Ripple has raised $500 million at a $40 billion valuation, a major win for institutional crypto adoption, but XRP’s price barely moved.

Key Takeaways

- Ripple secured $500 million in strategic funding, led by top institutional players like Fortress Investment Group and Citadel Securities, boosting its valuation to $40 billion.

- The funding supports expansion in custody, stablecoins, and prime brokerage while enhancing Ripple’s institutional services and global payments infrastructure.

- XRP’s price reaction was muted, staying within its recent range despite the massive funding and company growth.

- Ripple’s stablecoin RLUSD surpassed $1 billion in market cap, and the company emphasized growth under the GENIUS Act and new US stablecoin framework.

What Happened?

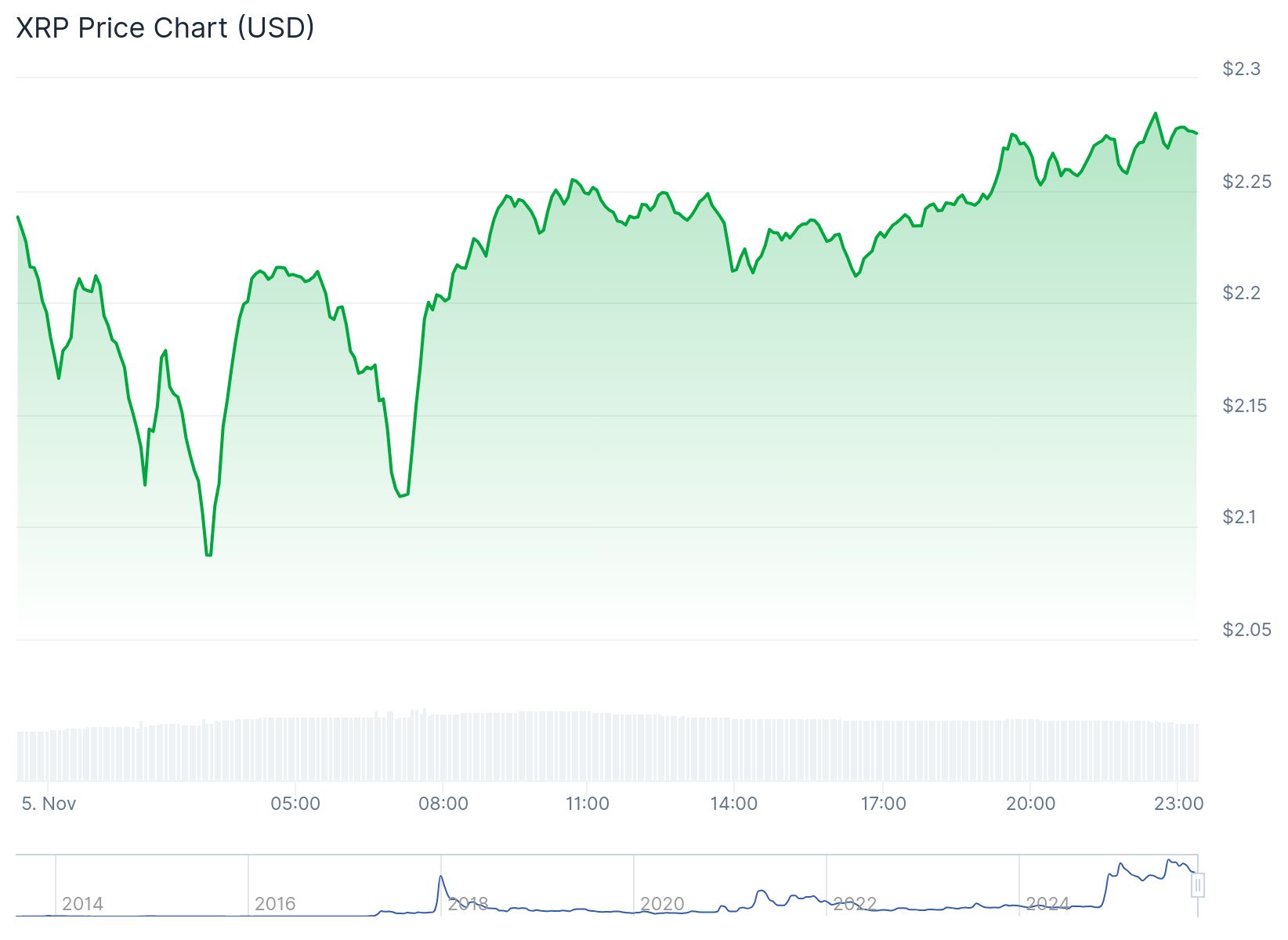

On November 5, 2025, at its annual Swell conference, Ripple announced a $500 million investment round at a valuation of $40 billion. This strategic funding round is designed to accelerate Ripple’s institutional services, payment infrastructure, and product development across blockchain financial tools. Yet, despite the massive funding and institutional backing, XRP’s market price has shown little to no immediate response, sparking debate across the crypto community.

