This year marks a pivotal chapter for Riot Platforms, Inc. (“Riot”) as it navigates the converging trends of large-scale Bitcoin mining and data-centre infrastructure. We’re seeing Riot not only expand its hash-rate capacity but also explore applications in high-performance computing (HPC). In one scenario, Riot’s Bitcoin-mining operations in Texas and Kentucky powerfully illustrate how crypto infrastructure is scaling in the US. In another, Riot’s engineering arm highlights how surplus power and mining platforms can be repurposed for AI-driven compute workloads. Read on to explore the full scope of Riot’s numbers and outlook.

Editor’s Choice

- Riot achieved a deployed hash rate of 36.5 EH/s as of September 2025.

- Riot produced 1,426 bitcoin in Q2 2025, up from 844 in Q2 2024.

- Total revenue for Q2 2025 reached $153.0 million, up from $70.0 million in Q2 2024.

- For September 2025, average fleet efficiency hit 20.5 J/TH, improved from 23.2 J/TH a year earlier.

- All-in power cost (net of power credits) for September 2025 was approximately 4.2 ¢/kWh, up from 3.5 ¢/kWh a year earlier.

- The average cost to mine one bitcoin in Q2 2025 (excluding depreciation) was $48,992, compared with $25,329 in Q2 2024.

- Bitcoin held by Riot stood at 19,273 BTC as of June 30, 2025.

Recent Developments

- In September 2025, Riot produced 445 bitcoin, a drop of about 7% from 477 in August, yet up 8% year-over-year from 412 in September 2024.

- As of end-September 2025, Riot’s deployed hash rate was 36.5 EH/s, up roughly 29% from 28.2 EH/s a year earlier.

- The average operating hash rate in September 2025 was 32.2 EH/s, up from 19.5 EH/s in September 2024 (a ~65% increase).

- Power credits in September 2025 were only $1.4 million, down ~91% from $16.1 million a year earlier.

- August 2025 updates reported average operating hash rate at 31.4 EH/s and power credits at $15.2 million.

- Analyst coverage ahead of Q3 2025 expected revenue of around $172.6 million, up from $84.8 million a year ago.

- The stock market is closely watching upcoming earnings for Q3 2025 as a catalyst for sentiment around Riot.

