Robinhood Markets, Inc. stands at the forefront of retail investing with rapid growth in users and assets shaping how individuals engage with financial markets. The platform’s data highlights strong momentum in account growth, trading volumes, and asset inflows, signaling robust user activity and expanding product demand. Institutions and everyday investors alike are watching Robinhood’s evolution, from commission‑free trading to broader financial services such as crypto custody and premium subscriptions. Below, explore the latest quantitative trends defining Robinhood’s performance in detail.

Editor’s Choice

- ~27.1 million funded customers on Robinhood as of October 2025.

- $343 billion in total platform assets reported in October 2025.

- $51 billion in crypto assets under custody as of Q3 2025.

- 3.9 million Robinhood Gold subscribers in Q3 2025.

- $232 billion in crypto trading volume (12‑month) as of Q3 2025.

- Net deposits at least $68.3 billion (LTM) by Q3 2025.

- Equity volumes over $209 billion in mid‑2025.

Recent Developments

- Q3 2025 saw Robinhood’s Gold subscription base grow +77% year‑over‑year to ~3.9M subscribers.

- Average revenue per user (ARPU) increased by ~82% compared with the prior year in Q3 2025.

- Robinhood’s margin balances grew to approximately $16.8 billion by late 2025, reflecting a significant year-over-year increase exceeding 150%.

- Bitstamp’s acquisition in June 2025 added ~500K funded customers to platform counts.

- The platform continued adding crypto assets, with over 45+ digital assets listed by 2025.

- Robinhood expanded into 30 countries, including EU markets.

- Robinhood earned recognition for novel banking product announcements (Robinhood Banking) targeting Gold subscribers.

