Shopify Payments, Shopify charges 0.6% to 2% extra transaction fee.

- Basic plan incurs 2%, Shopify plan 1%, Advanced plan 0.6% per transaction processed externally.

- Shopify Payments offers seamless integration with a unified dashboard; third-party gateways require separate setup and reconciliation.

- Third-party gateways may support more local methods, but increase complexity and cost.

- Shopify Payments lowers total processing cost and eliminates the extra Shopify fee.

- High-volume merchants with global payment needs may still use hybrid approaches after cost-benefit review.

- Merchants report better conversion and fewer declines when using Shopify’s native payments.

- Many U.S. merchants find Shopify Payments financially advantageous unless they need specific local gateways.

The Impact of Shopify Payments on Merchant Success

- Merchants using Shopify Payments report a higher checkout conversion, with over a 50% increase after switching from other processors.

- Improved payment success (0.26% higher approval) adds $471 million in additional payment volume across the ecosystem.

- Lower chargebacks (20% reduction) means merchants retain more revenue.

- Faster and predictable payouts support better cash-flow management.

- Integrated reporting and a unified dashboard reduce administrative burden.

- Multi-region merchants benefit from consistent rates and fewer settlement surprises.

- Transparent fees enable accurate forecasting of margins and profitability.

- Case studies show that migrating to Shopify Payments leads to smoother scaling, fewer hold-ups, and improved profitability.

Key Benefits of Using Shopify Payments

- Merchants using Shopify Payments save up to 2% in extra transaction fees otherwise charged by third-party providers.

- Standard processing fees range between 2.4%–2.9% + $0.30 per transaction, varying by plan tier.

- Businesses on the Basic plan save roughly $12,000 annually by avoiding external processor fees on $50,000 monthly sales.

- Using Shopify Payments unifies order, inventory, and payment tracking across the entire platform for near 100% data sync accuracy.

- Shop Pay checkout converts up to 36% better than competitors, greatly boosting store sales.

- 90%+ of top-performing stores use Shopify Payments for faster settlements and reduced manual accounting effort.

- Shopify Payments supports over 100 global payment methods, including BNPL, wallets, and credit cards.

- Integrated fraud detection and Level 1 PCI DSS security compliance protect millions of transactions monthly.

- Unified dashboards allow merchants to manage 100% of transaction analytics from a single admin interface.

- Multi-currency and global settlement support improve cross-border efficiency by 15–20%, enhancing operational flexibility.

Frequently Asked Questions (FAQs)

16 new countries.

20%.

26 basis points, representing $471 million in additional annual payment volume.

$47.5 billion

Conclusion

Shopify Payments clearly stands as a strategic lever for merchants using the Shopify platform. It offers streamlined payments integration, a favorable cost structure, faster payouts, and robust fraud and chargeback protections. For merchants who qualify and operate in supported regions, the advantages over third-party gateways are substantial, from cash flow to conversion.

That said, eligibility, regional availability, and merchant-specific requirements still matter. As merchants scale and expand globally, choosing the right payment configuration becomes a performance decision, not just a checkbox. If you’re using Shopify, exploring Shopify Payments should be high on your roadmap. You’re now equipped with detailed statistics and insights to evaluate how Shopify Payments may impact your business.