The retirement savings gap continues to widen as millions of Americans and workers worldwide fall short of the amounts they say they need to live comfortably in retirement. The data today paint a clear picture: many adults either haven’t saved enough or don’t participate in retirement planning at all. Across industries and countries, this gap impacts financial security, health coverage planning, and economic stability. In the U.S., low savings levels affect decisions on retirement age and lifestyle, while globally, projections show long-term systemic pressures on retirement systems. Explore the statistics below to understand the depth and breadth of this crisis.

Editor’s Choice

- 48% of Americans expect to have saved less than $500,000 for retirement, far below the ideal of more than $1.28 million they believe they need.

- Median retirement savings for U.S. workers aged 55–64 are about $185,000, significantly undercutting adequacy targets.

- Between 40% and 46% of U.S. adults have no retirement savings at all.

- Around 20% of U.S. adults say they are not currently saving for retirement, with 5% saying they never plan to start.

- 42% of full‑time U.S. workers lack access to any employer retirement plan; the figure jumps to 79% for part‑time workers.

- Globally, a large share of retirement savers expect economic uncertainty to affect their nest eggs, with 50% expecting a recession by mid‑2026.

- Experts warn the global retirement savings gap could expand dramatically toward $400 trillion by 2050 if trends continue.

Recent Developments

- The 2025 U.S. Retirement Survey found the average target for a comfortable retirement is $1.28 million, yet nearly half expect to save far less.

- Just 30% of Americans feel on track for retirement in 2025.

- The average U.S. retirement contribution rate has declined from approximately 12% in 2019 to 10.1% in 2025, reflecting a drop in savings discipline amid economic uncertainty.

- A significant share of retirees report expenses higher than expected in retirement, with 45% saying costs exceed what they planned.

- Inflation and economic concerns rank high among global retirement savers, affecting confidence and planning.

- Retirement confidence, although slightly improving in some surveys, remains volatile in light of economic uncertainty.

- Savers globally worry about inflation more than any other economic factor.

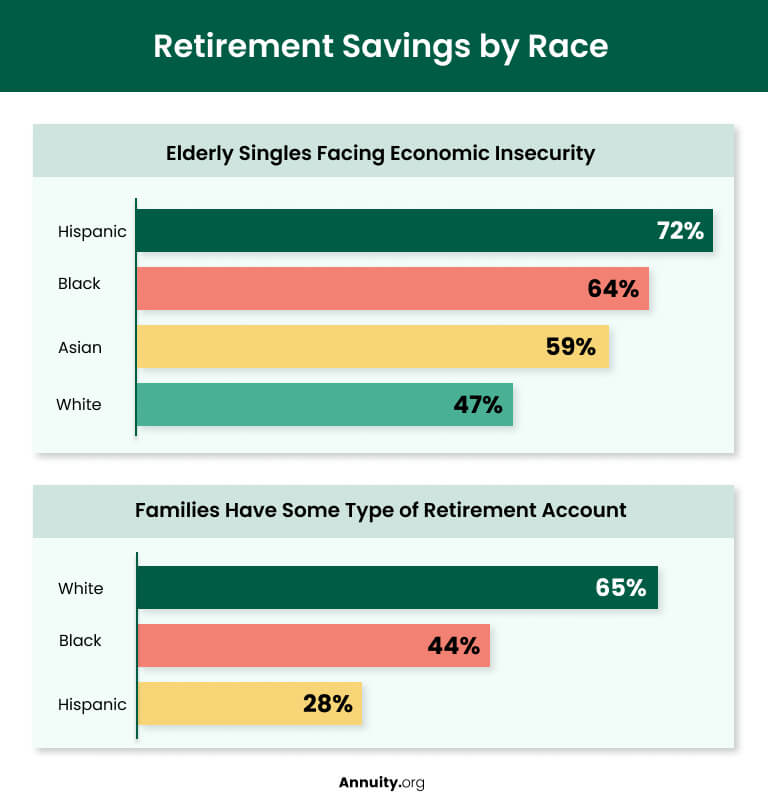

Retirement Savings Disparities by Race

- 72% of elderly Hispanic singles face economic insecurity.

- 64% of elderly Black singles are economically insecure.

- 59% of elderly Asian singles experience economic insecurity.

- 47% of elderly White singles face economic insecurity.

- 65% of White families have some type of retirement account.

- 44% of Black families have a retirement account.

- 28% of Hispanic families have a retirement account.

Global Retirement Savings Gap

- Analysts estimate the global retirement savings gap could balloon toward $400 trillion by 2050 due to demographic shifts and longer life expectancies.