Robinhood Business Highlights

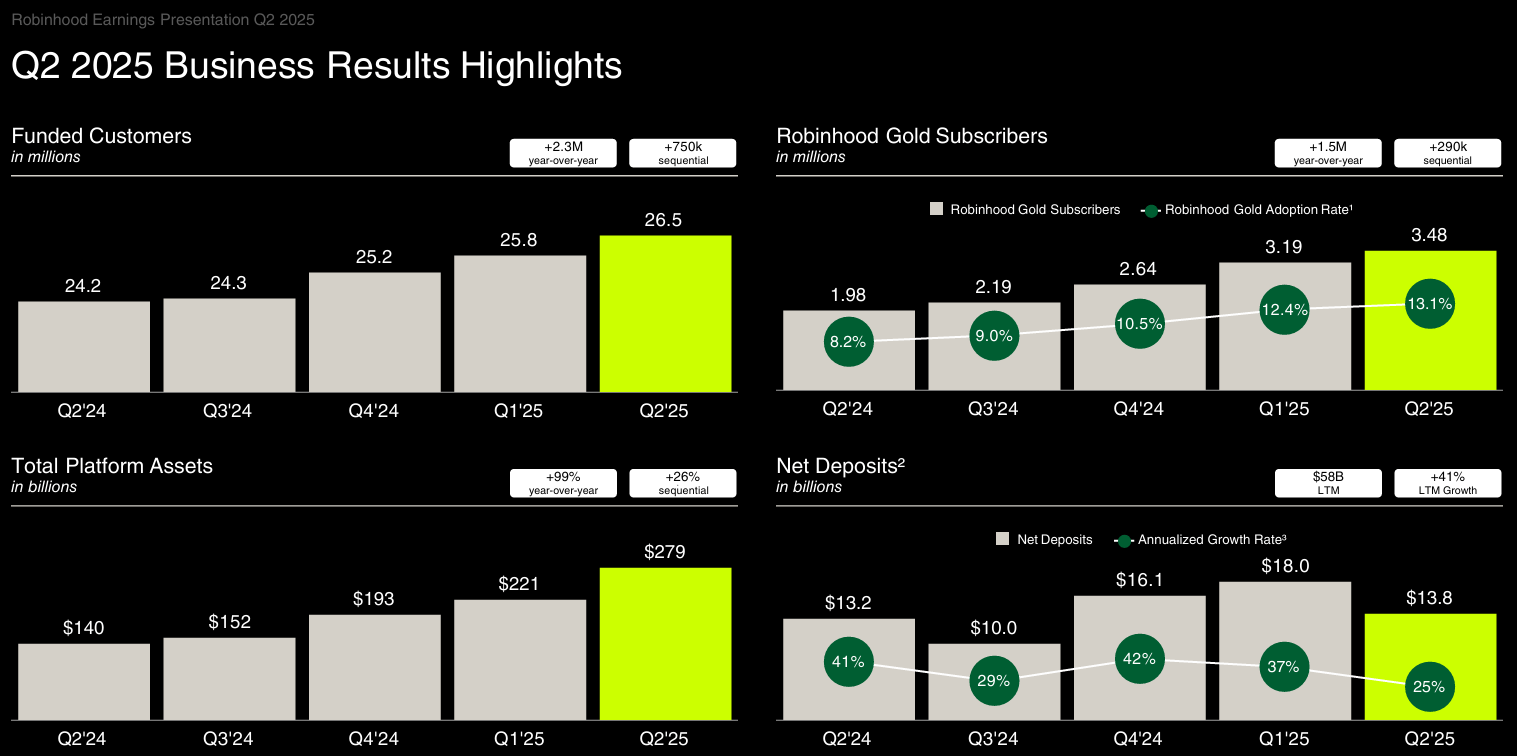

- 26.5 million funded accounts as of Q2 2025, up +2.3M year-over-year and +750K sequentially.

- 3.48 million Robinhood Gold subscribers, rising from 1.98M in Q2 2024, with an adoption rate reaching 13.1%.

- Total platform assets hit $279 billion in Q2 2025, a +99% YoY increase and +26% growth from the previous quarter.

- Net deposits totaled $13.8 billion in Q2 2025, with a 25% annualized growth rate.

- Over the last twelve months (LTM), Robinhood recorded $58 billion in net deposits, representing a +41% LTM growth rate.

Robinhood Key Facts

- $1.27 billion total net revenues in Q3.

- 26.8 million funded customers in Q3.

- 27.9 million investment accounts in Q3.

- $333 billion total platform assets in Q3.

- 3.9 million Robinhood Gold subscribers in Q3.

- $191 average revenue per user in Q3.

- $51 billion of crypto assets under custody in Q3.

- $232 billion crypto notional trading volume over the last 12 months as of Q3.

- 26.9 million funded customers in November.

- $324.5 billion total platform assets in November.

Monthly Active Users Statistics

- MAU reached ~15.7M by mid‑2025 according to aggregated user trend estimates.

- As of Aug 2024, MAU was ~11.8M, showing growth into 2025.

- MAU trend grew significantly from ~10.6M in Aug 2023 to ~15.7M in 2025.

- Monthly app engagement remains a key metric for trading activity analysis.

- User interaction drove higher notional trading volumes across equities and crypto.

- Active trading correlates with spikes in equity and options volume across monthly reports.

- Seasonal patterns show increased activity during market volatility phases.

- While direct Platform MAU reporting was reduced in 2025 disclosures, funded accounts act as a proxy engagement indicator.

