The reverse mortgage market has become a significant option for older homeowners seeking to tap into their home equity without having to sell. As housing values rise and retirement savings face pressure, reverse mortgages offer a way to convert real estate wealth into usable cash flow. Real-world applications range from old people supplementing retirement income to covering medical or living expenses, and for some, funding home modifications to age in place. Read on to explore detailed statistics and market trends that shape this growing sector.

Editor’s Choice

- The market is forecast to reach $2.71 billion by 2030, reflecting a compound annual growth rate (CAGR) of 5.9%.

- In the U.S., the bulk of reverse mortgages remain insured under the Home Equity Conversion Mortgage (HECM) program.

- In fiscal year 2023, the U.S. saw 32,963 HECM endorsements, marking a steep decline from earlier years’ peaks.

- As of early 2024, the federally allowed reverse mortgage loan cap per home stood at $1,149,825.

- Among newly initiated HECMs in the first half of 2024, roughly 19,894 older homeowners tapped home equity.

- The average age of HECM borrowers in 2023 rose to about 74.8 years.

Recent Developments

- In 2025, the federally insured reverse mortgage sector saw a 6% increase in issuances compared with the prior year, driven by rising living costs and shrinking retirement buffers.

- Some lenders report up to 64% growth in customer interest for reverse mortgages, especially from homeowners needing extra income or cash flow.

- Industry players are intensifying efforts to collaborate with traditional mortgage lenders and real estate professionals to widen distribution.

- Despite increased interest, experts caution that reverse mortgages remain less popular overall compared to other alternatives like home equity lines of credit (HELOCs) or cash-out refinancing.

- A segment of reverse mortgage professionals views 2025 as a “year of collaboration”, hoping for smoother integration between forward and reverse loan products.

HECM Statistics

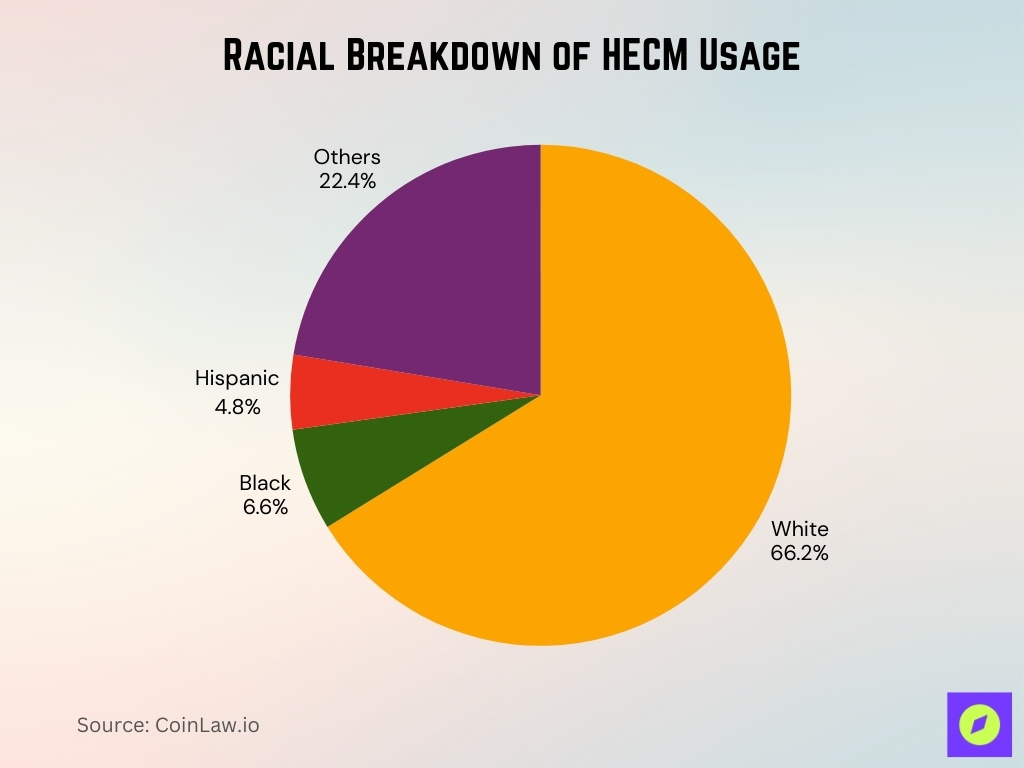

- Racial breakdown of HECM usage: 66.2% White, 6.6% Black, and 4.8% Hispanic borrowers.