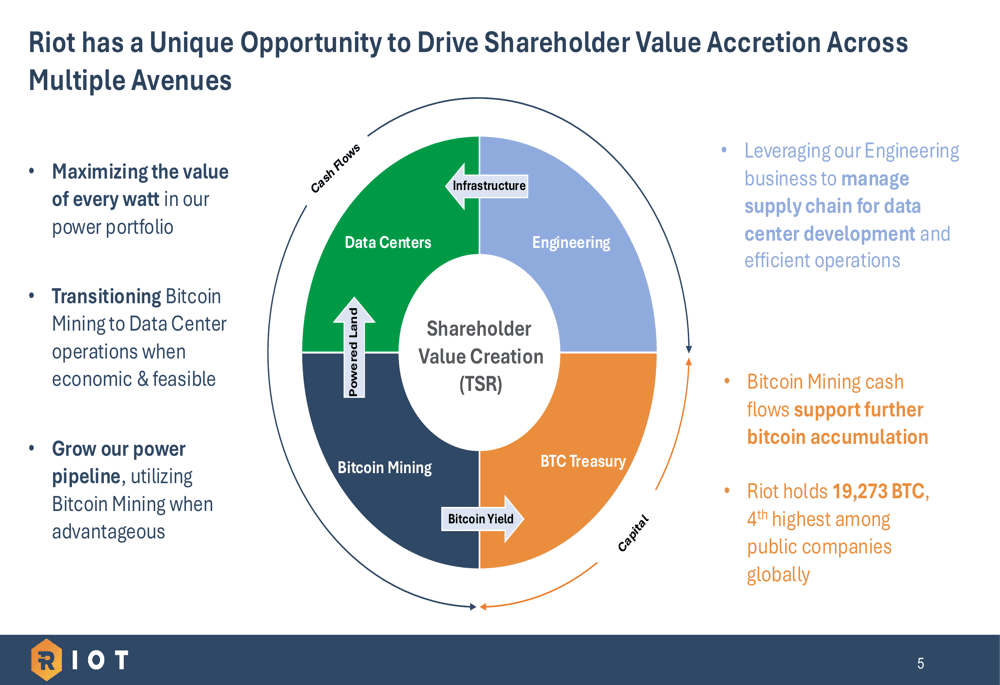

Riot’s Shareholder Value Creation Strategy

- Riot Platforms aims to drive shareholder value (TSR) through a multi-avenue model combining Bitcoin mining, engineering, and data center infrastructure.

- The company focuses on maximizing the value of every watt in its power portfolio, turning energy efficiency into a direct profitability driver.

- Riot is transitioning Bitcoin mining operations to data centers when it becomes economically and technically feasible, improving scalability and diversification.

- The firm seeks to grow its power pipeline, leveraging Bitcoin mining only when market conditions are advantageous.

- Engineering operations are being used to manage supply chains for data center construction and optimize operational efficiency.

- Bitcoin mining cash flows are strategically reinvested to accumulate more BTC, reinforcing Riot’s treasury position.

- As of 2025, Riot holds 19,273 BTC, ranking as the 4th largest holder among all public companies globally.

Company Overview

- Riot operates two primary segments, Bitcoin mining and engineering business (which supports data-centre and infrastructure build-out).

- The company holds large-scale mining facilities in Texas and Kentucky.

- As of June 30, 2025, Riot held 19,273 BTC (including 3,300 BTC as collateral).

- For Q2 2025, engineering revenue was $10.6 million, up from $9.6 million in Q2 2024.

- Riot’s working capital as of Q2 included approximately $141.1 million, with $255.4 million in unrestricted cash.

- The company explicitly states its vision as being “the world’s leading Bitcoin-driven infrastructure platform.”

Riot Platforms’ Current Team (Key People)

- Jason Les – Chief Executive Officer & Executive Director. Mr. Les has served as CEO since February 2021 and earlier joined the board in 2017. He leads the company’s overall strategic direction, including scaling mining operations and expanding into AI/HPC infrastructure.

- Benjamin Yi – Executive Chairman. Appointed Executive Chairman in May 2021, he oversees the board agenda and strategic vision, combining corporate-governance experience with operational oversight.

- Colin Yee – Executive Vice President & Chief Financial Officer. As of August 2023, Mr. Yee serves as CFO, managing financial controls, capital markets work, and cost discipline across mining and infrastructure segments.

- Stephen Howell – Chief Operating Officer. Appointed in 2024, Mr. Howell oversees the operational execution of mining facilities, engineering projects, and capacity build-out.

- Ryan Werner – Senior Vice President & Chief Accounting Officer. Mr. Werner leads external reporting, audit readiness, and accounting infrastructure, supporting rapid growth and complex asset bases.

Hash Rate Statistics

- As of June 30, 2025, Riot’s deployed hash rate reached 33.7 EH/s, up ~172% from ~12.4 EH/s in March 2024.

- In September 2025, the deployed hash rate was 36.5 EH/s, up ~29% from 28.2 EH/s in September 2024.

- The average operating hash rate for September 2025 was 32.2 EH/s, compared with 19.5 EH/s in September 2024, a ~65% increase.

- In May 2025, the average operating hash rate was 31.5 EH/s, up from 29.3 EH/s in April 2025 and from 8.8 EH/s in May 2024.

- In February 2025, the total deployed hash rate was ~33.6 EH/s, up from ~12.4 EH/s a year earlier.

- Riot raised its 2025 year-end hash rate growth target from ~38.4 EH/s to ~40.0 EH/s.

- In Q2 2025, the self-mining hash rate grew ~5% vs. Q1 2025.