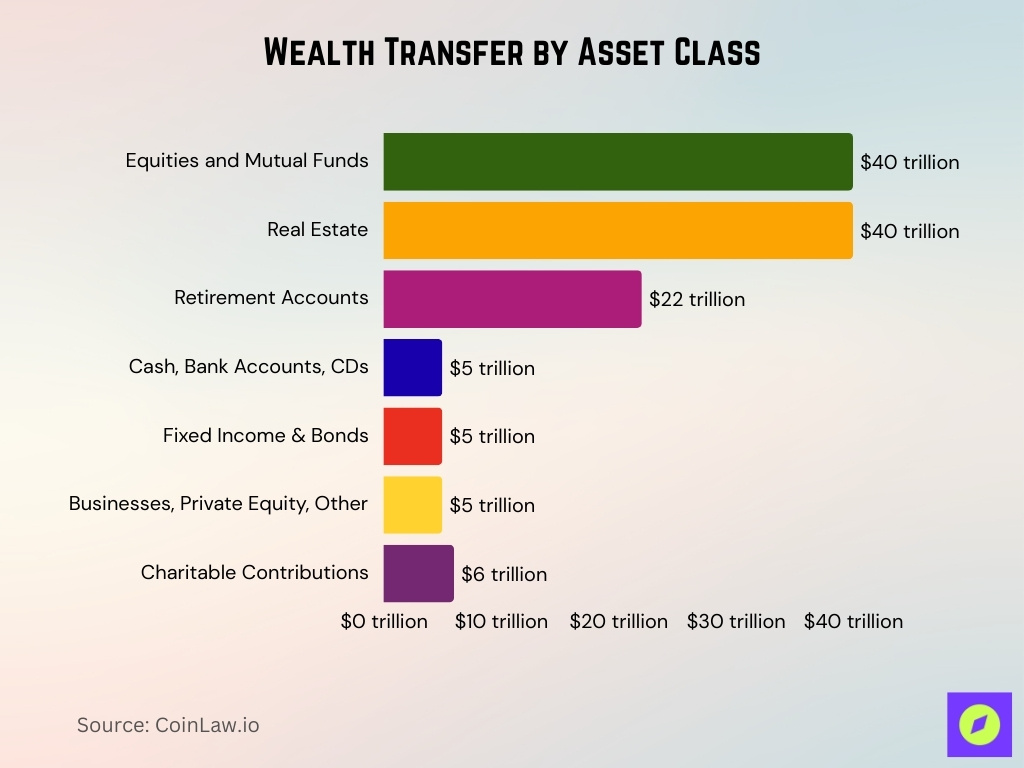

Wealth Transfer by Asset Class

- $40 trillion is expected to be transferred through equities and mutual funds, making it the joint-largest category.

- Another $40 trillion will come from real estate, including homes and investment properties.

- $22 trillion will shift via retirement accounts such as 401(k)s, IRAs, and pensions.

- $5 trillion each will be passed down through cash and bank accounts, fixed income & bonds, and business holdings like private equity.

- $6 trillion is projected to go toward charitable contributions, reflecting philanthropic priorities in intergenerational transfers.

Funded Accounts Statistics

- ~27.1 million funded customers reported in October 2025.

- 26.7M funded customers reported in August 2025, +10% YOY.

- 25.9M funded customers in May 2025, up ~7% year‑over‑year.

- 25.6M funded customers in February 2025, +8% YOY.

- Growth reflects continued new account additions across 2025.

- Bitstamp acquisition contributed roughly 500K funded clients mid‑2025.

- Y/Y funded customer trends showed steady increases across reported months.

- Funded accounts represent users with fully operational, funded trading accounts.

Assets Under Custody Statistics

- As of Q3 2025, Robinhood reported approximately $51 billion in crypto assets under custody.

- Over the last 12 months through Q3 2025, Robinhood’s crypto notional trading volume reached about $232 billion.

- Robinhood’s total platform assets, including investments, cash, and margin, reached roughly $298 billion by July 2025, up 106% year‑over‑year.

- In November 2025, total platform assets were reported at $325 billion, a 67% annual increase versus November 2024.

- Margin balances, a component of assets under custody, grew to around $16.8 billion by late 2025, up significantly year‑over‑year.

- Cash sweep balances supporting client funds were approximately $34.2 billion in October 2025.

- Robinhood’s assets under custody growth reflects net deposit inflows and higher market valuations across equities and crypto.

- The platform’s asset base expansion doubled year‑over‑year in key periods of 2025, underscoring broad investor activity.

