In the thick of the 2021 DeFi boom, Ethereum was the undisputed king of Layer-1 protocols. But today, the narrative has shifted dramatically. Polygon, once known merely as a scaling solution, now stands as a formidable Layer-2 contender carving out its ecosystem.

Picture a highway in rush hour, Ethereum, though powerful, was clogged with high tolls and slower speeds. Then came Polygon, building express lanes that rerouted traffic and reduced costs for millions of users. As both networks continue to evolve, this deep-dive comparison offers a data-backed view of how they stack up today across speed, cost, user base, and ecosystem scale.

Key Takeaways

- 1Polygon processed over 12.3 billion transactions in the first half of 2025, surpassing Ethereum’s 6.2 billion.

- 2Ethereum still leads in TVL with $218 billion, compared to Polygon’s $57.4 billion.

- 3Polygon’s active user base reached 5.9 million daily wallets, while Ethereum hovered around 1.7 million.

- 4Ethereum NFT volume hit $4.1 billion, while Polygon surged to $1.3 billion.

Total Value Locked (TVL) Across All Blockchain Networks

- Ethereum dominates with 57.06% of total value locked, maintaining its lead as the primary DeFi ecosystem.

- Solana secures the second spot, holding 6.98% of the total TVL across all chains.

- Tron comes in third with a 6.01% share, showcasing its continued relevance in DeFi activities.

- Binance Smart Chain (BSC) accounts for 4.24%, driven by its fast transactions and low fees.

- Bitcoin, though not DeFi-native, contributes 3.29% to the total TVL through wrapped solutions.

- Base, Coinbase’s L2 network, represents 3.04%, indicating growing adoption of layer-2 scaling.

- Arbitrum, a leading Ethereum L2, holds 2.54%, reinforcing the rise of L2 ecosystems.

- Hyperliquid, a newer entrant, captures 1.71%, showing traction in niche DeFi sectors.

- Sui, a layer-1 blockchain, holds 1.21% of the TVL, demonstrating early adoption potential.

- Avalanche contributes 1.15%, slightly trailing behind Sui in DeFi lockups.

- The remaining 12.77% is spread across other blockchains, reflecting a diverse but fragmented DeFi landscape.

Total Transactions Comparison

- In 2025, Polygon averaged 68 million transactions per day, while Ethereum handled 34 million.

- Polygon’s total transaction count hit 12.3 billion, double Ethereum’s 6.2 billion.

- Ethereum’s transaction growth slowed to 5.4%, while Polygon rose by 35.7% year-over-year.

- Polygon set a new record in May with 92 million transactions processed in one day.

- Ethereum saw 37% of its volume routed through L2s due to mainnet congestion.

- Polygon zkEVM contributed 1.9 billion transactions this year.

- The Polygon PoS chain processed over 9.4 billion transactions so far in 2025.

- Ethereum still leads in transaction value, averaging $3,500 per transfer vs Polygon’s $180.

- Ethereum Layer-1 throughput held at 16.3 TPS, while Polygon averaged 71.2 TPS.

- Polygon accounted for 64% of all Ethereum L2 transactions.

- Ethereum’s total transaction fees topped $3.8 billion this year; Polygon’s came in at $83 million.

Active Wallets and User Growth

- Polygon grew to 5.9 million daily active wallets.

- Ethereum reached 1.7 million daily wallets, growing 7% YoY.

- In April alone, Polygon onboarded 1.3 million new wallets.

- Ethereum saw a slowdown, averaging 220,000 new addresses per month.

- Polygon’s user retention rate is 71%, higher than Ethereum’s 54%.

- Web3 social apps helped Polygon add 18 million new users in H1.

- Ethereum wallets holding NFTs declined from 6.3 million to 5.6 million; Polygon NFT wallets rose to 4.9 million.

- DeFi users on Polygon reached 2.4 million monthly.

