Self‑custody wallets are rapidly reshaping how individuals and institutions control digital assets by keeping private keys under the user’s direct control. From a retail investor in the U.S. safeguarding their crypto portfolio to a fintech firm offering self‑custody as a service, the shift is happening across sectors. The following sections explore current statistics and trends around adoption, demographics, and usage, inviting you to dive deeper into the full article.

Editor’s Choice

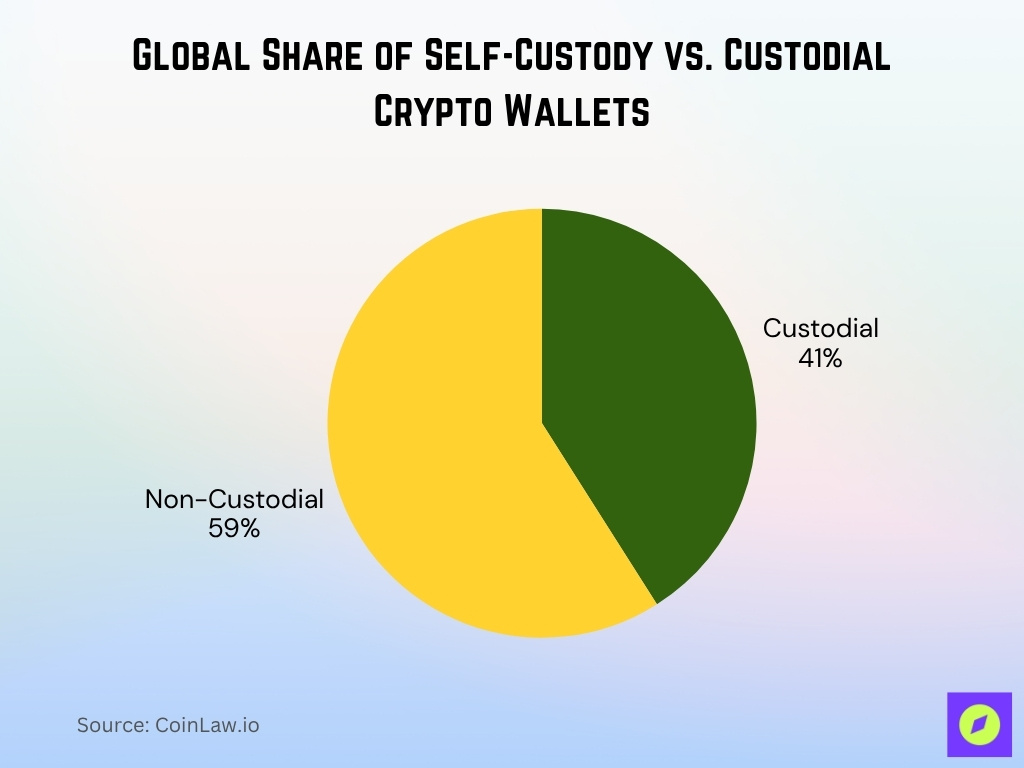

- 59% of crypto wallet users globally in 2025 prefer non‑custodial (self‑custody) wallets versus custodial solutions.

- About 820 million unique active cryptocurrency wallets exist globally in 2025.

- Hardware wallet sales are projected to reach $0.56 billion in 2025, expanding at a CAGR of nearly 30%, with institutional wallet usage up 51% year-over-year.

- In North America, there are around 134 million wallet users in 2025, accounting for ~16% of global users.

- For hot wallets (online, live wallets) in 2025, 78% of all crypto wallets fall into this category.

- Nearly 71% of crypto users reported increased awareness of self‑custody in 2025.

Recent Developments

- The global crypto wallet market is valued at $12.59 billion in 2024 and forecast to reach $100.77 billion by 2033 at a CAGR of 26.3%.

- A major institutional shift, 43% of institutional wallets in 2025 remain custodial, meaning 57% have moved (or are moving) toward non‑custodial or hybrid models.

- Mobile‑first wallets showed 2.3× higher user retention than browser‑extension wallets in 2025, reflecting the shift in how wallets are accessed.

- Cold wallets (offline storage) are capturing more adoption; in 2025, they made up about 22% of all crypto wallet usage globally.

- Security and user education have become core priorities; for example, wallets with MFA (multi‑factor authentication) have a 62% lower incidence of compromise.