- That represents a roughly 50% drop from the program’s earlier peak levels.

- About 93% of HECM borrowers chose a line of credit distribution option over cash or monthly payment alternatives.

- Since program inception, over 1.3 million older homeowners have used HECMs to tap into their home equity.

Proprietary Reverse Mortgages

- Proprietary reverse mortgages are projected to grow significantly through 2030 at a global reverse mortgage CAGR of 5.9%.

- Longbridge Financial achieves record proprietary reverse mortgage originations in Q3 2025 with $8.6 million profit.

- Jumbo proprietary loans allow borrowing up to $4 million, over three times FHA’s $1,249,125 limit.

- The proprietary segment appeals to high-value homes exceeding the HECM cap of $1,209,750.

- Finance of America Reverse leads with proprietary HomeSafe products up to $10 million property values.

- Proprietary loans serve homeowners aged 55+, younger than HECM’s 62 minimum.

- North America holds a 35.2% share of the reverse mortgage market in 2023.

Single Purpose Reverse Mortgages

- Single-purpose reverse mortgages remain the least common type among all reverse mortgage options.

- Participation in select senior property tax deferral programs totals only 702 residents as of fiscal year 2022.

- 12 states offer property tax deferral programs akin to single-purpose reverse mortgages as of 2023.

- Programs typically require homeowners aged 65+ with a household income below $42,000.

- Deferral options include up to $1,200 annually, providing $100/month benefit.

- Eligibility often mandates a 25% minimum home equity for loan security.

- Applications must prove funds for approved uses like taxes or repairs, aged 62+.

Application Breakdown

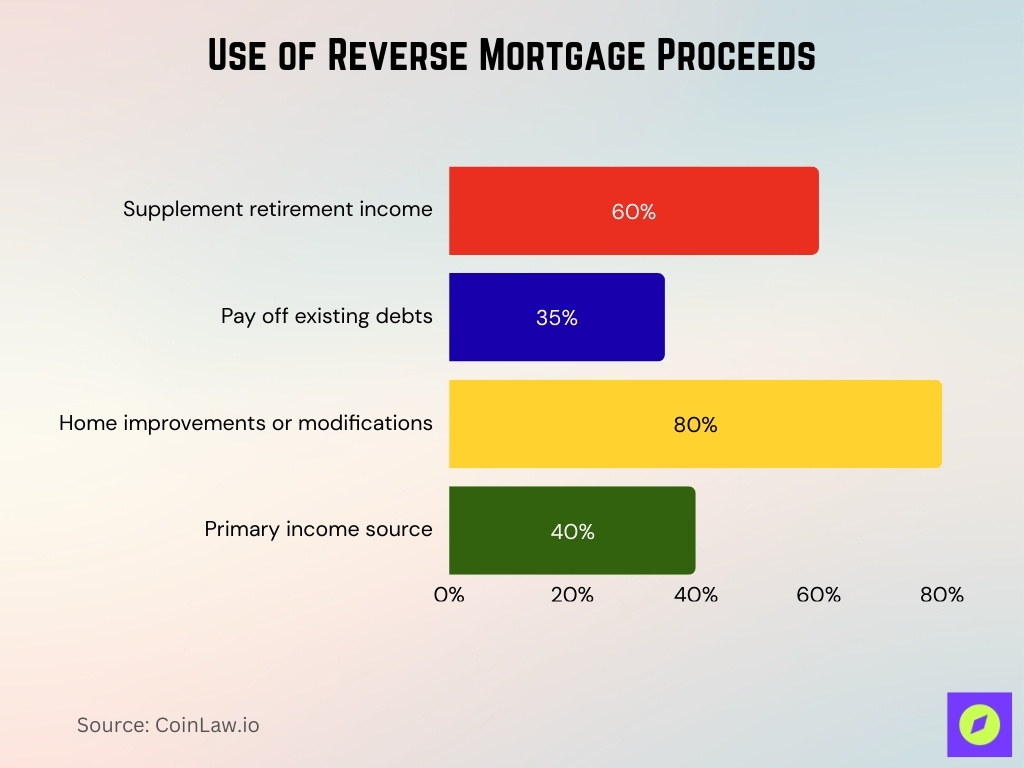

- 60% of borrowers use proceeds to supplement retirement income.