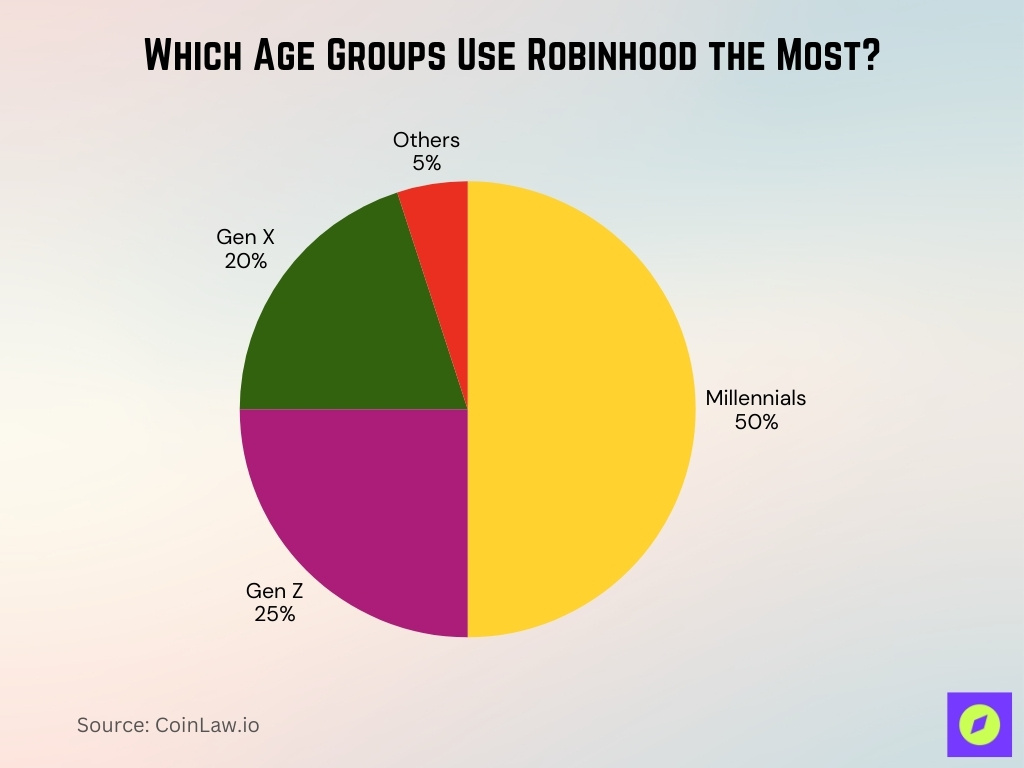

Demographic Statistics

- Internal data suggests ~50% of customers are millennials, with ~25% Gen Z and ~20% Gen X, indicating strong adoption among younger investors.

- As of early 2025, Robinhood’s average customer age is around 35 years, up from earlier estimates in prior years, signaling a maturing user base.

- Roughly 80% of Robinhood users report annual incomes above $50,000, reflecting engagement from higher‑earning retail investors.

- The platform’s user base remains predominantly U.S.‑based, with expanded availability in EU markets for crypto products.

- Male investors historically make up a majority of crypto traders on similar platforms, with surveys indicating male dominance (~61% globally), a trend visible in Robinhood’s user mix.

- Crypto user demographics skew younger, with the largest age group in the 25–34 bracket, aligning with Robinhood’s customer profile.

- Adoption among novice investors continues, with first‑time traders and crypto owners growing year‑over‑year across mobile platforms.

- Retirement account users on Robinhood saw notable increases, with assets in IRAs and Roth IRAs climbing sharply in recent reports.

Deposits and Net Inflows Statistics

- Over the last 12 months, as of November 2025, Robinhood reported net deposits of about $70.2 billion.

- In November 2025 alone, net deposits totaled approximately $7.1 billion, marking a 25% annualized growth rate relative to October 2025 assets.

- As of Q3 2025, net deposits measured $20.4 billion, growing at a 29% annualized rate versus Q2 2025.

- Net deposits totaled about $68.3 billion over the last 12 months through Q3 2025, and rose to roughly $70.2 billion over the 12 months through November 2025, underscoring robust net inflows.

- In July 2025, net deposits were about $6.4 billion, supporting ongoing asset expansion.

- Net deposit growth remained a key driver of Robinhood’s asset scale in 2025, underpinning elevated custody levels.

- Consistent monthly net inflows reflect sustained investor confidence and demand for diversified trading products.

- Net deposits trends outpaced platform asset growth in several reported periods, highlighting strong liquidity inflows.

Gold Subscription Statistics

- As of Q3 2025, Robinhood reported ~3.9 million Gold subscribers, a 77% year‑over‑year increase.

- Gold adoption rates climbed from approximately 9% to over 14% of funded accounts year‑over‑year.

- Gold subscribers contributed significantly to average revenue per user (ARPU), which rose 82% year‑over‑year to $191.

- Subscriber growth outpaced broader account growth in multiple 2025 reporting periods.

- Premium features tied to Gold, like margin access and enhanced trading tools, boosted engagement metrics.

- Gold subscribers typically show higher trading frequency and larger asset balances versus standard accounts.

- Expansion of Gold benefits correlated with elevated net deposit activity in the 2025 financial results.

- Growth in Gold services reflects Robinhood’s strategy to diversify revenue beyond trading commissions.