Swell 2025: We have closed a $500 million strategic investment at a $40 billion valuation, led by Fortress Investment Group and Citadel Securities: https://t.co/orsBjdkWbE

— Ripple (@Ripple) November 5, 2025

→ $95B+ in total Ripple Payments payment volume

→ $1B+ $RLUSD stablecoin market cap

→ 6 strategic…

Ripple Secures Major Institutional Support

Ripple’s latest funding round was led by Fortress Investment Group and Citadel Securities, with participation from Pantera Capital, Galaxy Digital, Brevan Howard, and Marshall Wace. CEO Brad Garlinghouse described the deal as validation of Ripple’s progress, saying the company has evolved from a single-use case in payments to a diversified financial services platform including custody, stablecoins, prime brokerage, and treasury solutions.

Garlinghouse remarked during Swell:

The funding builds on Ripple’s earlier $1 billion tender offer completed in 2025 at the same valuation, highlighting consistent investor confidence despite a volatile crypto market.

Record Growth in Payments and Stablecoins

Ripple has processed over $95 billion in payment volume, showing strong demand for its cross-border transaction platform. The firm uses XRP and its stablecoin RLUSD for liquidity and settlement, making international payments faster and cheaper.

RLUSD has now crossed the $1 billion mark in market cap within its first year, showcasing rapid institutional adoption. This stablecoin growth is especially significant under the GENIUS Act and updated US stablecoin regulations, which offer legal clarity for treasury and settlement use by large enterprises.

Strategic Acquisitions Strengthen Ripple’s Offerings

In the last two years, Ripple has completed six acquisitions, including two valued at over $1 billion. These moves have enhanced the company’s capacity in custody, prime brokerage, and institutional liquidity services. Ripple noted that the new funding will further support engineering hires, integrations, and expanded on-ramps for tokenized finance.

The firm’s vision is to be a comprehensive financial platform for both traditional institutions and blockchain-native enterprises. With services now spanning payments, stablecoins, custody, and corporate finance tools, Ripple is positioning itself as a crypto-native alternative to legacy financial giants.

XRP Price Remains Flat Despite the Buzz

Despite Ripple’s landmark announcement, XRP’s price remained largely unchanged, staying between $2.26 and $2.52 in a broader market downturn. Historically, XRP has responded strongly to legal and regulatory news, but this time, even a $500 million funding boost failed to move the needle.

Trading volume did see a modest uptick, but there was no major liquidity shift or resistance breakout, leaving many XRP holders frustrated. Comments across X (formerly Twitter) and Reddit expressed confusion, with some calling the market response “a joke.”

Ripple CTO David Schwartz emphasized that the XRP Ledger is built for payments, not short-term price pumps, though he acknowledged that broader adoption would eventually strengthen XRP’s position.

Institutional Confidence and Market Maturity

Industry analysts note that Ripple’s funding is more than just capital. It reflects growing institutional appetite for regulated, enterprise-grade blockchain solutions, and points to a maturing crypto market where token price action no longer mirrors corporate success in the short term.

Ripple plans to use the funding for expanding its global payments reach, enhancing DeFi and RWA (Real-World Asset) integration, and potentially pursuing new acquisitions in 2026. The company’s goals align with forecasts of a multi-trillion dollar tokenized finance market.

CoinLaw’s Takeaway

In my experience, this is one of those moments where the market is missing the forest for the trees. Ripple’s $500 million funding round and $40 billion valuation are monumental in signaling traditional finance’s trust in blockchain. And yet, XRP’s price is snoozing.

But here’s the thing. Real change takes time. The price of XRP may be stagnant now, but the infrastructure and institutional momentum Ripple is building could set up XRP for massive gains down the line. I found the disconnect between investor sentiment and retail price reaction fascinating. It tells me that the smart money sees the long game. If you’re in crypto for more than a quick flip, Ripple’s trajectory should give you confidence.