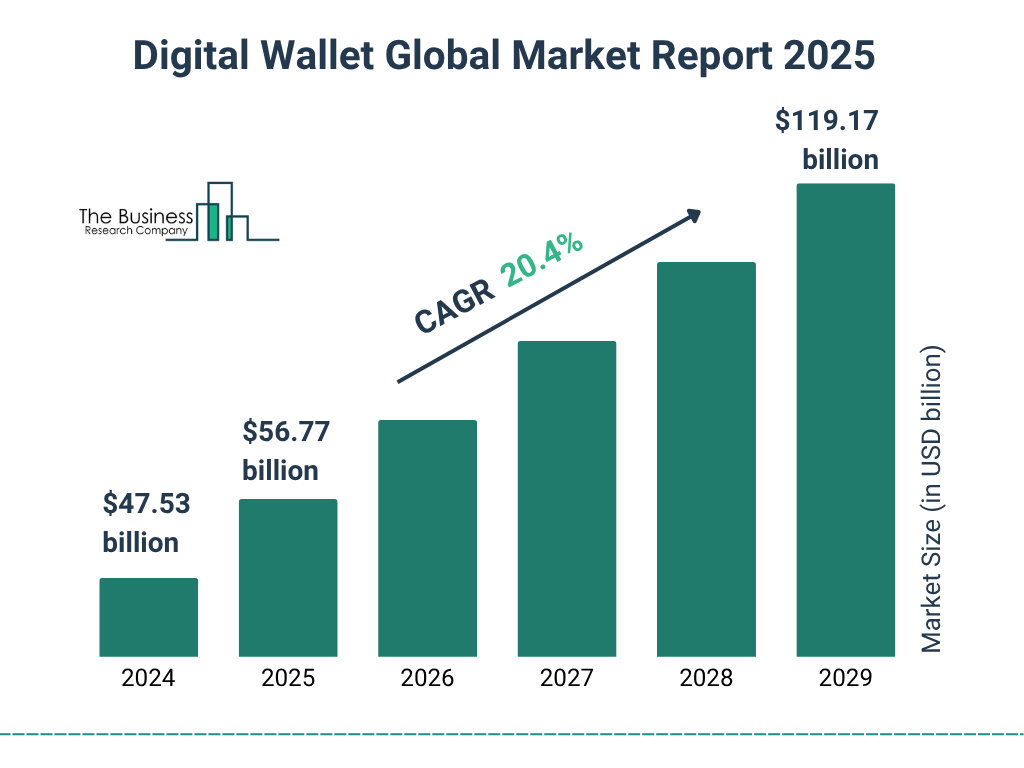

Digital Wallet Market Size Forecast

- The global digital wallet market is expected to reach $56.77 billion in 2025, up from $47.53 billion in 2024.

- This reflects a projected CAGR of 20.4%, indicating robust growth across consumer and institutional adoption.

- By 2029, the market size is forecasted to nearly double, hitting $119.17 billion.

- The growth trajectory suggests increasing demand for mobile payments, self-custody wallets, and fintech integrations globally.

- This surge is fueled by expanding e-commerce penetration, blockchain wallet innovation, and rising digital financial inclusion in emerging markets.

Self‑Custody Wallet Adoption Rates

- In 2025, approximately 59% of users use non‑custodial (self‑custody) wallets, while 41% use custodial wallets.

- Hot wallets constitute 78% of all crypto wallets in 2025, with cold wallets at 22%.

- Desktop wallet usage dropped to just 9% of hot wallet usage in 2025, showing a preference for mobile platforms.

- Hardware wallet sales increased by 31% in 2025, signalling rising adoption of self‑custody in offline forms.

- In the Asia‑Pacific region, wallet adoption reached 350 million users in 2025, representing ~43% of the global share.

- In Latin America, adoption reached ~92 million users in 2025, driven by inflation hedging and crypto usage.

- The market for non‑custodial wallets is expected to grow strongly, forecasted to reach around $10 billion by 2028.

- In the United States, around 27% of internet users owned a crypto wallet in 2025.