- 35% of borrowers apply funds to pay off existing debts.

- 80% of loans support home improvements or modifications.

- 40% of borrowers rely on proceeds as their primary income source.

- The majority cover daily expenses like groceries, utilities, and maintenance.

- Significantly share funds for healthcare costs, medical bills, and long-term care.

- 65% of borrowers aged 65+ use it for financial flexibility.

Debt Management Stats

- 35% of reverse mortgage borrowers use proceeds to pay off existing debts.

- The average amount owed by households before a reverse mortgage totals $156,500.

- Typical mortgage debt represents about 30% of home value for borrowers.

- 40% of borrowers rely on proceeds as primary income after debt relief.

- Reverse mortgage default rates stay below 1% annually due to low payments.

- Borrowers maintain responsibility for taxes, insurance, and upkeep to avoid default.

- 65% of borrowers aged 65+ gain cash flow flexibility from no payments.

- Median loan-to-value ratio for reverse mortgages averages 45%.

- Average borrowed amount reaches $160,000, supporting debt consolidation.

Healthcare Expenses

- Healthcare-related reverse mortgage applications are projected to grow significantly through 2030.

- One-third of reverse mortgage borrowers use proceeds for medical expenses.

- Rising medical and long-term care costs drive old people to tap home equity via reverse mortgages.

- 65% of borrowers aged 65+ access funds supporting unpredictable health needs.

- Reverse mortgages fund in-home care, accessibility upgrades like ramps, and grab bars.

- 40% of the old people rely on proceeds covering treatments, surgeries, and home-based services.

- Line of credit option used by 50-60% for ongoing medical cost flexibility.

Reverse Mortgage Market Growth Forecast

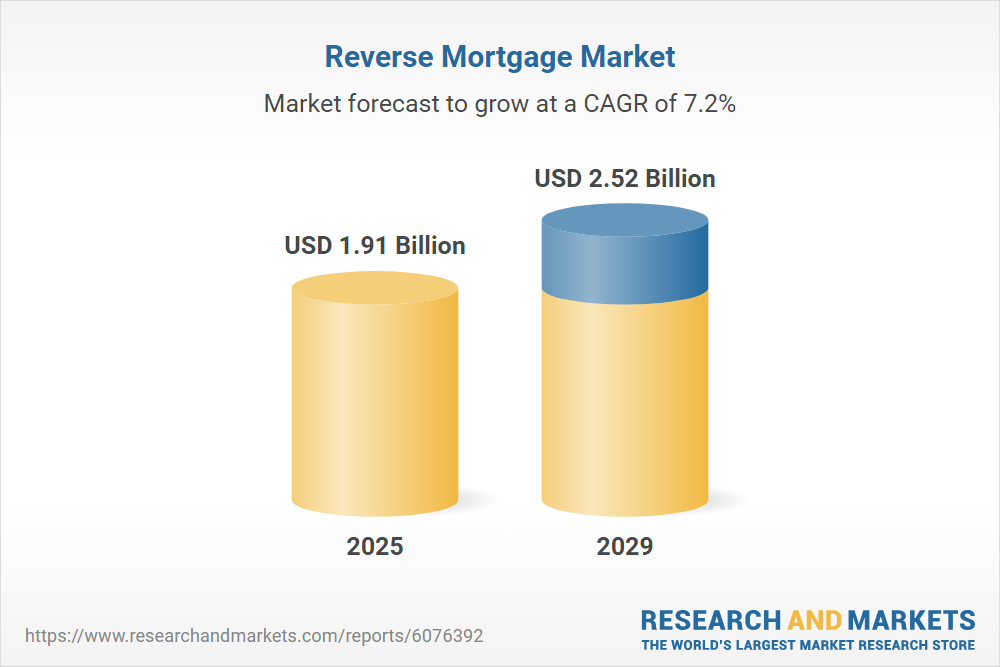

- The reverse mortgage market is projected to grow at a CAGR of 7.2% between 2025 and 2029.