- Polygon added over 6,500 dApps with user bases above 10,000; Ethereum added around 3,700.

- Cross-chain activity on Polygon bridges brought in 3.8 million unique users.

- Average wallet balances: Ethereum at $1,240, Polygon at $320.

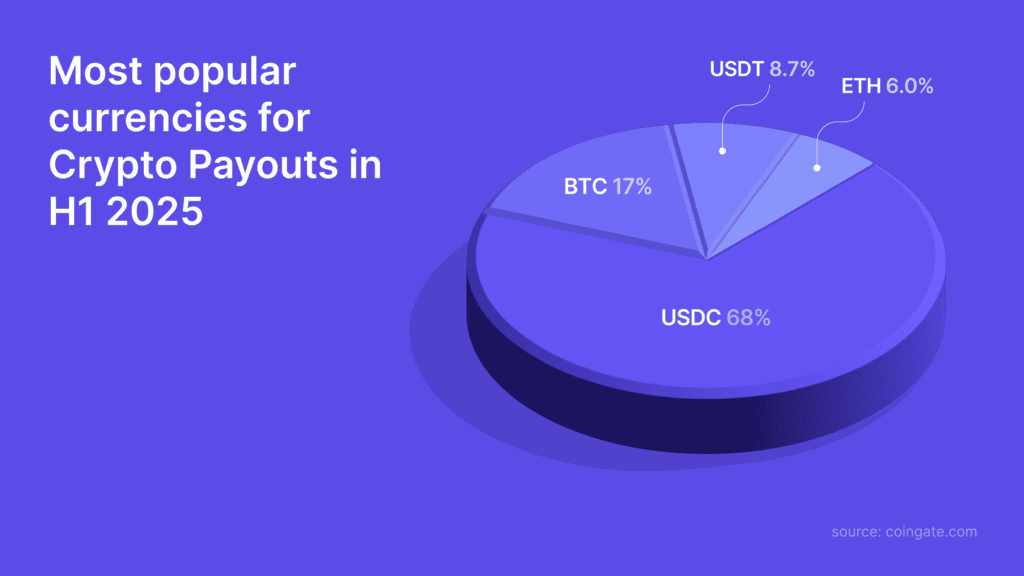

Most Popular Currencies for Crypto Payouts

- USDC leads crypto payouts with a dominant 68% share, indicating strong trust in this stablecoin for business transactions.

- Bitcoin (BTC) ranks second with 17%, showing continued preference for the original cryptocurrency in payroll and payments.

- USDT (Tether) follows with 8.7%, benefiting from its wide adoption and liquidity across platforms.

- Ethereum (ETH) accounts for 6.0%, used less frequently likely due to its gas fees, but still relevant in the payout space.

Network Speed and Throughput

- Polygon’s average transaction confirmation time is 2.1 seconds, versus Ethereum’s 12.4 seconds.

- Polygon zkEVM clocks in at 0.98 seconds, making it one of the fastest L2s.

- Ethereum’s block finality remains at 13.1 seconds.

- Polygon handles 71.2 TPS on average, peaking at 92 TPS during surges.

- Ethereum mainnet holds around 16.3 TPS, with L2s boosting total throughput to 41 TPS.

- Polygon Nightfall delivers up to 115 TPS for enterprise applications.

- Polygon CDK chains average between 50–75 TPS in production.

- L2s now carry 69% of Ethereum’s total network activity.

- Polygon uptime remains stable at 99.99%, higher than Ethereum’s average.

- Ethereum’s time-to-inclusion rose to 18.6 seconds under high congestion.

- Polygon SDK-based chains sync 10x faster than Ethereum-compatible nodes.

Average Gas Fees and Cost Efficiency

- The average gas fee on Polygon sits at just $0.0009, compared to Ethereum’s $1.58 in 2025.

- Polygon’s gas fees have decreased by 41% YoY, while Ethereum’s have decreased only 7% due to improved L2 usage.