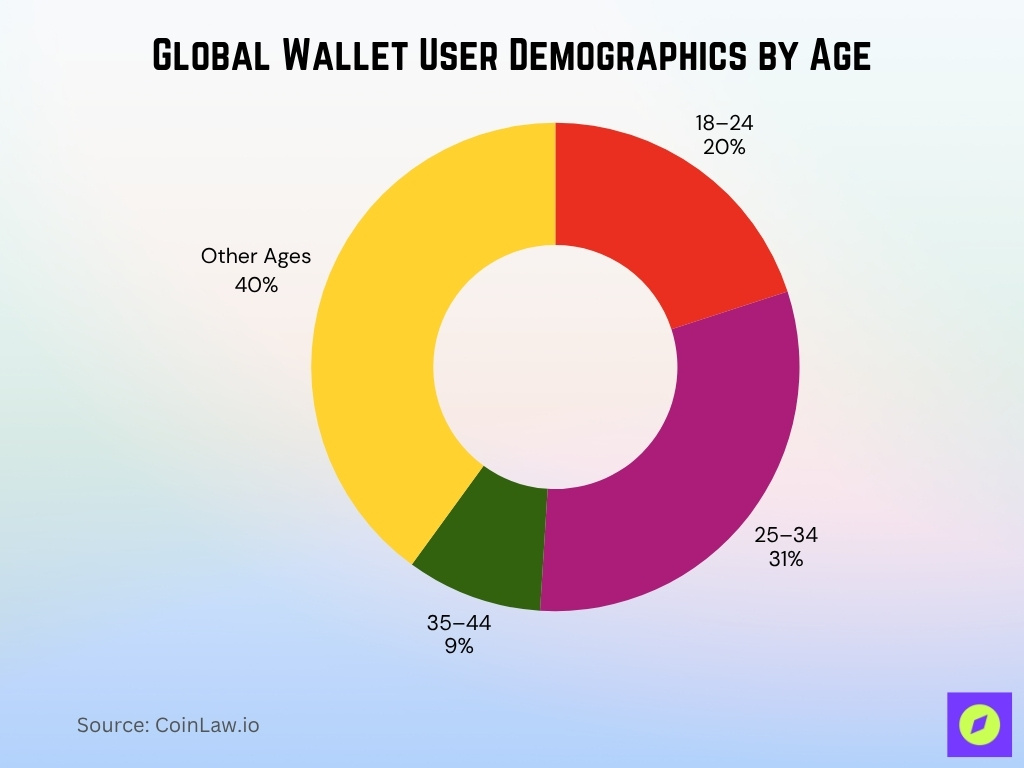

Demographics of Self‑Custody Wallet Users

- The 25–34 age group accounts for approximately 31% of global wallet users in 2025.

- Millennials (ages 25–44) make up around 40% of all users, making them the dominant demographic.

- Gen Z (ages 18–24) represents about 20% of users, with strong growth in NFT and DeFi adoption.

- Gender split globally for crypto wallet users, roughly 67% male, 33% female, in 2025.

- Mobile platform usage dominates, with over 78% of hot wallet users accessing via mobile apps in 2025.

- Android devices hold ~61% of mobile wallet installs/usage, iOS about ~36%.

- The median age of US crypto wallet users has moved toward ~37 years in 2025, reflecting maturing adoption.

- Regions outside traditional markets are catching up; Africa’s adoption doubled in around two years, reaching ~75 million wallet users in 2025.

Security Features of Self‑Custody Wallets

- A recent technical review found that around 90% of widely used browser extension wallets had at least one exploitable security vulnerability.

- Research shows that wallets integrating multi‑signature (multisig) support reduce key‑compromise risk by more than 40% compared with single‑key wallets.

- According to a 2025 checklist, $3.1 billion in crypto was lost in the first six months of the year, making 2025 already the worst year on record for losses tied to weak wallet security.

- A study comparing wallet security features found that wallets offering hardware key storage and air‑gap signing had incident rates under 5%, versus over 15% for software‑only models.

- More than 70% of self‑custody wallet providers in 2025 offer biometric login combined with seed‑phrase backup, up from ~50% in 2024.

- Research shows that wallets with built‑in phishing detection and transaction‑screen alerts reduced user‑reported losses by nearly 60% in trials.

- Approximately 15% of wallet breaches in 2024 involved credential compromise (passwords or seed phrases), highlighting key management as the weakest link.