Mining Efficiency

- In April 2025, Riot reported a fleet efficiency of 21.0 J/TH, which was a 22% improvement compared to ~27.0 J/TH in April 2024.

- In May 2025, fleet efficiency was 21.2 J/TH, up from 21.0 J/TH the prior month.

- By September 2025, fleet efficiency stood at 20.5 J/TH, down slightly from 21.0 J/TH in September 2024.

- Riot emphasises lower power cost instead of being the most efficient per terahash.

- The company reported an uptime metric of ~88% in Q2 2025 for its mining operations.

- Riot’s engineering business notes indicate ~$18.5 million in capex savings since the acquisition of ESS Metron.

- The company’s “Hash Cost” metric in Q2 2025 was noted as $25/PH/s/day, indicating margin potential.

Net Income and EBITDA

- For Q2 2025, Riot reported net income of $219.5 million, up from a prior-year net loss.

- In the same quarter, the company recorded adjusted EBITDA of $495.3 million.

- Total revenue in Q2 2025 was $153.0 million, compared to $70.0 million for the same quarter in 2024.

- The Bitcoin-mining segment revenue in that quarter was $140.9 million.

- Gross margin for Bitcoin mining was ~50% in Q2 2025.

- Working capital and cash position as of mid-2025 reported ~$141.1 million in working capital and $255.4 million in unrestricted cash.

- The bulk of revenue is driven by Bitcoin mining (≈92%), with engineering revenues representing ~7%.

- Non-cash charges (stock-based comp, impairment) were $141 million in Q2 2025.

Cost to Mine Bitcoin

- In Q1 2025, the average cost to mine BTC was $43,808, compared to $23,034 in the same quarter last year.

- Power cost per Bitcoin in Q1 2025 was $35,313 on average.

- Q2 2025 direct costs consisted of ~$35,313 “power” cost per Bitcoin, and ~$8,495 non-power cost per Bitcoin.

- For Q2 2025, the cost to mine one Bitcoin (excluding depreciation) was $48,992, an increase from $25,327 in Q2 2024.

- Non-power direct costs increased to about $11,225 per BTC in Q2 2025, compared to $8,495 in Q1.

- Global network hash rate increased (876 EH/s in Q2 2025 vs. 801 EH/s in Q1), which reduced reward per hash.

- “Hash Cost” per PH/s/day in Q2 2025 was ~$25, while “Hash Price” was ~$51, indicating operating cost is about 49% of revenue.

- Property tax reassessment at Corsicana added ~$2,650 per Bitcoin in non-power costs in Q2.

Power Strategy and Credits

- In June 2025, Riot earned $5.6 million in total power credits, including $3.8 million in power curtailment credits and $1.8 million in demand-response credits.

- In May 2025, total power credits were $2.2 million, and all-in power cost was 3.8 ¢/kWh.

- In September 2025, the all-in power cost was reported at 4.2 ¢/kWh, up from 3.5 ¢/kWh a year earlier.

- In September 2025, power credits collapsed to $0.7 million, representing a ~95% month-over-month drop.

- Riot highlights participation in ERCOT’s 4 Coincident Peak (4CP) and other demand-response programs.

- The company frames its value proposition as “monetizing megawatts,” shifting power capacity between mining and grid services.

- The all-in cost metric includes transmission, distribution, and taxes, net of power credits.

Facility Expansion and Capacity

- At the Corsicana, Texas facility, the company halted the previously announced 600 MW Phase II Bitcoin-mining expansion, instead evaluating for AI/HPC uses.

- As of January 2025, Riot had approximately 400 MW deployed for Bitcoin mining at Corsicana, with approval for up to 1 GW in total.

- In Q2 2025, the engineering backlog reached $118.7 million, up from $72.8 million in Q2 2024.

- For the 2025 capital-expenditure forecast, total capex of $381.2 million, with $179.6 million already spent and $201.6 million planned for H2.

- In Kentucky, Riot is expanding from 65 MW to 127 MW (Commerce and Blue Steel expansions).

- The company acquired an additional 355 acres near Corsicana in May 2025 and 238 acres in July 2025.