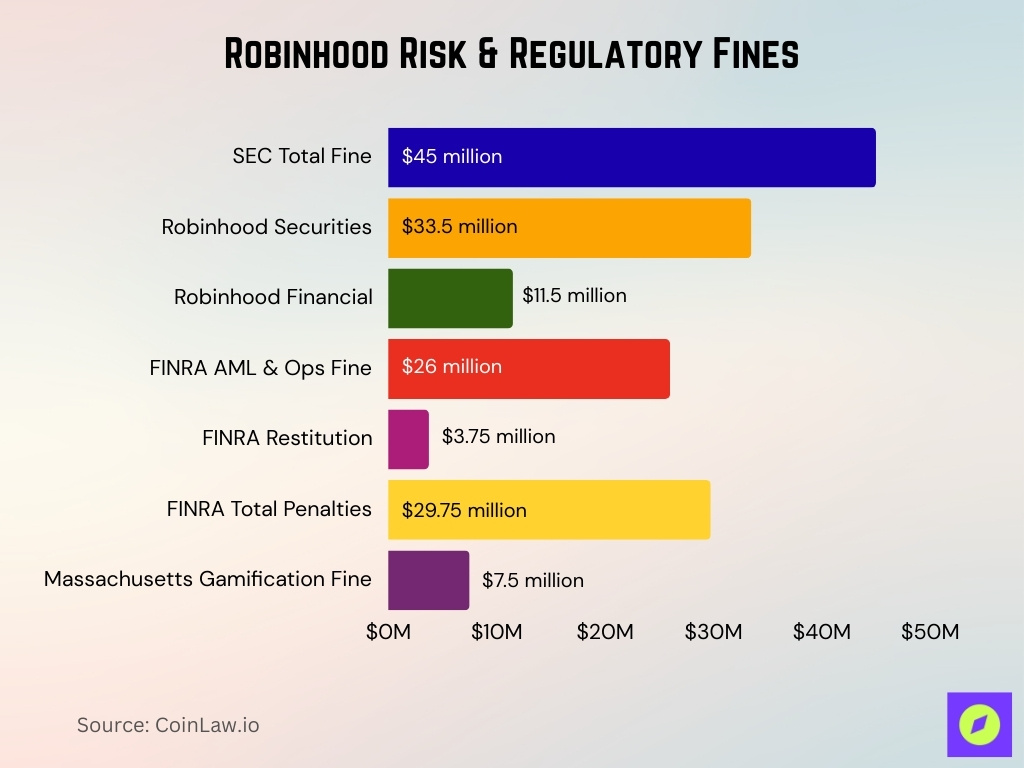

Risk, Compliance, and Regulatory Statistics

- Robinhood agreed to pay $45 million SEC penalty for over 10 securities law violations.

- $33.5 million paid by Robinhood Securities and $11.5 million by Robinhood Financial in the SEC settlement.

- FINRA fined Robinhood $26 million for AML and operational deficiencies.

- $3.75 million restitution ordered to affected customers for order collaring practices.

- Total FINRA penalties reached $29.75 million, including fines and restitution.

- Robinhood racked up over $1 million daily in penalties through early 2025.

- Failures in the timely filing of suspicious activity reports from 2020-2022 are cited by the SEC.

- FINRA identified inadequate anti-money laundering programs and hacker detection.

- $7.5 million fine for gamification violations settled with the Massachusetts Securities Division.

Crypto Trading Statistics

- Robinhood’s crypto notional trading volume for the 12 months through Q3 2025 hit approximately $232 billion.

- Over 45 digital assets were listed on Robinhood’s U.S. crypto platform by 2025.

- Roughly $1 billion worth of crypto was staked as of Q3 2025.

- Crypto activity surged ~480% over 12 months through Q3 2025 in notional trading volumes.

- App crypto volume in mid‑2025 saw significant percentage increases month‑over‑month.

- Bitstamp exchange, acquired in 2025, contributed materially to crypto flows with billions in traded volume.

- Despite strong annual growth, some later 2025 monthly results showed crypto volume declines versus prior months, reflecting market shifts.

- Robinhood’s crypto segment remains a core driver of transaction‑based revenue and user engagement.

Options Trading Statistics

- Options contracts traded reached approximately 195.8 million in July 2025, up 22% year‑over‑year.

- In the late 2025 monthly results, ~193.2 million options contracts were reported, up 24% versus the prior year.

- Equity and options trading combined accounted for a large share of Robinhood’s transaction revenues.

- Options DARTs (daily average revenue trades) grew meaningfully year‑over‑year, indicating heightened trading frequency.

- Options revenues climbed 51% year‑over‑year in certain 2025 earnings summaries, showing broad demand.

- Robinhood’s platform supports multi‑leg strategies that attract both novice and experienced options traders.

- Options trading activity expanded with educational tools and strategy features rolled out in 2025.