Losses and Hacks in Self‑Custody Wallets

- In the first half of 2025, losses due to crypto hacks and scams already exceeded $2.37 billion, a ~66% increase over H1 2024.

- Approximately 70% of stolen funds in 2024 stemmed from private‑key or seed‑phrase compromise.

- In H1 2025, 48% of exchange‑platform breaches were due to phishing attacks, underlining the human factor in wallet security.

- Since 2011, over $19 billion worth of crypto assets have been lost to hacks, scams, or custody failures.

- The number of reported incidents rose from 282 in 2023 to 303 in 2024, showing the trend of threats escalating.

- Losses from hot‑wallet attacks continue to dominate, while cold‑wallet/air‑gap failures still account for ~10‑15% of major incidents.

Self‑Custody vs. Custodial Wallet Usage Statistics

- For hot wallets in 2025, custodial models account for ~41%, non‑custodial ~59%.

- 56.58% of users now prefer self-custody wallets, while 26.97% trust exchanges for managing their crypto assets.

- Among institutional wallets in 2025, 43% are custodial; therefore, ~57% are non‑custodial or hybrid.

- Crypto-related hacks resulted in $2.2 billion in losses in 2024, with 2025 expected to surpass $2.37 billion due to rising wallet and protocol breaches.

- Self‑custody gives direct private‑key control, custodial wallets relieve that responsibility but impose counterparty risk.

- Newer users often prefer custodial due to convenience, power users or DeFi users lean into self‑custody.

Key Innovations in Self‑Custody Wallet Technology

- Multi‑chain wallet solutions are rapidly advancing; by 2025, many will support over 70 blockchain networks in a single interface.

- Use of threshold‑signature schemes (e.g., 2‑of‑3 multisig) is up by over 35% year‑over‑year among hardware wallet vendors.

- Some wallets now include social recovery systems, enabling users to delegate trusted contacts or devices to recover assets. Adoption is estimated at ~22% of new wallet setups.

- Privacy‑focused wallet designs are emerging, e.g., a prototype mobile wallet using zk‑SNARKs to reduce storage overhead by ~20×.

- Wallets integrating DeFi staking, NFT management, and token swaps natively within a self‑custody interface saw usage rise by ~40% in 2025.

- Research into “omni‑chain” wallets (that span Bitcoin, Ethereum, Cosmos, Solana, etc) shows cross‑chain interoperability is becoming standard.

- Many self‑custody wallets now apply built‑in compliance modules (proof‑of‑reserve, on‑chain audits) to improve institutional comfort.

- Hardware wallets are increasingly using secure‑enclave chips certified at higher assurance levels (e.g., EAL 6+) and supporting contactless/NFC methods.

Institutional vs. Retail Usage of Self‑Custody Wallets

- Institutional wallet ownership grew by 51% in 2025, now accounting for over 31 million crypto wallets, with 43% custodial and 57% non-custodial/hybrid.

- Among institutions, cold‑storage holdings average 95%–99% of digital assets, mirroring best‑practice custody models.

- For retail users, 78% in 2025 still use hot wallets as their primary access point.

- Institutional self‑custody service providers now combine self‑custody options with insurable trusteeship to satisfy regulatory demands; growth in this sector is over 30% annually.

- Retail users report ~63% satisfaction with self‑custody autonomy, but only ~46% feel fully confident managing key recovery themselves.

- Institutions increasingly view self‑custody as risk mitigation over custodial counterparties; ~59% of institutional crypto‑allocations now include self‑custody solutions.

- For retail, convenience remains a barrier; ~41% still prefer custodial wallets because of ease‑of‑use, despite accepting increased counterparty risk.

- In North America, self‑custody awareness among retail users rose to 71% in 2025.