- Users moving assets via Polygon bridges paid under $0.03 on average; Ethereum L1 bridge costs exceeded $12.00.

- A standard token swap costs approximately $0.0014 on Polygon versus $15.60 on Ethereum.

- Over 83% of transactions on Polygon cost less than $0.01, compared to just 5% on the Ethereum mainnet.

- Ethereum rollups like Arbitrum and Optimism offer lower fees, but Polygon remains the cheapest at scale.

- Polygon zkEVM fees average $0.0021, while Ethereum’s L2 median is around $0.18.

- For NFT minting, Polygon charges under $0.05, while Ethereum averages $30.70 in busy periods.

- Year-to-date, Ethereum users spent over $3.8 billion in gas fees; Polygon users spent under $83 million.

- Polygon’s gas fee-to-TVL ratio is 0.0014, far more cost-efficient than Ethereum’s 0.017.

- 2025 marks the third consecutive year where Polygon maintained fees 98% lower than Ethereum’s.

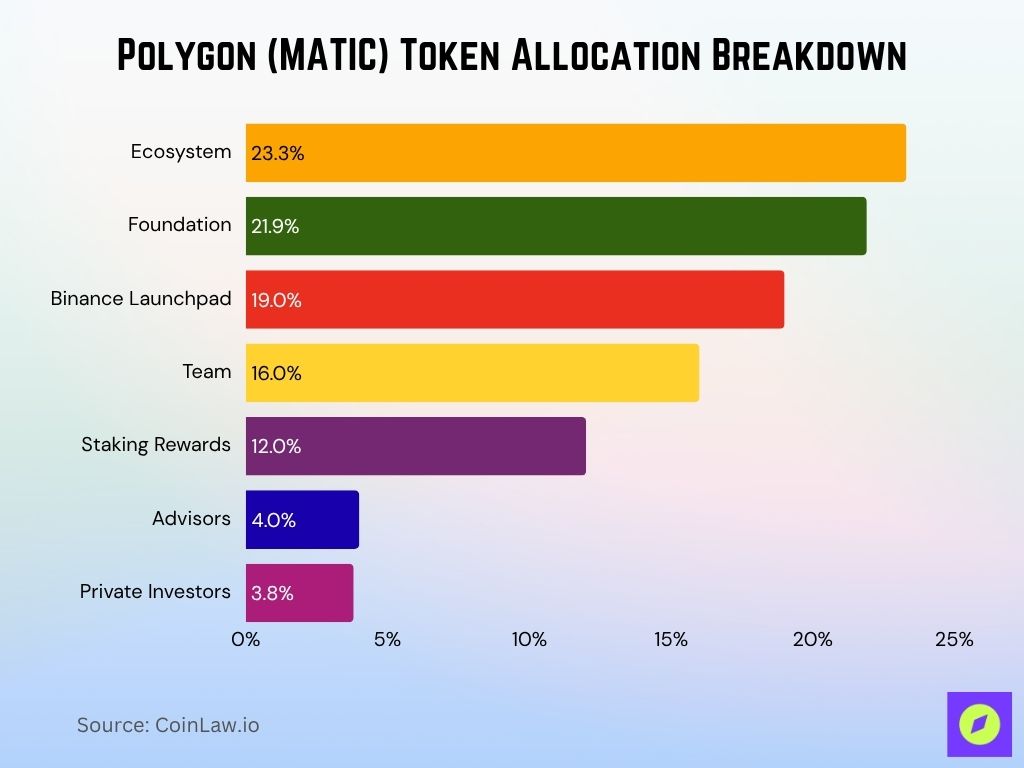

Polygon (MATIC) Token Allocation Breakdown

- Ecosystem development receives the largest share with 23.3%, supporting growth, adoption, and platform integration efforts.

- The Foundation holds 21.9%, ensuring long-term sustainability and strategic governance of the Polygon network.

- Binance Launchpad participants were allocated 19.0%, highlighting early public distribution through the IEO.