- Contract volumes maintained positive annual trends even amid broader market volume shifts.

Equities Trading Statistics

- Equity notional trading volume was about $209.1 billion in July 2025, up 100% year‑over‑year.

- In November 2025, equities volume stood near $201.5 billion, growing ~37% year‑over‑year.

- Equity DARTs increased by ~55% year‑over‑year, signaling rising daily engagement.

- Equity trading growth contributed a substantial portion of total trading revenue gains.

- Notional volume expansion was consistent across quarterly reporting in 2025.

- Equity trading remains the largest segment by transaction count compared with crypto and options.

- Market volatility in 2025 supported higher equity turnover and more frequent trades.

- Robinhood’s zero‑commission model continued to attract retail equities traders in 2025.

Product and Feature Adoption Statistics

- ~33% of new Q1 2025 customers adopted key product features shortly after signup, reflecting active engagement across the platform.

- International customer count surpassed 150,000, indicating increased feature adoption outside the U.S. in 2025.

- Futures trading facilitated over 4.5 million contracts in April 2025, showing strong uptake of new asset classes.

- Prediction markets processed >1 billion contracts over six months, highlighting rapid user adoption of novel features.

- Robinhood Strategies gained >40,000 customers managing over $100 million in assets, underscoring demand for portfolio tools.

- The Robinhood Gold Card doubled its cardholder base to ~200,000, showing traction for financial products beyond trading.

- Retirement assets on the platform rose to $16 billion, up ~20% from the start of the year, revealing adoption of long‑term investing products.

- Robinhood’s advanced futures and prediction markets features cater to power users and active traders, enhancing stickiness.

- The rollout of Robinhood Social and AI‑driven tools aims to boost community engagement and feature usage in 2026.

- Browser‑based Robinhood Legend adoption increased among sophisticated traders, reflecting expansion beyond mobile use.

Robinhood Stock (HOOD) Price Performance Statistics

- As of mid‑December 2025, HOOD stock traded around $120.40, reflecting significant volatility year‑to‑date.

- In 2025, Robinhood’s share price has surged over +270% year‑to‑date, outperforming many peers.

- Over the preceding 6 months, HOOD was up nearly +90%, demonstrating strong momentum.

- The stock has shown extended gains compared with broader indices like the S&P 500, which saw modest growth.

- Robinhood’s EPS jumped +258% in Q3 2025 to $0.61, lifting investor sentiment.

- Revenue more than doubled in Q3 2025 to $1.27 billion, signaling operational strength.

- Acquisition news and strategic launches occasionally triggered short‑term price volatility.

- Institutional activity, such as ARK Invest buying shares during dips, reflects strategic interest in HOOD.

- Despite general gains, HOOD experienced sell‑offs tied to mixed monthly metrics and regulatory outcomes.

- Analyst outlook remains divided, with pricing expectations ranging substantially based on market conditions.

Customer Satisfaction and Ratings Statistics

- Robinhood app rated 4.2/5 on Google Play with 522K reviews.

- Robinhood Credit Card app rated 4.9/5 on Google Play with 13.4K reviews.

- Robinhood Wallet app rated 4.4/5 on Google Play.

- Net Promoter Score stands at 18 with 49% promoters.

- Brokerage NPS benchmark averages 5% across industry peers.

- Trustpilot features 4,215 customer reviews with mixed feedback.

- 31% detractors in the NPS breakdown reflect dissatisfaction areas.

- Customer support reviews highlight inconsistent responsiveness.

- Robinhood Gold services receive higher user ratings than basic accounts.

Frequently Asked Questions (FAQs)

Robinhood reported about 26.9 million funded customers at the end of November 2025.

Total platform assets reached $325 billion, up 67 % year‑over‑year.

Robinhood reported $70.2 billion in net deposits over the past 12 months.

Robinhood held $51 billion in crypto assets under custody at the end of Q3 2025.

Conclusion

Robinhood solidified its position as a major retail financial services platform, combining user growth with expanding product adoption, diversified trading volumes, and robust price performance. While regulatory actions and compliance challenges remain part of its evolving narrative, the platform continues to innovate with tools like prediction markets, futures, and community features that attract active traders and long‑term investors alike. Customer satisfaction data shows a mixed but improving picture, with user ratings climbing for advanced services. As HOOD stock performance underscores investor confidence, Robinhood’s trajectory into broader financial ecosystems suggests continued momentum.