- 50% of global retirement savers expect a recession by mid‑2026, revealing international uncertainty about future income.

- Inflation is the top concern worldwide among retirement savers, cited by 42%.

- Investment choice preferences vary; 68% of savers globally want control over their retirement investments.

- Economic expectations differ across major markets, with retirement savers in some regions reporting higher optimism than others.

- Global indices show mixed performance of pension systems, with gaps in sustainability and coverage across developed economies.

- Countries differ significantly in pension adequacy and coverage, with some systems facing structural shortfalls.

- Worldwide retirement confidence remains fragile as economic pressures persist.

US Retirement Savings Shortfall

- Nearly half of the adults surveyed expect to save under $500,000 for retirement, far below need estimates.

- Only 30% of Americans feel they are ready for retirement in 2025.

- Median retirement savings for ages 55–64 is roughly $185,000.

- Over 54% of U.S. households have dedicated retirement savings accounts.

- Among non‑retired adults, 33% do not expect to rely on Social Security for essential expenses.

- Social Security’s primary funding trust fund may be depleted as early as 2033, raising concerns about benefit levels.

- Retirement plans like 401(k)s vary widely in participation and balance size, often insufficient for long retirements.

- Roughly 40% of U.S. workers aren’t saving enough to maintain their lifestyle post‑employment.

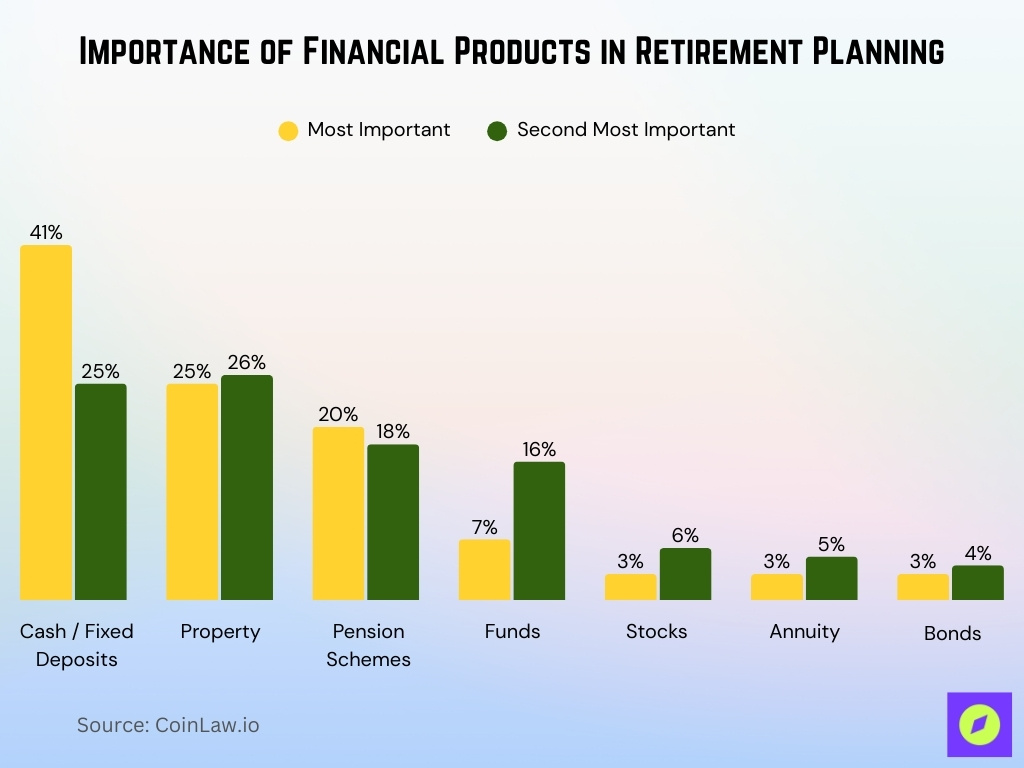

Importance of Financial Products in Retirement Planning

- 41% of respondents consider cash or fixed deposits the most important retirement product.

- 25% chose cash or fixed deposits as the second most important.

- 25% of respondents ranked property as the most important.

- 26% selected property as the second most important.

- 20% said pension schemes are the most important product.

- 18% listed pension schemes as the second most important.

- 7% view funds as the most important.

- 16% see funds as the second most important.

- 3% named stocks as the most important option.

- 6% ranked stocks as the second most important.

- 3% consider annuities most important for retirement.

- 5% placed annuities as the second most important.

- 3% selected bonds as most important.

- 4% said bonds are the second most important.