- The Team receives 16.0%, incentivizing continued development and project leadership.

- Staking Rewards account for 12.0%, encouraging network security and participation through validator incentives.

- Advisors were allocated 4.0%, compensating strategic contributors and consultants.

- Private Investors received the smallest portion at 3.8%, likely from early fundraising rounds.

Developer Activity and GitHub Commits

- Polygon recorded over 460,000 new developer registrations in 2025; Ethereum followed with 310,000.

- Polygon’s GitHub saw 7.2 million commits across repos; Ethereum logged around 5.4 million.

- Weekly active dev contributors for Polygon surpassed 4,900, while Ethereum averaged 3,200.

- Polygon SDK and zkEVM repositories were the most forked, with a combined 83,000 forks.

- Ethereum had more Ethereum Improvement Proposals (EIPs) published, totaling 178 in 2025.

- Polygon launched its Chain Development Kit (CDK), adopted by over 2,300 developer teams.

- More than 1,200 hackathon projects were deployed on Polygon versus 700+ on Ethereum in 2025.

- Polygon’s dev grants exceeded $190 million, outpacing Ethereum Foundation’s $130 million allocation.

- Daily commits to the Polygon zkEVM repo averaged 340, reflecting rapid updates and tooling growth.

- Ethereum saw a strong focus on protocol upgrades, especially around EIP-7002 and account abstraction.

- GitHub repo watchers for Polygon grew to 98,000, closing the gap with Ethereum’s 106,000.

Ecosystem Size and DApp Deployments

- Polygon now supports over 24,300 dApps, growing 19% YoY; Ethereum has about 17,400 active dApps.

- GameFi dApps exploded on Polygon, now accounting for 6,000+.

- Ethereum’s DeFi sector remains dominant, with $112 billion in DeFi TVL across its ecosystem.

- Polygon’s dApps registered over 59 million MAUs in H1 2025; Ethereum dApps saw 31 million.

- Polygon’s ecosystem includes over 420 deployed subnets or appchains using Polygon CDK.

- Ethereum saw new entrants in real-world assets (RWAs), with $8.3 billion of tokenized assets on-chain.

- Daily dApp usage is higher on Polygon, averaging 8.2 million transactions vs Ethereum’s 3.1 million.

- Web3 social dApps like Lens helped bring 15 million new MAUs to Polygon in 2025.

- Ethereum remains the leader in DAOs, hosting over 6,100 active organizations.

- Polygon’s DePIN (Decentralized Physical Infrastructure) projects grew to 1,200+, showing hardware protocol traction.

- Polygon surpassed 190 million total smart contracts deployed to date; Ethereum holds 240 million.

Ethereum Supply Breakdown by Issuance Type

- Initial Coin Offering (ICO) accounts for the largest share at 49.29%, marking the major source of Ethereum’s initial supply.

- Proof-of-Work Mining represents 40.34%, reflecting the network’s original consensus mechanism prior to Ethereum’s shift to PoS.

- Premine to Ethereum Foundation + Early Project Contributors makes up 9.87%, allocated for core development and early backers.

- Proof-of-Stake Validating holds a minimal share at 0.50%, indicating its relatively recent role in Ethereum issuance post-Merge.

Staking and Validator Count

- Ethereum’s validator count reached 1.56 million in 2025; Polygon’s reached 3,900.

- Polygon validators are selected by stake and reputation, with the minimum stake now set at 500,000 MATIC.

- Ethereum’s annualized staking yield is around 3.8%, while Polygon offers 5.4% average APR.

- Total ETH staked surpassed 36 million ETH, representing 30% of the circulating supply.

- Polygon’s total MATIC staked stands at 5.3 billion, or roughly 49% of the total supply.

- LSTs (Liquid Staking Tokens) on Ethereum, like Lido, account for $27 billion of the total staked value.

- Polygon’s staking participation rate increased by 12.7% in 2024.