Riot Platforms Revenue and Profitability Overview

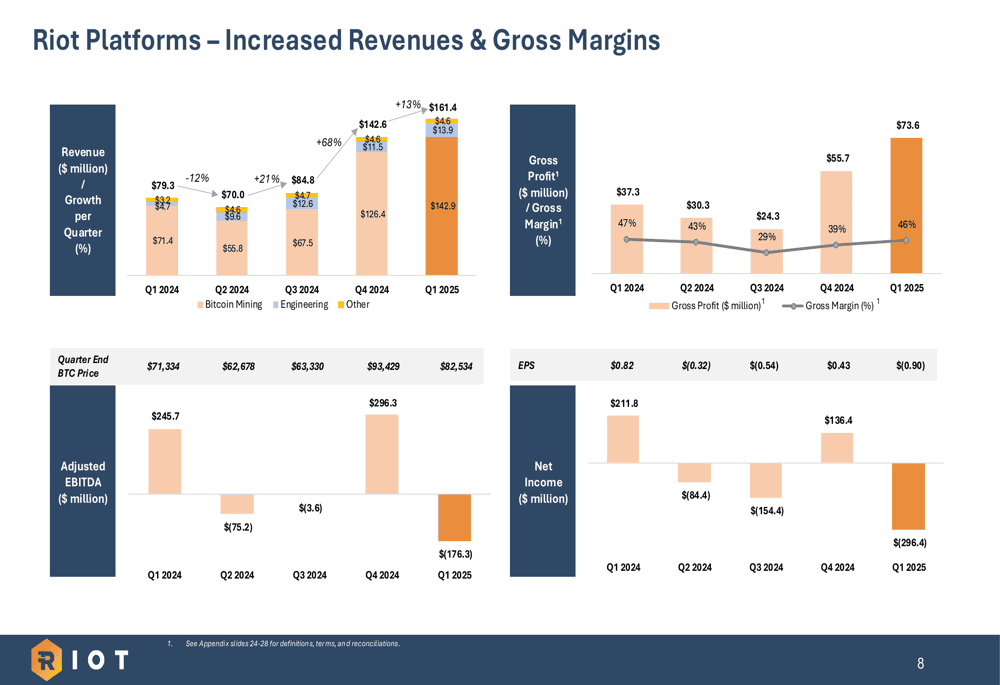

- Total revenue reached $161.4 million in Q1 2025, a 13% increase from the previous quarter, reflecting the continued scaling of Riot’s Bitcoin mining and infrastructure businesses.

- Bitcoin mining accounted for $142.9 million, or nearly 89% of total revenue, reinforcing its position as Riot’s primary growth driver.

- Engineering and other business segments contributed $13.9 million and $4.6 million, respectively, highlighting incremental diversification beyond mining.

- Gross profit climbed to $73.6 million, representing a 46% gross margin, up from 39% in Q4 2024, showing improved operational efficiency.

- Despite strong revenue, net income turned negative at -$296.4 million, compared to a profit of $136.4 million in Q4 2024, largely due to higher depreciation and non-cash adjustments.

- Adjusted EBITDA fell to -$176.3 million, reversing from +$296.3 million in the prior quarter, indicating volatility tied to Bitcoin price and energy dynamics.

- Quarter-end Bitcoin price stood at $82,534, down from $93,429 in Q4 2024, which contributed to reduced mining margins.

- Overall, Riot’s Q1 2025 results show record-high revenue but weaker profitability, emphasizing the need for cost optimization and diversification across data centers and engineering services.

Engineering Business Results

- For Q2 2025, the engineering segment revenue was $10.6 million, up from $9.6 million in 2024.

- Cap-ex savings since the ESS Metron acquisition reached approximately $18.5 million.

- Engineering backlog stood at $118.7 million by Q2 2025, compared to roughly $72.8 million a year prior.

- The engineering business contributed about 7% of total revenue in Q2 2025.