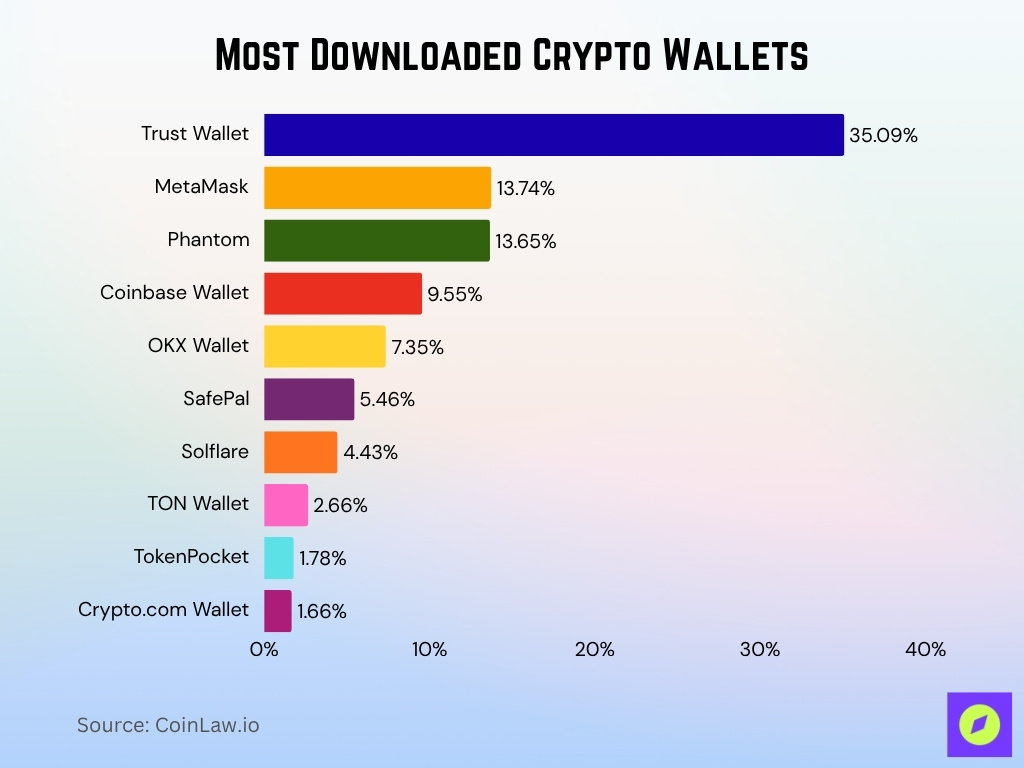

Most Downloaded Crypto Wallets

- Trust Wallet led all crypto wallets with a commanding 35.09% share of downloads in March 2025.

- MetaMask ranked second, capturing 13.74% of total downloads.

- Phantom followed closely with a 13.65% share, showing continued popularity among Solana users.

- Coinbase Wallet accounted for 9.55%, reflecting strong traction among U.S. retail users.

- OKX Wallet secured 7.35%, boosted by integrations across multiple blockchains.

- SafePal and Solflare saw moderate download shares at 5.46% and 4.43% respectively.

- TON Wallet registered 2.66%, supported by Telegram’s growing ecosystem.

- TokenPocket held a 1.78% share, with niche adoption in Asian markets.

- Crypto.com Wallet rounded out the list with 1.66% of downloads.

Migration Trends: Custodial to Self‑Custody Wallets

- Global active crypto wallets exceeded 820 million in 2025, with self-custody wallets driving the majority of new growth, up 47% year-over-year.

- Among new wallet registrations in 2025, an estimated 33% migrated from custodial to non‑custodial platforms.

- In the U.S., a user survey indicated that about 41% of retail crypto holders still primarily use custodial wallets for convenience.

- Migration trends show heavier movement in emerging markets, where self‑custody adoption rose faster (Latin America, Africa) compared to mature markets.

- Among Gen Z crypto users in 2025, NFT wallet ownership increased by 42%, and many of these are self‑custodial wallets.

Regulatory Impact on Self‑Custody Wallet Usage

- Global regulators issued 21+ new advisories on wallet fraud and self-custody risks in 2025.

- The FATF and Europol include non-custodial wallets in over 75% of their updated regulatory frameworks.

- NYDFS updated virtual currency custody guidance impacting 100+ institutions in September 2025.

- About 65% of new regulations focus on centralized exchanges, sparing many self-custody users from direct KYC/AML requirements.

- Hybrid self-custody options surged by 40% among custodial platforms in 2025 due to regulatory pressure.

- 55% of EU-based crypto firms debate mandatory identity verification for non-custodial wallet users.

- 48% of surveyed retail crypto holders in 2024 want stronger fraud protections linked to regulatory risk perception.

- Self-custody wallets with compliance features like proof-of-reserve grew by 30% in global adoption in 2025.