Americans Without Savings

- Between 40% and 46% of U.S. adults have no retirement savings at all.

- 20% of adults report they aren’t saving for retirement, and 5% say they never will.

- Older Americans are also affected; 1 in 5 adults ages 50+ report no retirement savings.

- About 60% of adults report having some form of retirement account, meaning 40% do not.

- Those with retirement savings are far more likely to feel financially comfortable today than non‑savers.

- Lack of savings correlates strongly with income and education levels.

- Many Americans who lack retirement savings also lack confidence in future Social Security benefits.

- The most vulnerable groups report higher rates of zero retirement savings.

Average Savings vs Needs

- The median retirement savings for Americans aged 55–64 is about $185,000, far below ideal retirement targets.

- For ages 65–74, median retirement savings only rise to roughly $200,000, still insufficient for most retirees.

- The “magic number” many Americans believe they need to retire comfortably in 2025 is about $1.26 million overall, rising to roughly $1.28 million among workers with employer retirement plans, yet most fall short of these targets.

- Millennials’ average 401(k) balance is around $67,300, compared with $192,300 for Gen X and $249,300 for baby boomers.

- Younger millennials (25–34) average just $42,640 in 401(k) balances.

- A quarter of Americans save only small amounts, with many struggling to reach even $250,000 in total retirement assets.

- Nearly 48% of people surveyed expect to save less than $500,000, far short of savings goals.

- Nationwide, many retirement savings remain lower than needed to cover future healthcare and living costs.

Debt and Savings Barriers

- 42% of Americans prioritize lowering debt as their top financial goal.

- Five out of six American households (83%) hold at least some debt.

- 60% of households carry credit card debt, competing with savings.

- 30% cite too much debt as a key barrier to financial resolutions.

- 46% of indebted older Americans blame insufficient income for debt persistence.

- 33% have more credit card debt than emergency savings.

- 25% of Gen Z and Millennials hold unsecured debts of $10,000–$49,999.

- 82% of Americans find debt stressful, hindering retirement contributions.

- 90% face financial obstacles like debt impeding retirement savings goals.

Retirement Readiness Rates

- According to Vanguard research, 58% of Americans are not on track to maintain their current living standards in retirement.

- Baby Boomers face the largest shortfall of $9,000 annually, nearly 25% of expected expenses.

- 67% of workers are confident they will retire comfortably despite widespread underpreparation.

- Workers with defined contribution plans are nearly 2x more likely (54% vs 28%) to reach savings goals.

- 55% of workers would keep funds in employer plans if structured retirement income options were offered.

- 78% of retirees feel confident in living comfortably throughout retirement.

- 33% of workers revised retirement plans to retire later amid market volatility.

- Gen Z shows stronger readiness, with nearly 50% on track to sustain living standards.

- 70% of workers worry about reducing spending due to inflation, volatility, and housing costs.

Low‑Income Household Risks

- Low‑income workers often lack access to retirement plans, risking inadequate savings later in life.

- About 78.7% of full‑time workers in the lowest earnings decile lack access to employer retirement plans.

- Many low‑income workers also lack emergency savings, with 30% unable to cover three months of expenses.

- In households without a rainy‑day fund, 30% can’t cover three months of expenses by any means.

- Workers in small companies are far less likely to receive retirement plan offers than those in larger firms.

- Nearly 64% of Latino workers and 53% of Black workers lack access to retirement savings programs at work.

- Low‑income retirees depend more heavily on Social Security, heightening risk if benefits fall short.

- Economic insecurity among lower earners results in delayed retirement or extended workforce participation.

Employer Plan Access Gaps

- 42% of full-time private-sector workers aged 18-65 lack access to employer retirement plans.

- 79% of part-time workers lack access to any retirement plan.

- 78.7% of lowest-earning full-time workers (under $27,400) lack plan access.

- 65.2% of bottom 50% earners lack retirement plan access versus 25% in the top half.

- 44.1% of full-time workers do not participate in available retirement plans.

- 50.5% of full-time workers receive no employer match on retirement contributions.

- 82.1% of lowest-income workers lack employer matching contributions.

- 79% of part-time employees do not participate in retirement plans.

- Small businesses (1-99 workers) show 61% overall worker access to retirement benefits.

Financial Literacy Shortfalls

- In 2025, U.S. adults answered only 49% of financial literacy questions correctly on the TIAA‑GFLEC P‑Fin Index, unchanged from 2017 levels, indicating stagnant financial knowledge.

- Adults with very low financial literacy are 2× more likely to be debt‑constrained and 3× more likely to be financially fragile.