- Engineering is being leveraged to support data-centre build-out and HPC infrastructure ambitions.

- Operations are primarily located in Denver, Colorado, and Houston, Texas.

- Management expects the engineering segment to accelerate in H2 2025 as contracts mature into revenue.

AI/HPC Initiatives

- Riot Platforms repurposed 600 MW of power capacity at the Corsicana site for AI/HPC in 2025, reducing Bitcoin mining expansion plans.

- Corsicana facility targets up to 1.0 GW total power capacity for future AI/HPC and data-center builds.

- Riot hired Jonathan Gibbs as Chief Data Center Officer in Q2 2025 to lead its AI/HPC data center platform.

- Riot’s Bitcoin mining revenue rose 104% YoY to $161.4 million in Q1 2025 despite a net loss of $296.4 million due to AI/HPC investments.

- The Corsicana site includes 265 acres of land with 65 acres developable for AI/HPC infrastructure growth.

- Management plans to begin leasing or building-to-suit AI/HPC infrastructure by late 2025 or 2026.

- Over 90% of Riot’s revenue in 2025 is still from mining, but AI/HPC expansion is expected to grow.

- Riot acquired an additional 238 acres at Corsicana in 2025 to expand AI/HPC capacity.

- Riot’s low-cost power of approximately 2.6 cents per kWh supports competitive AI/HPC compute services.

Stock Performance and Market Cap

- As of mid-October 2025, market capitalization was approximately $8.2 billion.

- Share price has delivered a 1-year total return of ~122%, and a 5-year return of ~555%.

- Analyst price targets have been raised on optimism around the data-centre transition.

- The stock holds a high Relative Strength (RS) Rating of 89, signalling strong momentum.

- Beta is around 4.63, indicating over four times market volatility.

- With ~369.6 million shares outstanding as of July 29, 2025, share dilution remains a watch point.

- Market observers caution that valuation already prices in the data-centre transition.

Geographic Operations (Texas, Kentucky, Colorado)

- Mining operations in Corsicana, Texas, represent the largest facility, with 1.0 GW capacity planned.

- The mining facility in Kentucky expanded from 65 MW to 127 MW in 2025.

- Engineering/fabrication operations in Denver, Colorado, and Houston, Texas, support infrastructure builds.

- In Texas, the company participates in ERCOT demand-response programs.

- As of July 2025, Riot owned 858 acres in Corsicana for future development.

- In September 2025, the all-in power cost for Texas operations was 4.2 ¢/kWh.

- Bitcoin production in September 2025 reached 445 BTC, up ~8% year-over-year.

Outlook and Growth Projections

- Year-end hash-rate target raised to approx 40 EH/s for 2025.

- Management expects data-centre and HPC demand to accelerate after 2025.

- With a cost per Bitcoin near $48,992, efficiency and power strategy remain focus areas.

- If hash-price rises to ~$60, run-rate adjusted EBITDA could expand >70%.

- Capital expenditure in H2 2025 is planned at roughly $201.6 million.

- Risks include global hash-rate growth, regulatory changes, or power-cost spikes.

- Growth levers remain low-cost power, expanded hash-rate deployment, data-centre lease-up, and capital discipline.

Frequently Asked Questions (FAQs)

32.2 EH/s, representing a ~3% increase from August 2025.

1,000 MW (1.0 GW).

$495.3 million.

19,273 BTC, valued at about $2.1 billion at ~$107,174 per BTC.

Conclusion

In summary, Riot Platforms, Inc. presents a complex but compelling hybrid infrastructure story blending large-scale Bitcoin mining with emerging high-performance computing and data-centre capabilities. Its strong results show considerable profitability in mining, while the engineering business and land/facility assets create optionality for medium-term growth in AI/HPC. That said, execution risk remains meaningful, from managing cost per Bitcoin, avoiding asset-stranding, to converting power capacity to high-value compute demand. For US-based and global investors alike, understanding both sides of this business will be critical. Dive deeper to assess how Riot is navigating the transition and whether it can translate scale into sustained growth.