- In 2025, 24 countries introduced new wallet compliance frameworks impacting self-custody wallet policies.

- Approximately 67% of active wallets in regulated markets are now linked to KYC-compliant identities.

User Preferences and Satisfaction Levels

- In 2025, about 71% of crypto users reported increased awareness of self‑custody wallets.

- Among those who choose wallets with transaction previews and scam alerts, trust ratings were about 1.9× higher.

- A survey showed ~63% of retail users report satisfaction with self‑custody autonomy, but only ~46% feel fully confident managing their own key recovery.

- For mobile self‑custody wallet users, ~84% reported biometric login as important in 2025.

- Younger users (18‑34) show a higher preference for self‑custody wallets compared to older demographics (35+).

- Among DeFi and NFT users, ~48% state self‑custody is a must rather than optional.

- Regions outside North America show even higher satisfaction growth for self‑custody, buoyed by mobile‑first wallet usage.

Common Challenges and User Errors

- Around 15% of wallet breaches in 2024 involved seed-phrase or private-key compromise.

- Phishing attacks caused roughly 48% of exchange platform breaches in H1 2025.

- Less than 50% of self-custody users feel confident recovering their seed phrases.

- Device loss or theft accounts for more than 20% of self-custody wallet user errors.

- Asset mis-transfer incidents occur at a rate between 5-8% for multi-chain wallet users.

- Around 35% of crypto wallet users in 2025 cite security as their top selection concern.

- Wallet drainer scams caused approximately $500 million in losses in 2024.

- Phishing and social engineering caused $594 million of the $3.1 billion stolen in H1 2025.

- Credential theft incidents increased by over 160% in 2025 compared to previous periods.

Self‑Custody Wallets for DeFi and NFTs

- In 2025, about 198 million wallets are active in DeFi, approximately 24% of all wallets.

- NFT‑linked wallets reached ~294 million in 2025, up ~33% year‑over‑year.

- Among Gen Z users, NFT wallet ownership surged by 42% in 2025.

- The average DeFi wallet in 2025 supports ~5.4 tokens and interacts across ~2.3 chains.

- Self‑custody wallets are now the “gateway” to DeFi; surveys show users who hold keys themselves access lending/borrowing protocols 2× more often than custodial users.

- Multi‑chain and NFT features are often bundled; wallets with NFT support and dApp browser features saw ~40% usage rise in 2025.

- DeFi liquidity pools increasingly require self‑custody wallet integration, and about 48% of dApp users prefer non‑custodial wallets.

- For NFT creators, ~61% of wallet operations originate from gaming or metaverse sectors in 2025.

Future Trends in Self‑Custody Wallet Adoption

- The self-custody wallet market is forecasted to grow at a 23.6% CAGR from 2025 to 2033.

- 84% of mobile wallets will use biometric authentication in 2025 for enhanced security.

- Wallets supporting 70+ blockchains are emerging as the multi-chain omni-wallet norm.

- Traditional finance integration in wallets with stablecoins and tokenized assets is expected to grow by over 30% in 2025.

- User experience improvements reduced entry barriers, with 71% of crypto users aware of self-custody in 2025.

- Privacy-focused wallet features like zero-knowledge proofs are projected to gain 25% adoption in 2025.

- Decentralized identity projects involve over 1,100 public entities across more than 100 countries.

- Institutional multi-signature wallet deployments reached 9 million in 2025.

- Self-custody wallets accounted for 68% of crypto transactions by Q3 2025.

Frequently Asked Questions (FAQs)

68% of crypto transactions were processed via self‑custodial wallets in 2025.

Over 820 million active crypto wallets worldwide as of 2025.

Hot wallets account for 78% of all crypto wallets in 2025.

Around 63% of retail users report satisfaction with self‑custody autonomy.

Conclusion

In summary, the rise of self‑custody wallets marks a meaningful shift in how individuals and institutions manage crypto assets. Adoption rates are accelerating, user awareness is climbing, and innovation is reshaping wallet design, security, and functionality. Real‑world moves like migrations from custodial platforms, deeper DeFi/NFT integration, and regulatory shifts reinforce that self‑custody is not just a trend but a structural change. As the ecosystem evolves, the wallets of tomorrow will offer control, security, and usability in equal measure.