- Those with low financial literacy are 5× more likely to lack one month’s emergency savings compared to adults with high literacy.

- Only 16% of U.S. adults show a very high level of financial literacy by P‑Fin standards.

- Functional knowledge of risk and investment concepts remains especially low at 36% correct responses in 2025.

- Financial literacy strongly correlates with income; adults earning $100,000+ score significantly higher than lower‑income peers.

- Nearly half of the surveyed adults spend 7 hours or more weekly addressing financial issues, highlighting complexity and lack of confidence.

- Groups with lower literacy, including less educated and lower‑income adults, are disproportionately unprepared for retirement planning.

Rising Living Costs Pressure

- In early 2025, 73% of U.S. adults expressed worry that prices are rising faster than income, making retirement savings more difficult.

- 64% of adults say having enough money in retirement remains a top financial worry.

- Rising housing, food, and healthcare costs were cited by adults as key obstacles to boosting retirement savings.

- Unexpected expenses and debt payments continue to limit retirement contributions for many households.

- Nearly one‑third (33%) of adults reported large unexpected expenses in 2024, hurting savings progress.

- 20% experienced unexpected income reductions, further tightening budgets.

- Inflation remains a persistent stressor, contributing to a decline in confidence about retirement prospects.

- Many pre‑retirees anticipate they will need to self‑rely on personal savings more than on Social Security.

Social Security Dependency

- The 2025 Social Security Trustees Report finds the Old‑Age and Survivors Insurance trust fund could be depleted by 2033 if no reforms occur.

- After depletion, Social Security could cover only about 77% of scheduled benefits, potentially triggering a 23% benefit cut.

- About 77% of Americans aged 50+ say the 2026 Social Security cost‑of‑living adjustment (COLA) isn’t enough to meet real costs.

- The average monthly Social Security check for retired workers in 2025 is roughly $2,009.

- Average benefits for all retirement beneficiaries are about $1,957 per month in 2025.

- Social Security typically replaces only about 40% of pre‑retirement income, increasing reliance on personal savings.

- Many financial advisors recommend delaying benefits to age 70 to maximize payouts and improve retirement income.

- Continued dependence on Social Security heightens vulnerability if reforms reduce benefits or raise retirement ages.

Health Expense Impacts

- A 65-year-old retiring couple needs $345,000 in healthcare savings over retirement.

- A healthy 65-year-old male faces $275,000 lifetime healthcare costs.

- Healthy 65-year-old female projects $313,000 in retirement medical expenses.

- The average 65-year-old expects $172,500 in total healthcare and medical costs.

- The national average nursing home costs $109,628 annually for a private room.

- Assisted living averages $67,085 yearly nationwide.

- In-home care national average reaches $72,874 per year.

- Healthcare costs rose 4% from prior year estimates.

- Below-average health retirees spend 15-34% more on care.

Longevity and Savings Strain

- With life expectancies rising, retirements could stretch 30–40 years or more, increasing demands on savings.

- The U.S. may see approximately 422,000 centenarians by 2054, reflecting longer average lifespans.

- 42% of adults age 50+ globally are underprepared for retirement by 10+ years relative to life expectancy expectations.

- Longevity increases the probability that retirees will outlive their savings without robust planning.

- Households with fewer assets may face extended financial insecurity as costs accumulate over longer retirements.

- Wealth disparities tie directly to retirement longevity outcomes, with lower‑wealth older adults dying nearly 9 years earlier than wealthier peers.

- Longevity risk raises demands for annuities, diversified portfolios, and guaranteed income products.

- Retirement strategies increasingly emphasize saving more and planning for long‑term care needs due to longer life spans.

Frequently Asked Questions (FAQs)

Nearly 48% of Americans surveyed expect to save less than $500,000 for retirement in 2025.

Many Americans cite about $1.26 million to $1.28 million as the retirement savings needed for a comfortable retirement in 2025.

Up to 46% of Americans report having no retirement savings.

About 83% of adults with incomes of $100,000+ have a retirement plan compared with 28% of households earning less than $50,000.

Conclusion

Retirement savings gaps remain a pressing economic and social challenge in the U.S. and worldwide. Low financial literacy, rising living costs, and heavy reliance on Social Security strain individuals’ ability to build secure retirements. Health expenses and longer life expectancies add further complexity to planning. Many workers are underprepared due to decades of income needs and may face reduced benefits and increased out‑of‑pocket costs in retirement. Understanding these statistics helps clarify the scale of the issue and highlights areas where policymakers, employers, and individuals can act to strengthen retirement security for current and future retirees.