- Market size is expected to rise from $1.91 billion in 2025 to $2.52 billion by 2029.

- This growth reflects increasing demand among aging homeowners for retirement income solutions.

- The projected increase of $610 million over 4 years highlights the expanding role of home equity conversion in retirement planning.

Home Renovations Data

- 80% of reverse mortgage loans are used for home improvements or modifications.

- 28% of borrowers apply proceeds directly to home renovations and upgrades.

- 23% cite home improvements as the initial reason for reverse mortgage consideration.

- Accessibility modifications like ramps, grab bars rank among the top renovation uses.

- 36% of active borrowers fund repairs, enabling aging in place.

- Renovation projects preserve retirement savings while meeting FHA standards.

- The line of credit option supports phased renovations without monthly payments.

- Home upkeep ranks third among self-reported counseling motivations.

- 70% of the primary age group 65-74 prioritize safety flooring, wider doors.

Income Supplement Figures

- 60% of borrowers use reverse mortgage proceeds to supplement retirement income.

- Proceeds are considered loan advances, tax-free and non-countable toward Social Security eligibility.

- 14% of the retired population finds reverse mortgages suitable for an income boost, averaging 19%.

- Monthly tenure payments turn home equity into a steady cash flow, like a second paycheck.

- 55% maximum borrowable home value supports fixed income gaps without repayments.

- Line of credit used by 50-60% preserving principal balance growth over time.

- Average retired couple’s Social Security totals $2,800/month; reverse mortgages fill remaining gaps.

- Delaying Social Security via proceeds yields 8% annual benefit increase up to age 70.

- Less than 2% of retired households currently use reverse mortgages for income supplementation.

U.S. Home Price Forecasts (What Experts Expect)

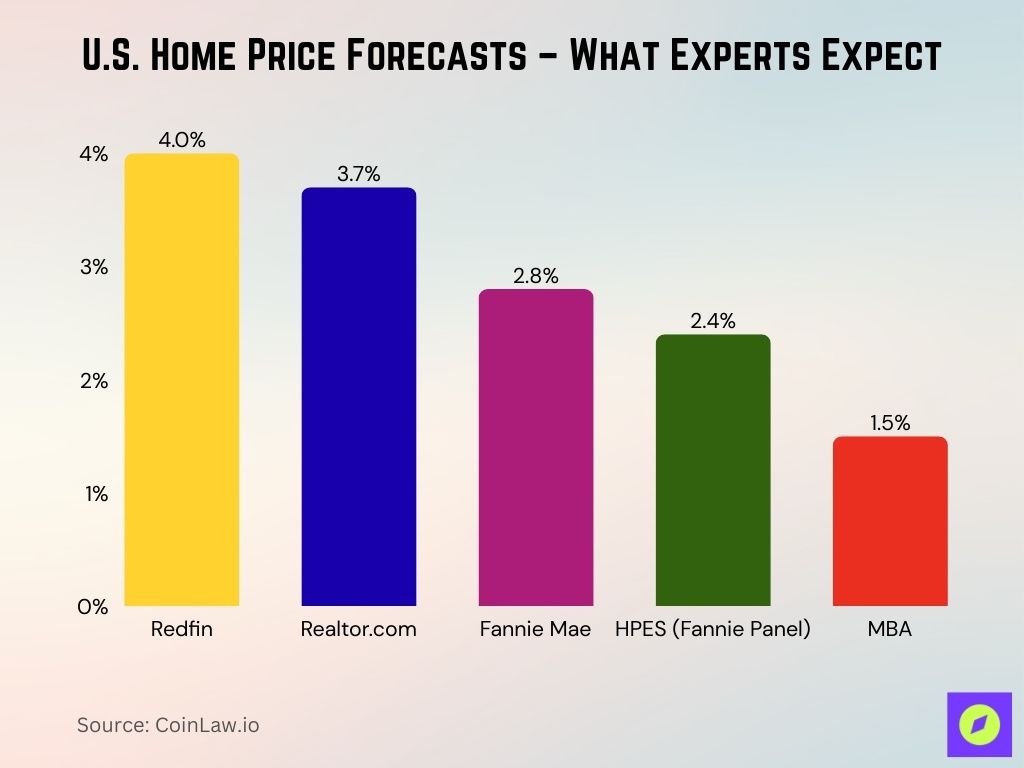

- Redfin forecasts home-sale prices will rise by 4.0% by the end of 2025, the most optimistic among major sources.