- Validator slashing on Ethereum remains under 0.04%, with Polygon reporting 0.01% incidents.

- The average Polygon staking delegation per user is 17,200 MATIC; Ethereum’s is 2.8 ETH.

- Validator decentralization on Polygon improved, with 22% of validators now located outside the top 5 countries.

- Ethereum continues to rely heavily on Lido, which controls 29.4% of staked ETH.

NFT Market Performance on Polygon vs Ethereum

- Ethereum still leads in total volume, with $4.1 billion in NFT sales so far in 2025.

- Polygon’s NFT market surged to $1.3 billion.

- Monthly Polygon NFT mints average 28 million, far higher than Ethereum’s 3.5 million.

- Polygon became the top choice for gaming NFTs, hosting over 16 million active game-linked NFTs.

- Ethereum remains dominant in high-value collections, averaging $1,230 per sale vs Polygon’s $72.

- Polygon powered 70% of all brand-led NFT campaigns in Q1 2025.

- Reddit Avatars and Starbucks Odyssey drove over 4 million NFT mints on Polygon this year.

- Ethereum saw a decline in daily NFT buyers, dropping to 14,000, while Polygon reached 38,000.

- Polygon launched NFT royalty enforcement contracts, with over 68% adoption across marketplaces.

- Ethereum’s leading collections (like Bored Ape) lost 28% volume YoY; Polygon-native collections grew 54%.

- Polygon NFT wallets grew to 4.9 million, while Ethereum dropped from 6.3 million to 5.6 million.

USDC Usage Across Blockchain Networks

- Ethereum leads with 23.3% of USDC usage, reinforcing its role as a core infrastructure layer for stablecoin transactions.

- Binance Smart Chain (BSC) follows with 21.6%, reflecting its popularity for fast and cost-efficient transfers.

- Solana captures 15.0%, showing strong adoption driven by high throughput and low fees.

- Arbitrum, an Ethereum Layer-2, holds 9.5% of USDC activity, highlighting growth in the L2 ecosystem.

- Polygon accounts for 8.5%, continuing to attract stablecoin users due to its scalability.

- Base, Coinbase’s L2 solution, sees 6.1%, indicating rapid adoption in its early phase.

- Optimism registers 1.5%, suggesting modest traction among L2 users.

- Tron trails with just 0.03%, despite its historical relevance in stablecoin circulation.

Institutional and Enterprise Adoption

- Over 420 enterprises are now building or piloting solutions on Polygon in 2025.

- Ethereum remains the primary choice for on-chain settlement, with over 65% of Fortune 500 blockchain experiments utilizing it.

- Polygon’s enterprise tools, like Nightfall and zkEVM, saw 118 new corporate deployments this year.

- Ethereum is integrated in nearly 78% of tokenization platforms targeting financial institutions.

- Major brands like Adobe, Mastercard, and Franklin Templeton are building on Ethereum in 2025.

- Polygon partnered with major logistics and supply chain firms, including Maersk and DHL, for verifiable document tracking.

- Banking pilots on Ethereum now span 12 countries, with central banks testing programmable CBDCs.

- Polygon announced a partnership with AWS, supporting zero-knowledge rollups natively on Amazon’s cloud infrastructure.

- Ethereum custody tools, like Fireblocks and Anchorage, saw institutional inflows of over $28 billion in H1 2025.

- Polygon’s NFT ticketing initiatives processed over 9.8 million verifiable event tickets this year.

- More than 50 universities now use Polygon blockchain credentials for diplomas and certifications.

Environmental Impact and Energy Consumption

- Ethereum reduced energy usage by over 99.95% after its 2022 transition to proof-of-stake, consuming around 0.0026 TWh/year in 2025.

- Polygon’s mainnet uses just 0.0009 TWh/year, with near-zero emissions from PoS operations.

- Polygon’s carbon offset initiatives reached 120% net neutrality, making it climate-positive in 2025.

- Ethereum remains carbon-neutral via purchased offsets, covering about 100% of emissions from validator operations.

- Polygon Labs pledged to maintain a zero-carbon target through 2030 and reports its metrics quarterly.

- The average Polygon transaction emits 0.00012 kg CO₂, versus 0.00079 kg CO₂ on Ethereum.

- Polygon zkEVM chains have adopted energy-minimized SNARK generation, cutting power costs by 33%.

- Ethereum validator nodes now use energy-efficient hardware with avg power draw below 65W.

- Polygon joined the Crypto Climate Accord, reporting 100% renewable energy usage across all validator infrastructure.

- Ethereum Foundation’s “Green Chain” initiative launched in 2025, with $19 million earmarked for climate R&D.

- Polygon has helped offset over 22,000 tons of carbon since 2023 through ecosystem-funded efforts.

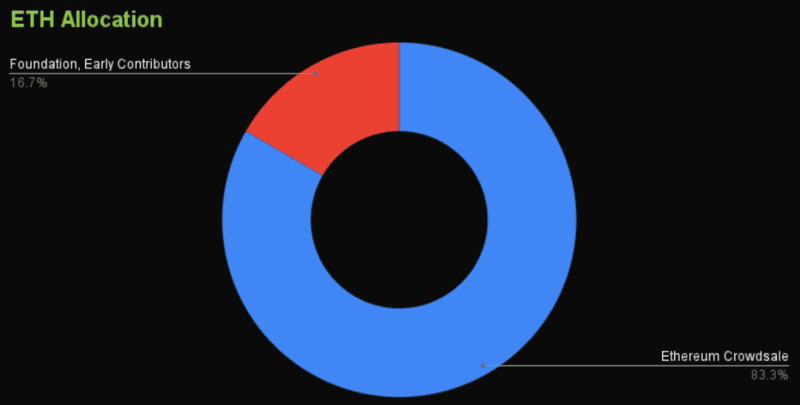

ETH Allocation Breakdown

- Ethereum Crowdsale accounts for 83.3% of the total ETH allocation, emphasizing its community-driven launch through public participation.

- Foundation and Early Contributors received 16.7%, reserved for development, research, and initial project supporters.

Recent Developments

- Polygon 2.0 launched its governance layer and unified liquidity framework in Q2 2025.

- Ethereum finalized EIP-7002, enabling native account abstraction features for smart wallets.

- Polygon introduced AggLayer, an aggregator bridge protocol, reducing settlement times by 62%.

- Ethereum launched “Verkle Trees” on the mainnet, reducing node sync sizes by over 65%.

- Polygon CDK now supports pluggable execution layers, attracting over 230 appchain launches in 2025.

- Ethereum saw 42 major protocol upgrades and security patches implemented this year.

- Polygon partnered with Google Cloud for data indexing APIs integrated into BigQuery.

- Ethereum’s Beacon Chain now supports validator rotation intervals of just 12 hours, improving liveness.

- Polygon ecosystem tokens saw a 19% average gain in Q2 2025, driven by NFT and gaming activity.

- Ethereum saw its first full-fledged bond issuance via smart contracts by a US bank, worth $73 million.

- Polygon announced the opening of 3 new R&D hubs in the US and Europe to accelerate zero-knowledge research.

Conclusion

Polygon and Ethereum no longer occupy the same lanes in the blockchain world; they are both foundational in their own right. Ethereum remains the go-to for security, institutional adoption, and high-value DeFi. Meanwhile, Polygon has carved out a space focused on speed, affordability, and Web3 scalability.

The numbers speak clearly: Polygon is no longer just a scaling solution. It’s a parallel ecosystem powering millions of users, dApps, and businesses. Ethereum continues to innovate and lead, especially in value retention and deep protocol research. Together, they now define a multi-chain Ethereum future, where collaboration, not competition, is the new norm.