- Realtor.com predicts a 3.7% increase in national home prices during 2025.

- Fannie Mae recently revised its estimate to about 2.8% growth for 2025.

- The Fannie Mae HPES panel (expert survey) expects home prices to grow 2.4% next year.

- MBA (Mortgage Bankers Association) projects a moderate 1.5% increase in FHFA home prices in 2025.

Living Expenses Trends

- Homeowners aged 62+ hold $14.39 trillion in home equity as of Q2 2025, up 4% year-over-year.

- 60% of borrowers use proceeds to supplement retirement, covering daily living costs.

- Over 40% of retirees rely on proceeds as the primary source for recurring expenses.

- Tax-free loan advances support living costs without affecting benefits.

- Flexible line of credit used by 50-60% to match unpredictable expense needs.

- Property tax delinquency among borrowers is at 17.5% vs the national 2.6% homeowner rate.

- Median home value of borrowers reaches $250,000, enabling equity access.

Regional Market Shares

- As of September 2025, proprietary reverse mortgages accounted for about 40% of the U.S. market.

- Growth reflects demand for non-federally insured products offering higher loan limits or flexibility.

- In July 2025, HECM endorsements rose 5.6% month over month to 2,369 loans, the highest since February.

- Regional increases were led by the Midwest and New England, both +19.8%, followed by +12.1% in the Southeast.

- In 2024, the Southeast region recorded a 42% monthly jump to 724 HECM loans in December.

- Market share shifts toward proprietary products often align with higher-value housing markets.

U.S. Market Insights

- U.S. contributes 54% of the global reverse mortgage market share.

- HECM lending limit rises to $1,209,750, enabling higher equity access.

- The reverse mortgage market is projected to grow from $1.79 billion to $1.92 billion, reflecting a 7.6% CAGR.

- HECM endorsements reach 2,320 loans in April, up 9% month-over-month.

- 17-27% of older homeowners qualify for HECM, far exceeding current volumes.

- Market penetration remains below the 2009 peak of 115,000 annual originations.

- North America dominates with a 35.2% global reverse mortgage share.

- FHA HECM originations average 58,000 annually post-2011.

Top Reverse Mortgage Lenders

- Finance of America Reverse holds 27% market share, leading U.S. originations.

- Mutual of Omaha tops retail lender rankings with 22% market share.

- HECMs comprise 62% market, dominated by top specialty non-bank lenders.

- Mutual of Omaha Mortgage originates 6,020 reverse mortgages, ranking second.

- Longbridge Financial secures top-five position with $262 million Q4 originations.

- FAR leads September 2025 HMBS issuance at $151 million [query context].

- Longbridge reports $552 million portfolio growth via proprietary products.

- Finance of America funds $1.97 billion in reverse mortgages first 10 months.

- Mutual of Omaha is recognized largest provider, closing over 5,000 HECMs annually.

Frequently Asked Questions (FAQs)

U.S. homeowners age 62 and older held a total of $14.39 trillion in home equity as of Q2 2025.

The 2025 HECM limit is $1,209,750.

Around 17–27% of older homeowners (actual and rejected borrowers) would have qualified for a HECM, suggesting a potential market size many times larger than the current active volume.

Conclusion

The reverse mortgage market today reflects a sector adapting to economic headwinds while tapping growing home equity reserves held by older Americans. Rising living and healthcare costs, combined with increasing home equity, drive interest in reverse mortgages as a tool for income, living expense support, or retirement stability. Top specialty lenders remain active and competitive, working to overcome challenges around interest rates, borrower education, and regulatory clarity. As the demographic relying on home equity grows, reverse mortgages could play a larger role, especially for those seeking financial flexibility without leaving their homes.